K1 Tax Form Explained A Guide for Investors

K1 Tax Form Explained A Guide for Investors

Our guide to the K1 tax form explained for investors. Learn how to read your Schedule K-1, avoid common mistakes, and understand its impact on your taxes.

Domingo Valadez

Sep 26, 2025

Blog

When you invest in a real estate syndication, you become a part-owner in a partnership. Because of this structure, you won't get the simple W-2 or 1099 forms you might be used to. Instead, you'll receive a Schedule K-1.

Think of the K-1 as the official "report card" for your investment's performance over the past year. It's the document that details your specific slice of the partnership's profits, losses, deductions, and credits, all of which you'll need for your personal tax return. It's the bridge that connects the property's financial activity directly to your Form 1040.

Getting your first K-1 can be a bit intimidating. It looks a lot more complex than a W-2 from your job, and that's because it's doing something fundamentally different. A standard corporation (a C-corp) pays its own income taxes. But the partnerships used in real estate syndications are "pass-through" entities.

This means the business itself doesn't pay federal income tax. Instead, it passes through all financial results—both the good and the bad—directly to the investors. The K-1 is the messenger that delivers your share of that news.

Why Pass-Through Taxation Matters

The entire system is designed to avoid what's known as double taxation. With a typical C-corp, the company first pays corporate tax on its profits. Then, if it pays out dividends to shareholders, those shareholders have to pay personal income tax on that same money. It gets taxed twice.

Pass-through entities, like the LLC or LP that holds the real estate, get rid of that first layer of tax. The K-1 is the mechanism that allocates the net income or loss among all the partners, who then report it on their own returns.

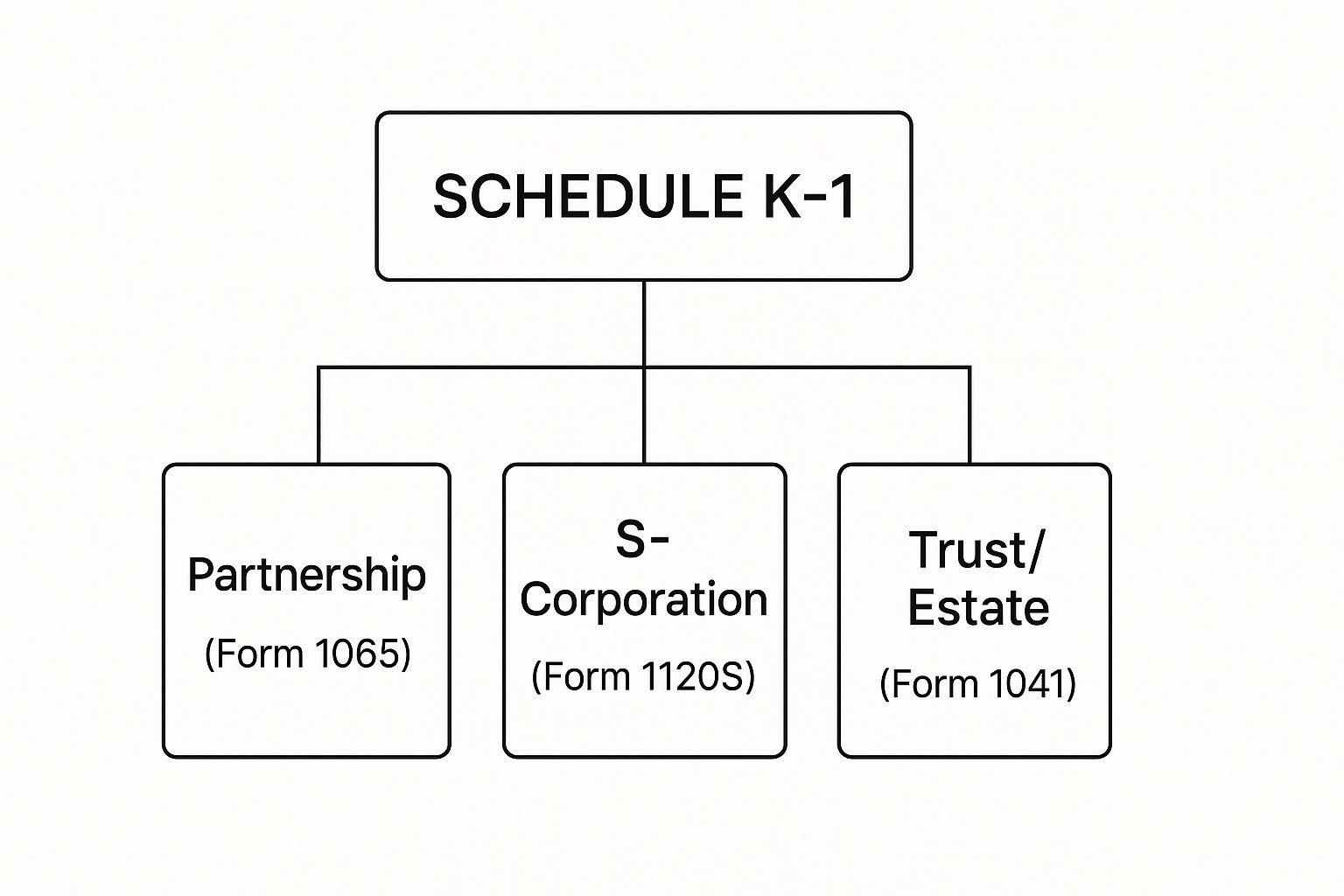

The Schedule K-1 is the critical link in the pass-through tax system. The partnership files an informational return (Form 1065) with the IRS to show its total activity, then issues a separate K-1 to each partner, breaking down their individual share of that activity.

What this means for you is that your personal tax situation is now directly tied to the investment's performance and the sponsor's tax strategy. A crucial point to remember is that you are taxed on your share of the profits, even if you never received that money as a cash distribution.

How a K-1 Differs From Other Common Tax Forms

To get a clearer picture, it helps to see how a K-1 stands apart from the tax forms most people see every year.

As you can see, the K-1 reflects your status as an owner, not an employee or a contractor.

Connecting the K-1 to Your Personal Tax Return (Form 1040)

Ultimately, the numbers on your Schedule K-1 are just the starting point. They don't just sit there; you have to transfer the figures from the various boxes on the K-1 to the correct lines on your personal tax return, mainly your Form 1040 and its supporting schedules (like Schedule E).

The partnership's accountants handle the complex investment accounting that generates the numbers on the K-1. Your job, or your CPA's job, is to correctly report those numbers on your return. By understanding what the K-1 is and why you have it, you're in a much better position to make sense of your investment's financial results.

How to Read Your K-1 Form: Parts I and II

Before you dive into the numbers and financial data that fill the rest of the form, take a moment to look at the top sections. Think of Parts I and II as the "cover page" for your investment's tax story. Getting these details right from the start is absolutely essential for a smooth tax season.

Part I is all about the partnership that issued the K-1, while Part II is all about you, the partner. It might just look like basic contact info, but a single mistake here can cause major headaches and delays with the IRS. So, let's walk through it.

Part I: Information About the Entity

This first section is pretty straightforward—it identifies the business you've invested in. It's always a good idea to give it a quick once-over to make sure everything lines up.

- Box A - Employer Identification Number (EIN): This is the business's version of a Social Security Number. It’s the unique ID the IRS uses to track the partnership.

- Box B & C - Name and Address: This should be the official name and address of the real estate syndication or LLC you put your money into.

- Box F - IRS Center: This just tells you which IRS service center the main partnership tax return (Form 1065) was filed with.

You won't typically need to do anything with this information, but it's good to confirm that the K-1 you're holding is from the correct entity.

Part II: Information About the Partner

Okay, now it's time to slow down and pay close attention. This section is all about you, and accuracy is everything. An incorrect Social Security Number or even a simple typo in your name can get your entire e-filed tax return rejected. That means dealing with mismatch notices from the IRS and probably having to file by paper mail.

Crucial Takeaway: Double-check every single entry in Part II. I've seen a single wrong digit in a ZIP code cause tax software to flag an error or trigger a letter from the IRS months later. It’s a hassle you can easily avoid.

Before you move on, put your eyes on these specific boxes:

- Box E: Your Social Security Number (SSN) or Taxpayer Identification Number (TIN).

- Box F: Your full name and current mailing address.

- Box H: The checkbox indicating if you are a domestic or foreign partner.

If you spot any error in this section, stop right there. Contact the syndicator or their accountant immediately. Do not file your taxes with an incorrect K-1. You'll need them to issue a corrected Schedule K-1 before you can proceed.

Understanding Your Ownership Stake and Liabilities

Part II also gets into the nitty-gritty of your ownership and your share of the entity’s debt. These aren't just random numbers; they directly impact your tax calculations, especially something called your "basis."

Item J - Your Share of Profit, Loss, and Capital: This box breaks down your ownership percentages at the start and end of the year. The partnership's accountant uses these percentages to figure out your slice of the pie. For example, if the property generated $100,000 in profit and your profit-sharing percentage is 5%, your K-1 will show $5,000 of income allocated directly to you.

Item K - Your Share of Liabilities: This is a big one, especially in real estate investing. This box shows your portion of the partnership’s mortgage and other debts. It’s typically broken down into three types:

- Nonrecourse: This is debt you aren't personally on the hook for, which is the case for most commercial real estate loans in a syndication.

- Qualified Nonrecourse Financing: A specific flavor of nonrecourse debt that's secured by the real estate itself.

- Recourse: This is debt you are personally responsible for paying back. It’s pretty rare to see this for limited partners.

These debt figures aren't income you have to report. Instead, they get added to your investment basis. A higher basis is a good thing—it generally allows you to deduct more of the paper losses (like depreciation) that real estate is famous for.

Nailing down these foundational details in Parts I and II ensures the rest of your K-1 journey is built on solid ground.

Decoding Part III Box by Box: Income and Deductions

Alright, let's get into the real meat of the K-1: Part III.

If Parts I and II are the "who" and "what," Part III is the "how much." This is the section that breaks down your specific slice of the investment's financial pie for the year—all the income, losses, and deductions that get passed through to you.

Don't let the grid of boxes intimidate you. Think of it less like a tax form and more like a translated summary of the deal's performance, written in a language your personal tax return (your Form 1040) can understand.

The K-1 is essentially the bridge between the partnership's tax return and yours. It takes the big-picture numbers from the business and allocates the right portion to each investor.

As you can see, no matter the type of pass-through entity—a partnership, S-Corp, or even a trust—the K-1 is the standardized report card that lands in your mailbox.

Let’s walk through the boxes you’ll most likely encounter as a real estate investor.

Box 1: Ordinary Business Income or Loss

For a typical operating business, like a startup or a consulting firm, this box is the main event. It shows the net profit or loss from the company's day-to-day business.

But for investors in real estate syndications? This box will often be zero. Why? Because the core business activity is rental real estate, and that has its own special place on the form.

Box 2: Net Rental Real Estate Income or Loss

Pay close attention here—this is the most important box for real estate syndication investors. Box 2 reports your share of the profit or, more commonly, the loss generated directly by the rental property.

This number is what’s left after you take all the rental income and subtract operating expenses, mortgage interest, and the real superstar of real estate tax benefits: depreciation.

Because depreciation is a massive "on-paper" expense that doesn't actually come out of the property's bank account, it's incredibly common for this box to show a net loss even when the property is cash-flowing beautifully. This is the "paper loss" you hear about, and it's a powerful tool that can help offset other passive income you might have. The number here almost always flows directly to your Schedule E (Supplemental Income and Loss).

Box 3: Other Net Rental Income or Loss

You probably won't see much action in this box. It’s a bit of a niche category for rental income that isn't from real estate. Think of a partnership that rents out heavy construction equipment or a fleet of vehicles. Your share of that kind of income or loss would land here.

Passive vs. Active Income: A Critical Distinction

The IRS is very particular about sorting income into different buckets. As a limited partner in a syndication, your rental income or loss is almost always considered passive. This is a crucial detail because passive losses can generally only be used to offset passive gains, not the "active" income you earn from your W-2 job.

Boxes 5, 6, and 7: Interest, Dividends, and Royalties

These boxes cover what's known as "portfolio income"—money the partnership earned from its investments, not its main operations.

- Box 5 (Interest Income): Your share of interest earned from the partnership's cash sitting in a bank account.

- Box 6a (Ordinary Dividends): If the partnership owned stock in another company, any dividends received would show up here.

- Box 7 (Royalties): This is for income from things like mineral rights or intellectual property. It’s pretty rare in a standard real estate deal.

This type of income gets reported on Schedule B (Interest and Ordinary Dividends) on your personal return.

Boxes 8 and 9: Capital Gains and Losses

This is where the big payoff shows up. When the partnership sells an asset—like the apartment building itself—your share of the profit or loss is reported here.

- Box 8 (Net Short-Term Capital Gain/Loss): For assets the partnership held for one year or less.

- Box 9a (Net Long-Term Capital Gain/Loss): For assets held for more than one year. This is the one you’re looking for after a successful exit, as long-term gains are taxed at much friendlier rates.

These numbers will make their way onto your Schedule D (Capital Gains and Losses). A big, positive number in Box 9a is the tell-tale sign of a profitable property sale.

The use of K-1s has exploded as more people discover partnership investing. Back in 2017, the IRS processed 39.3 million of them. That number is projected to hit 45.7 million by 2025, showing just how common this form is becoming.

Box 11: Other Income or Loss

Think of this as the "miscellaneous" drawer for income. It’s a catch-all for any income that doesn't fit into the more specific categories. The K-1 must include a statement explaining exactly what's in here. A common example is a Section 1231 gain, which can come from the sale of business property.

For investors with international interests, it's also important to understand how tax treaties might affect the numbers reported here. For example, the US Tax Treaty with Hong Kong can influence how certain foreign income is ultimately taxed in the U.S.

Box 13: Other Deductions

Just like Box 11 is for miscellaneous income, Box 13 is for miscellaneous deductions. The partnership is required to give you a statement detailing what these deductions are.

The most common item you'll find here as a passive investor is your share of any charitable contributions the partnership made. You would then take this number and report it on your Schedule A (Itemized Deductions), assuming you itemize. Other items like investment-related expenses could also appear here.

Mapping K-1 Part III Boxes to Your Tax Return

To make this crystal clear, here’s a simple table that connects the dots between the most common K-1 boxes in Part III and where that information typically ends up on your personal Form 1040.

This table should help you or your CPA quickly see how the K-1 translates directly onto your return, turning a confusing form into a clear roadmap for your taxes.

Wrapping Up Your K-1: Credits, Distributions, and Other Key Items

The financial story of your investment doesn't end with simple income and deductions. In fact, some of the most important—and often most confusing—pieces of the puzzle are found in the final section of Part III, specifically boxes 14 through 21.

This is where you'll find everything from tax credits and cash distributions to the powerful "paper losses" that make real estate such an attractive investment. Let's break down what these final boxes are telling you.

Box 14: Self-Employment Earnings

Seeing the words "Self-Employment Earnings" in Box 14 can cause a bit of a panic. Does this mean you owe self-employment tax on your investment income? For the vast majority of passive real estate investors, the answer is a relieving no.

This box is really meant for the general partners—the people actively running the show day-to-day. Their share of the income is considered "earned" and gets hit with self-employment taxes (think Social Security and Medicare). But as a limited partner, you're a passive investor. Your income isn't "earned" in the same way, so this box should be blank for you.

Box 15: Credits

Here's a crucial distinction: a tax deduction lowers your taxable income, but a tax credit reduces your actual tax bill, dollar-for-dollar. That makes credits incredibly valuable, and any that flow through the partnership to you will show up in Box 15.

While they aren't everyday occurrences in typical real estate syndications, you might see credits show up for specific types of projects, such as:

- Low-income housing credits for investments in qualifying affordable housing.

- Rehabilitation credits for bringing certified historic buildings back to life.

- Energy credits for adding solar panels or other green-energy tech.

If you have a number in this box, it's fantastic news. Your accountant will use it to directly slash the amount you owe the IRS.

Box 19: Distributions

This is it. Box 19 is arguably the most misunderstood spot on the entire K-1 for new investors, but getting it right is the key to seeing the true beauty of real estate tax benefits. This box shows Distributions—the actual cash the syndication paid out to you during the year.

Here’s the common mistake: people assume the cash they received (Box 19) should match the taxable income reported back in Box 2. It almost never does. The two numbers represent completely different things.

Distributions vs. Income: The ATM Analogy

Think of your investment as a bank account. Your taxable income (Box 2) is like the interest your account earned. The distribution (Box 19) is the money you withdrew from an ATM. You don't get taxed when you take your own money out of an ATM; you get taxed on the interest it earned, regardless of whether you withdrew it.

So, why are these numbers so different in real estate? The secret ingredient is depreciation. The property might have generated $100,000 in positive cash flow, and you received your share of that cash. But after the accountants subtract a massive, non-cash depreciation expense, the partnership could easily show a taxable loss in Box 2.

This is the magic right here: you get tax-deferred cash in your pocket while reporting a paper loss on your tax return. This single concept is one of the most powerful real estate syndication tax benefits you can find.

Box 20: Other Information

Think of Box 20 as the "miscellaneous" drawer. It’s a catch-all for important details that don't have their own dedicated box. You’ll always find an attached statement that explains what each code means, and for real estate investors, this is often where the gold is hidden.

For example, this is where the partnership breaks down the numbers behind that big depreciation deduction. You might see notes about Section 179 deductions or other depreciation-related details that justify the paper loss you're claiming.

Other items you might find in the Box 20 statement include:

- Investment expenses: Your slice of the costs for managing the partnership's assets.

- Portfolio income details: More specifics on interest or dividends earned.

- Foreign tax information: Relevant only if the partnership had international activities.

Always, always review the Box 20 statements with your tax pro. This is where you'll find the "why" behind the numbers, and it often holds the key to unlocking even more tax-saving strategies. By understanding these final boxes, you’ve basically completed the K-1 puzzle, turning a daunting form into a clear report on how your investment is performing for you.

Common K-1 Mistakes and How to Avoid Them

Alright, let's talk about the real-world bumps in the road. Knowing what a K-1 is and what the boxes mean is one thing; actually using it correctly during the chaos of tax season is another. A few common snags can trip up even seasoned investors, but once you know what to look for, you can handle them like a pro.

The number one freak-out moment for first-time syndication investors? The K-1 hasn't shown up, and it's already March. It's totally understandable. You're used to W-2s, which have to be in your hands by January 31. But K-1s play by a completely different set of rules.

The partnership has to do its own massive tax return first (that's Form 1065), and that isn't due until March 15. Only then can they start generating the K-1s for all the partners. So, don't be surprised if yours doesn't land in your inbox until late March or even early April.

Key Takeaway: Filing a tax extension isn't a red flag or a sign of trouble. For real estate investors, it's business as usual. It's the standard, expected move that gives you and your CPA the breathing room to file correctly without rushing.

What to Do If Your K-1 Arrives Late

Think about the sheer scale of this for a moment. In Fiscal Year 2024 alone, the IRS had to process returns for over 5 million partnerships and 6 million S-corporations. Each of those entities then sends out K-1s to all their partners. The system is practically designed for delays. If you're curious, you can explore these IRS processing volumes to see just how massive the numbers are.

So, what's your game plan?

- Give your CPA a heads-up. Just let them know a K-1 is coming. They can get the rest of your return ready to go and easily file an extension for you.

- Don't panic. This is completely normal. Most good sponsors will send out updates with an expected timeline for K-1 delivery.

- File an extension. This is the key. Your CPA will file Form 4868, which automatically pushes your filing deadline to October 15. No stress, no rush.

Taking this simple step just removes all the pressure of the April deadline.

Handling Errors on Your K-1 Form

The moment your K-1 arrives, stop and give it a once-over. Before you even look at the numbers, check your personal details in Parts I and II. Is your name spelled correctly? Is your address right? Is that your Social Security Number?

If you spot an error—any error at all—do not file your taxes with that form.

Get on the phone or email the syndicator or their accounting team right away. Point out the mistake. They are legally required to look into it and issue a brand new form that is clearly marked "Corrected Schedule K-1." You absolutely must wait for this corrected version to file. If you jump the gun and file with the wrong one, you’ll be stuck filing an amended return (Form 1040-X), which is a headache nobody needs.

Understanding Why Losses Aren't Always Deductible

This is probably the most confusing part for new investors. You look at Box 2, see a big passive loss, and think, "Great! This will wipe out some of my W-2 income." I wish it were that easy. The IRS has a couple of very important rules that get in the way.

- Basis Limitations: You can only deduct losses up to the amount you have "at-risk" in the deal—essentially, your tax basis.

- Passive Activity Loss (PAL) Rules: This is the big one. As a passive investor (which you are in a syndication), you can generally only use passive losses to offset passive income. It doesn't count against your "active" income from your day job.

So what happens to those losses? They aren't gone forever. They get "suspended" and carried forward to future years. You can then use them to offset passive income from that same investment down the road, or they will all be "released" to offset other income when the property is finally sold.

Answering Your Top K-1 Questions

Diving into a K-1 can bring up a lot of questions. Let's tackle some of the most common ones I hear from investors to clear up any confusion.

When Will My K-1 Arrive?

This is probably the number one question every investor asks. Unlike a W-2 that has to be in your hands by January 31, K-1s operate on a much later timeline. The partnership itself has to wrap up its own complex tax return (Form 1065) and get it to the IRS by March 15.

Because of that, don't be surprised if your K-1 doesn't show up until late March or even early April. In fact, it's completely normal for real estate investors to file an extension on their personal taxes just to accommodate this timing.

Wait, the Income on My K-1 Doesn't Match the Cash I Received. Why?

No, it rarely does, and this is a crucial point to grasp. The income figure you see (like in Box 2) is your slice of the partnership's taxable profit, not the actual cash that hit your bank account.

The cash you were paid out is listed separately as "Distributions," usually down in Box 19.

So why the difference? It almost always comes down to depreciation. Depreciation is a massive non-cash expense that lets the partnership reduce its taxable income on paper, even while cash flow remains strong. This is how you can get a healthy cash distribution while your K-1 actually shows a taxable loss—a key benefit of real estate investing.

What Happens if I Spot an Error on My K-1?

First off, don't file your taxes with it. The second you think something is wrong, get in touch with the sponsor or company that sent it to you. Be specific about what you think the mistake is.

They are legally required to check their numbers and, if they made a mistake, send you a new form clearly marked as a "Corrected" Schedule K-1. You'll need to wait for that corrected version before you file. If you’ve already filed, you'll unfortunately have to go through the process of filing an amended tax return with a Form 1040-X.

Do I Have to Pay Self-Employment Tax on This Income?

This all boils down to your role in the deal. For the vast majority of investors in real estate syndications, you are a limited partner or a passive investor. If that's you, then no, you generally do not owe self-employment tax.

However, if you're a general partner who is actively involved in running the business, then your share of the income (reported in Box 1 and detailed in Box 14) is usually considered active business income and will be subject to self-employment tax.

Keeping investors happy while juggling tax documents can eat up your most valuable resource: time. Homebase is built to handle the entire investor relations lifecycle, from raising capital to calculating distributions, all in one clean portal. It’s time to ditch the spreadsheet chaos so you can focus on what you do best—finding the next great deal. Find out how to automate your back office operations.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.