Joint Venture vs Partnership: Which is Best for You?

Joint Venture vs Partnership: Which is Best for You?

Confused about joint venture vs partnership? Discover key differences to choose the right legal structure for your real estate investments.

Domingo Valadez

Oct 13, 2025

Blog

The simplest way to think about the joint venture vs partnership debate comes down to time and scope. A joint venture (JV) is a temporary team-up for a single project or deal. A partnership, on the other hand, is a long-term business relationship meant to handle ongoing operations.

Think of it this way: a JV is like assembling a specialized crew to pull off one big heist. Once the job is done, the crew disbands. A partnership is like starting a security company—you're in it for the long haul, tackling multiple jobs over many years.

Defining the Core Structures

For real estate syndicators, this choice isn't just a legal formality; it's the blueprint for how you'll operate, share profits, and handle liability. Picking the right structure from the start is crucial because it sets the entire foundation for your collaboration and ultimately impacts your bottom line.

Each model has its place. A JV offers a clean, self-contained structure perfect for a single asset acquisition, while a partnership provides a durable framework if you're looking to build a multi-asset portfolio with the same people. Both are incredibly popular for a reason. Despite economic headwinds, the global volume of new joint ventures and partnerships actually jumped by 13% in 2022, proving just how valuable these collaborative models are. You can dig deeper into these trends in the full joint ventures and partnerships review.

A High Level Comparison

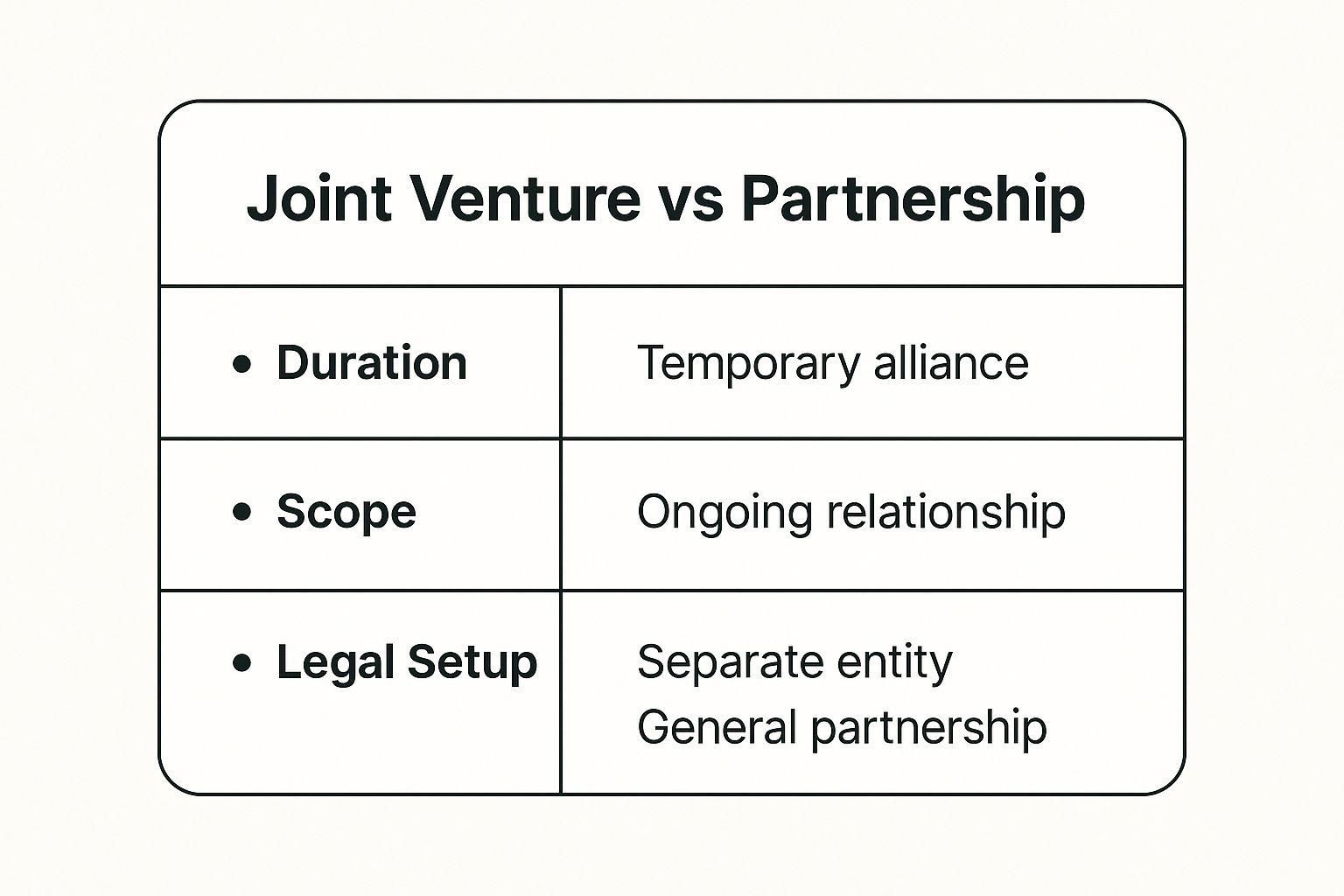

To get a quick visual on how these two structures stack up, the infographic below lays out the primary differences in duration, scope, and legal setup.

As you can see, the choice really boils down to whether you're planning a one-off deal or building a lasting business enterprise together.

Key Takeaway: The question isn't which structure is "better," but which one is the right tool for the job. A JV is tactical and finite; a partnership is strategic and built to last.

To put some finer points on it, let's break down the key attributes in a simple comparison table. This gives you a side-by-side view to help clarify the distinctions even further.

Joint Venture vs Partnership Quick Comparison

This table provides a high-level snapshot. The real decision comes from weighing these differences against the specific goals of your real estate venture.

Comparing Legal Structures and Liability Protection

When you’re weighing a joint venture against a partnership, the legal structure is where the rubber really meets the road, especially when it comes to protecting your assets. This isn’t just about ticking boxes on some legal forms; it's about building a solid financial firewall around everything you've worked for.

A joint venture is almost always set up as a new, separate legal entity—typically a Limited Liability Company (LLC). This new LLC is what owns the property, signs the contracts, and takes on the debt. The whole point of this setup is to deliberately wall off the project's risks from the parent companies or the individual investors involved.

A general partnership, on the other hand, is a much simpler beast and often doesn't create that separate legal shield. In that model, the partners are the business. This difference seems small, but the liability implications are huge.

How Liability Differs in Practice

The single biggest advantage of a JV’s separate entity structure is limited liability. If something goes wrong—say, the project gets hit with a lawsuit or defaults on a loan—creditors can generally only go after the assets held inside that specific JV LLC. Your other business ventures and personal assets are safely out of reach.

A general partnership offers no such comfort. Every partner can be held personally responsible for 100% of the partnership's debts and obligations, no matter what their ownership stake is. If the business goes under, your personal savings, your home, and other investments could all be on the line. It's a critical detail that syndicators, in their excitement to get a deal done, sometimes gloss over. If you're leaning this way, it's worth exploring structures with better liability shields, like a real estate limited partnership.

Real-World Scenario: Picture a JV formed as an LLC to build a new apartment complex. A serious construction accident happens, triggering a massive lawsuit. Because of the LLC structure, the liability is contained within the JV. The developer's personal assets and the capital partner's other investments are protected. Had they just shaken hands and operated as a general partnership, both of them could have been sued personally, putting their entire net worth at risk.

Documentation and Formal Agreements

The legal structure you choose also dictates the kind of paperwork you'll be dealing with. A joint venture operates under a very specific JV agreement. This document is laser-focused on a single project, clearly defining its scope, timeline, and how everyone will exit the deal. Think of it as a temporary, purpose-built contract.

A partnership, however, is run by a much broader partnership agreement. This is the foundational document for an ongoing business relationship, designed for the long haul and a much wider scope of activities. Getting this right is crucial, as it sets the rules for a lasting business, not just a one-off deal. It's worth understanding the complexities involved in drafting partnership deeds to appreciate what goes into formalizing that long-term commitment.

Analyzing the Tax Implications for Your Returns

Finding a great deal is only half the battle in real estate syndication. How you structure that deal can have a massive impact on your net returns, and nowhere is this more true than with taxes. The differences in how a joint venture vs partnership handles profits and losses can make or break your bottom line.

Most of the time, a joint venture is set up as its own separate legal entity, very often a Limited Liability Company (LLC). This choice is a big deal for tax purposes. An LLC is what's known as a pass-through entity, which means the business itself doesn't get hit with corporate income tax.

Instead, all the profits and losses flow directly to the individual members. This is how you sidestep the infamous "double taxation," where a corporation pays taxes on its earnings, and then its shareholders get taxed again on the dividends they receive.

This pass-through approach is especially powerful in real estate. Why? Because deductions like depreciation can generate substantial paper losses, particularly in the first few years of owning a property. These losses can be passed on to the members to offset their other income, a classic and effective strategy for building wealth.

Partnership Tax Frameworks

Partnerships also operate on a pass-through basis, so you might be thinking, "What's the actual difference, then?" It all comes down to the details—specifically, the type of partnership and the flexibility baked into the agreement. A general partnership (GP) or a limited partnership (LP) will pass profits and losses to the partners just like an LLC, but the agreement can allow for more creative allocations.

One of the key procedural differences is in tax reporting. Even though the individual partners or members are the ones paying the taxes, the entity itself has to file an informational return with the IRS. For multi-member LLCs and partnerships, this is Form 1065. This form outlines the business's income, deductions, gains, and losses, which are then reported to each partner on their individual Schedule K-1.

Key Insight: The major tax benefit for both JVs and partnerships is avoiding corporate double taxation. Your decision often hinges more on the liability protection and operational simplicity of a separate JV entity versus the ongoing, potentially more flexible nature of a partnership.

A Practical Tax Scenario

Let's walk through a real-world example: acquiring a multifamily property.

- In a Joint Venture (structured as an LLC): The JV entity owns the building. Depreciation on the asset creates a large tax deduction. This "loss" is passed through to the JV members, which can lower their personal taxable income even if the property is cash-flowing positively.

- In a Partnership: The result is largely the same on the surface. But the partnership agreement could get more granular. For instance, it might stipulate complex profit and loss splits, where one partner takes a bigger slice of the early-year losses in exchange for a smaller piece of the profits down the road. This can be customized to fit the financial situations of everyone involved.

No matter which structure you choose, keeping meticulous financial records is non-negotiable for accurate tax reporting. For a solid overview of what you'll need to get organized, this small business tax preparation checklist can be a helpful resource. At the end of the day, though, there's no substitute for running the numbers with a qualified tax professional to see how each structure plays out for your specific deal.

Evaluating Governance Control and Decision Making

When you team up on a real estate deal, one of the biggest questions is: who calls the shots? How you structure your governance answers that question. In the joint venture vs partnership debate, the way control is handled is a massive differentiator, shaping everything from daily operations to long-term strategy.

A joint venture agreement is all about project-specific clarity. It’s designed to meticulously outline each party’s roles, responsibilities, and decision-making power for a single, focused objective. This can feel a bit rigid, but its real purpose is to leave no room for guesswork.

On the other hand, a partnership agreement usually sets up a more flexible, ongoing framework. It’s built for a long-term business relationship, not just one transaction, so it has to be adaptable as the business grows and changes.

Allocating Control and Authority

In the world of real estate syndication, control is rarely a simple 50/50 split. Power is often divided based on what each person brings to the deal—think of it as the classic capital-versus-expertise dynamic. A solid JV agreement will specify exactly which decisions need everyone's sign-off and which ones can be made by a single partner.

For instance, the capital partner might hold veto power over major financial moves like selling the property or refinancing the debt. Meanwhile, the operating partner—the one with the local market expertise—could have total control over day-to-day management, like handling tenant issues and scheduling routine maintenance. This division of labor keeps the project moving forward without bottlenecks while protecting the core financial interests of all involved.

A rookie mistake is thinking that equal investment automatically means equal control. A thoughtfully crafted agreement allocates decision-making authority based on specific roles, giving the expert in any given area the freedom to act while still protecting the capital partner’s investment.

Aligning on Objectives and Resolving Disputes

Good governance isn't just about defining roles; it’s about making sure everyone is pulling in the same direction from the very beginning. One of the top reasons collaborations go south is misaligned goals. A McKinsey study found that 47% of managers believe alignment on objectives is the most critical factor for a JV’s success. That same research pointed to communication breakdowns and a lack of trust for 38% of failures, which really drives home the need for a well-defined governance structure. You can explore the full findings on launching a world-class joint venture to get deeper insights.

Every agreement, whether it's for a JV or a partnership, needs a clear plan for resolving disputes. You have to plan for disagreement. This could look like:

- Tiered Escalation: Requiring partners to try and negotiate a solution first before bringing in outside help.

- Mediation: Involving a neutral third party to help facilitate a conversation and find a middle ground.

- Arbitration: Using a private arbitrator to make a binding decision, which is often faster and less expensive than going to court.

In the end, the structure you pick has to fit the level of control you want and what your partner expects. A JV offers a tight, project-based command structure, while a partnership provides a more durable, relationship-driven model for the long haul.

Choosing the Right Structure for Your Real Estate Deal

Deciding between a joint venture and a partnership isn't just a legal formality; it's a critical business decision that sets the entire tone for your real estate deal. Get it right, and you create a clear roadmap for success. Get it wrong, and you're building in friction and risk from day one. It really all boils down to matching the legal structure to the reality of your deal.

Think of a joint venture as the perfect tool for a one-off, project-specific deal. You're essentially putting together a special-ops team for a single mission—build a property, flip a house, syndicate an apartment complex. Once the mission is complete and you’ve exited the deal, the team disbands. This structure gives you incredible precision and contains all the activity to that one project.

A partnership, on the other hand, is built for the long haul. This is what you choose when you’re building a lasting real estate enterprise with the same group of people. The focus isn’t on a single transaction but on creating a durable business that will acquire and manage a portfolio of properties over many years.

Matching the Structure to the Scenario

This all becomes much clearer when you start looking at real-world situations. Let's walk through a couple of common examples to see which structure makes more sense.

- Scenario 1: Development Project: A seasoned developer with construction know-how teams up with a money partner to build and sell one multifamily complex. This is a classic joint venture.

- Scenario 2: Portfolio Acquisition: A few investors decide to pool their money to buy, manage, and grow a diverse portfolio of commercial properties over the next 10 years. That's a partnership through and through.

The move toward these focused, project-based collaborations isn't just anecdotal. A 2023 McKinsey survey found that a whopping 68% of executives expect their companies' joint venture activity to ramp up in the next five years. This tells us that many of the biggest players prefer agile, targeted structures over broad, all-encompassing mergers. You can find more details on why joint ventures are on the rise on McKinsey.com.

A Practical Decision-Making Framework

To help you map this out for your own deals, I've put together a simple table that connects common real estate plays with the structure that usually fits best. Think of it as a cheat sheet for scoping out your next collaboration.

Choosing the Right Structure for Your Real Estate Deal

The table below outlines a few real-world scenarios syndicators often face and recommends the most logical business structure for each.

Ultimately, this isn't just about legal definitions. It's about aligning your business structure with your strategic intent, ensuring everyone is on the same page from the very beginning.

So, Which One is Right for You?

Choosing between a joint venture and a partnership isn't just a legal formality; it's the very foundation of your deal. There's no magic formula here. The right answer is the one that best fits the reality of your project, your goals, and the relationship you have with your collaborators. Get this wrong, and you're setting yourself up for friction down the road. Get it right, and you’ve built a solid base for success.

Instead of just recapping everything, let's talk about how to actually make the decision. The best way forward is to ask the tough questions before a single document is drafted. A frank, open conversation with your potential partners now can save you from a world of hurt later and ensures everyone walks into the deal with their eyes wide open.

The Pre-Flight Checklist

Grab your collaborators, sit down, and hash out these key points. As you work through them, the right structure—JV or partnership—will almost always reveal itself.

- The Scope: Are we teaming up for a one-and-done project, like a specific value-add renovation on a single property? Or are we building a long-term business to acquire a whole portfolio?

- The Timeline: Does this thing have a natural end date, like when we sell the property in 5 years? Or are we in this for the long haul, with no defined end in sight?

- The Vision: Are we truly on the same page with the business plan? What about risk tolerance and what a "win" actually looks like for this deal?

- The Money: Who's bringing what to the table? How does that cash translate into ownership and, more importantly, who has the final say on major financial decisions?

- The Work: Let's get specific. Who is handling the day-to-day grind of property management, and who is in charge of the books, investor updates, and reporting?

- The Exit: How do we plan to get out of this investment? What’s the trigger for a sale? And what's the protocol if one of us needs to cash out early?

Answering these questions does more than just give you clarity. It's a stress test for the relationship itself. If you can’t find common ground on these fundamental points, the legal structure you pick won't matter—the venture is already on shaky ground.

This isn't just an exercise; it's a framework for making a smart, strategic choice. By mapping your answers to the pros and cons of each structure, you can move forward with confidence, knowing your deal is built to last.

Navigating the world of real estate collaborations can feel like a maze. To help you find your way, here are some straightforward answers to the questions I hear most often from investors weighing a joint venture against a partnership.

Can A Joint Venture Become A Partnership?

Yes, and it happens all the time. Think of a joint venture as a trial run—a way for two parties to test the waters on a specific project.

If you team up to develop a single property and it’s a home run, you might decide you work well together. The logical next step is often to formalize that relationship into a long-term partnership, ready to tackle a whole portfolio of deals. It's a smart way to build trust before making a bigger commitment.

Which Is Better For A Single Real Estate Deal?

For a one-off real estate deal, a joint venture is almost always the right tool for the job. It’s designed from the ground up for a project with a defined scope and a clear finish line.

By setting up a separate LLC for the deal, you build a financial firewall around that single project. This shields everyone’s personal assets from the project’s specific risks—a crucial protection you don’t get with a general partnership. The JV agreement keeps everyone laser-focused on the single goal at hand.

What Is The Main Difference In Liability?

The core distinction boils down to personal risk exposure. In a joint venture structured as an LLC, your liability is limited to what you’ve invested in that specific entity. If things go south, creditors can't come after your personal bank account or home.

A general partnership is a different story. Partners typically face unlimited personal liability. This means you are personally on the hook for all of the partnership's debts. If the business gets into trouble, your personal assets are fair game. This single difference is often the deciding factor for many real estate investors.

Ready to manage your next deal with confidence? Homebase provides an all-in-one platform to streamline fundraising, investor relations, and deal management, letting you focus on what matters most. See how we can support your syndication business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.