Your Guide to Real Estate Limited Partnership

Your Guide to Real Estate Limited Partnership

Discover how a real estate limited partnership works for passive investors. This guide breaks down the structure, benefits, risks, and key legal differences.

Domingo Valadez

Jul 31, 2025

Blog

Ever dreamed of owning a piece of a major commercial property, like an office building or a large apartment complex, but didn't have the millions in cash or the time to deal with tenants and toilets? This is exactly the problem a real estate limited partnership (RELP) was designed to solve.

At its core, a RELP brings together two types of people: a General Partner (GP) who finds and manages the deal, and a group of Limited Partners (LPs) who provide the bulk of the investment cash. In return, the LPs get a share of the profits without the headaches of day-to-day management.

Understanding the Real Estate Limited Partnership

Think of a RELP as a professional team assembled for a single, focused mission: to buy and operate a specific property. The General Partner is the expert coach and quarterback rolled into one. They're the one on the ground scouting opportunities, running the numbers, and executing the business plan from start to finish.

The Limited Partners, on the other hand, are the financial backers. They trust the GP’s expertise and provide the capital needed to make the deal happen, taking a completely passive role. This clear division of labor is the magic of the RELP, offering powerful benefits to everyone involved.

The Two Key Roles Explained

The entire structure is built around these two distinct roles, each with very different responsibilities and, crucially, different levels of risk. Getting a handle on who does what is the key to understanding how a RELP really works.

- General Partner (GP): This is the hands-on operator. The GP is responsible for everything from sourcing the property and performing due diligence to securing the loan and managing the asset until it’s eventually sold. Because they hold all the operational control, they also assume unlimited liability for the partnership's debts and obligations.

- Limited Partner (LP): This is the passive, "silent" investor. An LP's primary role is to contribute capital to the project. They have no say in daily management, and in exchange, their liability is strictly limited to the amount of money they invest.

This setup gives investors a ticket to large-scale real estate projects that would otherwise be out of reach. Of course, once the property is up and running, the partnership relies on expert financial management services to ensure that cash flow, expenses, and investor distributions are handled professionally.

The bedrock principle of a RELP is the protection it offers passive investors. Their personal assets are walled off from the partnership's liabilities, meaning the absolute most they can lose is the capital they put in. It turns an otherwise open-ended risk into a calculated one.

All of these rules, roles, and responsibilities are officially laid out in a critical legal document. You can find a deeper dive into how this works if you learn more about what is a limited partnership agreement.

To make the distinction even clearer, here's a quick breakdown of how the two roles compare side-by-side.

General Partner vs Limited Partner Roles at a Glance

This table provides a quick summary of the key differences in responsibilities, liability, and involvement between General Partners and Limited Partners in a RELP.

As you can see, the structure is designed to let each party do what they do best—the GP manages, and the LPs invest.

The Scale of the Opportunity

The appeal of the RELP is magnified when you consider the sheer size of the market it plays in. Real estate is the largest single store of wealth on the planet, creating an enormous field of opportunity.

As of the end of 2022, the total value of global real estate was estimated at a staggering $379.7 trillion. While that number dipped slightly (2.8%) from the previous year, the market is undeniably massive. Nearly half of that value (47%) is concentrated in North America and Europe, which is where many of these partnerships focus their efforts.

This vast, high-value market means there’s a continuous pipeline of potential deals for GPs to find, analyze, and bring to investors, making the RELP a durable and highly relevant structure for building wealth.

Key Benefits of Investing in a RELP

So, why do so many experienced investors flock to real estate limited partnerships (RELPs)? It really boils down to a powerful mix of protection, simplicity, and access that’s tough to find anywhere else. For anyone who wants to build wealth through property but isn’t keen on becoming a full-time landlord, a RELP can be a perfect fit.

The main advantages center on shielding your personal assets from risk, creating a genuinely passive income stream, and opening the door to institutional-grade deals. Let's dig into what makes each of these benefits so appealing.

Your Personal Assets Are Protected

For any Limited Partner (LP), the single most important feature is limited liability. Think of it as a financial firewall. It creates a solid wall between your personal finances and the business activities of the partnership.

Let’s say the RELP buys a large apartment building and gets hit with a major, unexpected lawsuit. As an LP, your exposure is strictly capped. The most you could possibly lose is the amount you invested. That’s it. Your home, your savings, and your other investments are completely off-limits.

This protection turns what could be a nerve-wracking gamble into a well-defined, calculated investment. You get to enjoy the potential upside of a big real estate deal while knowing exactly what your downside risk is from day one.

Generate True Passive Income

The idea of earning passive income from real estate sounds fantastic until you face the reality of property management. It’s the late-night calls about a leaky faucet, the headache of finding good tenants, and the endless upkeep. That’s not passive—that’s a demanding job.

A real estate limited partnership strips all of that away. Your role is simple: you're the investor.

As a Limited Partner, you are not involved in management. Your job is to provide capital and cash the distribution checks. The General Partner handles every operational detail, allowing you to benefit from property ownership without any of the hands-on work.

This structure allows you to earn from two main sources, both handled entirely by the General Partner:

- Cash Flow: These are the regular checks you receive from rental income after all the bills, like the mortgage and operating expenses, are paid.

- Appreciation: This is the big payout you get when the property is eventually sold for more than it was bought for, capturing its growth in value over time.

This hands-off model is the heart of true passive investing. It frees up your time and mental energy so you can focus on what matters most to you, all while your capital is hard at work.

Access to Larger, More Profitable Deals

Maybe the biggest draw of a RELP is the sheer power of pooled capital. Let’s be realistic—buying a $20 million office building on your own is probably out of reach. But what if 50 investors each put in $100,000? Suddenly, you have a $5 million down payment, which is more than enough to get financing for that kind of premier asset.

This collective buying power opens up a completely different class of real estate. Instead of fighting over single-family homes, you become a part-owner in institutional-quality properties, such as:

- Large multifamily apartment complexes

- Modern medical office buildings

- Busy retail shopping centers

- Sprawling industrial warehouses

These bigger deals often have better financing terms, professional third-party management, and more significant potential for appreciation than smaller properties. They're the kinds of assets typically snapped up by big funds and institutions. A RELP gives you a seat at that table. When projecting a potential deal's upside, a Real Estate Flip Profit Estimator can be useful for modeling the returns on value-add strategies. For the individual investor, gaining this kind of access is a true game-changer.

Understanding the Risks and How to Mitigate Them

While the benefits of a real estate limited partnership (RELP) are pretty compelling, every investment has a flip side. It’s just as important to have a clear-eyed view of the potential downsides as it is to get excited about the upside. For Limited Partners (LPs), the risks really boil down to three things: a lack of liquidity, putting too much faith in the General Partner (GP), and being exposed to the wider market.

Ignoring these factors is a recipe for mismatched expectations and, frankly, financial disappointment. The good news? With the right diligence and a proactive approach, you can manage these risks and invest with a lot more confidence. Let's break down these challenges and what you can actually do about them.

The Challenge of Illiquidity

One of the biggest trade-offs you make as a Limited Partner is kissing your liquidity goodbye. This isn't like buying stocks you can sell with a few clicks. When you invest in a real estate limited partnership, your money is locked in for the long haul.

These deals are structured to be held for a set period, usually somewhere between five and ten years. The partnership agreement almost always includes strict rules that prevent you from easily selling or transferring your interest. There's no public market for these things, so you can't just cash out if you suddenly need the money or have a change of heart.

This lack of liquidity means you have to be absolutely sure you won't need that capital for anything else for the entire life of the investment.

Dependence on the General Partner

As a passive investor, your success is almost completely in the hands of the General Partner. You're placing an enormous amount of trust in their skill, their integrity, and their ability to execute the business plan. This concentration of control in one person or team is a major risk.

If a GP makes bad calls, mismanages the property, or doesn't pivot when the market changes, the whole investment can underperform or even fail. Their expertise in finding the deal, managing the project, and selling at the right time is everything. If the GP drops the ball, there's very little the LPs can do to right the ship.

An investment in a RELP is as much an investment in the General Partner as it is in the property itself. Their track record, communication style, and trustworthiness are non-negotiable elements that demand rigorous scrutiny before you commit any capital.

This is why doing thorough due diligence on the sponsor isn't just a good idea—it's an absolute must for any smart investor.

Exposure to Market Volatility

Even the most buttoned-up business plan can get thrown off course by forces outside the GP's control. Real estate moves in cycles and is sensitive to big-picture economic shifts. A sudden jump in interest rates can crank up borrowing costs and eat into cash flow, while a recession can gut tenant demand and drag down property values.

Just look at the global commercial real estate market recently. In 2023, transactions for income-producing properties fell off a cliff, dropping by a massive 48% to $615 billion worldwide. This sharp downturn was fueled by rising interest rates and economic jitters, proving just how fast things can change.

How to Mitigate Your Risks

These risks are very real, but they aren't deal-breakers. Savvy investors protect themselves by taking deliberate, proactive steps before they ever sign a check.

- Scrutinize the General Partner: Don't get distracted by the shiny property; investigate the sponsor. Dig into their track record, call up references from their past deals, and make sure their investment philosophy truly aligns with your own.

- Analyze the Deal Itself: Get into the weeds of the numbers. Are the projections for rent growth and expenses actually realistic? Does the business plan make sense for that specific asset in that specific market?

- Read Every Word of the Agreement: That partnership agreement is the rulebook for your investment. You need to understand the fee structure, the profit-sharing waterfall, and the exact rights and duties of the GP. If something doesn't make sense, get a lawyer to explain it.

Going beyond the specifics of a limited partnership, it's crucial for any aspiring investor to understand the essential real estate investing tips for beginners and common mistakes to avoid. By making due diligence your priority, you stop being a passive passenger and become an informed, empowered investor.

How a Real Estate Limited Partnership Is Formed

Setting up a real estate limited partnership isn’t something you do on a whim. It's a formal, structured process that takes a potential deal and turns it into a real, investable entity. For a Limited Partner (LP), understanding this process brings transparency. For an aspiring General Partner (GP), it's the essential roadmap to follow. Knowing these steps is key to telling a well-run opportunity from a shaky one.

The whole thing starts with the General Partner. Think of them as the architect of the deal. They're the ones who hunt down and meticulously vet a promising property, making sure it fits a clear investment strategy—whether that's a value-add apartment complex needing a facelift or a stable medical office building that's already churning out income. This initial groundwork is where the foundation for success is poured.

Once a target property is under contract, the GP’s job kicks into a much higher gear, moving into the most critical phase of the whole formation.

The Due Diligence and Legal Framework

This is where the real work begins. The GP launches into an exhaustive due diligence period, which is essentially a top-to-bottom investigation of both the property and its market. This isn't just kicking the tires; it's a forensic-level deep dive into everything that could possibly impact the investment's bottom line.

This deep dive almost always includes:

- Physical Inspections: Bringing in engineers to check the big-ticket items—the roof, foundation, HVAC systems, and the building's overall structural integrity.

- Financial Audits: Going through the current owner’s books with a fine-tooth comb. This means verifying the rent rolls, operating statements, and even old utility bills to confirm the stated income and expenses are real.

- Market Analysis: Double-checking that the projected rent growth and occupancy rates are based on solid market data, not just wishful thinking.

At the same time, the GP is working closely with lawyers to draft the two most important documents you'll find in any real estate limited partnership:

- The Partnership Agreement: This is the legal constitution for the RELP. It spells out everyone's roles, responsibilities, compensation, and exactly how profits will be split between the GP and the LPs.

- The Private Placement Memorandum (PPM): This is the official disclosure document for potential investors. It details the business plan, all the risks involved, background information on the GP, and, of course, the specifics of the property itself.

These legal documents are not just formalities; they are the bedrock of the entire deal. They protect all parties by clearly defining the rules of engagement before a single dollar is invested, ensuring everyone understands their rights, obligations, and the potential risks.

Fundraising and Closing the Deal

With the legal structure built, the GP can finally move on to raising capital. This is the stage where they present the investment opportunity to potential Limited Partners. The PPM is the main document they use to communicate the deal, and anyone interested will subscribe to the partnership by signing the agreement and wiring their funds.

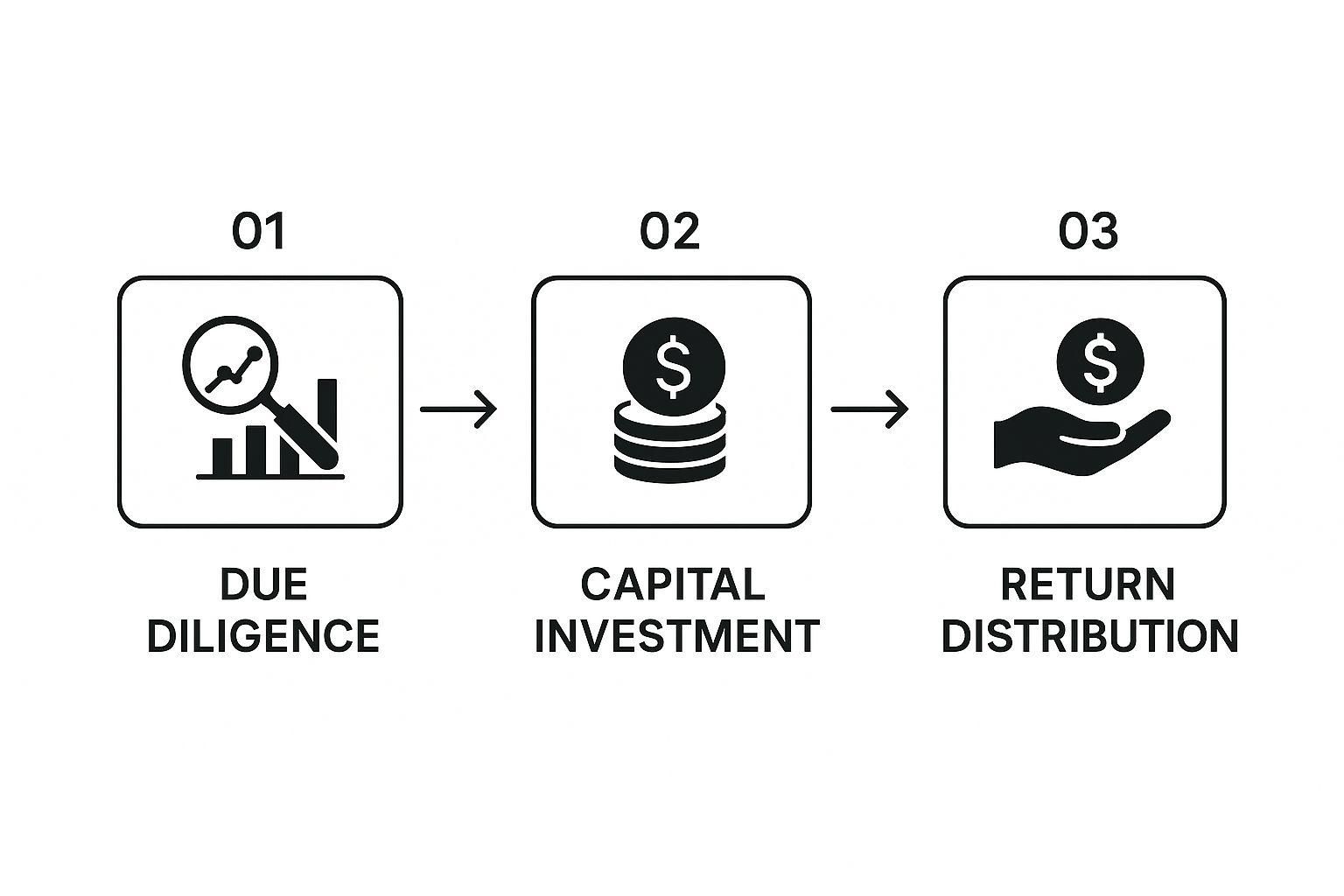

This process is what transforms a deal from a blueprint into a fully funded venture. This visual gives you a simplified look at the flow, from initial analysis all the way to the final payout.

As the infographic shows, the lifecycle of a RELP starts with rigorous analysis, moves to capital commitment from investors, and ultimately leads to the distribution of returns.

Once the total required equity is in the bank, the last step is closing the deal. The capital raised from the LPs gets combined with the loan secured by the GP, and the full amount is wired to the seller. The title to the property is officially transferred to the limited partnership, and at that moment, the GP’s job shifts from deal-making to asset management. Their focus is now on executing the business plan to generate returns for their investors.

RELP vs. LLC for Your Real Estate Investment

When you're putting together a real estate deal, two of the most common business structures you'll hear about are the Real Estate Limited Partnership (RELP) and the Limited Liability Company (LLC). On the surface, they look similar—both can protect you from liability and offer tax advantages. But they are definitely not the same.

The right choice really boils down to what you're trying to achieve with management control, how you define investor roles, and how much flexibility you need.

Think of it like choosing a vehicle for a group trip. A RELP is like a tour bus with a professional driver. The General Partner (GP) is in the driver's seat, following a set route, and the Limited Partners (LPs) are passengers enjoying the ride. An LLC, on the other hand, is more like a shared van. Everyone can take a turn at the wheel, or the group can agree to let one person drive. The destination might be the same, but how you get there—and who’s in charge—is worlds apart.

Liability Protection: A Tale of Two Structures

One of the biggest differences between a RELP and an LLC is how they protect their owners' personal assets. This is a crucial point, as it directly shapes the risk for everyone involved.

In an LLC, the liability shield is uniform. All members of an LLC get liability protection, meaning their personal assets are separate from the company's debts or any legal issues that might pop up. It doesn't matter if you’re running the daily operations or are a completely silent investor; your risk is capped at the amount you invested.

A real estate limited partnership, however, works differently. The protection is lopsided. Only the Limited Partners get that liability shield. The General Partner, who makes all the management decisions, is on the hook with unlimited personal liability for the partnership's debts. This is a huge risk for the GP, which is why you'll often see the GP role filled by another LLC to create a layer of protection.

Management and Control

The way management is handled is another key distinction. A RELP is intentionally rigid and hierarchical, which is actually a good thing for investors who just want to be passive and have no desire to get involved in the day-to-day.

- RELP Management: The General Partner has all the power. They run the show, and the Limited Partners are legally prevented from participating in management. If an LP gets too involved, they risk losing their protected liability status. This setup creates a very clear and fixed power dynamic.

- LLC Management: An LLC gives you much more freedom. It can be member-managed, where all the owners have a say in how things are run, or it can be manager-managed, where the members pick one or more managers to take charge. This is perfect for groups that want to collaborate or define management roles in a more customized way.

The choice between a RELP's strict hierarchy and an LLC's flexible control often comes down to the sponsor's philosophy and the investors' desired level of involvement. A RELP is built for passive capital, while an LLC can accommodate a wider range of investor participation.

Taxation and Profit Distribution

When it comes to taxes, both are typically treated as pass-through entities. This means profits and losses flow directly to the partners or members, who report them on their personal tax returns. This is a big plus, as it avoids the "double taxation" that hits C-corporations.

The way profits are split, however, can be quite different. A real estate limited partnership often uses a complex "waterfall" structure, which is spelled out in the partnership agreement. This model sets a priority for payouts, usually giving the LPs a preferred return first. After that, the GP gets a larger, disproportionate share of the remaining profits, known as carried interest.

While LLCs can also use waterfall distributions, they frequently opt for simpler splits based on ownership percentage. This flexibility lets sponsors design a payout structure that fits the specific deal.

Historically, the RELP model has a track record of strong performance, though it's not without its trade-offs. According to industry analysis, publicly-held limited partnerships have delivered average annualized returns between 10% and 15% over several decades. The catch? These interests often trade at a 20% to 35% discount because they aren't easy to sell. You can find more data on partnership performance at PartnershipProfiles.com.

RELP vs LLC Key Structural Differences

To see these differences side-by-side, it helps to break them down into a simple table. This highlights the core distinctions that will likely drive your decision when choosing a structure for your next real estate investment.

Ultimately, both the RELP and the LLC are powerful tools for real estate investment. The "better" option is the one that aligns with the specific goals of your project, the expectations of your investors, and the level of control the sponsor wants to maintain.

Common Questions About Real Estate Limited Partnerships

Even after you've wrapped your head around the basic structure and benefits, some very practical questions always pop up before anyone writes a check for a real estate limited partnership. It's only natural. Getting clear, straightforward answers is a crucial part of doing your homework and making a smart investment decision.

This section tackles the nitty-gritty details that investors ask me about all the time. We'll cover everything from financial commitments and profit splits to what happens when you need to get your money out. Let's dig in.

What Is a Typical Minimum Investment for a Limited Partner?

This is usually the first question on everyone's mind: "How much do I need to get in?"

The minimum investment to become a Limited Partner can swing pretty widely depending on the deal. However, for most private real estate syndications, you'll typically see a minimum buy-in somewhere between $25,000 and $100,000.

The General Partner (GP) sets this number based on how much capital the project needs and how many investors they want to bring on board. For massive, institutional-quality properties or funds targeting very wealthy individuals, that minimum check size can easily climb much higher.

How Are Profits Distributed in a RELP?

Profit distribution in a real estate limited partnership is rarely a simple 50/50 split. Instead, it almost always follows what's called a "waterfall" structure—a tiered system spelled out in the partnership agreement that dictates the order in which money flows to the partners.

Here’s a common breakdown of how the waterfall works:

- Preferred Return: The Limited Partners (LPs) get paid first. This is a fixed annual return on their investment—often between 6-8%—that must be paid out before the GP sees a dime of the profit share. Think of it as a hurdle the deal must clear.

- Return of Capital: After the preferred return is paid, the next priority is giving the LPs their initial investment back. All available cash flow goes toward this until everyone is made whole.

- The Catch-Up and Carried Interest: Once the LPs have received both their preferred return and their original capital, the GP starts to earn a disproportionately larger share of the profits. This bonus, known as carried interest, is the GP's big reward for executing a successful project.

This waterfall structure is designed to align everyone's interests. It protects the Limited Partners by paying them first, but it also gives the General Partner a powerful incentive to hit it out of the park.

Can I Sell My Interest in a Real Estate Limited Partnership?

The short answer here is almost always no. This is a critical point to understand. Interests in a private real estate limited partnership are highly illiquid. You can't just log into a brokerage account and sell your share like a stock.

The partnership agreement will spell out heavy restrictions on transferring your ownership. Any potential sale would, at a minimum, require the General Partner's explicit approval, which they are often reluctant to give.

Investors should go into a RELP fully expecting to keep their capital in the deal for the entire projected timeline, which is typically 5 to 10 years. This long-term commitment is the fundamental trade-off you make for access to these kinds of private real estate deals.

Managing all the moving parts of a real estate limited partnership—from investor communications and capital calls to complex distributions—can be a huge headache. Homebase is an all-in-one platform built specifically for real estate sponsors to simplify that entire process. We handle the administrative burden so you can focus on what you do best: finding great deals. See how Homebase can support your next project.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

The Ultimate Rent Roll Sample Guide for Real Estate Investors

Blog

Unlock property performance with our rent roll sample. Learn to analyze deals, verify income, and master real estate syndication with our expert guide.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.