Joint Venture Versus Partnership in Real Estate Deals

Joint Venture Versus Partnership in Real Estate Deals

Joint venture versus partnership? Discover the definitive guide for real estate sponsors on choosing the right deal structure for liability, tax, and control.

Domingo Valadez

Nov 14, 2025

Blog

The real difference between a joint venture and a partnership boils down to two things: purpose and duration. Think of a joint venture (JV) as a temporary team-up for a single project with a clear finish line—like developing one apartment complex and then going your separate ways. A partnership, on the other hand, is built for the long haul, designed to acquire and manage an entire portfolio of properties over time.

Choosing Your Real estate Deal Structure

For any real estate sponsor, the choice between a joint venture and a partnership is one of the most fundamental you'll make. It sets the rules for control, liability, and how everyone gets paid. This decision isn't just about legal definitions; it shapes the entire operational DNA of your deal, and getting it right from the start aligns your strategic goals with the legal and financial framework you'll be operating in.

To pick the right path, you need to get into the weeds of what makes each structure tick. This guide is designed to give you clear, practical insights by comparing them across the areas that matter most:

- The scope and timeline of your real estate project.

- Who calls the shots on governance and key decisions.

- Your exposure to risk and personal liability.

- How each structure impacts raising capital and managing investor relationships.

Core Distinctions at a Glance

A joint venture feels like a tactical mission focused on a single asset. A partnership is more like building a lasting company meant for sustained operations. The table below breaks down the high-level differences that will drive your decision.

It's worth noting that JVs have shown some serious resilience lately. Between 2021 and 2022, the worldwide volume of new joint ventures jumped by 13%, a growth rate that outpaced traditional M&A activity, which was struggling at the time. You can dig into more JV and partnership trends to see the data for yourself. This really underscores how attractive JVs have become for their flexibility and focus, especially when navigating a choppy economic climate.

Decoding JVs and Partnerships for Real Estate

When you're deciding between a joint venture and a partnership, you have to get past the textbook definitions. Real estate sponsors need to understand how each structure actually feels and functions on the ground. The right choice really comes down to the scope and timeline of what you’re trying to build.

A Joint Venture (JV) is best thought of as a tactical alliance for a single mission. It’s a temporary team-up, usually formed as a special purpose LLC, bringing a sponsor's expertise together with a capital partner's checkbook for one specific deal. By its very nature, a JV is finite—it exists to get a project done and then it dissolves.

On the other hand, a Partnership, whether it’s a General Partnership (GP) or a Limited Partnership (LP), is built to last. This is the foundation for an ongoing business, not just a one-off project. This structure is for people who share a long-term vision for acquiring and managing an entire portfolio.

Real World Scenarios

Let's put this into practice with a couple of common situations that really drive home the core differences.

Scenario 1: The One-Off Development

A sponsor finds a killer piece of land, perfect for a new 150-unit apartment building. They’ve got the development chops but need to bring in a major institutional investor for the equity. That investor wants a heavy hand in major decisions and a clear exit strategy once the asset is built, stabilized, and sold within five years.

- Structure of Choice: A Joint Venture.

- Why it Works: The JV’s limited scope is the perfect fit. It creates a dedicated legal entity just for this one development, giving the capital partner direct oversight while shielding both parties from outside business liabilities. The built-in endpoint perfectly matches the investor's desire to cash out and move on.

A joint venture is like a specialized tool for a specific job. You use it to accomplish a clear, time-bound objective with maximum focus and then put it away. It’s not meant for building the whole workshop.

Scenario 2: The Portfolio-Building Enterprise

Now, picture a seasoned sponsor with a great track record in value-add industrial deals. Their ambition is to build a portfolio of 15-20 warehouses across the Sun Belt over the next decade. They need to raise capital from various high-net-worth investors who believe in their strategy and are looking for passive, long-term growth.

- Structure of Choice: A Limited Partnership.

- Why it Works: A partnership establishes a durable, scalable business. It lets the sponsor (the General Partner) raise capital and make decisions across many different acquisitions without having to spin up a new legal entity every single time. The Limited Partners get to invest passively, trusting the GP's expertise to grow the portfolio over the long haul.

These examples make it clear that the question isn't about which structure is inherently "better." It's about which one is strategically right for the mission. A single-asset, high-stakes development practically demands the focused alignment of a JV, while building a diversified, long-term portfolio is the natural home of a partnership.

When you're structuring a real estate deal, the choice between a joint venture and a partnership isn't just about legal paperwork. It's a fundamental decision that shapes everything—your control, your risk, and how you (and your investors) ultimately make money. These aren't just technicalities; they are the gears that make the entire deal machine work. Getting this right is about matching the deal's DNA to the right legal framework.

Let's dig into the practical differences that every real estate sponsor needs to understand.

Legal Structure and Formation

The starting point is always the legal foundation. A joint venture (JV) is almost always set up as a limited liability company (LLC) built for a single purpose, like acquiring and repositioning one specific asset. Its rulebook is a highly customized operating agreement. In contrast, a partnership—most often a limited partnership (LP)—is a broader business entity governed by a partnership agreement designed for ongoing activity, not just a single project.

The setup process for a JV is typically an intense, one-on-one negotiation. When you're dealing with just one or two major capital partners, every single clause in that LLC operating agreement gets put under a microscope. This document has to spell out the project scope, capital contributions, and the exact exit strategy with painstaking detail.

Partnerships, especially those built for syndications with many limited partners, tend to use a more standardized agreement. The goal here is to establish a clear, long-term relationship between you, the General Partner (GP), and your passive investors, the Limited Partners (LPs). While still a critical legal document, it’s built for scale and repeatability, not the single-mission focus of a JV.

Governance and Control Dynamics

Control is where these two structures really diverge. In a joint venture, control is almost always shared. If a capital partner is writing a seven or eight-figure check, you can bet they’ll want veto rights over major decisions. We're talking about crucial calls like when to sell, whether to refinance, or approving a major capital improvement budget.

A limited partnership, on the other hand, establishes a very clear chain of command. As the General Partner, you have a fiduciary duty to manage the business, and you hold all the cards for both day-to-day and strategic decisions. Your Limited Partners are passive investors by design; they have no say in management, which is a key protection and feature of this structure. To get a better sense of these roles, you can check out our deep dive on the real estate limited partnership model.

The core difference in control is simple: a JV is a negotiation among near-equals for a single purpose, while a partnership is a clear delegation of authority from passive investors to an active manager for a long-term business.

Liability and Risk Exposure

Protecting your personal assets is paramount, and this is where the LLC structure of a typical JV really shines. Both you (the sponsor) and your capital partner get a liability shield, which means personal assets are off-limits if the project goes south. Generally, your risk is capped at whatever you invested in the deal.

The risk profile in a partnership is a different story. Your Limited Partners get the same liability protection as members in a JV. You, as the General Partner, do not. The GP assumes unlimited personal liability for the partnership's debts and obligations. This is the classic trade-off: you get complete operational control, but you also take on all the risk.

This Investopedia screenshot drives home how a joint venture is a legally separate entity, distinct from the partners' other businesses, which is the key to containing liability.

The big takeaway here is that a JV structure builds a wall around the risk of a specific project. In a partnership, the GP’s liability can jump that wall and extend to personal assets.

Profit Allocation and Tax Implications

The good news is that both structures are typically "pass-through" entities for tax purposes. This means profits and losses flow directly to the members or partners, who report them on their personal tax returns. This setup neatly avoids the double taxation you'd see with a C-corporation.

Where they differ is in how those profits get split.

- Joint Ventures: These often have more straightforward distribution waterfalls that are heavily negotiated between the few partners involved. The splits might be simpler, directly reflecting each party's capital and operational contributions.

- Partnerships: It's common to see more complex, multi-tiered waterfalls here. These typically include preferred returns for investors and various performance hurdles that reward the General Partner for hitting specific return targets.

No matter which structure you choose, maximizing distributable cash flow is the name of the game. A big part of that is reducing operational costs wherever possible to boost returns. The financial engine of a well-run partnership can be incredibly powerful; some mature programs have been shown to generate 28% of a company's total revenue, proving their value as a growth driver. Ultimately, this financial efficiency is what your investors care about most.

Figuring out whether to structure your deal as a joint venture or a partnership isn't just a box to check for the lawyers. It's a foundational decision that can make or break your project, your relationships, and even your long-term business goals. Getting it right means aligning the legal framework with the reality of your deal.

The simplest way to think about it is this: a joint venture (JV) is for a single, specific project with a clear finish line. A partnership is for building an ongoing business. That core difference in intent dictates which structure will serve you best.

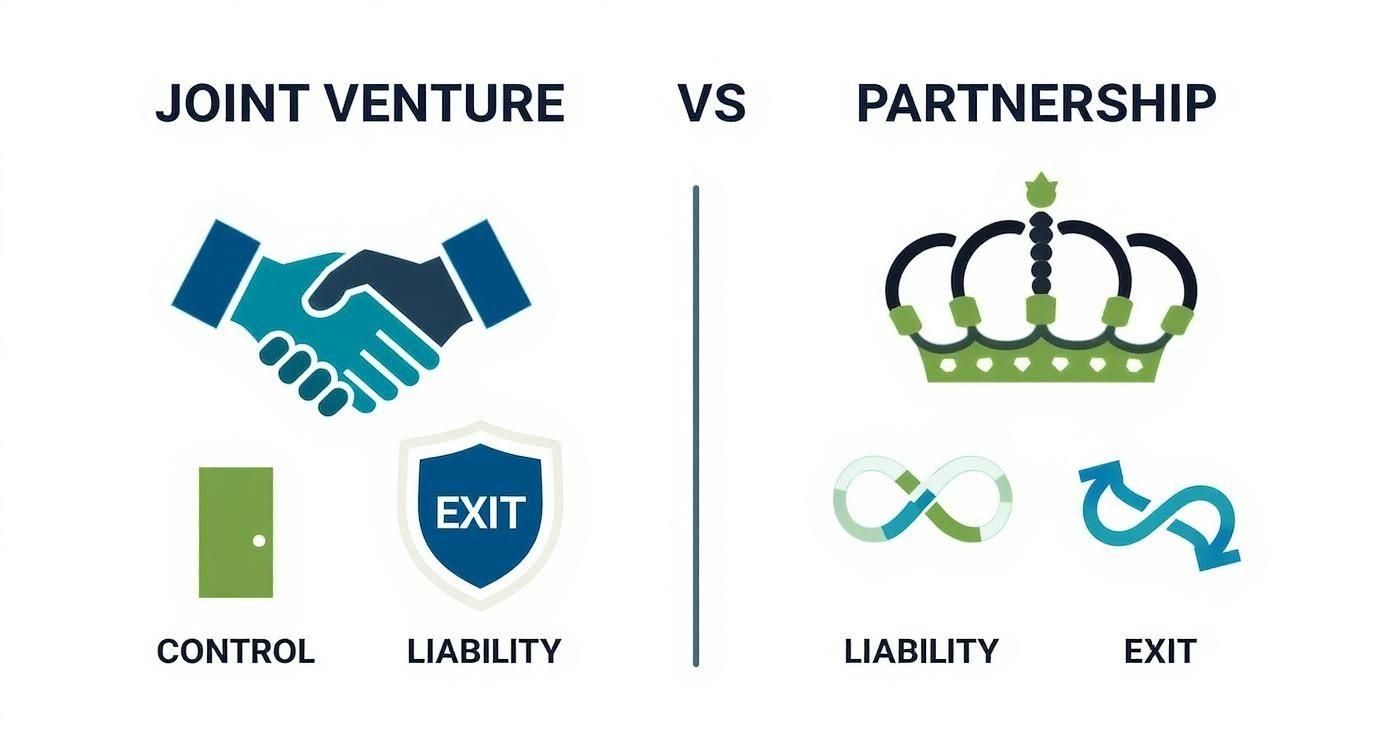

This breakdown highlights the key differences in how control, liability, and the exit are handled in each structure.

As you can see, JVs are all about shared control and contained risk for one deal. Partnerships, on the other hand, are built for a GP to lead and grow a lasting business.

Ideal Scenarios for a Joint Venture

A joint venture is your go-to when the mission is targeted and temporary. It’s the perfect vehicle for bringing your operational expertise together with a capital partner’s checkbook for a single, well-defined purpose.

Here are a few classic real estate scenarios where a JV makes the most sense:

- One-Off Development Projects: Let's say you’ve tied up a great piece of land for a ground-up apartment building. Your capital partner, perhaps an institutional fund, wants a say in major decisions—think design, debt, and when to sell. A JV operating agreement can be meticulously crafted to give them exactly those control rights, but only for this specific project.

- Testing a New Market or Relationship: You're looking to expand into a new city or maybe you're working with a new capital source for the first time. A JV lets you "date before you get married." You can collaborate on a single deal without locking yourselves into a long-term business relationship. If it goes well, you’ve built a solid foundation for future deals.

- High-Risk or Niche Asset Classes: Tackling something complex, like a historic redevelopment or a specialized life sciences facility? A JV allows you to bring in the exact expertise you need. You might team up with a specialized construction firm or a niche operator, creating a single-purpose entity where each party contributes their unique skill set and the project's unique risks are walled off from your other ventures.

A joint venture is a surgical tool. It allows you to align perfectly with a partner for a single objective, giving capital partners the granular control they often demand while containing the project's risks from your other business activities.

When a Partnership Is the Superior Choice

A partnership is the play when you're thinking bigger than just one project. This is the structure for building a real estate enterprise—a scalable platform for acquiring and managing a whole portfolio of assets for years to come.

This is where a partnership structure truly shines:

- Building a Scalable Portfolio: Your business plan involves buying multiple value-add properties over the next five to ten years. A limited partnership lets you, as the General Partner (GP), raise capital from a pool of passive Limited Partners (LPs). You can then deploy that capital across different assets without having to set up a new legal entity every single time.

- Syndicating Deals to Passive Investors: When you're raising money from a group of high-net-worth individuals, they're investing in you and your expertise, not just one building. The LP structure is tailor-made for this. It gives you the authority to execute the strategy while your investors can remain passive.

- Creating a Long-Term, Branded Real Estate Firm: If your vision is to build a reputable real estate investment company with a brand name, a partnership provides the permanent foundation you need. It establishes your firm as a continuous operation, which makes it much easier to build a track record, attract repeat investors, and create lasting equity in your brand.

The confidence in these collaborative models is growing. In fact, 68% of executives now expect their company's joint venture activity to increase, signaling a strong belief in these focused arrangements as a key growth strategy. You can discover additional insights into joint venture growth on McKshey.com and see how this trend underscores the strategic value of picking the right structure for the right opportunity.

How Your Deal Structure Affects Capital Raising

Choosing between a joint venture and a partnership isn't just a legal formality—it's a critical decision that sends a clear signal to potential investors and fundamentally shapes your entire capital-raising strategy. The structure you pick determines who you can attract, how you manage them, and the kind of deal you're ultimately running.

Think of it this way: the legal documentation is your first impression. A joint venture is built on a highly detailed, heavily negotiated operating agreement. It's a bespoke document created for a single asset and a handful of sophisticated capital partners who will want to dig into every clause. This is the world of institutional players.

A Limited Partnership, on the other hand, is designed for scale. The Limited Partnership Agreement is more of a standardized template, making it far more efficient for bringing in a larger group of passive investors who are essentially backing you, the sponsor, and your vision for a future portfolio.

Attracting Institutional vs. Retail Capital

The type of money you want to raise is often the biggest factor in this decision.

Joint ventures are the go-to for institutional capital—think private equity funds, large family offices, or insurance companies. These groups write big checks, and in return, they demand a seat at the table. They want significant oversight and direct control over major decisions for a specific, well-defined asset. A JV gives them that control through veto rights on critical events like a sale, a refinance, or major capital expenditures.

In contrast, the Limited Partnership is the classic vehicle for syndications. It’s perfect when you're pooling capital from many high-net-worth individuals. These investors aren't looking to co-manage the property; they're investing in you and your business plan. They happily delegate authority to the General Partner in exchange for truly passive returns and, crucially, limited liability. This structure is built for efficiently raising capital from a broad base.

The trade-off is simple: institutional partners in a JV offer larger checks in exchange for more control. Retail investors in an LP give up control for passive exposure to your expertise.

Streamlining Investor Relations and Management

No matter which path you take, managing investor communications, documents, and distributions is a huge operational task. As the number of stakeholders grows, so does the complexity. Keeping everything organized is essential for maintaining investor confidence and your own sanity.

This is exactly where modern platforms like Homebase come in. They are designed to handle the administrative lift for both JVs and partnerships, giving you a central place to manage the entire investor lifecycle.

Here’s how it works:

- Professional Deal Rooms: You can set up a dedicated online portal to present your deal, whether it’s a single-asset JV or a new partnership fund.

- Automated Subscription: Investors can fill out and e-sign subscription documents online. The platform can even automate tedious but critical steps like accreditation verification and KYC/AML checks.

- Centralized Communications: Sending out performance reports, important updates, or annual K-1s becomes a one-click task, ensuring everyone gets the same information at the same time.

- Effortless Distributions: You can execute ACH distributions automatically, which removes the headache and potential for human error when paying out returns.

By plugging a tool like Homebase into your workflow, you can focus on what you do best—finding great deals and building relationships—knowing the back-office side of capital management is running smoothly.

Your Go-To Checklist for Structuring the Next Deal

Choosing between a joint venture and a partnership isn't just a legal formality; it's the bedrock of your deal. To get it right, you need a repeatable process. Think of these questions as your strategic filter, helping you match the deal's reality to the right legal framework.

Getting this right from the start turns your structure into an asset, not a future headache.

What’s the Scope and Timeline?

First things first: what are you actually building? Is this a one-and-done ground-up development project you plan to build and sell in three years? A specific, finite mission like that is a perfect fit for a joint venture. The structure is temporary by design, built for a single, focused objective.

On the other hand, if your plan is to acquire and operate a portfolio of properties over the next decade, you're not just doing a deal—you're building a business. That kind of long-term, multi-asset vision is exactly what a partnership is designed for. It gives you a durable, scalable foundation for an ongoing enterprise. Of course, keeping any project on track is key; a solid understanding of preventing scope creep is essential for protecting your timeline and budget.

How Much Control Do Your Capital Partners Need?

This is often the question that settles the entire debate. If you're bringing in a single institutional partner who is writing a massive check, you can bet they'll want a heavy hand in major decisions. They will expect veto rights on a potential sale, a refinance, or any significant budget changes.

A joint venture is built to handle this kind of shared control. But if your investors are passive—coming in because they trust your track record and want you to run the show—a partnership is the clear winner. It consolidates authority with you as the General Partner, letting you make swift decisions across the entire portfolio.

What’s Everyone’s Tolerance for Liability?

You can't afford to get this wrong. A joint venture, which is almost always set up as an LLC, creates a protective liability shield for everyone involved. Both you (the sponsor) and your capital partner are shielded from personal liability beyond what you've invested in the deal.

A partnership, however, creates a two-tiered risk structure. The Limited Partners get liability protection, but as the General Partner, you take on unlimited personal liability for all the partnership's debts and obligations. It's a classic trade-off: in exchange for full operational control, you shoulder a much greater personal risk.

Is This a One-Off Deal or a Long-Term Business Relationship?

Finally, think about the relationship itself. Are you just "dating" a new capital partner on a trial run? A joint venture is the perfect way to collaborate on a single deal without signing up for a permanent business marriage. It’s a low-commitment test.

But if you’re building an enduring real estate firm with a trusted group of investors who are bought into your long-term vision, a partnership is the only way to go. It offers the stability and permanence you need to build a brand and a lasting enterprise.

Frequently Asked Questions

When you're trying to decide between a joint venture and a partnership, a few questions always seem to pop up. Let's cut through the noise and get straight to the practical answers that sponsors need to hear. Getting these fundamentals right is crucial for picking the best structure for your next deal.

What's the Real Difference in Control?

At its core, the difference comes down to who has the final say. It’s a matter of shared authority versus delegated authority.

In a joint venture, control is a negotiated give-and-take. Your capital partner will almost certainly have veto rights on major decisions—think selling the property, refinancing, or approving a huge capital expense. You're working together, but that collaboration means you don't have total freedom.

A Limited Partnership is a completely different ballgame. The General Partner (that’s you, the sponsor) runs the show. Your Limited Partners are passive investors by definition; they hand over the reins and trust you to manage the day-to-day and execute the strategy. This structure is built for decisive, centralized leadership.

Which Structure Is Better for Taxes?

This is a common question, but the answer isn't black and white. Both a joint venture (usually set up as an LLC) and a partnership are typically pass-through entities. This is great because it means the business itself doesn't pay corporate tax. Instead, all profits and losses flow through to the individual members or partners, who report them on their personal returns, avoiding the double taxation you'd see in a C-corp.

So, is one better? Not necessarily. The most tax-efficient choice really depends on the unique DNA of your deal and your investors. You have to look at:

* The specific mechanics of your profit distribution waterfall.

* The individual tax situations of every investor involved.

* The nuances of state-specific tax laws and filing requirements.

A word of caution: Tax implications are highly specific and can get complicated fast. You absolutely must consult with a qualified tax advisor. They can run the numbers and model different outcomes to find the most efficient tax strategy for everyone at the table. This is not a corner you want to cut.

Can a Joint Venture Just Turn Into a Partnership?

It’s a logical thought. A successful JV can build incredible trust and often feels like the start of a long-term partnership. But legally, they are two very different animals. A JV is designed for a single project with a clear finish line, while a partnership is set up for continuous, ongoing business.

You can't just flip a switch and turn a JV into a partnership. The process would involve legally dissolving the single-purpose JV entity and then forming a brand-new partnership entity with a much broader business scope. Think of the JV as a great "test drive" for a relationship; it doesn't automatically morph into a long-term commitment.

Ready to streamline your next real estate deal, whether it's a JV or a partnership? Homebase provides an all-in-one platform to manage fundraising, investor relations, and deal administration, letting you focus on what matters most. Learn more and schedule a demo to see how it works.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

The Ultimate Rent Roll Sample Guide for Real Estate Investors

Blog

Unlock property performance with our rent roll sample. Learn to analyze deals, verify income, and master real estate syndication with our expert guide.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.