How to Value a Commercial Property

How to Value a Commercial Property

Learn how to value a commercial property using proven methods. Our guide covers the income, sales, and cost approaches with real-world examples.

Domingo Valadez

Oct 12, 2025

Blog

Figuring out what a commercial property is truly worth comes down to three core methods: what it earns, what similar properties have sold for, and what it would cost to build from scratch. A solid valuation rarely relies on just one of these. Instead, by combining the Income, Sales Comparison, and Cost approaches, you get a much clearer picture of a property's market value and its potential as an investment.

Decoding Commercial Property Valuation

Valuing a commercial property is part science, part art. The "science" is in the formulas and hard numbers. The "art" is in the experience—reading market trends, understanding a location's quirks, and seeing the potential that isn't on a spreadsheet.

This isn't like valuing a house. Residential real estate is often tied to emotion. But commercial properties? They're pure investment vehicles. Their value is almost entirely linked to their ability to generate cash flow.

Before we get into the weeds of the calculations, it’s essential to understand the three foundational methods appraisers and investors use. Each gives you a different lens to look through, and the real skill lies in knowing which one to lean on for a specific property.

The Three Core Valuation Methods at a Glance

These primary methods are designed to look at a property from every important angle—what it earns, what others like it are worth, and what it would cost to build from scratch. A smart investor never relies on just one.

To put it simply, here’s how they break down:

Each of these methods provides a crucial piece of the puzzle. Let's briefly touch on what makes each one tick.

The Income Approach

This is the bread and butter for most commercial real estate investors. It directly connects a property's value to the money it makes. The core metric here is Net Operating Income (NOI)—all revenue generated by the property, minus all necessary operating expenses.

The Sales Comparison Approach

Often called the "market approach," this method is all about context. It answers a simple but powerful question: "What are people actually paying for properties like this, in this area, right now?" It's a reality check grounded in real-world transactions.

The Cost Approach

This one is a bit more specialized. It's most useful for brand-new buildings or unique properties that don't have many direct comps, like a fire station or a university building. The logic is simple: a property is worth what it would cost to build an equivalent one from the ground up, minus any depreciation.

A savvy valuation today goes beyond the basics. For example, experienced investors are increasingly integrating climate risk assessment tools to price in long-term threats like flooding or wildfires, which can have a huge impact on operating costs and future viability.

Understanding these fundamentals is the first step. For instance, knowing a property's NOI doesn't mean much without understanding the local Capitalization Rate (Cap Rate). The cap rate is what translates that income into value, reflecting the market's current appetite for risk and return. It's how all these pieces fit together that paints the complete financial picture.

Valuing a Property Based on Its Income Potential

When you get right down to it, most commercial real estate investors care about one thing above all else: how much cash a property can generate. This is exactly why the Income Approach is often the most critical tool in an investor's valuation toolbox.

Forget what it would cost to build or what the building next door sold for. The Income Approach cuts straight to the chase by linking a property's value directly to its earning power. It answers the one question that truly matters: "What's this asset's cash flow actually worth?"

This method is the gold standard for income-producing properties like office buildings, shopping centers, and apartment complexes because it forces you to think like an investor. You're not just buying brick and mortar; you're buying a stream of future income. The whole process is about meticulously calculating that income and then figuring out its value in today's dollars.

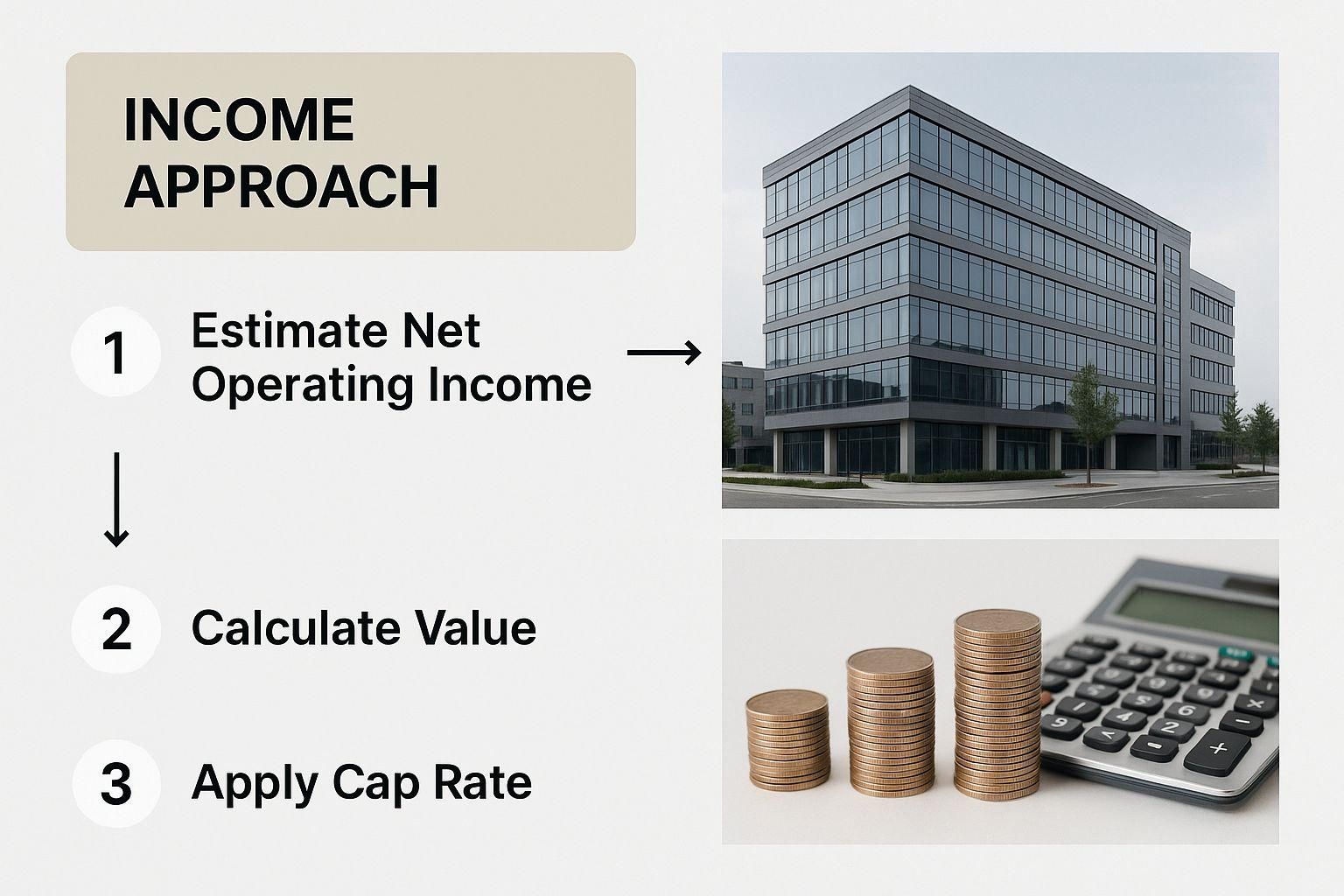

This infographic breaks down the core steps of the Income Approach, showing how you go from a property's theoretical maximum income to its final valuation.

As you can see, it's a methodical process. You start with the absolute best-case-scenario income and then subtract all the real-world costs to land on a number that reflects the property's true earning potential.

Nailing the Net Operating Income (NOI) Calculation

The entire Income Approach is built on one number: the Net Operating Income (NOI). This figure is the property's annual income after you've paid all the necessary operating expenses. It's calculated before factoring in any mortgage payments (debt service) or income taxes. Getting this number right is everything—even a small mistake here will be magnified significantly in your final valuation.

You start with the Gross Potential Income (GPI). Think of this as the property's perfect-world income, where it's 100% occupied all year and every single tenant pays their rent in full and on time.

Of course, we don't live in a perfect world. You immediately have to adjust for reality by subtracting an allowance for Vacancy and Credit Loss. No property stays full forever. Tenants leave, and sometimes, they don't pay. A standard vacancy rate is often around 5-10%, but you have to base this on what's happening in the local market and that specific property's track record. After this deduction, you have your Effective Gross Income (EGI).

Next up, you subtract all the Operating Expenses—every single cost required to keep the lights on and the property running smoothly. It's so important to be thorough here. Forgetting an expense category will artificially inflate your NOI and could trick you into overpaying for the property.

- Property Taxes: One of the biggest and most predictable expenses.

- Property Insurance: You'll need coverage for liability, fire, and other potential disasters.

- Utilities: Even if tenants pay their own, you’ll likely have common area costs for things like hallway lighting or landscape irrigation.

- Repairs & Maintenance: The day-to-day costs of keeping the property in good shape, from fixing leaky faucets to patching drywall.

- Management Fees: Whether you hire a pro or pay yourself for the time, property management is a real cost, typically running 4-8% of the EGI.

- Capital Expenditures (CapEx) Reserves: This is the one people always forget, and it's a huge mistake. This is money you set aside for the big-ticket items down the road, like a new roof, an HVAC system, or repaving the parking lot.

Once you’ve subtracted all of these operating expenses from the EGI, you've finally arrived at the Net Operating Income. For a more detailed look at the nuances of this calculation, check out our guide on the income capitalization approach.

Finding and Applying the Right Cap Rate

With a solid NOI in hand, the final step is to translate that annual income figure into a property value. We do this using the Capitalization Rate, or Cap Rate. In simple terms, the cap rate represents the annual return you'd get on the property if you bought it with all cash.

The formula is incredibly simple but powerful: Property Value = Net Operating Income (NOI) / Capitalization Rate (Cap Rate).

The trick is that you don't just pull a cap rate out of thin air; it's set by the market. To find the right one, you need to look at what similar properties in the same area have sold for recently. If comparable office buildings are trading at cap rates between 6% and 7%, you can't justify using a 5% cap rate for your analysis. It would be unrealistic and lead to an inflated value.

The cap rate is a market-driven metric with a massive impact on value. Take a Class A office building in Austin, Texas, with an NOI of $500,000. If the market cap rate for that asset is 5.5%, its value would be roughly $9.1 million ($500,000 / 0.055).

These rates vary wildly by asset type and location. In 2023, prime industrial properties in hot markets like Los Angeles were commanding cap rates as low as 4.0%. At the same time, a retail center in a smaller, secondary market might trade at 7.5% or higher, reflecting different investor perceptions of risk.

The sensitivity is astounding. A mere 1% change in the cap rate on a property with a $1 million NOI can swing its value by over $3.3 million. It just goes to show how critical it is to get this number right.

Using Market Sales to Ground Your Valuation

While the Income Approach shows you what a property could be worth on paper, the Sales Comparison Approach pulls you back to reality. It answers one of the most fundamental questions in real estate: what are people actually paying for similar properties in the current market?

This method, which many in the industry simply call the market approach, is all about tracking down "comps"—recently sold properties that are as similar as possible to yours. Their sale prices become the foundation for your valuation. It's an indispensable tool that provides a powerful counterpoint to a valuation built purely on spreadsheets and financial projections. Without it, you're just guessing in a vacuum.

Think about it. Your financial model might spit out a value of $2 million based on projected income. But if three nearly identical buildings down the street all sold for around $1.75 million in the last six months, you’ve got a major disconnect. The market is telling you something your numbers aren't.

Finding and Selecting Quality Comps

The entire accuracy of this method hinges on the quality of your comps. Let me be clear: finding a perfect, one-for-one match is a fantasy. The real goal is to get as close as humanly possible. Bad comps will tank your valuation from the start, so don’t rush this part.

When you're hunting for comps, you need to be laser-focused on properties that mirror yours across a few non-negotiable attributes:

- Recency of Sale: Markets can turn on a dime. A sale from two years ago is practically ancient history. You need transactions from the last 6 to 12 months to have any real relevance.

- Location: Real estate is and always will be local. Your comps must be in the same submarket or neighborhood, facing the same traffic, zoning rules, and economic conditions.

- Property Type and Class: You can't compare an industrial warehouse to a retail storefront. It's just as pointless to compare a shiny, new Class A office tower with a dated Class C building that needs a ton of work.

- Size: Stick to properties with a reasonably similar building and lot size. The metrics for a 10,000 sq. ft. property are completely different from those for a 100,000 sq. ft. one.

Key Takeaway: The Sales Comparison Approach is only as reliable as the data you feed it. Garbage in, garbage out. You have to prioritize recent, local, and physically similar sales to build a valuation that can stand up to scrutiny.

The effectiveness of this approach is directly tied to how active the market is. In busy markets with a high volume of transactions, finding solid comps is much more straightforward. For instance, valuing commercial real estate in a dense business district like Manhattan, which can see up to 1,500 transactions annually, provides a rich pool of data. An appraiser might easily find three office buildings that recently sold between $2.5 million and $2.7 million, giving them a strong baseline.

On the other hand, in slower markets like Cleveland or when you're dealing with a unique property, finding direct parallels is tough. This is where the approach becomes more of a challenge. You can find more practical insights on commercial real estate valuation methods on viprealestate.com.

The Art of Making Adjustments

Since no two properties are ever identical, you have to make adjustments. This is where experience and judgment—the "art" of valuation—really come into play. Once you’ve locked down three to five solid comps, your next job is to adjust their sale prices to account for the differences.

Here's the crucial rule: you always adjust the comp's price, not your property's value.

If a comparable property is better than yours in some way (like a recent renovation), you adjust its price downward. If it's inferior (maybe it's on a worse corner lot), you adjust its price upward.

Example Scenario: Valuing a Small Retail Space

Let’s walk through a real-world example. Imagine you're valuing a 5,000 sq. ft. retail building. It's in good shape, but the roof is about five years old. You've found three recent comps that are pretty close:

- Comp A: Sold for $1,050,000. It's almost identical but has a brand-new roof (a superior feature). You need to account for that, so you might make a negative adjustment of -$20,000 to its sale price.

- Comp B: Sold for $980,000. This one is on a less desirable side street with less foot traffic (an inferior location). To bring it in line with your property, you'd make a positive adjustment, maybe around +$40,000.

- Comp C: Sold for $1,000,000. The size and location are perfect, but it has an ancient HVAC system that's on its last legs (an inferior condition). That's a big-ticket item, so you'd make a positive adjustment of +$30,000.

After you've made these tweaks, you have a much tighter and more reliable range of indicated values. This process turns raw sales data into a specific, defensible valuation for your asset and is a core part of learning how to value a commercial property.

When Do You Actually Use the Cost Approach?

The Income and Sales Comparison methods are the go-to tools for most commercial property valuations. They’re fantastic for properties with tenants or plenty of recent sales data. But what happens when you’re faced with a building that doesn't generate income, or is so unique that there’s nothing else like it to compare against?

This is where the Cost Approach shines. It's the valuation method of last resort, but for certain properties, it's the only one that makes sense.

Think about valuing a brand-new community church, a specialized public school, or a government building. You can't use an income analysis, and you'll be hard-pressed to find comparable sales. The Cost Approach gives you a logical framework for determining value in these specific situations.

The fundamental idea is pretty straightforward: a buyer wouldn't pay more for a property than what it would cost to build a similar one from the ground up.

Breaking Down the Cost Approach

Valuing a property this way means looking at it not as a single asset, but as the sum of its parts. It boils down to a three-part calculation that reconstructs the property's value piece by piece.

- Figure out the land's value. First, you have to value the land as if it were empty. The best way to do this is to look at recent sales of similar vacant lots in the area.

- Calculate the cost to build it new. Next, you estimate what it would cost to construct an equivalent building today, using modern materials and methods. This includes everything—labor, materials, and contractor profit.

- Subtract for depreciation. This is the crucial final step. You have to account for any and all loss in value the existing building has experienced over its life. It's much more than just age-related wear and tear.

The Cost Approach isn’t really about what the market is willing to pay. It’s a nuts-and-bolts calculation that answers the question: "What would it cost to replace this asset?"

The Tricky Part: Understanding Depreciation

Depreciation is easily the most subjective and misunderstood element of the Cost Approach. It's not just that the building is getting older. Appraisers meticulously break down value loss into three distinct categories.

- Physical Deterioration: This is the obvious stuff. Think of a roof that needs replacing, cracked pavement in the parking lot, or an HVAC system on its last legs. It’s the tangible decay you can see and touch.

- Functional Obsolescence: This is about design flaws that are outdated by today's standards. Imagine an old office building with ceilings so low they feel claustrophobic, or an industrial warehouse built before modern semi-trucks existed, leaving it with uselessly small loading docks. The building itself is the problem.

- External Obsolescence: This type of value loss comes from outside the property lines. It could be a new zoning law that limits what you can do with the property, the town's largest employer shutting down and gutting the local economy, or a general decline in the neighborhood.

While not the most common method, the Cost Approach is still a vital tool, especially for insurers and municipalities calculating property taxes. Globally, it’s estimated that around 15-20% of commercial valuations rely on this method, particularly in markets with a lot of new construction. For a deeper dive into how this fits into the broader picture, you can discover more insights about commercial property value on exitwise.com.

A Real-World Example: Valuing a Self-Storage Facility

Let’s walk through how this works with a practical example: a three-year-old, 50,000-square-foot self-storage facility.

- Land Value: You’ve researched comparable land sales and determined the two-acre lot is worth $500,000.

- Replacement Cost: Based on current construction costs, you estimate it would take $120 per square foot to build a similar facility today. So, the replacement cost is $6,000,000 (50,000 sq. ft. x $120/sq. ft.).

- Depreciation: The building is nearly new, so physical wear is minimal—let's say $50,000. Its design is modern, so there’s no functional obsolescence. However, a brand-new competitor just opened down the street. This external factor negatively impacts your value, so you estimate $150,000 for external obsolescence. Your total depreciation is $200,000.

Now for the final math:

$500,000 (Land) + $6,000,000 (Replacement Cost) - $200,000 (Depreciation) = $6,300,000

This final number gives you a solid, defensible valuation based on the physical reality and cost of the asset.

Reaching a Defensible Final Value

After running the numbers on the Income, Sales Comparison, and Cost approaches, you'll find yourself looking at three different values. Don't panic—that's completely normal. A professional valuation isn’t about landing on a single magic number; it’s about drawing a well-reasoned conclusion from multiple, distinct data points. This final, crucial step is called reconciliation.

Reconciliation is much more than just taking a simple average of the three values. That's a classic rookie mistake that completely ignores the specific nuances of the property and the current market. Instead, think of it as a thoughtful process of weighing each approach to arrive at a single, defensible figure you can confidently stand behind.

The real skill here is deciding which method deserves the most weight. This decision hinges entirely on the type of property you're valuing and, just as importantly, the quality and relevance of the data you managed to gather for each method.

Weighing the Different Valuation Approaches

I like to think of each valuation approach as a witness in a courtroom. Depending on the case, some witnesses are far more credible than others. Your job is to play the judge and determine whose testimony is the most reliable for the property in question.

While assigning weight is subjective, it must be logical and defensible. To truly get this right, you can apply principles from value engineering, a systematic method for boosting a project's "value." The same mindset applies here: you're building a clear case to justify why one valuation method is more relevant than the others.

Here’s a look at how this plays out in different real-world scenarios:

- For a fully leased office building: The Income Approach is your star witness. The entire reason an investor buys this type of asset is for its cash flow, making its earning potential the most critical indicator of value. The Sales Comparison Approach serves as a strong reality check, but the Cost Approach is largely irrelevant for an established, income-generating building.

- For a new, special-use property like a church: Here, the Cost Approach takes center stage. Since the property doesn't generate income and you'll struggle to find direct sales comps, figuring out what it would cost to replace it becomes the most logical starting point for its valuation.

- For an owner-occupied warehouse: The Sales Comparison Approach is almost always the most reliable method. With no tenants, the Income Approach is purely speculative. The clearest picture of market value will come from finding recent sales of similar industrial buildings in the area.

This practice of weighted reconciliation isn't just a suggestion; it's a mandated practice under global professional standards. In fact, research on appraisal reports shows that in over 85% of commercial property valuations, the final concluded value is within a 5% range of the figure from the most heavily weighted approach. This demonstrates that while all methods are considered, one typically drives the final conclusion. You can find more details on these professional standards on appraisalinstitute.org.

A Practical Reconciliation Example

Let's walk through a tangible example. Imagine you're valuing a 10-unit suburban medical office building. After your analysis, you have the following three values:

- Income Approach Value:$2,500,000

- Sales Comparison Value:$2,700,000

- Cost Approach Value:$2,300,000

A simple average gives you $2,500,000, but that's not how a pro would do it. You need to assign weights based on the credibility of each approach for this specific property.

For an income-generating asset like a medical office, the Income Approach is almost always the most persuasive indicator of value. Investors are buying the stable cash flow from the doctor and dentist tenants. The Sales Comparison Approach is also highly relevant as a market check, but the Cost Approach is the least applicable.

Here’s how an appraiser would likely assign the weights:

By reconciling the values this way, you arrive at a final market value of $2,540,000. This figure isn't just a number—it’s a conclusion backed by a compelling narrative that prioritizes the most relevant data. It shows a deep understanding of how to value a commercial property by building a logical case that mirrors how real-world investors actually think.

Where Valuations Go Wrong (And How to Keep Yours on Track)

Even the sharpest investors can get it wrong when valuing a commercial property, and a small misstep can quickly turn a great deal into a money pit. The key isn't just knowing the right formulas, but also recognizing the common traps that can skew your numbers.

One of the easiest mistakes to make is getting too bullish on future rent growth. It's tempting to project rosy, above-market rent increases, but that kind of wishful thinking can get you into trouble fast. You need to stress-test your assumptions. Ask yourself: what if the market goes sideways and rents don't budge for the next two years? How does that impact my returns?

Another classic blunder is using the wrong cap rate. Simply pulling a generic cap rate from a national report is a recipe for disaster. Cap rates are intensely local and depend entirely on the specific property type, its class, and its current condition. Applying a 5% cap rate when similar local buildings are actually selling at a 6.5% will leave you with a massively inflated valuation.

The Silent Killer: Underestimating Future Costs

If there's one mistake that can truly sink an investment, it's underestimating Capital Expenditures, or CapEx. These aren't your typical operating costs; we're talking about the big-ticket items—the new roof, the complete HVAC overhaul, the parking lot repaving.

Forgetting to budget for a $500,000 roof replacement on a 100,000 sq. ft. building can completely derail your investment, wiping out years of expected profit. When you fail to account for these inevitable future expenses, you're artificially inflating the property's Net Operating Income (NOI) and, by extension, its value.

A revealing study from the Building Owners and Managers Association (BOMA) found that unexpected CapEx is a primary driver of cash flow problems. In fact, nearly 40% of investors admitted their initial budgets fell short by over 25%. You can find more of these crucial property management findings on BOMA.org.

A solid valuation requires a bit of healthy pessimism. You have to scrutinize your own numbers. Poke holes in your pro forma, question every assumption from vacancy rates to repair costs, and build a financial model that's tough enough to handle what the real world throws at it.

Common Questions We Hear

Even after you've got the three main valuation methods down, a few specific questions always seem to pop up. Learning how to value a commercial property is a continuous process, and these answers should help clear up some common hurdles you might encounter.

Does the Buyer's Financing Change My Property's Value?

This is a classic point of confusion, and for good reason. The short answer is no. A property's market value is an independent figure based on its physical and financial attributes—what it is and what it can earn. It has nothing to do with a particular buyer's mortgage.

That said, unusually good financing can absolutely make a property more appealing to a specific buyer, which might convince them to pay more. But this doesn't actually change the property's appraised market value. An appraiser is laser-focused on what a typical buyer would pay, assuming typical financing available in the market at that time.

How Often Should I Get a New Valuation?

The real answer here is, "It depends on what you're trying to do." If you're just keeping an eye on your portfolio's performance, a high-level review once a year is usually enough to catch major market shifts.

But for bigger financial moves, you'll need a formal, professional appraisal. You can't skip it in these situations:

- Buying or Selling: You need a current, defensible number to anchor your negotiations.

- Refinancing: Lenders won't even talk to you without a fresh appraisal to back the new loan.

- Challenging Your Taxes: If you think your property tax bill is out of line, a recent appraisal is your primary evidence for an appeal.

A good rule of thumb I always follow: get a new valuation whenever a major financial decision is on the line. Relying on old data is one of the biggest—and most avoidable—risks you can take.

What's the Deal with AI and Tech in Property Valuation?

Technology is becoming a huge part of the process, but it's a tool to help us, not a replacement for expertise. You’ll see things like Automated Valuation Models (AVMs) that can crunch mountains of data to give you a ballpark figure almost instantly. They're great for a quick first look at a potential deal.

But here’s the catch: an AVM can't walk the property, assess the quality of the tenants, or understand the subtle shifts happening on a specific block. The best valuations today come from blending that powerful tech-driven data with the seasoned judgment of a professional who knows what to look for and how to interpret what the numbers are really saying.

At Homebase, we know that a sharp valuation is just the starting point. Our platform is built to help real estate sponsors handle the entire investment lifecycle—from raising capital and managing investor relations to handling distributions and reporting. We take care of the administrative grind so you can focus on what you do best: finding great properties and building your investors' trust. See how Homebase can streamline your operations.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.