How to Raise Capital for Real Estate: Modern Strategies for Success

How to Raise Capital for Real Estate: Modern Strategies for Success

Learn how to raise capital for real estate with proven modern strategies. Boost your investments today and achieve your real estate goals!

Domingo Valadez

Jul 26, 2025

Blog

So, you're wondering how to raise capital for real estate in today's market. It really comes down to a few core strategies: leaning on your private relationships, syndicating deals to pool investor money, bringing in institutional partners, or going the traditional debt route. The real trick is knowing which strategy fits your specific project and your own experience level.

Your Playbook for Real Estate Capital

Successfully raising money for a real estate deal can feel like a huge mountain to climb, but it's absolutely a skill you can learn and sharpen over time. The funding world today offers more pathways than ever, and it's a lot more sophisticated than just walking into a bank for a loan. Getting a handle on these options is the first real step toward building a real estate business that can actually scale.

At its heart, it’s all about debt or equity. Debt is simple: you borrow money and pay it back with interest, just like a mortgage. Equity, on the other hand, means you're selling a piece of the ownership to partners who share in both the risks and the potential rewards. Most successful deals I've seen use a smart blend of both.

Navigating the Capital Landscape

Different types of properties are magnets for different kinds of capital. You’ll find that resilient assets like multifamily apartment buildings and industrial warehouses tend to attract a lot of attention from institutional partners and private equity firms. Why? Because their stable cash flows and strong market fundamentals are exactly what big money looks for.

This is a critical point to remember when you're crafting your pitch. If you align your project with what investors are currently hungry for, you dramatically boost your chances of getting funded.

The global real estate market is definitely showing signs of life. For instance, direct transaction activity hit about US$185 billion in the first quarter of 2025 alone, which is a 34% jump from the year before. This rebound signals that investor confidence is returning, creating a much better environment for well-structured deals to find funding.

The secret to raising capital isn't just about finding a great property. It's about telling a great story, having a rock-solid plan, and finding the right partners who truly believe in your vision. Your ability to clearly articulate all three is what will make you stand out.

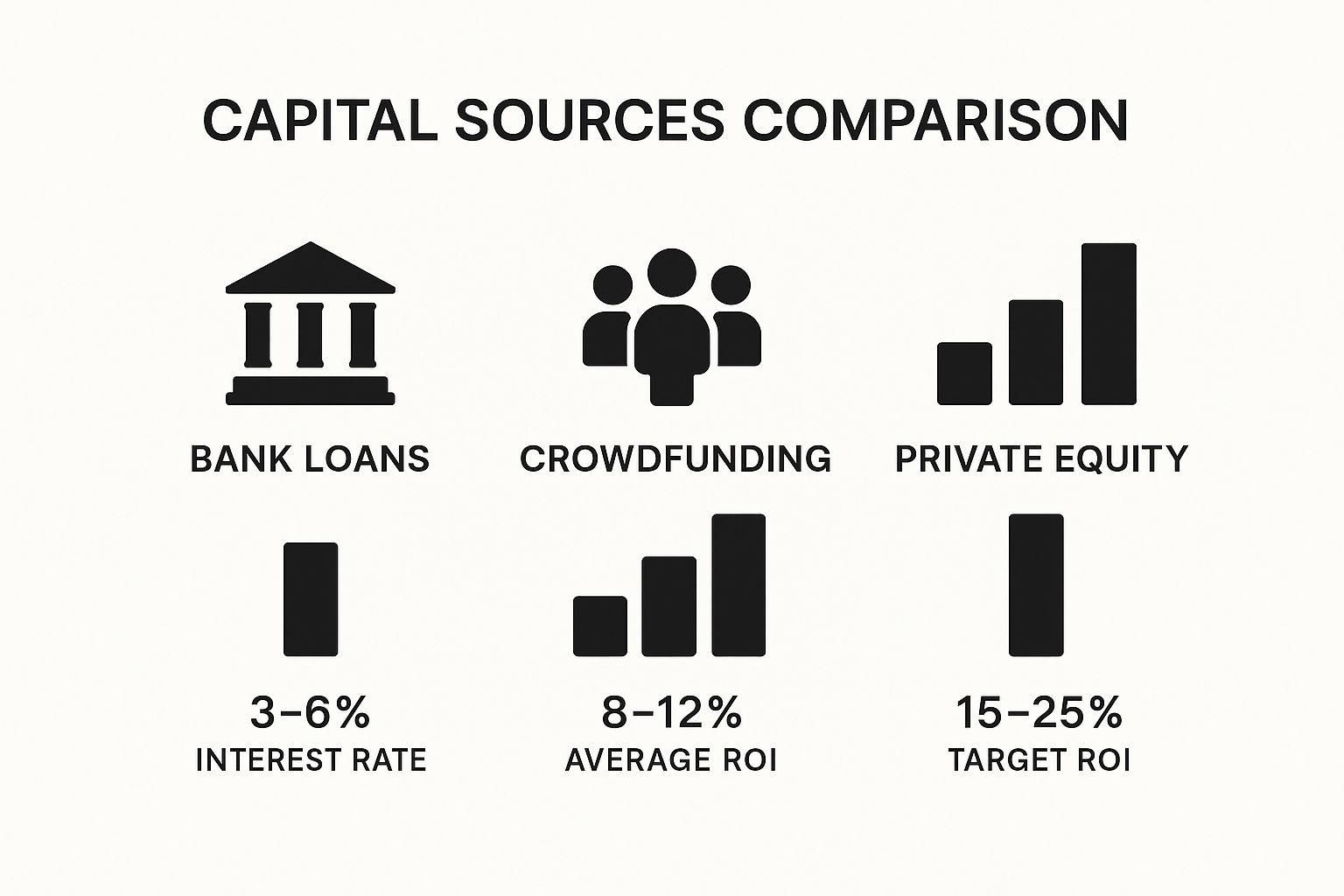

Comparing Your Funding Options

The image below gives you a quick visual on the expected returns or costs tied to three common capital sources.

As you can see, there’s a clear trade-off between risk and return. Higher potential returns from sources like private equity almost always come with higher expectations and mean you have to give up more of your ownership stake.

The path you choose will really depend on the specifics of your deal, your track record, and what you want to achieve in the long run.

To help you sort through this, let's break down the most common funding sources. The table below offers a quick comparison of where you can find capital, highlighting what each is best for and the pros and cons you'll face.

Primary Real Estate Capital Sources At a Glance

Each of these avenues has its place, and many seasoned investors use a combination of them across their portfolio.

As you build your own playbook for real estate capital, remember that understanding the market is everything. For a real competitive edge, consider mastering web scraping for real estate to identify lucrative deals and inform your entire strategy. Think of this guide as your map to navigating these paths and securing the funding for your next big deal.

Building Your Foundation of Investor Trust

Before anyone writes you a check, they’re investing in you. They need to believe you're a credible, professional operator who knows what they're doing. This foundation of trust isn't a "nice-to-have"—it's everything. And you start building it long before you ever ask for capital.

It’s all about showing you’re a pro with a clear vision and an unwavering commitment to protecting their money. This goes way beyond just having a good idea. It starts with hammering out a powerful investment thesis that becomes your North Star.

Think of it as your specific declaration of what you do and why you're the one to do it. Are you focused on buying and renovating underperforming Class B multifamily properties in Sun Belt cities? Or is your specialty ground-up development of last-mile industrial facilities near major ports? A sharp, well-defined thesis tells investors you have a plan and aren't just chasing random "good deals." It proves you understand a specific market inside and out.

Defining Your Investment Thesis

Your investment thesis is the core story of your strategy. It needs to clearly answer what you buy, where you buy, and how you'll make money for your partners. A solid thesis is focused and compelling, giving investors a crystal-clear picture of what they can expect.

Let's look at the difference.

- Vague Idea: "I want to invest in apartment buildings."

- Strong Thesis: "My focus is acquiring 50-100 unit, value-add multifamily properties built between 1980-2000 in suburban Dallas-Fort Worth. We force appreciation through targeted interior renovations and by implementing institutional-quality property management to increase net operating income by 15% over a five-year hold."

See the difference? The second example immediately projects expertise and a repeatable system. When you're figuring out how to raise capital for real estate, that's what gets investors to pay attention. They back operators with a clear, executable plan.

Showcasing Your Track Record and Experience

Your track record is your proof. For seasoned operators, this is simple—you lay out your portfolio of past deals, showing off key metrics like IRR and equity multiple.

But what if this is your first syndication? Don't sweat it. You build credibility by highlighting relevant experience. Maybe you have a deep background in construction management, or you handled asset management for another firm. Even a W-2 job that involved complex project management and financial oversight can be framed to show you have the necessary skills.

Pro Tip: Create a one-page summary of your background that directly connects your past professional wins to the tasks needed to execute your real estate business plan. This helps investors connect the dots, even if you don't have a long list of closed deals yet.

This proactive approach proves you have the operational chops to manage a project. You're showing, not just telling, that you'll be a responsible steward of their capital. Every bit of relevant experience helps build that crucial first layer of trust.

Formalize Your Business with a Legal Entity

One of the most powerful signals of professionalism you can send is to set up a formal legal entity—usually a Limited Liability Company (LLC)—for your operations. Getting this done before you approach investors is a game-changer.

This isn’t just a legal hoop to jump through; it’s a profound statement. It shows you're serious, organized, and already thinking about asset protection. It communicates that you're building a real business, not just pursuing a side hustle.

Forming an LLC accomplishes several key things:

* Credibility: It provides a professional structure for doing business.

* Protection: It separates your personal assets from the business's liabilities.

* Preparedness: It demonstrates you're ready to handle legal and financial responsibilities the right way.

Taking this step early can dramatically shorten the time between getting a "yes" and closing a deal, since the foundational legal work is already done. It’s a simple action that speaks volumes about your commitment and readiness.

Crafting Your Irresistible Investment Pitch

A fantastic deal can fall flat with a weak pitch. Your marketing materials are what connect a great opportunity to an investor's checkbook. You have to think of them less like reports and more like a compelling story—one that earns trust and gets a potential partner to lean in and say, "Tell me more."

It all kicks off with the investment summary, which many in the industry call a "teaser." This is your one-page hook. It needs to be clean, scannable, and give just enough information to make someone want to see the full story in your investment deck.

Think of the teaser as the high-level snapshot that answers the most immediate questions floating in an investor's mind.

- Property Snapshot: You need a high-quality photo, the address, and the key stats like unit count or square footage.

- The Opportunity: In just a sentence or two, what's the play? Is it a value-add renovation, a ground-up development, or a stable asset bought for its cash flow?

- Key Financial Metrics: This is where you flash the headline numbers. Showcase the projected Internal Rate of Return (IRR), Cash-on-Cash (CoC) Return, and the Equity Multiple.

- Capital Request: Be direct. Clearly state the total equity you're raising for the deal.

This single page is your first impression. A professional, data-driven teaser signals that you're an organized and sophisticated operator, making it far more likely an investor will set aside time to review your full presentation.

Building Your Comprehensive Investment Deck

Once your teaser has done its job and snagged their attention, the investment deck (or pitch deck) does the heavy lifting. This is where you lay out the entire story of the deal. So many syndicators make the mistake of just throwing a bunch of facts and figures onto slides. A great deck, however, tells a cohesive story that guides the investor through the opportunity logically and persuasively.

Your deck has to build a case, layer by layer, anticipating and answering every question an investor might have. It's your chance to really show off your deep understanding of the property, the market, and the financial engine of your plan. You're turning raw data into a powerful argument for why this specific deal is a smart place for their capital.

A powerful investment deck doesn’t just present numbers; it builds a narrative. It should walk an investor from the broad market opportunity down to the specific details of how you will execute your business plan and deliver returns. Transparency is your greatest asset here.

The Anatomy of a Winning Pitch Deck

How you structure your deck is critical for clarity and impact. While every deal has its own quirks, a proven flow ensures you cover all the essentials. Think of it as taking your prospective partner on a logical journey.

- Executive Summary: This is a one-slide distillation of the whole opportunity. It's basically an expanded teaser for people who want the highlights first.

- The Property Details: Now you go deeper. Talk about the property's history, its current condition, and specific physical attributes. You absolutely need photos, floor plans, and a site map here.

- Market Analysis: This is where you prove you’ve done your homework. Present real data on the local economy, population trends, major employers, and—most importantly—comparable property sales and rents. You need to show why this submarket is the right place to be, right now.

- The Business Plan: Get into the nitty-gritty of your value-add strategy. What specific renovations are you making? What operational tweaks will you implement? Provide a clear budget and timeline for getting it all done.

- Financial Projections: Lay out your underwriting with conservative, transparent assumptions. This section must have a pro forma, a sources and uses table, and a clear breakdown of projected returns (IRR, CoC, Equity Multiple) over the planned hold period. Including a sensitivity analysis that shows how returns might change under different scenarios adds a ton of credibility.

- The Team: Who are the key players? Introduce the principals and highlight your team's collective experience, track record, and the specific role each person will play in making this project a success.

- The Offer: Spell it out clearly. Outline the investment structure, including the minimum investment, the proposed equity split (e.g., a 70/30 split over an 8% preferred return), and any fees involved.

By following this structure, you build a persuasive argument that's easy for investors to digest. It shows you've thought through every angle of the deal, which is absolutely critical when you're figuring out how to raise capital for real estate. Your deck stops being just a sales document and becomes a testament to your professionalism and expertise.

Finding and Engaging the Right Investors

Alright, you've got your polished pitch deck. Now the real work begins—raising the capital. The goal here isn't to just blast your deal out to anyone with a pulse. It's about surgical, targeted outreach to find partners whose investment goals are a perfect match for your opportunity.

This is where you have to think beyond your immediate circle. Friends and family are a fantastic foundation for your first deal, but scaling a real estate business demands a more systematic way of finding and engaging new capital. Success boils down to knowing exactly who your ideal investor is and, just as importantly, where to find them.

Mapping Your Ideal Investor Profiles

Think of it this way: not all investors are looking for the same thing. They come to the table with different motivations, comfort levels with risk, and expectations for returns. If you don't understand these nuances, your pitch will fall flat. You’re not just selling a property; you're offering a solution that fits their specific financial objectives.

Let's break down a few common investor types:

- High-Net-Worth Individuals (HNWIs): These are often busy professionals—think doctors, lawyers, or tech executives. Their primary driver is often passive income and the significant tax advantages, like depreciation, that real estate provides. When you talk to them, you need to highlight stable cash flow and tax efficiency.

- Family Offices: These groups manage the wealth of a single family and tend to be more conservative. They prioritize preserving capital and generating steady, long-term returns over chasing risky, high-multiple home runs. They love to see a syndicator who is organized, transparent, and has a clear, repeatable process.

- Other Real Estate Operators: Sometimes your best partner is someone who already speaks your language. Bringing another operator into a deal can provide more than just capital; you also get their specialized expertise and a valuable second opinion on your assumptions.

Knowing who you're talking to lets you tailor the conversation. A highly analytical investor will want to pour over every line of your underwriting spreadsheet. Someone else might be more captivated by the story of the neighborhood's revitalization and the vision for the asset.

As you start these conversations, knowing how to qualify potential investors is a game-changer. It helps you focus your time and energy on the people who are genuinely interested and financially capable of investing.

Strategic Networking Beyond Your Inner Circle

Once you’ve defined your target investors, it's time to get out there and meet them. This isn't a passive activity; it requires consistent and proactive effort.

A fantastic starting point is your local Real Estate Investor Association (REIA). These meetings are hotbeds of activity, full of active investors and other industry pros. The key is not to just show up and sling business cards. The real goal is to become a known and valued member of that community. Share what you know, ask smart questions, and build real relationships.

Professional platforms like LinkedIn are also incredibly powerful tools if used correctly. You can establish yourself as a thought leader by sharing content about your market niche, engaging thoughtfully on other professionals' posts, and connecting directly with individuals who match your investor profile. It’s not about a hard sell. It’s about building a reputation as an authority in your space.

To really dig into this, check out our complete guide on how to find real estate investors for more strategies to expand your network.

Key Takeaway: The most successful capital raising happens through authentic relationships built over time. People invest with operators they know, like, and trust. Your job is to become that trusted operator long before you ever ask for a check.

Aligning Your Deal With Current Market Sentiment

Your investment opportunity doesn't exist in a bubble. To truly connect with savvy investors, you have to frame your deal within the broader economic climate.

For example, by early 2025, market indicators began pointing toward a stabilization in global property prices as inflation cooled. In an environment like that, experienced investors start hunting for deals with 'functional relevance'—assets that can be strategically refurbished or repositioned to meet clear, existing tenant demand.

Your pitch needs to show exactly how your project meets this need, proving its resilience and relevance right now. This is a critical piece of the puzzle. By demonstrating that you understand these market dynamics, you build incredible confidence. It shows you're not just a deal-finder, but a strategic operator, positioning you as a safe and intelligent steward of their capital. That’s how you get investors to back you not just on this deal, but on many more to come.

Navigating the Legal and Compliance Maze

So, you've found a great deal and you're ready to bring in investors. This is where things get serious. The moment you take a single dollar from someone else for an investment, you've officially stepped into the world of securities. That world is governed by the U.S. Securities and Exchange Commission (SEC), and they don't mess around.

Getting this part wrong isn't just a simple mistake. It can lead to severe legal and financial penalties that could end your real estate career before it even gets off the ground.

Don't let the legal jargon intimidate you, though. Understanding the basic rules is crucial, and it's more manageable than it seems. Most private real estate deals, like the ones you'll be doing, operate under an exemption from the SEC's full, burdensome registration process. The most common path for syndicators is called Regulation D.

Within Regulation D, you’ll encounter two key options: Rule 506(b) and Rule 506(c). The one you choose will fundamentally shape how you raise money and who you can raise it from.

The Quiet Approach with Rule 506(b)

Think of Rule 506(b) as the "friends and family" route. It's often where new syndicators start. Under this rule, you can raise an unlimited amount of money and bring in up to 35 non-accredited (but financially sophisticated) investors. You can also have an unlimited number of accredited investors.

Here’s the big catch: You are absolutely forbidden from any form of general solicitation or advertising. No public announcements. No email blasts to a purchased list. No social media posts talking about your deal.

You can only raise money from people with whom you have a "pre-existing, substantive relationship." That phrase is critical. "Substantive" means you know enough about them financially to reasonably believe they are a suitable fit for the investment. "Pre-existing" means that relationship was in place before you started pitching this specific deal. Meeting someone at a networking event last week and immediately hitting them up for cash won't cut it.

The Public Route with Rule 506(c)

Rule 506(c) is the complete opposite. This rule lets you advertise your deal to the public. You can shout it from the rooftops—use social media, run ads, host public webinars, whatever you want. This opens the door to a much larger pool of potential investors.

But this freedom comes with a very strict trade-off. You can only accept money from accredited investors, and you are required to take "reasonable steps to verify" that they are, in fact, accredited. This is a big deal. Simply having them check a box on a form is not enough.

Common ways to verify an investor's status include:

* Tax Documents: Looking at recent W-2s or tax returns to confirm their income meets the required threshold.

* Financial Statements: Reviewing bank or brokerage statements to confirm their net worth.

* Third-Party Letter: Getting a formal confirmation letter from their CPA, attorney, or financial advisor.

This verification isn't optional. It’s a mandatory, auditable step for every single person who invests in your 506(c) offering.

Your Most Important Hire: A Securities Attorney

Trying to figure all this out on your own is a terrible idea. Seriously. Your first and most critical move when you decide to raise capital is to hire a qualified securities attorney. This is not a corner you can afford to cut; it’s your best defense against making a ruinous mistake.

An experienced securities attorney does more than just draft paperwork. They're your strategic partner. They'll help you structure the entire deal, pick the right SEC exemption for your situation, and make sure every single step you take is compliant. Think of their fee as your business's insurance policy.

This is the professional who will prepare all your essential offering documents, including:

* Private Placement Memorandum (PPM): The official disclosure document that details the investment, risks, and all terms.

* Subscription Agreement: The legal contract your investor signs to officially join the deal.

* Operating Agreement: The bylaws for the LLC that will own and operate the property.

Spending the money on proper legal counsel from day one isn't just a cost—it's an investment in your company's future and your own peace of mind. It frees you up to do what you do best: find great deals and create value for your investors, knowing your legal foundation is solid as a rock.

From Commitment to Close

Getting that "yes" from an investor feels like crossing the finish line, but it’s really just the start of the final lap. This is where the rubber meets the road. The moments between a verbal commitment and the actual closing will put your professionalism and organization on full display.

A sloppy, confusing closing can undo all the trust you've worked so hard to build. On the other hand, a smooth, professional process cements your reputation and can turn a first-time backer into a long-term partner for every deal you do. Your job now is to make it incredibly simple for them to review documents, sign, and send their money. This is where you prove you’re not just a savvy deal-finder, but a competent operator who respects their time and capital.

Streamlining the Investor Onboarding Experience

A seamless onboarding experience is everything. The second an investor gives you the green light, it's time to shift into a structured closing workflow. This is absolutely not the time for a flurry of emails with random attachments. You need a single, secure system.

A digital data room is non-negotiable. Think of it as a secure online vault where you’ll house all the final legal documents for review and signature. This typically includes:

* The Private Placement Memorandum (PPM), which spells out all the terms and, just as importantly, the risks.

* The Subscription Agreement, which is the formal contract they'll sign to officially invest.

* The Operating Agreement for the LLC that will hold the property.

Giving investors one simple link to a well-organized data room looks far more sophisticated and keeps critical documents from disappearing into a chaotic inbox.

Your investor's closing experience is their first real taste of what it's like to be a partner in your business. A clean, efficient, and transparent process sets a powerful precedent for the entire hold period of the investment.

Managing Q&A and Executing Agreements

Even with the most thorough pitch deck, expect last-minute questions. It’s natural. How you handle them is what matters. Be responsive, be professional, and have a system. You could create a dedicated FAQ section right in your data room or simply be lightning-fast and thorough with your email replies.

Once their questions are answered, it's all about getting the paperwork signed. This is where modern syndication platforms like Homebase become a game-changer. They completely automate these final steps, letting investors e-sign documents right in a secure portal. This eliminates the painful, old-school process of printing, signing, scanning, and emailing.

Not only does this speed everything up, but it also creates a perfect digital paper trail of all signed agreements, which is a lifesaver for compliance. As you navigate these final conversations, knowing how to master sales negotiation skills can be invaluable in getting everyone over the finish line feeling great about the deal.

Securely Handling Funds and Providing Proactive Updates

The last piece of the puzzle is collecting the funds. You have to provide crystal-clear, secure instructions for this. Platforms like Homebase often integrate with services that handle secure ACH transfers, which is a much cleaner and safer alternative to chasing down wire transfers or waiting for checks to clear.

Throughout this entire closing sequence—from sending the subscription documents to confirming their funds have landed—proactive communication is your best friend. Keep your investors in the loop. A quick update like, "Just a heads-up, we've received your signed documents and are just waiting on two more to finalize this round," goes a long way in building confidence.

This isn't just about getting one deal funded. This meticulous attention to detail during closing proves you run a tight ship. And that’s exactly the kind of sponsor good investors want to back again and again.

Frequently Asked Questions

When you're getting into real estate syndication, you're bound to have questions. It’s a complex world, but a rewarding one. Here are some of the most common questions I get from sponsors who are just starting out.

How Much Capital Can I Raise for My First Deal?

This is probably the number one question I hear. For your first syndication, it's smart to think smaller and build momentum. A realistic and manageable goal for a first-time sponsor is to raise between $250,000 to $1 million.

This initial capital almost always comes from your immediate circle—friends, family, and trusted professional colleagues—typically under a 506(b) exemption. By starting this way, you can build a proven track record, demonstrate your ability to execute, and set the stage for much larger deals down the road.

What Is the Difference Between Debt and Equity Financing?

Think of it this way: debt financing is like getting a mortgage. You borrow money from a lender (like a bank), make regular interest payments, and they don't own any part of your property. You maintain full ownership.

Equity financing is bringing on partners. You sell a piece of the ownership in your property to investors in exchange for their cash. They become part-owners, sharing in both the risks and the rewards. The big upside here is you aren't making fixed monthly payments to them.

The most successful real estate deals almost always use a smart mix of both debt and equity. This strategy helps you balance risk effectively while still keeping a significant ownership stake for yourself as the sponsor.

What Fees Are Standard in a Real Estate Syndication?

Syndicators get paid through a few standard fees, which compensate them for their work in finding, managing, and selling the asset. The most common ones you'll see are:

- Acquisition Fee: Typically 1-3% of the property's purchase price for finding and closing the deal.

- Asset Management Fee: An ongoing fee, usually 1-2% of the collected revenue, for overseeing the property and business plan.

- Disposition Fee: A fee of 1-2% of the final sale price when the property is sold.

Ready to stop juggling spreadsheets and start closing deals faster? See how Homebase streamlines every step of your capital raise, from investor onboarding to distributions. Get your demo today!

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.