How to Find a Private Investor & Secure Funding

How to Find a Private Investor & Secure Funding

Learn how to find a private investor with our guide. We share actionable strategies for preparing your pitch, networking, and closing your deal.

Domingo Valadez

Jul 20, 2025

Blog

Before you even think about looking for private investors, you need to get your own house in order. Seriously. Showing up with a half-baked plan is the fastest way to get a "no." Securing private capital is all about building confidence, and that starts with having every single piece of your documentation—from your financial models to your professional website—looking sharp and ready for scrutiny.

This prep work sends a clear signal: you're a serious operator who respects an investor's time and, more importantly, their money.

Getting Your Venture Investor-Ready

Finding a private investor isn’t about having a secret list of names; it’s about what you bring to the table when you finally get a meeting. An unprepared pitch will fall flat with even the most interested investor. From my experience, seasoned investors are looking for well-organized, data-driven opportunities presented by credible, trustworthy people.

Your job is to anticipate every question they might have and build a foundation of trust before you even pick up the phone. This is what separates a fundable deal from a hopeful dream. It flips the script from you needing their money to them wanting a piece of your deal.

Build a Compelling Investment Summary

Forget those generic, fill-in-the-blank templates. Your investment summary needs to tell a compelling story, and that story needs to be backed by hard numbers. This is often the very first document a potential investor will see, so it has to grab their attention immediately. It needs to be concise, crystal clear, and leave them wanting to know more.

Make sure it briefly covers these essentials:

* The Opportunity: What's the asset? Where is it? And why is this the moment to invest in it?

* The Business Plan: How are you going to make money? Lay out your strategy, whether it's through renovations, improving operations, or repositioning the property in the market.

* The Financials: Give them the headline numbers—projected returns, the anticipated hold period, and how much capital you need to raise.

* The Team: Who are the key players? Briefly highlight your team's relevant experience and what makes you the right people for this project.

My Two Cents: Keep this summary to one or two pages, max. Think of it as an "executive teaser." It shows you respect their time while delivering a powerful snapshot of the opportunity.

Document Your Track Record Meticulously

Even if you're just starting out, what you have done needs to be documented with absolute precision. Investors are betting on the jockey, not just the horse. They need to see evidence that you can actually execute a business plan. Create a clean, professional portfolio that showcases every deal you’ve touched, even if you played a smaller role.

For every past project, you should detail:

* Your exact role and what you were responsible for.

* The original plan versus the final outcome.

* The numbers: purchase price, renovation costs, and the sale price or current valuation.

* Visuals and proof, like photos, testimonials, or any data that backs up your success.

This isn't about bragging; it's about transparency. A detailed history proves you are results-oriented and that you’re selling a proven process, not just a dream.

Cultivate a Professional Digital Footprint

Make no mistake, before an investor takes your call, they're going to Google you. Your digital presence is your silent handshake, and it has to scream professionalism and expertise.

Start with your LinkedIn profile. Make sure it's complete, current, and squarely focused on your real estate experience and successes. Go a step further by sharing relevant industry news, posting your own market insights, and engaging in conversations with other professionals. This helps position you as a thought leader, not just another person with their hand out. A polished online presence is doing passive due diligence for you 24/7.

To really stand out, you need to show investors you're thinking bigger than just one deal. They want to see growth potential. For example, understanding the principles behind effective strategies for scaling a service business can show you're building a real company with systems that can handle expansion. Investors love scalability—it's what turns a good deal into a great long-term partnership.

Where to Find the Right Investors for Your Deal

Finding the right private investor isn't about chasing every dollar you can find. I've learned from experience that it’s more like a surgical operation—you need to pinpoint the right capital for your specific deal. A generic, shotgun approach just burns time and, worse, valuable relationships.

The real key is to map out the different pools of capital. Think high-net-worth individuals, family offices, or specialized funds. Your goal is to find the ones that already have an appetite for deals just like yours. This turns your search from a desperate plea into a professional, targeted campaign. You'll work from your closest connections outward, use smart digital tools to find new prospects, and, most importantly, show up where real conversations about deals are already happening.

Start With the People Who Already Know You

Your first ring of potential investors is often hiding in plain sight. I'm talking about your first-degree connections: former colleagues you respected, mentors who guided you, and business partners you’ve worked with. Even friends or family who have seen your drive and understand your capabilities can be a great starting point.

Approaching them isn't about asking for a handout. It's about professionally presenting a solid investment opportunity to people who already trust your judgment.

A warm introduction is infinitely more powerful than a cold email. Someone in your immediate circle might not be an investor themselves, but they almost certainly know someone who is. When you ask for that intro, be specific and respectful of their time and relationship.

- Be Clear With Your Ask: Don't just say, "Do you know any investors?" That’s too vague. Instead, try something like, "I'm putting together a value-add multifamily deal in Austin and am looking for introductions to people who have experience with these types of real estate projects. Does anyone come to mind?"

- Make It Easy for Them: Give them a short, forwardable blurb about your project. This little paragraph makes it simple for your contact to pass the info along without having to interpret your entire business plan.

Professionally Broaden Your Reach

Once you’ve explored your immediate circle, it's time to move to second and third-degree connections. This is where a platform like LinkedIn becomes absolutely essential. I use its advanced search filters all the time to find people with titles like "angel investor," "private investor," or partners at family offices.

The trick is to look for shared connections who can provide that crucial warm introduction. A message from a mutual contact has a much higher chance of getting a response than a shot in the dark. For real estate syndicators, our guide on https://www.homebasecre.com/posts/finding-investors-for-real-estate dives deeper into specific tactics for this.

My Two Cents: The goal isn’t to connect with everyone. It’s to identify a handful of highly relevant potential investors and then figure out the warmest possible path to get in front of them. Quality always beats quantity here.

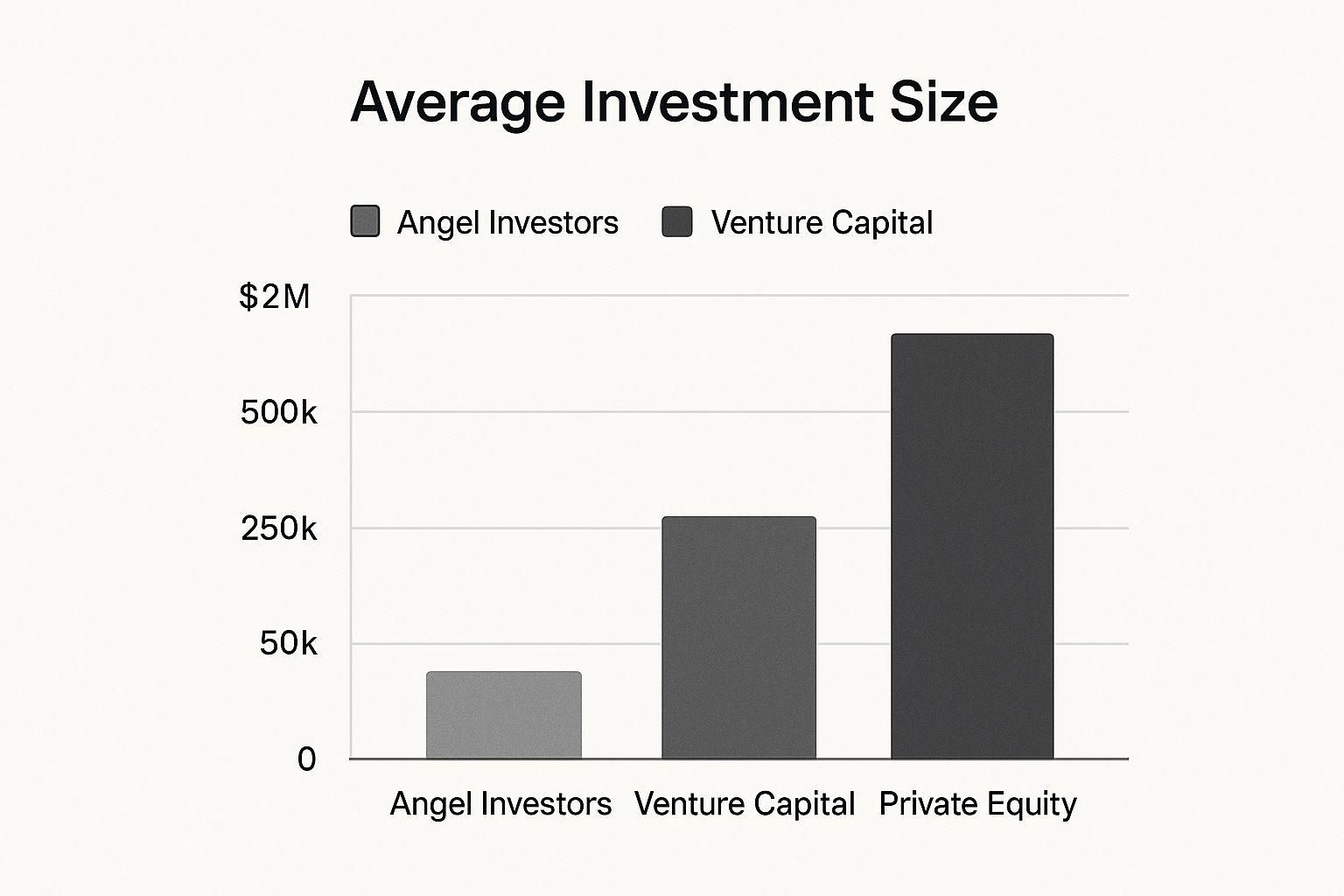

Knowing the typical check size for different investor types helps you focus your search. For instance, angel investors and private equity firms play in completely different sandboxes.

As you can see, private equity firms are built for much larger deals, while angel investors are a better fit if you're raising a smaller, early-stage round. Matching your deal size to the right investor type is step one.

Comparing Investor Sourcing Channels

Choosing where to spend your time and money is critical. Some channels offer wide reach but low conversion, while others are more targeted but require significant effort. This table breaks down the pros and cons I've seen in the real world.

Ultimately, a balanced approach works best. Start with your warm network and then strategically expand into more time-intensive channels as you build momentum.

Put Digital Platforms to Work for You

Beyond simple networking, modern digital tools can give you a serious analytical edge. I rely on industry-standard platforms like Crunchbase and PitchBook to identify and research potential private investors. These databases are goldmines of information, showing you an investor's past deals, their preferred industries, and typical investment sizes.

This research lets you tailor your approach perfectly. When you can open a conversation by referencing a specific past investment of theirs that clicks with your project, you immediately signal that you’ve done your homework. It’s an incredibly powerful way to stand out from the noise.

Show Up Where the Deals Are Made

Digital tools are fantastic, but nothing truly replaces a face-to-face conversation. That said, don't just blow your budget on the largest, most generic conferences. Instead, seek out niche industry events, local real estate investor meetups, and specialized symposiums.

These smaller, more focused gatherings attract a self-selected group of serious players who are there to do business. The conversations you'll have are often more direct and substantive. Historically, real estate has always been a relationship business, and these communities are where those relationships are forged. Making a genuine connection at a small roundtable or a local association meeting is far more valuable than a fleeting exchange at a massive trade show.

Making First Contact That Gets a Response

This is the moment of truth. An investor's inbox is a battlefield, and a generic, copy-pasted email is the fastest way to get your proposal sent to the trash. A strong first impression isn't just a nice-to-have; it's a fundamental requirement if you're serious about finding private investors.

Your initial outreach has to be sharp, respectful, and immediately show you’ve done your homework. The goal isn't to walk away with a check. It's simply to earn the right to a five-minute conversation.

The Power of a Warm Introduction

There's no contest: the single most effective way to reach a potential investor is through a warm introduction. When a trusted mutual connection vouches for you, you instantly sidestep the wall of skepticism that every cold email faces. Investors are busy people, and they rely on their networks to filter out the noise.

But how you ask for that introduction is everything. A lazy, vague request like, "Do you know any investors?" puts all the work on your contact and is almost guaranteed to go nowhere.

Instead, get specific and be professional. Try an approach like this: "I’m raising capital for a value-add multifamily property in Phoenix, and I noticed you're connected with Jane Doe on LinkedIn. Given her background in real estate, would you feel comfortable making a brief introduction?"

This simple script works wonders because it:

* Proves you've done your research.

* Gives your contact a clear, low-effort task.

* Shows respect for their relationship with the investor.

My Pro Tip: Always arm your contact with a short, forwardable blurb about you and your deal. This "mini-pitch" makes it incredibly easy for them to pass your information along, which dramatically increases your odds of getting that intro.

Crafting Cold Outreach That Feels Warm

Sometimes, a warm introduction just isn't in the cards. That’s when you need to master the art of cold outreach—and no, that doesn't mean spamming a generic template to a hundred people. Effective cold outreach is all about deep personalization and offering value before you ask for anything in return.

Your mission is to prove you understand their world and have something relevant to share. A quick look at their portfolio, a recent interview they gave, or a panel they spoke on can give you the perfect opening.

Here’s how a personalized opening might look:

"Hi John, I saw your recent panel discussion on the future of industrial real estate and was particularly struck by your comments on last-mile logistics. Your insight aligns perfectly with a data point I found showing a 22% increase in demand for small-bay warehouses in the Midwest, which is the focus of my next acquisition."

This opener is so effective because it hits three key points:

1. It shows you did your homework: Referencing a specific activity proves you're not just blasting out emails.

2. It offers value upfront: You're sharing a relevant piece of data, not just asking for their time.

3. It builds immediate rapport: You're connecting their expertise directly to your opportunity.

Only after establishing this common ground should you briefly introduce your project and make a soft ask. Something like, "Would you be open to a brief 10-minute call next week to discuss this trend further?"

From First Meeting to Serious Pitch

You got the meeting. Congratulations! Whether it’s a quick coffee or a formal video call, your primary goal is to build rapport and qualify their interest—not to unleash a full-blown pitch deck. Remember, this is a two-way street. You're vetting them just as much as they're vetting you.

Start by making the conversation about them. Ask about their investment thesis, what kind of deals they get excited about, and their biggest frustrations in the market. This frames you as a potential partner, not just another syndicator with their hand out.

As the conversation flows, you can naturally pivot to your deal by connecting it to their stated goals. For instance, if they mention they’re looking for cash-flowing assets, that’s your cue.

You can then say, "That’s great to hear, because our projected Year 1 cash-on-cash return for this deal is 8.5%, which sounds like it fits perfectly with what you're looking for."

This approach makes your deal feel like a collaborative solution, not a hard sell. You’re not just pitching; you're presenting an opportunity that solves their problem. Your ability to find a private investor often comes down to this subtle but crucial shift from "selling" to "solving."

Delivering a Pitch That Resonates and Persuades

Alright, you’ve done the heavy lifting—the research, the networking, the outreach. Now comes the moment of truth. This is where a potential deal becomes a closed deal, and it all hinges on your pitch. Once you have an investor's attention, your presentation needs to do more than just lay out the facts; it has to inspire genuine interest and, ultimately, a firm financial commitment.

A great pitch isn't a dry recitation of data. It's a compelling story that builds trust and creates a palpable sense of a can't-miss opportunity. The trick is to move beyond just describing what your deal is. You have to skillfully explain why it's a fantastic opportunity, why now is the perfect moment to act, and most importantly, why you are the only person they should trust to get it done.

Weaving a Story That Sells

Your pitch needs a clear, persuasive arc. Don't just bombard investors with numbers. Instead, lead them on a journey that begins with a clear problem or untapped opportunity and concludes with your deal as the undeniable solution. This narrative structure makes complex information much easier to digest and connect with on an emotional level.

I like to think of it as a three-act play:

- The Setup: Kick things off by clearly defining the market opportunity or the specific problem the property currently faces. Back it up with hard data. For instance, "The submarket has a 98% occupancy rate for Class B multifamily, yet our target property is limping along at 82% due to absentee management."

- The Conflict: This is where you introduce your unique solution—your business plan. Detail the specific, actionable steps you'll take to close that performance gap. This could be targeted renovations, new operational efficiencies, or a revamped marketing strategy.

- The Resolution: Finally, you bring it all home by showing them the money. Connect your plan directly to the financial projections, illustrating precisely how your actions will drive up income and lead to a profitable exit for everyone involved.

Presenting Financials with Unshakable Confidence

Your financial projections are the heart of your pitch, but this is also where many syndicators stumble. An investor needs to believe not just in the numbers themselves, but in your command of them. When you present that pro forma, you have to own every single assumption.

Instead of just flashing a spreadsheet, walk them through the "why" behind your key metrics. Explain your rent growth assumptions by pointing to specific market comps. Justify your renovation budget with actual quotes you've secured from contractors. This level of detail proves your projections are grounded in reality, not wishful thinking.

A savvy investor once told me, "I don't invest in spreadsheets; I invest in people who understand their spreadsheets." Your confidence in the numbers is a direct reflection of your competence as an operator. Be ready to defend every line item.

To really nail this part of the conversation, it helps to master persuasive writing techniques. This skill is crucial for framing your narrative and making your data-driven points stick.

Handling Tough Questions and Acknowledging Risk

Every smart investor is going to look for the weak spots. They want to know the risks. Don't shy away from these questions—embrace them. This is your chance to showcase your foresight and preparedness. A truly great pitch anticipates the tough questions and addresses them head-on before they're even asked.

Common Investor Questions to Prepare For:

* What happens if construction costs run over budget?

* How will you handle a market downturn or rising interest rates?

* What are the three biggest things that could go wrong with this deal?

* Why shouldn't I just invest with a more experienced operator?

Have solid, well-reasoned answers ready to go. Talk about your contingency plans, how you've stress-tested the financials, and the specific risk mitigation strategies you have in place. Being transparent about potential risks and showing you have a plan to manage them builds immense credibility. It proves you're a prudent steward of their capital, not just an overly optimistic salesperson. Frankly, showing you’ve thought through the downsides is often more persuasive than only focusing on the upside.

From Handshake to Hard Money: Nailing Due Diligence and Closing Your Deal

Getting a verbal "yes" from an investor is a great feeling, but don't pop the champagne just yet. You've just entered the final, most crucial phase: due diligence. This is where the deal is either made or broken. Your ability to handle this stage with speed, professionalism, and absolute transparency will determine whether that handshake turns into a funded investment.

Momentum is everything here. An investor's excitement can evaporate if they hit roadblocks, disorganized documents, or what feels like evasiveness. Your job is to make it incredibly easy for them to confirm everything you've told them and sign on the dotted line. This is your chance to prove you're not just a good storyteller, but a competent and trustworthy operator who can execute.

Your Digital Data Room: The First Impression

Long before an investor asks for a single document, you need a secure, perfectly organized virtual data room ready to share. This isn't just a junk drawer for PDFs; it’s a meticulously structured library that screams preparedness. A messy data room hints at a messy operation.

Think like an investor. What would they want to see first? Organize your files into clear, top-level folders:

- Corporate & Legal: Your LLC formation docs, operating agreements, and any existing partnership paperwork.

- The Numbers: The detailed pro forma, historical P&L statements if it’s an existing asset, current rent rolls, and any third-party financial audits.

- Property Docs: The fully executed purchase and sale agreement (PSA), title report, zoning info, and the property survey.

- Third-Party Reports: Every inspection you've commissioned—environmental, physical, market analysis, the works.

- The Team: Professional bios and track records for every key principal involved.

Get ahead of their questions. If you have renovation bids from contractors, put them in a subfolder. If you've pulled market comps to back up your rent projections, make them impossible to miss. This kind of proactive organization builds massive confidence.

My personal rule is simple: if an investor requests a document and it takes you more than five minutes to find it, you’re not ready. A well-oiled data room is non-negotiable for anyone serious about raising private capital.

Keep the Information Moving

Once you grant access, the questions will start flowing. Managing this back-and-forth is critical. You need to respond with a sense of urgency. A quick, well-thought-out answer shows you respect their time and know your deal inside and out.

Remember, investors are ultimately vetting you as an operator who can protect their capital and deliver returns. This has never been more true. While the private equity world has seen some fundraising headwinds lately, it’s also seen a spike in distributions back to investors—outpacing capital calls for the first time since 2015. This tells us the market has a laser focus on actual performance. For a deeper dive, check out the latest findings in this global private markets report. Your professionalism during due diligence is a direct preview of how you’ll perform.

Bringing in the Legal Pros

As you get deeper into the weeds, your attorney becomes your most important ally. They are absolutely essential for drafting and negotiating the term sheet and the final subscription documents. Trying to DIY the legal side to save a few bucks is a classic rookie mistake that can cost you the entire deal, or worse.

Work hand-in-glove with your lawyer to dissect every clause. The term sheet lays out the core economic and control rights of the partnership. While you obviously want to protect your own interests, this is a negotiation, not a war. The real goal is to structure a win-win that aligns everyone for the long haul.

You can expect to negotiate these key points:

- Preferred Return: The hurdle rate investors earn before the sponsor gets a cut of the profits.

- Profit Splits (The "Promote"): How the profits are carved up after the preferred return is paid out.

- Sponsor Fees: Your compensation for finding the deal (acquisition fee), managing it (asset management fee), etc.

- Control Rights: Big decisions—like selling or refinancing—that might require investor approval.

Come to the table with a collaborative mindset. Don’t just state your terms; explain the "why" behind them. If you’re asking for a 2% asset management fee, justify it by detailing the hands-on work required. A successful negotiation isn't about winning every point. It’s about building a fair, attractive structure that makes your new private investor confident they’ve found the right partner. This final step is what solidifies a profitable, long-term relationship.

Common Questions I Hear About Finding Investors

Even with a perfect deal in hand, stepping into the world of private capital can feel like navigating a maze. I get it. Over the years, I've seen countless syndicators and entrepreneurs grapple with the same set of questions when they're first starting out. Let's break down some of the most common ones with real-world answers to give you some clarity.

How Long Does Fundraising Actually Take?

There's no magic number here, but I can tell you this: it almost always takes longer than you think. For a solid, well-prepared real estate deal, you should realistically budget for a three to six month fundraising timeline. That's not just for the initial pitch; it covers the whole nine yards—the outreach, the follow-up meetings, the deep-dive Q&A sessions, due diligence from their side, and finally, getting the legal docs signed.

Delays are the rule, not the exception. Trying to rush it is a classic rookie mistake that can force you into accepting bad terms or making sloppy errors. My best advice? Start raising capital long before the clock is ticking. You want to be negotiating from a position of strength, not desperation.

My Two Cents: Don't just plan for the raise; plan for the follow-up. The bulk of your time isn't spent on the initial pitch. It’s spent on the back-and-forth—managing the conversations, answering detailed questions, and chasing down the paperwork that gets you to the finish line.

How Should I Handle Getting a "No"?

Hearing "no" is just part of the game. You have to learn not to take it personally. A rejection is almost never about you or your potential. It’s usually a matter of fit. Your deal might not match an investor's current strategy, their appetite for risk, or how it balances with the other assets in their portfolio.

Every "no" is a chance to get smarter. When it happens, always try to politely ask for feedback. Was it the market? The deal's structure? The projected returns? That kind of direct insight is gold and will sharpen your pitch for the next person you talk to. A professional, graceful response also leaves the door open. You never know when they might be a perfect fit for a future deal.

What's the Real Difference Between Angels, VCs, and Family Offices?

Knowing who you're talking to is crucial. These three investor types operate in completely different worlds with unique motivations.

- Angel Investors: Think of these as wealthy individuals who are investing their own personal capital. They're often more flexible and willing to get in on earlier stages, but the checks they write are typically smaller.

- Venture Capital (VC) Firms: VCs are professionals investing other people's money from a large, managed fund. They are hunting for massive, explosive growth and need to see a clear exit strategy, usually within a 5-10 year timeframe.

- Family Offices: These are private wealth management firms that handle the fortune of a single, ultra-high-net-worth family. They often think in terms of generations, not years, and can be more patient with their capital. Sometimes, their primary goal is preserving wealth rather than just aggressive growth.

Bringing in investors and keeping them happy involves a ton of moving parts. Homebase is a platform built to streamline that entire lifecycle, from launching your deal and getting investors verified to managing distributions and reporting. It lets you ditch the messy spreadsheets and focus on what you're best at—finding great real estate deals. Learn how Homebase can help you scale your real estate business today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.