How to Finance Apartment Buildings

How to Finance Apartment Buildings

Discover how to finance apartment buildings with our guide on securing loans, raising capital, and navigating the underwriting process for multifamily deals.

Domingo Valadez

Oct 7, 2025

Blog

Financing an apartment building isn't just about finding a lender. The real work starts long before you ever make that first phone call. It all comes down to building a rock-solid foundation that transforms your deal from a good idea into a genuinely fundable project.

This means you need to get intimate with the numbers—mastering metrics like Net Operating Income (NOI), understanding the local cap rate, and weaving it all into a compelling investment story. Honestly, getting this groundwork right is the most critical part of the entire financing process.

Building Your Foundation for Multifamily Financing

Before a lender will even glance your way, the success of your deal rests on your preparation. Think of it this way: lenders aren’t just funding a property; they're investing in your business plan for that property. This initial phase is all about building an undeniable case that proves the deal's viability and, just as importantly, your ability to execute the plan.

A strong starting point is a comprehensive feasibility study. This document becomes your blueprint. It lays out everything from your deep-dive market analysis to your detailed financial projections, giving lenders the hard data they need to feel confident moving forward.

Mastering the Core Financial Metrics

Lenders speak the language of numbers, so you need to be fluent. Your ability to accurately calculate and confidently explain these core metrics is what separates the pros from the amateurs. It instantly signals your competence.

Three metrics, in particular, form the bedrock of any serious multifamily deal analysis:

- Net Operating Income (NOI): This is your property's total income minus all operating expenses (but before you account for loan payments). It’s the purest measure of a property's raw profitability.

- Capitalization (Cap) Rate: You get this by dividing the NOI by the property's purchase price. For a lender, the cap rate is a quick-glance tool to gauge the potential return and assess risk compared to other properties in the same market.

- Cash-on-Cash Return: This metric shows the annual pre-tax cash flow you'll get back relative to the total cash you actually invested. It cuts straight to the chase and answers the investor's favorite question: "What return am I getting on the money I put in?"

Before you even think about approaching a lender, you need to have a firm grip on the key financial ratios they'll be scrutinizing. This table breaks down the essentials.

Essential Metrics for Your Loan Application

A quick look at the critical financial metrics you'll need to master before approaching any lender for an apartment building loan.

Having these figures calculated, double-checked, and ready to discuss will immediately put you in a stronger position with any potential lending partner.

A deal without solid numbers is just an expensive hobby. Lenders won't fund a story; they fund a well-supported financial projection. Getting your NOI and cash-on-cash return calculations right is the first test you must pass.

Crafting a Compelling Investment Thesis

Beyond the raw numbers, lenders want to understand the story behind your deal. Your investment thesis is a concise narrative that explains why this property, in this market, at this time, is a smart investment.

It should clearly lay out your strategy. Are you planning a value-add play to renovate units and bump up the rents? Or is this a long-term hold in a stable, steadily growing neighborhood? Be specific.

You can strengthen your thesis by tying it to broader market trends. For instance, the demand for rental housing remains incredibly robust, partly because high home prices are keeping many people in the rental market. This has fueled significant rent growth, with national effective rents climbing more than 20% compared to pre-pandemic levels. Weaving data like this into your story shows lenders you've done your homework and understand the bigger picture.

Choosing the Right Apartment Building Loan

Financing an apartment building is far from a one-size-fits-all game. The loan you pick will fundamentally shape your deal's structure, your potential profits, and even your exit strategy. I’ve seen investors get stuck with unfavorable terms that choked their value-add plans, while others used the right loan to fast-track their profitability.

This isn't just about chasing the lowest interest rate. It's about a strategic match. You need to align the loan's characteristics—its term length, flexibility, and specific requirements—with what you plan to do with that exact property.

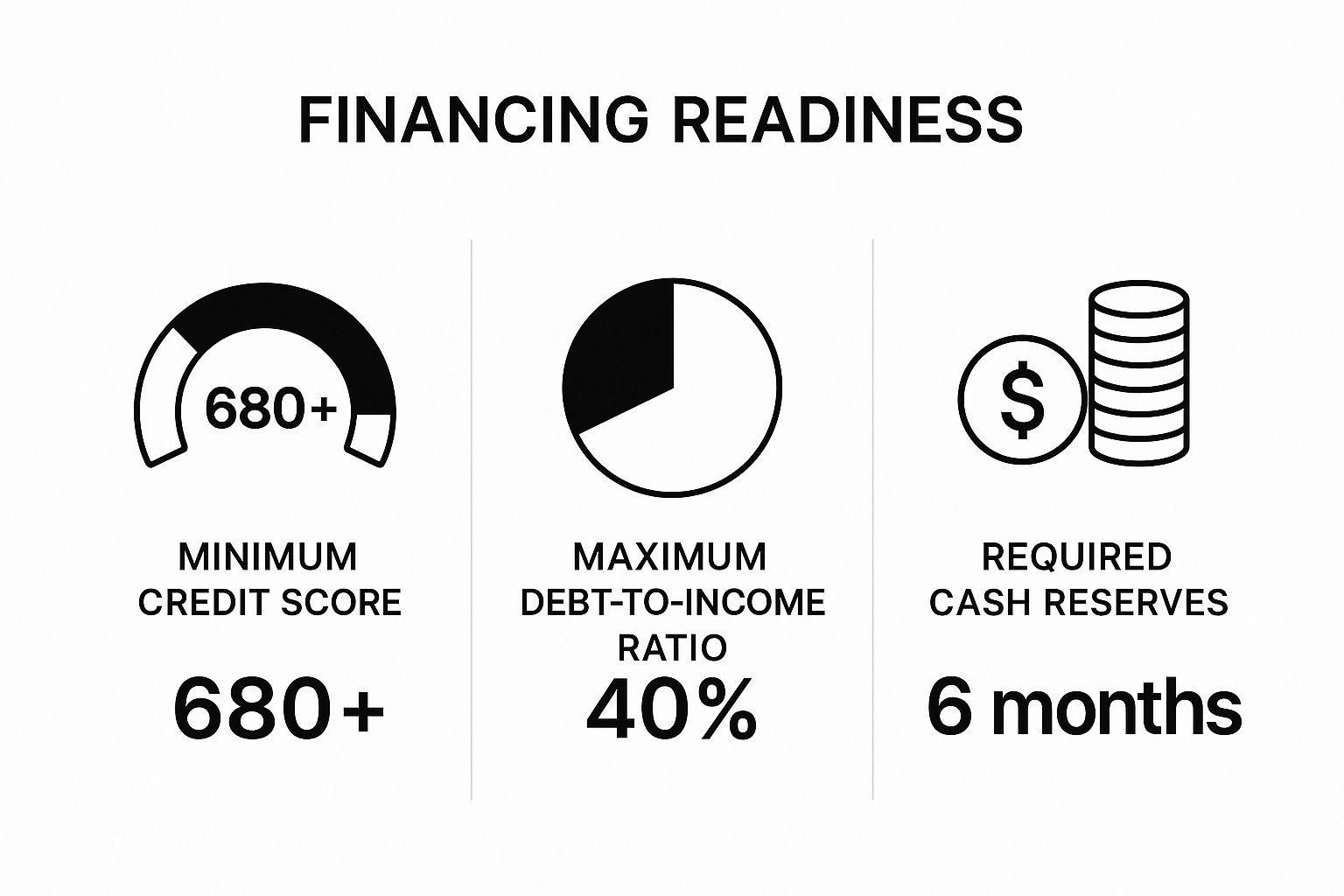

Before you even start talking to lenders, you need a clear picture of your own financial standing. Lenders have non-negotiable baselines for your credit, debt, and liquidity.

Think of these numbers as the price of admission. Hitting these marks shows you have the financial backbone to handle a commercial mortgage, making you a credible borrower from the get-go.

The world of multifamily financing offers a variety of tools for different jobs. Let's walk through the most common loan options and see where they fit.

Comparing Popular Multifamily Loan Options

The table below breaks down the major players side-by-side. It’s a quick-reference guide to help you see how each loan type lines up with different investment goals.

Each of these loans serves a purpose. The key is knowing which one to pull out of your toolbox for the deal in front of you.

Conventional Bank Loans: The Workhorse Option

For many investors, especially those tackling their first few deals, a conventional loan from a local or regional bank is the default choice. These are what we call "portfolio loans," meaning the bank keeps the loan on its own books instead of selling it off. This gives them more leeway and often results in a more personal, relationship-driven process.

Their biggest plus is versatility. I’ve worked with banks that have tailored loan terms to fit a specific project, whether it was a turnkey property or a light value-add deal. The flip side? They usually come with shorter terms, typically 5 to 10 years, and almost always require a personal guarantee. That means your personal assets are on the line.

The current economic environment has definitely made these loans pricier. In mid-2025, we were seeing five-year bank loans for multifamily quoted anywhere from 5.8% to 7.0%. This shift, paired with rising construction costs, is making it tougher to pencil out new deals and has put the brakes on some new development. You can find more market analysis from the team at Essex Capital Markets.

Government-Backed Agency Debt: Fannie Mae and Freddie Mac

Once you start looking at larger or more stabilized properties, agency loans from Fannie Mae and Freddie Mac become a game-changer. These aren't direct loans. Instead, these government-sponsored enterprises (GSEs) buy loans from approved lenders, which keeps money flowing into the market.

Agency debt offers some of the most attractive terms you can find:

- Longer amortization: We're talking up to 30 years, which significantly boosts your monthly cash flow.

- Non-recourse financing: This is huge. The loan is secured only by the property, protecting your personal assets if things go south.

- Competitive rates: Rates are often fixed for the long haul, giving you stability and predictable payments.

Of course, there’s a trade-off. The underwriting process is much more rigid and standardized. They’ll put your property's financials, your track record, and your net worth under a microscope. These loans are perfect for stable, cash-flowing assets, not for properties needing a major overhaul. We cover a wider array of loan types in our guide to commercial property financing options.

Specialized Financing: Bridge and HUD/FHA Loans

Beyond the mainstream options are specialized loans designed for very specific situations. Knowing when to use these can give you a serious competitive edge.

Bridge loans are short-term, interest-only loans that are a value-add investor's best friend. Let's say you find a mismanaged building with high vacancy and a laundry list of deferred maintenance. A conventional bank might run the other way, but a bridge lender provides the capital for both the purchase and the renovations. The whole point is to stabilize the property, boost the Net Operating Income (NOI), and then refinance into a permanent loan within 12 to 36 months.

A bridge loan is your financial toolkit for transformation. It buys you the time and resources to take an underperforming asset and force its appreciation, creating value that a traditional loan couldn't unlock upfront.

HUD/FHA loans are on the complete opposite end of the spectrum. These government-insured loans are built for the long haul, offering fixed-rate terms that can stretch up to 35 or even 40 years. They're fantastic for affordable housing or fully stabilized properties where your only goal is decades of steady cash flow. The catch? The application process is notoriously long and bureaucratic, often taking many months to finally close. It's a true test of patience, but the stability they provide is unmatched.

How to Secure Favorable Terms from Lenders

Alright, you've run the numbers and you know what kind of loan you need. Now comes the real test: convincing a lender to see the deal through your eyes. This isn’t just about filling out forms; it’s about sales and strategic persuasion. Your loan application has to tell a compelling story about the property's untapped potential and its path to predictable returns.

Don't treat this as a simple formality. The terms you lock in here—the interest rate, the amortization, the prepayment penalties—can easily swing your deal's profitability by tens or even hundreds of thousands of dollars. Think of your loan package as your single most important marketing document for the entire project.

Assembling a Bulletproof Loan Application

An underwriter’s job is to find the holes in your deal. Your job is to make sure there aren't any. A sloppy, incomplete application screams "disorganized operator," which is an immediate red flag for any lender. A truly professional package anticipates their questions and has the answers ready before they even ask.

Your application needs to be a complete narrative. It should include:

- A Punchy Executive Summary: This is your one-page pitch. In a few powerful paragraphs, it should cover the property, the market, your business plan, and exactly what you're asking for.

- The Property's Financial Story: You'll need at least three years of historical P&L statements. The T12 (trailing twelve months) is absolutely critical, as is the current rent roll. Be prepared to explain any weird dips or anomalies in performance.

- Your Personal Financial Statement: Lenders need a global view of your financial health. This means your net worth, liquidity, and a clear schedule of all other real estate you own. Honesty and accuracy are non-negotiable here.

- Your Real Estate Resume: This is where you sell yourself. Highlight your experience as an operator. If you're newer to the game, showcase your team's track record or any relevant professional background that proves you're capable of executing the plan.

Putting this all together in a clean, professional package sets the tone. It tells the lender you're a serious partner they can trust with their capital.

Getting Inside the Underwriter's Head

Let's be clear: underwriters are paid to mitigate risk, not to get excited about your pro forma. They are laser-focused on two things: your ability to repay the loan and the property's ability to perform if you can't. They will stress-test every number you give them, poking holes in your rent growth assumptions and questioning your expense projections.

You have to be ready to defend your business plan with cold, hard data. If you're projecting a 10% rent bump after renovations, you better have a folder of comps from the area that justify it. If your budget shows a lower expense ratio than the previous owner, come armed with vendor quotes or a detailed explanation of the management efficiencies you'll implement.

Lenders don't fund potential; they fund proven, predictable cash flow. Your goal is to strip every bit of speculation from your projections and replace it with concrete evidence and a logical, well-supported plan.

Don't forget that broader market conditions are a huge factor. Right now, the multifamily market is seeing lenders favor acquisitions of existing assets over new construction. With $157.7 billion in multifamily sales volume over the past year, the consensus is that existing properties are the safer bet as the pipeline of new supply slows. You can dig into more of these current multifamily market trends from NAHB to understand the landscape.

Negotiating the Terms That Matter Most

Once a lender sends over a term sheet or a letter of interest (LOI), the real negotiation starts. Everyone gets fixated on the interest rate, but other terms can have an even bigger impact on your returns.

Here’s where you should focus your energy:

- The Amortization Period: This is huge. Pushing for a 30-year amortization schedule instead of 25 years can dramatically improve your monthly cash flow, even at the same interest rate.

- Prepayment Penalties: These clauses determine the price you pay to sell or refi early. You want to negotiate for the most flexible terms you can get—maybe a shorter penalty period or a "step-down" penalty that decreases each year.

- Recourse vs. Non-Recourse: Non-recourse debt is the gold standard. It means the lender can't come after your personal assets if the deal goes south. If you have to accept some recourse, fight for a "burn-off" provision where the personal guarantee goes away after the property hits certain performance targets for a year or two.

Getting this part of the process right is a skill that will pay you back on every single deal you do. It's about creating a win-win where the lender feels secure and you get the terms you need to make the project a home run.

Growing Beyond Your Own Capital: The Power of Real Estate Syndication

Sooner or later, your ambition is going to outgrow your bank account. It happens to every successful investor. When you find a fantastic multifamily deal that's just too big to handle on your own, you don't have to walk away. This is where real estate syndication comes in.

Syndication is simply a way to pool capital from passive investors to acquire larger, more profitable properties that would otherwise be out of reach. It's the difference between buying a duplex by yourself and leading a team to buy a 100-unit apartment complex. This is how the pros scale, and mastering it is a game-changer for serious multifamily investors.

The Two Sides of the Coin: Key Players in a Syndication

At its core, a syndication is a partnership with very specific roles. It all boils down to two groups:

- The General Partner (GP): That’s you, the deal-maker. You're the one finding the property, running the numbers, securing the loan, and managing the day-to-day execution of the business plan. You provide the expertise and the sweat equity.

- The Limited Partners (LPs): These are your investors. They provide the bulk of the equity capital needed for the down payment and other costs. In return, they get a share of the cash flow and profits, but their role is entirely passive. They’re betting on you to make it all happen.

This division of labor is the secret sauce. It lets you play to your strengths—finding and operating great deals—while giving investors a way to tap into commercial real estate returns without the headaches of being a landlord.

Building a Bulletproof Legal Framework

You can't just pass a hat around to buy an apartment building. To protect yourself and your investors, you need a rock-solid legal structure that complies with securities laws. This isn't a corner you ever want to cut.

The go-to structure is a Limited Liability Company (LLC). Smart operators will set up a brand new, single-purpose LLC for each property they buy. This compartmentalizes the risk, ensuring that if one deal goes south, it can't torpedo your entire portfolio.

The single most important legal document in this process is the Private Placement Memorandum (PPM). Think of it as the ultimate disclosure package for your investors. It lays out everything, including:

- A detailed description of the property and market

- Your full business plan, with financial projections

- Your track record and experience as the GP

- A clear-eyed breakdown of every potential risk

- The precise terms of the deal, from fees to profit splits

A well-drafted PPM is your best insurance policy. It builds trust by ensuring your investors are making a fully informed decision, which dramatically reduces the chances of disputes down the road. This is non-negotiable: hire a great securities attorney.

How to Structure a Deal Investors Can't Resist

The way you slice the pie is everything. A good deal structure needs to reward you for the incredible amount of work involved while giving your LPs a return that makes them excited to write a check.

The most common approach is a "waterfall" structure that includes a preferred return. This is a promise that your LPs get paid first, up to a certain return threshold, before you start sharing in the profits. An 8% preferred return is pretty standard in the industry.

Here’s a look at a classic 70/30 split structure:

This kind of structure creates perfect alignment. The LPs love it because their return is prioritized, lowering their risk. You, as the GP, are heavily incentivized to outperform the projections to get to that lucrative 30% split. It’s a transparent, fair model that's the foundation for building a loyal investor base who will follow you from deal to deal.

Mastering Due Diligence and the Closing Process

You’ve wrestled with lenders, secured a loan commitment, and have your equity lined up. It feels like the finish line is in sight, but don't celebrate just yet. The final sprint—due diligence and closing—is where great deals are cemented and bad ones fall apart.

This is your last chance to verify every single assumption you made during underwriting. It's less of a formality and more of a forensic audit. Get this wrong, and a small oversight can easily snowball into a six-figure problem. This is, without a doubt, the most critical risk-management phase of the entire acquisition.

The Battle-Tested Due Diligence Checklist

You absolutely cannot wing due diligence. A systematic approach is non-negotiable. You need a rock-solid checklist to ensure nothing falls through the cracks as you methodically confirm the asset's health.

I like to break my diligence into three core pillars:

- Physical Inspection: This is so much more than a simple walkthrough. You need to get inside a significant percentage of the units—not just the pretty "model" unit the seller wants you to see. Get a pro to inspect the roof, bring in an HVAC tech, and definitely scope the main sewer lines. Spending a few thousand on expert opinions for big-ticket items now can save you a fortune later.

- Financial Audit: Trust, but verify. Get the seller’s T12 (trailing twelve months) and stack it up against actual bank statements and utility bills. Does it all line up? A crucial part of this is not just confirming value, but actively managing financial risk to stop revenue leakage before it becomes your problem.

- Lease File Audit: This is where you confirm your income stream. You have to put your eyes on every single lease agreement. Does the rent on the page match the rent roll? Are the security deposits actually accounted for? Every dollar of projected income must be real and legally documented.

This intense process is your final opportunity to go back to the seller and renegotiate based on what you’ve found. Or, in a worst-case scenario, it's your chance to walk away from a deal that no longer pencils out.

Uncovering Hidden Liabilities

Your mission during due diligence is to hunt for anything that deviates from what the seller told you. These "surprises" are almost always costly, but finding them before closing is a huge win.

From my experience, these are the most common problem areas:

- Service Contracts: Dig into every existing contract—landscaping, laundry, pest control, you name it. Can they be transferred? More importantly, what are the termination clauses? The last thing you want is to be chained to an overpriced, long-term contract you can't escape.

- Property Tax Assessment: This is a classic rookie mistake. Never assume the seller's property taxes will be your property taxes. The sale will almost certainly trigger a reassessment based on your higher purchase price. Pick up the phone and call the local assessor’s office to get a realistic estimate.

- Zoning and Permitting: Confirm that the property is fully compliant with local zoning. You also need to check for any open permits from past work. An old, forgotten permit can morph into a bureaucratic nightmare and a major expense to close out after you own the place.

Due diligence isn't about hoping for the best; it's about preparing for the worst. Every inconsistency you find is a negotiation point that can save you thousands and safeguard your investment.

Navigating the Closing Maze

Once due diligence is wrapped up and you’ve dealt with any issues, it’s time to head to the closing table. This process can feel like controlled chaos with a lot of different people involved. Knowing who’s on your team and what they do is key to staying in control.

Your closing team will typically include:

- Your Attorney: They are your last line of defense, reviewing every legal document to protect your interests.

- The Title Company: They search for any liens or claims against the property and issue title insurance to protect you from any surprises down the road.

- The Escrow Agent: This is the neutral third party holding all the money and paperwork, making sure everything is exchanged correctly and only when all conditions are met.

The final hurdle is signing a mountain of paperwork. Pay extremely close attention to the closing statement, ensuring every number—prorations for rent, taxes, and utilities—is perfect. Once the ink is dry and the funds are wired, it's official. You now own an apartment building.

Your Apartment Financing Questions, Answered

Jumping into multifamily financing can feel like learning a new language. There's a lot of jargon and specific requirements that can trip up even seasoned investors. To help you get your bearings, let's walk through some of the most common questions I hear from people looking to finance their first apartment deal.

What’s a Typical Down Payment for an Apartment Building?

You should plan on bringing 20% to 35% of the purchase price to the table. The exact number really hinges on the loan you're going for and, frankly, your own track record.

If you’re working with a local bank on a conventional loan, they'll likely want to see 25-35% down. They need to know you have serious "skin in the game," which makes them feel a lot more comfortable about the risk they’re taking.

Government-backed loans, like those from Fannie Mae or Freddie Mac, can sometimes let you get in with a bit less, maybe closer to 20%. But be prepared for a much deeper dive into your finances and the property's performance. Their underwriting process is famously rigorous.

How Much Does My Personal Credit Score Really Matter?

It matters a lot, especially in the beginning. For your first few deals, your personal credit score is one of the first things a lender will look at. Most commercial lenders won't even start a conversation unless you have a FICO score of 680 or higher. It's their baseline for judging your financial reliability.

A great credit history does more than just open doors—it saves you money. A high score can unlock better interest rates and more favorable terms, which adds up to a huge savings over the life of the loan. As your portfolio grows and you start chasing larger agency debt, the property’s cash flow becomes the star of the show. Still, a bad credit history can kill a deal before it even starts.

Lenders often see your credit score as a window into your character. A solid score shows you meet your obligations, which gives them confidence you’ll handle a commercial mortgage responsibly.

What Is DSCR, and Why Are Lenders So Obsessed with It?

DSCR, or Debt Service Coverage Ratio, is the holy grail metric in commercial lending. It’s a straightforward formula that tells a lender if your property can actually afford its mortgage payments. You just divide the Net Operating Income (NOI) by the total annual mortgage payments.

Lenders live and breathe by this number. The industry-standard minimum DSCR is 1.25x.

So, what does that actually mean? It means your property needs to bring in 25% more cash than what’s required to pay its mortgage each year. That extra cushion is the lender’s safety net. A healthy DSCR tells them the property can handle a few vacancies or an unexpected repair without missing a loan payment. It's all about minimizing their risk.

Can I Actually Buy an Apartment Building with No Money Down?

The honest answer? Yes, but it's incredibly difficult and not for the faint of heart. The idea of a zero-down apartment deal isn't a total myth, but you won't pull it off with a traditional loan from a bank.

The most common way this happens is through real estate syndication:

- You become the General Partner (GP): Your job is to find a fantastic, can't-miss deal and get it under contract. Your contribution is your expertise, your time, and the "sweat equity" you'll put into making the project a success.

- You raise all the capital: You then bring in passive investors (Limited Partners, or LPs) to fund the entire down payment, closing costs, and any renovation reserves.

Another, much rarer, path is negotiating seller financing where the current owner carries a second note for the down payment. Either way, you need an absolutely killer deal, an impeccable track record that inspires confidence, and top-notch negotiation skills. For almost everyone else, bringing your own capital to the closing table is standard practice.

At Homebase, we know that managing your investors is just as crucial as securing the right loan. Our platform helps real estate sponsors streamline fundraising, simplify investor communications, and manage everything from a single portal. Spend your time closing deals, not shuffling paperwork. Learn how Homebase can help you scale your real estate business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.