mezzanine debt meaning: A quick guide

mezzanine debt meaning: A quick guide

Discover mezzanine debt meaning, how it fits in the capital stack, its terms, and how it's used in real estate financing.

Domingo Valadez

Nov 21, 2025

Blog

In the world of real estate finance, you’ll often hear the term mezzanine debt. So, what does it actually mean? Put simply, it’s a unique type of financing that fills the gap between the primary bank loan (senior debt) and the developer's own cash investment (equity). It’s a hybrid tool, mixing features of both debt and equity to help sponsors complete their project's funding puzzle.

What Is Mezzanine Debt, Really?

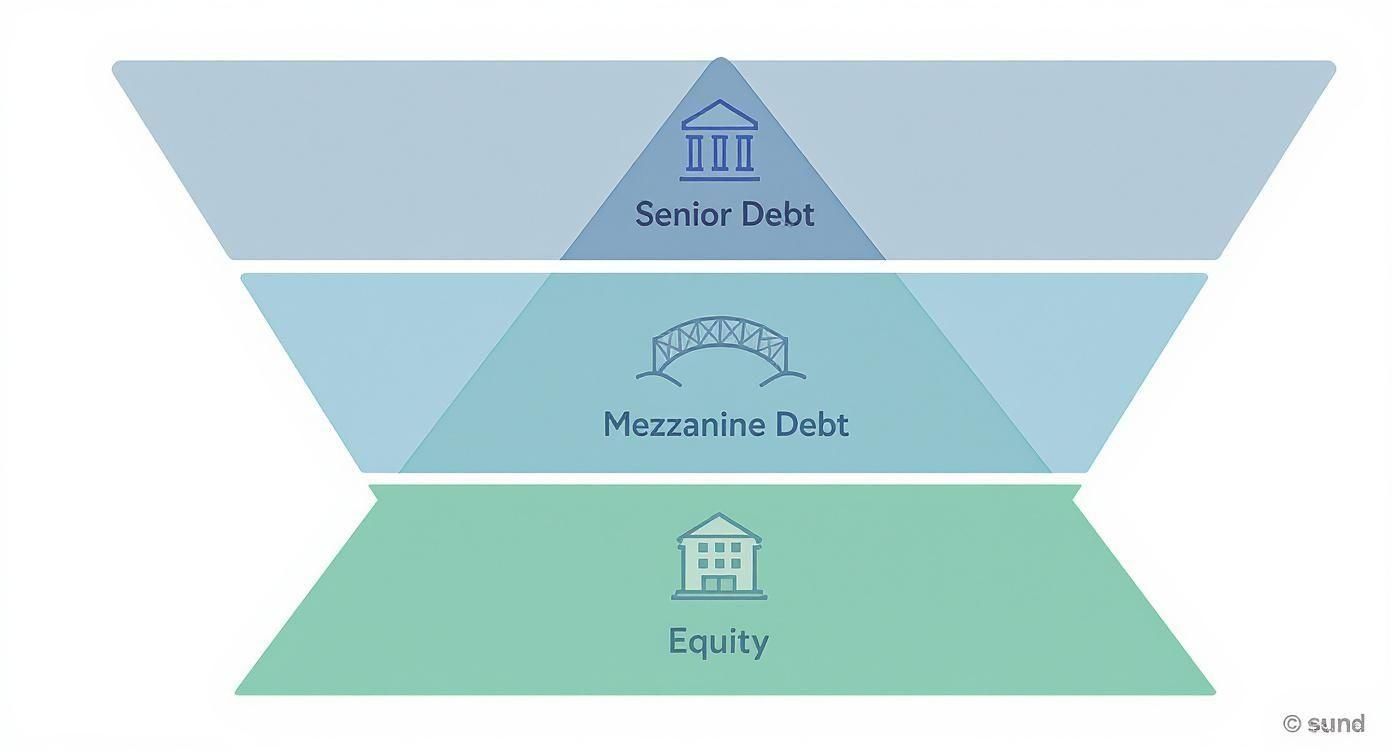

Imagine you're building a skyscraper. The financing for that building is called the capital stack, and it has different layers.

The bank's senior loan is the massive, solid foundation. It's the biggest and most secure piece of funding, so it gets paid back first if anything goes wrong. Your cash and your investors' money—the equity—is the penthouse suite at the very top. It represents ownership and has the highest risk, but also the highest potential reward.

Mezzanine debt is like the middle floors of that skyscraper. It’s stacked right on top of the senior debt foundation but sits just below the equity penthouse. This position is key to understanding its nature: it’s riskier than a standard bank loan but safer than a pure equity stake.

A True Hybrid of Debt and Equity

What makes mezzanine financing so interesting is its dual personality. On one hand, it acts like a loan, with the borrower making regular interest payments. But it often comes with an "equity kicker," which gives the lender a small slice of the project's future profits or even a tiny piece of ownership.

This hybrid structure is a creative solution for sponsors who need more capital than a bank is willing to provide but don't want to dilute their ownership too much by bringing in more equity partners.

Because of its spot in the capital stack, mezzanine debt is subordinate to the senior mortgage. In plain English, if the project defaults and goes into foreclosure, the bank gets paid back first from the sale. The mezzanine lender only gets paid after the senior lender is made whole. This higher risk is why mezzanine loans come with higher interest rates, typically in the 8% to 15% range.

To give you a clearer picture, here’s a quick summary of what defines mezzanine debt.

Mezzanine Debt At a Glance

This combination of features makes it a powerful, if complex, tool in a real estate sponsor's financing toolkit.

The Growing Appeal of Mezzanine Financing

This isn't just some niche product for mega-deals; its use is growing fast. The global mezzanine financing market is on track to hit $9.43 billion by 2026. This growth is fueled by a real need for capital that doesn't force sponsors to give up a huge chunk of their ownership.

As traditional banks remain conservative with their lending, mezzanine debt provides a crucial layer of funding. It can be the one thing that gets a great project off the drawing board and into construction. You can find more insights on this market growth on the Saratoga Investment Corp blog.

Ultimately, mezzanine debt is a strategic tool. It helps developers stretch their capital further, close funding gaps, and boost the potential returns for their equity investors—all while keeping control of their vision.

Placing Mezzanine Debt in the Capital Stack

To really get a feel for mezzanine debt, you first need to picture where it lives in a project's financial structure. The easiest way to think about it is like a layered cake or a pyramid, which in real estate we call the capital stack. Each slice represents a different type of funding, and each has its own level of risk and expected return.

The capital stack is all about the pecking order. It determines who gets paid first if the deal goes south, but it also dictates how profits are split when things go well.

The Foundation: Senior Debt

At the very bottom, the largest and safest layer, is senior debt. This is almost always the first mortgage from a bank or another traditional lender. Because it’s secured by the property itself and is first in line to get repaid, it has the lowest risk. And lower risk means a lower interest rate.

If a project ever defaults and ends up in foreclosure, the senior lender gets their money back before anyone else sees a dime. That security is precisely why banks are willing to put up the most money at the best terms.

The Middle Layer: Mezzanine Debt

Right on top of the senior debt sits mezzanine debt. Think of it as the bridge connecting the ultra-safe bank loan to the riskier equity investment. It’s "subordinate" to the senior debt, which is just a fancy way of saying the mezzanine lender only gets paid after the bank has been paid in full.

This secondary position makes it riskier than a standard mortgage, so mezzanine lenders charge higher interest rates. They also often require an "equity kicker"—a small piece of the profits—to make the extra risk worthwhile. But, it’s still senior to all the equity, which gives the mezz lender more protection than the project's investors.

This visual shows exactly how a typical real estate capital stack is layered, highlighting mezzanine debt's position between the senior loan and the equity.

As you can see, moving up the stack from senior debt to equity means both the risk and the potential reward for the capital provider jump up significantly.

The Top Tiers: Equity

At the very top of the capital stack, you'll find equity. This is the skin in the game, and it’s usually split into two parts:

- Preferred Equity: This sits just above mezzanine debt. "Pref" investors get a priority return over the common equity investors, almost like a fixed dividend that gets paid out before anyone else gets profit distributions.

- Common Equity: This is the riskiest spot but also the one with the highest potential reward. It's the money put in by the project sponsor and their limited partners. They are the last to get paid, but they also get the lion's share of the profits if the deal is a home run.

Key Takeaway: Think of the "payment waterfall" this way: risk flows down from the top, while cash flows up from the bottom. The riskiest position is at the peak (equity), and the safest is at the base (senior debt). Mezzanine debt’s spot in the middle offers a blend of risk and return.

Getting your head around this structure is crucial. For a more detailed breakdown of how these layers work together, check out our guide to the real estate capital stack. By cleverly slotting in mezzanine financing, a sponsor can borrow more than a senior lender is willing to offer, which means they need to raise less of the expensive equity and can potentially boost returns for their investors.

Decoding a Mezzanine Loan Agreement

Knowing where mezzanine debt sits in the capital stack is one thing, but actually staring down a loan agreement is another beast entirely. Let’s move from theory to practice and pull apart the key terms you’ll actually see on a term sheet. If you can get comfortable with these components, you'll be able to see the true cost and structure of the financing.

At its heart, a mezzanine loan’s return is built to compensate the lender for stepping into a riskier position than the senior bank. This compensation usually comes in a few different flavors, and each one hits your project's cash flow in a different way. The most common pieces are cash interest, PIK interest, and an equity kicker.

The Three Pillars of Mezzanine Returns

Mezzanine lenders are clever—they structure their returns to get some immediate cash flow while also grabbing a piece of the long-term upside. To model your project’s financials correctly, you absolutely have to understand how each piece works.

- Cash Interest: This is the simple part. Just like your standard bank loan, you’ll pay a fixed or floating interest rate in cash, usually every month or quarter. It’s the lender’s bread and butter, giving them a steady, predictable income stream.

- Payment-in-Kind (PIK) Interest: Now, this is where things get interesting. Instead of getting paid in cash, PIK interest gets tacked onto the loan’s principal balance. That new, larger balance then starts accruing its own interest. This is a huge advantage for sponsors, especially when you’re in the middle of a heavy renovation or ground-up development and cash is tight. It lets you keep cash in the project right when you need it most.

- The Equity Kicker: Think of this as the lender’s grand prize for taking the risk. The equity kicker (sometimes called a warrant) gives the lender a right to a small slice of the project’s ownership or a share of the profits down the road, usually somewhere between 1% and 5%. It’s a smart way to align everyone’s interests—when you win, they win.

A pretty common structure might target a 12% total return, broken down like this: 8% cash interest paid monthly, 2% PIK interest that accrues, and an equity kicker valued at another 2%. This blend gives the lender current income, lets the borrower hang onto cash, and shares the upside.

Covenants and Other Key Terms

Beyond the money, a mezzanine loan agreement comes with a set of rules and conditions, called covenants, that you have to follow. They’re often not as rigid as what a senior lender might impose, but you still need to pay close attention.

Here are a few common terms you’ll run into:

- Loan-to-Value (LTV) Limits: Mezzanine debt is all about pushing your total leverage higher than what a bank will offer. A senior loan might tap out at 65% LTV, but adding a mezzanine piece can get your combined LTV up into the 75-85% range.

- Term Length: These loans are typically shorter than the senior mortgage. You’ll often see terms of three to seven years, which usually lines up perfectly with the sponsor’s plan to stabilize the property and then either sell or refinance.

- Intercreditor Agreement: This is a make-or-break legal document signed by both the senior lender and the mezzanine lender. It lays out the pecking order and spells out the rights of each party, especially what happens if things go south and the loan defaults.

The market for this kind of financing is strong, especially for real assets. In Europe, for instance, returns on mezzanine debt often land between 8% and 15% per year, which is why it attracts big players like private credit funds. They’re drawn to the higher yields and the way mezzanine debt can help optimize a project's overall cost of capital. To see these trends in action, you can dig deeper into the European market for real asset financing.

By understanding these core pieces—cash interest, PIK, equity kickers, and key covenants—you can look at a mezzanine debt term sheet with confidence and figure out if it’s the right tool for your deal.

Mezzanine Debt vs. Other Financing Options

To really get why mezzanine financing is such a powerful tool, you have to see where it fits. Think of it this way: every layer of funding in the capital stack plays by a different set of rules, with its own unique risks and rewards. For a sponsor, picking the right mix is everything—and that means knowing exactly what separates mezzanine debt from senior debt and preferred equity.

The biggest differences really come down to a few core things: who gets paid first, what collateral is backing the deal, how much it costs, and what happens when things go south. These distinctions aren't just academic; they dramatically shape a deal's structure, its risk profile, and ultimately, its profitability.

Mezzanine Debt vs. Senior Debt

Let's start with the most common comparison: senior debt. This is your typical first mortgage on the property. While both are technically "debt," they operate in completely different universes when it comes to security and risk.

A senior lender is in the safest seat in the house. They hold a first-position lien on the physical real estate. If the borrower defaults, the bank can simply foreclose on the property and sell it to get their money back. Because they have a direct claim on the hard asset, their capital is the cheapest you can find.

Mezzanine debt, on the other hand, isn't secured by the property at all. The mezzanine lender’s security is actually a pledge of the ownership interests in the company that owns the property (usually an LLC). This is a critical distinction.

In a default, a mezzanine lender doesn't foreclose on the building; they foreclose on the ownership of the company that owns the building. This process, known as a Uniform Commercial Code (UCC) foreclosure, lets them effectively step into the sponsor's shoes and take control of the project.

Because the mezzanine lender is second in line to get paid after the bank, their position is inherently riskier. To make up for that extra risk, they charge a much higher interest rate.

Mezzanine Debt vs. Preferred Equity

This is where things can get a little fuzzy for people. Both mezzanine debt and preferred equity sit between senior debt and the sponsor’s common equity, but they are fundamentally different animals with different legal rights.

Preferred equity is just that—an equity investment, not a loan. "Pref" investors get paid their return before the common equity partners (the sponsor and their investors) see a dime. It can feel like debt because it often has a fixed, regular payment, but it isn't secured by a pledge of ownership.

The biggest difference shows up when a deal gets into trouble. If a sponsor misses a payment to a preferred equity investor, the investor’s main recourse is whatever was negotiated in the operating agreement. This usually involves seizing management control of the project, but they can't just foreclose on the ownership shares the way a mezzanine lender can.

This makes preferred equity a slightly riskier position, which is why it often costs even more than mezzanine debt. That UCC foreclosure is a powerful remedy, and it gives the mezzanine lender a level of control that a preferred equity investor just doesn't have.

Comparing Financing Options in the Capital Stack

Seeing these options side-by-side really helps clarify their distinct roles. Each has its place, but they are not interchangeable.

Ultimately, the true mezzanine debt meaning comes from seeing it in context. It provides more leverage than a bank is willing to offer but comes with more security and a cleaner path to taking control than preferred equity. That’s what makes it such a unique and valuable instrument for the right kind of deal.

When to Strategically Use Mezzanine Debt

Knowing the textbook definition of mezzanine debt is one thing. Knowing exactly when to pull that lever is what separates a good sponsor from a great one. This isn't a tool for every deal, but in the right situations, it can be the key that unlocks a project's true potential. It can help you move faster, scale bigger, and ultimately, drive better returns for your investors.

So, when does it actually make sense? You’ll find mezzanine debt is most powerful when you’re facing a clear capital gap—that space between what your senior lender will give you and what you need to close the deal. Let's walk through a few real-world scenarios where experienced operators lean on this flexible capital.

Bridging an Acquisition Funding Gap

Picture this: you've found a fantastic value-add multifamily property. The seller wants $12 million, and you’ve already lined up a senior loan for $8 million (a 66.7% LTV). That leaves a $4 million gap for the down payment and closing costs.

Without another option, you’d have to raise the entire $4 million from your equity investors. But what if you could bring in a $1.5 million mezzanine loan to fill part of that gap?

- Senior Loan: $8.0 million

- Mezzanine Loan: $1.5 million

- Required Equity: $2.5 million

Just like that, you’ve cut your equity requirement by 37.5%. This simple move gives you options. You could do the deal with a smaller circle of investors, keep more of the ownership for yourself, or even take that $1.5 million in equity you just freed up and put it toward another deal. Suddenly, the higher interest rate on the mezz piece feels like a small price to pay for that kind of firepower.

Financing Major Value-Add Renovations

Here’s another classic play. You're buying an older apartment complex with a solid plan to gut the units, modernize the amenities, and push rents. Your senior lender is happy to finance the purchase, but they’re getting nervous about funding your entire renovation budget upfront. Why? Because the property's current cash flow doesn't support that much debt.

This is a perfect spot for mezzanine debt. A mezzanine lender is betting on your vision. They're more focused on the property's future stabilized value, so they're willing to provide the capital needed for the heavy lifting. This lets you execute the full renovation in one clean shot, stabilize the property faster, and start collecting those higher rents much sooner. Typically, that loan is designed to be paid off when you refinance or sell the property at its new, higher valuation.

A mezzanine loan provides the "growth capital" needed to execute an aggressive business plan. It allows a sponsor to fund improvements based on a property's future potential, not just its current performance.

Executing a Partner Buyout or Recapitalization

Mezzanine debt is also a fantastic tool for restructuring the ownership of a deal. Imagine you and a partner bought a building years ago, and now they’re ready to cash out and move on. A mezzanine loan can provide the liquidity to buy out their equity stake without being forced to sell a great asset or bring in a new equity partner who will dilute your position. It’s a clean way to consolidate control and hold onto a winner for the long haul.

These examples really show how versatile this type of financing can be. It’s especially popular in more complex situations, like leveraged buyouts, where its hybrid nature gives sponsors an edge over traditional bank loans. Its use tends to pick up during times of market uncertainty, helping sponsors close funding gaps without having to give away a huge chunk of the upside. It's no surprise that institutional investors like pension funds and insurance companies pour billions into mezzanine debt strategies, chasing the attractive, risk-adjusted yields. You can find more data on this trend in the global private markets report at McKinsey.com.

Common Questions About Mezzanine Debt

Even after you've got the capital stack and loan terms down, a few practical questions always pop up when sponsors start thinking about using mezzanine financing. Let's tackle the most common ones I hear, so you can feel confident talking about this powerful tool.

Think of this as your back-pocket guide for the details that really matter when you're structuring a deal.

Is Mezzanine Debt Secured?

Yes, but not in the way you might think. A senior loan is secured with a first mortgage—a direct claim on the physical property. Mezzanine debt works differently. Its security is a pledge of the ownership interests in the LLC that actually owns the building.

So, instead of foreclosing on the brick-and-mortar asset, the mezz lender forecloses on the ownership shares. This clever structure is what lets them step directly into the borrower's shoes and take control of the deal if things go south, all without disrupting the senior lender's first-lien position.

What Happens in a Mezzanine Loan Default?

If a borrower defaults, the mezzanine lender can kick off a UCC foreclosure. This is usually much faster and cheaper than the drawn-out process of a traditional property foreclosure.

A UCC foreclosure lets the lender take over the entire company that owns the property. They essentially become the new sponsor overnight, taking on all the project's responsibilities, which absolutely includes making the senior loan payments. This is a powerful remedy, and it’s precisely why mezz lenders dig so deep into a sponsor's track record and operational abilities during underwriting.

Key Takeaway: A default lets the mezzanine lender take control of the entire project, not just seize a single asset. This swift change of command is a key feature that separates it from other financing.

Can You Prepay Mezzanine Debt?

Usually, yes—but it'll likely cost you. Mezzanine loans almost always come with prepayment penalties or a "lockout" period where you can't pay the loan off early at all.

Lenders build these in to protect their projected returns. A typical structure might be a two-year lockout, followed by a declining penalty—say, 2% in year three and 1% in year four. You absolutely have to model these costs into your exit strategy, because an unexpected prepayment fee can take a real bite out of your profits from an early sale or refi.

Who Provides Mezzanine Financing?

Don't expect to walk into your local bank and get a mezzanine loan. This is a specialized product offered by lenders who understand and are comfortable with the unique risk. The main players you'll encounter are:

- Private Debt Funds: These are the most common providers. They manage investment funds specifically raised for private credit opportunities like this.

- Insurance Companies: Many larger insurers have real estate investment arms that hunt for higher-yield debt products.

- Specialized Finance Companies: These are niche firms that live and breathe structured real estate finance.

These groups have serious expertise in underwriting not just the property, but the sponsor's business plan. They're often more like strategic partners than just a source of cash.

Juggling a complex capital stack with senior debt, mezzanine financing, and a dozen equity investors can turn into an administrative nightmare. Homebase simplifies everything by giving you a single platform to manage your deals, investors, and communications. Our portal makes fundraising, e-signatures, distributions, and investor updates easy, freeing you up to do what you do best—find and close great deals. Find out how we can support your next syndication at the Homebase website.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.