How to Calculate IRR for Investment Analysis

How to Calculate IRR for Investment Analysis

Learn how to calculate IRR to make smarter investment decisions. Our guide demystifies the IRR formula with practical examples for real estate and finance.

Domingo Valadez

Aug 26, 2025

Blog

Calculating the Internal Rate of Return (IRR) is all about finding the one specific interest rate where the Net Present Value (NPV) of all your cash flows—both in and out—hits exactly zero. It’s the true, annualized rate of return on your investment, showing you the exact point where your money breaks even over time.

What IRR Really Tells You About a Deal

Before you even think about plugging numbers into a spreadsheet, let's get one thing straight: IRR is more than just a fancy formula. Think of it as the storyteller of your investment's performance. It answers the one question every investor asks: "What's the actual annual growth rate of my money in this deal?"

This single percentage is your secret weapon for making apples-to-apples comparisons between completely different opportunities. You could be looking at a five-year multifamily syndication and a ten-year NNN lease deal. How do you choose? IRR cuts through the noise.

Because it factors in the timing of cash flows—when you invest capital and, more importantly, when you get it back—it paints a much more dynamic and realistic picture than simpler metrics.

The Idea Behind the Number

At its core, IRR is the discount rate that makes the present value of all your future cash inflows (your monthly distributions and final sale profit) perfectly balance out your initial investment. The math behind it is a bit complex, and frankly, it’s why we have software to do the heavy lifting.

The magic of IRR is that it takes a series of uneven, unpredictable cash flows spread out over many years and boils them all down into a single, easy-to-understand annualized percentage.

This is exactly why it’s a non-negotiable tool for any serious real estate investor. While other metrics have their place, IRR gives you that comprehensive, bird's-eye view of a deal's profitability from start to finish.

It's More Than Just a Percentage

Now, a word of caution from experience: don't get tunnel vision. A high IRR looks great on paper, but a seasoned investor knows it never tells the whole story on its own.

You have to look at it alongside other key metrics. For instance, knowing how to calculate rental yields gives you a fantastic snapshot of the property's day-one income potential.

When you pair a long-term projection like IRR with an immediate health check like rental yield, you get a much clearer, more reliable picture of the investment. It ensures you're making a decision based on the complete puzzle, not just one shiny piece.

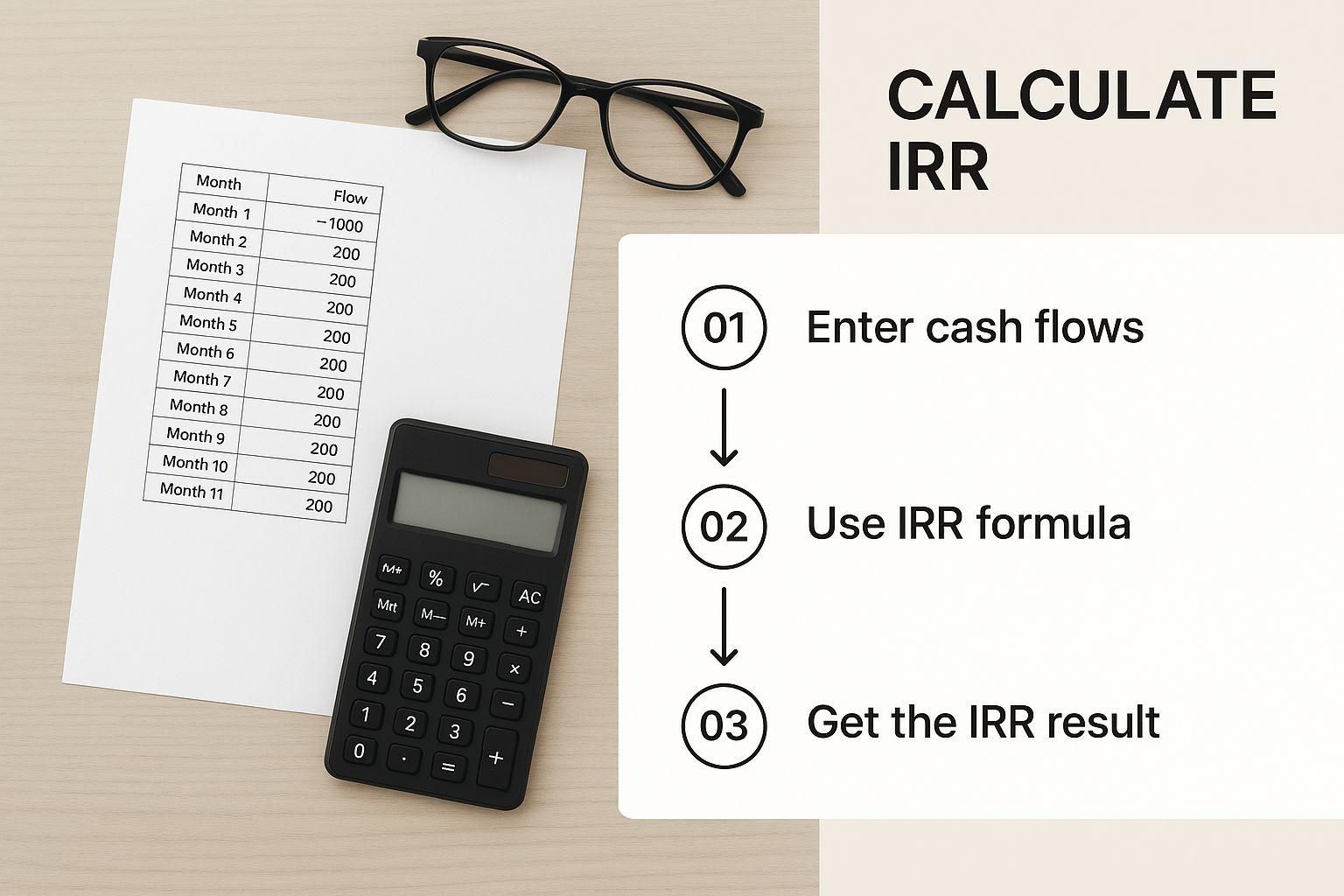

Calculating IRR Using a Spreadsheet

Let's be honest, nobody is calculating IRR by hand with a financial calculator anymore. The easiest and most reliable way to figure out the IRR for any real estate deal is to fire up a spreadsheet. Whether you're a fan of Microsoft Excel or prefer Google Sheets, both have built-in functions that do all the heavy lifting for you.

This isn't just about saving time; it's about accuracy. When you let the software handle the complex iterative math, you minimize the risk of a costly mistake. Your only job is to get the cash flows lined up correctly. Let's walk through exactly how to do that.

Setting Up Your Cash Flow Table

The entire IRR calculation hinges on a clean, chronological table of your cash flows. Think of it as the financial story of your investment—every dollar that goes in and every dollar that comes out, from start to finish.

Here's the simple breakdown of what you need to list:

* Initial Investment: This is your first entry, the money you put into the deal. Crucially, this must be a negative number. If you invest $250,000, you’ll enter it as -$250,000 in your spreadsheet. This represents cash leaving your pocket.

* Operating Cash Flows: These are the periodic distributions you get back from the investment, usually from rental income. These are all positive numbers.

* Sale Proceeds: This is the big one at the end—the return of your initial capital plus all the profits when the asset is sold. It's the final, and usually largest, positive number.

Laying out your data this way gives you a clear timeline, which is exactly what the IRR formula needs to work its magic.

Applying the IRR Formula

With your cash flows all lined up in a single column, the final part is almost laughably simple. You just need to use the IRR function. In both Excel and Sheets, the command is the same: =IRR(values, [guess]).

The values part is just the range of cells that holds your cash flow data. The [guess] is an optional argument you can pretty much always ignore. The software is smart enough to figure it out on its own.

My Two Cents: I’ve seen this mistake a hundred times. Double-check that your initial investment is a negative number. If you forget that minus sign, the formula will either break or give you a bizarre, meaningless result. It's the single most common error I see.

Let's put this into practice with a realistic example from a five-year real estate syndication deal.

To help visualize this, here’s a sample table showing a typical cash flow structure for a five-year real estate investment. This is exactly how you'd set it up in your spreadsheet before using the IRR function.

Sample Real Estate Cash Flow for IRR Calculation

With this data organized in cells A1 through A6, for example, you are now ready to calculate the IRR with a simple formula.

An Example Straight from the Field

Imagine you invest $100,000 into a multifamily deal.

* For the first four years, the sponsor sends you an $8,000 distribution check.

* In year five, the property is sold, and your final payout (including return of capital and profits) is $150,000.

In your spreadsheet, the column would look like this:

* Cell A1: -100,000

* Cell A2: 8,000

* Cell A3: 8,000

* Cell A4: 8,000

* Cell A5: 8,000

* Cell A6: 150,000

Find an empty cell, type in =IRR(A1:A6), and hit Enter. Boom. The spreadsheet will instantly give you the answer: 15.15%.

That’s it. What used to be a tedious manual calculation is now done in seconds. If you want to dive deeper into the mechanics, you can read more about how spreadsheet functions streamline these financial calculations in this helpful guide from Wall Street Prep. You’ve just calculated the IRR for a real estate investment.

IRR vs. XIRR: Why Timing Is Everything

The standard IRR function in your spreadsheet is a great starting point, but it has one glaring weakness: it assumes all your cash flows happen in neat, evenly spaced intervals. It thinks every transaction is exactly one year (or one month, or one quarter) after the last.

But we know real estate doesn't work that way. A capital call might hit your bank account in March, the first check might land in October, and the big sale could happen in July five years from now. The timing is always messy.

That’s precisely why the XIRR function is the professional’s go-to tool. It’s built for the realities of real estate investing.

The Critical Difference: Dates

Think of the standard IRR function as just looking at a list of numbers. It sees a -$100,000 investment followed by a +$15,000 distribution and assumes a full, standard period passed between them. It doesn't know or care if that period was 11 months or 13.

XIRR, on the other hand, is much smarter. It demands two things for every entry:

- The cash flow amount (the money in or out).

- The exact date the transaction happened.

This simple addition of dates completely changes the game. Your calculation goes from a decent ballpark estimate to a precise, time-weighted return. For syndication deals with their unpredictable capital calls and distributions, this level of precision isn't just nice to have—it's essential.

How This Plays Out in a Real Deal

Let’s look at a quick, realistic example to see why this matters so much.

Imagine these cash flows:

* January 15, 2024: You invest -$100,000.

* November 5, 2024: You receive a +$7,500 distribution.

* September 1, 2025: A special distribution of +$10,000 comes through.

* July 20, 2026: You get your final payout of +$125,000 from the sale.

If you just jammed these numbers into a standard IRR formula, you'd be telling the spreadsheet to treat each event as a full "year," which is obviously wrong. You got your first return in less than a year, and the property sold mid-way through the third year.

Let's see what the two formulas would spit out for the exact same deal:

That's a massive difference. The 2% gap between the two results could be the difference between a deal looking average and a deal that genuinely outperforms its target. The XIRR correctly shows that the investment performed better because you got your money back faster.

In all my years of underwriting, I can tell you that virtually every private real estate deal needs to be modeled with XIRR. The timing is never clean. Sticking with the basic IRR function is a rookie mistake that can seriously distort your perception of a deal's performance.

The good news is that using it in a spreadsheet is simple: =XIRR(values, dates, [guess]). Just highlight your column of cash flows, then your column of corresponding dates, and you're done.

This tiny tweak to your process delivers a huge leap in accuracy. It ensures the returns you're modeling are grounded in reality. Understanding how to calculate IRR is the first step, but knowing which formula to trust is what truly sets you apart.

How to Interpret Your IRR Results

So you've wrestled with the spreadsheet, plugged in all the cash flows, and now a single percentage is staring back at you. This is where the real analysis begins. An IRR of 16% doesn’t mean a thing in a vacuum; its real value comes from the context surrounding the deal.

Is it a good return? Is it great? That depends entirely on the deal’s risk profile and, just as importantly, your personal investment goals.

A "good" IRR is always a moving target. For a stabilized, low-risk apartment building in a great neighborhood, an IRR in the low teens could be a fantastic result. But for a riskier value-add project that requires a ton of renovation and a complex lease-up strategy, you should be looking for a much higher return—often 18% or more—to compensate you for taking on all that uncertainty.

Set Your Personal Hurdle Rate

Before you even start looking at deals, you need to know your number. This is your personal hurdle rate—the absolute minimum rate of return you’re willing to accept. Think of it as the bar a deal has to clear just to get your attention.

If your hurdle rate is 15% and a deal projects a 14% IRR, the decision is simple. It's a pass. If it comes in at 19%, now it’s worth digging deeper. This simple rule keeps you disciplined and prevents you from getting wooed by a slick pitch deck, ensuring you stay focused on what actually matters to your financial goals.

This concept isn't unique to real estate. Across private equity and venture capital, IRR is the go-to metric for comparing performance. One fund might target steady 15-20% IRRs with lower-risk assets, while another chases 30%+ through aggressive growth strategies. It’s the universal language for return.

Why IRR Can't Be Your Only Metric

Relying solely on IRR is one of the biggest rookie mistakes you can make. It’s a powerful tool, but it has a notorious blind spot: IRR tells you how fast your money is working, but it says nothing about how much money you actually get back.

That's why you have to pair it with another key metric: the Equity Multiple (EM).

This one is refreshingly simple. It measures the total cash you get back divided by the total cash you put in.

- An EM of 1.0x means you broke even.

- An EM of 2.0x means you doubled your money.

- An EM of 2.5x means for every $1.00 you invested, you got $2.50 back.

Pairing IRR with the Equity Multiple gives you the full story. A high IRR tells you your capital is working efficiently, while a strong Equity Multiple confirms the deal is actually generating a substantial profit. You need both.

Let’s say you’re looking at two deals, and both project a 17% IRR. Deal A has a 1.8x equity multiple over a three-year hold. Deal B has a 2.5x multiple over a five-year hold. Which one is better?

There’s no single right answer. It comes down to your strategy. Do you want your cash back sooner to reinvest elsewhere (Deal A), or are you willing to wait longer for a larger overall payday (Deal B)?

This is also where you need to understand how the sponsor structures their payouts. Getting familiar with the real estate waterfall structure shows you exactly how profits are split and when you can expect to see distributions, which directly impacts both your IRR and your equity multiple. Always look at these two metrics together to make a truly informed decision.

Common IRR Calculation Mistakes to Avoid

When you're running the numbers on a deal, it's alarmingly easy to make a small mistake that completely skews your results. A single misplaced negative sign or a flawed assumption can turn a promising analysis into a recipe for disaster. Knowing how to calculate IRR is only half the battle; knowing the common traps is what protects your capital.

One of the first and most frequent errors I see is simply mixing up positive and negative cash flows. Your initial investment is money leaving your pocket—it's an outflow. It has to be entered as a negative number in your spreadsheet. If you forget that little minus sign, your calculator will either spit out an error or, far worse, a nonsensical IRR that could fool you into thinking a bad deal is a home run.

Another classic blunder is using the wrong tool for the job. Many people default to the standard IRR function in Excel, but real estate rarely sticks to a perfect, once-a-year cash flow schedule. Distributions might come quarterly, and the final sale happens on a specific date, not neatly at a year-end. Using IRR instead of XIRR for a real-world syndication will almost always give you a distorted picture of the investment's true performance.

The Problem of Multiple IRRs

Things can get even stranger with more complex deals. A typical investment is straightforward: one negative cash flow at the start (your investment), followed by a series of positive ones (distributions and sale proceeds). But what if the project requires a capital call two years in to fund a renovation? Now you have a second negative cash flow after the project has started.

This kind of pattern can create a mathematical quirk where more than one IRR technically solves the equation. Your spreadsheet will give you one answer, but another valid rate might exist, which can cause a ton of confusion.

When your project has non-conventional cash flows—meaning the sign flips from negative to positive more than once—be wary of the single IRR figure your spreadsheet returns. It might not be telling you the whole story.

Understanding the Reinvestment Rate Assumption

Perhaps the biggest and most misunderstood limitation of IRR is something called the reinvestment rate assumption. In short, the formula inherently assumes that every dollar you get back from the project is immediately reinvested at a rate equal to the project's own IRR.

Let’s put that into a practical example:

* Imagine a deal with a projected IRR of 18%.

* In year two, you receive a $10,000 cash distribution.

* The IRR calculation automatically assumes you can take that $10,000 and put it to work in another investment that also earns 18%.

As any experienced investor knows, that's a tall order. Realistically, that money might sit in a savings account earning 4% while you hunt for your next deal. This optimistic assumption can make high-IRR projects, especially those with big distributions early on, look more attractive than they really are. Keeping this in the back of your mind is crucial for staying grounded and making sound decisions.

Got Questions About IRR? We've Got Answers.

Once you get the hang of the formulas, you'll find that IRR is an incredibly powerful tool. But like any sharp tool, it has its quirks. A few common questions tend to trip people up when they're running their numbers.

Let's clear up some of the most frequent sticking points. Getting these details right is what separates a decent analysis from a truly insightful one that drives smart investment decisions.

What Does It Mean if My IRR is Negative?

Yes, IRR can definitely be negative, and you should treat it as a big red flag. A negative IRR means one simple thing: the deal is projected to lose money.

Think of it this way: the total cash you expect to get back over the life of the investment is less than the cash you put in. If you invest $100,000 and the total distributions over five years only add up to $90,000, your IRR will be negative. It's a clear signal that the project didn't even return your original capital, let alone generate a profit.

Why is Excel Giving Me a #NUM Error?

Ah, the infamous #NUM! error. When Excel's IRR function throws this at you, it's almost always one of two things.

First, your string of cash flows needs to have at least one negative number (your initial investment) and at least one positive number (a distribution). The formula can't calculate a rate of return if there's no "return" to speak of, or no initial "investment" to measure against.

The other, less common reason is that the cash flows are so erratic that Excel’s internal calculator just can't solve for a rate.

Pro Tip: The fix is usually simple. Check that your initial investment in Year 0 is entered as a negative number. If that's already correct, try giving Excel a little nudge. By adding a "guess" to the formula, like =IRR(A1:A5, 0.1), you give it a starting point to help it find the answer.

How is IRR Different From ROI?

This is a big one. The single most important difference is that IRR understands the time value of money, while Return on Investment (ROI) is completely blind to it.

ROI is a basic, static snapshot. It's calculated as (Gain - Cost) / Cost and tells you how much you made as a percentage of your initial investment. But it has a huge blind spot—it doesn't care how long it took to get that profit.

Let's look at a quick example to see why this matters so much:

* Deal A: Invest $100k, get back $150k after just one year. Your ROI is 50%.

* Deal B: Invest $100k, get back $150k after ten long years. Your ROI is also 50%.

Both deals have the exact same ROI, but any experienced investor knows Deal A is worlds better. You got your capital and your profit back in a fraction of the time, freeing you up to reinvest it elsewhere. IRR is the metric that captures this crucial distinction. Deal A’s IRR would be significantly higher, accurately reflecting its superior speed and efficiency.

Running a real estate syndication involves a lot more than just finding deals. Managing investor relations, handling fundraising, and creating reports can eat up your time. At Homebase, we built an all-in-one platform to automate that side of the business so you can focus on what you’re great at. For a simple flat monthly fee, you can streamline your entire process. See how we can help you scale at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering the Cross Collateral Loan for Real Estate Deals

Blog

Discover how a cross collateral loan can help you secure larger real estate deals. Our guide breaks down the process, risks, and rewards for syndicators.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.