How to Calculate Equity Multiple: Quick Guide

How to Calculate Equity Multiple: Quick Guide

Learn how to calculate equity multiple with our step-by-step guide designed to boost investment returns and insight.

Domingo Valadez

Feb 27, 2025

Blog

Understanding the Power of Equity Multiple

Real estate investors use equity multiple to assess potential returns on their investments. This metric shows how much an investment is expected to grow compared to the initial money invested. By calculating the equity multiple, investors can better evaluate different opportunities and make smarter decisions about where to put their money.

Why Equity Multiple Matters

The equity multiple helps investors quickly determine an investment's profitability. It combines both ongoing income and final sale profits to give a complete picture of potential returns. This allows investors to compare different properties side by side.

Consider two properties generating similar yearly cash flow - one might have much better potential for value growth over time. The equity multiple would reveal this difference, helping investors pick the option with better overall returns. This makes it especially useful for planning long-term investments.

How Equity Multiple Works in Real Estate

Calculating the equity multiple is simple - divide the total money received from an investment by the total money invested. For example: An investor puts in $250,000 on a multifamily property. They receive $50,000 in cash flow plus $425,000 when selling. The equity multiple would be $475,000 / $250,000 = 1.9x. This means they nearly doubled their initial investment over five years. Learn more about equity multiples in real estate deals here.

Interpreting Equity Multiple Results

Reading equity multiple results properly is crucial. A 1.0x multiple means breaking even - getting back exactly what was invested. Less than 1.0x shows a loss, while greater than 1.0x indicates profit.

What makes a "good" equity multiple depends on risk level, investment type, and market conditions. For lower-risk investments held 5-7 years, multiples between 1.5x and 2.0x are typically solid returns. Higher-risk investments might target 2.0x to 3.0x or more over shorter periods.

Using Equity Multiple in Investment Decisions

Don't rely on equity multiple alone. While helpful for evaluating returns, it's just one piece of the puzzle. Consider it alongside other metrics like internal rate of return (IRR) and capitalization rate for a complete analysis. This balanced approach helps real estate investors make choices that match their financial goals and comfort with risk.

Mastering the Calculation Process

Learning to calculate equity multiples is crucial for real estate investors. This key metric gives you a clear view of your investment's total returns by factoring in both ongoing income and final sale proceeds.

Breaking Down the Formula

The equity multiple uses a simple calculation - divide your total cash distributions by your total equity invested. This straightforward approach makes it easy to evaluate potential returns on real estate deals.

Step-by-Step Calculation Guide

Here's how to calculate the equity multiple:

- Add Up Total Cash Distributions: Combine all money received from the investment - rental income, refinancing proceeds, and final sale price

- Calculate Total Equity Invested: Sum your initial investment plus any additional capital added during the holding period

- Divide Distributions by Investment: Take your total distributions from step 1 and divide by your total equity from step 2

For example, if you invest $1 million in a property that generates $300,000 yearly for 5 years and sells for $2.5 million, your total distributions would be $4 million ($1.5M from rent + $2.5M from sale). With a $1 million investment, your equity multiple is 4.0x. Learn more about equity multiples from Wall Street Prep.

Illustrative Example

Consider investing $500,000 in an apartment building. Over 5 years, you collect $100,000 in annual cash flow ($500,000 total). Upon selling for $750,000, your total distributions reach $1,250,000. Dividing this by your $500,000 investment gives an equity multiple of 2.5x - meaning you more than doubled your money.

Components of Equity Multiple Calculation

This table breaks down the key elements needed to calculate equity multiples:

Practical Tips for Accurate Calculation

Follow these tips to ensure precise calculations:

- Keep Detailed Records: Track every dollar that flows in and out, including operating income, expenses, and capital costs

- Verify Your Numbers: Double-check all figures against reliable sources

- Use Software Tools: Create spreadsheets to automate calculations and reduce errors

- Get Expert Help: Consult financial advisors or real estate professionals when needed

With this knowledge and systematic approach, you can confidently calculate equity multiples to evaluate and compare real estate investment opportunities. This helps you make well-informed decisions aligned with your investment goals.

Real Estate Investment Success Strategies

Making smart real estate investment decisions requires careful analysis using proven metrics. The equity multiple stands out as one of the most valuable tools for evaluating potential returns by examining both ongoing cash flow and final sale proceeds. Let's explore how investors can use this metric to make better-informed real estate decisions.

Evaluating Different Property Types with Equity Multiple

Different property types offer varying risk-reward profiles that can be compared using equity multiple analysis. Commercial developments may provide higher potential equity multiples than residential properties, primarily due to structured lease agreements and diverse tenant composition. However, this increased potential typically comes with greater risk. Many investors choose residential properties for their more predictable, if modest, equity multiples.

How to Calculate Equity Multiple for Commercial Real Estate

The equity multiple offers clear insights for commercial real estate analysis. To calculate it, divide the total cash received (including both operating income and sale proceeds) by your initial investment amount. For instance, if you invest $1 million in a property and receive $2.5 million total returns over time, your equity multiple is 2.5x. This straightforward calculation helps investors quickly assess their total return relative to capital invested. Learn more about this metric here.

Case Studies: Equity Multiple in Action

Consider a developer investing in a mixed-use building project. By projecting cash flows from both retail and residential units, along with expected property appreciation, they can estimate the likely equity multiple. This analysis helps validate the investment and attract potential funding partners. Similarly, property management companies use equity multiple calculations to compare different assets in their portfolio, guiding decisions about property improvements or sales.

Optimizing Investment Decisions With Equity Multiple

The equity multiple serves as a practical decision-making tool. Here's how to put it to work:

- Find Good Deals: Compare expected returns across different investment options

- Understand Risk Levels: Match higher potential returns with your risk tolerance

- Improve Portfolio Results: Make better choices about when to buy, hold, or sell

Using equity multiple alongside other key metrics like IRR creates a solid foundation for real estate investment analysis. Property management platforms can help track these metrics across multiple properties and deals. For those managing multiple investors, these tools simplify complex calculations and reporting, allowing more time for strategic analysis.

Beyond the Basic Metrics

Understanding how to calculate equity multiple provides just a starting point. Getting the most from your investments requires examining both this foundational metric and how it connects with other key performance indicators. This broader view helps paint a complete picture when evaluating potential deals.

Integrating Equity Multiple with Other Metrics

The most successful investors rely on multiple indicators working together rather than just one number. Key metrics include Internal Rate of Return (IRR), Capitalization Rate (Cap Rate), and Cash-on-Cash Return. Each provides unique insights - equity multiple shows total return on investment, IRR factors in timing of returns, cap rate measures income potential, and cash-on-cash return evaluates initial cash flow. Together they create a comprehensive analysis.

For deeper understanding of these concepts, check out Agora Real Estate's guide on equity multiple.

The Synergy of Metrics: A Balanced Approach

Finding success in real estate requires carefully weighing different factors. A high equity multiple looks appealing, but needs to be balanced against the time required to achieve those returns through IRR analysis. Some investors may prioritize quick gains through strong IRR, while others focus on maximizing total returns over longer periods with higher equity multiples.

Building a Robust Analytical Framework

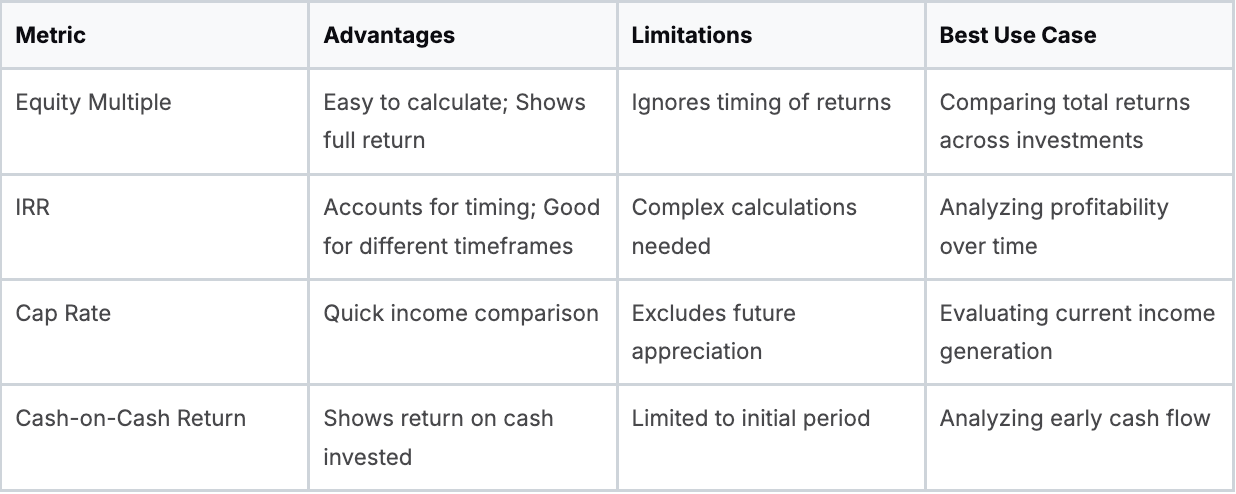

Creating a strong system for analyzing deals means understanding not just how to calculate key metrics, but also how they work together and what limitations each has. Here's a detailed comparison of the main metrics investors should consider:

Investment Metrics Comparison

Using multiple metrics together while understanding their individual strengths and weaknesses leads to better investment choices. Tools and platforms can help track and analyze these metrics across your portfolio, freeing up time to focus on strategic decisions rather than manual number-crunching.

Real-World Success Stories

Real investment examples help demonstrate how equity multiple calculations work in practice. Let's explore three cases where investors used this key metric to guide their decisions and achieve strong returns.

Case Study 1: The Multifamily Marvel

A group of investors pooled $1 million to purchase a multifamily property in a growing city neighborhood. Over five years, the property generated $500,000 in cash flow distributions. When sold, it brought in $2.5 million. The final equity multiple calculation showed excellent returns: ($500,000 + $2.5 million) / $1 million = 3.0x. This case shows how combining steady cash flow with property appreciation can multiply initial investments.

Case Study 2: The Value-Add Victory

An investment group spotted potential in an underperforming office building. They invested $1.5 million to buy it and spent another $500,000 on upgrades. Their improvements increased occupancy and income substantially. After three years, they sold for $4 million, achieving an equity multiple of ($4 million) / ($1.5 million + $500,000) = 2.0x. This shows how strategic improvements can boost returns in a shorter timeframe. For more insights, check out The Ultimate Guide to Real Estate Syndication Investor Returns.

Case Study 3: The Resilient Retail Revival

During an economic downturn, investors purchased a struggling retail center for $2 million and invested $500,000 in improvements. Through focused efforts to attract new tenants, they stabilized the property. After four years, they sold for $3 million, resulting in an equity multiple of ($3 million) / ($2 million + $500,000) = 1.2x. While modest compared to the other examples, this outcome shows how calculated improvements can preserve capital even in tough markets. Learn more about equity multiples.

The Impact of Strategic Decision-Making

These examples highlight how thoughtful property selection and active management drive investment success. Careful analysis of equity multiples helps investors identify opportunities and make informed decisions. When combined with market knowledge and proper timing, this metric becomes a powerful tool for building wealth through real estate.

Maximizing Your Investment Success

Understanding the equity multiple calculation is essential, but it's just the beginning. Success requires knowing how to analyze the results, spot potential issues, and incorporate this key metric into a comprehensive investment approach. Let's explore how to get the most value from this important tool.

Interpreting Equity Multiple Results

Context is everything when evaluating equity multiple results. What counts as a good return depends on your specific goals and market conditions. For example, a 1.5x multiple might make sense for a conservative, long-term investment held for seven years. But riskier, shorter-term ventures often target 2.5x or higher. The key is aligning the expected returns with your personal investment strategy.

Recognizing Red Flags

Be cautious of deals promising unusually high returns with minimal risk. Check the math behind projected returns carefully - overly optimistic assumptions about rental income, property values, or operating costs can paint an unrealistic picture. Thorough research and realistic projections help avoid disappointment later.

Integrating Equity Multiple Analysis into Your Investment Strategy

Don't rely on equity multiple alone. Use it together with other key measures like Internal Rate of Return (IRR) and Cash-on-Cash Return. IRR adds valuable perspective by factoring in when returns occur, not just the total amount. A balanced mix of metrics provides the most complete view for making solid investment choices.

Advanced Applications and Frameworks

Create a custom scoring system that weighs different metrics based on what matters most to you. If building long-term wealth is your goal, you might emphasize equity multiple more heavily. If quick returns are the priority, IRR could carry more weight. The right framework helps you evaluate opportunities consistently.

Track equity multiples across your investments over time to spot patterns and refine your approach. Regular analysis helps you understand what works best in different market conditions and continuously improve your results.

Looking for tools to help manage real estate investments and calculate key metrics? Check out Homebase, an integrated platform for handling deals, investors and financials. It helps streamline the process so you can focus on making smart investment decisions.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.