Essential Guide: Finding Investors for Real Estate

Essential Guide: Finding Investors for Real Estate

Unlock proven strategies for finding investors for real estate to secure long-term funding and drive success.

Domingo Valadez

Mar 23, 2025

Blog

The Real Estate Investment Landscape: What Drives Investor Interest

Understanding real estate investor motivations is crucial for effectively connecting with potential investors. This goes beyond simply showcasing a property; it requires a deep dive into the factors that truly influence investment decisions. This section explores the core drivers behind investor interest in real estate.

The Appeal of Tangible Assets and Steady Returns

Real estate has long been considered a safe haven due to its tangible nature. Unlike intangible investments like stocks or bonds, real estate offers a physical presence. Investors can see and touch their investment, fostering a sense of security. Real estate also often generates a steady income stream through rental payments.

This predictable cash flow is particularly attractive to investors seeking stability. For example, a multifamily property can deliver consistent monthly revenue, even when market conditions fluctuate. It’s important, however, to consider the broader investment landscape. Historically, real estate has drawn investors due to its potential for steady returns and tangible assets.

While the stock market has historically outperformed real estate in terms of overall returns – the S&P 500 averages a 10% annual return including dividends – real estate offers unique advantages, such as rental income and tax benefits. Real estate investments frequently allow for significant leverage.

Investors may only need to put down 20% of the purchase price. This leverage can magnify returns, making real estate attractive to those seeking consistent, though perhaps less dramatic, gains compared to stocks. The U.S. housing market has grown at approximately 5.5% annually.

While less than stocks, this provides stability and the potential for long-term appreciation. Learn more about historical stock market vs. real estate performance at Investopedia. Understanding different investor profiles is therefore even more important.

Investor Psychology: From Individuals to Institutions

Investor motivations vary greatly depending on individual goals and circumstances. High-net-worth individuals may seek to diversify their portfolios and preserve wealth. Institutional investors, on the other hand, often target specific yield objectives and risk-adjusted returns.

A family office, for instance, might prioritize long-term growth and legacy building, while a private equity firm might pursue shorter-term, higher-return opportunities. Tailoring your approach to each investor type is essential when seeking real estate investment.

Market Forces and Investment Decisions

Current market conditions significantly impact investor interest. Factors like interest rates, inflation, and local market dynamics play a crucial role in shaping investment choices. Furthermore, emerging trends, such as the growing demand for sustainable and energy-efficient properties, attract environmentally conscious investors.

Staying informed about the evolving market is crucial for attracting investment capital. Understanding these dynamics allows you to position your real estate opportunity to resonate with the specific goals of potential investors.

Identifying Your Ideal Investors: Match-Making In Real Estate

Finding the right investors for your real estate project is crucial for success. It's not just about securing funding; it's about forming strategic partnerships that align with your vision and objectives. This requires understanding the diverse landscape of real estate investors and carefully matching them to your specific project needs.

Different Investor Profiles: A Diverse Landscape

The real estate investment world is populated by a variety of players, each with their own unique characteristics and investment goals. Recognizing these differences is the first step in identifying the ideal partners for your project.

Family offices, for instance, often prioritize long-term growth and wealth preservation. Their focus tends to be on stable, lower-risk investments with consistent cash flow. They typically have a longer investment horizon, aligning with their multi-generational wealth management strategies.

On the other hand, private equity firms often seek higher returns in a shorter timeframe. They're generally more comfortable with higher-risk projects that offer greater potential upside. Their investment strategies are often geared towards maximizing returns within a specific timeframe.

Individual investors represent another important segment, driven by diverse motivations. Portfolio diversification, personal interest in real estate, or a combination of factors can influence their investment decisions.

Understanding Investor Preferences: Key Considerations

Several key factors come into play when identifying the ideal investor for your project. Understanding these considerations will help you narrow your focus and target the most suitable partners.

Project scale is paramount. Some investors focus exclusively on large-scale developments, while others specialize in smaller, niche projects. Matching your project's scope to the investor's typical investment size is critical.

Risk tolerance is another crucial element. Some investors embrace higher-risk ventures, while others prefer more conservative approaches. Aligning your project's risk profile with the investor's comfort level is essential for a successful partnership.

Finally, timeline expectations play a significant role. Understanding an investor's preferred holding period helps ensure alignment and avoids potential conflicts down the line. Some prioritize quick returns, while others are in it for the long haul.

To understand the market landscape better, it's always a good idea to be aware of the current trends and statistics in the U.S. real estate market. The median U.S. home price is reported at $396,900, with housing starts at 1,366,000 in January and new home sales at 698,000 in December. For more detailed insights, check the resources available at the National Association of Realtors (NAR).

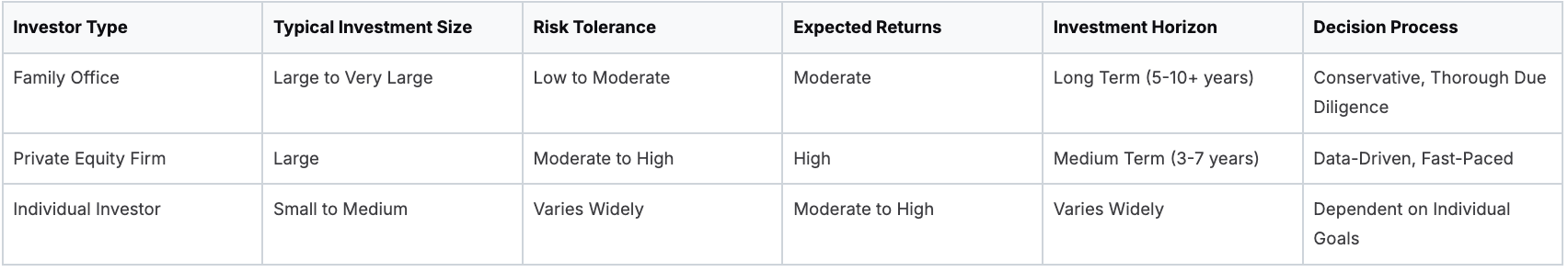

To help illustrate the different types of investors, let's take a look at the following table:

Types of Real Estate Investors Comparison

This table compares different types of real estate investors based on their typical investment criteria, preferences, and expectations.

This table highlights some key differences between investor types. While family offices prioritize long-term, stable returns, private equity firms target higher returns over a shorter period. Individual investors exhibit a wide range of preferences across all categories.

Qualifying Prospects: A Proactive Approach

Successful developers take a proactive approach to investor relations. Qualifying prospects before pitching saves valuable time and resources. This involves researching potential investors, understanding their past investments, and assessing their alignment with your project. By carefully evaluating potential investors and focusing on those with a genuine interest, you’ll significantly increase your chances of securing the right funding and building long-term, mutually beneficial partnerships.

Crafting an Investment Package That Gets Funded

Attracting investors for real estate ventures requires a compelling investment package that showcases the opportunity’s potential and mitigates risk. It takes more than simply having a promising property. This section explores creating materials that resonate with investors and help secure funding.

Financial Projections That Withstand Scrutiny

Solid financial projections are essential to any successful real estate investment package. However, presenting numbers alone isn't sufficient. Investors need realistic and well-supported data. This requires detailed market analysis, expense breakdowns, and conservative revenue estimates.

For example, demonstrate how you arrived at your rental income projections. Be sure to incorporate vacancy rates and potential rent increases. Also, include a thorough analysis of operating expenses like property taxes, insurance, and maintenance costs. This transparency builds trust and shows your market understanding.

Property Analyses That Preemptively Address Concerns

A comprehensive property analysis goes beyond basic due diligence. It anticipates investor questions and addresses them proactively. This involves an in-depth assessment of the property's condition, location, and potential for appreciation.

Consider the surrounding infrastructure, access to amenities, and any potential development plans. Highlight any unique features or improvements that set your property apart. This proactive approach builds confidence and reduces investor hesitation. Understanding the current market conditions is vital.

Speaking of market conditions, healthy markets often correlate with strong employment in related sectors. Real estate industry employment (NAICS 531) grew from 1,871.5 thousand in November 2024 to 1,884.0 thousand in January 2025. This suggests strong demand, creating potential investment opportunities. Learn more at the Bureau of Labor Statistics. Let's consider presenting this information effectively.

The Narrative: Making Your Opportunity Stand Out

Crafting a compelling narrative is key to differentiating your opportunity. This involves a clear and concise story that highlights the property’s potential and aligns with investor goals.

Focus on the problem your property solves and how it meets market needs. For example, if developing affordable housing in a high-demand area, emphasize the social impact and long-term financial viability. A well-crafted narrative creates emotional resonance and memorability.

Psychological Triggers and Ethical Presentation

Understanding investor psychology can strengthen your presentation. Highlighting scarcity, social proof, and authority can subtly influence decisions.

However, transparency and honesty regarding risks and potential returns are paramount. Avoid overpromising or misleading investors. Building trust is crucial for long-term success in attracting real estate investors. This ethical approach fosters strong relationships and encourages repeat investments.

Building Networks That Deliver Real Estate Capital

When seeking investors for real estate ventures, your network is a crucial asset. This section explores building relationships that can lead to securing tangible investment capital. We'll examine various strategies, from time-tested networking approaches to utilizing online platforms. Remember, the goal isn't simply accumulating contacts; it's about cultivating genuine relationships that unlock funding opportunities.

Traditional Avenues for Connecting With Investors

Traditional networking remains highly effective for finding real estate investors. Investment clubs, for instance, offer direct access to a focused group of potential investors. Attending industry events, such as real estate conferences, provides valuable opportunities for face-to-face interactions.

Joining local business organizations and chambers of commerce can also be beneficial. These groups offer chances to connect with individuals who may have an interest in real estate investment. Building these in-person relationships fosters trust and strengthens your credibility.

Leveraging Digital Platforms to Expand Your Reach

The online world presents numerous platforms for connecting with potential investors. Online communities specifically designed for real estate investment can be excellent resources. These platforms allow you to participate in discussions, share insights, and establish connections with prospective investors.

LinkedIn is another powerful tool for expanding your network and demonstrating your expertise. By maintaining an active presence, you can connect with investors, share relevant content, and position yourself as a knowledgeable figure in the real estate industry. This increased visibility can effectively attract potential investors.

Building Your Brand as a Steward of Capital

Developing an authentic brand is essential for attracting investors. Presenting yourself as a reliable and capable manager of capital can greatly enhance your appeal. This involves showcasing your track record, highlighting successful ventures, and emphasizing your dedication to investor returns.

Sharing case studies of past projects that demonstrate your ability to generate strong returns is a valuable strategy. Actively participating in industry conversations and sharing valuable knowledge builds confidence and attracts potential investors. For further information, consider exploring resources like How to master real estate capital raising.

Nurturing Relationships and Building Long-Term Partnerships

Securing initial investments is just the beginning. Cultivating those relationships over time is vital for sustained success. This involves regular communication, transparent reporting, and a genuine focus on investor needs.

Providing consistent updates on project progress, including key milestones and addressing any obstacles, is essential. This open communication strengthens trust and fosters robust relationships. Consider organizing investor events or webinars to offer valuable insights and reinforce connections.

Turning first-time investors into long-term partners requires a consistent and proactive approach to relationship management. By demonstrating your commitment to investor success and building trust, you can establish a reliable funding network for future projects.

The Investor Pitch: Turning Meetings Into Commitments

Securing a meeting with a potential investor is a major step in real estate fundraising. However, the real challenge lies in converting that meeting into a tangible investment. This section offers a guide for effective presentations that transform prospects into invested partners.

Creating the Optimal Meeting Environment

First impressions are paramount. The environment you select for your pitch can significantly impact the outcome. Choose a professional, quiet location free from distractions. This might be a well-equipped conference room, a private office, or a neutral setting like a hotel meeting space. Ensure the space is comfortable and well-lit, creating a positive atmosphere. This shows professionalism and respect for the investor’s time.

Structuring Your Presentation for Maximum Impact

A well-structured presentation is essential for maintaining investor interest. Begin with a concise overview of the opportunity, highlighting the key value proposition. Clearly define the investment objectives, target returns, and exit strategy.

Present a detailed market analysis, demonstrating your understanding of local market trends. Include comprehensive financial projections that are realistic and attractive. This builds credibility and gives investors a solid basis for evaluation.

Finally, showcase your team's expertise and experience. Highlight your track record and emphasize your commitment to investor interests. This builds trust and positions you as a capable manager of their investment.

Handling Objections With Confidence

Addressing investor objections is crucial for a successful pitch. Be ready for tough questions about market risks, financial projections, and your team’s experience. An investor might question projected occupancy rates or the impact of interest rate changes. By confidently addressing these concerns, you demonstrate preparedness and build trust.

One strategy is to proactively address common objections within the presentation. This demonstrates foresight and thoughtful risk mitigation. Maintain a professional demeanor, even under pressure. This projects confidence and reassures investors of your ability to handle challenges.

Reading Body Language and Adapting in Real-Time

Paying attention to investor body language offers valuable insights. Observe non-verbal cues like eye contact, posture, and facial expressions. These can indicate whether an investor is receptive, skeptical, or disengaged.

Adjust your presentation based on these cues. If an investor seems confused, offer further explanation. If they appear disengaged, re-engage them with a relevant story or example. This adaptability demonstrates attentiveness and commitment to effective communication.

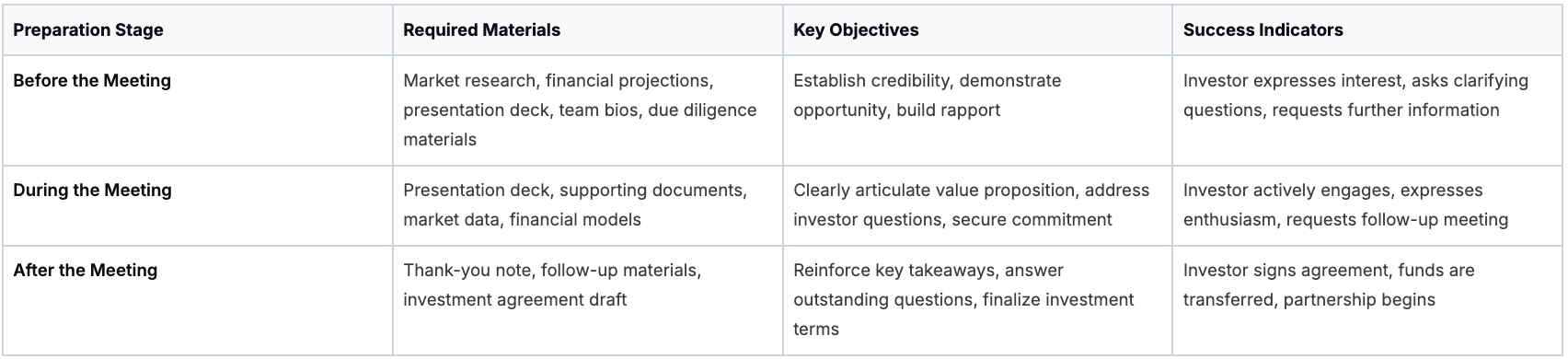

Before diving into your next investor meeting, review this checklist to ensure you're fully prepared. It covers essential items before, during, and after the meeting to maximize your chances of success.

To help streamline your preparation process, use the following checklist:

Investor Pitch Meeting Preparation Checklist: A comprehensive checklist of preparation items and materials needed before, during, and after investor pitch meetings.

This checklist helps ensure all essential aspects are addressed, leading to a more productive and successful fundraising process. By carefully preparing for each stage, you'll be well-positioned to secure the investment you need.

The Ask and Graceful Follow-Up

Knowing how and when to ask for the investment is key. Choose a moment after you’ve effectively presented the opportunity and addressed any concerns. Clearly state the investment terms and expected returns. Provide a clear call to action, outlining the next steps.

Follow up promptly after the meeting with a thank-you note and any requested information. Avoid being overly persistent. Respect the investor’s time and decision-making process. A thoughtful follow-up demonstrates professionalism and strengthens your relationship.

Beyond Traditional Capital: Alternative Funding Sources

Finding investors for real estate projects often requires exploring options beyond traditional banks. This opens doors to exciting opportunities, particularly for projects that may not meet conventional lending requirements. This section explores alternative funding sources gaining popularity in the real estate sector.

Real Estate Crowdfunding: Power of the Collective

Real estate crowdfunding platforms pool smaller investments from many individuals to finance larger developments. This democratizes real estate investment, allowing individuals to participate in deals they might not typically access. For instance, a platform might enable investors to contribute as little as $1,000 to a multi-million dollar project. This accessibility attracts both new and experienced investors. However, it's essential to research platforms thoroughly, as fees and minimum investment amounts vary.

Syndication Structures: Combining Resources and Expertise

Real estate syndications involve a group of investors pooling their resources under the guidance of a sponsor. This structure allows individuals to participate in larger, more complex projects that would be challenging to undertake individually. Syndications offer diversification and access to experienced management. A syndication might focus on a portfolio of multifamily properties, capitalizing on the sponsor's sector-specific expertise. Investors should carefully review the syndication agreement and understand the fee and profit-sharing structure.

Peer-to-Peer Lending Networks: Direct Investor Connections

Peer-to-peer (P2P) lending networks connect borrowers directly with individual investors, bypassing traditional banks. This can result in more favorable terms for both parties. P2P lending platforms offer investors a broader range of investment options, often with varying levels of risk and return. For example, an investor might fund a short-term loan for a fix-and-flip project, potentially yielding a higher return than a long-term mortgage. Thorough due diligence on both the platform and the specific loans is crucial.

Navigating Regulatory Requirements and Platform Selection

Alternative funding sources often have specific regulations. Understanding these requirements is vital for both sponsors and investors. This might involve compliance with securities laws, tax regulations, and platform-specific rules. Careful platform selection is also paramount. Choose established platforms with a proven track record, transparent fees, and robust due diligence processes. This minimizes risk and contributes to a smoother investment experience.

Choosing the Right Method for Your Project

The ideal alternative funding method depends on several factors, including the property type, investment scale, and investor preferences. Crowdfunding might suit smaller projects, while syndications are often better for larger ventures. P2P lending can be an effective solution for specific financing needs, like bridge loans or construction financing. Careful consideration of these factors allows real estate developers to successfully utilize alternative funding to unlock new opportunities.

Investor Relationship Management: Turning One Deal Into Many

Finding investors for real estate is the crucial first step. But cultivating lasting relationships with these investors is what creates a sustainable source of funding for future projects. This section explains how successful real estate developers transform one-time investors into loyal capital partners. This is accomplished through strategic relationship management, fostering a network of trust and mutual benefit that will streamline future fundraising efforts.

Building a Communication System That Fosters Trust

Open and consistent communication is paramount to building strong investor relationships. Establish clear communication channels right from the start, outlining how and when investors will receive updates. This could involve regular newsletters, periodic email updates, or even a dedicated online investor portal. Transparency is key to building trust, especially when navigating challenging periods.

For example, if a project experiences unforeseen delays, proactively communicate the issue to your investors. Explain the situation clearly and outline the plan to address it. Similarly, share positive developments and celebrate key milestones. This consistent, open approach fosters a sense of partnership and reinforces investor confidence in your leadership.

Reporting Practices That Matter to Investors

Investors value concise, data-driven reporting focused on key performance indicators (KPIs). Avoid overwhelming them with unnecessary details. Instead, provide clear, concise summaries of project progress, financial performance, and metrics relevant to their investment goals. Regular reporting on these metrics demonstrates professionalism and keeps investors informed without demanding too much of their time.

Think of it like a well-managed stock portfolio. Investors don’t need daily updates on every minor market fluctuation. They want to see consistent progress toward their overall investment objectives. Focus on providing data that truly matters, presented in a clear and easily digestible format.

Turning Satisfied Investors Into Enthusiastic Referrals

Satisfied investors can be your most powerful marketing tool. By consistently exceeding their expectations and nurturing strong relationships, you transform them into enthusiastic advocates. These advocates will actively introduce you to their networks, creating a self-perpetuating funding ecosystem and reducing your reliance on constantly seeking new capital.

Consider implementing a formal referral program that offers incentives to investors who introduce new partners. However, even without a formal program, cultivating genuine relationships organically leads to valuable referrals. Satisfied investors naturally share positive experiences within their network, creating powerful word-of-mouth marketing. This reduces acquisition costs and strengthens your reputation within the investment community.

Ready to streamline your investor relations and unlock the potential of long-term partnerships? Homebase is an all-in-one platform designed to simplify real estate syndication, from fundraising to investor communication. Visit Homebase to learn more and transform your investor management today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.