Expert Guide: Offering Memorandum Real Estate Success

Expert Guide: Offering Memorandum Real Estate Success

Discover top strategies to create compelling offering memorandum real estate documents that attract investors and close deals.

Domingo Valadez

Feb 25, 2025

Blog

Crafting Powerful Offering Memorandums That Convert

A compelling offering memorandum can make the difference between success and failure when seeking real estate investors. Rather than just listing property features, an effective memorandum tells a persuasive story about the investment opportunity through carefully presented information and data. The goal is to answer investor questions proactively while building a strong case for the property's profit potential.

Understanding the Purpose of an Offering Memorandum

An offering memorandum (OM) is the main marketing document used to attract real estate investors to a property. As their first detailed look at the investment opportunity, it must be both informative and engaging. Learn more about offering memorandums in commercial real estate. A well-crafted OM helps mitigate risk through transparency while a poorly written one can quickly turn away potential investors.

Key Elements of a High-Converting Offering Memorandum

The most effective offering memorandums include several critical components that help convert prospects into committed investors. The Executive Summary opens with a clear overview highlighting key strengths and investment potential. This is followed by a detailed Property Description outlining the unique advantages and features.

- Market Analysis: Include data on market trends, demographics, and competition to demonstrate the property's growth potential and market positioning

- Financial Projections: Provide realistic income statements, cash flow projections, and ROI analysis so investors clearly understand potential returns

- Risk Assessment: Address risks transparently while outlining specific mitigation strategies to build investor confidence. Learn more about creating powerful real estate offering memorandums.

Presenting Information Effectively

The most thorough analysis falls flat without clear, engaging presentation. Use straightforward language and avoid industry jargon. Strategic use of charts, graphs, and professional photography makes complex data more digestible.

Match the presentation style to your target investors' preferences. Understanding their investment criteria, risk tolerance, and communication style helps tailor the document effectively. By speaking directly to their needs and interests, you improve your chances of securing investment. A properly structured offering memorandum provides the foundation for attracting investors and closing deals successfully.

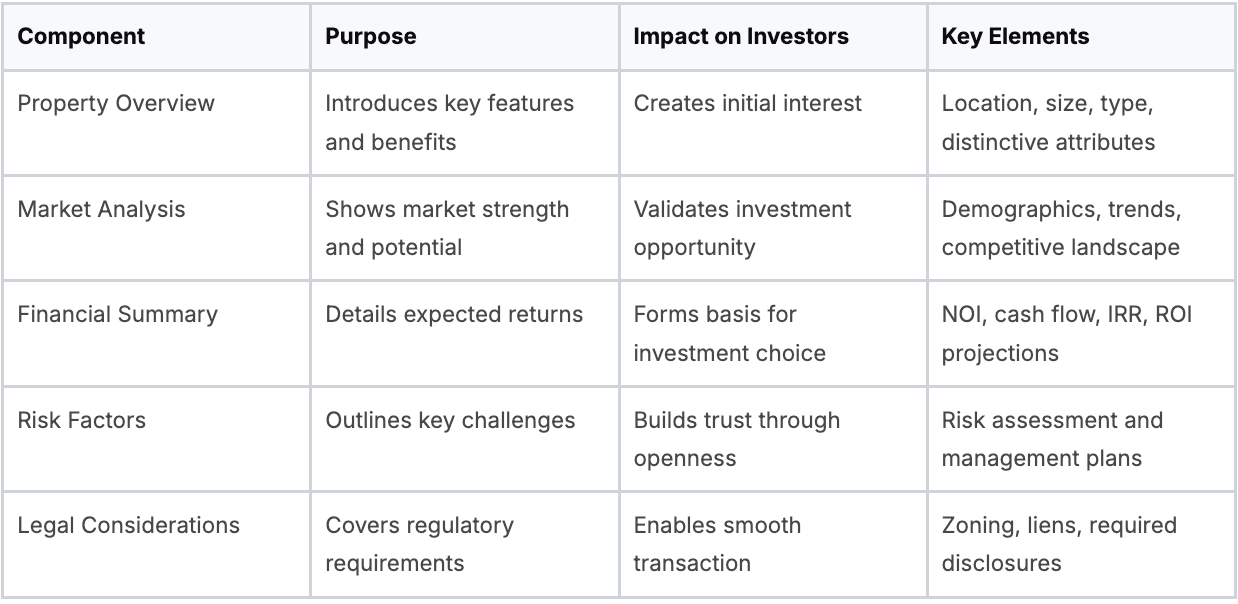

Essential Components That Drive Investment Decisions

The key elements of a successful offering memorandum can make or break real estate investment decisions. A well-crafted memorandum does more than list property features - it tells a compelling story that connects with investors and builds their confidence. Getting the structure and content right is essential.

The Foundation: Property Overview and Market Analysis

A strong offering memorandum starts with a focused property overview that captures the key selling points and unique advantages. This section needs to quickly grab attention and generate interest. The market analysis then validates the opportunity by examining local trends, demographic data, and competitive factors. Together, these sections answer why this specific property in this location represents a smart investment choice.

The Financials: A Story of Returns

While financial data is critical, presenting it effectively makes all the difference. The financial summary should explain complex metrics in clear terms that resonate with investors. Rather than just stating projected net operating income (NOI), show what those numbers mean for potential returns. Include cash flow projections, IRR calculations, and other key metrics in an accessible format. For deeper insights into structuring these components, explore this detailed guide.

Addressing Risk: Building Confidence Through Transparency

Every investment carries risks, and addressing them openly builds credibility. A dedicated risk factors section shows investors you've carefully analyzed potential challenges. Rather than downplaying risks, explain your strategies for managing them. This straightforward approach helps investors make informed decisions with confidence.

Legal Considerations: Ensuring a Smooth Transaction

The offering memorandum must cover all relevant legal requirements - from zoning rules to property liens and other key factors. Including this information upfront prevents surprises and demonstrates professionalism throughout the transaction process.

Essential OM Components Comparison

When these components work together effectively, an offering memorandum becomes a powerful tool for driving investment decisions. The document provides a clear picture of the opportunity while giving investors the confidence to move forward.

Mastering Risk Disclosure Strategy

Creating an effective risk disclosure section in your offering memorandum helps build trust with investors by openly addressing potential concerns. Rather than just listing risks, focus on showing your deep understanding of challenges and clear plans to handle them. Taking this proactive approach positions you as a prepared sponsor that investors can have confidence in.

Framing Challenges Constructively

Avoid the mistake of minimizing risk factors in your real estate offering memorandum. Experienced investors expect full transparency. Instead of hiding issues, present challenges in a constructive way. For example, if property taxes are rising in the area, acknowledge this fact directly. Then outline specific plans to manage it through strategic lease structures or operational efficiencies. This shows investors you've carefully evaluated potential obstacles.

Balancing Transparency and Potential

Finding the right balance between disclosing risks and highlighting opportunities is key. While you must be upfront about risks, the overall story should emphasize the property's strengths and return potential. Present an honest analysis of market conditions and competition, addressing challenges while explaining what makes this a compelling investment. Over time, offering memorandums have evolved to include more detailed financial and operational data as investors demand greater transparency. Learn more about risk disclosure best practices.

Strategic Approaches to Presenting Market Challenges

Market analysis is essential for addressing risk effectively. Go beyond raw data to analyze market dynamics in relation to your property. If there's increased competition, highlight your property's unique features or prime location that set it apart. This demonstrates you understand market forces and have positioned the property for success.

Addressing Competitive Threats

Be direct in discussing competition. Analyze key competitors' strengths and weaknesses compared to your property. Explain your strategy for maintaining competitive advantages through superior amenities, targeted marketing, or strategic pricing. This proactive approach shows your grasp of the competitive landscape and commitment to maximizing value.

Building Trust Through Open Communication

Effective risk disclosure creates trust with investors. By being straightforward about challenges and outlining management strategies, you demonstrate integrity and build investor confidence. This transparency forms the foundation for strong, lasting relationships. With Homebase, you can securely manage and share risk disclosures and other key documents with investors in one central platform, making communication clearer and more efficient throughout the investment process.

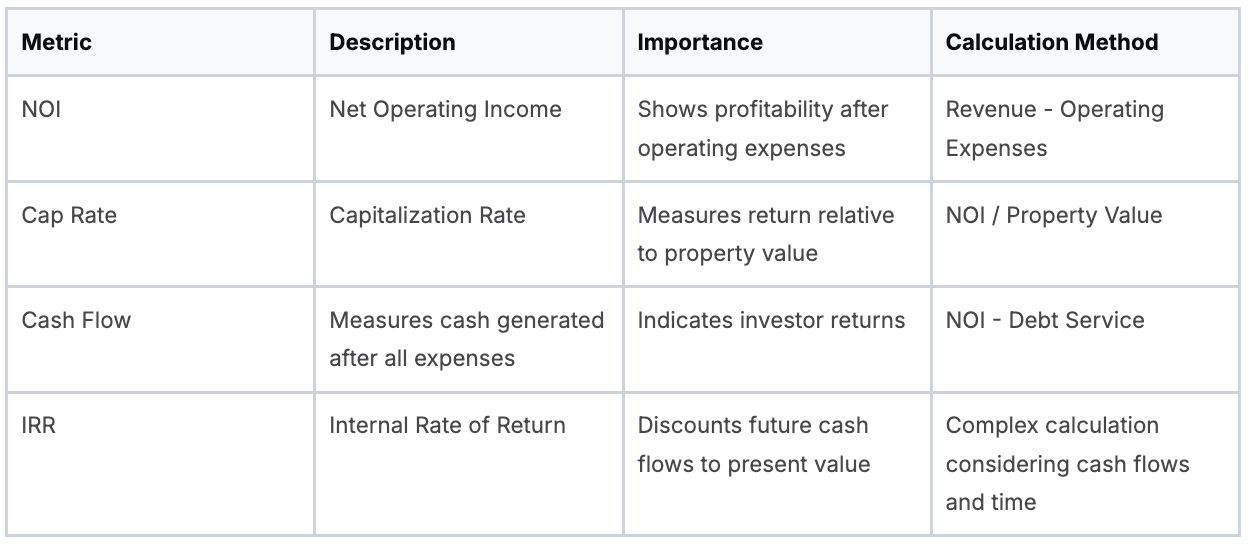

Financial Storytelling That Captures Interest

A real estate offering memorandum needs to do more than list financial data - it must tell a compelling story that connects with investors. Raw numbers alone rarely motivate action. The key is converting those figures into a clear narrative that shows the property's full potential and drives investment decisions.

Beyond the Numbers: Creating a Compelling Narrative

Consider your offering memorandum like a movie preview - it should highlight the most exciting aspects while making investors eager to learn more. Focus on demonstrating how the numbers translate into real benefits and returns.

Rather than simply stating projected net operating income (NOI), explain how that NOI creates strong cash flow opportunities. Show how the property outperforms similar assets, establishing its unique advantages. Paint a picture of financial success that engages investors and encourages deeper exploration.

Visualization Techniques: Bringing Data to Life

Complex financial information can overwhelm investors. Smart data visualization makes the numbers more accessible and memorable:

- Simple bar charts to compare performance metrics over time

- Clear line graphs to illustrate growth projections and trends

- Clean infographics to break down key financial data points

Good visuals make the offering memorandum more engaging while helping investors better understand the opportunity.

Projection Methodologies: Building Confidence in Future Performance

Investors want clarity on expected future performance. A strong methodology explanation builds credibility in your forecasts. Detail your assumptions about occupancy, rent growth, and expenses.

Include sensitivity analysis showing outcomes under different market conditions. This demonstrates you've thought through potential challenges. Clear, well-supported projections strengthen your overall investment narrative.

Tailoring Your Message: Addressing Different Investor Types

Different investors have unique priorities and risk profiles. Customize your story accordingly:

- Conservative investors: Focus on reliable cash flows and lower risk

- Growth investors: Emphasize appreciation potential and higher returns

- Value investors: Highlight below-market pricing and value-add opportunities

Understanding your audience and speaking to their specific interests makes your offering memorandum more effective.

Financial Metrics Overview

Strong financial storytelling transforms your offering memorandum into a powerful tool for attracting investment. The story matters as much as the numbers. Using Homebase, you can organize and present financial data clearly and professionally. The platform also enables secure document sharing and investor communications, making the process smooth and efficient.

Market Analysis That Builds Credibility

A strong market analysis in your real estate offering memorandum does more than present data - it tells a compelling story about your property's competitive edge and growth potential. This critical section helps establish your expertise and gives investors confidence in the opportunity.

Understanding Your Target Audience

Before diving into market data, get clear on your ideal investor profile. Are they focused on building long-term equity or generating immediate cash flow? Their investment goals should guide how you present the analysis. For income-focused investors, emphasize metrics like current and projected NOI and cap rates.

Demonstrating Market Expertise

Show deep knowledge of your local market with specific, relevant insights. Analyze recent comparable sales, economic drivers, and upcoming developments that impact property value. If the area has strong population growth, explain how that translates to increased rental demand or commercial leasing opportunities.

Highlighting Competitive Advantages

Position your property strategically against competitors. Create a clear comparison table showing key features, amenities, location benefits and pricing. This helps investors quickly grasp what makes your property stand out in the market.

Presenting Data Effectively

Make complex data digestible through strategic use of visuals. Charts and graphs work well for key metrics like:

- Historical and projected rent growth (line graphs)

- Occupancy rates vs market averages (bar charts)

- Price per square foot comparisons

- Demographic breakdowns

Demographic Analysis: Targeting the Right Opportunities

Demographics directly impact real estate values. Include data on:

- Population growth rates

- Household income levels

- Age distribution

- Employment trends

This helps investors understand the target market. For example, properties near universities attract student renters, while suburban locations appeal to families seeking long-term homes.

Market Trend Presentation: Forecasting Future Growth

Show foresight by analyzing emerging trends that will shape future performance:

- New commercial/residential development

- Infrastructure improvements

- Changes in consumer preferences

- Job market expansion

Connect these trends back to your property's strengths and growth potential.

Leveraging Homebase for Market Analysis

Homebase provides essential tools for creating professional market analysis. The platform offers secure document sharing and integrated financial modeling to help you present data effectively and build investor confidence. By combining thorough research with clear presentation, your market analysis will attract serious investors to your offering memorandum.

The Evolution of Modern Offering Memorandums

Real estate professionals are adopting digital tools to create more engaging offering memorandums (OMs). The shift from static PDFs to interactive presentations helps investors better understand and evaluate opportunities.

Interactive Financial Models

Modern OMs feature dynamic financial models that let investors explore different scenarios. By adjusting key variables like occupancy rates and rent growth, investors can see how changes impact potential returns in real-time. This hands-on approach gives investors deeper insights and greater confidence in the investment fundamentals.

Virtual Property Tours

While photos provide basic visuals, 360° virtual tours create an immersive experience that brings properties to life. Remote investors can thoroughly explore buildings, amenities, and unit layouts from anywhere. This technology is especially valuable for out-of-state investors who can't easily visit in person.

Data Visualization Tools

Complex financial data becomes more digestible through interactive visualizations. Rather than dense spreadsheets, investors can interact with responsive charts and dashboards that highlight key metrics. Visual analytics tools make it easier to spot trends and understand performance drivers.

Professional Standards in Digital Format

The move to digital requires maintaining institutional-quality presentation. The best digital OMs combine enhanced functionality with polished design, clear navigation, and consistent branding. Success means finding the right balance between innovation and professionalism.

Implementation Guide

To create effective digital OMs:

- Identify where interactive elements add the most value

- Choose software that integrates with existing systems

- Start with a test project to refine the approach

- Gather feedback before wider adoption

Homebase offers an all-in-one platform for real estate syndication. Create compelling digital OMs, manage investor communications, and track deals in one central location. Focus on growing your business rather than managing complex spreadsheets.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.