Definition of Cash on Cash Return | Key Real Estate Metric

Definition of Cash on Cash Return | Key Real Estate Metric

Learn the definition of cash on cash return and how to use this crucial real estate metric to boost your investment success. Simplified and explained!

Domingo Valadez

Aug 3, 2025

Blog

When you're diving into real estate investing, you'll hear a lot of different terms and metrics thrown around. But if there’s one you absolutely need to get comfortable with, it's cash on cash return.

So, what is it? Put simply, it’s a straightforward way to measure the annual cash income you’re getting back compared to the actual cash you put into the deal. It’s all about the performance of your out-of-pocket money, not the entire property value.

The True Meaning of Cash on Cash Return

Let's use a simple analogy. Imagine you buy an apple tree for $100. That's your cash investment. In the first year, you harvest and sell $10 worth of apples. Your cash on cash return for that year is 10%. It’s a very direct, gut-level way to see how hard your invested cash is working for you right now.

This metric becomes absolutely critical when you use financing, which most real estate investors do. It isolates the performance of your down payment and other upfront costs, giving you a crystal-clear picture of your investment's immediate profitability. To really nail this down, it helps to understand the fundamental principles of cash flow analysis, which is the bedrock of tracking money in and out of any investment.

Why It Zeros In on Your Invested Cash

Unlike other metrics that might look at the total value of the property, cash on cash return is laser-focused on your personal stake in the game. This distinction is crucial because it’s the best way to see the true power of leverage.

When you take out a loan, you reduce your initial cash outlay. This can dramatically boost your cash on cash return percentage, even if the property's overall profit doesn't change. You're making your money work harder for you.

To get the most out of the cash on cash return formula, it's important to understand its core components. The table below breaks down the key inputs you'll need for the calculation.

Table: Core Components of Cash on Cash Return

Understanding these two pieces—what you're making and what you've paid—is the foundation for accurately assessing an investment's performance from your personal financial perspective.

What Cash on Cash Return Really Tells You

At the end of the day, this metric helps you answer one of the most important questions an investor can ask: "For every dollar I put into this deal, how many cents am I getting back each year?" It gives you a clean, apples-to-apples way to compare different potential investments, no matter their purchase price.

Here's why it's so valuable:

- A Quick Performance Snapshot: It gives you an immediate, easy-to-understand grade on how well an investment is generating income on an annual basis.

- The Impact of Leverage: It clearly shows you how using borrowed money can amplify your personal returns.

- Aligning with Your Goals: It helps you quickly filter through properties to find the ones that actually meet your specific income targets.

For anyone serious about real estate, especially syndicators and active investors, mastering this concept is the first real step toward making smarter, more consistently profitable decisions. Once you have this down, you can explore our guide on https://www.homebasecre.com/posts/cash-on-cash-return to build on these fundamental concepts.

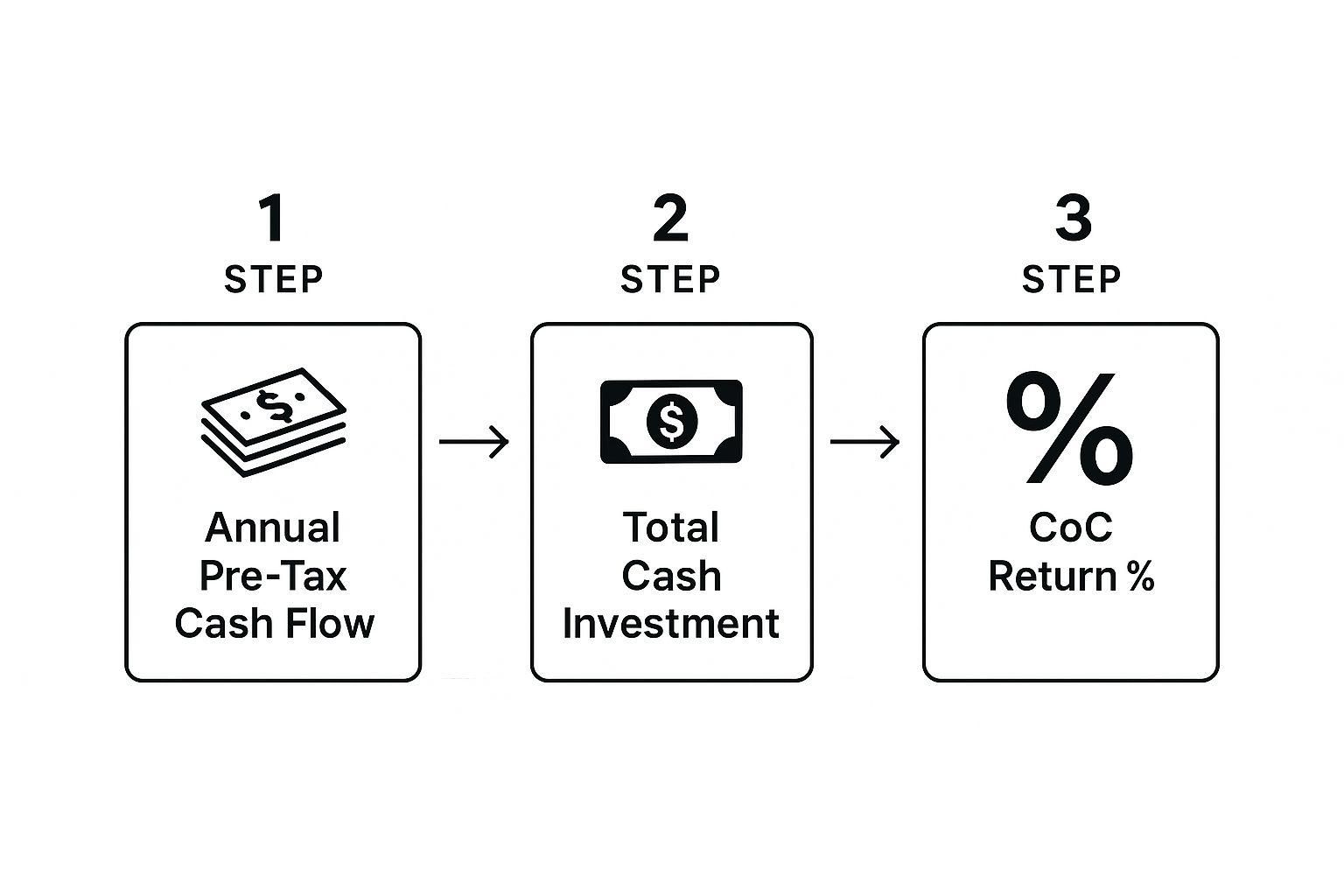

How to Calculate Cash on Cash Return Step by Step

Working out your cash on cash return is a lot less intimidating than it sounds. At the end of the day, it really just comes down to two key numbers: the cash your property actually generates and the total cash you paid out of pocket to get it. Knowing the definition of cash on cash return is helpful, but being able to run the numbers yourself is what truly separates savvy investors from the rest.

If you're new to these kinds of metrics, getting a handle on how to calculate a general rate of return is a great starting point. It lays a solid foundation before you jump into more specific calculations like this one.

Let's walk through the formula with a real-world example so you can see exactly how it works.

Step 1: Calculate Your Annual Pre-Tax Cash Flow

First things first, we need to figure out how much cash the investment generates in a single year, before taxes are taken out. This isn't just the rent you collect—it's the actual profit left over after you've paid all the property's bills.

You'll start with your Gross Rental Income (GRI), which is the maximum potential rent you could collect if the property were full all year. From there, you subtract all the costs.

- Factor in Vacancy: Let's be realistic—no property stays rented 100% of the time. It's smart to use a conservative vacancy estimate, typically around 5-10% of your GRI, to get a more accurate income number.

- Deduct Operating Expenses: This is everything it takes to keep the lights on and the property running smoothly. Think property taxes, insurance, maintenance, repairs, property management fees, and any utilities you cover.

- Subtract Your Debt Service: This is your total annual mortgage payment, which includes both principal and interest. This is a critical step because it isolates the return on your money, not the lender's.

The Bottom Line: Your Annual Pre-Tax Cash Flow is what's left after all those deductions. It's the real cash that hits your bank account from the investment over the course of a year.

Step 2: Determine Your Total Cash Invested

Next, you need to tally up every single dollar that came out of your pocket to close the deal. This is a lot more than just the down payment.

Your total cash invested should include:

- The Down Payment: This is usually the biggest chunk of your initial investment.

- Closing Costs: Don't forget these! Fees for the loan, appraisal, title insurance, and legal work can easily add another 2-5% of the purchase price to your initial outlay.

- Immediate Renovation Costs: Did you have to spend money on repairs, a remodel, or new appliances to get the property rent-ready? Add that in here.

This infographic does a great job of showing how all these pieces fit together.

As you can see, the path is pretty direct: figure out your annual cash flow and your total cash invested, and you're just one step away from the final percentage.

Step 3: Put It All Together

Once you have your two main figures—annual cash flow and total cash invested—the final calculation is simple division.

Cash on Cash Return = (Annual Pre-Tax Cash Flow / Total Cash Invested) x 100

We multiply the result by 100 to express it as a percentage, which makes it much easier to read and compare against other potential deals. This final number is the definition of cash on cash return in practice, showing you exactly how hard your invested capital is working for you each year.

Analyzing Real-World Cash on Cash Return Examples

The formula is a great starting point, but let’s be honest—it doesn't really come to life until you plug in some real numbers. This is where theory meets reality. Watching how the numbers interact in different scenarios is what turns the abstract definition of cash on cash return into a practical tool you can use to vet deals and make smart decisions.

To see it in action, we'll walk through two very different investment examples: a standard residential rental and a much larger commercial property. This will really show you how things like financing and property type can drastically change your returns.

Example 1: The Financed Residential Rental

Let's start with a classic. Imagine you're eyeing a single-family home to use as a rental property. This is a common entry point for investors, so it's a perfect, clean example for our metric.

First, we need to know how much cash you're actually putting into the deal:

- Purchase Price: $300,000

- Down Payment (20%): $60,000

- Closing Costs & Initial Repairs: $10,000

- Total Cash Invested:$70,000

Next, we figure out how much cash the property puts back in your pocket each year:

- Monthly Rent: $2,500 (or $30,000 annually)

- Annual Operating Expenses (Taxes, Insurance, Maintenance): $12,000

- Net Operating Income (NOI): $18,000 (that’s $30,000 - $12,000)

- Annual Mortgage Payments (Debt Service): $15,000

- Annual Pre-Tax Cash Flow:$3,000 (the $18,000 NOI minus your $15,000 mortgage payments)

Now we have the two numbers we need. The calculation is simple:

Cash on Cash Return = ($3,000 Annual Cash Flow / $70,000 Total Cash Invested) = 4.3%

That 4.3% is the punchline. It tells you exactly what kind of annual return you’re getting on the $70,000 you pulled out of your bank account. It's a pure, direct measure of how hard your cash is working for you.

Example 2: The Leveraged Commercial Property

Now, let's switch gears and look at a bigger, more complex commercial deal. Here, the numbers are larger, and using leverage (a loan) has a much more dramatic effect on the outcome.

In the world of big commercial real estate, it’s not uncommon to see cash on cash returns in the 6% to 12% range. This often comes down to the scale of the operation and how efficiently it's managed.

For instance, say a commercial building generates a net operating income (NOI) of $2.1 million. After paying its $540,000 in debt service for the year, the investors are left with a pre-tax cash flow of $1.56 million. If the total equity they put into the deal was $21 million, their cash on cash return would be about 7.43%. If you want to dive deeper into the terms used in these larger deals, a good commercial real estate glossary can be a huge help.

What these two examples make clear is that a "good" return is completely relative. The 4.3% on the rental house might be perfectly fine in a hot market where you expect the property value to shoot up. Meanwhile, the 7.43% on the commercial property reflects a totally different risk profile and operational scale.

By running these numbers, you gain the power to compare completely different types of assets on a level playing field. Your own cash becomes the ultimate measuring stick.

Understanding the Limits of Cash on Cash Return

While cash on cash return is a fantastic tool for taking the pulse of an investment's immediate cash flow, it’s crucial to understand that it doesn't tell the whole story. Think of it as a powerful snapshot, not the full-length movie of your investment's life. Relying on it exclusively can create some serious blind spots.

The biggest issue is its myopic focus on a single year. Real estate is a long-term game, but this metric completely sidesteps many of the key ways investors build serious wealth over time.

Key Takeaway: Cash on cash return measures current cash flow, not total wealth creation. It’s an incredibly useful metric for what it does, but it should never be the only number you look at when sizing up a real estate deal.

By its very nature, the classic definition of cash on cash return is narrow. To make truly smart decisions, you have to be aware of exactly what it leaves out.

What Cash on Cash Return Fails to Measure

The metric’s simplicity is both its greatest strength and its biggest weakness. It intentionally ignores several factors that are absolutely critical for a complete financial analysis of a property.

Specifically, it overlooks three primary engines of long-term value:

- Property Appreciation: This is the increase in the property's market value over time. In many deals, appreciation ends up being the single largest contributor to your total return, yet cash on cash return doesn't account for it at all.

- Equity Buildup: Every time you make a mortgage payment, a portion of it pays down your loan principal. This builds your ownership stake (equity) in the asset—a form of forced savings that grows your net worth.

- Tax Advantages: Real estate comes with some powerful tax benefits, especially depreciation. This allows you to deduct a portion of the property's value from your taxable income each year, which can dramatically boost your actual, after-tax returns.

These elements are vital pieces of your total return on investment, but they are completely invisible to the cash on cash calculation.

Its Dynamic and Sometimes Misleading Nature

Another major limitation is that this metric can be highly variable and, frankly, a bit misleading. The projections used to calculate it are just that—projections. A sponsor who is a little too optimistic about rental income or underestimates future repairs can make a deal look far better on paper than it will ever perform in reality.

On top of that, the number isn't static. In the real world, cash on cash return is dynamic and can fluctuate from year to year based on changes in cash flow or any additional capital you put in. For instance, if you inject an extra $100,000 for a major renovation, your "Total Cash Invested" just went up, which will change the return calculation for that year and all the years that follow. This is why it’s best analyzed annually, and you can see more examples of how this metric changes on PropertyMetrics.com.

Because of these blind spots, seasoned investors always pair cash on cash return with other metrics. Using it alongside the Internal Rate of Return (IRR), which accounts for the time value of money and long-term appreciation, gives you a much more complete and reliable picture of an investment's true potential.

Using Cash on Cash Return to Make Better Investments

Knowing how to calculate cash on cash return is one thing. But the real magic happens when you start using it to filter deals, compare different kinds of properties, and ultimately, make smarter investment choices. This is where the textbook knowledge turns into a genuine strategic advantage in the real world.

Think of it as your first line of defense. By applying cash on cash return practically, you build a framework that instantly tells you whether a deal is even worth a second look, saving you from chasing properties that don't fit your financial goals.

Setting Your Investment Benchmark

One of the most powerful ways to use this metric is by setting a personal "minimum acceptable return." This is your line in the sand—the absolute minimum return you'll accept before moving forward on a deal. For an investor laser-focused on immediate cash flow, that number might be 10% or even higher. For someone else buying in a hot, up-and-coming market, a 5-7% return might be perfectly fine if they're banking on future appreciation.

Once you set this standard, it helps you:

- Instantly filter deals: If a property's projected return doesn't hit your minimum, you can toss it aside without wasting another minute.

- Maintain discipline: It stops you from getting swept up in the emotion of a "great" property that just doesn't work on paper.

- Stay goal-oriented: Your benchmark keeps you focused on what truly matters to you, whether that's income now or growth later.

This simple rule can take a mountain of potential properties and shrink it down to a manageable list of real contenders.

Comparing Apples to Oranges

So, you're looking at two completely different deals. On one hand, you have a duplex that looks like it will be a cash-flow machine. On the other, a single-family home in a neighborhood that's appreciating like crazy. How on earth do you compare them? Cash on cash return is your Rosetta Stone.

By zeroing in on how your out-of-pocket cash is performing, the metric allows for a direct, apples-to-apples comparison. A 12% return from the duplex versus a 4% return from the single-family home makes the trade-off crystal clear: are you prioritizing immediate income or holding out for future gains?

This comparison puts the power back in your hands, letting you make decisions based on hard data, not just a gut feeling. Of course, to really make your money work for you, understanding how to get the right investment property loan is crucial, as your financing terms will directly shape these return calculations.

Structuring the Most Profitable Deal

Finally, cash on cash return is a fantastic tool for playing with different deal structures before you ever make an offer. You can model how different down payments or loan terms will impact your final return. For instance, what happens if you put an extra $20,000 down? Your monthly mortgage payment drops and your cash flow goes up, but your overall percentage return might actually decrease because you have more cash tied up in the deal.

Playing with these numbers helps you find that perfect sweet spot between risk and reward, allowing you to structure the most profitable deal possible right from the get-go.

Your Cash on Cash Return Questions, Answered

Alright, so we've covered the basics. But let's be honest, real estate investing happens in the real world, not in a textbook. This is where the rubber meets the road, and you start running into those specific, practical questions.

Even seasoned investors get tripped up by the details sometimes. Let's tackle some of the most common questions I hear about cash on cash return to make sure you can use this metric with confidence.

What’s a Good Cash on Cash Return, Really?

This is probably the number one question people ask, and the honest answer is: it depends. There’s no universal "good" number. It all comes down to the market you're in, your specific investment strategy, and how much risk you're comfortable taking on.

That said, most investors I know use a few benchmarks to get their bearings. For a standard, long-term rental property, a target between 8% and 12% is a pretty common goal. But if you’re looking at something like a short-term vacation rental, which is way more hands-on and can be riskier, you'd probably want to see returns closer to 15% or even 20% to make the extra hassle worth your while.

Context is everything. A 5-7% cash on cash return might be a fantastic deal in a hot, high-appreciation market like Austin, where you're banking on future growth. But in a stable, cash-flow-heavy market like Cleveland, you might not even look at a deal unless it’s projecting 15% or more. The key is to weigh a property's potential against other local opportunities that have a similar risk profile.

How Is This Different From ROI?

It's easy to mix these two up, but they tell you completely different stories about your investment's performance. Getting the distinction right is crucial for understanding your true financial picture.

- Cash on Cash Return: Think of this as your annual snapshot. It’s hyper-focused on one thing: how much cash your actual invested capital is generating each year. It's the perfect tool for judging how well your financing is working for you and the property's immediate income-producing muscle.

- Return on Investment (ROI): This is the big picture, long-term view. ROI calculates your total profit over the entire time you own the asset. It includes not just cash flow but also the equity you build and the property's appreciation, all measured against the total cost.

Here's a simple way to remember it: cash on cash is your annual report card. ROI is your final grade when you sell.

Does the Calculation Include Taxes?

Nope. The standard cash on cash formula deliberately uses pre-tax cash flow. Why? It creates a level playing field. It lets you compare an apartment building in Dallas to a duplex in Denver without getting tangled up in different state taxes and individual financial situations.

Of course, tax benefits like depreciation are a huge part of what makes real estate investing so powerful. Those benefits absolutely boost your final take-home profit. To see that number, you'd simply run the calculation again using your after-tax cash flow.

Can Cash on Cash Return Be Negative?

Absolutely, and it's not as rare as you might think. A negative cash on cash return just means the property isn't bringing in enough income to cover its operating expenses and mortgage payments for the year.

When that happens, you have negative cash flow, and you have to dip into your own pocket to cover the difference.

You’ll often see this happen in a few key scenarios:

- The first year you own a "value-add" property that needs serious renovations before it can be fully rented.

- A building is struggling with high vacancy rates.

- You get hit with a massive, unexpected capital expense, like a new roof or a busted HVAC system.

A negative return is a crystal-clear signal that, for that period, the property is costing you money to hold.

Managing all the moving parts of a real estate deal—from fundraising and legal docs to investor reporting—can be a huge headache. Homebase is an all-in-one platform built to simplify your operations, so you can stop wrestling with spreadsheets and focus on what you do best: finding great deals.

See how we can support your growth at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.