Explore definition hurdle rate: A Guide for Real Estate Syndicators

Explore definition hurdle rate: A Guide for Real Estate Syndicators

Learn definition hurdle rate: discover how it protects investors, aligns incentives, and guides real estate syndication with practical examples.

Domingo Valadez

Feb 6, 2026

Blog

In real estate syndication, the hurdle rate is a simple but powerful concept: it’s the minimum return investors must get before the deal sponsor starts earning their big performance bonus.

Think of it like a high-jump bar. The project's profits have to clear that bar first. Only then does the sponsor get to share in the extra profits on the other side.

Understanding the Hurdle Rate in Real Estate

At its heart, the hurdle rate is all about aligning the interests of everyone at the table. It’s not just Wall Street jargon; it's the foundation of a fair deal between the sponsor (the General Partner or GP) and the investors (the Limited Partners or LPs).

This structure creates a powerful incentive for the sponsor to perform. Their most significant payday only comes after they've delivered solid returns to their investors first. In most deals, you'll hear the hurdle rate called the preferred return, or "pref" for short. It’s the first tier in the profit distribution plan, often called a "waterfall."

The Role of the Preferred Return

When a property starts producing cash flow or is eventually sold, the money doesn’t just get split up randomly. The preferred return dictates the pecking order.

- Investors Get Paid First: All distributable cash flows directly to the Limited Partners until they’ve hit that pre-agreed return percentage.

- Sponsor Waits for Their Promote: The General Partner doesn't touch their performance fee—often called "carried interest" or a "promote"—until every investor has received their full preferred return.

This investor-first structure is a crucial layer of protection. It guarantees that the people who put up the capital get the first slice of the profits.

For a quick reference, here’s how the key components break down:

Hurdle Rate At a Glance

This setup is standard across private equity, including real estate funds focused on multifamily or commercial properties. The typical hurdle rate you'll see is between 6% to 10% annually. For a deeper dive, you can explore more details on carried interest and how it works with hurdle rates in private funds.

Key Takeaway: The hurdle rate is a simple promise: investors get paid first. It's a clear benchmark that sponsors must hit before they can share in the deal's success, keeping everyone focused on the same goal.

How Sponsors Calculate the Hurdle Rate

So, where does the hurdle rate actually come from? It's not a number sponsors just pull out of a hat. A well-constructed hurdle rate is a thoughtful benchmark, specifically built to mirror the risk of a particular real estate deal.

The calculation starts with the safest investment imaginable and then systematically layers on premiums for every additional risk an investor is asked to take. This process gives the entire deal structure a logical foundation. Once you understand the components, you can see exactly why a hurdle rate is set at 8% or 10% and decide if it truly compensates you for the risk involved.

Breaking Down the Hurdle Rate Formula

At its core, the hurdle rate formula is a simple sum of three risk components. Each piece accounts for a different kind of uncertainty, starting from the broad financial markets and narrowing all the way down to the specific property itself.

Hurdle Rate = Risk-Free Rate + Market Risk Premium + Property-Specific Risk Premium

Think of it like building a financial layer cake. The base is the safest return you could possibly get, and each layer on top is the extra reward for taking on more specific kinds of risk.

The first piece is the Risk-Free Rate. This is the return you could expect from an investment with virtually zero risk. For most in the U.S., the go-to proxy for this is the yield on a U.S. Treasury bond, often the 10-year T-note. If a 10-year Treasury is yielding 4.5%, that’s our foundation—it’s the return anyone could get without taking on real investment risk.

Next up is the Market Risk Premium. This layer is all about compensating investors for the risks of being in the real estate market in general, as opposed to the safety of government bonds. Things like economic cycles, interest rate swings, and overall market liquidity all play a role here. This premium might add another 3% to 5% on top of the risk-free rate.

Key Takeaway: The hurdle rate isn't an arbitrary figure. It's built by starting with a baseline "safe" return and then methodically adding premiums to compensate investors for every level of risk they take on, from broad market volatility to asset-specific challenges.

Accounting for Property-Specific Risks

The final—and usually most variable—ingredient is the Property-Specific Risk Premium. This is where the unique DNA of the deal really comes into focus. A sponsor has to analyze all the distinct characteristics of the asset to figure out how much extra return is warranted.

Here’s what they’re looking at:

- Asset Class: There’s a world of difference between a stable, leased-up multifamily building and a more speculative ground-up hotel development.

- Business Plan: A simple, cash-flowing property (a "Core" deal) will carry a much lower premium than a value-add project that requires major renovations and a tricky lease-up phase.

- Location: An apartment building in a gateway market like New York City is seen as less risky than one in a smaller, less proven tertiary market.

- Sponsor Experience: A seasoned sponsor with a flawless track record might justify a slightly lower risk premium than a newer operator still proving their model.

Let's put it all together. A value-add multifamily renovation in a growing secondary market might carry a property-specific premium of 2% to 4%. Adding that to our running tally (4.5% risk-free + 4% market premium), we land on a final hurdle rate somewhere between 10.5% and 12.5%. This logical buildup provides a crystal-clear definition of the hurdle rate for that specific deal.

See the Hurdle Rate in a Waterfall Distribution

Alright, enough with the theory. Let's see how the hurdle rate actually works in the real world. This is where the abstract concept of a minimum return gets real—dictating exactly who gets paid, how much, and when.

We're going to follow the money through a common structure in real estate syndications known as a distribution waterfall.

Imagine a syndication just sold an apartment building and walked away with a $1,000,000 profit after every investor got their original capital back. The deal was structured with an 8% hurdle rate (also called a preferred return) and an 80/20 split between the Limited Partners (LPs) and the General Partner (GP) after that.

Let’s trace the path of that million-dollar profit, step-by-step, to see how the hurdle rate acts as the first gatekeeper.

Tier 1: The Preferred Return

The first stop for any profit is satisfying the initial promise made to investors. Before the sponsor (the GP) sees a single dollar of their performance fee, the LPs have to get their preferred return. It’s that simple.

Let's say the LPs invested a total of $5,000,000 into the deal. Their 8% preferred return comes out to $400,000.

Since our total profit is a cool $1,000,000, there's more than enough cash to clear this first hurdle. The first $400,000 of profit goes straight to the LPs.

- LP Distribution: $400,000

- GP Distribution: $0

- Remaining Profit: $600,000

With the preferred return now paid, the cash "spills over" into the next tier of the waterfall.

Tier 2: The Sponsor Catch-Up

Many deals include what’s called a "catch-up" for the sponsor. This tier is designed to let the GP get a bigger slice of the pie right after the LP's hurdle is met, letting them quickly "catch up" to their agreed-upon profit split.

A common setup gives the GP 100% of the profits in this tier until they’ve received 20% of all distributions made so far (in both Tier 1 and Tier 2 combined).

Here’s the quick math:

* Total distributed in Tier 1 was $400,000 (which is the LP's 80% share).

* To find the GP's 20% share, you calculate: $400,000 / 80% * 20% = $100,000.

* So, the next $100,000 in profit goes entirely to the GP.

- LP Distribution: $0

- GP Distribution: $100,000

- Remaining Profit: $500,000

At this point, a total of $500,000 has been paid out—$400,000 to the LPs and $100,000 to the GP. This perfectly aligns the distributions to the 80/20 split we started with.

Tier 3: The Final Split

Now that the investors have received their preferred return and the sponsor has been caught up, any remaining profit is split according to the final, ongoing ratio. In our deal, that’s a straightforward 80/20 split.

The remaining $500,000 is divided up:

- LP Distribution (80%): $400,000

- GP Distribution (20%): $100,000

- Remaining Profit: $0

And just like that, all the profits have been distributed. This example clearly shows how the hurdle rate works in practice, making sure investors get paid first before the sponsor earns their big payday.

It's important to know that all of these specifics—the exact hurdle rate, the tiers, and the splits—are legally defined in a critical document called the Private Placement Memorandum (PPM). This is the rulebook for the investment that all parties agree to.

To make it even clearer, let's lay out the total distributions in a table.

Example of a 4 Tier Waterfall with an 8% Hurdle

This table breaks down how our $1,000,000 profit flows through each tier of the waterfall, showing exactly what the LPs and the GP receive at each stage.

As you can see, the final split matches the 80/20 structure, but the journey to get there was guided entirely by the hurdle rate and the waterfall tiers.

Common Hurdle Rate Structures You Will Encounter

Not all hurdle rates are built the same. While the core principle is always that investors get paid first, the actual mechanics of how a sponsor earns their performance fee can look very different from one deal to another. Getting a handle on these variations is absolutely critical for projecting your own returns.

The two most common structures you'll run into are hard hurdles and soft hurdles. Think of them as two different rulebooks for the same game—each one creates a unique incentive structure and can dramatically change how the final profits are split.

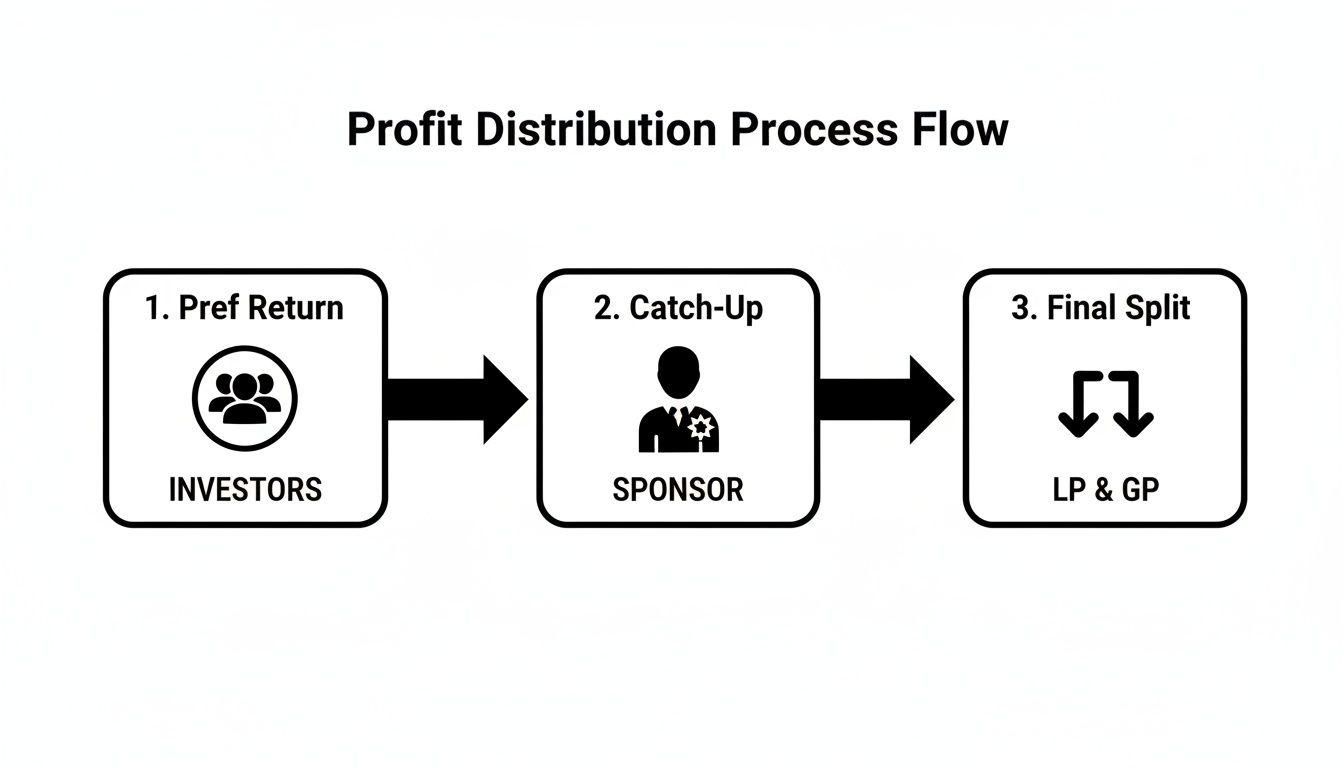

This flowchart gives you a bird's-eye view of how cash flows through a typical real estate waterfall, starting with the investors' preferred return.

As you can see, once the initial investor hurdle is cleared, there's often a "catch-up" phase that rebalances the economics before everyone gets to the final profit-sharing tier.

Understanding the Hard Hurdle

A hard hurdle is the most straightforward and investor-friendly structure you'll find. It’s simple: the sponsor's performance fee (their "promote") is calculated only on the profits that come in above the hurdle rate.

Let's say the deal has an 8% hard hurdle and ends up returning 12%. The sponsor's promote is only calculated on that extra 4% of profit. The first 8% belongs entirely to the investors; the sponsor doesn’t touch it. This creates a really clean alignment—the sponsor is rewarded directly and only for true outperformance.

The Dynamics of a Soft Hurdle

A soft hurdle works a little differently and is more sponsor-friendly. This structure usually includes a "catch-up" clause. Once the deal clears the minimum return threshold, the sponsor gets to collect their performance fee on all profits, including the returns below the hurdle.

Key Takeaway: The big difference is what the sponsor’s fee is based on. A hard hurdle applies the fee only to profits above the line, while a soft hurdle applies it to all profits once that line is crossed.

Using our same example, let’s imagine an 8% soft hurdle. If the project returns 12%, the sponsor gets to "look back" and collect their promote on the entire12% return. As you can imagine, this allows them to share in a much larger slice of the pie once that baseline performance is met. The evolution of these structures in private equity has taught real estate syndicators a lot, with 5-8% fixed hurdles becoming a common gateway to performance fees—a model many successful general partners stand by. You can explore the history of hurdle rates in private funds for a deeper dive.

Beyond these two, you might also see more complex, multi-tiered waterfalls. These deals feature escalating hurdles where the sponsor's profit share increases as they hit higher return targets. For instance, a sponsor might earn 20% of profits after an 8% hurdle, but their share could jump to 30% for all profits generated after a 15% hurdle is met. This really lights a fire under the sponsor to knock it out of the park.

How the Hurdle Rate Aligns Sponsor and Investor Interests

A well-crafted hurdle rate isn't a source of conflict—it's the very thing that turns a real estate deal into a true partnership between the sponsor (General Partner or GP) and their investors (Limited Partners or LPs). It's the central mechanism ensuring everyone is rowing in the same direction, focused on the same profitable outcome.

For investors, the hurdle rate acts as a critical safety net. It’s a straightforward promise: their capital gets paid first. Before the sponsor can touch their performance-based bonus (the "promote"), the project has to clear that minimum return threshold for the LPs. This investor-first approach is fundamental to building trust.

From the sponsor's perspective, offering a fair hurdle rate is a mark of confidence. It tells potential investors that the GP believes in their own projections and their ability to execute the business plan. When a sponsor agrees to delay their biggest payday until after investors get paid, it sends a powerful signal about the deal's potential, making it far more attractive.

The Hurdle Rate as a Two-Way Street

Think of the hurdle rate as the central pivot point in a balanced partnership. It creates a powerful win-win dynamic where the sponsor’s success is directly linked to the investors' success. It’s all about shared risk and shared reward.

This symbiotic relationship is the lifeblood of any healthy real estate syndication:

- For Investors (LPs): The hurdle rate is their assurance that they will be compensated for the risk of putting up the capital. It sets a clear performance bar the deal must clear before the sponsor gets to share in the profits.

- For Sponsors (GPs): It’s a massive incentive to perform. A sponsor’s most significant financial reward is locked away until they've delivered real value to their partners.

Ultimately, negotiating a hurdle rate isn't just a numbers game. It’s about setting the ground rules for the entire partnership.

A well-structured hurdle rate transforms the GP-LP relationship from a simple transaction into a collaborative venture. It ensures that the sponsor is not just managing an asset, but is a true steward of their investors' capital.

Balancing Risk and Attracting Capital

When sizing up a deal, experienced investors always look at the hurdle rate in the context of the project’s risk. A higher-risk, value-add development should naturally come with a higher hurdle rate than a stabilized, cash-flowing property. This just makes sense—the potential reward has to match the risk involved.

For sponsors, finding the right hurdle rate is a balancing act. Set it too low, and you'll scare off sharp investors who know they aren't being compensated fairly for their risk. Set it too high, and you might put too much pressure on the project's performance. The right definition for a hurdle rate is always the one that accurately reflects the deal's strategy.

Beyond the returns driven by the waterfall, understanding effective top real estate investment tax strategies is also essential for maximizing what investors ultimately take home.

Bringing Hurdle Rate Calculations Into the 21st Century

Let's be honest: calculating complex waterfall distributions by hand is a recipe for disaster. Anyone who's spent hours buried in a spreadsheet, meticulously tracking capital accounts, compounding preferred returns, and splitting profits across different tiers knows the pain. It’s not just tedious—it’s incredibly risky.

One wrong cell reference or a simple typo can spiral into a major financial miscalculation. The result? Unhappy investors, a damaged reputation, and a potential breach of your operating agreement. It's a massive administrative headache that pulls you, the sponsor, away from what you do best: finding great deals and maximizing asset value.

Ditching the Spreadsheet for Smart Automation

Thankfully, we're no longer stuck in the dark ages of manual calculations. Purpose-built software for real estate syndication now handles all the heavy lifting, turning a multi-day nightmare into a few simple clicks.

These platforms are designed to manage the entire distribution process with precision:

* Flawless Calculations: The software automatically runs the numbers, calculating the pref and executing every tier of the waterfall exactly as outlined in your legal documents. No more human error.

* Total Investor Transparency: Your Limited Partners get their own professional investor portal. They can log in anytime to see clear distribution statements and watch their investment performance in real-time.

* Effortless Payments: Once the calculations are done, you can often initiate ACH payments directly from the platform. The whole workflow, from calculation to cash-in-bank, is handled in one place.

This shift to automation is a game-changer. The clear, on-demand reporting builds incredible trust and saves you from the mind-numbing task of creating and emailing dozens of individual statements.

When you hand off these complex administrative tasks to a platform built for the job, like Homebase, you ensure every number is right, every time. More importantly, you get your time back to focus on growing the business and making your investors money.

In today's market, using the right technology to manage investments with a hurdle rate isn't just a nice-to-have. It's essential for running a professional, scalable, and trustworthy operation.

Unpacking the Nuances: Your Hurdle Rate Questions Answered

Diving into the specifics of a real estate deal can feel like learning a new language. Let's clear up some of the most common questions that pop up around hurdle rates.

Is a Higher Hurdle Rate Always Better for an Investor?

On the surface, yes. A higher hurdle rate generally favors the investor. It means the sponsor has to clear a higher performance bar before they can start taking their share of the profits—their promote. A 9% hurdle is certainly a better starting point for an investor than a 7% one.

But it's not always that simple. You have to look at the whole picture. An exceptionally high hurdle might be a red flag for a risky deal, or it could even disincentivize a sponsor from pushing for returns far beyond that threshold. Always weigh the hurdle rate against the deal's business plan, the type of property, and the current market.

What Is the Difference Between a Hurdle Rate and a Preferred Return?

This is a great question, and it's a point of confusion for many. In the day-to-day talk of real estate syndication, you'll often hear hurdle rate and preferred return used as if they mean the exact same thing. For the most part, they do.

Both terms describe the minimum return investors must get before the sponsor shares in the upside. Think of it this way:

The preferred return is the concept—the promise that investors get paid first. The hurdle rate is the number that defines that promise (e.g., an 8% annual return).

So, the hurdle rate is the specific percentage that makes the preferred return a concrete, measurable target in the waterfall.

Does the Hurdle Rate Apply to the Return of Capital?

No, and this is a critical distinction. The hurdle rate is all about the profits. In any standard waterfall structure, the first money back to investors is always their own initial investment.

Only after you've received 100% of your original capital back does the hurdle rate come into play. It dictates how the profits are split, starting with ensuring you get your preferred return before the sponsor gets their promote.

Ready to modernize your real estate syndication and ditch manual waterfall calculations for good? Homebase offers an all-in-one platform to streamline fundraising, manage investor relations, and automate distributions with precision. See how Homebase can help you scale your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

What is a dscr loan and how it fuels profitable real estate deals

Blog

Discover what is a dscr loan and how it unlocks financing for your next real estate deal.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.