Cash on Cash Calculation Guide: Build Real Estate Wealth

Cash on Cash Calculation Guide: Build Real Estate Wealth

Master cash on cash calculation with proven strategies from successful investors. Learn practical formulas and analysis techniques for smarter deals.

Domingo Valadez

May 29, 2025

Blog

Mastering Cash on Cash Calculation Fundamentals

The cash on cash calculation is a crucial tool for real estate investors. It provides a clear picture of an investment's profitability by focusing on the cash flow generated relative to the cash invested. This makes it incredibly useful for comparing different investment opportunities and assessing capital efficiency.

Understanding the Core Components

The cash on cash return revolves around two key figures: annual pre-tax cash flow and total cash invested. Annual pre-tax cash flow is the money remaining after covering all operating expenses and debt service. This is the actual cash you receive before taxes, not just the rental income. Total cash invested includes all upfront costs related to acquiring and stabilizing the property.

This distinction is important. Many new investors mistakenly focus solely on potential rental income. They often overlook the impact of expenses and financing. The cash on cash calculation provides a more realistic assessment of an investment’s potential by accounting for these factors. Historically, cash-on-cash return (CoCR) has been a critical metric, especially in major U.S. markets. For example, in the early 2020s, multifamily properties in cities like New York and Los Angeles typically offered CoCRs between 5% and 8% annually, influenced by factors like leverage and local rental demand. Learn more about CoCR here: Cash-on-Cash Return (CoCR) in Real Estate

Why Cash on Cash Matters

The cash on cash calculation cuts through the complexity of other metrics. It offers a direct way to evaluate the cash return on your investment. This simplicity makes comparing deals across different asset classes, financing structures, and market conditions much easier.

Moving Beyond Simple Returns

Metrics like internal rate of return (IRR) and return on investment (ROI) are valuable, but they don't always provide the same clarity for evaluating current income. IRR focuses on long-term potential, including projected future cash flows and appreciation. ROI considers the overall gain or loss, but doesn't isolate the cash component.

The cash on cash calculation, however, focuses specifically on current cash generated. This makes it an essential tool for assessing the immediate performance of real estate holdings. This focus on cash flow helps investors make informed decisions about reinvestment strategies and overall portfolio management. Understanding this metric helps identify profitable opportunities and build wealth through real estate.

Step-by-Step Cash on Cash Calculation Formula

Understanding the cash on cash return is crucial for evaluating real estate investments. Calculating it is straightforward, using a simple formula. This section provides clear examples, covering annual pre-tax cash flow and total cash investment calculations in various scenarios, from all-cash deals to leveraged purchases.

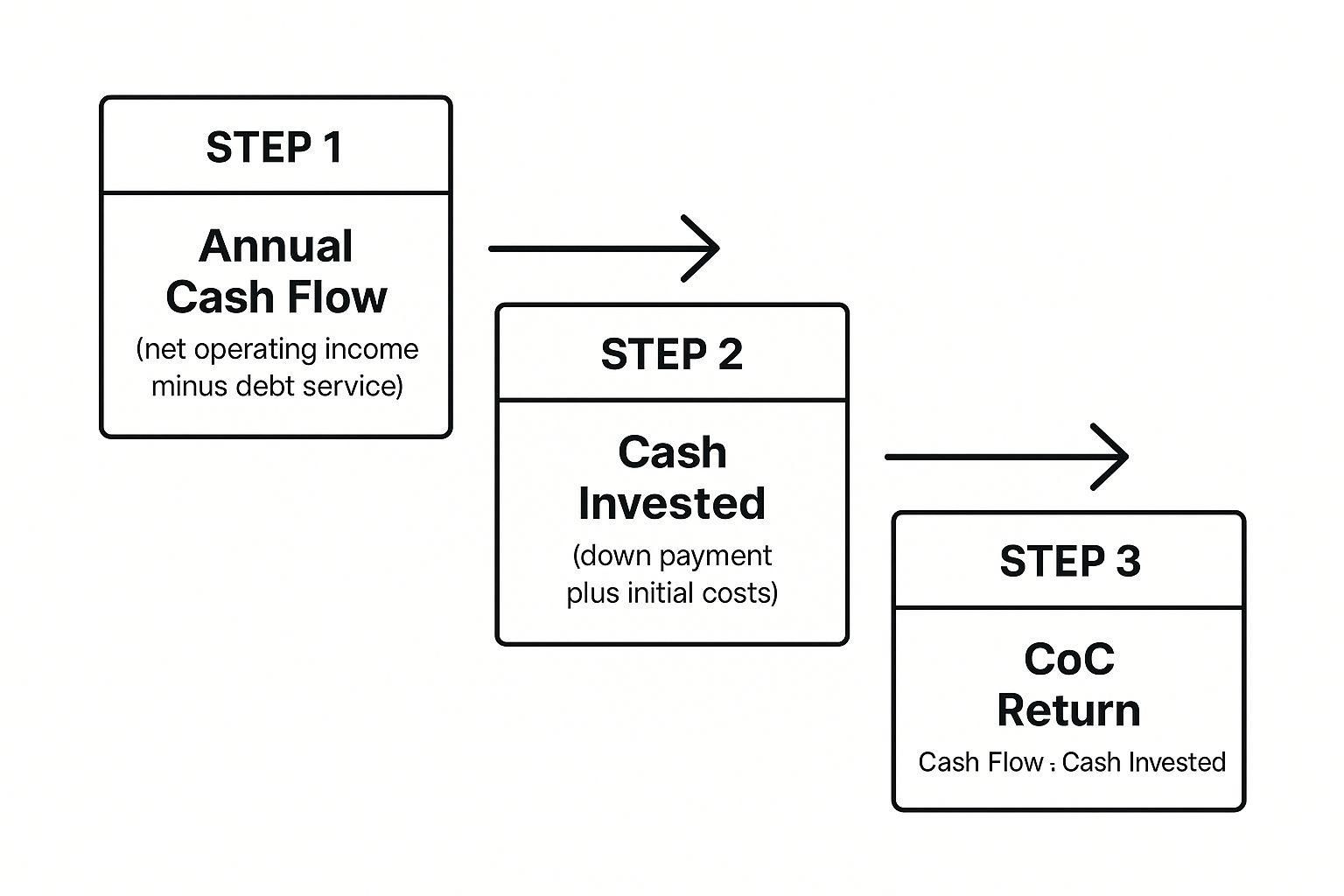

This infographic illustrates the three steps to calculate your Cash on Cash Return: determining your Annual Cash Flow, calculating your total Cash Invested, and finally, dividing Cash Flow by Cash Invested to find your CoC Return. As shown, understanding your income and expenses is critical for an accurate CoC Return.

Calculating Annual Pre-Tax Cash Flow

First, determine your annual pre-tax cash flow. This is the property's net income after deducting operating expenses and debt service (mortgage payments). For example, with $50,000 in annual rental income, $20,000 in operating expenses, and $10,000 in mortgage payments, your annual pre-tax cash flow is $20,000.

Determining Total Cash Invested

Next, calculate your total cash invested. This includes all upfront costs: the down payment, closing costs, and immediate renovations or repairs. A $100,000 down payment, $5,000 in closing costs, and $15,000 in renovations equal a $120,000 total cash investment.

The Cash on Cash Return Formula

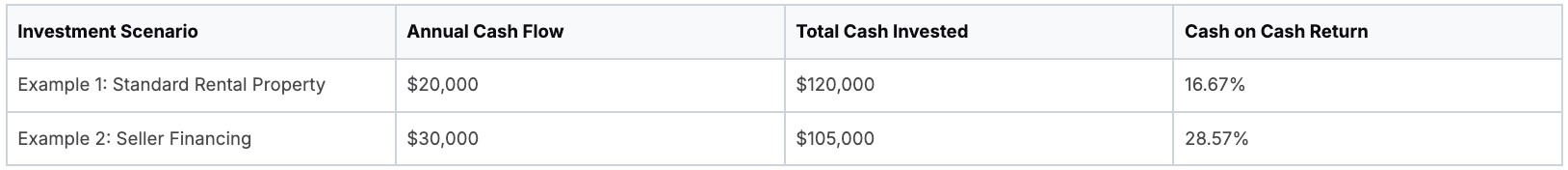

Finally, divide your annual pre-tax cash flow by your total cash invested. Using the above example, $20,000 divided by $120,000 results in a 16.67% cash on cash return. This means for every dollar invested, the property generates $0.1667 in annual pre-tax cash flow.

Handling Different Scenarios

The basic formula remains the same, but applying it to different investment structures requires considering all cash inflows and outflows. Let's look at seller financing. Imagine purchasing a $500,000 property with a $100,000 down payment and seller financing for the remaining $400,000. Your annual pre-tax cash flow is $30,000, with $5,000 in closing costs. Your total cash invested is $105,000, leading to a 28.57% cash on cash return ($30,000 / $105,000).

This illustrates how financing impacts cash on cash return. Accurate accounting of every outlay, from down payments and closing costs to renovations and seller financing payments, ensures precise calculations and informed decisions. This is especially important for real estate syndicators using platforms like Homebase to manage deals and investors. Understanding these calculations facilitates transparent discussions about potential returns, building trust with investors. Ultimately, grasping the cash on cash calculation empowers you to evaluate opportunities and make strategic investment decisions.

Let's examine different investment scenarios and their respective cash on cash returns. The following table provides a step-by-step breakdown:

As demonstrated in the table, different scenarios can significantly impact your return. Understanding these variations helps investors tailor their strategies to maximize profitability.

What Actually Counts as Cash Investment

Accurately calculating your total cash investment is crucial for a meaningful cash-on-cash return. Many investors overlook key expenses that can significantly impact their returns. This section breaks down the essential components to include.

The Obvious: Down Payment and Closing Costs

The most apparent components are the down payment and closing costs. The down payment is the initial cash outlay towards the property purchase. Closing costs include expenses like appraisal fees, title insurance, and lender fees. For instance, a 20% down payment on a $200,000 property is a $40,000 cash investment. Closing costs, typically ranging from 2% to 5% of the purchase price, could add another $4,000 to $10,000 to your initial investment.

The Often Overlooked: Pre-Rental Expenses

Beyond the initial purchase, pre-rental expenses are often forgotten. These include inspection fees, crucial for identifying potential problems. Loan origination fees, charged by lenders for processing your loan, are also part of your total investment. Don't forget necessary repairs to make the property rent-ready, such as fixing a leaky roof or replacing appliances.

Capital Improvements vs. Repairs: A Crucial Distinction

Understanding the difference between capital improvements and repairs is essential. Repairs restore a property to its original condition. Capital improvements increase its value or lifespan. Patching a hole is a repair, while replacing the entire roof is a capital improvement. This distinction affects your cash-on-cash calculation. Repairs are typically expensed immediately, while capital improvements are depreciated over time.

Navigating Complex Financing Scenarios

Calculating the total cash invested becomes more complex with seller financing or assumable loans. With seller financing, your down payment and any upfront fees paid to the seller are included. For assumable loans, your cash outlay might be significantly lower, potentially only involving assumption fees and closing costs. Accurately accounting for these variables ensures a precise cash-on-cash return. The calculation of cash-on-cash return is particularly relevant during periods of interest rate volatility, like the period from 2020 to 2023 in the U.S. When interest rates rose sharply in 2022, well-underwritten real estate deals still offered attractive cash-on-cash returns above 6% in many markets. Learn more: Cash-on-Cash Return 2025

The Impact of Timing

When you incur expenses also matters. Expenses before rental income begins contribute to your initial investment. Ongoing expenses, such as property management fees and property taxes, are deducted from your annual cash flow, affecting your overall return. Tracking every dollar spent, from the initial offer to ongoing maintenance, is essential for calculating a realistic cash-on-cash return.

Building Accurate Annual Cash Flow Projections

Accurate cash flow projections form the foundation of a reliable cash on cash calculation. This is where discerning realistic expectations from overly optimistic ones is critical. This section will guide you through creating dependable annual cash flow projections, ensuring you're well-prepared for the financial realities of your investment. Check out our guide on How to master real estate cash flows.

Essential Expense Categories

Developing an accurate annual cash flow projection requires considering all possible expenses. These expenses typically fall into several key categories:

- Operating Expenses: These recurring costs are associated with the day-to-day operation of the property. They include property taxes, insurance, and utilities. For instance, annual property taxes might be $5,000, insurance $2,000, and utilities $3,000.

- Property Management Fees: If you employ a property manager, their fees represent a significant expense. These fees typically range from 4% to 10% of the monthly rent collected.

- Maintenance Reserves: Setting aside funds for unforeseen repairs is essential. A standard practice is to allocate approximately 1% of the property's value annually for maintenance.

- Vacancy Allowance: Realistically, your property may experience periods of vacancy. Incorporating a vacancy rate, usually between 5% and 10% of the potential rental income, accounts for these periods.

- Capital Expenditures (CapEx): These are significant expenses, such as roof replacements or HVAC system upgrades. While less frequent, these costs can have a substantial impact on cash flow.

Avoiding Rookie Mistakes

New investors often make the mistake of underestimating expenses or relying on overly optimistic projections. A common oversight is neglecting to account for vacancy rates. Another frequent error is underestimating maintenance costs, particularly in older properties. For example, an unexpected roof repair can significantly impact your annual cash flow if it hasn’t been budgeted for.

Handling Complexities

Different property types present unique challenges for cash flow projections. Seasonal rentals, for example, experience fluctuating occupancy rates. Multi-tenant properties require more intricate management. Mixed-use investments, encompassing both residential and commercial spaces, introduce diverse income streams and expense structures.

Practical Examples and Best Practices

Consider a multi-tenant property with five units. Projecting cash flow accurately necessitates considering potential vacancies in each unit individually. For a mixed-use property, accurately forecasting commercial rental income and associated expenses is crucial.

Additionally, consulting with seasoned investors or property managers familiar with your target market can offer valuable insights. Learning about local expense trends and typical vacancy rates from experienced professionals can strengthen the reliability of your projections. This detailed approach to expense projection ensures your cash on cash calculation provides a realistic assessment of your investment’s potential. Accurately forecasting expenses facilitates informed decision-making and helps investors avoid unexpected financial burdens. This proactive planning is particularly important for real estate syndicators who manage investments from multiple parties. A clear understanding of potential expenses promotes transparency and builds trust with investors.

Cash on Cash Returns in Different Market Conditions

Understanding market conditions and their impact on investment returns is a cornerstone of successful real estate investing. This knowledge empowers you to make well-timed decisions and navigate potential challenges. Let's explore how factors like interest rates, local market dynamics, and economic cycles influence cash on cash returns, using real-world scenarios to illustrate these important concepts.

Impact of Interest Rate Changes

Fluctuations in interest rates have a direct impact on financing costs, ultimately affecting your cash on cash return. Higher interest rates translate to increased mortgage payments, reducing your annual pre-tax cash flow and, consequently, your return. For instance, if a rise in interest rates pushes your annual mortgage payments from $10,000 to $12,000, your annual pre-tax cash flow and cash on cash return will decrease. Conversely, lower rates can enhance returns by lessening the financial burden of borrowing. Astute investors recognize this dynamic and incorporate interest rate projections into their investment analyses.

Navigating Local Market Dynamics

Local market conditions, including rental demand, vacancy rates, and property values, also play a crucial role. A robust rental market with low vacancy rates can positively impact your rental income, potentially boosting your cash on cash return. On the other hand, a sluggish market with high vacancy rates can negatively affect your bottom line. For example, a sudden influx of new apartment constructions in an area could increase competition, driving down rents and potentially lowering your cash on cash return. Careful analysis of local market trends is essential for developing realistic cash flow projections.

Riding the Economic Cycles

Broader economic cycles, such as periods of expansion or recession, have a significant impact on real estate. During economic downturns, property values and rental demand may decline, potentially reducing cash on cash returns. Conversely, periods of economic growth can create attractive investment conditions, with rising property values and rental income potentially leading to higher returns. Successful investors adjust their strategies based on the prevailing economic climate. They may prioritize capital preservation during recessions and actively seek higher-return opportunities during periods of expansion.

Adapting Your Investment Criteria

Smart investors adapt their investment criteria based on the prevailing market conditions. They may adjust their target cash on cash return depending on the current market environment and their individual risk tolerance. For instance, during a booming market with high demand and escalating prices, investors might accept a slightly lower cash on cash return, anticipating future appreciation. Conversely, in a slower market, they might aim for a higher cash on cash return to offset the reduced likelihood of substantial price growth.

Regional Variations and Property Types

Cash on cash returns can differ significantly across regions and property types. Some markets consistently deliver higher returns due to strong local economies or limited housing supply. Certain property types, such as multifamily or commercial properties, may generate greater cash flow and consequently higher cash on cash returns compared to single-family homes. Understanding these regional and property-specific nuances is essential for identifying truly profitable investment opportunities.

Identifying Opportunities in Challenging Markets

While challenging markets present obstacles, they can also create unique opportunities for discerning investors. During downturns, property prices may become more appealing, and motivated sellers might be more willing to offer favorable financing terms. This can lead to higher cash on cash returns for investors who can identify undervalued properties and negotiate advantageous deals. In these situations, the cash on cash calculation becomes particularly valuable. By focusing on current cash flow, investors can pinpoint properties offering strong cash returns, even in adverse market conditions. Using Homebase, real estate syndicators can effectively track and manage multiple investments across various market conditions, enabling data-driven decisions. This close monitoring of cash on cash returns becomes increasingly crucial during periods of market volatility, allowing syndicators to proactively adapt their strategies and mitigate potential risks.

Comparing Cash On Cash Returns To Other Investments

After exploring how to calculate cash on cash returns, it's important to understand how these returns compare to other investment options. This section compares real estate cash on cash returns with stock market performance, bond yields, and alternative real estate investments like REITs and crowdfunding platforms. This comparison can help you make more informed decisions about how to invest your capital.

Understanding Opportunity Costs

Every investment involves an opportunity cost. When you invest in real estate, you're choosing not to invest that capital elsewhere. Comparing cash on cash returns to other asset classes highlights this trade-off. For example, if the stock market historically returns 8% annually, and your potential real estate investment projects a 6% cash on cash return, you need to consider whether real estate's other benefits outweigh the potentially higher returns from stocks.

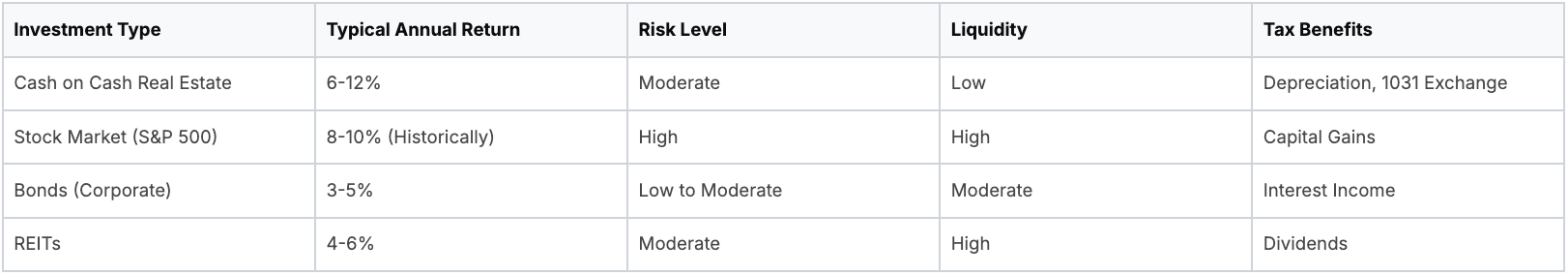

Stocks, Bonds, and REITs: A Comparative View

The stock market offers the potential for high returns but also comes with higher volatility. Bond yields tend to be more stable, but often offer lower returns than real estate. REITs provide exposure to real estate without direct property ownership, but their performance can fluctuate with market conditions.

To better understand the differences, let's examine a comparison of typical returns and risk profiles:

To help you compare different investment options, the following table summarizes typical returns, risk levels, liquidity, and tax benefits:

This table provides a general overview. Actual returns can vary significantly depending on market conditions and the specific investment.

Beyond Cash Returns: The Real Estate Advantage

Real estate offers benefits beyond cash flow. Tax benefits, like depreciation and 1031 exchanges, can significantly boost overall returns. Real estate also offers appreciation potential, meaning your investment can grow in value over time. Additionally, it can act as a hedge against inflation, as property values and rents often rise along with inflation. These advantages aren't usually found in investments like stocks or bonds.

Risk-Adjusted Returns: A Holistic View

While comparing raw returns is helpful, it's crucial to consider risk-adjusted returns. This involves evaluating potential returns relative to the level of risk involved. Real estate typically offers a more stable return profile compared to the stock market, although it still carries some risk. This makes it a suitable option for investors seeking a balance between growth and capital preservation.

The Investor’s Toolkit: IRR and Total Return

Savvy real estate investors don't rely solely on cash on cash return. They use it alongside other metrics like IRR (Internal Rate of Return) and total return. IRR provides a more comprehensive view of long-term profitability by considering projected future cash flows and potential appreciation. Total return accounts for all gains from the investment, including cash flow and appreciation, giving you a complete picture of your investment's performance.

For real estate syndicators using platforms like Homebase, incorporating these metrics into deal analyses is critical for informed decision-making and transparent communication with investors. By understanding these factors and using comprehensive investment analysis tools, you can build a portfolio that balances risk, return, and long-term wealth creation.

Key Takeaways

This guide offers a practical roadmap for successfully using the cash on cash calculation. We'll explore common pitfalls, provide solutions for accurate analysis, discuss how to realistically interpret property pro formas, and finally, examine methods for tracking your returns and improving your investment analysis over time.

Common Calculation Errors and How to Avoid Them

Even seasoned investors occasionally stumble with the cash on cash calculation. A common oversight is neglecting hidden costs, such as recurring maintenance or special assessments. Forgetting a $2,000 annual HOA fee, for example, can significantly skew your projected return.

Another frequent mistake involves miscalculating the impact of financing. Inaccurate mortgage payments, especially with adjustable-rate mortgages, can lead to skewed projections. Similarly, overlooking closing costs can underestimate your initial investment, thus overstating your return.

To avoid these common errors, consider the following:

- Create a Comprehensive Checklist: Include all potential expenses, from property taxes and insurance to management fees and maintenance reserves.

- Double-Check Your Financing Assumptions: Verify mortgage payments, interest rates, and loan terms.

- Be Conservative in Your Projections: Overestimating rental income or underestimating expenses can be detrimental. A conservative approach ensures your calculations hold up in real-world scenarios.

Spotting Red Flags in Property Pro Formas

Property pro formas, while helpful tools, can sometimes present an overly optimistic view. Be cautious of unusually high projected rental incomes or low expense estimates. For instance, a 0% vacancy rate is rarely realistic. Compare the pro forma's assumptions with market data and your own due diligence to identify any discrepancies.

Realistic Expectations and Better Investment Decisions

Setting realistic expectations is paramount for sound investment decisions. Recognizing that market conditions fluctuate and unforeseen expenses can arise helps you prepare for potential challenges. A conservative approach to the cash on cash calculation, combined with thorough due diligence, empowers you to make more informed investment choices.

Tracking and Updating Your Returns: A Continuous Improvement Framework

Calculating your cash on cash return is not a one-time event. Regularly tracking and updating your return based on actual performance offers valuable insights. This ongoing monitoring helps identify areas for improvement in your projections and refine your analysis for future deals.

For example, if your actual vacancy rate consistently exceeds projections, adjust your assumptions accordingly. Analyzing the difference between projected and actual returns allows you to learn from each investment and continuously improve your analytical skills. Furthermore, tracking returns over time reveals trends and patterns to inform your overall investment strategy.

Streamline Your Syndication Process With Homebase

Managing the complexities of real estate syndication, including cash on cash calculations for multiple investors and deals, can be demanding. Homebase provides an all-in-one platform to simplify fundraising, investor relations, and deal management. From automated fundraising workflows and KYC/AML verification to integrated reporting and secure document sharing, Homebase empowers you to focus on business growth, not spreadsheet management. Learn more about how Homebase can help you streamline your syndication process.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

What Is a Real Estate Trust: what is a real estate trust and asset protection

Blog

Explore what is a real estate trust and how it can protect assets, simplify investments, and unlock tax-efficient real estate opportunities.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.