Cash Flow Real Estate Your Wealth Building Guide

Cash Flow Real Estate Your Wealth Building Guide

Unlock wealth with our guide to cash flow real estate. Learn proven strategies to analyze properties, maximize returns, and build sustainable passive income.

Domingo Valadez

Oct 2, 2025

Blog

When we talk about real estate investing, "cash flow" is the term you'll hear over and over again. So, what is it? Simply put, it's the money left in your pocket each month after you've collected all the rent and paid all the bills, including the mortgage.

If you have money left over, you have positive cash flow. If you have to dig into your own savings to cover the costs, that's negative cash flow. This one number is the true measure of a property's profitability and its health as an investment.

Why Cash Flow Is the Lifeblood of Your Investment

It's easy to get caught up in the excitement of appreciation—the idea that your property's value will shoot up over time. But banking on appreciation is basically just speculation. It’s a hope, not a strategy. Real, sustainable wealth from property investing comes from consistent, predictable cash flow.

It helps to think of your rental property as a small business.

The Small Business Analogy

Imagine running a local coffee shop. Your revenue is what you make from selling lattes and croissants. Your expenses are the rent, your barista's salary, and the cost of coffee beans. If you're making more than you're spending each month, your business is thriving.

Your rental property works the exact same way. The rent you collect is your revenue. The mortgage, taxes, insurance, and that leaky faucet you had to fix are your expenses. The profit you're left with is your cash flow.

A property with positive cash flow is a self-sustaining business. It pays for itself and then pays you. That monthly income becomes a financial cushion, giving you the stability to weather a surprise vacancy or a dip in the market.

A property that doesn't generate positive cash flow isn't an investment—it's a liability. It relies on the hope of future market growth to be profitable, which is a high-risk gamble rather than a sound financial strategy.

The Two Sides of the Cash Flow Coin

To really get a handle on cash flow, you need to look at both sides of the equation: what's coming in and what's going out.

To break it down even further, let's look at the specific components that make up your income and expenses. These are the levers you can pull to manage your property's financial performance.

The Anatomy of Real Estate Cash Flow

Mastering these components is the first step toward taking control of your investment's profitability. Once you understand how the money flows in and out, you can start making smart decisions to increase what's left for you at the end of the month. That's how you turn a single property into a true wealth-building machine.

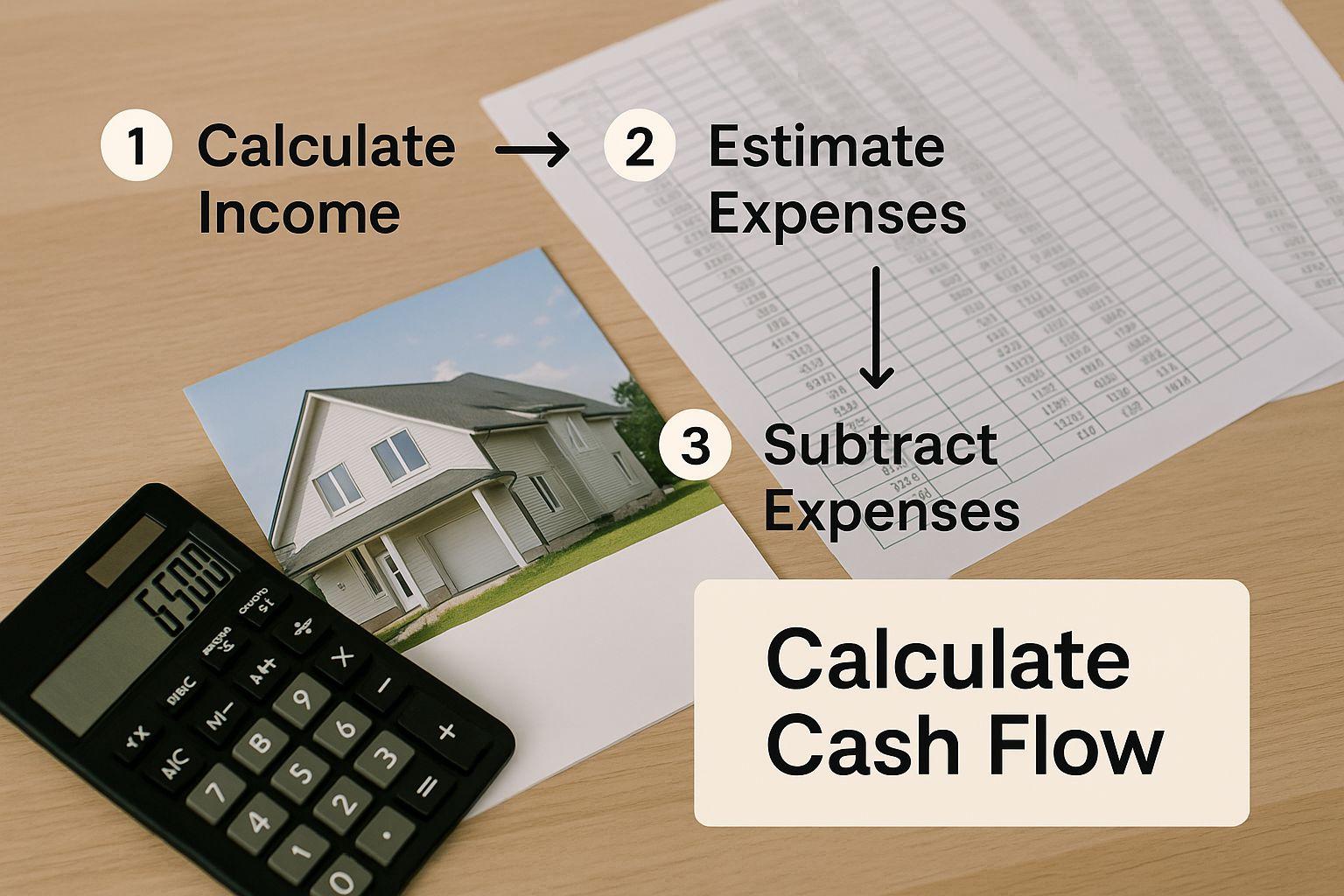

How to Calculate Real Estate Cash Flow Accurately

Knowing what cash flow is in theory is great, but running the numbers yourself is where you actually start making money. Calculating the potential cash flow in real estate isn't rocket science, but it absolutely requires attention to detail. Get this wrong, and a "great" deal can turn sour fast.

Let's walk through the process step-by-step so you can analyze any property with confidence.

As you can see, finding your real profit isn't as simple as rent minus mortgage. It's a layered process of adding up all your income streams and then subtracting every single realistic expense.

Step 1: Start with Gross Scheduled Income

First things first, figure out the absolute maximum income the property could possibly generate in a year. This is your Gross Scheduled Income (GSI). Think of it as the best-case scenario—if the property was 100% occupied all year and every single tenant paid their rent on time, without fail.

For a single-family home renting for $2,000 a month, the math is simple:

- $2,000/month x 12 months = $24,000 annually

If you're looking at a multi-unit property, you'll need to add up the rent from every unit. Don't forget other income sources, too, like coin-operated laundry machines, parking fees, or pet rent. It all counts.

Step 2: Account for Vacancy and Credit Loss

Here's where we get real. No property stays occupied 100% of the time. It's just not realistic. Tenants move out, and it takes time and money to find new ones. This is why you must factor in a Vacancy Loss.

A good rule of thumb is to set aside 5-10% of your GSI for vacancy, but this can vary depending on how hot your local market is.

Let's apply this to our example:

- $24,000 (GSI) x 8% (Vacancy Rate) = $1,920

Subtracting this from your GSI leaves you with $22,080. This new figure is your Effective Gross Income (EGI), and it’s a much more honest projection of what you’ll actually collect.

Step 3: Subtract All Operating Expenses

Next up are your Operating Expenses (OpEx). These are all the recurring costs of simply owning and maintaining the property—everything except the mortgage payment itself.

Common operating expenses you can't ignore include:

* Property Taxes: Your annual bill from the local government.

* Insurance: A landlord or homeowner's policy is a must.

* Maintenance and Repairs: Budget for everything from leaky faucets to a new water heater. A safe bet is 5-10% of GSI.

* Property Management Fees: If you're not managing it yourself, expect to pay 8-12% of collected rent.

* Utilities: Any bills you're responsible for, like water, sewer, or trash.

* HOA Fees: If the property is part of a homeowners' association.

When you subtract all of these costs from your EGI, you get your Net Operating Income (NOI). This is a critical metric that investors use to evaluate a property's profitability before financing even enters the picture.

Step 4: Factor in Your Debt Service

The last major piece of the puzzle is your mortgage payment, also known as Debt Service. This is the total principal and interest you pay on your loan each year. You can get a solid estimate by plugging the numbers into a good mortgage calculator.

It's also worth noting that the lending world is changing. Alternative lenders now account for 24% of U.S. commercial real estate lending, a big jump from the 10-year average of 14%. This just means investors today have more options than ever when it comes to financing a deal.

The final cash flow formula is simple but powerful: Net Operating Income (NOI) - Annual Debt Service = Pre-Tax Cash Flow. This is your bottom line. It's the actual money that hits your bank account every year.

Following these steps with conservative numbers is the only way to build a reliable financial model for a potential investment. It takes the guesswork out of the equation and forces you to ground your decisions in financial reality.

What Really Drives a Property's Cash Flow?

Ever wonder why two almost identical houses, maybe even on the same street, can produce completely different financial results? The secret isn't luck. It's in the key drivers that dictate a property's performance. Getting a handle on these is what separates the investors who steadily build wealth from those who always seem to be scrambling.

Think of it like tuning a high-performance engine. Small, precise adjustments to the right components can unlock a massive surge in power and efficiency. The same goes for cash flow real estate. Success isn't just about the building itself; it's about how all the pieces—location, asset type, financing, and management—are working together in harmony.

The Power of Location and Market Dynamics

You’ve heard the old saying a thousand times: "location, location, location." It might be a cliché, but its importance is impossible to overstate. A great location acts as a powerful engine, driving rental demand, attracting quality tenants, and giving you the leverage to increase rents over time. So, what actually makes a location "good" for cash flow?

- Job Growth: A healthy local economy with a mix of industries is a magnet for new residents, and those people need places to live. Look for areas with strong, consistent job growth, as they tend to have much lower vacancy rates.

- Population Trends: Is the area growing, or are people leaving? Population data is a crystal ball that tells you whether housing demand is likely to climb or fall in the years ahead.

- Landlord-Tenant Laws: This is a big one. Some cities and states have regulations that are friendly to landlords, while others are heavily skewed in favor of tenants. These laws can dictate everything from your eviction process to rent control, hitting your bottom line directly.

A property located in a market with strong fundamentals is like having an insurance policy. Even when the broader economy takes a hit, areas with solid job markets tend to keep their rental income much more stable, protecting your investment.

For an investor, a prime location isn't just a trendy neighborhood. It's a place with the perfect storm of economic growth, reasonable regulations, and high rental demand—an environment where profits are predictable.

Matching the Property Type to Your Goals

The kind of property you choose to buy will fundamentally shape your risk, your expenses, and your cash flow potential. A single-family home and a four-plex are two completely different types of businesses, each with its own rulebook.

Single-Family Homes (SFHs):

These are often the easiest to finance and manage. They also tend to attract long-term tenants who treat the home as if it were their own. The major downside? The moment that tenant leaves, your vacancy rate shoots to 100%, and every single expense is on you.

Multi-Family Properties (2-4 Units):

With a multi-family, you're immediately diversifying your risk. If one unit is empty, you still have rent coming in from the others to help cover the bills. While they can be a bit more work to manage, the potential for higher and more stable cash flow is a huge plus. It also opens the door for "house hacking"—living in one unit while your tenants' rent pays the mortgage—a popular strategy for slashing personal living expenses.

Financing: The Engine of Your Return

The loan you get is one of the most powerful levers you have for controlling cash flow. The terms of that loan—your interest rate, the loan's duration, and how much you put down—directly set the amount of your single largest monthly expense.

Think about this for a second: a 0.5% difference in your interest rate on a $300,000 loan can change your monthly payment by almost $100. Over a year, that's $1,200 that either goes into your pocket or to the bank. This is why shopping for the best loan isn't just a one-time task; it's a critical strategy for maximizing your returns.

The Management Advantage

Finally, property management is where the rubber meets the road. This is how you protect and grow your cash flow, month after month. It doesn't matter if you do it yourself or hire a professional—effective management is non-negotiable.

Great management really boils down to two key things:

1. Maximizing Your Income: This means finding reliable tenants through rigorous screening, keeping vacancy periods as short as humanly possible, and strategically raising rents to keep pace with the market.

2. Controlling Your Expenses: It's about proactive maintenance that stops small problems from becoming budget-busting disasters. It’s about efficiently handling repairs and managing vendor relationships to keep your operating costs lean.

At the end of the day, smart management is what transforms a physical asset into a high-performing business, ensuring it generates every dollar of cash flow it possibly can.

Analyzing Potential Investment Properties

Once you've got the hang of calculating cash flow, it's time to put that knowledge to work. This is where you shift from just learning the concepts to actually thinking like a savvy investor—learning how to dissect a deal, spot the real opportunities, and confidently walk away from the ones that don't make sense. It’s all about building a reliable system to evaluate a property not just for what it is today, but for its potential to deliver steady, predictable income.

The real estate market is always in motion. In a recent quarter alone, direct transaction volumes hit a staggering US$179 billion globally. The Americas accounted for US$99 billion of that, an 18% jump from the previous year. With so many properties changing hands, your ability to analyze them effectively is what will give you a serious edge.

Using Quick Filters: The 1% Rule

Before you dive deep and build out a complex spreadsheet for every potential property, you need a quick way to weed out the obvious duds. This is where a simple rule of thumb like the 1% Rule comes in handy.

The 1% Rule is straightforward: a property's gross monthly rent should be at least 1% of its purchase price.

- For example: If a property is on the market for $250,000, it should rent for at least $2,500 per month to meet the rule ($250,000 x 0.01 = $2,500).

If a property hits this mark, it’s a good sign it has a fighting chance to be cash-flow positive and is worth a closer look. If it falls way short, you can probably move on without wasting another minute. But remember, this is just a first-pass filter. It's a quick gut check, not a final judgment. It doesn’t see things like sky-high property taxes or a roof that needs replacing, which could easily sink an otherwise promising deal.

Diving Deeper with Key Performance Metrics

Once a property makes it past your initial screen, it's time to dig into the numbers that really tell the story of its financial health. When it comes to cash flow real estate, two of the most critical metrics you'll use are the Capitalization Rate (Cap Rate) and Cash-on-Cash Return.

Understanding the Cap Rate

The Capitalization Rate, or Cap Rate, is your go-to tool for comparing the relative value of different properties, no matter their price. Think of it as a way to measure the property's potential return if you were to buy it with all cash.

The formula is: Cap Rate = Net Operating Income (NOI) / Property Purchase Price

Generally, a higher Cap Rate signals a higher potential return, but it can also mean more risk. On the flip side, a lower Cap Rate often points to a safer, more stable property in a great location. This metric is what lets you make true apples-to-apples comparisons between different investment options.

Measuring Your True Return with Cash-on-Cash Return

While the Cap Rate is fantastic for comparing one deal to another, the Cash-on-Cash Return gets to the heart of what you really want to know: how hard is my money working for me? This metric calculates the annual pre-tax cash flow you receive against the total cash you actually pulled out of your pocket (your down payment, closing costs, and any initial repair funds).

The formula is: Cash-on-Cash Return = Annual Pre-Tax Cash Flow / Total Cash Invested

A property might have a decent Cap Rate, but if your loan terms are terrible, your Cash-on-Cash Return could be abysmal. This metric cuts right through the theoreticals and shows you the real-world performance of your invested capital. Most seasoned investors I know aim for a Cash-on-Cash Return of 8-12% or higher.

The entire process of digging into these numbers is a discipline known as underwriting. For a much more detailed look, you can explore the fundamentals of cash flow underwriting for real estate deals in our guide.

Conducting Thorough Market Analysis

Finally, remember that no property is an island. A fantastic deal in a dying market can turn into a nightmare pretty quickly. A solid market analysis means looking beyond the four walls of the building and into the economic and regulatory climate of the area.

Make sure you're looking at these factors:

* Economic Drivers: Are new jobs coming to the area? Is the population growing or shrinking? A healthy local economy is the engine that drives rental demand.

* Rental Comps: What are other, similar properties in the neighborhood actually renting for? This is your reality check to make sure your rent estimates aren't just wishful thinking.

* Landlord-Tenant Laws: Spend some time researching the local regulations. Are they generally balanced, or do they heavily favor tenants? The answer can have a huge impact on your risk and how you're able to operate.

When you combine quick filters with a deep dive into the metrics and solid market research, you create a repeatable system for finding great deals. This structured approach helps take the emotion out of the decision, empowering you to invest based on sound financial principles.

Common Mistakes That Erode Cash Flow

A property that looks perfect on paper can easily become a money pit in the real world. I’ve seen it happen time and time again. The road to consistent cash flow in real estate is paved with common, yet incredibly costly, mistakes that can quietly bleed your profits dry.

Learning to spot these pitfalls is the first step. It's about building a defensive strategy that sees problems coming before they hit your bank account. Even experienced investors get tripped up by these—they aren't usually big, dramatic failures, but slow, silent leaks that drain you month after month.

Underestimating Capital Expenditures

One of the sneakiest cash flow killers is underestimating Capital Expenditures (CapEx). These are the big, expensive, and unavoidable replacements that don't fit into your regular monthly budget. We’re talking about a new roof, an HVAC system giving up the ghost, or repaving a cracked parking lot.

These aren't just minor repairs; they’re major projects that can run into tens of thousands of dollars. Not planning for them is like sailing a ship without a single life raft. When a major system inevitably fails, your cash flow is going down with it.

A savvy investor treats CapEx reserves as a non-negotiable monthly expense. Every month, set aside 5-10% of your gross rent into a separate savings account. This simple habit turns a future crisis into a predictable, manageable cost.

Overlooking Vacancy Rates

Optimism is a dangerous thing in real estate analysis. Assuming your property will be 100% occupied all the time is a classic rookie mistake, and it's a fast track to a cash flow disaster. People move. Life happens.

Every single day a unit sits empty, it’s not just failing to make you money; it’s actively costing you money in utilities, marketing, and cleaning. You have to bake a realistic vacancy rate—usually 5-8%, depending on your market—into your numbers from day one. If you don't, your entire financial projection is built on wishful thinking, not reality.

Conducting Poor Tenant Screening

The quality of your tenant determines the quality of your investment. Full stop. Rushing to fill a vacancy without a rock-solid screening process is a short-term fix that almost always creates long-term nightmares. One bad tenant can set off a chain reaction of financial pain.

- Late or Missed Rent: This is the most obvious hit to your monthly income.

- Property Damage: The cost of repairs can quickly blow past the security deposit, coming directly out of your pocket.

- Eviction Costs: The legal fight to remove a problem tenant is draining, expensive, and can take months—all while you’re earning zero income from the unit.

Your screening process is your best defense. A thorough system that includes credit checks, background searches, and income verification protects your asset and helps secure a reliable, steady income stream.

Deferring Essential Maintenance

I get it. It’s tempting to put off a non-urgent repair to save a few bucks this month. But deferred maintenance is a debt that always collects, and it always charges interest. That tiny leak under the sink you ignored? It can easily become thousands in rotted cabinets, ruined flooring, and mold remediation.

You have to shift your mindset. Proactive maintenance isn’t just a cost; it’s an investment. It preserves the value of your property and prevents small headaches from morphing into budget-killing emergencies. Plus, a well-kept property attracts better tenants who treat the place with respect and stay longer, which is the ultimate key to stable cash flow.

Here is the rewritten section, crafted to sound like it was written by an experienced real estate investor.

How to Squeeze More Cash Flow Out of Your Properties

Turning a decent rental property into a real cash-flow machine doesn't happen by accident. It takes a hands-on approach where you're constantly looking for ways to pull the right levers—cranking up the income on one side while strategically trimming the fat from your expenses on the other.

This isn't just about passively collecting a rent check once a month. Think of your property as a business. The most successful investors are always on the hunt for opportunities to make that business more profitable and efficient. These strategies are your playbook for taking firm control of your investment's financial performance.

Boosting Your Rental Income

The most obvious path to better cash flow is getting more money in the door. You could just raise the rent, but a much smarter, more sustainable strategy is to give tenants a compelling reason to pay more. This is where "value-add" upgrades become your best friend.

Think about the features that today's renters truly want and are willing to pay a premium for:

- In-Unit Laundry: This is a huge one. Adding a washer and dryer can easily justify a significant rent bump and make your unit lease up much faster than the competition's.

- Smart Home Features: Things like smart thermostats, keyless entry, or video doorbells aren't just gadgets anymore. They offer real convenience and security that modern tenants expect and will pay extra for.

- Upgraded Finishes: You don't always have to do a full gut-renovation. Sometimes, simple touches like new light fixtures, modern cabinet hardware, or a fresh, neutral coat of paint can make a unit feel more premium and command a higher rent.

Slashing Your Operating Expenses

Now for the other side of the coin. Trimming your expenses can be just as impactful as raising the rent, sometimes even more so. Every single dollar you save on operations drops straight to your bottom line, directly beefing up your monthly profit. Too many investors leave money on the table by not paying close enough attention to their costs.

Maximizing your cash flow in real estate is a two-front battle. You have to be just as obsessed with finding savings as you are with increasing revenue. Small, consistent efficiencies add up to huge gains over time.

Here are a few key areas to attack to stop the financial leaks:

- Challenge Your Property Taxes: Tax assessments are not set in stone, and they're often wrong. If you have a good reason to believe your property is overvalued by the county, filing an appeal could save you a serious chunk of change every single year.

- Refinance Your Mortgage: Your mortgage is almost always your biggest single expense. As financing conditions improve and fuel market recovery—global real estate deal values grew 11% in one year, partly due to better interest rates—it’s the perfect time to see if you can lock in a lower rate. You can learn more about the market dynamics from this global private markets report on mckinsey.com.

- Get Serious About Preventative Maintenance: Waiting for things to break is a recipe for expensive, middle-of-the-night emergency calls. A simple, regular maintenance schedule for your HVAC, plumbing, and major appliances will prevent those costly surprises and make your systems last much longer.

Your Top Questions About Real Estate Cash Flow, Answered

As you dive into the world of cash flow real estate, you're going to have questions. That's a good thing. Getting clear answers is what builds the confidence to analyze deals correctly and sidestep those common early mistakes.

Let’s tackle some of the most frequent questions I hear from new investors, moving from the numbers on a spreadsheet to what actually happens out in the field.

What Is a Good Cash Flow for a Rental Property?

This is the big one, isn't it? Everyone wants a magic number, but the truth is, there isn't one. You'll often hear people toss around $100 to $200 per month per unit as a decent target, but that figure can be incredibly deceiving without context. A property in a pricey coastal market might cash flow less than that but have massive appreciation potential.

A much better way to look at it is through the lens of cash-on-cash return. This tells you how efficiently the actual money you pulled out of your pocket is working for you.

Many experienced investors won't even look at a deal unless it projects an 8% to 12% cash-on-cash return. This benchmark ensures your down payment and closing costs are pulling their weight from the very beginning, making the investment truly productive.

At the end of the day, what's "good" really comes down to your own goals, your market, and your stomach for risk.

Can a Property with Negative Cash Flow Be a Good Investment?

It can be, but let's be clear: this is playing on hard mode. It's a risky, advanced strategy. When you buy a property with negative cash flow, you are committing to losing money every single month. The entire play hinges on the hope—the speculation—that the property’s value will skyrocket enough to make up for all those losses when you finally sell.

This is not investing; it's speculating. I strongly advise beginners against this. Your first goal should be building a portfolio of properties that can stand on their own two feet. Positive cash flow real estate is your financial safety net. Negative cash flow takes that net away, leaving you completely exposed if the market turns or a big expense pops up.

How Should I Budget for Major Repairs Like a New Roof?

You have to treat big-ticket repairs—what we call Capital Expenditures or CapEx—as if they are a guaranteed monthly expense, even though they only hit every few years. Don't ever fool yourself into thinking you'll just magically come up with $15,000 for a new roof when the time comes. The smart money builds a reserve fund from day one.

A solid rule of thumb is to sock away 5% to 10% of the gross monthly rent specifically for CapEx. Set up an automatic transfer to a separate savings account. By doing this, you transform a future five-figure crisis into a manageable, predictable budget item. That discipline is what keeps a property financially healthy for the long haul.

Ready to streamline your real estate deals and investor relations? Homebase provides an all-in-one platform to manage your fundraising, communications, and reporting, so you can focus on finding your next great investment. Learn more about how Homebase can help.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.