Cash Flow Underwriting A Modern Investor's Guide

Cash Flow Underwriting A Modern Investor's Guide

Unlock smarter real estate investing with cash flow underwriting. This guide explains key metrics and real-world applications for better decisions.

Domingo Valadez

Jul 9, 2025

Blog

When you're sizing up a potential real estate investment, how do you judge its financial strength? Traditionally, the focus has been on historical data—looking backward. Cash flow underwriting flips that script, concentrating instead on an asset's current and projected ability to generate cold, hard cash. It’s a forward-looking approach that asks a simple but powerful question: can this property actually pay its own bills?

What Is Cash Flow Underwriting

Think of it this way: traditional underwriting is like driving a car by only looking in the rearview mirror. It relies almost entirely on past performance, like credit scores and historical payment records, to make a judgment call. While that history is certainly part of the picture, it doesn’t tell you what’s happening on the road ahead.

Cash flow underwriting, on the other hand, is like keeping your eyes on the road in front of you. It zooms in on the real-time movement of money—the income pouring in, the expenses going out, and the resulting net operating income. This gives you a much more dynamic and accurate sense of an investment's true financial health and its ability to handle its obligations right now and in the near future. For more expert takes on modern investment strategies, the articles on fundpilot's blog are a great resource.

A Dynamic View of Financial Health

In real estate, where market conditions can pivot and income isn't always perfectly stable, this forward-looking perspective is crucial. You might come across a property with a less-than-perfect history that is now generating incredibly strong and consistent cash flow. A traditional model might flag it as a risk, but a cash flow analysis would see it for what it is: a potentially sound investment.

Cash flow underwriting isn't about ignoring the past, but rather prioritizing the present financial reality. It’s laser-focused on one essential question: "Does this asset generate enough cash today to cover its operating expenses and debt service?"

This shift from historical credit to current performance offers some clear advantages for investors:

- Pinpoint Accuracy: It gives you a real-time, up-to-date assessment of financial viability.

- Smarter Risk Assessment: The focus is squarely on the property's ability to pay its debts from its own operations.

- Wider Opportunities: It opens the door to assets and borrowers who have strong current financials but may not have a perfect, long-standing credit history.

- Predictive Insight: It helps forecast future performance based on current momentum, not just past behavior.

To really understand the shift, it helps to see the two approaches side-by-side. The table below breaks down the fundamental differences between them.

Traditional Underwriting vs Cash Flow Underwriting

This table highlights the fundamental differences in data sources, focus, and outcomes between traditional and cash flow-based underwriting approaches.

As you can see, the difference is significant. One method looks backward to judge character, while the other looks forward to assess capability. For real estate syndicators, understanding this distinction is key to uncovering opportunities that others might miss.

The Shift From Past Performance to Present Reality

The evolution of cash flow underwriting wasn't an overnight revolution. It was a slow, deliberate crawl away from dusty file cabinets and toward the dynamic, digital analysis we see today. For decades, gauging a borrower's ability to repay a loan was a painstaking, manual chore. Picture a loan officer literally buried in stacks of paper bank statements, armed with nothing but a highlighter and a calculator, trying to stitch together a coherent financial story one transaction at a time.

This old-school method wasn't just brutally slow; it was also inherently biased against anyone whose financial life didn't fit a neat, predictable pattern. A new business with choppy startup income or a freelancer juggling multiple payment streams? Their applications often looked too messy, too unpredictable. Their true financial strength was lost in the static of a system built for W-2 employees with perfectly linear careers. The entire process was about looking backward, not understanding the present.

Embracing Real-Time Financial Behavior

The real breakthrough came with a fundamental shift in mindset, fueled by technology. Instead of asking, "What did this person or property do last year?" the critical question became, "What is their financial reality right now?" This is the very heart of modern cash flow underwriting.

Moving from manual reviews to automated analysis has been a game-changer. What used to involve poring over paper statements is now done by accessing digital financial data directly, often through open banking platforms and sophisticated analytical software. This leap forward allows for much more inclusive lending because it evaluates a borrower's actual, current financial habits—like income patterns and spending—instead of just relying on past credit events. You can get a deeper sense of how data powers this approach and its impact on modern lending to see the full picture.

This pivot to present-day reality has cracked open the door for countless people and businesses who were simply misunderstood by old-school credit models.

By focusing on real-time financial behavior, cash flow underwriting provides a more inclusive and precise understanding of a borrower's true capacity to handle debt. It values present strength over past struggles.

Who Benefits From This Modern Approach?

This switch to analyzing live data has created opportunities for a whole new group of borrowers and investments that traditional models used to push to the side. While the impact is broad, a few groups have really reaped the rewards.

- Gig Economy Workers: Freelancers and contractors with fluctuating monthly paychecks can finally prove their consistent earning power, something a simple credit score could never capture.

- New Businesses and Startups: Young companies that lack years of financial statements can secure capital based on their current revenue and healthy cash flow, rather than being punished for a short track record.

- Real Estate Investors: In a syndication, a sponsor can show a property's current rent roll and operating statements to prove its viability, even if its performance under previous, less-skilled ownership was poor.

- Borrowers with Thin Credit Files: People who are new to credit or simply don't use it often are no longer financial ghosts. Their responsible cash management becomes the main proof of their creditworthiness.

At the end of the day, this represents a huge step toward a fairer and more accurate way of assessing risk. It’s an acknowledgment that the economy has changed, and the best predictor of someone's ability to pay their bills tomorrow is their ability to generate cash today.

Decoding the Core Metrics of Cash Flow

Alright, let's get into the nitty-gritty. To really get a handle on cash flow underwriting, you have to move past the high-level concepts and get comfortable with the numbers themselves. These core metrics are what tell you the real story of a property's financial health—its profitability, stability, and overall risk. Think of it less like doing math and more like learning to read a financial story.

The first chapter of that story, and the absolute foundation of your analysis, is a property’s ability to turn a profit from its daily operations. This is where Net Operating Income, or NOI, enters the picture. It's the first and most important number you'll calculate.

Calculating Net Operating Income

Think of NOI as the property's annual profit before you even think about the mortgage. It’s a pure, clean look at how much cash the asset itself can produce. The formula is refreshingly simple: take all the money the property brings in (Gross Operating Income) and subtract all the necessary costs to keep it running (Operating Expenses).

We intentionally leave out things like loan payments, depreciation, or income taxes. Why? Because doing so isolates the property's operational performance. It lets you make apples-to-apples comparisons with other properties, no matter how they’re financed or what their owner's tax situation looks like.

Let's walk through a quick example with a multifamily building:

- Gross Potential Rent: $150,000/year

- Other Income (laundry, parking): $5,000/year

- Vacancy Loss (5%): -$7,500/year

- Total Operating Expenses (taxes, insurance, maintenance): -$55,000/year

Do the math, and you land at an NOI of $92,500. This single number is the bedrock for everything else we're about to do.

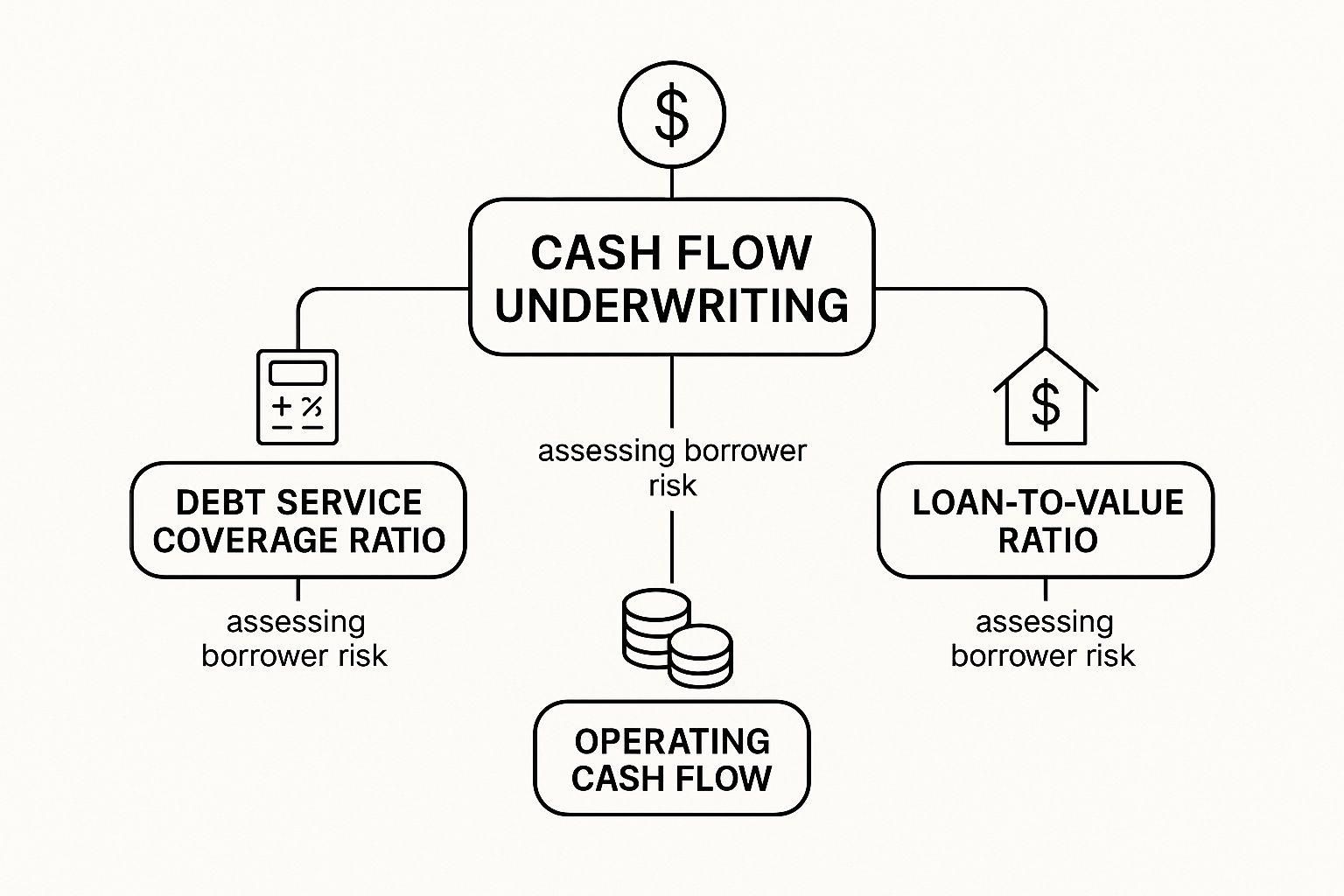

This image below does a great job of showing how metrics like the Debt Service Coverage Ratio (DSCR) and Loan-to-Value (LTV) all tie back together to paint a full picture of risk.

As you can see, none of these numbers live in a vacuum. They all work together, giving you a complete view of an asset's financial footing and the borrower's ability to handle the debt.

Determining Debt Service Coverage Ratio

Once you have the NOI, you can answer the million-dollar question every lender has: can this property actually pay its own mortgage? That's precisely what the Debt Service Coverage Ratio, or DSCR, tells you. It measures how many times over the property's annual net income can cover its annual mortgage payments (the "debt service").

DSCR is the ultimate stress test for an investment property. A ratio below 1.0x means the property isn't generating enough cash to pay its own mortgage, signaling immediate financial distress.

Lenders will almost always demand a DSCR well above 1.0x. This buffer is their safety net. A common minimum these days is 1.25x, which means the property is generating 25% more cash than it needs for debt payments. The higher the DSCR, the lower the risk.

Let's stick with our example. If the property's total annual mortgage payments are $70,000, the DSCR calculation looks like this:

$92,500 (NOI) / $70,000 (Debt Service) = 1.32x

That 1.32x DSCR is a healthy number. Most lenders would be happy with that, as it shows a solid cushion to absorb any surprise expenses or a temporary drop in income.

Adding Advanced Variables for Deeper Insight

While NOI and DSCR are the stars of the show, seasoned investors know that the real magic is in looking behind the numbers. You have to analyze the quality and stability of the income and expenses that produce those core metrics.

- Income Stability: Where is the rent coming from? A property leased long-term to a credit-worthy corporate tenant is a world away from one filled with short-term vacation rentals in a highly seasonal market. Dig into the tenant roster and lease terms.

- Expense Volatility: Are the expenses predictable? A building with a brand-new roof and HVAC systems is going to have much more stable maintenance costs than an old property with a long list of deferred repairs. Get your hands on the maintenance history to see what future costs might be lurking.

When you layer these qualitative insights on top of the hard numbers, you graduate from simply calculating to truly assessing risk. This deeper dive is what separates a decent deal from a great one and builds a much more resilient financial model for your underwriting.

How Technology Is Changing The Underwriting Game

The old-school image of an underwriter—hunched over a desk with highlighters and a calculator, manually poring over bank statements—is quickly becoming a relic of the past. What once took days of meticulous, line-by-line review can now be done in a matter of seconds. But this isn't just about doing the same job faster; it's about doing it better, with a level of depth and accuracy that was previously unimaginable.

Modern underwriting has evolved, fueled by big data and sophisticated analytics that can transform raw financial data into powerful, predictive insights.

Fintech lenders, in particular, have been at the forefront of this shift. They use secure software to directly link to a borrower's bank accounts, allowing them to analyze months, or even years, of transaction history almost instantly. This process goes far beyond just ticking a box to verify income. It’s about uncovering the subtle yet crucial patterns in financial behavior that tell the real story of a borrower's stability. An algorithm can immediately distinguish a one-off cash injection from a pattern of consistent, reliable deposits, painting a much more honest picture of actual income.

From Data Points to Real Insights

This technological leap enables a far more detailed analysis than any manual review ever could. Lenders can instantly flag red flags that signal potential financial distress, often long before those issues would ever appear on a traditional credit report. The use of big data has dramatically enhanced cash flow analytics, with fintechs building tools specifically designed to pull these insights directly from bank account data. This helps them accurately assess debt capacity, identify recurring bill payments, and even track seasonal shifts in cash flow.

For example, analyzing how many times an account has been overdrawn in the past 90 days gives a lender immediate, vital information about a borrower's financial discipline. You can discover more insights about how big data and SQL are applied in loan underwriting on materialize.com.

This is a genuine game-changer. An underwriter no longer just sees if a borrower has enough money; they can see how that borrower manages their money day-to-day. This clarity leads to more responsible lending and opens doors for creditworthy people who might have been unfairly overlooked by older, less nuanced methods.

The real power of technology in cash flow underwriting is its ability to turn a chaotic stream of transactions into a clear, predictive story about financial health.

This process is only getting better. Techniques like AI-powered information extraction are making the collection of comprehensive borrower data even faster, leading to quicker and more intelligent underwriting decisions.

The Direct Link to Better Outcomes

Ultimately, this data-driven approach leads to a stronger, more accurate assessment of risk. By automating the analysis of real-time financial behavior, lenders can build a far more complete profile of a borrower or an investment property. This directly improves the lending process in several key ways.

- Expanded Access to Credit: People with non-traditional income, like freelancers or small business owners, can finally have their true earning power properly evaluated. Their consistent cash flow is made visible, even if it doesn't fit the neat box of a W-2 employee. This unlocks capital for a huge and often underserved part of the economy.

- Lower Default Rates: By catching early warning signs—frequent overdrafts, consistently low daily balances, or erratic income—lenders can more accurately predict a borrower’s ability to take on new debt. This proactive approach to risk helps prevent defaults before they ever occur, leading to a more stable lending environment for everyone.

- More Efficiency and Scale: Automating the data gathering and analysis drastically reduces the time and manpower needed for underwriting. This doesn't just cut operational costs for lenders; it allows them to handle more applications and serve a larger market without ever compromising the quality of their review.

In the end, technology has transformed cash flow underwriting from a niche, labor-intensive art form into a scalable, data-backed science. It gives lenders the power to look past a simple credit score and truly understand the financial dynamics at play, resulting in smarter decisions and greater economic opportunity.

A Practical Guide to Real Estate Syndication

Alright, let's take these concepts out of the textbook and see how they work on the ground. This is where theory gets real. We'll walk through a deal with a fictional real estate syndicator, Sarah, as she analyzes "The Crestwood," a 50-unit multifamily property.

Watch how she uses cash flow underwriting at every stage. Her goal isn't just to buy a building; it's to forge an investment thesis that can stand up to some serious scrutiny.

The first thing Sarah does isn't to look at the asking price. Instead, she dives headfirst into the property's financial paperwork. She gets her hands on the trailing 12 months (T-12) of operating statements and the current rent roll. These documents are the lifeblood of any good analysis, showing precisely how the property has been performing.

Building the Pro-Forma from the Ground Up

With the T-12 statements in hand, Sarah starts building her own financial forecast—what we call a pro-forma. She doesn't just take the seller's numbers at face value. Think of them as a starting point, a rough draft that needs to be torn apart and rebuilt with real-world data.

First up: the rent roll. She sees the current average rent is $1,200 per unit. But her own market research tells a different story. Newly renovated apartments in the same neighborhood are getting $1,450. That $250 per unit difference is her primary value-add opportunity, and she starts budgeting for the renovations needed to close that gap.

Next, she tackles expenses. The seller's T-12 shows a property management fee of 3% of gross revenue. That might sound good, but Sarah knows the top-tier local management firm she partners with charges 5%. She immediately plugs in the higher, more realistic number. This single change makes her entire forecast more conservative and, frankly, more believable.

A classic rookie mistake in cash flow underwriting is blindly accepting the seller's expense report. A seasoned syndicator always builds their expense profile from scratch, using their own team, contracts, and hard-won market knowledge.

This meticulous, line-by-line verification continues. She confirms property tax estimates with the county assessor's office, gets actual quotes from her insurance broker, and projects utility costs based on historical consumption, not just the numbers the seller provided.

Stress-Testing Key Assumptions

Now that her initial pro-forma is built, Sarah’s work is far from over. The next step is to "stress-test" her assumptions to see if the deal can withstand a few punches. After all, a deal that only works in a perfect world is a deal that's destined to fail.

She zeroes in on two of the most critical variables: vacancy rates and operating expenses.

- Vacancy Rate Sensitivity: The property has historically been 4% vacant. Sarah’s pro-forma already has a conservative 5% built-in. But what happens if the market softens? She runs scenarios at 7% and even 10% vacancy to see how it hammers her Net Operating Income (NOI) and Debt Service Coverage Ratio (DSCR). If the property can still cover its mortgage payments at 10% vacancy, that signals a strong margin of safety.

- Operating Expense Spikes: What if property taxes get reassessed much higher than expected? Or a major, unforeseen repair pops up? Sarah runs another scenario where total operating expenses suddenly jump by 10%. She needs to know the property's cash flow can absorb that kind of shock without putting investor capital on the line.

This rigorous testing takes her analysis miles beyond simply hoping the market goes up. It creates a foundation built on operational strength. The tax advantages of a deal are great, but they're only valuable if the investment itself is solid. If you're curious, you can learn more by exploring the tax benefits of real estate syndication in greater detail.

Uncovering the Full Story

Through this exhaustive process, Sarah uncovers the deal's true potential and its hidden risks. She confirms the significant upside in rent growth, but she also discovers that the building's water heaters are all nearing the end of their useful life—a major capital expense the seller conveniently forgot to mention.

Her final investment thesis is now clear, logical, and defensible. It’s not a wild guess; it’s a conclusion backed by a tough, realistic cash flow analysis. By focusing on the money the property can generate day in and day out, she has built a model that can weather economic storms and deliver the kind of predictable returns her investors expect. This is the real power of cash flow underwriting in action.

Here is the rewritten section, crafted to sound like an experienced human expert:

A Fairer Path to Funding: How Cash Flow Underwriting Opens Doors

Cash flow underwriting isn't just a smarter way for investors to vet deals; it's a game-changer for economic opportunity. Think about the countless small businesses and entrepreneurs out there—the real engine of our economy. Many are perfectly healthy and profitable, yet they're invisible to traditional lenders who get stuck on old-school credit scores.

By shifting the focus to what’s happening with a business’s money right now, this approach throws a lifeline to deserving companies.

For any new business, building a long credit history is a catch-22. You need credit to build history, but you can't get credit without it. Traditional underwriting sees a new business and flags the lack of history as a major risk, completely ignoring its actual, present-day performance. Cash flow analysis flips that script entirely. It asks a much more relevant question: "Is this business making money and managing it well today?"

Getting a True Picture of Business Health

Instead of digging through credit reports that can be months or even years out of date, modern lenders can now tap into real-time financial data. This gives them a forward-looking, almost live-action view of a company's financial pulse.

Here’s what underwriters are actually looking at:

* Deposit Trends and Consistency: Is money coming in steadily and growing? Or is it all over the place? This tells the real story about revenue stability.

* Average Daily Balances: A healthy, consistent bank balance shows good financial discipline and a cushion for those inevitable surprise expenses.

* Balance Volatility: Wild swings from a full account to an empty one can be a red flag for poor cash management, even if the sales numbers look good on paper.

This kind of day-to-day analysis allows lenders to move forward with much more confidence. A recent study from FinRegLab actually confirmed this, finding that using cash-flow data makes default predictions significantly more accurate for everyone. The study highlighted a major benefit for entrepreneurs with lower credit scores and businesses under five years old. You can dig into the complete findings in the press release about how cash flow data expands small business lending.

Building a More Inclusive Economy

The ripple effect here is huge. When lenders can see the true risk—or lack thereof—they become comfortable lending to a much wider pool of businesses.

By valuing present performance over past history, cash flow underwriting doesn't just assess risk—it actively creates economic opportunity. It ensures that capital flows to where it is most deserved, not just to where it has been before.

What this means in the real world is that a startup with fantastic early sales or a gig worker with a steady stream of income can finally get the loan they need to scale up. They're no longer being judged by a system that wasn't built for them.

Ultimately, this creates a far more vibrant and fair economy where a great idea backed by solid execution can get the fuel it needs to succeed. It’s a win-win: lenders tap into new, creditworthy markets, and entrepreneurs get a real shot at turning their vision into reality.

Frequently Asked Questions

As you move from understanding the theory behind cash flow underwriting to putting it into practice, some common questions usually pop up. Let's tackle a few of the most frequent ones to help you apply these concepts with confidence.

Clarifying Key Concepts

How is cash flow underwriting different from just looking at a credit score?

Think of a credit score as a rearview mirror. It’s a great summary of someone's past financial behavior—a report card on how they’ve handled debt before. It's historical.

Cash flow underwriting, on the other hand, is like looking at a live GPS feed of their current financial health. It’s focused on the here and now, analyzing real-time income and expenses to see if they can actually afford the loan today and tomorrow. It answers the most important question: "Is there enough cash coming in to cover this new payment?"

Is this method only useful for real estate investing?

While it’s absolutely essential in real estate, the principles of cash flow underwriting are used all over the financial world. Small business lenders, venture capitalists funding startups, and even personal loan providers rely on it.

It's especially powerful for people who don't have traditional W-2 jobs, like freelancers or gig economy workers. Their income might be strong but inconsistent, and a simple credit report just doesn't tell the whole story.

Tools and Important Metrics

What tools are needed to perform cash flow underwriting?

If you're an individual investor looking at a single property, you don't need anything fancy. A simple spreadsheet in Excel or Google Sheets is more than enough to calculate key numbers like NOI and DSCR.

However, professional lenders and big firms use specialized software. These platforms often plug directly into bank accounts through open banking APIs, automatically pulling and analyzing financial data. This gives them a much deeper and faster understanding of an asset's or borrower's financial situation.

While every metric tells part of the story, the Debt Service Coverage Ratio (DSCR) is the one most lenders zoom in on. A DSCR above 1.25x is the classic benchmark for a healthy investment, meaning the property generates 25% more cash than what's needed to cover its mortgage payment.

That single number is a powerful gut check. It tells you, at a glance, how much financial cushion an investment has to absorb a surprise vacancy or an unexpected repair bill.

Ready to stop wrestling with spreadsheets and start scaling your real estate portfolio? Homebase provides an all-in-one platform to manage your deals, investors, and fundraising seamlessly. Book a demo and see how you can streamline your syndication business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.