Maximize Your Wealth with Cash Flow From Real Estate

Maximize Your Wealth with Cash Flow From Real Estate

Learn how to generate steady income and build wealth through cash flow from real estate investments. Discover tips to boost your property income today!

Domingo Valadez

Jun 18, 2025

Blog

Understanding Cash Flow From Real Estate: Your Foundation

When you listen to experienced real estate investors, you'll notice they keep coming back to one key idea: cash flow. Think of cash flow from real estate as your property's net monthly paycheck. It's the cash that remains after you've collected the rent and settled all the bills—from the mortgage payment to unexpected repairs. This isn't about crossing your fingers and hoping a property's value soars; it's about creating a dependable income that turns a piece of real estate from a speculative bet into a functioning business.

This discipline of focusing on steady income is what separates investors who build long-term wealth from those who chase quick, unpredictable profits. While property appreciation is a wonderful perk, it's never a guarantee. Cash flow is the financial engine that keeps your investment portfolio running month in and month out, giving you stability and the resources to expand.

Cash Flow vs. Appreciation: A Mindset Shift

It’s easy for new investors to get caught up in stories of properties doubling in value. This is the appreciation mindset, which depends on market trends that are mostly out of your hands. A cash flow mindset, however, centers on operational skill. It's about running your property so efficiently that your income consistently outpaces your expenses.

- Appreciation: This is the "sell high" part of the investment. It relies on good market timing and can be easily erased by an economic downturn.

- Cash Flow: This is the "earn while you own" component. It’s generated through smart management and provides immediate, tangible returns.

This screenshot from Wikipedia shows the different avenues for real estate investing, making it clear that owning a property directly is just one of many options.

The key takeaway is that no matter how you invest—whether through direct ownership, REITs, or partnerships—the core value is almost always tied to the income the property generates. In other words, its cash flow.

The Resilience of Real Estate Income

History has shown that this type of income is remarkably stable, even in turbulent times. Recent studies reveal that despite market fluctuations, total returns from global real estate have remained positive for several straight quarters. This strength is largely due to the consistent nature of rental income. You can dive deeper into the full analysis of global real estate performance from UBS to see these trends for yourself.

This fundamental reliability is exactly why building a portfolio on strong cash flow from real estate is a cornerstone of any solid investment strategy. It gives you the financial footing to withstand market storms and the confidence to act on new opportunities as they appear.

The Complete Cash Flow Calculation That Actually Works

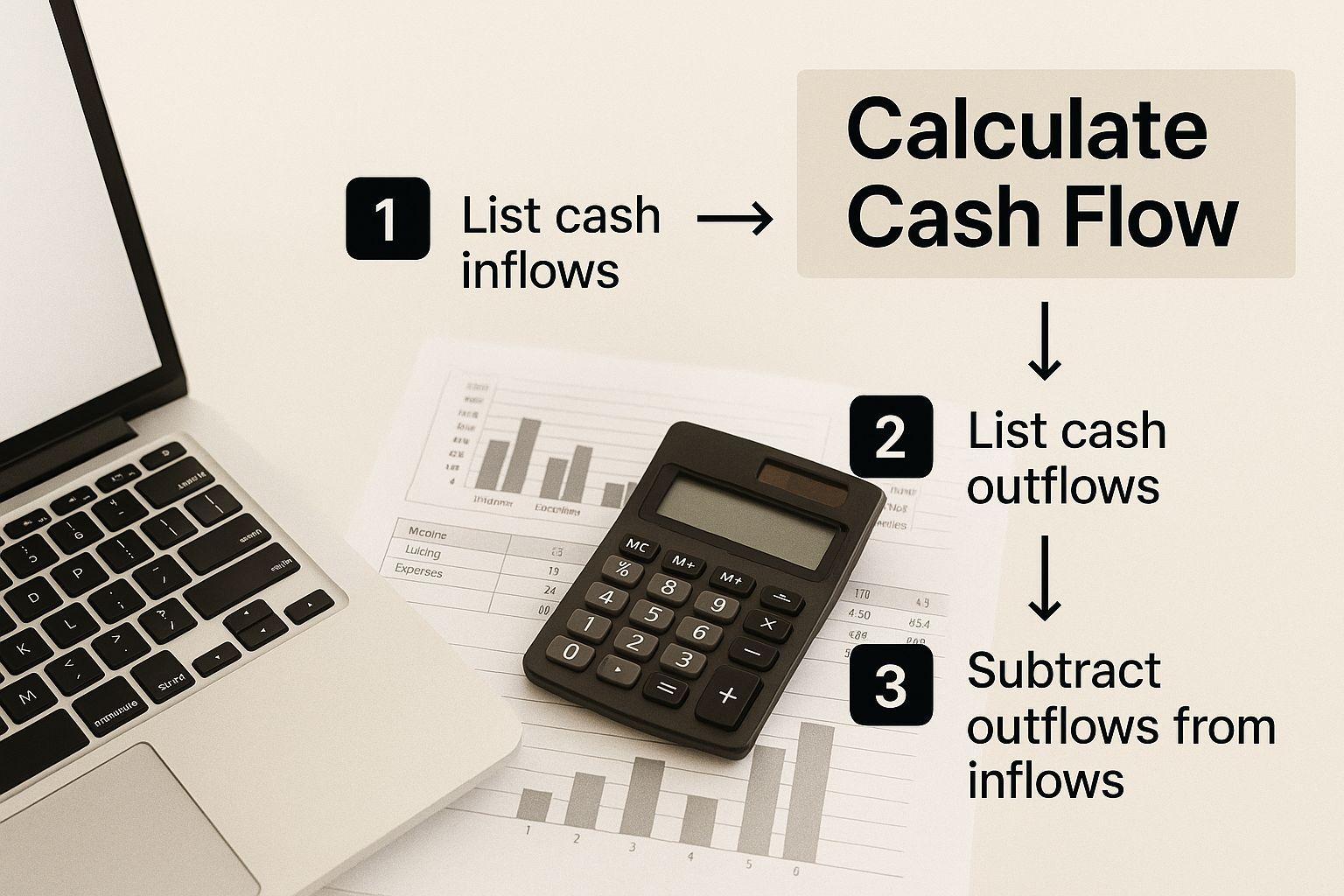

To truly get a handle on cash flow from real estate, you have to move past simple estimates and dig into the numbers. The formula itself is not overly complex, but its real power is in its completeness. Think of it as starting with your total potential earnings and carefully subtracting every single expense to find out what your property actually makes you each month. It's not just about the mortgage; it’s about accounting for every cost, big or small.

This visual shows the basic process of turning gross rental income into net cash flow by subtracting all associated expenses.

The main takeaway here is that missing even one expense category can seriously distort your numbers, potentially leading you to make a poor investment decision.

From Gross Income to Net Cash Flow

Let's break down the calculation, piece by piece. We'll start with the maximum income your property could generate and then work our way down to the actual cash that lands in your bank account.

- Gross Scheduled Income (GSI): This is the ideal scenario—the total rent you would collect if every unit were occupied for the entire year. If you have a single-family home rented for $2,000 per month, your annual GSI is $24,000.

- Vacancy Loss: The reality is that no property stays 100% occupied forever. A good rule of thumb is to budget for a vacancy loss, typically 5-10% of your GSI. Using a conservative 5%, the vacancy loss on our example property would be $1,200 per year.

- Gross Operating Income (GOI): This is your GSI after accounting for vacancy. So, in our example: $24,000 - $1,200 = $22,800. This is your realistic annual income before expenses.

- Operating Expenses (OpEx): This is where many new investors trip up. This bucket includes everything needed to keep the property running, except for your loan payments. These costs include:Property Taxes & InsuranceUtilities (if you pay for any, like water or trash)Property Management Fees (often 8-10% of collected rent)Repairs & Maintenance (budget 5-10% of GOI for this)Capital Expenditures (CapEx) for major replacements like a roof or HVAC system (set aside another 5-10%)Other miscellaneous costs like landscaping, pest control, or HOA fees.

The Final Calculation

After you subtract all those operating expenses from your Gross Operating Income, you get your Net Operating Income (NOI). This is a key metric showing the property's profitability before financing. But you're not done yet. The last step is to subtract your annual mortgage payments (both principal and interest), also known as your debt service.

NOI - Annual Debt Service = Pre-Tax Cash Flow

This final figure is the actual money your property puts in your pocket each year. To make this easier, many investors use rental property calculators to keep all the variables straight. To illustrate how this works across different property types, let's look at a detailed breakdown.

Monthly Cash Flow Calculation Breakdown

Step-by-step breakdown showing how to calculate net cash flow from gross rental income

As the table shows, even though a commercial property has much higher income, its expenses are also significantly greater. The final net cash flow is what matters most, highlighting the importance of a thorough calculation for every type of investment.

Knowing what deductions rental property owners can claim is also crucial, as these directly affect your net income and tax burden. A systematic approach to calculation removes the guesswork and gives you the financial clarity needed to succeed in real estate investing.

Market Forces That Make or Break Your Returns

While calculating cash flow is a vital internal exercise, your property doesn't operate in a bubble. Its financial success is heavily swayed by the external world. Think of your investment property as a well-built boat and the real estate market as the ocean. A powerful current can either carry your boat forward effortlessly or push it far off course. Understanding these forces is key to ensuring your cash flow from real estate doesn't just survive, but thrives.

At its heart, this all comes down to the classic principle of supply and demand. When a growing number of people want to live in an area with a limited number of homes, landlords find themselves in a strong position. This imbalance leads to higher rents and fewer empty units, which directly boosts your income. On the flip side, a market flooded with rental properties forces landlords to compete, often by lowering rent or offering move-in deals, which can quickly shrink your cash flow.

Spotting Markets with Strong Potential

Successful investors learn to identify the tell-tale signs of a rising market before it becomes obvious to everyone else. The simple trick is to follow the movement of jobs and people. A few indicators that signal a healthy rental market include:

- Consistent Job Growth: When large companies move to or expand in a city, they bring an influx of employees who need a place to live, creating a steady demand for rentals.

- Population Inflows: Keep an eye on census data and moving trends. Cities experiencing positive net migration are excellent hunting grounds for real estate because the pool of potential tenants is always being replenished.

- Infrastructure Investment: Major projects like new highways, public transit lines, or downtown revitalization efforts make an area more desirable. These improvements often come just before a jump in property values and rental prices.

The Impact of Supply Constraints

Another crucial factor is how easy it is to build new housing. In many popular markets, constructing new properties is challenging due to a lack of available land or strict building codes. This situation creates a natural and ongoing housing shortage, which is a major advantage for current property owners.

For example, a global forecast shows that new construction in key real estate sectors is expected to stay well below past peaks in both North America and Europe. This limited pipeline of new supply helps insulate the cash flow of existing properties. You can dive deeper into these supply dynamics by exploring the full global real estate outlook from JLL.

The main takeaway here is that regions with limited future supply, such as Europe and North America, offer a lasting edge to owners of existing rental properties. By selecting markets with strong demand and little new competition, you position your investment for steady growth, making positive cash flow from real estate a much more achievable goal.

Property Types That Deliver Consistent Cash Flow

Choosing the right property is like picking the right tool for a job; each type is designed for a specific purpose and offers different results. Not every property is set up for steady income, so understanding their unique cash flow profiles is essential before investing. Your best choice depends on your financial goals, risk tolerance, and how much time you’re willing to spend on management.

Think of it like a farmer choosing between fast-growing seasonal crops and slow-growing, resilient orchards. An investor must decide between different real estate assets. Some offer higher potential returns but demand more attention, while others provide slower, steadier income with less hands-on work.

Residential Properties: The Classic Starting Point

For many investors, residential real estate is the most familiar territory. These properties are in constant demand, as people always need a place to live. This built-in need makes them a reliable starting block for a cash-flowing portfolio.

- Single-Family Homes (SFHs): These are often the entry point for new investors. They attract long-term tenants, typically families, which can lead to lower turnover and more predictable income. The main drawback? With only one stream of rent, a single vacancy means a 100% income loss for that month, making SFHs more sensitive to cash flow interruptions.

- Small Multifamily (2-4 Units): Properties like duplexes or fourplexes are a popular next step for a reason. They significantly reduce your vacancy risk—if one unit is empty, you still have income from the others. This diversification under one roof provides a powerful buffer, making it easier to maintain positive cash flow from real estate even during tenant transitions. Plus, managing multiple units in one location is much more efficient.

Commercial Real Estate: A Different Ballgame

Moving into commercial real estate opens up new opportunities but also introduces more complexity. Here, you're leasing to businesses, not individuals, and the property's success is often tied to the broader economy.

- Retail and Office Space: These properties can generate strong returns, especially with long-term leases from established businesses. A major advantage is the triple-net (NNN) lease, a structure where the tenant is responsible for paying taxes, insurance, and maintenance. This arrangement creates highly predictable, passive income for the landlord.

- Industrial and Self-Storage: These sectors have become favorites for their resilience and lower management needs. The growth of e-commerce fuels demand for industrial properties, while self-storage facilities have proven to be recession-resistant, offering a dependable stream of income through economic ups and downs.

To help visualize how these property types stack up, let's compare their key characteristics.

Property Type Cash Flow Comparison

Comparison of average cash flow yields, management intensity, and risk factors across different property types

This table shows a clear trade-off: properties with lower initial investments like single-family homes often require more hands-on management and may have lower yields. In contrast, higher-yield assets like self-storage facilities typically require a larger upfront investment but offer more passive income.

Ultimately, building a portfolio with strong, consistent income requires matching the property type to your strategy. Whether you prefer the straightforward nature of residential rentals or the scale of commercial assets, the goal is the same: find properties that reliably generate more income than they cost to own and operate.

Advanced Strategies to Maximize Your Monthly Income

Once you have a solid handle on your property's cash flow, it's time to shift from monitoring to actively improving it. This means moving beyond basic management and adopting a proactive mindset. It’s about increasing your income and fine-tuning your operations. These are the strategies experienced investors use to turn good returns into great ones, systematically boosting their cash flow from real estate and building wealth more quickly.

These are not just abstract concepts; they are concrete steps you can take to elevate your property's financial performance. Think like a business owner and look for every chance to add value and strengthen your bottom line.

Strategic Upgrades and Rent Optimization

One of the most direct ways to increase income is by raising the rent. But this requires a delicate touch to keep good tenants happy. The key is to justify any rent increase through value-add improvements—upgrades that tenants see as a genuine benefit and are willing to pay more for.

- Focus on High-Impact Upgrades: Instead of a full-scale, expensive renovation, concentrate on improvements that deliver the best return. This could mean modernizing a kitchen with new countertops and a backsplash, updating bathroom fixtures, or installing durable and attractive flooring like luxury vinyl plank.

- Add In-Demand Amenities: Depending on your market, certain features can justify a significant rent premium. In-unit laundry is a classic example. For a multifamily property, you might consider adding a small dog run or secure package lockers to meet modern tenant demands.

- Systematic Rent Increases: Get into the habit of implementing small, regular rent increases each year. Base these on current market rates and the improvements you've made. A gradual increase is much easier for tenants to accept than a sudden, large hike, and it ensures your property's income keeps pace with the market.

Creative Income and Financing Techniques

Looking beyond rent increases, smart investors find extra income streams and use clever financing to improve their cash position. A little creative thinking can reveal revenue potential you hadn't considered.

A great example is exploring different financing options. The lending landscape is changing, opening up new doors for investors. With traditional banks tightening their belts, private lenders are filling a financing gap of about $150 billion each year across the U.S. and Europe. This shift gives investors access to more flexible financing and potentially higher yields. You can explore a full analysis on new economy real estate investing from Ares to learn more.

You can also consider these tactics:

* House Hacking: This popular strategy involves living in one unit of a small multifamily property (like a duplex or triplex) while renting out the others. The rental income can offset or even completely cover your mortgage, allowing you to live for free while building equity.

* Adding Fee-Based Services: In multifamily buildings, you can generate extra income by offering services like paid storage units, reserved parking spots, or coin-operated laundry facilities.

* Short-Term Rental Arbitrage: Where local rules allow, converting a unit or even a spare room into a short-term rental on platforms like Airbnb can dramatically increase your income per square foot. Be aware, however, that this approach demands much more active management.

By combining targeted property improvements with smart income and financing strategies, you can significantly grow your monthly cash flow, putting you on the fast track to your financial goals.

Cash Flow Killers Every Investor Must Avoid

Stepping into real estate investing isn't just about spotting great properties; it's also about playing defense to protect your profits. A promising asset can turn into a financial headache if you stumble into common traps. These "cash flow killers" are the critical mistakes that eat away at your returns, potentially transforming a solid investment into a monthly money pit. Knowing what they are—and how to sidestep them—is essential for building the healthy cash flow from real estate that fuels long-term wealth.

One of the most common blunders is underestimating expenses. It's easy to fixate on the mortgage payment, but the true cost of owning a property runs much deeper. Think of it like buying a car—the purchase price is only the start. You also have to budget for fuel, insurance, regular maintenance, and the occasional surprise repair. In the same way, your property needs a realistic budget for routine upkeep, unexpected repairs, major capital expenditures (like a new roof), and property taxes. If you fail to set aside 10-15% of your rental income for these costs, a broken HVAC unit or a leaky roof can throw your finances into chaos.

Overleveraging and Poor Tenant Screening

Another major threat to your bottom line is overleveraging. This is when you borrow too much to acquire a property, leaving yourself with a dangerously thin margin between your rental income and your mortgage payment. A small dip in rent or even a brief vacancy can completely erase your positive cash flow. While leverage can amplify your gains in a good market, too much debt makes your investment fragile, with no room for error.

Finally, nothing can drain your cash flow quite like a bad tenant. A weak tenant screening process can set off a chain reaction of costly problems, including:

* Late or missed rent payments, which directly impact your monthly income.

* Expensive eviction processes that consume both your time and money.

* Property damage that requires repairs costing far more than the security deposit can cover.

These issues often lead to vacancies, which are the ultimate cash flow killer. Every month a unit sits empty, you are still paying all the bills without any income to balance them out. Your best defense is a thorough screening process and a well-planned budget. To better understand how your property's financials affect your taxes, check out our guide on real estate investment tax benefits. Actively guarding against these common pitfalls is the key to protecting your investment.

Your Cash Flow Investment Action Plan

Knowing how real estate cash flow works is one thing, but turning that knowledge into action is what truly separates successful investors from hopeful ones. Now it's time to create a concrete roadmap. This isn't about setting fuzzy goals; it's about building a disciplined, repeatable system for finding and managing properties that produce steady income. This plan will be your guide to building a resilient and scalable real estate portfolio.

Think of this as drawing up the blueprint for your financial future before you even think about laying the first brick.

Establish Your Investment Criteria

Before you even start browsing property listings, you need to define what a "good deal" means to you. This step is crucial because it takes the emotion out of decision-making and lets you evaluate opportunities with speed and precision. Your investment criteria should act as your personal, non-negotiable filter.

- Set Clear Cash Flow Goals: Decide on the minimum monthly cash flow you'll accept per property. For example, you might aim for $200 in positive cash flow per unit after covering all expenses and setting aside money for future repairs. This number immediately filters out properties that don't meet your standard.

- Identify Your Target Markets: Based on your research, pick two or three specific cities or neighborhoods to focus on. Zero in on areas with solid job growth and population trends, as these factors fuel rental demand.

- Define Your Property Profile: Pinpoint the exact type of property you want to buy. Will it be single-family homes, duplexes, or small multifamily buildings? Sticking to one niche helps you become an expert in that specific asset class much faster.

Building Your Team and Systems

Trying to build a real estate empire on your own is a recipe for burnout. Assembling a reliable team is essential if you want to scale your business and protect your time. This team will manage the day-to-day work, which frees you up to focus on what really matters: finding new deals and growing your portfolio.

Once your criteria are defined and your team is in place, the last piece of the puzzle is creating systems that can grow with you. This involves having standard procedures for analyzing properties, checklists for due diligence, and clear protocols for managing tenants. By systematizing your approach, you create a model for success that you can use over and over again. This discipline is the foundation of building lasting wealth through real estate.

Ready to professionalize your investment operations? Homebase provides an all-in-one platform to manage your deals, investors, and fundraising seamlessly, allowing you to focus on growth. Learn how Homebase can help you scale your real estate business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.