Capital Call Definition: Essential Guide

Capital Call Definition: Essential Guide

Explore the capital call definition and its role in funding private equity and venture capital investments.

Domingo Valadez

May 3, 2025

Blog

Demystifying Capital Calls: The Essential Definition

At its core, a capital call is a fund manager's legal right to request a portion of pledged capital from investors. This on-demand funding mechanism is primarily used in private investment funds like private equity, venture capital, and real estate. Instead of collecting all invested capital upfront, fund managers call upon investors to contribute only when needed for a specific investment or to cover fund expenses. This differs from traditional investments where the full amount is invested immediately.

Understanding Committed Capital vs. Called Capital

Understanding the difference between committed capital and called capital is key to grasping the capital call definition. Committed capital is the total amount an investor pledges to a fund upon joining. However, this isn't transferred immediately. Instead, the fund manager requests portions of this committed capital in installments, known as called capital, as investment opportunities arise. The remaining committed capital is referred to as uncalled capital. This system allows funds to deploy capital strategically, minimizing idle funds and maximizing investment efficiency. For a deeper dive, explore this guide on Understanding Capital Calls.

How Capital Calls Function in Practice

Capital calls are crucial for private equity and real estate funds, enabling quick access to committed capital from limited partners. For example, if an investor commits $100,000 and the initial drawdown is $30,000, the remaining $70,000 is uncalled capital. This benefits both investors and fund managers. Investors can keep their uncalled capital invested elsewhere until needed, while fund managers avoid holding large sums of idle capital. This practice is especially prevalent in real estate, where project delays or unforeseen costs often necessitate rapid access to funding. Capital calls allow private equity firms to adapt to market fluctuations and seize opportunities. Learn more about understanding capital calls.

The Importance of the Limited Partnership Agreement (LPA)

The Limited Partnership Agreement (LPA) governs the specifics of capital calls, outlining details such as frequency, notice periods, and procedures. This legally binding document is crucial for both the General Partners (GPs) who manage the fund and the Limited Partners (LPs) who invest in it. The LPA provides transparency and legal protection by clearly defining the terms and conditions of capital calls, ensuring all parties are aligned on how and when capital can be requested. Understanding the LPA is essential for navigating the complexities of private investment funds.

Inside the Capital Call Process: A Strategic Breakdown

Understanding the capital call definition is just the first step. The real value lies in understanding the process itself. It involves a series of defined steps ensuring funds are transferred efficiently and transparently. This breakdown illustrates how capital calls move from opportunity to execution.

From Investment Opportunity to Capital Request

The process begins with identifying a promising investment. This might involve acquiring property, funding a startup, or covering operational costs. Once the General Partner (GP) decides to proceed, they determine the required capital. This often involves financial modeling and due diligence. This foundational step sets the stage for a successful capital call.

Crafting the Capital Call Notice

After determining the necessary capital, the GP prepares a formal capital call notice for the Limited Partners (LPs). This document includes key information: the total capital requested, each LP's contribution, the payment deadline, and bank transfer instructions. The notice period is crucial, giving LPs sufficient time to liquidate assets as needed. This preparation is vital for a seamless transaction. As fund operations grow in complexity, systems like Homebase can streamline and automate these communications.

The Legal Framework and Timelines

The entire process is governed by the Limited Partnership Agreement (LPA). This legally binding document outlines the rules surrounding capital calls, including the GP's authority to issue calls, notification procedures, and penalties for non-payment. This framework protects both GPs and LPs. The capital call process involves several key steps. The GP notifies LPs with a formal notice detailing the amount, deadline, and transfer information. This notice is sent in advance to allow LPs preparation time. LPs failing to meet the capital call may incur penalties, such as interest or legal action, as outlined in the LPA. The LPA also specifies terms like call frequency and volume limits. Efficient capital call management is critical for maintaining investor trust and operational success. Learn more about the process of making a capital call.

Managing Market Volatility and Unexpected Expenses

Capital calls can be especially challenging during market volatility or unexpected expenses. For example, if a real estate fund faces cost overruns during a project, the GP might issue an unplanned capital call. Similarly, a venture capital fund might inject additional capital into a portfolio company facing unforeseen challenges. These scenarios demonstrate the dynamic nature of capital calls.

Capital Calls Across Investment Classes: Compare and Contrast

Understanding capital calls is crucial for navigating the world of investment funds. However, these mechanisms differ significantly across various investment types. Just as investment strategies vary, so does the implementation of capital calls. This section explores these differences across several key investment classes, including private equity, venture capital, real estate, and infrastructure funds.

Private Equity: Infrequent but Substantial

Private equity funds often use capital calls to fund significant acquisitions or buyouts. These calls can be quite large, sometimes representing a substantial portion of the committed capital. However, they tend to occur less frequently compared to other investment classes. This aligns with the typical long-term investment horizon of private equity.

Venture Capital: Strategic Timing

Capital calls play a unique role in venture capital (VC). VC funds frequently invest in startups with high growth potential. Capital calls provide the flexibility to seize opportunities as they arise. For instance, an investor might commit $100,000 to a VC fund but only pay $25,000 upfront. The remaining $75,000 represents uncalled capital, available when needed. This structure allows investors to potentially earn returns on their uncalled capital until the fund manager requires it. Learn more about capital calls in venture capital.

Real Estate: Frequent but Smaller

Real estate funds often have different capital call needs. They typically require more frequent calls, although the amounts are usually smaller. This stems from the ongoing expenses associated with real estate projects, such as development, renovations, and property management. These regular, smaller calls provide flexibility in managing cash flow. Platforms like Homebase can streamline the management of these frequent calls, particularly for real estate syndicators.

Infrastructure: Phased Deployment

Infrastructure funds, which focus on long-term projects like toll roads or energy facilities, often use a phased approach to capital calls. These calls are aligned with the project's stages, ensuring capital availability when needed for construction or operational milestones. This phased approach promotes efficient capital deployment over potentially decade-long projects and minimizes the risk of holding large sums of idle capital.

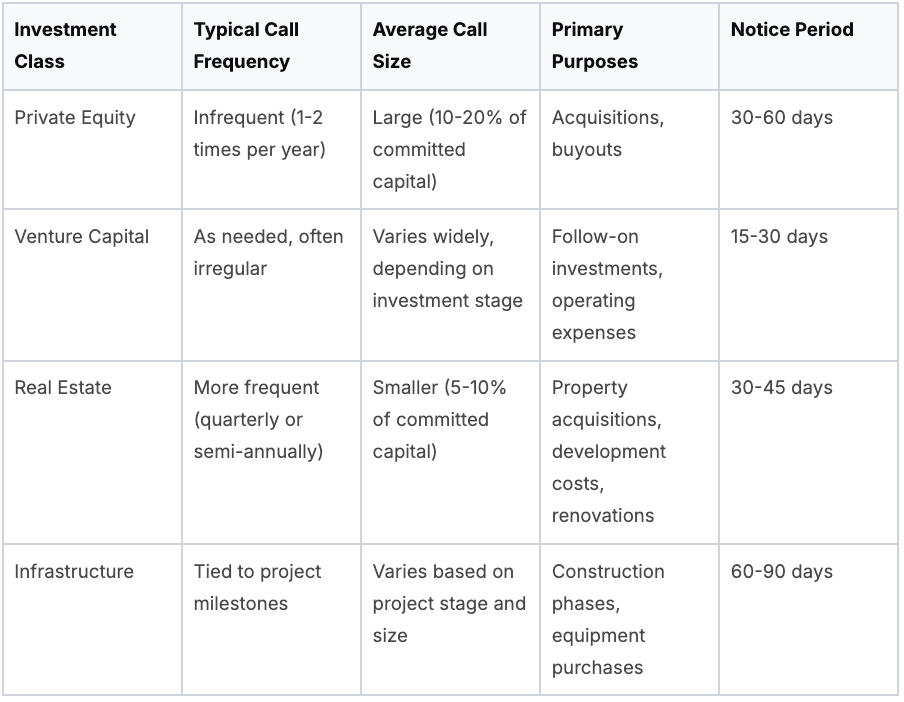

To better illustrate these differences, consider the following table:

To understand the nuances of capital calls, let's look at a comparison across different investment classes. The table below highlights the key differences in how capital calls are implemented.

Capital Call Comparison Across Investment Classes: This table compares how capital calls are implemented across various investment fund types, highlighting key differences in frequency, typical amounts, and common purposes.

This table provides a general overview, and specific terms can vary depending on the individual fund agreement.

Understanding the specific mechanics of capital calls across various investment classes is crucial for both fund managers and investors. It empowers managers to optimize capital deployment and allows investors to better anticipate and manage their liquidity needs.

Weighing The Scales: Benefits Vs. Challenges of Capital Calls

This section explores the two sides of capital calls: the advantages they offer and the potential drawbacks they present. Understanding both is crucial for fund managers and investors alike. This balanced perspective will allow you to better navigate the complexities of this vital funding mechanism.

Benefits of Capital Calls

Capital calls offer several significant advantages, solidifying their role as a popular tool for private investment funds. These benefits contribute to enhanced efficiency and flexibility for fund managers.

- Precise Investment Timing: Fund managers can call capital exactly when it's needed for an investment. This avoids the issue of large sums of uninvested capital remaining idle and potentially decreasing in value. This "just-in-time" funding approach maximizes investment returns.

- Minimized Idle Capital Drag: Holding substantial amounts of uninvested cash can negatively affect a fund's overall performance. Capital calls mitigate this drag by ensuring that capital is deployed swiftly and strategically. This is particularly important in fluctuating market conditions.

- Operational Flexibility: Unexpected expenses are inevitable in the world of investments. Capital calls provide the flexibility to address these unanticipated costs without compromising the fund's overarching strategy. This adaptability is invaluable in today's dynamic markets.

These advantages empower fund managers to react promptly to opportunities and manage unforeseen events effectively. This proactive approach benefits both the fund and its investors.

Challenges of Capital Calls

While the advantages of capital calls are substantial, they also present challenges that demand careful consideration and proactive management. A thorough understanding of these challenges is essential for successful capital call implementation.

- Investor Liquidity Planning: Capital calls require investors to have ready access to liquid assets when a call is made. This can present difficulties for investors who may need to liquidate holdings quickly, potentially at less-than-ideal prices. This liquidity challenge can be especially problematic during market downturns.

- Unpredictability of Timing: The unpredictable timing of capital calls can make financial planning more complex for investors. It can be difficult to anticipate when and how much capital will be required, which can impact an investor’s ability to manage other investments and financial commitments. This uncertainty necessitates that investors maintain a degree of financial flexibility.

- Potential For Strained Relationships: Frequent or unexpected capital calls can strain the relationship between fund managers and investors. During periods of economic difficulty, investors may be unwilling or unable to meet capital calls, potentially leading to conflict. Open communication and clearly defined expectations are paramount to navigating these challenges.

These challenges underscore the need for meticulous planning and transparent communication from both fund managers and investors. Successfully navigating these potential pitfalls is critical to fostering successful long-term investment partnerships. For real estate syndicators, platforms like Homebase offer tools to streamline investor communications and effectively track capital calls, promoting transparency and operational efficiency. This facilitates smoother operations and more effective management of these inherent complexities.

When Capital Calls Go Unanswered: Legal Frameworks and Consequences

Failing to meet a capital call has serious consequences. This isn't simply missing a payment; it represents a breach of the Limited Partnership Agreement (LPA), the binding contract between General Partners (GPs) and Limited Partners (LPs). This section explores the legal and financial ramifications when investors can't meet their capital call obligations.

The Role of the Limited Partnership Agreement (LPA)

The LPA serves as the governing document for capital calls, detailing procedures for handling defaults. Consequences for non-payment are clearly defined within the agreement. The LPA outlines a range of potential repercussions, from minor penalties to more serious actions, designed to protect the fund's overall health. For instance, the LPA might specify interest charges on overdue payments, similar to late fees on a credit card. This discourages tardiness and compensates the fund.

Default Scenarios and Their Unfolding

A missed capital call triggers a series of events, typically starting with communication between the GP and the defaulting LP. The GP may offer a short grace period or a payment plan. If the issue persists, however, the LPA empowers the GP to pursue stronger measures.

Remedies and Recourse for GPs

The LPA equips GPs with several remedies to address defaults, safeguarding the fund and its investors.

- Penalty Interest: LPAs typically include interest charges on late payments, providing a financial disincentive for delayed contributions.

- Partnership Dilution: In certain situations, defaulting LPs might experience a reduction in their fund ownership. This penalizes them while protecting the interests of other LPs.

- Forced Sale Provisions: Some LPAs allow the GP to force the sale of the defaulting LP's stake. This could involve finding a buyer within the existing LP group or on the open market.

- Legal Action: Though a last resort, the LPA authorizes the GP to take legal action against a defaulting LP. This emphasizes the seriousness of capital call obligations.

To understand the potential consequences in more detail, let's examine the following table:

Capital Call Default Consequences

This table outlines the potential consequences investors may face when failing to meet capital call obligations, from minor penalties to severe legal actions.

As the table highlights, the consequences can escalate significantly, impacting an investor's financial standing and reputation.

Protecting Investors and Minimizing Default Risks

Savvy investors carefully negotiate LPA terms to protect themselves from unexpected liquidity issues. They may seek provisions for partial payments or options to exchange assets instead of cash. Experienced fund managers also structure agreements to minimize default risks, implementing staggered capital calls or flexible payment options. This proactive approach helps prevent defaults and strengthens GP-LP relationships. Real estate syndicators can leverage platforms like Homebase to streamline communication and track capital calls, enhancing transparency and mitigating default risk.

Understanding the implications of unanswered capital calls is crucial for both fund managers and investors. Careful LPA structuring and open communication can help navigate the complexities of capital calls and foster successful, long-term partnerships.

Mastering Capital Calls: Best Practices for Fund Managers

Beyond simply understanding what a capital call is and how the process works, effective management of these calls is critical for fund managers. This involves carefully choosing the timing of calls, maintaining open communication with investors, and using technology to make the whole operation more efficient. Leading fund managers understand this: they turn a routine process into a competitive advantage, building trust with investors and ensuring smooth operations.

Optimizing Call Timing and Frequency

Strategic timing is everything. Issuing capital calls too often can put a strain on an investor's available funds, while issuing them infrequently but for large sums can create budgeting difficulties. High-performing fund management firms analyze their historical data and keep an eye on market trends to anticipate capital needs, opting for a balanced approach. This involves forecasting anticipated investments and expenses and establishing a predictable call schedule that works for both the fund's strategy and investor expectations.

For example, a real estate fund might issue smaller, quarterly capital calls to cover ongoing property management costs, while a private equity fund might issue larger, less frequent calls for major acquisitions.

Enhancing Investor Communications

Transparency and clear communication are essential for building investor confidence. Top fund managers provide detailed explanations for each capital call, outlining the investment opportunity or operational need it addresses. This open approach fosters trust and reduces any anxiety associated with unexpected funding requests.

Providing ample notice also allows investors time to prepare their liquidity and minimizes potential disruptions to their financial plans. This proactive communication strategy strengthens the manager-investor relationship, leading to a more stable and cooperative investment environment.

Leveraging Technology for Efficiency

Technology plays a vital role in optimizing capital call management. Platforms like Homebase streamline the entire process, automating tasks such as generating call notices, tracking contributions, and managing investor communications. These tools eliminate manual processes, reducing errors and freeing up valuable time.

This automation allows fund managers to concentrate on their core investment activities, ensuring efficient and accurate capital call execution. Standardized, yet flexible, documentation processes improve consistency and ensure compliance. Data analytics tools like those offered by Homebase can help predict future capital needs more accurately, further refining forecasting and minimizing unnecessary calls. These technological advancements lead to greater operational efficiency and higher investor satisfaction.

Furthermore, developing robust tracking systems provides real-time visibility into capital flows, allowing fund managers to monitor progress, quickly identify potential issues, and make well-informed decisions.

Building Stronger Investor Relationships

Capital calls, when managed effectively, represent an opportunity to build stronger investor relationships. By creating a transparent narrative around each call, fund managers demonstrate accountability and bolster investor confidence. This could involve sharing the investment rationale, projected returns, and potential risks associated with the investment.

Regular updates on the progress of funded investments further enhance transparency and keep communication channels open. This proactive approach cultivates trust and fosters long-term partnerships, even during challenging market conditions. It transforms capital calls from a purely transactional process into a strategic opportunity to strengthen the bond between fund manager and investor.

Ready to streamline your real estate syndication and become a master of capital calls? Explore how Homebase can revolutionize your fund management process and elevate your investor relations.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.