Accredited Investor Verification: Ultimate Compliance Guide

Accredited Investor Verification: Ultimate Compliance Guide

Streamline accredited investor verification with proven tips that boost compliance and secure your offerings. Click for expert insights.

Domingo Valadez

Mar 20, 2025

Blog

The New Landscape of Investor Verification

Accredited investor verification is crucial for anyone navigating the complexities of private investment markets. This process ensures only investors who meet specific financial criteria can participate in particular investment offerings, protecting both investors and issuers. For issuers, verification is a critical component of regulatory compliance, mitigating legal risks and fostering investor trust. For investors, it opens doors to potentially higher-return investments not available to the public.

This careful balance between access and protection forms the cornerstone of the modern investment landscape.

Navigating Regulation D and the JOBS Act

The bedrock of accredited investor verification lies within Regulation D and the JOBS Act. Regulation D provides exemptions from certain SEC registration requirements for private placements, simplifying capital raising for businesses. The JOBS Act of 2012 further expanded these exemptions by establishing Rule 506(c). This rule allows general solicitation and advertising, fundamentally changing how issuers connect with potential investors, but only if all participants are accredited.

This shift significantly increased the need for robust and reliable verification methods.

506(b) vs. 506(c): Key Differences

Understanding the distinctions between traditional 506(b) and 506(c) offerings is crucial for accurate accredited investor verification. Under 506(b), issuers can raise an unlimited amount of capital from an unlimited number of accredited investors and up to 35 non-accredited, sophisticated investors. General solicitation, however, is prohibited. 506(c), on the other hand, permits general solicitation but mandates that all investors be accredited.

Issuers using 506(c) must take "reasonable steps" to verify investor accreditation. This subtle yet significant difference dramatically affects the verification process itself. The concept of accredited investor verification has changed markedly since the 2012 introduction of Rule 506(c) under the Jumpstart Our Business Startups (JOBS) Act. This rule permitted issuers to generally solicit and advertise private offerings, provided all investors were accredited.

It also introduced a requirement for issuers to take 'reasonable steps' to confirm accredited investor status. Initially, this was a cumbersome process, often involving extensive documentation and third-party verification services. As of March 2025, the SEC has released guidance allowing issuers to factor high minimum investment amounts (at least $200,000 for individuals and $1 million for entities) into their verification of accredited investor status, along with written representations from the investors themselves. Learn more about these changes here: SEC No-Action Letter Guidance.

Who Qualifies as an Accredited Investor?

Generally, an accredited investor is an individual with an annual income exceeding $200,000 (or $300,000 jointly with a spouse) or a net worth over $1 million (excluding their primary residence). Certain entities, like trusts and corporations, also qualify based on asset thresholds or ownership structure. Accredited investor status helps ensure investors possess the financial sophistication to understand and manage the risks tied to private placements.

The verification process confirms that investors satisfy these requirements, protecting them and ensuring compliance with regulations. Check out our guide on modern compliance solutions: Read also: Ultimate Guide to Modern Compliance Management Solutions.

How Verification Requirements Have Transformed

Accredited investor verification has undergone a significant evolution. This reflects the ongoing challenge of balancing investor protection with the need to facilitate capital formation. Understanding this journey, from simpler regulations to today's complex standards, provides valuable insights into modern compliance.

Early Days of Accredited Investor Verification

Initially, accredited investor verification relied heavily on self-certification. Investors essentially confirmed their own financial status with minimal documentation. This approach, while simpler, presented potential risks. It increased the possibility of unqualified individuals participating in private investments, potentially leading to losses.

The Shift Towards Increased Scrutiny

As financial markets developed and investment options expanded, regulators recognized the need for more robust investor protections. The 2012 JOBS Act, while aiming to simplify capital raising through general solicitation under Rule 506(c), also introduced more stringent verification requirements. Issuers were now obligated to take "reasonable steps" to verify an investor's accredited status. This marked a significant shift toward greater due diligence and oversight.

Minimum Investment Amounts as an Indicator

The use of high minimum investment amounts as a proxy for accredited status has a long history. When Regulation D was first adopted in 1982, an investment of at least $150,000 could be an indicator, provided it didn't exceed 20% of the investor's net worth. More recently, in June 2014, the Securities Industry and Financial Markets Association (SIFMA) proposed using substantial minimum investments as a reliable indicator of financial sophistication. This approach, now supported by recent SEC guidance, streamlines the verification process for issuers. Learn more about this guidance.

The Rise of Third-Party Verification

The increasing complexity of accredited investor verification has led to the growth of third-party verification services. These firms offer solutions to help issuers navigate compliance obligations. They provide independent, standardized verification, enhancing security and efficiency. This has become especially crucial with the increasing volume and complexity of private investment transactions. The evolution of accredited investor verification continues to shape the investment landscape, highlighting the importance of staying informed and adapting to new regulations.

Verification Methods That Actually Work

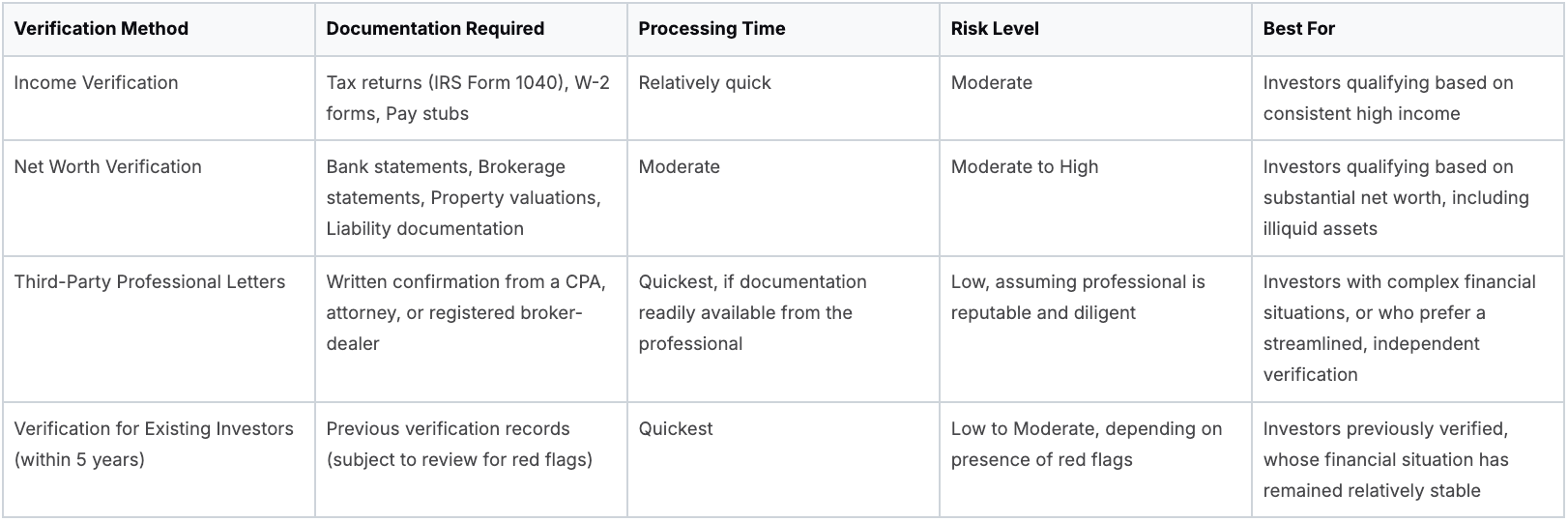

Now that we understand the evolution of accredited investor verification, let's explore the practical methods that align with current SEC standards. Knowing these different approaches is essential for building a compliant and streamlined verification process.

Income Verification

One of the most common ways to confirm accredited investor status is through income verification. This typically involves reviewing documents like tax returns (IRS Form 1040), W-2 forms, and pay stubs. These documents offer insights into an investor's income history and demonstrate their capacity to meet the necessary financial thresholds. For instance, an investor could provide two years of tax returns showing an annual income over $200,000.

However, relying only on pay stubs can be insufficient, as they only offer a limited view of an investor's financial picture. Combining pay stubs with tax returns provides a more well-rounded perspective and strengthens the verification process.

Net Worth Verification

Verifying accredited investor status based on net worth requires a different set of documents. This typically includes reviewing bank statements, brokerage account statements, property valuations, and documentation of liabilities. An investor might, for example, submit bank and brokerage statements showing assets exceeding $1 million, along with mortgage statements detailing any outstanding debts.

Assessing net worth can be more intricate than verifying income, as it involves evaluating both assets and liabilities. Understanding the valuation methods for various asset classes, such as real estate or private businesses, is crucial for an accurate assessment.

To help illustrate the different SEC-approved methods, the following table provides a comparison of each, highlighting their key aspects:

This table summarizes the different approaches to verification, allowing for a quick comparison of their strengths and weaknesses. Understanding these differences is essential for selecting the most appropriate method for each individual investor.

Third-Party Professional Letters

Another valid method is obtaining a written confirmation from a qualified third-party professional, such as a Certified Public Accountant (CPA), a licensed attorney, or a registered broker-dealer. This professional must have a prior relationship with the investor and confirm their accredited status after reviewing the relevant financial documents.

This approach adds an extra layer of validation. However, it’s essential to confirm the professional’s credentials and ensure they comply with SEC requirements. This due diligence maintains the integrity of the process. The SEC's Division of Corporation Finance offers further guidance, including two Compliance and Disclosure Interpretations (CDIs) and a no-action letter: SEC Guidance on Accredited Investor Verification.

Verification for Existing Investors

Issuers can rely on previous verification records for investors verified within the past five years, provided they used an acceptable method. If an investor was confirmed as accredited three years prior through income and net worth verification, the issuer might be able to rely on those records.

However, further verification may be necessary if there are red flags suggesting a significant change in the investor’s financial status. These red flags could include substantial changes in employment, reported income, or net worth. Ongoing monitoring helps maintain compliance and protect investors. Using these various methods allows issuers to effectively manage accredited investor verification.

Building Your Verification System That Scales

Successfully navigating accredited investor verification involves more than a simple one-time check. It requires a robust and scalable system that streamlines compliance while supporting efficient capital raising. This means establishing clear processes, standardized documentation, and adaptable internal controls that can grow with your business.

Developing Standardized Documentation Templates

Creating standardized templates for income verification, net worth verification, and third-party professional letters is essential. These templates ensure consistency in the information gathered and help prevent oversights.

For example, a standardized income verification template would clearly specify the required documents, such as tax returns and W-2s. It would also offer investors clear instructions for submission. Well-designed templates also enhance the investor experience by making the verification process transparent and easy to follow, fostering trust and building stronger investor relationships.

Establishing Clear Internal Policies

Clear internal policies are the foundation of a successful verification system. These policies should define roles and responsibilities within the organization. They should specify who is responsible for verification, the accepted verification methods, and the procedures for handling discrepancies or red flags.

For instance, a policy might stipulate that a designated compliance officer is responsible for reviewing all verification documents. It might also mandate that any inconsistencies are escalated to senior management. This structured approach to verification promotes compliance, reduces errors, and protects your business from potential legal issues by ensuring a consistent and auditable process.

Implementing Quality Control Checkpoints

A scalable verification system incorporates quality control checkpoints throughout the entire process. These checks are crucial for ensuring accuracy and completeness. They might include a second review of verification documents by a separate team member or automated checks to identify any missing or expired documentation.

These checkpoints significantly reduce the chance of errors, strengthening both compliance and investor confidence. This meticulous approach to due diligence helps maintain a positive reputation within the investment community.

Maintaining Audit-Ready Verification Records

Maintaining detailed and organized verification records is paramount for demonstrating compliance to regulators. These records should include all collected documentation, the chosen verification method, and the verification date for each investor. Using a centralized, secure database can significantly improve efficiency.

This is like having a well-organized library of investor information, readily accessible for review. Such preparedness simplifies regulatory audits and underscores your commitment to proper accredited investor verification. Proactive and transparent communication of verification requirements with prospective investors is also essential for managing expectations and fostering a smooth, efficient onboarding process. This focus on investor experience reinforces your commitment to compliance and strong investor relations. Building a robust verification system sets the stage for long-term success. It protects your investors and your offerings while facilitating efficient capital raising.

Avoiding The Common Verification Pitfalls

Even seasoned investment professionals encounter recurring challenges with accredited investor verification. These challenges create unnecessary regulatory risks. By exploring real-world examples and drawing from compliance specialists' expertise, we'll identify the most common verification errors and outline strategies to avoid them. This proactive approach enables you to establish verification procedures that satisfy regulatory scrutiny and prevent compliance issues.

Inconsistent Verification Standards

One common pitfall is applying inconsistent verification standards across different investors. This occurs when different team members use varying methods or interpret requirements differently. Imagine one investor being verified solely based on their LinkedIn profile suggesting a high-level position, while another is required to submit extensive financial documentation. This inconsistency creates potential compliance gaps.

The solution? Standardization. Implement clear, written procedures outlining the specific documents required for each verification method. Regularly train your team on these procedures to ensure uniform understanding and application.

Insufficient Documentation

Another frequent issue is accepting incomplete or insufficient documentation. Relying solely on bank statements showing a high balance without considering potential liabilities provides an incomplete picture of an investor's net worth. Accepting outdated tax returns might not accurately reflect their current income.

To avoid this, establish clear guidelines for acceptable documentation, including specific document types, date ranges, and required information. For example, require two years of tax returns, not just one. Use checklists to ensure all necessary elements are present before deeming an investor verified.

Over-Reliance On Investor Representations

While investor self-certification plays a role, over-reliance on it without proper documentation is a significant risk. Accepting an investor's word without corroborating their financial status with supporting evidence can lead to non-compliance. Think of it like verifying someone's age – you wouldn't simply take their word for it; you’d ask for proof.

Always back up investor representations with concrete financial documentation. Even with a signed letter attesting to their accredited status, it should be supported by verifiable records like tax returns or audited financial statements. Independent verification is fundamental for robust compliance.

Expired Verification Credentials

Failing to re-verify accredited investor status within the required timeframe is another potential trap. Relying on expired verifications exposes issuers to compliance risks, as investor financial situations can change significantly.

Just as a driver's license expires, so too does accredited investor verification. Establish a system for tracking verification dates and proactively reminding investors to update their credentials. This ensures you’re working with accurate, up-to-date information, keeping you compliant.

Identifying And Addressing Red Flags

Even with seemingly complete documentation, potential red flags can arise. Inconsistencies between stated income and lifestyle, or unusually large, unexplained asset transfers, warrant further investigation.

Train your team to recognize these warning signs and develop a clear protocol for addressing them. This might involve requesting additional documentation or engaging a third-party verification service for an independent review. Proactive issue addressing demonstrates a strong commitment to compliance.

Self-Auditing Your Verification Processes

Regularly auditing your verification procedures is essential for ongoing compliance. This involves reviewing completed verifications to assess adherence to established standards. Think of it as a system health check, identifying potential weaknesses or areas for improvement.

Develop a checklist for self-audits covering key aspects like documentation completeness, consistency of applied methods, and timely re-verification. Regular checks strengthen your compliance framework and promote continuous improvement. This strengthens your accredited investor verification processes, minimizes regulatory risks, and ultimately builds trust and maintains a positive reputation within the investment community.

Leveraging Third-Party Verification Services

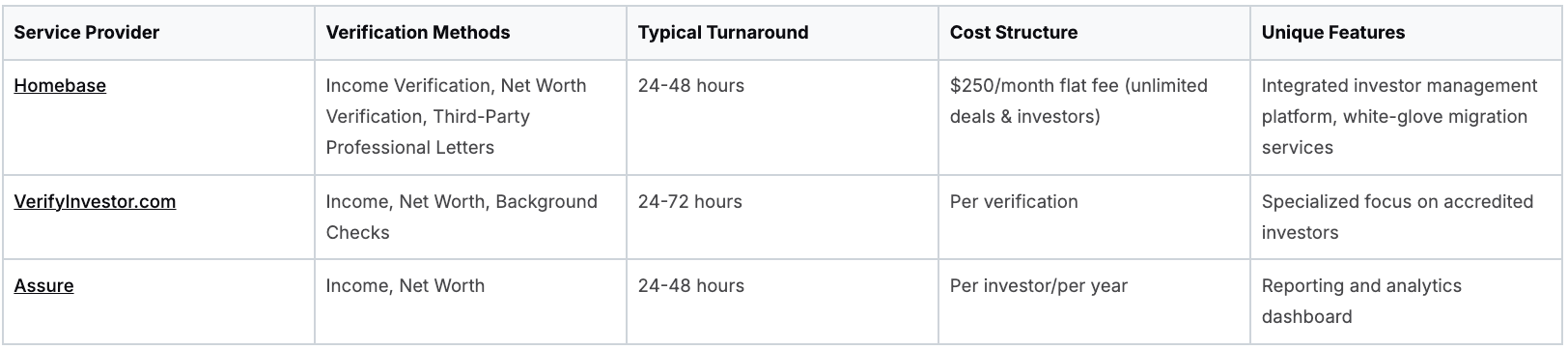

Many issuers now use third-party accredited investor verification services to streamline compliance and improve the investor experience. However, with a range of providers offering various approaches, selecting the right fit requires careful consideration. This section offers an objective look at the current landscape of these services, informed by practical implementation experiences.

Understanding the Verification Landscape

Third-party services range from comprehensive platforms to more niche, specialized providers. All-in-one platforms like Homebase often integrate verification into a broader suite of investor management tools. This creates a centralized solution for fundraising, investor relations, and compliance, making them attractive for real estate sponsors seeking a unified system. Specialized providers, conversely, concentrate solely on verification, often providing more nuanced options for complex investor profiles.

Key Considerations When Choosing a Service

Selecting the right verification partner requires a thoughtful evaluation process. Here are some critical questions to consider:

- Methodology: What verification methods are employed? Are options beyond income and net worth verification available, such as accepting third-party professional letters?

- Security: How is sensitive investor data protected? Does the provider employ robust encryption and secure data storage practices?

- Regulatory Alignment: Does the service adhere to the latest SEC regulations and guidance on accredited investor verification? This is paramount for maintaining ongoing compliance.

- Fee Structures: What is the pricing model? Is it per verification, per investor, or a flat monthly fee? Understanding the cost structure is crucial for accurate budgeting.

- Integration: How easily does the service integrate with existing investor onboarding workflows? Is integration with your CRM or other management tools possible? Seamless integration is key for a streamlined process.

- Customer Support: What level of support is provided? Responsive customer service can be invaluable when addressing verification complexities.

Integrating Verification Services into Your Workflow

Leading firms seamlessly integrate third-party services into their investor onboarding processes. This starts with educating potential investors about the verification requirements. Clear and proactive communication sets expectations and promotes a positive investor experience. The verification process itself should be as straightforward as possible. Automated workflows, secure document uploads, and digital signatures can contribute to a smoother, more efficient experience.

Measuring Success

Several key performance indicators (KPIs) point to successful implementation. These include a high verification completion rate, a low error rate, and positive investor feedback. A high completion rate suggests a user-friendly process. A low error rate signifies accurate and comprehensive verification. Finally, investor feedback provides valuable insights into their overall experience.

To assist you in your research, we've compiled a table outlining key features of some leading accredited investor verification services:

Leading Accredited Investor Verification Services

This table provides data on major verification service providers, their specializations, pricing models, verification timeframes, and unique features.

This table offers a comparison of several prominent services and serves as a useful starting point for further investigation.

By leveraging third-party verification services and carefully evaluating these factors, real estate syndicators can achieve both regulatory compliance and operational efficiency in their accredited investor verification processes.

The Future of Accredited Investor Verification

The accredited investor landscape is constantly evolving, shaped by regulatory changes, technological advancements, and market dynamics. Understanding these trends is crucial for real estate syndicators to maintain compliance and stay ahead of the game.

Expanded Accredited Investor Definitions and New Verification Challenges

The definition of an accredited investor has broadened in recent years, aiming to democratize access to private investment markets. However, this also introduces new complexities in the verification process. For example, the inclusion of professional certifications, such as holding Series 7, 65, or 82 licenses, adds another layer of complexity. Issuers now need systems capable of verifying these credentials, potentially increasing both the time and cost of investor onboarding. This expansion necessitates more flexible and adaptable verification systems that can efficiently handle these new criteria.

The Rise of Digital Identity and Blockchain Verification

Technological innovation offers promising solutions for streamlining accredited investor verification. Digital identity solutions provide secure and verifiable digital representations of investor credentials. This can significantly expedite the verification process and reduce reliance on manual document reviews.

Blockchain technology also offers the potential for tamper-proof and transparent verification records. Imagine a decentralized, secure database of accredited investor credentials, instantly accessible to issuers. This would eliminate the need for repeated verification each time an investor participates in a new offering, revolutionizing the process's speed and security for both investors and issuers.

Regulatory Changes on the Horizon

The regulatory landscape remains fluid, with ongoing discussions regarding potential changes to accredited investor definitions and verification requirements. Staying informed about these potential shifts is crucial for a future-proof verification strategy. This may involve engaging with industry associations, attending webinars, or subscribing to SEC regulatory updates. Actively monitoring these developments allows you to prepare for upcoming changes and ensure continued compliance.

Positioning Your Compliance Approach for the Future

To prepare for the future of accredited investor verification, consider the following best practices:

- Embrace Technology: Explore and implement digital solutions to enhance the efficiency and security of your verification processes. Consider using automation tools, integrating digital identity verification, or migrating to an all-in-one digital platform.

- Maintain Flexibility: Build adaptable verification systems that can accommodate evolving regulatory requirements and expanded investor definitions. Modular systems offering customization and integration with new technologies are crucial for long-term success.

- Prioritize Investor Experience: Focus on creating a positive investor experience while maintaining robust compliance. Provide clear instructions, minimize friction in the process, and ensure transparent data handling.

- Stay Informed: Actively monitor regulatory developments and industry best practices. Subscribe to industry newsletters, follow reputable news sources, and participate in professional development events.

By implementing these strategies, you can position your compliance approach to navigate future developments in accredited investor verification, mitigating risks and facilitating efficient capital raising.

Looking for a comprehensive solution to simplify accredited investor verification and streamline your real estate syndication process? Learn more about how Homebase can help you achieve both compliance and operational efficiency.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.