Your Guide to a 1031 Exchange for Syndicators

Your Guide to a 1031 Exchange for Syndicators

Master tax deferral with our guide to a 1031 exchange. Learn the rules, timelines, and strategies for real estate syndicators and multifamily investors.

Domingo Valadez

Nov 3, 2025

Blog

If you've been in the real estate game for any length of time, you've heard of the 1031 exchange. But what exactly is it? At its heart, a 1031 exchange, rooted in IRC §1031 of the tax code, is a way for investors to sell a property and defer paying capital gains tax on the profit. Instead of cashing out, you roll the entire sale proceeds into a new, similar investment property.

Think of it as trading up. This powerful strategy allows you to keep 100% of your equity working for you, building your portfolio bigger and faster without taking a tax hit with every transaction.

Unlocking Growth Through Tax Deferral

A 1031 exchange is essentially a swap of one investment property for another of “like-kind,” all without Uncle Sam taking an immediate cut. For multifamily syndicators and their investors, this isn't just a neat tax trick; it's a fundamental wealth-compounding machine. By deferring the tax bill, you’re freeing up a significant amount of capital to buy larger, better-performing assets.

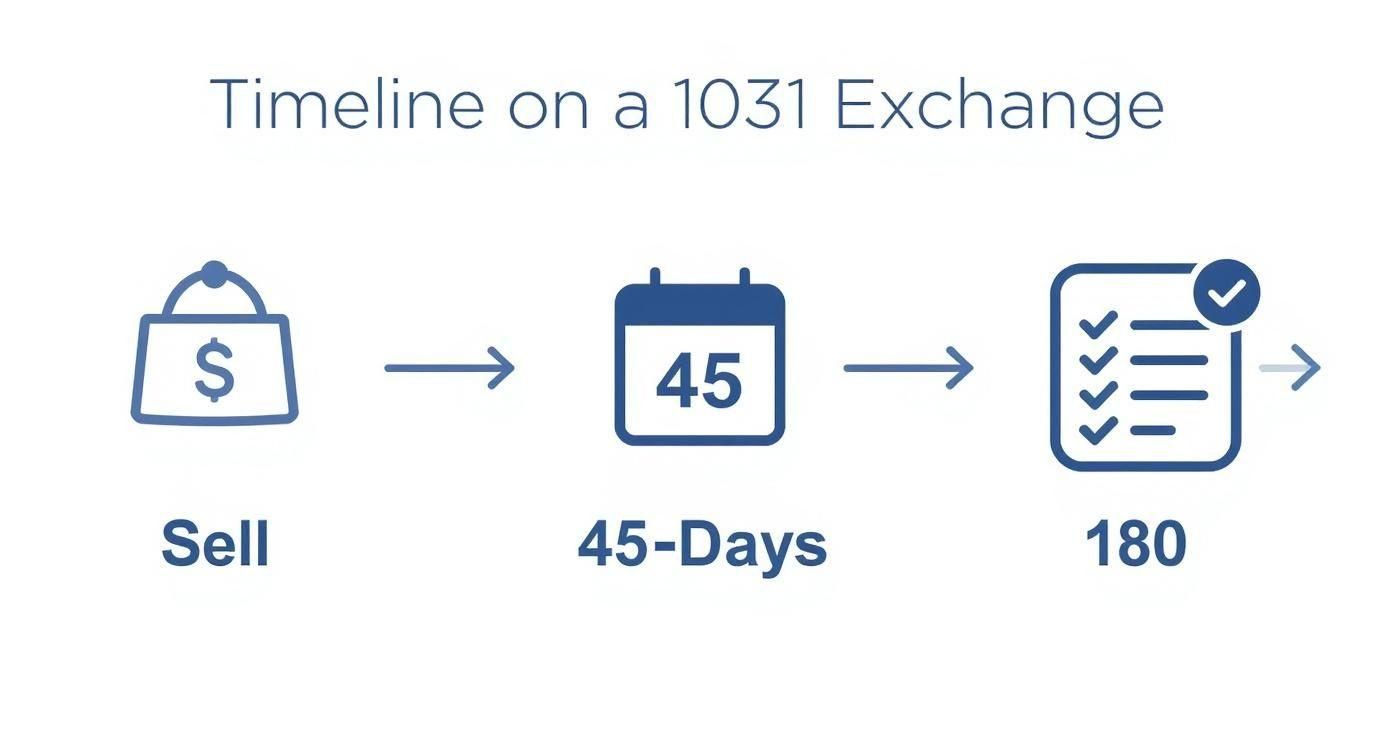

This isn't some new-fangled loophole. The concept has been around for over a century, first appearing in the Revenue Act of 1921. The modern rules took shape in 1954, but it was a 1979 court case that really opened the door for the "delayed" exchanges we use most often today. Seeing its popularity, Congress stepped in and formalized the strict timing rules we all live by: 45 days to identify a replacement property and 180 days to close the deal.

Why It Matters For Syndicators

For a syndicator, knowing the ins and outs of a 1031 exchange is more than just a good idea—it's a critical tool for supercharging investor returns and portfolio growth. It turns what would be a taxable exit into a strategic launchpad for the next deal.

Here’s how it gives you a serious edge:

- Accelerated Portfolio Scaling: When you reinvest the full sale proceeds, you can buy bigger and better properties much faster than if taxes were eating into your capital after every sale.

- Increased Investor Returns: Preserving equity that would have gone to the IRS means you can generate much stronger long-term returns for your limited partners. This makes your deals incredibly attractive.

- Market Adaptability: The 1031 allows you to pivot strategically. You can sell a stabilized Class B building and roll the funds into a value-add Class A opportunity in a new market, all without a tax penalty holding you back.

A successful exchange is like getting an interest-free loan from the government on the taxes you owed. You get to put that money back to work, generating more income and creating a powerful compounding effect that builds serious wealth over time.

To really get a feel for how these concepts play out in real-world scenarios, it’s worth tuning into relevant commercial real estate podcast discussions where pros break down their deals.

Now that we have the big picture, let's dive into the nitty-gritty rules you have to follow to pull one off successfully.

To get started, here is a quick overview of the most important elements you need to know.

Key Components of a 1031 Exchange at a Glance

This table covers the fundamentals, but as you’ll see, the devil is in the details—especially when partnerships and syndications are involved.

Understanding the Core Rules of the Game

To pull off a 1031 exchange, you have to play by a very strict set of rules. Think of it less like a flexible strategy and more like a precise legal maneuver. Getting these rules right is the difference between a smooth tax deferral and a costly mistake that triggers an immediate, hefty tax bill.

The first concept you'll run into is the "like-kind" requirement. This term throws a lot of people off, but for real estate, it’s surprisingly broad. It doesn't mean you have to swap a duplex for a duplex.

"Like-kind" actually refers to the nature of the property, not its specific type. As long as you're exchanging one investment property for another, you're generally in the clear. That means you can absolutely trade a multifamily complex for a portfolio of single-family rentals, a piece of raw land, or even a commercial warehouse.

The Unforgiving Deadlines

The most critical—and frankly, unforgiving—part of a 1031 exchange is the timeline. The moment you close the sale on your old property (the "relinquished" property), two clocks start ticking. These are non-negotiable.

- The 45-Day Identification Period: You have exactly 45 calendar days from closing to formally identify potential replacement properties. This isn't just a mental list; it must be in writing and submitted to your Qualified Intermediary.

- The 180-Day Closing Period: You have to close on one or more of the properties you identified within 180 calendar days of the original sale. And no, it’s not 45 days plus 180 days. The clock for the 180-day period starts on the very same day as the 45-day clock.

Miss these deadlines by a single day, and the entire exchange is blown. That’s why seasoned syndicators often have their replacement properties scouted out long before their original property even goes under contract.

The Role of the Qualified Intermediary

Here's another ironclad rule: you can't touch the money. If the proceeds from your sale hit your bank account, even for a second, the game is over. The IRS calls this "constructive receipt," and it makes your entire gain taxable immediately.

This is where a Qualified Intermediary (QI) comes in. Sometimes called an accommodator, the QI is an independent third party who acts as the middleman. They hold the sale proceeds in escrow and then wire the funds directly to the closing for your new property, ensuring you never have access to them.

Your Qualified Intermediary is the legal safe harbor that makes a delayed 1031 exchange possible. Choosing a reputable, insured, and experienced QI is one of the most important decisions you'll make in this entire process.

Understanding and Avoiding Taxable Boot

The whole point of a 1031 exchange is to defer 100% of your capital gains tax. To do that, the deal has to be structured properly: you must acquire a new property of equal or greater value and take on an equal or greater amount of debt.

Any cash, debt relief, or non-like-kind property you receive from the exchange is called "boot," and it's taxable.

There are two kinds of boot to watch for:

- Cash Boot: This one is easy to understand. If you sell a property for $2 million but your new property only costs $1.8 million, that leftover $200,000 comes back to you as cash boot, and you'll pay taxes on it.

- Mortgage Boot (Debt Relief): This one is a little trickier. It happens when the mortgage on your new property is less than the mortgage you paid off on the old one. If you paid off a $1 million loan but only took out a $700,000 loan on the new property, that $300,000 difference is considered boot. You can offset this by adding your own cash to the deal, but if you don't, it's taxable.

Getting these rules right is everything. By understanding the like-kind definition, respecting the deadlines, hiring a great QI, and structuring the deal to avoid boot, you'll be well on your way to a successful exchange.

Understanding the Different Types of 1031 Exchanges

The 1031 exchange isn’t a single, rigid formula. Think of it more like a toolkit. Depending on your goals, market timing, and the specific deal in front of you, you’ll need to pull out the right tool for the job. For syndicators, knowing which exchange structure to use—and when—is what separates a smooth, profitable deal from a frantic, tax-heavy mess.

The Delayed Exchange: The Industry Standard

This is the bread and butter of the 1031 world. The Delayed Exchange, also known as a "Starker Exchange," is the most common path investors take, and for good reason. It’s a clean, straightforward process that works beautifully when the stars align.

You simply sell your property first, have the proceeds wired directly to your Qualified Intermediary (QI), and then you’re on the clock. You get 45 days to identify potential replacement properties and a total of 180 days to close on one of them. It’s predictable and easier to manage, making it the workhorse for most transactions.

The main catch? That 45-day identification window can feel incredibly short, especially in a competitive market where good deals are scarce.

The Reverse Exchange: Seizing Opportunity in a Hot Market

So, what happens when you find a perfect replacement property before you've sold your current one? You can't just ask the seller of a great deal to sit on their hands while you market and sell your asset. This is precisely where the Reverse Exchange comes into play.

It does exactly what the name implies—it flips the traditional 1031 timeline on its head.

- Buy First: You go ahead and acquire the new property.

- "Park" the Property: Since you can't own both properties at once, your QI steps in and creates a special entity called an Exchange Accommodation Titleholder (EAT). The EAT takes title and essentially "parks" the new property for you.

- Sell Second: You then have 180 days to sell your original property, pay back any financing used for the acquisition, and complete the exchange.

A Reverse Exchange gives you the power to act fast. When a great acquisition opportunity pops up, you can lock it down without being held hostage by the timeline of your existing property's sale. It's a massive strategic advantage when inventory is tight.

This approach is definitely more complex and carries higher costs due to the extra legal and financing steps. But the ability to secure a prime asset without the pressure of the 45-day clock often makes the investment well worth it. The 1031 exchange is a cornerstone of the market; a 2020 analysis showed that like-kind exchanges account for 10% to 20% of all commercial real estate deals. You can dig into the full findings on the significance of 1031 exchanges to see just how integral they are.

The Improvement Exchange: Perfect for Value-Add Plays

For syndicators whose entire business model is built on value-add strategies, the Improvement Exchange (or Construction Exchange) is a perfect fit. It allows you to use your exchange proceeds not just to buy the new property, but also to fund the renovations you have planned for it.

Let's say you sell an asset for $5 million and find a great replacement property that only costs $4 million. In a typical exchange, that leftover $1 million would be considered taxable "boot."

With an improvement exchange, you can roll that $1 million directly into your renovation budget for unit upgrades, a new roof, or modernizing the amenities. The EAT holds title to the new property while the construction is underway. The final value of the improvements gets added to the purchase price, allowing you to defer the entire tax hit and execute your business plan from day one.

Navigating Partnership and Syndication Complexities

The standard 1031 exchange advice you read online? It’s perfect for a single owner. But for a real estate syndication, it hits a wall, fast. An exchange is built for one entity selling and one entity buying. A syndication, on the other hand, is a partnership of many investors, and you can bet they all have different financial goals when it's time to sell. This is where things get tricky for sponsors.

Your partnership, typically an LLC, is its own taxpayer. That means the entire LLC has to perform the exchange. What happens when half your LPs want to cash out and take their wins, while the other half are chomping at the bit to roll their gains into the next deal? Forcing everyone down the same path is a non-starter.

This is the fundamental conflict: individual investor goals versus the partnership’s tax status. Just dissolving the partnership right before a sale so everyone can do their own thing sounds easy, but it's a classic mistake that can trigger a taxable event for everyone, blowing up the entire strategy.

Unpacking Advanced Partnership Strategies

To get around this problem, savvy sponsors often use sophisticated strategies like the "drop and swap" or the "swap and drop." These are powerful tools, but they aren't for the faint of heart. They come with serious risks if you don't execute them perfectly, requiring meticulous timing and documentation to hold up if the IRS comes knocking.

A "drop and swap" is when you dissolve the partnership well before a sale is even on the horizon. The partners then receive their slice of the property as a Tenancy-in-Common (TIC) interest. After a "seasoning" period—and most pros will tell you to wait at least one to two years—each partner is free to decide. They can sell their TIC interest and pay the tax or go off and do their own 1031 exchange.

The "swap and drop" is just what it sounds like—the reverse. Here, the partnership itself completes the 1031 exchange and buys the new property. After holding that new asset for long enough to show clear investment intent, the partnership dissolves. The investors then get their individual TIC interests in the new property.

The big challenge with both of these is proving you had a legitimate "intent to hold for investment." If the IRS sees a quick series of transactions, they might argue it was just a coordinated plan to sidestep partnership rules and disallow the exchange. A long, conservative holding period is your best defense.

Using Tenancy-in-Common Structures

The Tenancy-in-Common (TIC) structure is the key that unlocks this flexibility for your partners. Under a TIC, up to 35 investors can co-own a property directly, each holding their own undivided fractional piece. This setup effectively separates the property ownership from the partnership entity itself.

Once you convert to a TIC, you give each investor the autonomy they need:

- Investors Seeking an Exchange: Anyone who wants to defer taxes can use their fractional TIC interest as the "relinquished property" for their own personal 1031 exchange.

- Investors Wanting to Cash Out: Partners ready to exit can simply sell their TIC interest to someone else (maybe even you, the sponsor) and settle up with the IRS on their capital gains.

This approach elegantly solves the headache of misaligned investor goals. It lets everyone choose the path that makes the most sense for them. To get the full picture, it helps to understand the broader landscape of real estate syndication tax benefits, as these strategies fit into a much larger puzzle.

Best Practices for Sponsors

Pulling this off successfully demands foresight and crystal-clear communication with your limited partners. This isn't something you can just wing at the last minute; it needs to be baked into your strategy from day one.

Here are a few essential practices to live by:

- Plan Ahead: Talk through potential exit strategies and the possibility of using a TIC structure with your legal and tax advisors before you even buy the asset.

- Communicate Clearly: Get your investors up to speed early on how a 1031 exchange would work for the partnership and what their options might be when it's time to sell. No surprises.

- Respect Holding Periods: Rushing a "drop and swap" is a massive red flag for the IRS. Most advisors will tell you to hold the TIC interest for at least a year, but two years is a much safer, more defensible timeframe.

By mastering these partnership structures, you can offer a powerful tax-deferral strategy that works for everyone, making your deals more attractive and strengthening your investor relationships for the long haul.

Your Step-by-Step Exchange Timeline and Checklist

Getting a 1031 exchange right all comes down to hitting your deadlines. There’s no room for error. If you miss a single date, the whole thing can fall apart, and that tax-deferred gain suddenly becomes a very real, very expensive tax bill.

Let's walk through the timeline, phase by phase, so you know exactly what to expect. Think of it as a flight plan—you wouldn’t take off without knowing your destination and having your crew ready. Preparation is everything. This is more true than ever, as the dollar volume of 1031 exchanges shot up by a staggering 70% between 2019 and 2021. As this report on the economic impact of 1031 exchanges shows, it's a critical tool for serious real estate investors.

Phase 1: Pre-Sale and Closing on Your Old Property

The foundation for a successful exchange is poured long before you close on the property you're selling. Getting your ducks in a row now will save you from frantic, last-minute decisions and costly mistakes down the line. The goal here is to have a clear strategy and your team locked in before the clock even starts.

Here’s your pre-sale checklist:

* Line Up Your Qualified Intermediary (QI): This is your first move. Your QI is an essential, non-negotiable partner. You need to have them vetted and under contract before you close on the property you’re selling.

* Add Intent Language to Your Contract: Have your attorney insert a "cooperation clause" into the purchase and sale agreement for your property. This clause officially states your intent to perform a 1031 exchange and legally requires the buyer to cooperate.

* Start Window Shopping for New Properties: That 45-day identification window closes faster than you think. Start scouting for potential replacement assets now so you aren't forced into a bad deal under pressure.

When you close on your relinquished property, the proceeds must go straight to your QI. You cannot, under any circumstances, have access to those funds. The day you close is Day 0, and the countdowns officially begin.

Crucial Point: The second your sale closes, you are on the clock. Every single day counts—weekends and holidays included. There are no extensions for financing snafus, market shifts, or personal issues.

Phase 2: The Critical 45-Day Identification Period

From the closing date of your old property, you have exactly 45 days to officially identify potential replacement properties. This isn't a verbal agreement; it has to be a formal, written list, signed by you, and sent to your QI before midnight on the 45th day.

You have three main ways to identify properties:

1. The Three-Property Rule: The most common and flexible choice. You can identify up to three properties, no matter their value.

2. The 200% Rule: You can identify more than three properties, but their total fair market value can't be more than 200% of the value of the property you sold.

3. The 95% Rule: You can name as many properties as you want, but you have to actually buy at least 95% of the total value of everything you identified. It’s risky and rarely used for a reason.

Phase 3: The 180-Day Closing Deadline

The final finish line is acquiring and closing on one or more of your identified properties within 180 days of your original sale date. It's important to remember that this 180-day clock runs at the same time as the 45-day clock; it doesn't start after it.

Getting across this finish line smoothly is all about tight coordination and staying on top of every detail.

Your Final Checklist:

* Get Financing Nailed Down ASAP: The minute you have a property under contract, get your loan application in. Underwriting delays are one of the biggest reasons exchanges fail.

* Power Through Due Diligence: Don't wait. Get all of your inspections, appraisals, and legal reviews done well ahead of your closing deadline.

* Coordinate with Your QI: Your QI is responsible for wiring the exchange funds directly to the closing agent to finalize the purchase. Keep them in the loop.

For syndication sponsors, this is where a platform like Homebase becomes invaluable. It gives you a central, secure hub to share due diligence files, closing documents, and regular updates with all your investors. It keeps everyone on the same page and feeling confident during these final, high-stakes steps.

Common Pitfalls and How to Avoid Them

Even for seasoned syndicators, a 1031 exchange is a high-stakes game where one small misstep can trigger a huge tax bill. You have to play defense to protect your investors' capital, and knowing the common traps is the best way to sidestep them completely.

The most common mistake? Underestimating the clock. Those deadlines are unforgiving. An investor might sell their relinquished property without a solid game plan, thinking 45 days is an eternity. Next thing they know, the clock is ticking, and they're frantically trying to identify anything, often forcing them into a subpar asset just to save the exchange.

This timeline lays out the critical deadlines that make or break a 1031 exchange, from the moment you sell to the final closing.

As you can see, the 45-day identification period and the 180-day closing window run at the same time. The pressure is on from day one.

Mishandling Funds and Boot

Another costly blunder is accidentally creating taxable "boot." It often happens without anyone realizing, usually through a mismatch in debt. Let's say you sell a property carrying $5 million in debt but the new one only has $4 million. That $1 million gap in debt relief is seen as income by the IRS and becomes taxable unless you add $1 million in fresh cash to the deal.

Just as bad is mishandling the actual sale proceeds. If that money hits your bank account, even for a second, the IRS calls it "constructive receipt." The entire exchange is immediately blown.

Here’s how to stay out of trouble:

* Always use a reputable Qualified Intermediary (QI). Their entire purpose is to hold the funds in escrow, ensuring you never touch them and the exchange remains valid.

* Model your debt meticulously. Make sure the debt on the replacement property is equal to or greater than the debt you paid off on the old one.

* Account for closing costs. Be careful not to pay for non-transactional expenses like property tax prorations with exchange funds, as this can create a small but taxable boot.

Poor Vetting of Your Qualified Intermediary

Don't just pick the cheapest Qualified Intermediary you can find. A surprisingly common mistake is failing to check their credentials, security measures, or track record. In a worst-case scenario, a fraudulent or incompetent QI could vanish with your funds, leaving you with a massive tax liability and no property to show for it.

A great QI does more than just hold funds; they act as your compliance partner, guiding you through the rules and ensuring every step is documented correctly. Their expertise is your best defense against procedural errors.

Do your homework before committing. Confirm the QI has significant insurance, including a fidelity bond and errors and omissions (E&O) coverage. Ask for references from other syndicators you trust and check their history. A little due diligence on the front end can prevent a complete catastrophe later, making sure the exchange goes off without a hitch for you and your partners.

Your 1031 Exchange Questions Answered

Even when you feel like you've got a handle on the rules, the real world has a way of throwing curveballs. Let's tackle some of the most common questions that pop up for syndicators and investors navigating the complexities of a 1031 exchange.

Can I Use a 1031 Exchange for My Primary Residence?

The simple answer is no. Section 1031 is exclusively for property held for investment or for productive use in a trade or business. Your family home or that vacation cabin you escape to on the weekends won't cut it because their primary purpose is personal enjoyment, not generating income.

That said, a property's character isn't set in stone. If you move out of your primary residence and convert it into a full-time rental property, it can become eligible for an exchange down the road. You'll just need a proper "seasoning" period—think one to two years at a minimum—to prove to the IRS that its use has genuinely changed to investment.

What Happens If I Miss the 180-Day Deadline?

This one is unforgiving. If you miss the 180-day deadline to close on your replacement property, the exchange fails. The consequences are swift and painful: the IRS treats the entire transaction as a standard, taxable sale.

When an exchange fails, that capital gains tax bill you were hoping to defer comes due immediately for the current tax year. Your Qualified Intermediary (QI) will have no choice but to release the sale proceeds directly to you, and you'll have to report the full gain on your tax return.

How Does Depreciation Recapture Work in an Exchange?

This is where the true power of a 1031 exchange really shines. A successful exchange lets you defer both your capital gains tax and the depreciation recapture tax. Remember all those depreciation deductions you've been taking over the years to reduce your taxable income? The IRS eventually wants its cut of that back when you sell.

A 1031 exchange allows you to roll your old property's adjusted cost basis—including all that accumulated depreciation—right into the new property. This means the depreciation recapture tax is kicked down the road along with the capital gains. It's a massive benefit that keeps your equity intact and working for you, supercharging your ability to compound wealth over the long term.

Keeping investors in the loop and managing documents during the tight exchange timelines is non-negotiable. Homebase gives you a single, secure portal to share updates, distribute key documents, and keep the whole process on track. See how you can manage your next deal at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.