3 C 1 Fund Secrets: Your Private Investment Playbook

3 C 1 Fund Secrets: Your Private Investment Playbook

Master 3 c 1 fund strategies with insider tips from veteran fund managers. Discover compliance secrets and investment tactics that actually work.

Domingo Valadez

Jun 9, 2025

Blog

The Hidden World Of 3(c)(1) Private Investment Exemptions

This screenshot, taken from the SEC website's guidance on private investment funds, highlights the importance of understanding regulatory compliance and the intricacies of exemptions, particularly structures like the 3(c)(1).

Imagine the world of private investment as a series of tiered memberships. At the highest level, there are exclusive clubs with their own unique set of rules. This is where you'll find 3(c)(1) funds, operating under a specific exemption within the Investment Company Act of 1940.

This exemption allows them to avoid the strict registration requirements public funds face. Think of it as a VIP pass, allowing for less bureaucratic hassle and greater flexibility for fund managers.

But this VIP access comes with a price. One key requirement is the limitation on investors: 3(c)(1) funds can only have 100 or fewer beneficial owners.

This restriction creates an atmosphere of exclusivity, attracting what are often termed "sophisticated" investors. This exclusivity also extends to the types of investments these funds can make, often involving more complex strategies.

Why 3(c)(1)?

So, why would investors choose this more exclusive route over the seemingly simpler world of public markets? The answer lies in the blend of privacy and potential high returns. 3(c)(1) funds have existed since the Investment Company Act of 1940, offering a distinct path for specific investors.

A digital transformation roadmap can be a useful framework for understanding market trends. However, navigating the private investment world requires careful consideration of these regulations. Unlike public mutual funds, these funds also offer a higher degree of privacy, appealing to investors who value discretion.

The 100-Investor Rule: Implications and Ramifications

This inherent exclusivity has a significant impact on fund strategy and operations. The limited number of investors influences the types of investments the fund can pursue and shapes its overall risk profile.

Maintaining this exclusive status requires strict adherence to regulatory compliance. This meticulous attention to detail is often what separates successful 3(c)(1) funds from those that struggle.

In the next section, we'll delve deeper into the 100-investor rule and explore its strategic implications in more detail.

The 100-Investor Rule That Changes Everything

Imagine you're hosting a fancy dinner party, but you can only invite 100 guests. Simple, right? Not so fast. What if some guests represent entire families, while others are flying solo? That's the challenge fund managers face with the 3(c)(1) fund and its 100-investor limit. One mistake, and the whole party—or fund—could be in trouble.

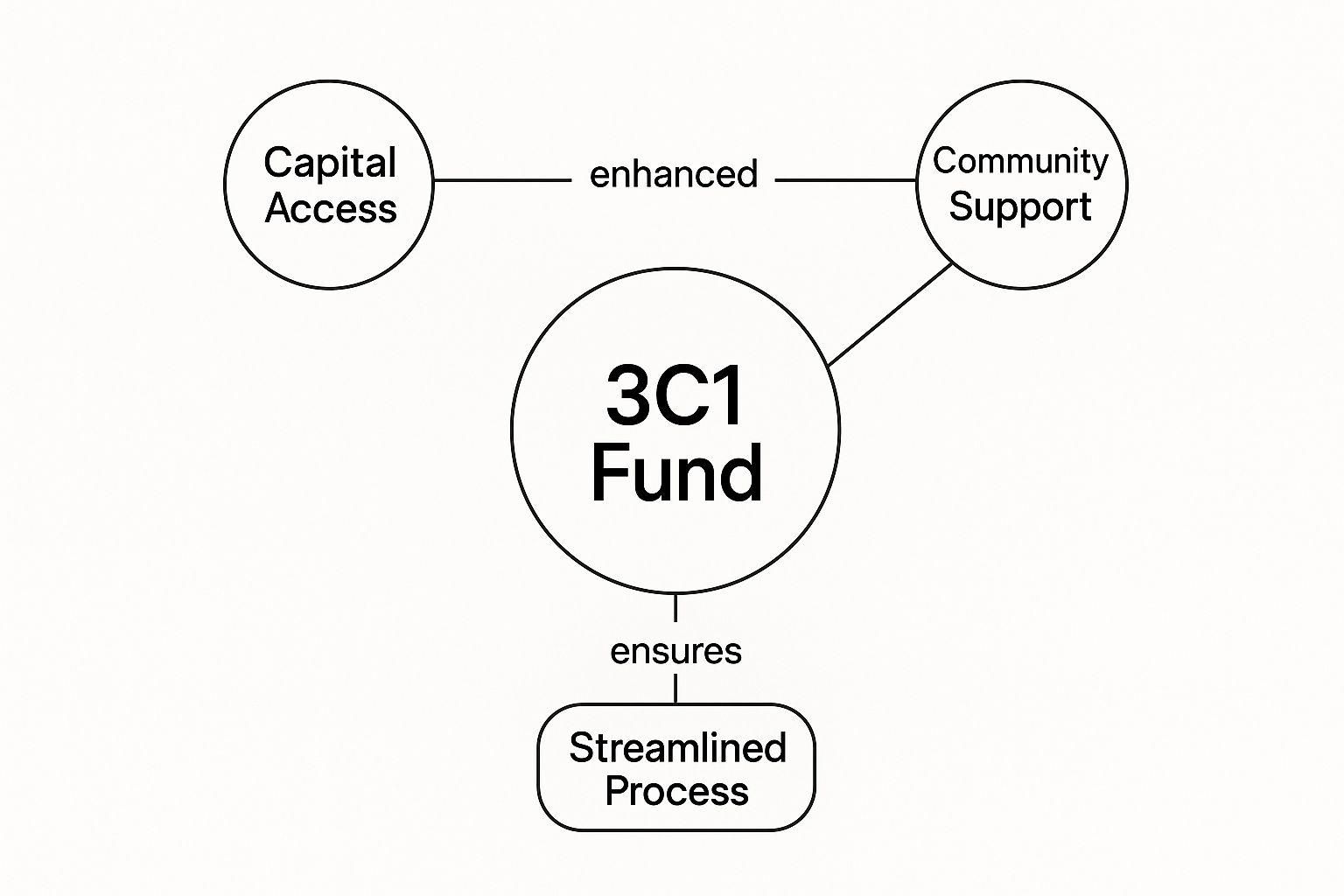

This infographic shows how a 3(c)(1) structure can influence key areas:

As you can see, access to capital, community support, and streamlined processes are all linked within the 3(c)(1) ecosystem. Maintaining this balance is key to maximizing the benefits of this structure.

Navigating the Nuances of Investor Counting

The 100-investor rule sounds simple, but it’s surprisingly complex. An investment from one trust might count as one investor, while a similar trust could count as ten, depending on its setup and beneficiaries. This is where many fund managers trip up.

Think about a fund of funds. Each investor in that fund could count towards the primary fund's 100-investor limit. This can quickly push a fund over the edge. The 100-investor limit under the 3(c)(1) exemption is strictly enforced, and the rules for counting beneficial owners are nuanced. A fund could accidentally trigger registration requirements by miscounting investors in certain trusts or partnerships. Discover more insights about the 3(c)(1) exemption.

The Stakes of Miscounting: Real-World Consequences

Misunderstanding these rules has real consequences. There are plenty of examples where established funds accidentally violated the rule, facing penalties and reputational damage. Some were even forced to close.

Strategies for Staying Within the Limit

Managing a 3(c)(1) fund successfully requires a strategic approach. Smart fund managers use robust monitoring systems and meticulous record-keeping. This careful management helps them maximize their investor base while staying compliant.

Beyond the Numbers: Impact on Investment Strategy

The 100-investor limit doesn’t just affect compliance; it shapes the entire investment strategy. It influences the types of investments, the fund's risk profile, and even how it interacts with its limited partners. This inherent exclusivity creates both challenges and opportunities. It’s not just about following the rules; it’s about mastering the game within those rules.

To understand the key distinctions between 3(c)(1) and 3(c)(7) funds, let's examine a side-by-side comparison. The following table breaks down key features, investor limits, and qualifications.

As this table highlights, the biggest difference lies in the investor limit. While both fund types cater to sophisticated investors, the 100-investor cap for 3(c)(1) funds requires a more selective approach to fundraising. This limit also creates a more intimate dynamic between the fund manager and the investors.

Why Elite Investors Choose Private Over Public

Ever wonder what draws billionaires and institutions to private funds, like 3(c)(1) funds, over the public market? It's more than just exclusivity. It's about accessing strategic advantages simply not available in the public arena. These advantages have significantly contributed to the growth of private markets, a trend that's showing no signs of slowing.

Flexibility and Alignment: A Bespoke Investment Strategy

Imagine choosing a tailored suit over something off the rack. That's the kind of personalized experience private funds offer. Unlike public funds, which face strict regulations, 3(c)(1) funds have greater flexibility with fee structures, creating closer alignment between the fund manager and investors. This can lead to innovative, performance-based incentives, where everyone is working toward the same goal: strong returns.

This tailored approach is a major draw for investors looking for customized investment strategies to meet their specific needs.

Concentrated Bets: Focusing on High-Conviction Investments

Think of a poker game. Public funds, due to regulations, often have to spread their bets across numerous hands. Private funds, however, can go "all in" on their best opportunities. 3(c)(1) funds can make concentrated investments in high-potential areas, a strategy public funds can’t easily replicate.

This ability to place larger bets on fewer, carefully chosen ventures is a significant driver of outsized returns. For instance, a private fund might zero in on a niche real estate sector like self-storage, while a public REIT often has to diversify across various property types.

Privacy and Long-Term Vision: Escaping the Quarterly Earnings Trap

Public companies are constantly under pressure to deliver strong quarterly earnings, sometimes at the expense of long-term value creation. Private funds, shielded from this public scrutiny, can operate with a longer-term perspective. This freedom from short-term performance pressures allows 3(c)(1) funds to make strategic investments that might take years to fully mature, nurturing genuine long-term growth. You might be interested in: Understanding Real Estate Syndication.

Reduced Regulatory Burden: Streamlined Operations

Private funds play by a different set of rules. While still regulated, 3(c)(1) funds avoid many of the reporting and compliance hurdles that public companies face. This streamlined regulatory environment enables greater agility and efficiency, letting fund managers react quickly to market shifts and strategically deploy capital. This flexibility allows them to seize opportunities that larger, more bureaucratic public entities might miss.

The Allure of Alpha: The Pursuit of Superior Returns

The core appeal of private funds lies in the quest for alpha, the measure of excess returns above market benchmarks. The advantages discussed – flexibility, concentrated investments, a long-term outlook, and a streamlined regulatory environment – all contribute to the potential for alpha generation. This is why institutions and high-net-worth individuals are drawn to private fund structures like the 3(c)(1) fund, seeking returns unavailable in public markets. They're essentially backing the expertise and strategic freedom of private fund managers to outperform traditional investments.

Getting Into The Exclusive Investor Club

Investing in a 3(c)(1) fund isn't like buying stocks on a public exchange. It's more like joining a selective club with specific membership requirements. These requirements aren't about exclusivity for its own sake; they're regulatory safeguards designed to protect investors and maintain financial stability.

Understanding Accredited Investor Status

Think of accredited investor status as your financial passport. It’s a way of demonstrating you have the financial capacity and savvy to understand the intricacies of private investments, like those offered by 3(c)(1) funds. There are a few different ways to qualify.

One common path is through demonstrating substantial wealth. This could mean a net worth, individually or with a spouse, exceeding $1 million (excluding your primary residence). Alternatively, a consistent high income also qualifies. Specifically, an annual income of $200,000 (or $300,000 jointly with a spouse) for the past two years, with the expectation of similar earnings this year, can grant you access.

But it's not all about dollars and cents. Certain professional certifications, like holding a Series 7, 65, or 82 license, can also qualify you. These certifications demonstrate a level of financial expertise that aligns with the complexity of these investments.

Let's delve deeper into the specific criteria for becoming an accredited investor. The table below provides a comprehensive overview.

Accredited Investor Qualification Criteria: Complete breakdown of income, net worth, and professional qualification thresholds for accredited investor status

As you can see, there are multiple pathways to becoming an accredited investor. The specific verification method will depend on the qualification type you are pursuing.

Verification: Proving You Belong

It's not enough to simply think you qualify. Fund managers are obligated to verify your accredited investor status. This typically involves a thorough review of your financial documentation, such as tax returns, bank statements, and investment account summaries. Sometimes, they may even require third-party verification from a CPA or attorney.

Strategies for Investors Close to Qualifying

What if you're almost there but not quite over the threshold? Don’t lose hope. If you're near the net worth requirement, consider working with a financial advisor to optimize your investment strategy. Getting a recognized professional certification can also unlock accredited investor status, even if your net worth or income is slightly below the mark. Remember, your qualification is assessed at the time of investment, so careful planning is key.

Beyond Accreditation: The Sophisticated Investor

While "accredited investor" is a formal regulatory designation, the term sophisticated investor describes something different. It signifies someone with significant investment experience and a deep understanding of complex investment strategies and their inherent risks. Although not a formal regulatory term, fund managers often consider this when evaluating potential investors.

The rules governing 3(c)(1) funds and investor qualifications continue to evolve in response to market conditions and regulatory changes. Staying informed about these updates is essential for anyone interested in this particular segment of the investment world.

Compliance Disasters That Kill 3(c)(1) Funds

Even the most experienced fund managers can stumble into compliance traps that can decimate a fund practically overnight. This section explores these potential disasters, focusing on real-world examples and the lessons learned, helping you steer clear of similar, costly mistakes.

Investor Counting Errors: A Fatal Miscalculation

The seemingly straightforward 100-investor limit for 3(c)(1) funds can be surprisingly tricky. Misinterpreting the rules surrounding beneficial ownership can lead to exceeding the limit, triggering SEC registration requirements and potentially forcing the fund to shut down. Think of it like a fund of funds investing in a 3(c)(1) fund. Each investor in the fund of funds could potentially be counted toward the 100-investor limit of the underlying 3(c)(1) fund, rapidly jeopardizing its exempt status.

Let's say, for example, a 3(c)(1) fund mistakenly believes a large family trust counts as one investor. If each beneficiary actually counts individually, they could easily exceed the 100-investor threshold. This seemingly small oversight can lead to forced investor redemptions and a costly restructuring process.

Documentation Gaps: Inviting Regulatory Scrutiny

Meticulous record-keeping is essential for 3(c)(1) funds. Gaps in documentation, such as incomplete investor questionnaires or missing subscription agreements, can attract unwanted regulatory attention. These investigations can be time-consuming, expensive, and damage a fund's reputation, even if no wrongdoing is uncovered.

Imagine facing an audit and being unable to provide proof of accredited investor status for all your limited partners. This scenario could result in significant fines and potential legal action. When establishing a fund, compliance is critical; be sure to consider the legal and compliance considerations for subscriptions.

Operational Failures: Losing Investor Trust

Beyond regulatory requirements, operational missteps can also have disastrous consequences. Failing to deliver timely and accurate reports to investors, mismanaging fund assets, or deviating from the fund's stated investment strategy can erode investor confidence and trigger withdrawals.

Consider a situation where a fund consistently underperforms its benchmarks without a clear explanation. This lack of transparency can severely damage the manager's reputation and lead to a significant loss of assets under management.

Losing the Exemption: A Painful Remediation Process

If a 3(c)(1) fund loses its exemption due to compliance failures, the remediation process can be a real headache. The fund might be required to register with the SEC, implement new compliance procedures, and potentially restructure its operations. This process can be costly, disruptive, and in some cases, could even lead to the fund's dissolution.

Early Warning Systems and Best Practices

The best 3(c)(1) fund managers take a proactive approach to compliance. They use investor management software to precisely track ownership, implement robust document management systems, and prioritize transparent communication with investors. They establish strong internal controls and conduct regular compliance audits to identify and address potential issues before they escalate. Understanding the interaction of state and federal regulations, along with the added challenges of international investors, is crucial for long-term success. This proactive approach protects the fund, its investors, and the manager's reputation.

How Top Funds Actually Use These Structures

The 3(c)(1) fund structure isn't just about checking regulatory boxes; it's a foundation that enables a wide range of investment strategies in the private market. Think of it as a versatile toolkit, adaptable to many different investment approaches. This section explores how successful funds use this exemption, revealing the diverse ways the same framework can be applied.

Hedge Funds: Navigating Volatility With Precision

Imagine two different hedge funds. One, a quantitative fund, uses complex algorithms to identify short-term market opportunities. They need to move fast, and the 3(c)(1) structure gives them the agility to do so without the burden of public reporting requirements. Think of it as a high-performance race car, built for speed and maneuverability.

Now consider a long-only equity manager. Their approach is entirely different: they seek undervalued companies and hold them for the long term. The 3(c)(1) exemption shields them from the pressure of quarterly reporting, allowing them to focus on long-term value creation. It's more like a sturdy, reliable truck, built for the long haul. When establishing a fund, legal compliance is paramount; for a deeper understanding of the intricacies involved, consider the legal and compliance considerations for subscriptions.

Private Equity and Venture Capital: Fueling Innovation

Venture capital firms use the 3(c)(1) structure to invest in early-stage companies. They're essentially providing the fuel for innovation, and the exemption allows them to accept the higher risks inherent in startups. It's like giving a young company the fertilizer it needs to grow.

Private equity funds, on the other hand, might use the 3(c)(1) structure to acquire established businesses, improve their operations, and increase their value over time. The exemption's flexibility lets them manage these investments without the constant scrutiny of public markets. It's like renovating an older house: you need time and space to do it right.

Sector-Specific Applications: From Real Estate to Crypto

The 3(c)(1) structure isn’t limited to a single sector. Real estate funds, for example, use it to provide investors with steady cash flow while maintaining the benefits of a private investment structure. Think of it as building a solid foundation for predictable returns.

Meanwhile, in the evolving world of cryptocurrency, the 3(c)(1) structure offers adaptability. It allows crypto investment vehicles to operate within existing regulations while positioning themselves for future changes. It’s like navigating uncharted territory with a reliable compass.

Emerging Applications: Impact and ESG Investing

The 3(c)(1) exemption is also being used in impact investing and ESG-focused strategies. Investors are increasingly looking for returns that align with their values, and this structure provides a framework for pursuing both financial and social/environmental goals. It's like investing with both your head and your heart.

These examples demonstrate how top funds tailor the 3(c)(1) structure to their specific needs. The key advantage is strategic: it provides flexibility, privacy, and the ability to execute specialized strategies that wouldn't be possible in public markets. By understanding these real-world applications, investors can better understand how this powerful tool might align with their own investment objectives. Analyzing performance data and success stories within the 3(c)(1) landscape can offer further insight into why this exemption remains a key driver of private market innovation, empowering investors with valuable knowledge for their own investment strategies.

Your Strategic Decision Framework

Choosing the right fund structure is a bit like choosing the right wine pairing for a meal. A robust Cabernet Sauvignon might be perfect for a steak, but it would clash terribly with a delicate fish dish. Similarly, a 3(c)(1) fund structure might be ideal for certain investment strategies, but completely unsuitable for others. Success hinges on understanding the nuances of each option and aligning it with your specific goals.

Decision Trees: Plotting Your Course

Imagine a choose-your-own-adventure book, where each decision leads you down a different path. That’s the idea behind using decision trees to evaluate the 3(c)(1) exemption. These tools, developed by industry experts, help you navigate the complexities of fund structuring based on factors like your target fund size, investor composition, and long-term strategy. For example, if your goal is to build a large fund with hundreds of investors, a 3(c)(1) structure, with its limit of 100 investors, probably won’t work. However, if you're building a more exclusive fund targeting a smaller group of high-net-worth individuals, 3(c)(1) might be the perfect fit.

Weighing the Trade-Offs: What You Gain and What You Give Up

Every decision has trade-offs. Think about choosing between a cozy cabin in the woods and a bustling beachfront hotel for vacation. Both offer unique benefits, but also require you to sacrifice certain comforts. Similarly, choosing a 3(c)(1) fund presents both advantages and disadvantages. While the potential for higher returns and increased flexibility might be alluring, you must also consider the limitations on the number of investors and the specific compliance requirements. Understanding the opportunity costs – what you give up by choosing 3(c)(1) over other structures like a 3(c)(7) fund – is crucial. This might include access to a broader investor base or a less complex regulatory environment.

Lifecycle Implications: From Startup to Established Fund

Just as a plant requires different care at different stages of its growth, the strategic implications of a 3(c)(1) structure evolve over a fund's lifecycle. A startup fund, focused on attracting its first investors, faces different challenges than a mature fund managing an established portfolio. For a new fund, operating within the 100-investor limit of a 3(c)(1) might be a primary concern. For a more established manager, the focus might shift to maintaining compliance and exploring strategic growth opportunities. A seasoned manager might even consider transitioning from a 3(c)(1) to a 3(c)(7) structure, weighing factors like investor accreditation requirements and reporting obligations.

Practical Tools and Planning Frameworks

Navigating the world of private fund structures can feel like exploring uncharted territory. That’s why we've equipped you with practical assessment tools and planning frameworks to guide your journey. These resources will empower you to make informed decisions, ensuring your fund structure aligns with your goals and positions you for sustainable growth within the regulatory landscape. Think of these tools as your compass and map, helping you navigate the complex terrain and chart a course toward success. These tools will help you ask the right questions, analyze the potential pitfalls, and ultimately, make the most strategic decision for your fund.

Ready to streamline your real estate syndication process and unlock greater efficiency? Explore how Homebase can help you manage your deals, investors, and compliance, all in one centralized platform.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.