Yield on Cost Explained A Guide for Real Estate Investors

Yield on Cost Explained A Guide for Real Estate Investors

Unlock the power of yield on cost. Learn how top real estate investors use this forward-looking metric to evaluate value-add deals and maximize returns.

Domingo Valadez

Jan 24, 2026

Blog

When you're looking at a real estate deal, especially a value-add or development project, the current numbers only tell half the story. That's where Yield on Cost (YOC) comes in. It’s a forward-looking metric that shows you what your return will be after all the hard work and capital are put into the property.

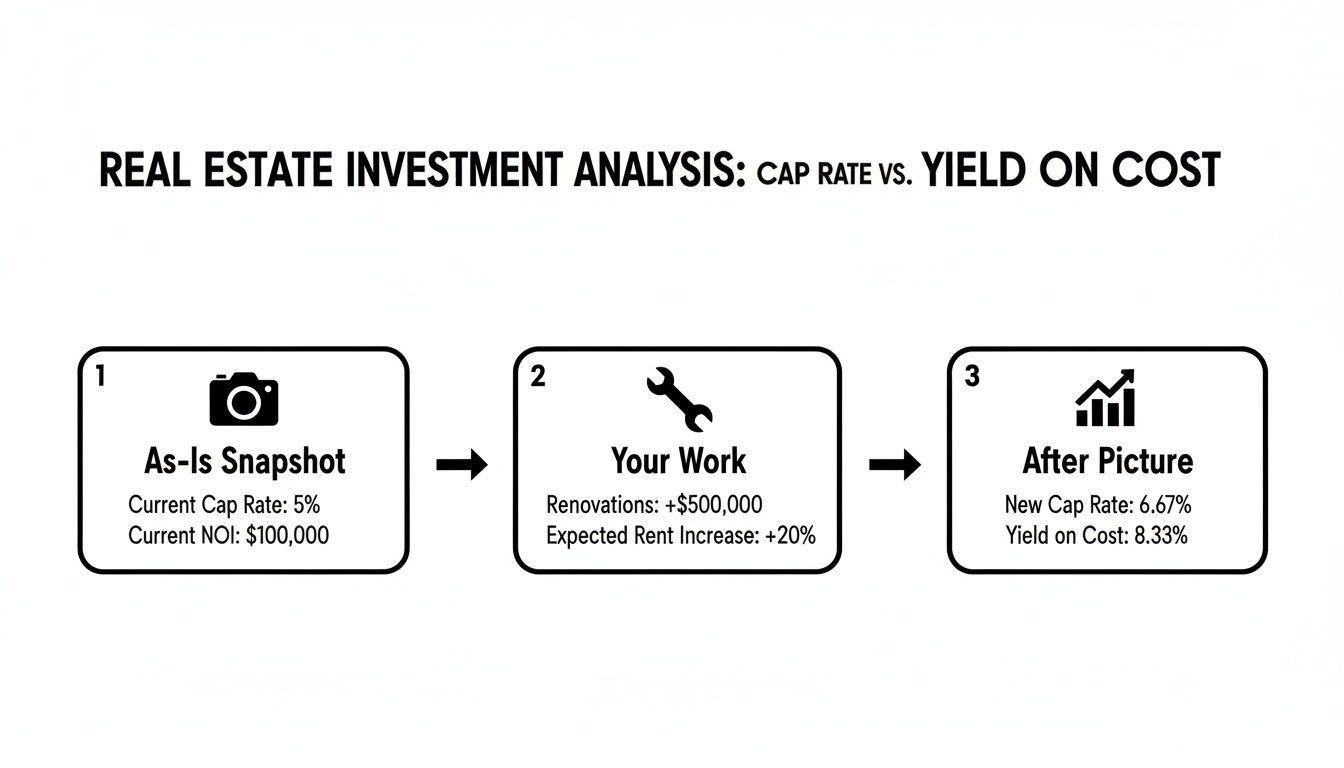

Think of it this way: a standard cap rate is like a snapshot of the property's income today. Yield on Cost, on the other hand, is the projected profitability once your business plan is complete—after the renovations, the lease-up, and all the associated costs are factored in. It’s the "after" picture.

Understanding Yield on Cost Beyond The Cap Rate

To really get a feel for Yield on Cost, it helps to break it down into its core pieces. This metric isn't just a number; it's a story about turning potential into profit.

Yield on Cost At a Glance

This table shows how YOC connects the future income potential directly back to the total capital required to get there, giving you a clear measure of profitability.

Why Yield on Cost Matters

So, why not just stick with the cap rate? Because Yield on Cost forces you to think like an owner and an operator, not just a buyer. It keeps your eyes on the prize: creating future value.

- It’s the ultimate gut-check for a value-add project, ensuring your renovation budget actually translates into higher returns.

- For ground-up development, it quantifies the "development spread"—the premium you earn for taking on the construction risk compared to just buying a finished building at market cap rates.

- It provides a clear financial benchmark for everything from securing loans to setting investor expectations.

In the world of real estate syndication, Yield on Cost is one of the most important metrics for determining if a project is even worth pursuing. For example, if you forecast a stabilized Net Operating Income (NOI) of $500,000 on a project with a total cost of $5,000,000, your Yield on Cost is a healthy 10% ($500,000 / $5,000,000). You can dive deeper into these calculations with resources like this great explainer on understanding Yield on Cost for real estate developers.

How YOC Guides Syndicators

“YOC gives syndicators a clear lens into potential returns, factoring in every dollar spent to create value.”

This single metric becomes a powerful guide throughout the deal lifecycle.

- Forecasting Success: Before you ever go under contract, you're modeling your expected NOI and total costs. YOC is the pass/fail test—if the projected yield doesn't comfortably beat the market cap rate for similar stabilized properties, the deal probably isn't worth the risk.

- Justifying Investment Risk: A strong YOC is your best argument for convincing partners and investors to come aboard. Showing them a significant spread over market cap rates proves the deal has real upside.

- Enhancing Reporting: In your offering memorandum and investor updates, YOC is a star player. It visually demonstrates how your strategic improvements are designed to directly boost the property’s value and deliver returns.

Smart sponsors build their underwriting models around YOC. They run sensitivity analysis to see how the number holds up if renovation costs run high, lease-up takes longer, or rental rates don't hit their pro forma targets. This rigorous analysis not only builds a more resilient business plan but also helps you negotiate better financing and tell a more compelling story to your investors.

Quick Tips for YOC Modeling

- Be realistic about stabilization. Don't just assume your NOI hits its peak the day construction ends. Factor in a realistic lease-up period to reach that stabilized income figure.

- Stress-test everything. What happens to your YOC if construction costs are 10% over budget? What if vacancy is higher than expected? Good modeling answers these questions.

- Know your benchmarks. Your target YOC should align with what your investors expect and what the market demands for the level of risk you’re taking on.

By making Yield on Cost a central part of your underwriting, you ensure every project is evaluated based on its future potential. When presented alongside the going-in cap rate and cash-on-cash return, it gives investors the complete financial narrative of the deal.

Imagine presenting a deal to an investor where the projected YOC is 12% in a market where similar stabilized properties are trading at a 7% cap rate. That 500 basis point spread (5%) is the profit you’re creating. It’s the most powerful number in your pitch deck.

How to Calculate Yield on Cost Accurately

Alright, let's roll up our sleeves and get into the actual math. The real power of yield on cost is its simplicity, but don't let that fool you—the accuracy of your final number is only as good as the numbers you put into it.

The formula itself is clean and simple:

Yield on Cost = Stabilized Net Operating Income / Total Project Cost

This little equation gives you a powerful, forward-looking snapshot of your unlevered return after all your hard work is done. To make sure that snapshot is a realistic one, we need to be surgical about how we define and calculate both the future income and the total cost.

Defining the Core Components

First up is the numerator: Stabilized Net Operating Income (NOI). This is a crucial distinction—we're not talking about the property's NOI today. We're forecasting the annual income after the value-add business plan is complete. Think of it this way: the renovations are done, the paint is dry, new tenants are in place paying market rents, and the property is running at its full potential.

Next, we have the denominator: Total Project Cost. This is the "all-in" number. It’s not just the sticker price of the building; it’s every single penny you have to spend to get from the day you close to the day you’re stabilized.

- Purchase Price: The price you pay for the property itself.

- Hard Costs: This is the budget for bricks and mortar—all the physical construction, materials, and labor for the renovation.

- Soft Costs: These are the often-overlooked but equally important expenses. We're talking loan fees, legal bills, architect drawings, and even property taxes that you have to cover while the property is empty during renovations.

Forgetting to account for soft costs is a rookie mistake. It can make your projections look far too rosy and lead to a nasty surprise down the road.

A Practical Multifamily Example

Let's walk through a real-world scenario to see how this plays out. Imagine you're underwriting a 50-unit apartment complex that’s a perfect candidate for a value-add strategy.

1. Determine Total Project Cost:

- Purchase Price: You negotiate and get the property under contract for $5,000,000.

- Renovation Budget (Hard Costs): You have a detailed scope of work to upgrade all units, refresh the common areas, and improve the landscaping. The budget for this is $1,500,000.

- Soft Costs: After talking to your lender and attorney, you conservatively estimate $250,000 for loan origination, legal work, and other closing costs.

- Total Project Cost: $5,000,000 + $1,500,000 + $250,000 = $6,750,000

2. Project Stabilized Net Operating Income (NOI):

- Post-renovation, your market research shows the property can command $975,000 in annual gross potential rent.

- You build in a 5% buffer for vacancy and credit loss, which subtracts $48,750 from your income.

- Your pro forma operating expenses (property management, taxes, insurance, repairs) are projected to be $386,250 annually.

- Stabilized NOI: $975,000 - $48,750 - $386,250 = $540,000

3. Calculate the Yield on Cost:

- YOC: $540,000 (Stabilized NOI) / $6,750,000 (Total Project Cost) = 8.0%

There it is. An 8.0% yield on cost. This is the number that tells you the story of the deal. You can now compare this projected return against the market cap rate for similar, already-stabilized properties in the area. This comparison is at the heart of deciding if the risk and effort of the value-add plan are justified by the potential reward.

This visual helps clarify the relationship between the "before" and "after" picture.

Essentially, cap rate measures the return on an asset "as-is," while yield on cost shows you the return you are creating through your strategic improvements. It's the difference between buying a return and building one.

Putting Yield on Cost to Work in Value-Add Deals

Yield on cost is a solid metric in theory, but its real magic happens in the world of value-add real estate. This is where it stops being just a formula on a spreadsheet and becomes the linchpin of your investment thesis, quantifying the actual profit you create through smart improvements.

Think about a tired, 100-unit apartment complex. The kitchens are dated, the carpets are shot, and the rents are way below market. On paper, the current numbers probably look pretty average. But a good syndicator sees the "after" picture—a renovated, sought-after property that commands higher rents and generates a much healthier Net Operating Income (NOI).

Yield on cost is the metric that builds a bridge from the property's current, underwhelming state to its profitable future potential.

Unlocking the Development Spread

The single most important way to use YOC in a value-add deal is to calculate the development spread. You might also hear this called the "profit spread" or "value-add spread," but the concept is the same. It's surprisingly simple, yet profoundly powerful.

The development spread is the difference between your projected yield on cost and the market cap rate for similar, already stabilized properties. This spread is your financial reward for taking on the renovation and lease-up risk.

A healthy spread is the ultimate proof that your business plan has legs. It sends a clear message to investors: "We aren't just buying a property; we are manufacturing value."

Let's put it another way. If you could buy a fully renovated, stabilized apartment building down the street at a 6% market cap rate, why on earth would you take on a risky renovation project just to hit a 6.5% yield on cost? That tiny 0.50% spread is nowhere near enough to justify the months of construction, leasing hassles, and budget risks. A truly compelling deal needs a much bigger cushion.

A Case Study in Creating Value

Let's walk through a concrete example. Imagine you're acquiring that tired apartment complex for $2.5 million. You've budgeted $750,000 for a full upgrade package, bringing your total project cost to $3.25 million.

Once the dust settles and the property is leased up, you project a stabilized NOI of $312,500.

Your yield on cost calculates out to a very healthy 9.6% ($312,500 / $3,250,000). Now, let's say comparable stabilized properties in the area are selling at an 8% cap rate. You’ve successfully created a 160 basis point (or 1.6%) spread. That extra return is your direct payment for navigating the acquisition, renovation, and re-leasing risks.

This is the kind of number that gets investors' attention. It’s a clean, defensible metric that proves your strategy is profitable.

Showcasing Your Strategy to Investors

When you're pitching a deal, the development spread should be your headline number. It's the most powerful way to show the upside. For example, popular value-add strategies like the BRRRR Method lean heavily on yield on cost to prove profitability after the renovation phase.

Here’s a simple way to frame it in your presentation:

- Establish the Baseline: Start by clearly stating the market cap rate for similar, already stabilized assets. This sets the benchmark.

- Present Your YOC: Next, detail your total project cost and your projected stabilized NOI to calculate your yield on cost.

- Highlight the Spread: Finally, drive home the difference. A spread of 150 to 250 basis points (1.5% to 2.5%) is often considered a strong target for value-add multifamily deals, as it provides a solid cushion for the risks involved.

Following this simple narrative transforms your pitch from just another property acquisition into a clear, compelling value-creation story backed by solid numbers.

YOC vs Cap Rate vs Cash on Cash Return

Real estate investors are surrounded by metrics, and it's easy to get lost in the jargon. To really get a feel for a deal’s potential, you have to know which tool to use for which job. Yield on cost is a fantastic metric for gauging future value, but it tells a completely different story than its more common cousins, the cap rate and the cash-on-cash return.

Think of these three metrics as specialized instruments in your underwriting toolkit. Each one is built to measure a different aspect of a deal's financial health. Relying on the wrong one can give you a skewed perspective and, frankly, lead to some bad investment decisions.

Comparing the Core Metrics

The biggest difference boils down to what each metric measures and when it’s most helpful. The cap rate gives you a snapshot of a property's unlevered return today, based on what it's worth on the open market right now. Cash-on-cash return, on the other hand, gets personal—it shows you the return on the actual cash you pulled out of your pocket to do the deal.

Yield on cost is the forward-looking one. It reveals the unlevered return you can expect on your total project cost once your value-add plan is complete and the property is stabilized.

Each metric answers a different, vital question for an investor. The cap rate asks, "What is this stable asset yielding today?" Cash-on-cash asks, "What's my return on my down payment?" And yield on cost asks, "What will our return be after we've created new value?"

To really appreciate why YOC is so important, it helps to first understand What Is Cap Rate In Real Estate. It’s a foundational metric that YOC is often compared against. They're related, but one measures the present while the other projects the future you intend to build. For a deeper dive into the numbers, check out our guide on how to calculate cap rate accurately.

Comparing Key Real Estate Return Metrics

Let's break these down side-by-side to get a really clear picture of how they fit together. This simple comparison helps you tell the full financial story of a deal to partners and investors, showing them you’ve analyzed it from every important angle.

Understanding these distinctions is crucial. Over the long haul, a property's success often comes down to its yield. In fact, a massive 145-year study across 16 countries found that rental yields were the main driver of total returns, contributing 7.05% and even beating stock market returns. This kind of historical data drives home why forward-looking metrics like yield on cost are so vital for any value-add investor.

By using all three metrics together, you get a complete, panoramic view of an investment’s true potential—not just what it is today, but what it could become.

Common YOC Mistakes and How to Avoid Them

The yield on cost metric is a fantastic tool for underwriting, but it has a critical weakness: its accuracy is entirely dependent on the quality of your assumptions. Get your projections wrong, even by a little, and what looked like a home run deal can quickly turn into a capital trap. Nailing this is absolutely essential for protecting your investors' money and building a solid track record.

Where do sponsors get into trouble? Most often, the danger lies in unchecked optimism. It's easy to make a deal look incredible on paper, but a rosy pro forma rarely survives first contact with reality. The best operators pressure-test their numbers and plan for the pitfalls, building a financial model that can stand up to real-world scrutiny.

Overlooking Soft Costs and Contingencies

One of the most common—and costly—errors is fixating only on the purchase price and the hard construction costs. In reality, a whole category of "soft costs" can sneak up on you, inflating your total project cost and quietly eating away at your final return.

Don't forget to account for these crucial line items:

* Loan Origination Fees: The points and fees your lender charges just to set up the financing.

* Legal and Title Expenses: All the closing costs required to get the deal done and ensure the title is clean.

* Architectural and Engineering Plans: The professional services needed for any serious renovation.

* Permitting Fees: The cost of getting the city to sign off on your construction plans.

A hallmark of responsible underwriting is baking in a healthy contingency fund—think 5-10% of your hard costs. This buffer is your project's safety net against surprise cost overruns, supply chain delays, or nasty problems you uncover during demolition. It’s what keeps your yield on cost on track when things don't go perfectly.

If you don't budget for these expenses from day one, your entire yield on cost calculation will be off. That means the return you promised investors will be much harder to achieve.

Using Untrended vs Trended Projections

Another classic misstep is building a static financial model that pretends the world stands still. When you project future income and expenses without accounting for market changes, you're creating an untrended projection. It's simple, but it’s rarely realistic.

A trended projection is far more sophisticated. It anticipates factors like inflation and market rent growth over your stabilization period. For example, if your renovation is slated to take 18 months, you absolutely should model for how much rents are expected to increase during that time. This can give your stabilized NOI—and by extension, your yield on cost—a significant and legitimate boost.

But this is where you have to be careful. Overly aggressive rent growth assumptions are a huge red flag for experienced investors. Your projections have to be grounded in solid market data and a conservative, defensible outlook. The true pros always stress-test these numbers through sensitivity analysis. They ask, "What happens to our YOC if rents grow slower, or if expenses rise faster than we think?" That's the mark of professional-grade underwriting.

Answering Your Questions on Yield on Cost

Now that we've walked through the formula and how to use it, let's tackle some of the practical questions that always pop up. Think of this as a quick FAQ to help you nail down the concept and use it with confidence.

What Is a Good Yield on Cost for a Multifamily Deal?

There's no single magic number, as a "good" yield on cost depends entirely on the market. The real goal is to create a healthy "spread" between your final yield on cost and the market cap rate for similar, already stabilized properties.

A strong target to shoot for is a spread of 150 to 200 basis points (that's 1.5% to 2.0%) over the market cap rate.

For instance, if stabilized apartment buildings in your target submarket are trading at a 6% cap rate, you'd want your project's yield on cost to land somewhere between 7.5% and 8.0%. That spread is your reward—it’s the tangible value you're creating to justify all the risks of construction, renovation, and lease-up.

How Does Financing Impact the Yield on Cost Calculation?

It doesn't. And that’s by design.

Yield on cost is calculated using Net Operating Income (NOI), which is figured out before you account for any mortgage payments. This makes it a capital-structure-neutral metric, meaning it shows you the raw, unlevered profitability of the asset itself, independent of your loan terms.

This is super useful for judging the property on its own merits. Once you want to see how the deal performs with debt, you’ll look at other metrics like the Cash-on-Cash Return.

When Should I Not Use Yield on Cost?

Yield on cost isn't the right tool for every job. It shines brightest for value-add or development projects.

If you're buying a fully stabilized building with no major improvements planned, the yield on cost is just your going-in cap rate (NOI divided by the purchase price). There’s no new "cost" to factor in, so the metric doesn't tell you anything new.

The metric's real power is as a forward-looking tool. It's built for projects where you’re actively spending money to force appreciation and boost future income.

What Are the Biggest Risks in Estimating Total Project Costs?

The two quickest ways to blow up your proforma are underestimating construction costs and forgetting about soft costs. It happens all the time.

To build a reliable budget, you need actual bids from contractors, not just a guess. Then, you absolutely must add a contingency fund—usually 5% to 10% of the total reno budget—for the inevitable surprises.

And don't overlook the soft costs. They add up fast and are just as real as the cost of new cabinets. These include things like:

* Loan fees and closing costs

* Legal and accounting expenses

* Architectural or design plans

* Property taxes and insurance during the renovation period

Your best defense is a bulletproof due diligence process. The more accurate your cost projections are, the more you can trust your yield on cost calculation.

Ready to manage your real estate deals more effectively? Homebase provides an all-in-one platform to streamline fundraising, investor relations, and deal management. See how you can focus on closing more capital, not chasing spreadsheets.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Single Family vs Multi Family Homes for Real Estate Syndicators

Blog

Discover the key differences in single family vs multi family homes. Our guide covers financing, risk, and operations to help syndicators choose wisely.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.