What Is the Gross Rent Multiplier? A Simple Guide

What Is the Gross Rent Multiplier? A Simple Guide

What is the gross rent multiplier? Learn how this simple metric helps real estate investors quickly evaluate rental properties and make smarter decisions.

Domingo Valadez

Aug 31, 2025

Blog

When you're trying to figure out if a rental property is a good deal, where do you even start? Let's cut through the noise. The Gross Rent Multiplier (GRM) is one of the first, simplest tools that seasoned real estate investors reach for.

Think of it this way: the GRM gives you a quick-and-dirty estimate of how many years it would take for a property's rental income to completely pay for its purchase price. A lower number is often a good sign, suggesting a faster payback period.

Unpacking The Gross Rent Multiplier

Imagine you're at a market, comparing two different crates of oranges. One is $30 for 15 oranges, and the other is $36 for 18 oranges. A quick bit of math shows they both work out to $2 per orange. The Gross Rent Multiplier does something very similar for investment properties. It gives you a single, standard number to compare different buildings, even when their prices and rental incomes are all over the map.

At its core, the GRM is a foundational metric that helps investors size up a property's value based purely on the gross income it pulls in. The key here is "gross"—we're looking at the total rent collected over a year before you subtract any expenses like taxes, insurance, or repairs. This simplicity is its greatest strength.

The Core Formula

The calculation itself is refreshingly straightforward. You only need two numbers: how much the property costs and how much rent it generates in a year.

GRM = Property Price / Gross Annual Rental Income

Let's run through a quick example. Say you're looking at a duplex priced at $400,000 that brings in $40,000 in total rent per year.

$400,000 (Property Price) ÷ $40,000 (Gross Annual Rent) = 10 GRM

That "10" tells you it would take a decade of collecting gross rent to equal the property's purchase price. It’s a powerful first look that helps you quickly sift through dozens of listings and zero in on the ones that make the most sense financially right from the start.

Why It Matters for Investors

So, why do investors lean on this metric so much? Speed and simplicity. In a hot real estate market, you don't have time to run a full financial analysis on every property that catches your eye. The GRM lets you perform a rapid gut check without getting bogged down in the nitty-gritty of operating expenses for every single listing.

Here’s why it’s a go-to tool:

- Fast Screening: It allows you to immediately weed out properties that are obviously overpriced compared to the rent they generate.

- Standardized Comparison: It puts different properties on a level playing field, creating a true apples-to-apples comparison within the same market.

- Market Analysis: By keeping an eye on the average GRM for a neighborhood, you can spot trends in property values and get a feel for local rental demand.

To make this even clearer, the table below breaks down the essential parts of the Gross Rent Multiplier.

Gross Rent Multiplier at a Glance

This table provides a quick summary of the key elements of the Gross Rent Multiplier for easy reference.

Ultimately, this simple ratio provides a solid starting point for any serious property analysis.

How to Calculate and Interpret GRM Like a Pro

Knowing the formula for the Gross Rent Multiplier is one thing. The real skill is in calculating it right and, more importantly, understanding the story that number is telling you. This is where you graduate from textbook theory to boots-on-the-ground application, turning a simple ratio into a powerful first-look tool for sizing up a property.

Let's walk through the calculation process with some real numbers, then get into what those results actually mean for your investment strategy.

Calculating GRM with Real-World Examples

The formula itself couldn't be simpler: Property Price / Gross Annual Rent. But as with anything in real estate, the devil is in the details—specifically, finding the right numbers to plug in.

Let’s run the numbers on a couple of common investment properties.

Example 1: A Single-Family Rental

Imagine you're looking at a single-family home in a decent suburban neighborhood.

- Property Price: The asking price is $350,000.

- Gross Monthly Rent: It's currently leased for $2,500 per month.

Right away, you need to convert that monthly figure to an annual one. It's the most common slip-up I see new investors make.

- Calculation: $2,500 (monthly rent) x 12 (months) = $30,000 (gross annual rent).

Now you can run the formula.

- GRM = $350,000 / $30,000 = 11.67

Example 2: A Duplex Property

Okay, now let's look at a small multi-family, a duplex with two separate units.

- Property Price: The list price is $500,000.

- Gross Annual Rent: Unit A rents for $1,800/month, and Unit B brings in $1,700/month.

First, you need to combine the income from both units to get the total monthly rent for the entire property.

- Calculation: $1,800 + $1,700 = $3,500 (total monthly rent).

Next, annualize it.

- Calculation: $3,500 x 12 = $42,000 (gross annual rent).

Finally, you can figure out the GRM.

- GRM = $500,000 / $42,000 = 11.9

See how that works? You’ve just standardized two very different properties into a single, comparable number.

Decoding the Numbers: What Your GRM Is Telling You

So you've got a GRM. What now? This is where the art comes in, because interpreting the number is all about context. A "good" GRM in a hot market like Austin might be a terrible one in Cleveland. It’s all relative.

At its core, the Gross Rent Multiplier gives you a rough idea of the payback period in years, if you were only looking at gross income. A lower GRM suggests a quicker payback and, potentially, a better deal upfront.

Think of it this way: a lower GRM means the property's price is relatively cheap compared to the rent it pulls in. A high GRM signals the opposite—the price is steep for the income it generates.

While you always need to compare apples to apples in your specific market, here are some general rules of thumb to get you started:

- Low GRM (4-7): This should make your ears perk up. It often points to a potential bargain—a property that might be undervalued or has unusually strong rents for its price. This is a green light to dig deeper.

- Average GRM (8-11): This range is often considered the sweet spot or the norm in many stable markets. Properties here are likely priced fairly in relation to their rental income.

- High GRM (12+): Time to be cautious. A high GRM could mean the property is overvalued, or its rents are weak. An investor might still consider it in a market with massive appreciation potential, but it demands a much closer look at the actual expenses and long-term outlook.

At the end of the day, the GRM is your first-pass filter. It’s a fantastic tool for quickly sifting through dozens of listings to see which ones are worth your time for a full-blown financial analysis, and which ones you can safely pass on.

Putting GRM to Work in Real Estate Markets

Knowing the formula is one thing, but the real magic of the Gross Rent Multiplier happens when you put it to work. Think of it less as a final verdict and more as a high-powered sorting tool. For any serious investor, time is money, and you can't afford to spend hours doing a deep financial dive on every single property that crosses your desk.

That's where GRM shines. It's your first-pass filter.

When you're staring at a dozen listings, a quick GRM calculation for each one can instantly tell you which properties are worth a closer look and which are likely duds. It helps you cut through the noise and focus your energy where it counts.

A Realistic Filtering Scenario

Let's walk through a quick example. Imagine an investor named Alex is looking at three similar duplexes in the same neighborhood. Alex needs to figure out which deal has the most potential, and fast.

Here’s the breakdown of the properties:

- Property A: Asking price of $450,000. Gross annual rent is $40,000.

- Property B: Asking price of $480,000. Gross annual rent is $52,000.

- Property C: Asking price of $420,000. Gross annual rent is $35,000.

Alex pulls out a calculator and runs the numbers:

- Property A: $450,000 / $40,000 = 11.25 GRM

- Property B: $480,000 / $52,000 = 9.23 GRM

- Property C: $420,000 / $35,000 = 12.0 GRM

Suddenly, the decision gets a lot easier. Property B, even with the highest asking price, has the lowest GRM. This is a strong signal that its price is more reasonable compared to the rent it brings in.

On the flip side, Property C has the lowest price tag but the highest GRM, suggesting it might be overpriced for its rental income.

Does this mean Alex should immediately put an offer on Property B? Not necessarily. But it absolutely means Property B goes to the top of the pile for a full, detailed analysis of its expenses, condition, and tenants. Property C, however, probably gets tossed aside unless there's a hidden opportunity for a massive rent hike.

Understanding Market Context

A GRM number is meaningless in a vacuum. A "good" GRM in a quiet Midwestern town is going to look completely different from one in a red-hot coastal city. Context is everything.

A lower GRM is usually better, but it's not a hard-and-fast rule. In markets where property values are skyrocketing, investors might be perfectly happy with a higher GRM. They're betting on appreciation to deliver their returns, not just cash flow.

Looking at the data, you'll see this play out across the country. In many major US cities, a typical GRM for a multi-family property falls somewhere between 6 and 12. But in high-demand markets like New York City, you might see GRMs creep above 15. In smaller, more stable markets, a GRM of 4 to 6 could be the norm.

This is why you always need to compare a property’s GRM to the local average. It’s not just about crunching numbers; it’s about understanding what those numbers mean right here, right now. Getting a handle on valuation tools like this can ease many of the common concerns for first-time real estate investors. When used correctly, the GRM helps you make smarter, faster initial decisions and sets you up for a much more successful deal.

The Good, The Bad, and The Ugly of GRM

Every real estate metric has its place, and the Gross Rent Multiplier is no different. It's a fantastic tool for a quick first look, but if you rely on it exclusively, you're flying blind. Think of it like a flashlight in a dark warehouse—it's perfect for a quick sweep to see what’s out there, but you wouldn't use it to perform a detailed inspection.

To really get the most out of GRM, you have to appreciate what it does well and, more importantly, what it completely ignores. It’s a sorting tool, not a decision-making tool.

Its Superpower: Back-of-the-Napkin Speed

The biggest win for the GRM is its sheer simplicity. In a hot market where good deals get snapped up in a flash, you need a way to sift through listings quickly. You don't always have time to dig into detailed operating statements for every single property you see.

This is where GRM shines:

- Quickly Weeds Out Duds: All you need is the asking price and the total annual rent. With those two numbers, you can calculate the GRM in your head and instantly see if a property is wildly overpriced compared to its neighbors. This lets you zero in on the deals that are actually worth your time.

- Creates an Apples-to-Apples Baseline: How do you compare a small bungalow to a fourplex? GRM gives you a common benchmark. It helps you see which property generates more rent for every dollar you invest, regardless of its size or type.

- A Great Starting Point for Beginners: If you're new to investing, diving into net operating income and cap rates can feel overwhelming. GRM is an easy-to-understand concept that helps you build a fundamental feel for the market before you get into the more complex math.

Its Fatal Flaw: Ignoring Reality

Here’s the catch: the very thing that makes the GRM so simple is also its greatest weakness. By focusing only on gross rent, it ignores every single cost of owning a property. This is a massive blind spot that can turn what looks like a great deal into a financial nightmare.

The GRM only sees the money coming in. It’s completely oblivious to property taxes, insurance, maintenance, management fees, and vacancies—all the things that actually determine your profit.

Leaning on GRM alone is like buying a car based only on its sticker price. You'd never do that, right? You'd ask about its gas mileage, insurance premiums, and common repair costs. Two cars could have the same price, but one could be a reliable sipper while the other is a gas-guzzling money pit. It's the exact same story with rental properties.

A Tale of Two Properties

Let's make this crystal clear with an example. You're looking at two duplexes in the same neighborhood. Both are listed for $500,000, and both bring in $50,000 a year in rent.

On the surface, they look identical. Their GRM is 10 ($500,000 / $50,000). Based on that single metric, you might think they're equally good investments.

But now, let's look at the numbers the GRM ignores.

All of a sudden, the two properties look worlds apart. Property A is clearly the better deal, putting an extra $10,000 into your bank account every year. The older fixer-upper, Property B, is a far weaker investment, even though it had the exact same GRM.

This is the danger of the Gross Rent Multiplier. It tells you part of the story, but it hides the most important chapter—the one about profitability. That's why it should only ever be your first step, never your last.

GRM vs. Cap Rate: Choosing the Right Tool for the Job

As you move from just window-shopping for properties to making serious investment decisions, you'll need to upgrade your toolkit. The Gross Rent Multiplier (GRM) is fantastic for a first-pass filter, but when the time comes to sign on the dotted line, you need a more precise instrument.

Enter its more sophisticated cousin: the Capitalization Rate, or Cap Rate.

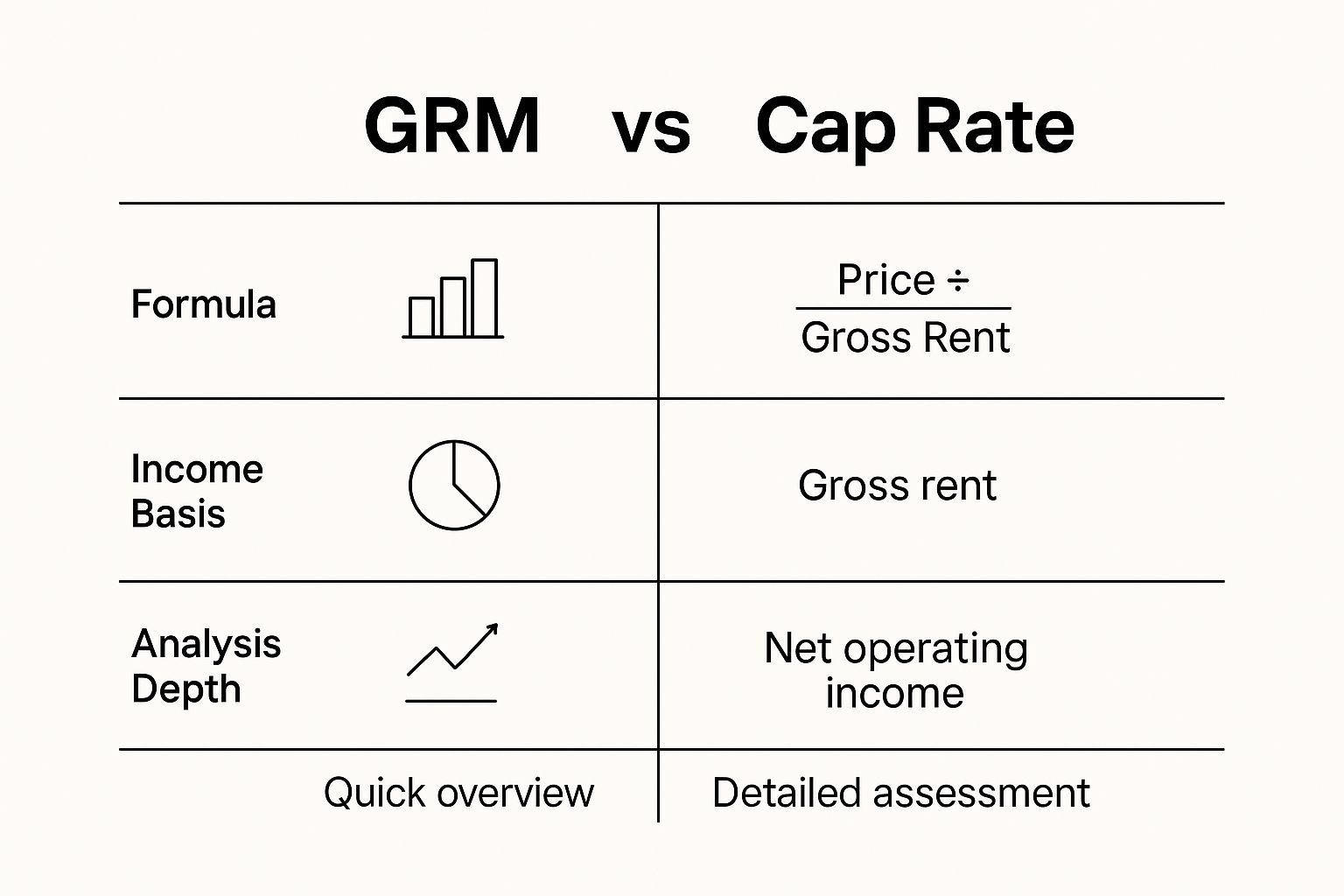

Think of it this way: GRM is like looking at a company’s total revenue. It tells you how much money is coming in the door. The Cap Rate, on the other hand, is like looking at its net profit. It tells you how much cash you actually get to keep after all the bills are paid. Both are useful, but they tell very different parts of the same story.

The Fundamental Difference: Income vs. Profit

The core distinction between these two metrics boils down to one crucial element: expenses.

The GRM’s formula is wonderfully simple: Property Price / Gross Annual Rent. It’s quick, dirty, and completely ignores the costs of actually running the property.

The Cap Rate, however, puts those costs front and center. Its formula is Net Operating Income (NOI) / Property Price. By starting with NOI, the Cap Rate automatically factors in all the property's operating expenses—things like property taxes, insurance, maintenance, and management fees. It’s a much sharper lens.

This visual helps clarify the different angles these two metrics use to evaluate a property.

As you can see, GRM gives you that high-level snapshot based on gross income, while the Cap Rate drills down to give you a detailed assessment of a property's net income.

GRM tells you how fast gross rent could theoretically pay off the purchase price, but it leaves out all the real-world costs. The Cap Rate picks up where GRM leaves off, providing a much more realistic estimate of a property's cash-on-cash return. Most seasoned investors use GRM as a preliminary screening tool but lean heavily on cap rates for the deep financial analysis that precedes an offer.

To help you see these differences side-by-side, this table breaks down how each metric functions.

GRM vs. Cap Rate: A Head-to-Head Comparison

This table shows why you can't rely on just one. The GRM helps you find the ballpark, but the Cap Rate helps you find your specific seat.

A Tale of Two Properties (Revisited)

Let's revisit the two properties we looked at earlier to see this difference in action. Remember, both cost $500,000 and bring in $50,000 in gross annual rent. Based on that alone, they both have an identical GRM of 10.

Now, let's bring the Cap Rate into the picture.

Property A: The Newer Build

* Net Operating Income (NOI): $35,000

* Cap Rate Calculation: $35,000 / $500,000 = 0.07 or 7%

Property B: The Older Fixer-Upper

* Net Operating Income (NOI): $25,000

* Cap Rate Calculation: $25,000 / $500,000 = 0.05 or 5%

Suddenly, the picture becomes crystal clear. Property A offers a solid 7% return on its value, while Property B only provides a 5% return. Even though they looked the same through the lens of GRM, their actual profitability is worlds apart. This is exactly why you can't stop your analysis at the GRM.

The GRM helps you find the right properties to analyze. The Cap Rate helps you decide which one to actually buy. They work together as a powerful one-two punch in your investment strategy.

To really get comfortable with this, you might want to delve deeper into capitalization rate calculations. Understanding both metrics is key to not just finding deals, but finding profitable ones.

When to Use Each Metric

So, when do you pull each tool out of the box? It all depends on where you are in the investment process.

Here’s a simple way to think about it:

- Use GRM for:High-Volume Screening: You're scrolling through dozens of online listings and need to quickly weed out the obvious non-starters.Initial Market Comparison: You want a general feel for how properties are priced relative to their income in a specific neighborhood.A Quick "Gut Check": You need a fast, back-of-the-napkin estimate before you invest any serious time into a property.

- Use Cap Rate for:In-Depth Due Diligence: You've used GRM to narrow your list down to a few serious contenders and are ready to dig in.True Profitability Analysis: You need to understand the actual return you can expect from a property after all expenses are paid.Making the Final Decision: You're comparing your top two or three properties and are ready to make a data-backed offer.

Ultimately, these two metrics aren't rivals; they're partners. Mastering the Gross Rent Multiplier allows you to efficiently scan the market for opportunities. Mastering the Cap Rate gives you the precision to confidently close on the best deals.

A Few Common Questions About the Gross Rent Multiplier

Once investors start playing around with the Gross Rent Multiplier, a few questions always pop up. It's a beautifully simple tool, but that simplicity can sometimes be a bit misleading. Let's clear up some of the most common points of confusion so you can use the GRM like a seasoned pro.

So, What's a "Good" Gross Rent Multiplier?

This is the big one, and the only honest answer is: it completely depends on the market. There's no magic number that works everywhere. A "good" GRM is simply one that's in line with, or ideally lower than, what similar properties are selling for in that specific neighborhood.

Generally, a lower GRM is what you're looking for. It hints that you’ll make back the property's purchase price faster from the rents you collect. Across many residential markets in the U.S., you'll often see GRMs fall somewhere between 6 and 12.

But context is everything.

- In a quiet, stable Midwestern town: You might find that a GRM of 5 is a great deal, signaling really strong rents compared to property prices.

- In a hot coastal city like San Francisco or LA: A GRM of 15 or even higher might be the local standard. In those markets, investors are often betting more on future appreciation than on day-one cash flow.

The best way to figure out what a "good" GRM looks like is to roll up your sleeves and look at recent sales of comparable rentals in your target area. That local benchmark is worth a hundred national averages because it tells you exactly what people are paying for rental income right there, right now.

Can I Use GRM for Commercial Properties?

Technically, you can calculate a GRM for anything that brings in rent, but it’s not really the go-to metric for commercial real estate. When you get into office buildings, retail strips, or large apartment buildings, investors tend to use a slightly different tool: the Gross Income Multiplier (GIM).

The GIM formula looks identical (Property Price / Gross Annual Income), but the "income" part is broader. It lumps in all sources of revenue from the property, not just tenant rent. This is a big deal for commercial properties that often have money coming in from all over.

For instance, a big apartment complex might have income from:

* Tenant Rents

* Parking fees

* Coin-operated laundry machines

* Vending machines

* Pet fees

Because commercial properties have more moving parts in both their income and expenses, investors usually use the GIM as a quick first look before quickly moving on to more detailed metrics like the Cap Rate and Net Operating Income (NOI). The GIM, much like the GRM, is a screening tool, not a final verdict.

Why Does the GRM Ignore Operating Expenses?

This is where people often get tripped up. The GRM's biggest advantage—its simplicity—is also its most significant blind spot. It intentionally ignores all operating expenses, and knowing why is the key to using it correctly.

The GRM was never designed to tell you if a property is profitable. Its only job is to give you a fast, back-of-the-napkin way to compare the sticker price of different properties against their potential to bring in rent. By leaving out things like property taxes, insurance, and maintenance, it creates an even playing field for a quick initial comparison.

Just think about it. Expenses can be all over the map, even for two identical houses side-by-side. One might be an older building needing constant repairs, while the other is brand new. One owner might manage the property themselves, while another pays a 10% management fee. Including these variables would turn a quick look into a deep dive.

This deliberate omission is what makes the GRM so useful for sorting through dozens of listings. It helps you flag properties that seem reasonably priced for their income without getting bogged down in everyone's financials. If you want to dive deeper into what is the gross rent multiplier and how it fits with other metrics, our full guide breaks it all down.

At the end of the day, the GRM helps you answer the first question: "Is this property's price in the right ballpark for the rent it generates?" It absolutely does not answer the final, most important question: "Will I actually make money on this property?" For that, you always have to dig into the expenses.

At Homebase, we know that moving from a quick GRM calculation to closing a deal involves a thousand different tasks. Our all-in-one platform helps real estate sponsors streamline their fundraising, investor relations, and deal management, so you can focus on finding great properties instead of getting lost in spreadsheets. Learn more at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.