What Is an Acquisition Fee? Essential Guide to Fee Structures and Strategic Management

What Is an Acquisition Fee? Essential Guide to Fee Structures and Strategic Management

Discover everything you need to know about acquisition fees, from real estate investments to lease agreements. Learn what acquisition fees cover, typical costs, and how to make informed financial decisions.

Domingo Valadez

Feb 16, 2025

Understanding the Basics of Acquisition Fees

Acquisition fees play an essential role in many financial deals by compensating professionals for their expertise and effort in completing transactions. In real estate, these fees typically make up 1-3% of a property's purchase price and are paid to fund managers or investment firms. For example, buying a $1 million property could incur acquisition fees between $10,000 to $30,000. These fees cover critical services like property research, deal negotiations, and purchase completion. Learn more about real estate acquisition fees.

Why Do Acquisition Fees Exist?

Fund managers and agents receive these fees as compensation for managing complex transactions. The fees ensure fair payment for essential services like:

- Due Diligence: In-depth property analysis and research

- Negotiations: Working to secure optimal terms and pricing

- Deal Closing: Managing documentation and logistics

Evaluating Acquisition Fees

Smart investors examine these fees carefully to determine if they match the value provided. This means comparing fees across different service providers and industries to understand typical ranges and included services.

Consider this example: One investment firm provides comprehensive market research and exclusive property access, while another offers basic transaction support. The more extensive service package may warrant higher fees due to its added benefits.

Common Misconceptions

Many assume lower acquisition fees automatically mean better value. However, reduced fees might indicate fewer services or less dedicated support, potentially leading to poorer investment outcomes.

Spotting Reasonable vs. Excessive Fees

Industry experts suggest this practical approach:

- Review standard fee ranges in your market

- Examine specific services covered by the fee

- Look for opportunities to negotiate when fees seem too high

Understanding acquisition fees helps investors make smarter choices. Knowing what these costs cover, recognizing fair fee structures, and avoiding excessive charges leads to better investment decisions and results.

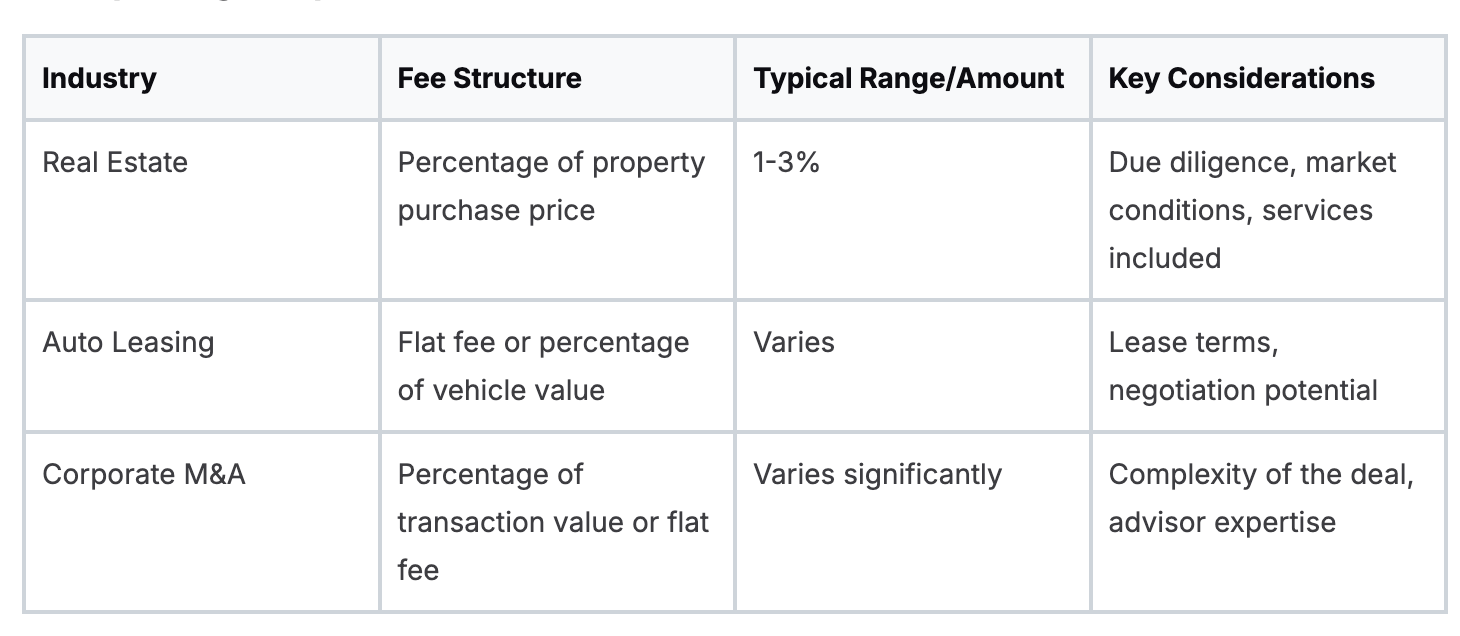

Navigating Acquisition Fees Across Industries

When investing in different markets, it's important to understand how acquisition fees work. While most commonly associated with real estate, these fees exist across multiple industries - each with its own unique structure and requirements. Being aware of these differences helps both investors and consumers make smarter financial decisions.

Acquisition Fees in Real Estate

In real estate transactions, acquisition fees cover the costs of finding, analyzing, and purchasing properties. These fees typically range between 1-3% of the property's purchase price and compensate the professionals involved. For example, a $500,000 property would have acquisition fees between $5,000 and $15,000. Learn more about real estate fees in this guide to real estate syndication fees.

Acquisition Fees in Automotive Leasing

Auto leasing also involves acquisition fees, but they work differently from real estate. When you lease a car, the fee covers administrative costs like credit checks, insurance verification, and paperwork processing. Most auto lenders charge this as a flat fee that can be paid upfront or rolled into monthly payments. Paying upfront often saves money by avoiding additional interest charges. Read more about these fees on Investopedia.

Acquisition Fees in Corporate Mergers and Acquisitions

The corporate world sees acquisition fees in a different light. During mergers and acquisitions, these fees pay for expert advisors who guide the deal process. Investment banks, legal teams, and other specialists earn these fees for their work in structuring and completing complex business transactions. The size of these fees often reflects the deal's complexity and value.

Comparing Acquisition Fees Across Industries

Knowledge of acquisition fees across different sectors helps people make better financial choices. Whether buying property, leasing a car, or involved in business deals, understanding these fees lets you evaluate costs properly and negotiate effectively. This awareness helps ensure you get good value for the services provided while keeping costs reasonable.

Mastering Fee Calculations and Negotiations

Strong negotiation skills around acquisition fees directly impact your returns as a real estate investor. Understanding fee calculations and key influence points will help you navigate fee discussions with confidence and get better deals.

Calculating Acquisition Fees

The basic math behind acquisition fees isn't complex - it's typically a percentage of the property's purchase price. Several factors affect the final percentage, including:

- Market conditions in your target area

- How complex the deal is

- What services the intermediary provides

A distressed property needing extensive due diligence may justify higher fees. Simple deals in stable markets often command lower fees. Access to off-market deals and detailed market analysis can also impact fee levels.

Identifying Leverage Points in Negotiations

When discussing fees, focus on these key areas to strengthen your position:

- Know Market Rates: Research standard fee ranges in your market. This gives you solid data to assess offers and make reasonable counterproposals.

- Create Competition: Having multiple intermediary options puts you in a stronger position. Let them know you're evaluating several partners.

- Highlight Long-Term Value: If you plan to do multiple deals, emphasize the potential for ongoing business. Many intermediaries will reduce current fees for future opportunities.

- Structure Fees Creatively: Consider proposing a lower base fee plus performance bonuses. This aligns incentives while reducing upfront costs.

Executing Successful Fee Negotiations

Beyond knowing your leverage points, these tactics help achieve better outcomes:

- Be Direct and Clear: Explain your fee expectations and reasoning upfront. This builds trust and keeps discussions focused.

- Stay Professional: Maintain respect and courtesy throughout talks. A positive approach leads to better deals.

- Document Everything: Get all agreed terms in writing, especially final fee structures. This prevents misunderstandings later.

Smart fee management makes a real difference to your returns over time. By understanding fee calculations and using these negotiation strategies effectively, you can secure more profitable deals while building strong industry relationships.

Measuring the True Impact on Investment Returns

When evaluating investment opportunities, it's essential to understand how acquisition fees affect your returns over time. Looking solely at upfront costs doesn't tell the full story. A thorough analysis needs to consider potential returns, calculate when investments break even, and determine if higher fees are justified by better results.

Modeling the Impact of Fees on Long-Term Returns

Let's compare two real estate investments - one with a 1% acquisition fee versus another at 3%. While lower fees seem better initially, the higher-fee option might provide access to better deals or properties with stronger growth potential.

Using a specific example: On $1 million properties, you'd pay $10,000 versus $30,000 in fees. However, if the higher-fee property grows 15% in five years while the lower-fee one only grows 8%, the extra upfront cost is recovered through better performance.

Calculating Break-Even Points and Evaluating Value

To assess if higher fees make sense, you need to find the break-even point - when increased returns offset the higher initial cost. In our example, this means determining how long it takes for better performance to make up the additional $20,000 in fees.

This requires creating detailed financial projections with different scenarios and time periods. By running the numbers across various growth rates and holding periods, you can identify when a higher-fee investment becomes more profitable.

Tools and Techniques for Informed Decision-Making

Several practical resources can help analyze acquisition fees:

- Spreadsheets: Build custom models to compare different fee structures and returns

- Financial Calculators: Use online tools to quickly find break-even points

- Investment Software: Access advanced modeling and analysis capabilities

Key best practices for evaluating fees include:

- Consult with Financial Advisors: Get expert guidance to make better-informed choices

- Compare Market Rates: Research typical fees in your area to ensure costs are reasonable

- Negotiate Terms: Discuss fee structures, especially for large investments or ongoing relationships

By carefully studying how acquisition fees impact total returns, you can make smarter decisions about which fee levels truly deliver value. Focus on long-term results, use appropriate analysis tools, and seek expert input to guide your investment choices.

Navigating Legal Requirements and Industry Standards

Both investors and sponsors need to understand the legal and industry standards that govern acquisition fees. This knowledge helps maintain compliance, safeguards interests, and builds trust in real estate syndication deals. Let's explore the key legal requirements, disclosure practices, and regulations that shape fee structures.

Compliance Requirements and Disclosure Standards

Being open about acquisition fees is essential. Complete fee disclosure isn't just best practice - it's often required by law. Sponsors must clearly explain what services the acquisition fee covers and its calculation method. Not disclosing fees properly can result in legal issues and harm your professional standing.

Homebase and similar platforms offer tools that help sponsors outline all deal-related fees clearly, making it easier to communicate costs to investors. This transparency helps create strong relationships between all parties.

Identifying Red Flags and Protecting Your Interests

Investors should know their rights when evaluating deals. Watch out for these warning signs:

- Fees that are much higher than market standards

- Missing documentation about included services

- Rushed decisions without full fee explanations

- Fees listed without detailed breakdowns

- Unclear answers about acquisition fee questions

Consider getting advice from a real estate attorney if something seems questionable.

Emerging Regulations Impacting Fee Structures

Rules around real estate syndication and acquisition fees change regularly. Staying current with these changes is key for maintaining compliance. Industry groups and legal experts can provide guidance on new trends and recommended practices.

Modern platforms simplify regulation tracking and help implement solid fee disclosure practices. Taking a proactive approach not only protects your business but also strengthens your reputation with investors.

Ensuring Fee Arrangements Meet Legal Requirements

Proper documentation and clear communication are essential for legal compliance. Use this checklist:

- Put all fee agreements in writing

- List every service covered by the acquisition fee

- Give investors complete fee structure details

- Keep thorough records of fee transactions

- Consult legal experts about compliance

When sponsors and investors follow these guidelines and focus on openness, they can handle acquisition fees confidently while keeping arrangements legal and ethical. This creates successful real estate syndications based on mutual trust and understanding.

Implementing Strategic Fee Management

Let's explore practical ways to manage acquisition fees effectively to boost your investment returns. Smart fee management isn't just about reducing costs - it's about ensuring you get real value for every dollar spent.

Optimizing Acquisition Fees for Maximum Return

The goal isn't to eliminate fees completely, but to find the sweet spot between costs and benefits. Here's a real example: paying a 1% fee might give you basic market access, while a 2% fee could open doors to off-market deals with better potential returns. The higher fee could be worth it if it leads to notably better investment opportunities.

Smart Fee Structures and Market Timing

Consider alternative fee arrangements that benefit both parties. Performance-based fees can align interests by tying compensation to investment success. This can reduce upfront costs while motivating intermediaries to deliver results.

Market timing also affects fees. During slower periods, you may have more room to negotiate better rates. Being aware of market conditions helps you time your investments for optimal fee structures.

Building Strong Industry Relationships

Developing good relationships with intermediaries pays off in multiple ways. When you establish yourself as a reliable investor who brings repeat business, you gain more power to negotiate better terms on future deals.

This creates a win-win situation. Your partners get steady business, while you secure improved fee arrangements based on your track record of successful deals.

Practical Steps for Fee Evaluation

Follow these key steps when analyzing acquisition fees:

- Research Local Market Rates: Know the typical fee ranges in your area and deal type

- Review Service Inclusions: Carefully check what services are covered by each fee

- Use Negotiation Leverage: Don't hesitate to discuss terms, especially for larger deals

- Calculate Long-Term Impact: Consider how fees affect your total returns over time

By taking a thoughtful approach to fee management, you can turn these costs into a strategic part of your investment plan. This helps optimize your returns while building valuable industry relationships.

Want to simplify your real estate syndication process? Homebase provides tools for fundraising, investor management, and clear fee tracking. Learn more about their platform today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Unlocking Your Deal's Value with Commercial Property Appraisal

Blog

A syndicator's guide to commercial property appraisal. Learn to decode reports, master valuation methods, and leverage findings for successful fundraising.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.