What is a Limited Partnership Agreement? Your Complete Guide

What is a Limited Partnership Agreement? Your Complete Guide

Discover what is a limited partnership agreement, its essential clauses, and how it works. Learn everything you need to know in our comprehensive guide.

Domingo Valadez

Jul 22, 2025

Blog

Think of a limited partnership agreement (LPA) as the foundational blueprint for a very specific type of business partnership. It's a legally binding contract that clearly lays out the ground rules for a venture that involves two distinct types of partners: General Partners (GPs) and Limited Partners (LPs).

The GPs are the hands-on managers, the ones steering the ship day-to-day. The LPs, on the other hand, are primarily financial backers. They provide the capital to get things moving but are shielded from daily operational duties and, crucially, from personal liability beyond their investment.

Decoding the Limited Partnership Agreement

Let's use an analogy. Imagine building a custom home. The General Partner is the master builder—they oversee the entire project, hire the subcontractors, make daily decisions, and are ultimately responsible for constructing the house. The Limited Partners are the investors who funded the project. They put up the money because they believe in the builder's vision and want to share in the profit when the house is sold, but they aren't swinging hammers or pouring concrete.

The LPA is the detailed architectural plan that everyone agrees on before the first shovel hits the dirt. It defines what the builder can do, how the investors' money will be used, and how everyone gets paid once the project is complete. This document is what prevents costly misunderstandings and ensures the entire venture is built on a solid legal and financial foundation.

Why This Agreement Is Not Just a Formality

You might wonder, can't we just shake on it? The short answer is no. Without a custom LPA, your partnership would automatically fall under a state's default partnership laws. These laws are incredibly generic and almost never suited for the nuanced world of real estate syndication or private equity funds.

An LPA allows you to create your own set of rules tailored specifically to your deal. This gives every partner a level of clarity and security that off-the-shelf state laws simply cannot provide. This is especially critical in investment scenarios where large sums of money and complex profit-sharing structures are involved.

This need for clear, modern agreements isn't just a local issue. It's a global one. For example, Japan's Ministry of Economy, Trade and Industry has been working to revise its model LPA to keep up with more than a decade of market changes. The goal is to lower negotiation costs and bring agreements in line with current standards.

A well-drafted LPA is the ultimate risk management tool. It anticipates potential conflicts over money, management, and exit strategies, and it provides a clear, pre-agreed path to resolve them before they can jeopardize the partnership.

Foundational Elements of a Strong LPA

At its heart, an LPA is all about creating a predictable and stable environment for the business to thrive. It accomplishes this by clearly defining several non-negotiable areas:

- Partner Roles and Responsibilities: It explicitly states what the General Partner is empowered to do (and what they can't do without approval), while cementing the passive, protected status of the Limited Partners.

- Economic Terms: This is the "money" section. It details capital contributions, the waterfall structure for how and when profits are distributed, and how any potential losses are allocated among the partners.

- Governance and Decision-Making: This outlines the GP's scope of authority and spells out any major decisions—like selling the asset or taking on significant new debt—that might require a vote or consent from the Limited Partners.

A great way to get a feel for what goes into these documents is by looking at the best templates for legal documents, which can illuminate the standard clauses and structures professionals use. This foundational knowledge is invaluable for anyone stepping into this kind of sophisticated business relationship.

To put it all together, the LPA serves several critical functions that hold the entire partnership structure in place.

Core Functions of a Limited Partnership Agreement

Ultimately, the Limited Partnership Agreement is far more than a legal formality; it's the operational and financial rulebook that allows General and Limited Partners to work together effectively toward a common goal.

Understanding General Partners vs. Limited Partners

At the heart of any limited partnership, you'll find two very different roles: the General Partner (GP) and the Limited Partner (LP). These aren't just job titles; they are distinct legal classifications. The limited partnership agreement is the document that draws the line in the sand, spelling out everyone's duties, rights, and—most critically—their liabilities. Without these clear boundaries, the whole deal can quickly fall apart.

A great way to think about it is like a professional theater production. The General Partner is the director. They’re running the show—casting the talent, managing rehearsals, overseeing set design, and making sure the curtain goes up on opening night. The director has total operational control and carries the weight of the production's success or failure on their shoulders.

The Limited Partners, on the other hand, are the financial backers. They’ve put up the money because they believe in the director’s vision and see the potential for a hit. Their job is simply to provide the capital, not to show up for rehearsals or give acting notes. Their financial risk is limited to what they put in; they can’t lose more than the cost of their "ticket."

The Active Role of the General Partner

The GP is the one in the driver's seat. As the active manager and decision-maker, they're responsible for bringing the business plan to life. This means managing the asset, keeping investors in the loop, and handling all the day-to-day administrative work.

But this hands-on involvement comes with a serious catch: unlimited liability. If the partnership racks up debts or gets hit with a lawsuit that its assets can't cover, the GP's personal wealth could be on the line. This is a high-stakes position, which is why GPs are compensated with fees and a larger slice of the profits. They're rewarded for taking on both the management headache and the immense financial risk.

The Passive Role of the Limited Partner

In stark contrast, Limited Partners are passive investors. Their one and only job is to provide capital for the venture. The biggest advantage for them is limited liability, a legal shield that is a cornerstone of the limited partnership agreement. This protection means their potential loss is capped strictly at the amount they invested.

A crucial function of the LPA is to maintain the "limited" status of the partners. If a Limited Partner becomes too involved in the management of the business, they risk being legally reclassified as a General Partner, thereby losing their liability protection.

This distinction is more than just a formality; it's the legal foundation of the entire partnership. As we've seen in business disputes from Texas to California, things get messy when these roles blur. An LPA acts as the official rulebook, preventing a passive investor from accidentally stepping into a management role and an active manager from overstepping their bounds. The success of the venture truly depends on each person playing their part exactly as it's written.

Key Clauses Your LPA Must Include

A limited partnership agreement is only as solid as the clauses within it. You can think of these clauses as the legal framework of your entire partnership—the support beams and foundation holding everything together. If one is weak or poorly written, the whole structure can wobble or even collapse when things get stressful.

To avoid that fate, it's crucial to understand the non-negotiable components that make up a strong LPA. These sections are the very heart of the contract, designed to head off the kind of arguments that can sink an otherwise successful venture. Let's dig into the clauses that every well-built agreement needs.

Capital Contributions and Calls

This is where it all begins: the money. This clause spells out, in black and white, who is putting in capital, exactly how much, and when that investment is due. It clearly states the initial contribution each limited partner must make to get in the game.

But a good LPA doesn't stop there. It also has to address the possibility of needing more money down the road through capital calls—when the General Partner requests additional funds from the investors. A rock-solid agreement will specify:

- The total capital commitment each LP is on the hook for over the entire life of the fund.

- The exact circumstances that allow a GP to make a capital call.

- The consequences for a partner who can't or won't meet a capital call, which could range from having their ownership stake diluted to forfeiting their interest entirely.

Profit and Loss Distributions

Let's be honest, this is the part of the agreement everyone reads first, and for good reason. It dictates how the profits (and, importantly, any losses) get carved up. Any fuzziness here is a direct invitation for future trouble.

A well-drafted distribution clause details the distribution waterfall—the precise order in which money is paid out to everyone. It’s rarely a simple even split. A typical structure might first return 100% of the LPs' initial investment, then pay them a "preferred return" (like an 8% annual return on their money), and only then split the remaining profits between the LPs and the GP.

When partnerships go sour, it's almost always about the money. A vague distribution clause leaves too much room for interpretation, and that uncertainty is what sparks conflict. Defining the exact mechanics of how profits are shared from the very beginning is the single most effective way to keep everyone aligned.

Management Duties and Powers

This section draws the lines of authority for the General Partner. It defines what they can do on their own and, just as critically, what requires approval from the Limited Partners. This is what gives the GP the green light to run the day-to-day show, execute the business plan, and make the decisions needed to keep the project on track.

At the same time, it acts as a vital check on that power. The clause will list "major decisions" that the GP can't make unilaterally, such as selling the property, refinancing the debt, or changing the core investment strategy. These actions typically require a majority vote from the LPs, giving them a say in the most critical moments of the investment.

These core clauses are the engine of your limited partnership agreement. They work in tandem to build a clear, predictable, and legally sound framework that protects everyone involved. Without them, you’re not really forming a partnership; you're just setting the stage for a messy and expensive dispute.

How LPAs Control Partnership Finances

Think of the limited partnership agreement as the financial blueprint for the entire deal. It’s the document that lays out, in no uncertain terms, how every dollar flows through the partnership. This isn't just a suggestion; it’s a legally binding rulebook that dictates who gets paid, when, and exactly how much. Honestly, getting this part right is probably the most critical function of the whole agreement.

At the heart of these financial mechanics is a concept known as the distribution waterfall. Imagine profits as water flowing down a series of tiered pools or buckets. The LPA defines the exact order in which these buckets get filled, ensuring everyone knows where they stand. This structure is designed to prevent arguments by leaving no room for interpretation when it's time to distribute the cash.

The Distribution Waterfall Explained

So, how does this waterfall actually work? Typically, the structure is set up to favor the limited partners first, since they're the ones putting up most of the cash. It ensures they get their initial investment back before the general partner starts seeing a significant share of the profits.

While the details can vary, here’s a common, simplified flow you'll see in many real estate deals:

- Return of Capital: The first bucket to fill is for the LPs. All profits are directed to them until they've received 100% of their original investment back. This is step one—making the investors whole for the risk they took.

- Preferred Return: Once the LPs have their capital back, the next stream of profits goes toward their "preferred return." You can think of this as a form of interest on their money. A common figure here is an 8% annualized return on their investment for the time it was tied up in the project.

- The Catch-Up: After the LPs have received their capital and preferred return, the General Partner often gets a "catch-up" distribution. This allows the GP to take a large chunk (sometimes all) of the profits until their share "catches up" to a specific ratio, like an 80/20 split.

- The Final Split: With everyone's initial needs met, any remaining profit is split between the general and limited partners. A typical arrangement might be 20% to the GP and 80% to the LPs, but this is all defined in the LPA.

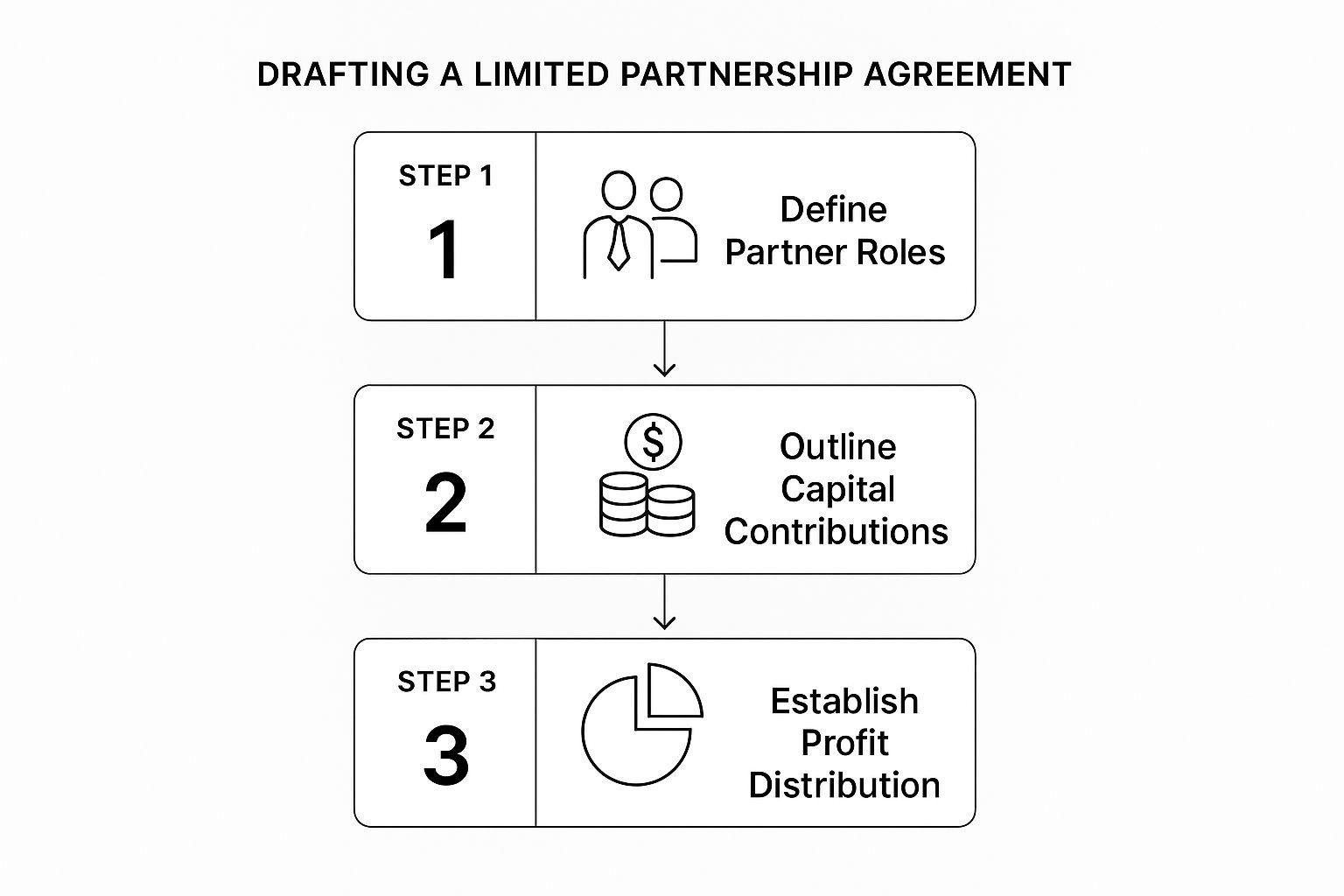

This image helps visualize how these crucial financial structures fit into the broader process of creating a solid agreement.

As you can see, defining roles and capital contributions sets the stage, but establishing how profits are shared is the final, critical piece of the puzzle.

Real World Financial Impact

These aren't just abstract terms; they have a direct and very real impact on every partner's bank account. For a tangible example, look at Global Partners LP’s Q1 2025 financial report. It clearly shows how the LPA’s rules dictated the allocation of income.

In that quarter, the general partner's share of net income was $4.4 million, while the preferred limited partners received $1.8 million. This is a perfect illustration of how these agreements translate from legal documents into actual dollars and cents on a balance sheet. For those interested, you can dive into their full financial results to see these mechanics in action.

LPAs in Real Estate and Venture Capital

A limited partnership agreement isn't just some dusty legal document; it's the operational playbook for some of the biggest investment games in town. To really get a feel for its importance, let's see how it works in two high-stakes worlds: real estate syndication and venture capital. These examples are perfect for showing how an LPA can manage complex deals and, just as importantly, keep everyone's interests aligned.

The Blueprint for Real Estate Syndication

Picture this: a group of people wants to buy a large apartment building. It’s a great opportunity, but none of them have the time or specialized knowledge to actually run the property. This is where real estate syndication comes in.

In this setup, a professional real estate operator—the General Partner (GP)—steps in. They pool money from the passive investors—our Limited Partners (LPs)—to acquire and manage the asset.

The LPA is the single most critical document in this entire arrangement. Think of it as the project's constitution. It gives the GP the green light to execute the business plan, whether that’s overseeing a major renovation, handling tenant issues, or eventually selling the building for a profit.

At the same time, it’s a shield for the LPs. It clearly draws the lines on the GP's authority and spells out exactly how and when investors get their original investment back, plus their share of the profits. If you're new to this world, understanding syndication in real estate is the best place to start.

This agreement dives into every financial detail imaginable, from the initial money each person puts in to the "distribution waterfall" that dictates the pecking order for payouts. It’s this level of detail that gives investors the confidence to hand over significant capital for a project they aren't managing day-to-day.

Structuring High-Risk Venture Capital Funds

Venture capital (VC) runs on a surprisingly similar track, just in a different arena. Here, a VC firm is the General Partner. They raise a large fund from Limited Partners, who might be anyone from university endowments and pension funds to wealthy individuals. Their goal isn't to buy one building but to build a portfolio of high-risk, high-reward startups.

The LPA for a VC fund is intensely detailed. It has to be. It lays out the rules for things like:

- The Fund's Lifespan: These are long-term plays, typically running for about 10 years.

- Management Fees: The GP collects an annual fee for their work, usually around 1.5% to 2.5% of the total fund size.

- Carried Interest: This is the big one. It's the GP's cut of the profits, usually 20%, but only after all the LPs have gotten their initial capital back, plus a pre-agreed-upon return.

Whether we're talking about a skyscraper or the next big tech startup, the LPA does the same fundamental job. It builds a legally binding bridge of trust between the hands-on manager and the passive investors who provide the fuel. It’s what lets the experts get to work while giving investors a clear and protected route to seeing a return.

For anyone diving into these high-stakes investments, doing your homework isn't just a good idea—it's essential. Using a comprehensive due diligence checklist is a smart way to make sure every financial, legal, and operational stone is turned over before any money changes hands.

What Does the Future Hold for Partnership Agreements?

A limited partnership agreement isn't a document you just sign and file away. Think of it less like a stone tablet and more like a living contract, one that has to breathe and adapt to the constant shifts in market trends, technology, and what investors expect. The classic, straightforward General Partner-Limited Partner relationship we’ve known for years is changing, and that means the agreements holding them together have to get smarter and more sophisticated to keep up.

The old power balance is definitely tilting. Limited partners are no longer content to be completely silent, passive money-providers. Today’s investors are savvy, well-informed, and they’re demanding a much higher level of transparency and involvement from the GPs managing their hard-earned capital. This fundamental shift is completely reshaping how these agreements are built from the very beginning.

The Growing Influence of Limited Partners

Look at any modern LPA, and you'll start seeing clauses that were once pretty rare. These new terms are designed to give LPs more oversight and better opportunities, fundamentally changing the feel of the partnership.

Here are a few of the biggest trends I’m seeing:

- Co-Investment Rights: It's becoming common for LPs to negotiate the right to invest directly into specific deals alongside the main fund. It's a huge win for them—they get to double down on the assets they're most excited about, often without paying the standard fund management and performance fees on that extra capital.

- Radical Transparency: Vague, once-a-quarter updates just don't cut it anymore. Investors expect detailed, frequent reports on how the fund is performing and how it's being managed. A good modern LPA will spell out exactly what metrics the GP needs to report and how often that communication has to happen.

- Meaningful Advisory Roles: LPs are pushing for real influence on advisory committees. This gives them a seat at the table for critical decisions, like navigating potential conflicts of interest or agreeing on how assets are valued.

This evolution is happening while investor confidence in private markets remains strong. Even with a recent dip in overall fundraising, a recent analysis showed that nearly 30% of limited partners are planning to put more money into private equity. The report also points out a fascinating trend: LPs are starting to invest in the GP management companies themselves, not just their funds. It's a clear move toward a more collaborative, intertwined future. You can dive deeper into these trends in the 2025 Global Private Markets Report.

The future of the limited partnership agreement is all about flexibility and shared goals. A rigid, old-school LPA is just going to create friction and missed opportunities in a market that rewards agility. The best agreements are the ones that build a strong foundation of trust but are flexible enough for the partnership to pivot when a great new opportunity comes along.

When you get right down to it, a forward-thinking LPA has to pull off a tricky balancing act. It needs to be a rock-solid, protective contract while also serving as a flexible blueprint for the future. Nailing that balance is what ensures a partnership can not only survive but truly thrive through whatever the economic landscape throws at it.

Frequently Asked Questions

Once you get past the definitions and see how these agreements work in the wild, a few practical questions always pop up. Let's tackle some of the most common ones about the flexibility, risks, and protections built into a limited partnership agreement.

Can a Limited Partnership Agreement Be Changed?

Yes, an LPA can definitely be changed, but it’s not something you do on a whim. The process is tightly controlled by the "Amendments" clause baked right into the original document—a critical protection for everyone involved, especially the investors.

Making a change usually requires a formal vote. Depending on what the agreement says, you might need a simple majority or even a supermajority of the limited partners to sign off. This is a crucial safeguard that stops a general partner from changing the rules of the game halfway through in a way that might hurt the investors' interests. It ensures any major pivot has the backing of the people who put up the capital.

What Happens If There Is No Limited Partnership Agreement?

Operating without a signed, written limited partnership agreement is like navigating a minefield blindfolded. It's incredibly risky. If you don't have an LPA, your partnership automatically defaults to the generic partnership laws of whatever state you're operating in.

Those state laws are one-size-fits-all, and they almost never fit a specific real estate deal. They leave huge gray areas around how profits are split, who’s liable for what, and who really has the authority to make decisions. This ambiguity is a recipe for expensive, time-consuming legal battles down the road.

The absence of an LPA doesn't mean there are no rules; it just means you're stuck with a set of generic ones that probably don't reflect what anyone actually intended. A proper agreement is the only way to make sure the deal runs the way everyone agreed it would from the start.

Is a Limited Partner Liable for the Partnership's Debts?

Generally, no. This is the main appeal of the limited partner structure. A core purpose of defining what is a limited partnership agreement is to formally establish limited liability for the LPs.

What this means in practice is that a limited partner’s financial risk is capped. The most they can lose is the amount of money they invested. Their personal assets—their house, their savings, their other investments—are protected from the partnership's debts or any lawsuits against it.

But this protection isn't absolute. An LP can lose this shield if they start acting like a general partner by getting too involved in managing the day-to-day business. The courts could reclassify them as a general partner, instantly exposing them to unlimited personal liability.

Ready to stop juggling spreadsheets and start scaling your real estate portfolio? Homebase provides an all-in-one platform to manage your deals, investors, and fundraising seamlessly. Learn how you can streamline your entire syndication process by visiting the Homebase website.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

The Ultimate Rent Roll Sample Guide for Real Estate Investors

Blog

Unlock property performance with our rent roll sample. Learn to analyze deals, verify income, and master real estate syndication with our expert guide.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.