Blue Sky Filing Guide for Real Estate Deals

Blue Sky Filing Guide for Real Estate Deals

Learn how blue sky filing helps syndicators navigate securities laws easily. Streamline compliance and protect your investments efficiently.

Domingo Valadez

Jul 24, 2025

Blog

Think of your SEC exemption as a national passport allowing you to raise capital. A blue sky filing, on the other hand, is the specific visa you need for each and every state where you have an investor. It’s a crucial state-level registration for any securities offering, and that absolutely includes real estate syndications.

What Is Blue Sky Filing in Real Estate Syndication?

When you're out raising capital for a new real estate deal, you're playing in two sandboxes at once: federal and state. While the SEC sets the broad federal framework for your offering (think Regulation D), each state has its own rulebook to protect its residents from questionable investments. These state-level rules are what we call blue sky laws.

At its heart, a blue sky filing is simply you telling a state, "Hey, I'm offering securities to one or more of your residents." This notification gives state regulators the transparency and oversight they need. For syndicators, effectively managing investor interest from the get-go, perhaps even using tools like a real estate investment inquiry form template, is the first step in a process that ultimately leads to these compliance filings.

The Origin of the Term

The name "blue sky" itself paints a perfect picture. It traces back to a court case in the early 1900s, where a judge described certain investment schemes as having "no more basis than so many feet of blue sky." That’s exactly what these laws are designed to prevent—deals built on nothing but air. They ensure your investors get the full, unvarnished truth about the offering.

Key Takeaway: Don't mistake blue sky laws for a simple box-ticking exercise. They are a serious layer of investor protection that works in tandem with federal SEC rules, adding essential, state-specific compliance hurdles to every real estate syndication.

Components of a Typical Filing

While the specifics can shift from one state to the next, a standard blue sky filing for a syndicator using a popular exemption like Rule 506(b) or 506(c) will almost always have these three parts:

- A Notice Filing: This is where you submit a copy of the same Form D you file with the SEC. It’s your official heads-up to the state about your capital raise.

- Consent to Service of Process: This is a legal form (usually a Form U-2) that appoints a state official as your stand-in to receive any legal paperwork. In plain English, it means if an investor from that state needs to sue you, they can do it on their home turf.

- A Filing Fee: Every state charges for this. The cost can be pretty minor or run into hundreds of dollars, depending on the state and sometimes the size of your offering.

Skipping these filings is a rookie mistake with serious consequences, potentially putting you and your entire deal in jeopardy. Getting your state-level compliance right isn't just a good idea—it's fundamental to raising capital legally and safely. For a more detailed breakdown, you can check out our guide on https://www.homebasecre.com/posts/blue-sky-filings.

The Real Risks of Ignoring State Compliance

It's tempting to see a blue sky filing as just another piece of administrative busywork. Many syndicators do, and they pay the price. Treating these state-level requirements as optional is a gamble you can’t afford to take. It's not a minor slip-up; it's a critical mistake that can put your entire syndication business in serious legal and financial jeopardy.

The consequences aren't some far-off legal theory. They are very real risks that can completely derail a great deal and stain your reputation, making it much harder to raise capital down the road. Getting your compliance right from the start isn’t just about checking a box—it’s about building a foundation of trust with your investors and securing the future of your business.

Steep Financial Penalties

The most immediate and obvious risk of getting this wrong is the financial hit. State securities regulators don’t mess around. They have the power to slap syndicators with significant fines for failing to file correctly and on time. And these aren't just wrist slaps.

Missing a filing deadline can trigger penalties that vary from state to state but can easily climb into the tens or even hundreds of thousands of dollars. A once-profitable deal can quickly turn into a massive financial liability. You can explore further insights on why timely filings are imperative to see just how severe these financial risks can be.

The Specter of Investor Rescission

This is the one that should keep you up at night: investor rescission rights. It’s a legal term with terrifying implications. If you fail to file in a state where one of your investors lives, that investor could gain the legal right to demand their entire investment back, plus interest—no matter how well the deal is performing.

Let that sink in. Imagine you've closed on a great apartment complex and are halfway through the value-add plan. Then you get a letter from an attorney. You discover you missed the 15-day filing window in the state where a major LP resides. That investor can now legally force you to unwind their investment and return their capital. This one oversight could create a sudden cash-flow crisis, forcing you to scramble for replacement capital or, in a worst-case scenario, sell the property at a fire-sale price.

Crucial Insight: Rescission rights give disgruntled investors incredible leverage. An investor who is unhappy for any reason—even a minor one—can use a missed filing as a get-out-of-jail-free card, leaving you holding the bag.

The Long Shadow of Reputational Damage

The fallout from a compliance failure doesn't just stop with one deal. The world of real estate syndication is surprisingly small, and word gets around fast. News of regulatory fines, investor lawsuits, or forced rescissions can permanently tarnish your name.

Once your reputation is damaged, raising capital for your next deal becomes exponentially more difficult. Sophisticated investors do their homework, and a history of compliance problems is a giant red flag. This can lead to a cascade of problems:

- Difficulty attracting new investors: Why would they partner with a sponsor who has a documented history of cutting corners?

- Strained relationships with current partners: The trust you worked so hard to build is gone, making them unlikely to reinvest.

- Increased scrutiny from lenders and brokers: They'll start seeing you as a higher-risk operator, which can affect your deal flow and financing terms.

In this business, your reputation is everything. Protecting it starts with treating every single blue sky filing with the seriousness it deserves.

How To Navigate The State Filing Labyrinth

Once you understand that blue sky compliance is a must-do, not a maybe, the practical questions start flooding in. "Okay, so what do I actually have to do?" This is where you enter the state filing labyrinth. Imagine a system where all 50 states act as their own regulatory kingdoms, each with a unique set of rules, deadlines, and fees. It can feel overwhelming, but it's entirely manageable with the right approach.

For most real estate syndicators using a Regulation D exemption, the path forward is a notice filing. This isn’t a full-blown registration where the state pores over every detail of your deal's merits. Instead, it’s a much simpler process. You're basically just giving the state a heads-up that you're raising capital from its residents.

This streamlined process came about thanks to the National Securities Markets Improvement Act of 1996 (NSMIA). The act stopped states from requiring hefty registrations for certain securities, including those under Rule 506. But, it left them with the power to require a notice filing, a consent to service of process, and, of course, a fee.

Assembling Your Blue Sky Filing Toolkit

Before you even think about filing, you need to get your documents in order. Think of it like packing for a trip—having everything ready beforehand saves a lot of headaches. While some states have their own little quirks, the core toolkit is pretty consistent.

Your typical filing package will include:

- A copy of your federal Form D: This is the heart of your filing. It's the exact same document you file with the SEC that outlines the details of your offering.

- The state-specific cover letter or form: Many states have their own unique form or required cover letter that must go with the Form D. This is a common tripwire where costly mistakes are made.

- A Form U-2 (Uniform Consent to Service of Process): This is a legal document that appoints a state official as your agent for legal matters. It makes it easier for your investors to take legal action if they ever need to.

- The filing fee: There's no getting around this one. Fees vary wildly, from less than $100 to over $1,000, and they have to be paid correctly.

Juggling these moving parts for every state where you have an investor gets complicated fast. For more perspective on navigating these kinds of regulatory waters, a key compliance guide for exempt reporting advisers can offer some valuable insights.

The Critical Element Of Timing

If there’s one thing to get right in the state filing labyrinth, it's the deadline. This isn’t a one-size-fits-all situation. Missing a deadline can have the same severe consequences as not filing at all—including giving investors the right to demand their money back.

Syndicators typically face two main timing requirements:

- Post-Sale Filing: This is the most common scenario. Many states, mirroring the federal rule for Form D, give you a 15-day windowafter the first sale to an investor in that state.

- Pre-Sale Filing: This one is stricter and more dangerous. A handful of states require you to complete your blue sky filingbefore you can accept any money or even make your first formal offer to an investor there.

Warning: Confusing a pre-sale state with a post-sale state is a classic syndicator mistake. Taking a check from a Florida investor before your Florida filing is complete, for instance, is a direct violation that could jeopardize your entire offering.

State-By-State Variations: A Quick Look

To give you a real sense of how different the rules can be, let's look at the requirements in a few key states. This isn't legal advice, but it does highlight the diverse landscape you need to prepare for.

The table below offers a glimpse into how a few popular states for real estate investment handle their filings.

Sample Blue Sky Filing Requirements for Reg D Offerings

As you can see, trying to use a "standard" approach for blue sky filings is a recipe for trouble. Every state demands its own focused attention. Taking the time to understand each one's specific rules is what keeps you compliant and ensures your deal stays on solid ground.

Your Step-By-Step Blue Sky Filing Workflow

Tackling your first blue sky filing can feel a bit like trying to navigate a new city without a map. It seems intimidating. But once you get the lay of the land, you'll find it's a straightforward process you can repeat for every single deal. Developing a solid workflow isn't just about checking a legal box; it’s about building a professional, scalable syndication business.

Let's break it down into four simple, manageable stages. This approach takes the guesswork out of the equation and ensures nothing critical gets missed, whether you have investors in one state or twenty.

Step 1: Pinpoint Your States

First things first: before you even think about accepting an investor's money, you need to know where they live. This is non-negotiable. An investor’s state of residence is the trigger that determines which set of rules you have to play by.

Get a simple spreadsheet going and list every single prospective investor and their home state. This document becomes your compliance roadmap. It literally tells you where you need to file. Trying to figure this out after you've already closed on funds is a classic rookie mistake that leads to headaches and potential violations.

Step 2: Assemble Your Documents

Okay, you've got your list of states. Now it's time to gather your paperwork. Think of this as getting all your ingredients prepped before you start cooking—it makes the actual filing process so much faster and smoother.

For a standard notice filing, you'll need a core package of documents. Your kit should generally include:

- A completed SEC Form D: This is the same federal form you're already filing, outlining the specifics of your offering.

- The state-specific cover letter or form: Don't assume the Form D is enough on its own. Many states require their own unique form to go with it.

- A signed Form U-2 (Consent to Service of Process): This is a legal form that essentially lets a state official accept legal notices for you in that state.

- Your private placement memorandum (PPM): While you might not need to submit it with the initial notice, some states will ask for it later. It's best to just have it ready to go.

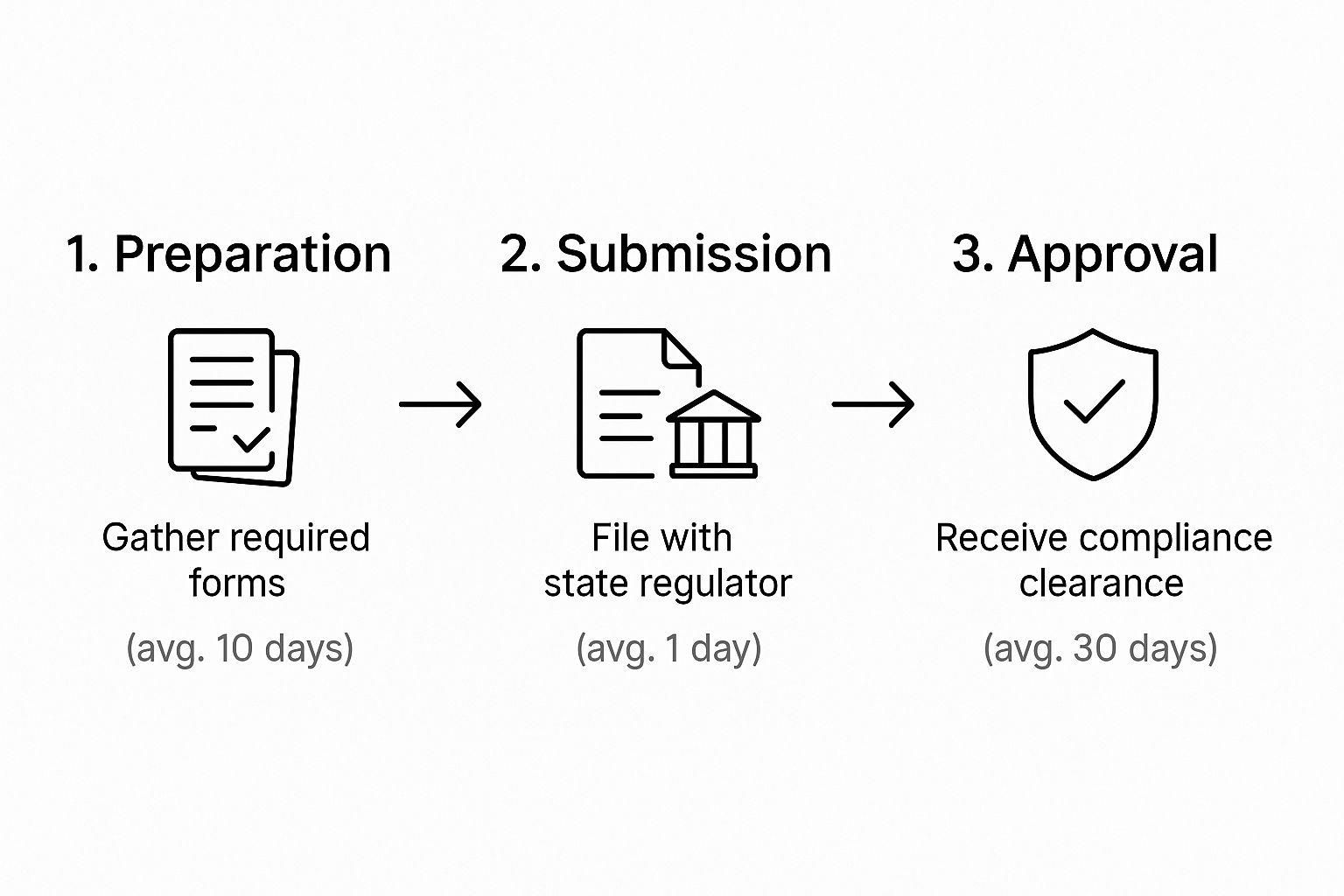

This infographic gives you a good visual of the typical timeline.

As you can see, the actual submission might be quick, but the real work is in the prep.

Step 3: Execute The Filing

With your documents in order, you're ready to submit them to the state regulators. You've got two main ways to get this done, and the right choice often depends on the state you're dealing with.

The old-school method is sending physical copies by certified mail. This gives you a tangible paper trail and proof of delivery, which is great for your records. The more modern route is the Electronic Filing Depository (EFD), an online portal run by the North American Securities Administrators Association (NASAA). The EFD is a lifesaver for filing in multiple states at once, but be aware—not every state uses it. You'll have to double-check which system each state requires.

Pro Tip: Even if you file online through the EFD, save PDF copies of your submission confirmation and payment receipts. The goal is to build an ironclad record of your compliance activities.

Step 4: Confirm and Organize

Don't celebrate just yet. Hitting "submit" or mailing the envelope isn't the finish line. This final step is what separates the pros from the amateurs: confirming receipt and meticulously organizing your records.

Follow up with the state securities office to get an official confirmation that your filing was accepted. This could be a stamped copy of your form mailed back to you, an email confirmation, or a reference number from the EFD system. Whatever form it takes, save it.

Create a dedicated compliance folder for each deal and, within it, create subfolders for each state. This is where you'll store digital copies of every form you submitted, your proof of payment, and any and all communication with the regulators. Trust me, if you ever face an audit, this level of organization will be an absolute godsend.

Taming the Compliance Beast with Modern Tools

If you're a real estate syndicator with investors in different states, you know the drill. The old way of handling blue sky compliance feels like a high-stakes juggling act. You’re wrestling with spreadsheets, trying to track a dizzying mix of filing deadlines, constantly changing forms, and unique state rules. This isn't just inefficient—it's practically asking for a mistake. A single slip-up, like a missed deadline or the wrong form, can trigger those serious consequences we've talked about, from painful fines to having to offer investors their money back.

It’s time for a change. Shifting from a reactive, paper-chasing system to a proactive, tech-driven one isn't just an upgrade; it’s a fundamental business necessity. The right tools can transform what was once a massive administrative headache into a smooth, almost automated process.

It’s Time to Ditch the Spreadsheets

Let's be honest: spreadsheets were never built for this. Thankfully, specialized platforms and services now exist that are designed specifically to tackle the tangled web of a multi-state blue sky filing strategy. Instead of spending your nights and weekends digging through state websites, these tools do the heavy lifting for you. They become your central command center for all things compliance.

This technology takes over the entire workflow, from creating the right paperwork for each state to handling electronic submissions through the Electronic Filing Depository (EFD). This shift frees you up to do what you're actually good at—finding great deals and building strong investor relationships, not getting buried in administrative quicksand.

Key Insight: The real game-changer with modern compliance tools is centralization. Your data is no longer scattered across random spreadsheets, email threads, and file folders. Instead, you get a single, clear dashboard showing your compliance status for every deal and every investor, whenever you need it.

The Real Power of Automation in Compliance

Moving to a tech-first approach for your blue sky filings delivers tangible results almost immediately. Automation tackles the most common points of failure in the manual process head-on.

Here’s what that looks like in practice:

- Human Error Vanishes: Automated systems fill out forms, track your deadlines, and make sure the correct documents go to the right regulators. The risk of those small but costly mistakes plummets.

- Hours of Your Time Back: What used to take hours of tedious research and paperwork can now be done in minutes. This frees up you or your team for high-value work.

- A Perfect Audit Trail: Every filing, every confirmation, and every piece of communication is stored in one secure, easy-to-find place. If regulators ever come knocking, you're ready.

New technologies like Robotic Process Automation for compliance and regulatory reporting show just how much efficiency is on the table. These systems are purpose-built to handle the kind of repetitive, detail-obsessed work that compliance demands.

How a Platform Like Homebase Changes Everything

This is where a platform like Homebase comes into play. It integrates compliance right into the workflow you already use for raising capital and managing investors. As soon as an investor commits to your deal through the portal, the system instantly identifies the necessary blue sky filing requirements based on that investor's home state.

Think about the broader securities world for a moment. With over 16,000 securities in the OTC equity universe alone, the scale of tracking compliance is staggering. To solve this, data providers have built sophisticated services that pull information from multiple official sources to create reliable, up-to-date exemption data. This automates the incredibly error-prone job of cross-referencing different state laws. You can discover more insights about simplifying blue sky data compliance to see how this trend is playing out across the market.

A platform like Homebase puts that same power right at your fingertips. It can automatically generate the forms you need, keep an eye on your filing deadlines, and give you a clear, at-a-glance view of your compliance health. This transforms compliance from a scattered, high-anxiety task into a seamless, low-stress part of running your syndication business.

Common Filing Mistakes and How to Avoid Them

When it comes to securities compliance, you want to learn from other people's mistakes. Trust me, it's a whole lot cheaper than making them yourself. A single slip-up in your blue sky filing can put your entire deal at risk, opening the door to investor lawsuits and some pretty serious penalties. The best defense is knowing where others have gone wrong.

Most of these blunders aren't caused by some grand, complex scheme—they're usually the result of a bad assumption or a small oversight. But their consequences can be huge. By getting familiar with these common pitfalls, you can build a rock-solid compliance process that protects your deals and your reputation.

Missing a Pre-Sale Filing Deadline

This is one of the easiest—and most dangerous—mistakes a syndicator can make. While a lot of states give you a 15-day grace period after your first sale to get your filing in, a few key states are much stricter. States like Florida and New York, for instance, require a pre-sale or pre-offer filing.

What does that mean? It means your paperwork has to be filed and accepted by the state regulator before you can legally take a single dollar from an investor in that state. Cashing a check from a Florida investor even one day before your filing is confirmed is a clear violation.

How to avoid it:

Think of your states like a traffic light system.

* Red Light States: These are your pre-sale states. You hit the brakes and don't accept any funds until you have a confirmed filing.

* Yellow Light States: These are your post-sale states. You can proceed with accepting funds, but be careful—the 15-day clock starts ticking the second you do.

* Green Light States: This is your goal. You're good to go only after the filing for that state is confirmed and you have the proof in your records.

Assuming All State Rules Are the Same

Thinking that every state's blue sky laws are interchangeable is a classic rookie mistake, and it's a recipe for disaster. You might find one state just needs a copy of your Form D and a check, but then you'll run into Texas, which demands its own specific state form on top of everything else. And don't even get started on New York—its requirements are in a league of their own.

Crucial Insight: Every state is its own regulatory kingdom. The second you get an investor from a new state, you have to operate as if you know nothing. Assume its rules are unique and do your homework from scratch. Don't ever rely on what you did for your last deal or for a different state.

This assumption is what leads to rejected filings, incomplete submissions, and a frantic scramble to get the right documents in before your deadline blows past.

Accepting Funds Before a Filing Is Complete

This one is a close cousin to missing a pre-sale deadline, but it’s a risk in every state. Even in a post-sale state, the act of accepting funds is the trigger. That's what starts the clock on your filing requirement. The problem pops up when syndicators cash the check but then put the actual blue sky filing on the back burner.

This creates a dangerous gap in your compliance. If that 15-day window slams shut before you file, you’re officially non-compliant.

How to avoid it:

Make this your golden rule: the check and the filing go together. As soon as an investor's subscription agreement is signed and their funds have cleared, your team or attorney needs to get the filing for that investor's state done. Immediately. Don't batch them to "get to later."

Keeping Inadequate or Disorganized Records

Your compliance job isn't over when you click "submit" or drop a check in the mail. It's done when you have definitive, organized proof that your filing was accepted. If an auditor ever comes knocking—or worse, a disgruntled investor—the burden is on you to prove you did everything by the book.

"I'm pretty sure we filed it" is not a legal defense. You need a clean, easy-to-follow paper trail.

How to avoid it:

For every single deal, you need a master compliance folder. Inside that folder, create a subfolder for each state where you have an investor. Each of those state folders must contain:

* A PDF of the exact forms you submitted.

* Proof of payment (the portal receipt or a copy of the cashed check).

* The confirmation of acceptance from the state (an email, a stamped form, a confirmation number).

This kind of meticulous record-keeping isn't just busywork. It's your ultimate insurance policy and the mark of a truly professional syndicator.

Your Blue Sky Filing Questions Answered

Even after you’ve got the basics down, the real world of real estate syndication loves to throw a few curveballs. Let's tackle some of the nitty-gritty questions that I see pop up all the time from syndicators navigating their first few deals.

What If an Investor Moves States?

This is a classic, and a great question. The short answer is that your filing obligation is locked in at the time of the sale.

If your investor lives in Texas when they sign the subscription agreement and wire the funds, you file in Texas. Simple as that. If they pack up and move to Colorado a year later, you don’t need to go back and file in Colorado for that original investment. The deal is already done.

Now, if you launch a new offering and that same investor wants in from their new home in Colorado, the clock resets. For that new deal, you’d absolutely need to follow Colorado’s blue sky rules. It always comes down to where the investor is when they make the investment decision.

Do I Need to File If an Investor Uses an LLC?

Yes, you almost always do. State regulators are savvy; they look past the paperwork to see where the actual decision-maker is located.

So, if an investor uses their shiny new Wyoming LLC to invest but they’re sitting at their desk in California making the call, you’re filing in California. The regulators are focused on protecting the resident of their state, regardless of the legal entity they use.

Guideline: A good rule of thumb is to follow the "mind and management" of the investment. Where does the person controlling the money live and work? When in doubt, this is a perfect question for your attorney, but thinking about the person, not the LLC, will point you in the right direction.

How Do Annual Renewals Work?

Here’s some good news. For most syndicators using a Rule 506 exemption, the blue sky filing is a one-and-done notice. You make the filing after the first sale in a given state, and you're all set for that specific offering.

However—and this is a big "however"—it’s not a universal rule. Some states or certain types of offerings, particularly those that are continuously raising capital, might require you to file an annual renewal and pay another fee. It's incredibly easy to forget these trailing obligations, but the penalties are just as severe as failing to file in the first place. This is where having a system to track these details becomes critical.

Ready to stop chasing paperwork and start focusing on deals? Homebase provides an all-in-one platform that automates your blue sky compliance, manages investor relations, and simplifies your entire fundraising process. Learn how Homebase can help you scale your syndication business today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.