What Is a Deal Room? Essential Guide for Secure Transactions

What Is a Deal Room? Essential Guide for Secure Transactions

Wondering what is a deal room? Discover how this vital tool streamlines and secures high-stakes M&A and real estate deals. Learn more now!

Domingo Valadez

Oct 15, 2025

Blog

So, what exactly is a deal room? You might hear it called a Virtual Data Room (VDR), but don't let the jargon intimidate you. At its core, a deal room is a highly secure, private online space where you can manage all the sensitive documents that come with a major business transaction.

Think of it as a digital bank vault, but one that’s also a sophisticated project management hub. It’s designed specifically to make complex processes like fundraising or real estate syndication run smoothly by giving everyone involved a single, reliable source of information.

What a Deal Room Looks Like in the Real World

Picture this: you're trying to close a multi-million dollar real estate deal. Your inbox is overflowing with email threads, you've got documents scattered across a dozen different shared folders, and there's a stack of physical papers on your desk. It’s messy, wildly insecure, and a massive headache waiting to happen. This is exactly the problem a modern deal room solves.

Instead of shooting confidential files back and forth over email, you invite all the key players—your investors, lawyers, accountants, and partners—into one centralized, professional environment. From there, you control exactly who sees what.

This digital-first approach isn't just a trend; it's quickly becoming the standard. The global Virtual Data Room market was valued at around $2.9 billion in 2024 and is expected to hit $7.6 billion by 2033. That explosive growth shows just how essential these platforms have become. You can dive deeper into the VDR market's growth to see how this shift is reshaping business deals.

The Three Pillars of a Deal Room

When you strip it all down, a deal room is built to do three critical things that your standard file-sharing service just can't handle:

- Ironclad Security: This is its bread and butter. Deal rooms use heavy-duty security measures like data encryption, dynamic watermarking (which stamps a user's name across documents), and incredibly detailed access controls. You get to decide—down to the individual file—who can view, print, or download anything.

- Accelerated Due Diligence: By putting all the necessary documents in one organized place, the deal room makes the due diligence process incredibly efficient. Investors can log in and review financials, legal agreements, and property reports without having to chase you for files. Many platforms even have built-in Q&A tools to keep all communication in one spot.

- Total Compliance and Auditability: Every single action taken inside the deal room is tracked and logged. Who logged in? What did they look at? How long did they view it? This creates a permanent audit trail, which is crucial for meeting regulatory requirements and heading off any potential disputes down the road.

To give you a quick snapshot, here’s how the core functions of a deal room translate into tangible benefits for your real estate syndication.

Deal Room at a Glance

Ultimately, a deal room gives you the control and professionalism you need to manage a high-stakes transaction effectively.

The primary job of a deal room is to create a single, controlled source of truth. It ensures everyone—from the general partner to the limited partner—is working from the same playbook, fostering trust and transparency throughout the transaction lifecycle. This organized approach minimizes risk and helps deals close faster.

Exploring the Core Features of a Deal Room

Sure, you could just dump all your deal documents into a shared drive, but that’s a bit like leaving confidential blueprints on a coffee shop table. A real deal room is something else entirely. It’s a purpose-built command center for your real estate transaction, loaded with specialized tools for security, control, and efficiency that basic cloud storage simply can't touch.

Think of it this way: a shared drive is a public library shelf. A deal room is a Swiss bank vault with armed guards, biometric scanners, and a detailed log of everyone who comes and goes.

Granular Access Controls and Permissions

The absolute cornerstone of any serious deal room is granular access control. We're not just talking about sending a shareable link. This is about dictating exactly what each person can do once they're inside. You can set permissions for individual users or entire groups, controlling who can view, download, or print specific files or folders.

For instance, you could let a potential investor view your financial projections but block them from downloading or printing the sensitive numbers. Meanwhile, your legal team gets full access to edit and manage the partnership agreements. This kind of surgical control is impossible with your standard file-sharing app and is non-negotiable for protecting your deal's integrity.

Advanced Security Protocols

Security in a deal room goes way beyond a simple password. These platforms are built like digital fortresses, employing multiple layers of protection to guard your information.

- Dynamic Watermarking: This is a game-changer. When a user opens a document, the platform can automatically stamp it with their name, email, and the time they viewed it. If that document ever leaks, you know exactly who to thank. It’s a powerful deterrent to unauthorized sharing.

- 256-bit Encryption: Your data is locked down with 256-bit encryption, both when it’s sitting on the server (at rest) and when it’s being sent over the internet (in transit). This is the same level of security used by major banks.

- Secure Viewer: Many platforms even have built-in viewers that can block users from taking screenshots of sensitive documents, adding yet another layer of defense against data leakage.

This screenshot gives you a feel for a typical deal room interface. Notice the clean, organized folder structure and user management tools—this setup is crucial for keeping the due diligence process moving smoothly and securely.

Comprehensive Audit Trails and Reporting

A deal room is like having a security camera watching every move. It meticulously tracks every single action, creating a permanent audit trail. You can see precisely who looked at what, when they opened it, and even how long they spent on each page.

This isn't just for paranoia's sake; it's incredibly valuable business intelligence. You can quickly see which investors are genuinely digging into the details and which ones are just kicking the tires, helping you focus your energy where it counts.

This detailed, unchangeable record is also a lifesaver for compliance. It gives you a complete history of the due diligence process, which can be critical for heading off potential legal issues down the road. Effectively organizing this mountain of data is key, and you can learn a lot from general knowledge base best practices.

Integrated Q&A and Communication Tools

Say goodbye to messy, insecure email chains where questions and answers get lost. Modern deal rooms include a built-in Q&A module that centralizes all communication.

Investors can submit their questions right on the platform. You can then answer them in a structured way, and if it's a common question, you can even publish the answer to an FAQ for everyone to see. This not only saves you from repeating yourself but also keeps the entire conversation in one secure, organized, and auditable place.

Unlocking the Strategic Advantages of Deal Rooms

It's easy to think of a deal room as just a fancy, secure folder. But that's missing the point entirely. A good deal room is less of a storage unit and more of a strategic asset—a command center that fundamentally changes how you manage high-stakes transactions. It's not just another line item on an expense report; it's a direct investment in faster closings, lower risk, and greater investor confidence.

When you see it as the nerve center for your entire deal, you start to understand its real power. It actively drives the process forward, ensuring everything runs smoother from the first handshake to the final signature.

Accelerate Due Diligence Timelines

One of the first things you'll notice is how dramatically a deal room can speed up due diligence. Think about the old way: endless email chains, confusing attachment names like Contract_v4_final_FINAL.docx, and constant back-and-forth trying to find a single document. A deal room kills that chaos.

By putting everything—financials, legal docs, property reports, investor questionnaires—in one organized place, you eliminate all that administrative drag. Investors and their teams can log in whenever they want, from anywhere in the world, and find exactly what they're looking for. This self-service approach keeps the deal moving without you having to play document traffic controller. A process that used to burn weeks of your time can now be wrapped up in a matter of days.

Fortify Data Security and Minimize Risk

In any major real estate transaction, your confidential information is gold. A deal room is the digital equivalent of Fort Knox, built to protect your most sensitive data from leaks, breaches, or simply falling into the wrong hands. Security isn't an afterthought; it’s the entire point.

Think of it this way: a deal room is your insurance policy against costly mistakes. Research consistently shows that 70-90% of mergers and acquisitions fail to meet their objectives, often due to issues that could have been identified with better data control and due diligence.

Advanced features like dynamic watermarking and fine-tuned user permissions mean you're always in control. Even if someone downloads a document, it's tracked and traced back to them. This level of security is crucial for protecting your deal's integrity and your own competitive edge.

Simplify Compliance and Foster Trust

A deal room creates a rock-solid foundation of transparency and trust. Every single action—every view, download, and comment—is logged in a permanent, unchangeable audit trail. This gives you a complete history of the due diligence process, which is invaluable for regulatory compliance and serves as a powerful defense if any disputes arise down the road.

But this transparency does more than just cover your bases legally. It sends a powerful message to your investors. When they see a well-organized, secure, and professional process, their confidence in you and the deal skyrockets. That trust is often the secret ingredient that gets a complicated deal across the finish line. In the end, a deal room doesn't just manage documents—it manages relationships.

How Deal Rooms Actually Work in Big-Money Deals

It’s one thing to talk about features and security protocols, but where a deal room really proves its worth is in the trenches of a high-stakes transaction. To see what I mean, let's step away from the abstract and look at two very different, yet equally demanding, scenarios: a chaotic merger and acquisition (M&A) deal and a precision-focused real estate syndication.

These examples show that a deal room is so much more than a glorified Dropbox folder. It’s the central nervous system that keeps a complex transaction alive and moving forward, providing the structure and control needed to survive the gauntlet of due diligence and investor scrutiny.

The M&A War Room

In the world of mergers and acquisitions, the deal room is the digital equivalent of a war room. This is where the future of entire companies is negotiated, and the sheer volume of sensitive documents is staggering. We're talking about everything from confidential financial statements and intellectual property blueprints to key employee contracts and private customer lists.

All this information has to be shared securely among a swarm of people—buyers, sellers, lawyers, accountants, and investment bankers. With the global M&A market projected to hit around $2.41 trillion USD in 2025, the need for a bulletproof system is obvious. Deal rooms have become indispensable, creating a single, secure hub for everyone involved. You can get a better sense of the sheer scale of these transactions by exploring key figures and trends in the global M&A market.

Think of the M&A deal room as the 'single source of truth.' It stops critical information from getting buried in endless email threads and, more importantly, gives the seller granular control over who sees what. This dramatically cuts the risk of a catastrophic data leak during tense negotiations.

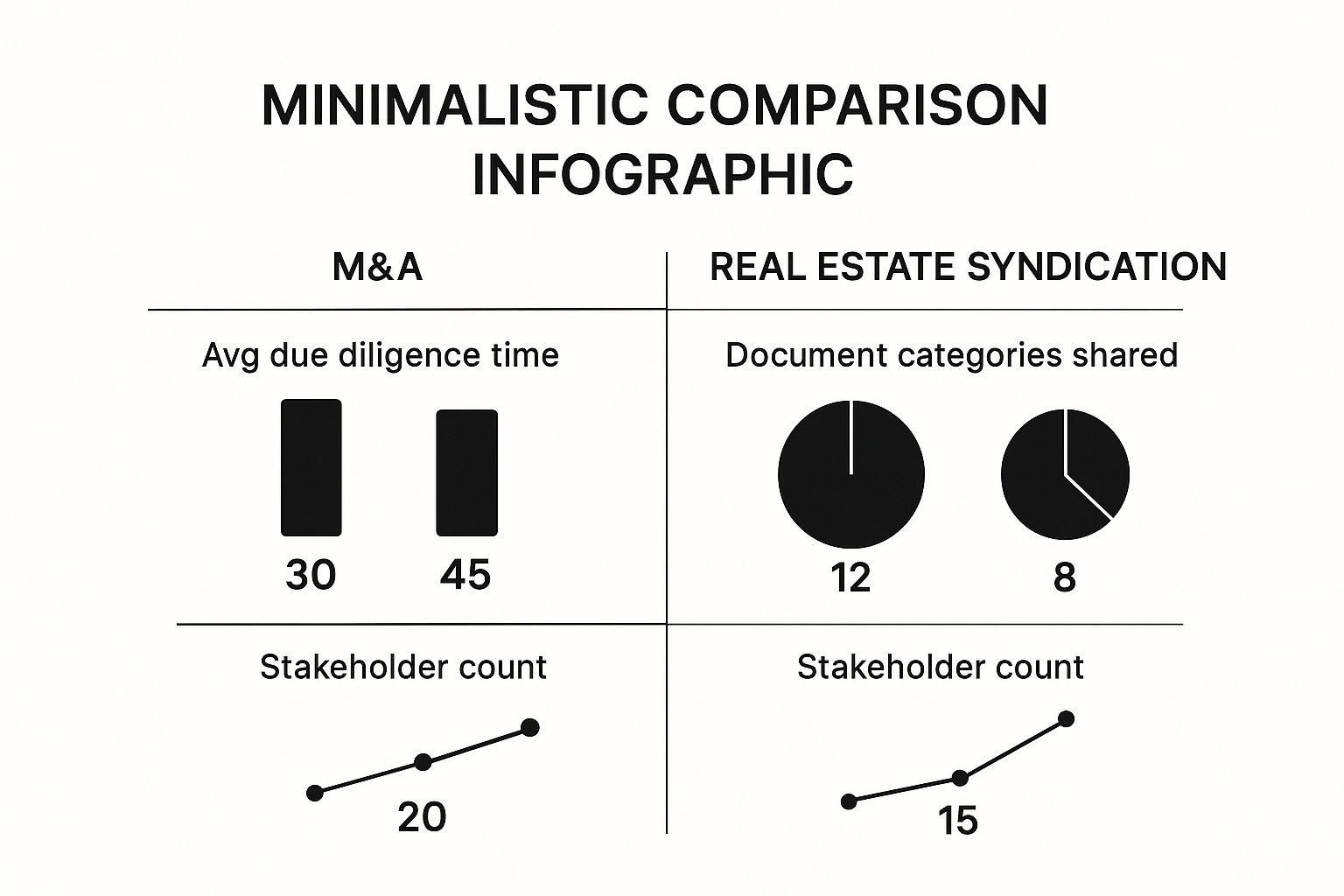

This infographic paints a clear picture of how the demands on a deal room differ between M&A and real estate syndication.

As you can see, M&A deals tend to be a sprint involving more people and a wider variety of documents. Real estate syndication, on the other hand, is more of a marathon, with a much longer due diligence timeline.

Fueling a Real Estate Syndication

For real estate syndicators, the deal room plays a slightly different, but no less critical, role. The main objective here is to present a polished, professional investment opportunity to a curated group of potential investors, or Limited Partners. The deal room effectively becomes the syndicator's digital showroom, perfectly staging the deal while locking down the confidential details.

Forget about just emailing a PDF of the Private Placement Memorandum (PPM) to every person who shows a flicker of interest. A deal room provides a far more structured, controlled, and impressive experience.

Typically, the documents you'll find neatly organized inside include:

* The Offering Memorandum: The complete story of the investment, from property specs to financial projections.

* Property Financials: Hard numbers like historical profit and loss statements, rent rolls, and operating budgets.

* Legal & Partnership Agreements: The nitty-gritty legal docs, including the subscription and operating agreements.

* Third-Party Reports: Independent validation from appraisals, property condition assessments, and environmental reports.

Here’s the real game-changer: by using a deal room, a syndicator can see exactly which investors are engaging with the material by tracking document views and downloads. This is gold. It tells you who is genuinely kicking the tires on the deal, letting you focus your follow-up efforts where they'll have the most impact. It turns the often-chaotic fundraising process into a smooth, professional, and far more effective operation.

Deal Room Use Cases Compared

While both M&A and real estate pros rely on deal rooms, how they use them can be quite different. The table below breaks down the subtle but important distinctions in how key features are applied in each field.

Ultimately, whether you're selling a tech company or a 200-unit apartment complex, the core principle is the same: the deal room provides the control and professionalism needed to get the deal done right.

How to Choose the Right Deal Room Solution

Picking the right deal room is a huge decision. It directly affects how secure your deal is and how smoothly everything runs. With so many platforms out there, it’s easy to feel lost. But if you focus on three core things—security, pricing, and user experience—you can find a solution that protects your data and leaves your investors seriously impressed.

Think of it like choosing a bank to hold your life savings. You wouldn't just go with the one that has the fanciest lobby. You’d dig into their security protocols, their fee structures, and what their customer service is really like. You need to apply that same level of diligence here.

Prioritize Verifiable Security

Security isn't just another bullet point on a feature list; it's the bedrock of a trustworthy deal room. Don't just take a provider's marketing claims at face value—look for independent, third-party proof that they take security seriously.

The most crucial element to verify is a provider's commitment to data protection. Your investors are trusting you with highly sensitive financial and personal information, and a security breach could be catastrophic for both your deal and your reputation.

When you're comparing platforms, make sure they hold industry-standard certifications. These aren't just a bunch of random acronyms; they're evidence that the company has passed rigorous security audits.

- SOC 2 Certification: This is a big one. It confirms a provider securely manages data to protect the interests and privacy of its clients. When selecting a deal room, prioritize solutions that demonstrate strong security postures, often backed by certifications like SOC 2 compliance, especially important for SaaS providers handling sensitive transaction data.

- ISO 27001: This is the global gold standard for information security, proving the provider has solid, repeatable processes for handling data safely.

Understand the Pricing Models

Deal room pricing is all over the map, so it’s critical to find a model that actually fits how you operate. Otherwise, you’ll get hit with surprise costs. You'll generally run into three common structures:

- Per-Page Pricing: This is an old-school model where you get charged for every single page you upload. It can get expensive fast, and honestly, it's best to avoid it.

- Per-User Pricing: Here, you pay a fee for each administrator or guest you invite. This might work for a small, contained deal, but the costs can spiral out of control on larger transactions with many investors.

- Flat-Fee Subscriptions: This is the most predictable model. You get all-inclusive pricing, usually with unlimited users, deals, and data. For active real estate syndicators juggling multiple projects, this almost always provides the best value and cost certainty.

Demand an Intuitive User Experience

Let's be real: the most secure, feature-packed deal room is completely useless if your investors can't figure out how to navigate it. A clunky, confusing interface creates friction at best and can make you look unprofessional at worst.

Always ask for a live demo and try to see it from your investors' perspective. Can you find documents easily? Is the layout clean and logical?

Responsive customer support is also non-negotiable. Before you sign anything, find out their support hours and ask about typical response times. You need a partner who will pick up the phone when you—or one of your key investors—run into a problem at a make-or-break moment.

For a deeper dive, explore our guide on selecting the right https://www.homebasecre.com/posts/deal-room-software to ensure your choice meets every need.

Answering Your Top Questions About Deal Rooms

Even after seeing all the benefits, you probably still have a few practical questions. That's completely normal. When you're thinking about bringing a new tool into your real estate syndication business, you want to be sure it's the right move.

Let's clear up the three biggest questions we hear from sponsors and investors every day.

How Is a Deal Room Different From Dropbox or Google Drive?

This is, without a doubt, the number one question we get. The answer really boils down to two things: purpose and control.

Think of it like this: Google Drive is a family minivan. It’s fantastic, versatile, and gets the job done for a million everyday tasks. A deal room, on the other hand, is an armored truck. It’s built for one specific, high-stakes job: moving valuable assets securely from one place to another.

Sure, both can share files, but a deal room is packed with features that are absolutely essential for a serious transaction.

- Granular Permissions: You don't just control who sees a file. You control if they can print it, download it, or even take a screenshot.

- Dynamic Watermarking: Every single document can be automatically stamped with the viewer’s name, email, and the exact time they accessed it. This is a massive deterrent against leaks.

- Complete Audit Trails: A deal room logs every single click, view, and download. This creates a bulletproof record for compliance and gives you incredible insight into which investors are most engaged.

Your standard cloud storage just wasn't designed for the security, control, and compliance that a high-stakes deal demands.

What Does a Deal Room Typically Cost?

Deal room pricing can feel a bit all over the place, but thankfully, most modern platforms have shifted to simple, flat-fee models. This is a huge relief compared to the old, nickel-and-dime pricing structures that used to be common.

Generally, you'll run into a few different ways providers charge:

- Per-Page Pricing: This is an outdated model that charges for every single page you upload. It's expensive, unpredictable, and a headache to manage.

- Per-User Pricing: You pay a fee for each administrator or guest you invite. This can get out of control fast, especially as your investor list grows.

- Flat-Fee Subscription: This has become the new standard, and for good reason. You pay one predictable fee for unlimited deals, unlimited users, and unlimited data. It’s easily the most cost-effective option for active syndicators.

For syndicators who plan on doing more than one deal, a flat-fee structure is a no-brainer. It completely removes surprise bills and lets you scale your business without getting penalized for your success.

How Long Does It Take to Set Up a Deal Room?

You might be surprised to hear this, but setting up a deal room is incredibly fast. Once you've picked a provider, you can have a professional, fully branded space ready for your investors in just a few hours—not days or weeks.

The process itself is simple. You’ll start by creating a clean folder structure for your documents (think "Financials," "Legal Docs," "Property Reports"). Then, you upload your files and start sending out invitations.

Honestly, the part that takes the longest is just getting all your documents organized beforehand. The actual technical setup on a modern platform is minimal, so you can spend your time focusing on presenting your deal, not fighting with software.

At Homebase, we designed our all-in-one platform to get rid of these exact hurdles. With our simple flat-fee pricing, easy-to-use deal rooms, and dedicated onboarding, you can focus on what you do best: closing more capital and building great relationships with your investors. Learn how Homebase can streamline your entire syndication process.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.