What are k1 tax forms and how they affect real estate investors

What are k1 tax forms and how they affect real estate investors

Discover what are k1 tax forms and how they affect real estate investments. Learn to read your K-1 and maximize tax benefits.

Domingo Valadez

Jan 13, 2026

Blog

Think of a Schedule K-1 less like a tax bill and more like a personalized financial report card from your investment. Whether you're in a partnership, an S-corporation, or a trust, this document breaks down your specific share of the investment's income, losses, deductions, and credits. It’s the key to reporting everything correctly on your personal tax return.

Your First Look at the K-1 Tax Form

If you're a new real estate syndication investor, the term "K-1" can sound intimidating. It’s definitely not as straightforward as the W-2 you get from an employer. But once you peel back the layers, its purpose is actually pretty simple: it’s a summary of your piece of the investment pie.

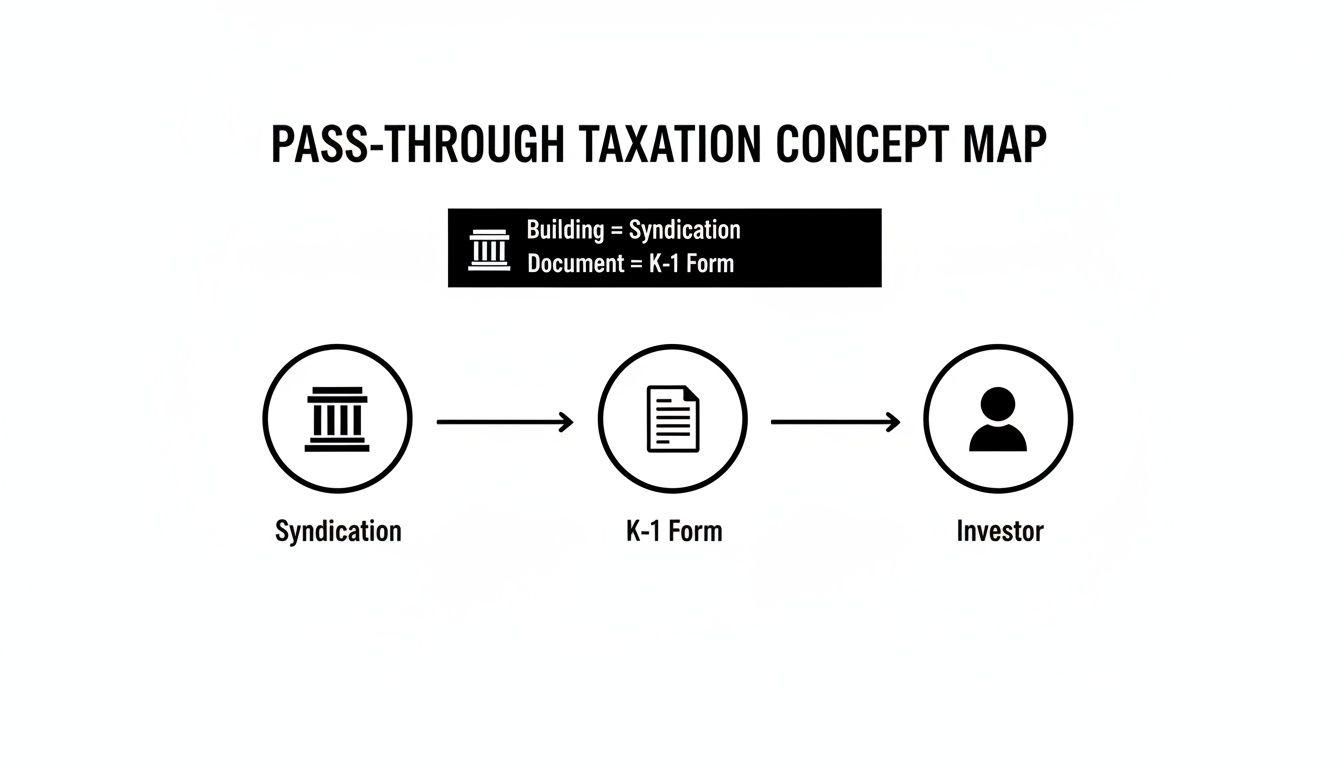

Let's use an analogy. Imagine a real estate partnership is a pizza. The partnership itself—the whole pizza—doesn't pay taxes on its profits. Instead, it "passes through" the financial results to each investor. The K-1 form is your slice, telling you exactly how much profit (or loss) and which tax deductions you get to claim.

The Role of Pass-Through Entities

The K-1 is issued by what the IRS calls pass-through entities. These business structures are set up to avoid the dreaded "double taxation" that corporations often deal with, where the business pays tax and then shareholders pay tax again on their dividends.

While the concept is the same, the specific form you get depends on the entity. Here's a quick breakdown of the most common ones.

Quick Guide to Common K-1 Forms

Each of these forms serves the same fundamental purpose: to report your share of the entity's financial activity for the year.

The core idea is that the business entity itself doesn’t pay income tax. Instead, all financial outcomes—positive or negative—flow directly to the partners or shareholders, who then report them on their individual returns.

This pass-through structure is a cornerstone of real estate investing. It's what allows powerful tax benefits, like depreciation, to be passed directly to you, the investor, helping you reduce your overall tax burden.

Ultimately, the K-1 is the official IRS document that makes this all possible. It gives you and your CPA the exact numbers you need to complete your Form 1040 accurately.

Why K-1s Are a Big Deal in Real Estate Syndication

To really get what a Schedule K-1 is all about, you have to look at it from inside a real estate deal. Most syndications, especially for properties like apartment complexes, are set up as partnerships—think Limited Liability Companies (LLCs) or Limited Partnerships (LPs). This isn't an accident; it's a strategic move designed for one big reason: tax efficiency.

These partnerships are what the IRS calls "pass-through" entities. It's a clever structure that lets them completely sidestep the "double taxation" headache that standard corporations deal with. For instance, a C-corp pays tax on its profits, and then its shareholders get taxed again on the dividends they receive. Syndications don't play that game.

Instead of the partnership itself paying income tax, all the financial outcomes—rental income, capital gains, and crucial tax deductions—"pass through" straight to the individual investors. The Schedule K-1 is the official report that details your exact slice of that pie.

The Gateway to Powerful Tax Benefits

This pass-through approach is the secret sauce that makes the tax benefits of real estate investing so potent. It’s how a good syndication delivers value that goes way beyond a simple check in the mail. The most powerful of these benefits is depreciation.

Depreciation is a fantastic non-cash deduction that lets real estate owners write off the value of a property over its useful life. This can slash your taxable rental income for the year, sometimes even wiping it out entirely. The K-1 is the document that tells you exactly how much of that powerful deduction belongs to you.

A K-1 isn't just a piece of tax paperwork. It's the delivery receipt for the very tax advantages that make real estate syndication one of the best wealth-building strategies out there. It turns your investment from a simple income stream into a smart, tax-efficient machine.

This entire structure is foundational to how the industry works. The Schedule K-1 is the critical link that lets a pass-through business report each partner's share of income, deductions, and credits, making sure everything flows to the right personal tax return without getting taxed twice. For a syndicator, this is how they attract investors—by passing along huge benefits like depreciation, which directly boosts an investor's after-tax returns. If you're a history buff, you can even trace the evolution of these partnership rules through old IRS forms and instructions.

When you know how this works, your K-1 becomes more than just a jumble of numbers. You can see the evidence of a savvy investment strategy in action, actively turning what could be a tax burden into a real financial advantage.

How to Read Your Real Estate K-1 Form

Getting your first Schedule K-1 can feel like trying to decipher a secret code. It’s a dense document, packed with boxes and numbers that can make your eyes glaze over. But for a real estate investor, you only need to focus on a few key areas to get the full story of your investment's performance and see how it impacts your personal taxes.

Think of it this way: the K-1 is the bridge that connects the property's financial life to your own tax return. This pass-through process is what makes syndications so powerful from a tax perspective.

As you can see, all the syndication’s financial activity gets distilled onto this single form, which then feeds the numbers directly into your personal tax filings. Let's walk through the most important boxes on a standard Form 1065 K-1, the one you’ll see for a partnership.

Part I and Part II Information

Before you even get to the numbers, do a quick sanity check on the basics at the top of the form. Part I and Part II cover the partnership's information (the LLC owning the asset) and your details as a partner.

- Confirm Your Details: Make sure your name, address, and Social Security Number or EIN are spot on. A simple typo here can create headaches and delays with the IRS.

- Ownership Percentages: Look for your profit, loss, and capital sharing percentages. These numbers dictate your slice of every financial item reported and should line up perfectly with what’s in your subscription agreement.

Part III Key Boxes for Investors

This is the heart of the K-1. It’s where your share of the partnership's income, losses, and deductions for the year is laid out. While there are more than 20 boxes here, only a few really matter for most real estate investors.

Box 2: Net Rental Real Estate Income (Loss)

This is the big one. It shows your share of the property's taxable income after all deductions have been taken, especially depreciation. Don't be surprised if this box shows a loss, even when you received cash distributions all year. This "paper loss" is one of the biggest tax advantages of real estate and flows directly to your Schedule E to offset other income.

Box 19: Distributions

Here’s where a lot of investors get confused. This box shows the actual cash you received from the partnership during the year. It's the total of your quarterly or monthly distributions.

Key Takeaway: The amount in Box 19 (your cash in hand) will almost never match the taxable income in Box 2. The gap is usually thanks to non-cash expenses like depreciation, which can make your distributions a tax-deferred return of capital rather than taxable profit.

Box 13: Other Deductions

This box uses a series of codes to report various other deductions. The most important one for real estate investors is usually Code W, which provides the numbers needed for the Section 199A deduction, also known as the Qualified Business Income (QBI) deduction. This is a significant tax break that you won't want to miss.

Getting comfortable with these key boxes will make your conversations with your CPA far more productive. For a deeper dive, our complete guide on how to read a K-1 breaks down every section in more detail. Once you learn to decode it, the K-1 transforms from a daunting tax form into a clear report card on your investment.

Navigating K-1 Deadlines and Filing

If you’re new to real estate investing, the timing of your first Schedule K-1 can come as a shock. Most of us are conditioned to get our W-2s and 1099s in January, ready to file our taxes. K-1s, however, play by a different set of rules, and if you’re not prepared, it can throw a wrench in your whole tax season.

The partnership that holds the real estate asset has its own tax return to file, Form 1065. The deadline for that return is March 15. Your K-1 is a direct output of that filing, which means you won't get it until after the partnership’s return is complete. You can expect it to show up in late March or even creep into early April.

Why Filing an Extension is Completely Normal

Because of this timeline, filing a personal tax extension is a standard, stress-free part of being a syndication investor. It’s not a red flag or a sign your sponsor is disorganized—it’s just how the tax calendar works.

By planning to file an extension from the very beginning, you eliminate a ton of unnecessary pressure. It gives you and your CPA the breathing room needed to accurately incorporate the K-1 data without rushing.

Don't view a tax extension as a last resort. For K-1 recipients, it's a strategic tool that ensures accuracy and prevents the hassle of filing an amended return later.

As you get a handle on the deadlines, remember that K-1s are just one piece of your financial puzzle. A helpful guide on how to prepare for tax season can give you a broader framework for getting everything organized.

Estimated Taxes and State Filings

Here are a couple of other things to keep on your radar:

- Estimated Taxes: The cash distributions you receive from a deal rarely match the taxable income reported on your K-1. You can’t use your distributions as a guide for what you’ll owe. It's a smart move to work with your CPA to project your likely K-1 income and make quarterly estimated tax payments to stay ahead of the IRS and avoid penalties.

- State K-1s: Your tax journey might not end at the federal level. If the property is located in a state with an income tax, you'll likely receive a separate state-level K-1. This usually means you’ll have to file a non-resident tax return in that state, adding another layer to your annual filing process.

The March 15 deadline for issuing K-1s is a common tripwire, causing an estimated 20-30% of new investors to file amended returns. For sponsors, the stakes are high. Penalties for furnishing incorrect K-1s can hit $330 per failure, which highlights why accuracy is so critical, as outlined in the IRS guidelines for Form 1065 partnerships.

Common K-1 Mistakes Investors Should Avoid

Getting your head around what a K-1 is is one thing; actually using it correctly is another game entirely. A few common slip-ups can catch even seasoned investors off guard, leading to missed tax savings or, worse, an unwelcome letter from the IRS.

Knowing what these pitfalls are ahead of time is the best defense. Let's walk through them so you can keep your filings clean and make the most of your investment's tax advantages.

Mistake #1: Mixing Up Cash Flow and Taxable Income

This is easily the most common point of confusion. You see cash hit your bank account from a distribution and think, "Great, that's my profit." But the cash you actually receive (Box 19) and your taxable income (Box 2) are almost never the same number.

Why the difference? It usually comes down to powerful non-cash deductions like depreciation. Think of it this way: your cash distribution is often considered a non-taxable return of capital—you're getting a piece of your own investment back. Your taxable income is what the IRS views as your share of the profit after accounting for all those deductions. Getting this wrong can lead you to overpay your taxes.

Mistake #2: Not Tracking Your Investment Basis

Another classic mistake is forgetting to track your basis. Your basis is, simply put, your total economic stake in the deal. It's not a set-it-and-forget-it figure; it’s a living number that changes every single year.

Here’s how it works:

- Basis Goes Up: When you put more money in (capital contributions) or when you're allocated a share of the partnership's income.

- Basis Goes Down: When you receive a cash distribution or when you're allocated a share of partnership losses.

Keeping a running tally of your basis is crucial. It sets the limit on how much loss you can deduct and is the starting point for calculating your capital gains when the property eventually sells. Your CPA will need this information, and it's ultimately your responsibility to track it.

Failing to properly track your basis can lead to paying more in capital gains taxes than necessary upon the sale of an asset. It's the investor's responsibility, not just the sponsor's, to maintain this record.

Mistake #3: Misunderstanding Passive Activity Rules

Finally, many investors don't fully grasp the passive activity loss (PAL) rules. For most limited partners in a real estate syndication, the investment is considered a passive activity.

This means the "paper losses" generated by the deal—often from depreciation—can typically only be used to offset income from other passive activities. You generally can't use these losses to wipe out the taxes on your W-2 salary or income from a business you actively run.

It's a critical piece of the tax puzzle. If you misinterpret these rules, you might claim deductions you aren't entitled to, which could trigger an audit. This is definitely a topic to bring up with your tax professional to make sure your strategy is sound.

How Smart Sponsors Tame the K-1 Beast

For any real estate sponsor, tax season can feel like a mad dash. Juggling all the moving parts—gathering correct investor info, keeping everyone in the loop, and securely delivering potentially hundreds of Schedule K-1s on time—is a huge lift. Even one tiny mistake can create a domino effect of delays and frustration for the entire partnership.

This is where the old way of doing things, with spreadsheets and a blizzard of emails, really falls apart. Forward-thinking sponsors have moved on, using dedicated investor management platforms to bring order to the chaos.

Getting the Data Right from the Start

The real secret is to stop scrambling for information at the last minute. A good investor portal bakes this into the process right from the get-go. When an investor first comes into a deal, the platform securely collects everything needed—tax IDs, contact info, entity details—as a natural part of the digital subscription process.

This simple shift from reactive to proactive dramatically cuts down on errors from typos or outdated information. Everything lives in one secure, central place, ready for the accounting team when they need it.

By turning the K-1 process from a chaotic fire drill into a structured workflow, sponsors do more than just save time. They deliver a professional, confidence-building experience that pays dividends in long-term investor trust.

Automating Distribution and Communication

Once the accountants have worked their magic and the K-1s are final, these platforms act as a secure digital vault for distribution. Investors get a simple notification that their tax document is ready, and they can log into their own portal to download it whenever they want. This completely sidesteps the security headaches and delivery failures that come with emailing sensitive documents.

For general partners managing a lot of investor capital, getting K-1s right is mission-critical. Investor portals that track commitments and distributions rely on this accuracy. When platforms handle the entire onboarding process, from KYC to e-signatures, they can slash K-1 errors by up to 40%. This lets sponsors get back to what they do best: finding great deals and closing capital. For a deeper dive into the specifics, check out these insights on tax form requirements.

Answering Your Top K-1 Questions

Even after you've got the basics down, a few K-1 questions tend to come up year after year. Let's tackle some of the most common ones that new real estate syndication investors ask.

Why Doesn't My K-1 Income Match My Cash Distributions?

This is, without a doubt, the number one question we hear from investors. It's a great question, and the answer gets to the heart of why real estate is such a powerful investment. The cash in your bank account (Distributions) is just that—cash. But your K-1 shows your share of the partnership's taxable income, which is a completely different number.

Think of it this way: the property might have generated enough cash flow to send you a $10,000 check. But on paper, after the accountants factor in powerful non-cash deductions like depreciation, your K-1 might only show $2,000 in taxable income. Sometimes, it even shows a loss! That cash you received is often treated as a non-taxable return of your original capital, not immediate profit, which is a huge tax benefit.

Do I Really Have to File Taxes in Every State Where the Partnership Owns Property?

In most cases, yes. If the syndication owns a property in a state that has an income tax, you can expect to receive a state-specific K-1 for that location. This means you'll likely need to file a non-resident state tax return, adding another layer to your annual tax prep. It's absolutely essential to talk this over with your CPA to make sure you're compliant.

It’s also worth remembering that K-1s are just one piece of the puzzle. Other activities, like understanding the house flipping tax implications, are crucial for well-rounded real estate investors.

Pro Tip: When those state K-1s arrive, keep them in a separate pile from your federal form. Giving your accountant a neatly organized package for each state will save them time and help ensure your non-resident returns are filed correctly.

What If I Think There's a Mistake on My K-1?

First things first: do not file your taxes with information you believe is wrong. If you spot something that looks off, reach out to the syndication sponsor or general partner right away.

They'll need to look into the issue with their accounting team. If it turns out there was a mistake, they are legally required to issue a corrected Schedule K-1. This might mean you need to file a tax extension, which is a perfectly normal and simple thing to do. It’s always better to file an extension and get it right than to rush and file with incorrect numbers.

Managing investor questions and tax documents is a huge undertaking, but the right tools make all the difference. Homebase is an all-in-one platform built to simplify fundraising, communications, and K-1 distribution, helping you build trust and keep your investors happy. Learn how Homebase can help you simplify your syndication business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Navigating The 2026 Commercial Real Estate Market

Blog

A definitive guide for syndicators navigating the 2026 commercial real estate market. Explore market cycles, asset classes, and proven deal-closing strategies.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.