Top 5 Best Cities for Real Estate Investment: How to Maximize ROI in Today's Market

Top 5 Best Cities for Real Estate Investment: How to Maximize ROI in Today's Market

Discover data-backed insights on the most profitable cities for real estate investment, with expert analysis of market trends, growth indicators, and proven strategies for maximizing your returns.

Domingo Valadez

Jan 1, 2025

Blog

Austin: The Tech-Driven Real Estate Revolution

Austin's evolution from music mecca to thriving tech hub has reshaped its real estate market in remarkable ways. As major tech companies establish their presence, they bring waves of skilled professionals seeking homes, creating fresh opportunities for real estate investors.

Understanding the Tech Influence

The arrival of industry giants like Apple, Samsung, and Tesla has sparked substantial job creation in Austin. This influx of tech talent has intensified housing demand, with local home prices nearly doubling over ten years - far exceeding national growth rates. For investors focused on long-term appreciation, Austin's strong job market and low 4.2% unemployment rate make it especially appealing.

Navigating the Competitive Landscape

The strong interest in Austin real estate means investors often face multiple offers and competitive bidding. Success requires looking beyond basic metrics like price per square foot. Investors need deep knowledge of specific neighborhoods and sub-markets to spot promising opportunities and make informed decisions quickly.

Micro-Markets and Appreciation Potential

Austin's real estate market varies significantly by area. Neighborhoods near tech campuses and amenity-rich zones tend to see faster price growth. Much like diversifying a stock portfolio across sectors, spreading investments across Austin's distinct micro-markets can help balance risk and rewards. Finding these growth pockets requires studying factors like job centers, transit access, and planned developments.

Rental Demand and Strategies

Tech professionals moving to Austin have created strong demand for quality rental properties that currently exceeds supply. However, successful rental investing takes more than just buying properties. Careful property management and understanding what tech workers want in a rental home are essential for steady income and low vacancy rates.

Beyond Traditional Metrics

While standard measures like price-to-rent ratios matter, Austin's dynamic market requires a broader view. Future development plans, infrastructure projects, and demographic trends all impact property values. New investors often benefit from partnering with local real estate experts who understand market nuances. Experienced investors can use detailed market analysis to refine their approach. By considering how these elements work together, investors can build profitable portfolios in Austin's tech-driven real estate market.

Phoenix: Where Smart Money Meets Sustainable Growth

While Austin has built its reputation on tech growth, Phoenix offers its own compelling story for real estate investors. This Southwestern city combines steady economic growth with strong demographics and unique market conditions that make it increasingly attractive to investors of all sizes. From major institutions to individual buyers, more capital is flowing into Phoenix's real estate market than ever before.

The Allure of Institutional Investment

The presence of major institutional investors in Phoenix speaks volumes about the city's potential. These sophisticated firms are investing billions based on Phoenix's solid fundamentals - robust population increases, strong job creation, and an increasingly diverse economy. Their substantial commitments provide clear validation of Phoenix as a prime location for real estate investment.

Emerging Corridors and Opportunity Zones

Success in real estate often comes down to identifying up-and-coming areas before prices surge. Phoenix has several promising corridors positioned for significant growth in the coming years. The city's designated Opportunity Zones also offer tax benefits that can boost returns. Smart investors are paying close attention to these areas and their impact on nearby property values.

Water Resources and Long-Term Appreciation

Beyond the sunshine and growing economy, water access is crucial for Phoenix's continued real estate appreciation. The city has made major strides in water management and conservation. When evaluating properties, investors should factor in long-term water availability as part of their due diligence process.

Property Types and Risk-Adjusted Returns

Phoenix's real estate market offers varied investment options:

- Single-Family Homes: Popular for both traditional rentals and the growing short-term rental market

- Multifamily Properties: Provide operational efficiency and strong cash flow potential

- Commercial Real Estate: Well-positioned to serve Phoenix's expanding business community

Each property type comes with its own risk-return profile that investors must carefully evaluate.

Strategies for Traditional and Short-Term Rentals

Phoenix's expanding population and year-round tourism create opportunities in both long-term and short-term rentals. Traditional leases provide steady income, while short-term rentals through Airbnb can generate higher returns in tourist-heavy areas. Success requires understanding local rules and seasonal patterns. Proper research and planning are essential, regardless of rental strategy. This highlights how local market knowledge directly impacts investment outcomes when choosing the best cities for real estate investment.

Denver: Capitalizing on Mile-High Opportunities

Denver stands out as a premier real estate investment destination, offering both economic resilience and exceptional quality of life. The city's economy draws strength from multiple sectors including technology, aerospace, and healthcare - creating stability that helps protect investors when individual industries face challenges. This diverse economic base provides a solid foundation for sustained growth in the real estate market.

Understanding Denver's Economic Drivers

The city consistently maintains unemployment rates below national averages, reflecting its robust job market. This strong employment picture creates steady housing demand from both buyers and renters. Young professionals, in particular, flock to Denver seeking its unique mix of urban amenities and outdoor recreation opportunities. This consistent influx of residents helps maintain strong rental demand, making Denver especially appealing to investors focused on both property appreciation and rental income.

Neighborhood Nuances and Growth Potential

Denver's real estate landscape varies significantly across different areas. Some neighborhoods are seeing major changes through new zoning laws that permit higher-density development, creating chances for substantial value gains. Areas near public transit hubs or popular amenities often see faster price increases. For example, neighborhoods along new light rail extensions have shown particularly strong appreciation. Success in Denver requires careful analysis of these local market dynamics.

Maximizing Rental Income in a Competitive Market

Getting the most from Denver rental properties requires understanding what local renters want. Many tenants value features that support active lifestyles, like secure bike storage or easy park access. Small touches like these can help properties stand out. Property owners who focus on responsive maintenance and building good relationships with tenants often see better returns through longer tenancies and fewer vacancies.

Navigating Property Management and Tenant Retention

Good property management makes a big difference in Denver's competitive rental market. Keeping quality tenants happy pays off through reduced turnover costs and more predictable income. Simple steps like offering online rent payment options and maintaining clear communication channels help create satisfied long-term renters. The key to success lies in thoroughly understanding both neighborhood dynamics and tenant needs while implementing solid management practices. Property owners who master these elements tend to see the strongest returns in Denver's real estate market.

Charlotte: Building Wealth in the New South

After examining Denver's thriving market, let's shift our focus to Charlotte, North Carolina - a flourishing Southern city that's attracting significant attention from both institutional and individual real estate investors. What makes Charlotte such an appealing destination, and how can investors make the most of its opportunities?

The Allure of the Queen City: Why Charlotte?

Charlotte's strength lies in its diverse economy. The city has built robust sectors in finance, technology, and healthcare, creating a stable foundation that helps protect against economic fluctuations. This economic diversity, combined with North Carolina's business-friendly tax structure, continues to attract companies and workers to the region. The resulting job growth naturally drives housing demand across the market.

Submarket Selection: Targeting Growth Pockets

Success in Charlotte's real estate market requires understanding its distinct neighborhoods and submarkets. Areas near major employers, transit hubs, or those undergoing renewal often show stronger appreciation rates than other parts of the city. Smart investors focus on identifying these growth zones before prices rise significantly.

Investor Strategies: Buy-and-Hold vs. Value-Add

Charlotte offers multiple paths to real estate success. Long-term investors benefit from steady property value increases and strong rental demand, especially from young professionals. For those seeking faster returns, the market also presents opportunities to purchase and improve properties, whether through renovations or better management practices.

Millennial Magnetism: Leveraging Demographic Trends

Young professionals increasingly choose Charlotte as their home, creating valuable opportunities for property investors. This generation typically seeks urban living spaces with easy access to amenities. Understanding these preferences - from walkable neighborhoods to proximity to entertainment districts - helps investors select properties that maintain high occupancy rates and command premium rents.

Navigating the Charlotte Market: Due Diligence and Local Expertise

While Charlotte shows clear investment potential, success requires thorough research and market knowledge. This includes analyzing properties carefully, understanding zoning rules, and staying current on market trends. Working with experienced local real estate professionals provides valuable insights into neighborhood dynamics and helps identify the best opportunities. Through careful planning and local partnerships, investors can build a strong portfolio in Charlotte's growing real estate market.

Indianapolis: The Midwest's ROI Powerhouse

Indianapolis, Indiana often flies under the radar when discussing prime real estate investment cities, yet this heartland hub offers a compelling mix of stability and growth potential. While its affordability tends to grab headlines, savvy investors are finding diverse opportunities here - from traditional rental properties to creative commercial projects.

A Diverse Economy Fuels Steady Growth

Unlike cities that rise and fall with a single industry, Indianapolis maintains economic balance through its mix of healthcare, logistics, and manufacturing sectors. This diversity helps shield the real estate market from major economic swings. For instance, the constant need for healthcare services helps maintain housing demand even during downturns. The city's central location and strong transportation infrastructure also cement its position as a key logistics center, adding another layer of economic strength.

The University Effect: A Built-In Renter Pool

The presence of major institutions like Indiana University-Purdue University Indianapolis (IUPUI) and Butler University creates reliable rental demand from students and faculty. This steady tenant base helps keep vacancy rates low for property owners. However, success in the student market requires understanding specific needs - like furnished units near campus with high-speed internet and study spaces - to attract and retain tenants.

Neighborhoods Primed for Appreciation: Identifying the Growth Pockets

While Indianapolis offers affordable properties overall, certain neighborhoods show strong signs of growth and appreciation potential. Areas experiencing renewal, those close to downtown, and locations with good amenities access tend to perform particularly well. Just as certain stocks outperform their sector, these neighborhood "growth pockets" can deliver outsized returns when identified early through careful market research.

Building a Sustainable Portfolio: Strategies for Long-Term Success

Indianapolis provides excellent conditions for building a lasting real estate portfolio. The mix of affordable prices, stable rental demand, and value-add opportunities allows investors to pursue various approaches, from long-term buy-and-hold to shorter-term fix-and-flip projects.

StrategyDescriptionBenefitsBuy-and-HoldPurchasing properties with the intention of holding them long-term and generating rental income.Steady cash flow, long-term appreciation, tax advantages.Fix-and-FlipBuying properties in need of repair, renovating them, and selling them for a profit.Quicker returns, potential for high profit margins.Value-Add InvestingAcquiring properties and making improvements to increase their value and rental income.Enhanced cash flow, forced appreciation, increased property value.

The city's business-friendly environment and moderate property taxes make Indianapolis even more appealing for real estate investment. By understanding local market dynamics and following a clear strategy, investors can tap into the significant opportunities in this often-overlooked Midwest market.

Market Comparison and Investment Strategies

When evaluating multiple real estate markets for investment, taking a systematic approach helps identify the best opportunities aligned with your goals. While cities like Austin, Phoenix, Denver, Charlotte, and Indianapolis each offer distinct advantages, choosing between them requires careful analysis of returns, risks, and market fundamentals.

Evaluating Risk-Adjusted Returns Across Markets

Each market presents a unique risk-return profile that investors must weigh carefully. Austin's tech-centric economy offers strong growth potential but could face challenges during tech sector downturns. Phoenix provides more stability through its diverse economic base, though potentially lower appreciation rates. Smart investors often spread investments across multiple markets and submarkets to balance these risks. You might be interested in: The Long-Term Benefits of Investing in Real Estate.

The Impact of Economic Trends on Market Selection

Local market performance is shaped by both national economic factors and city-specific dynamics. Interest rates and inflation impact all markets, but local elements like job growth, population trends, and infrastructure development drive individual market trajectories. For example, Charlotte's pro-business tax policies and expanding financial sector create strong fundamentals for appreciation. However, investors must monitor how changes in these factors could affect future returns.

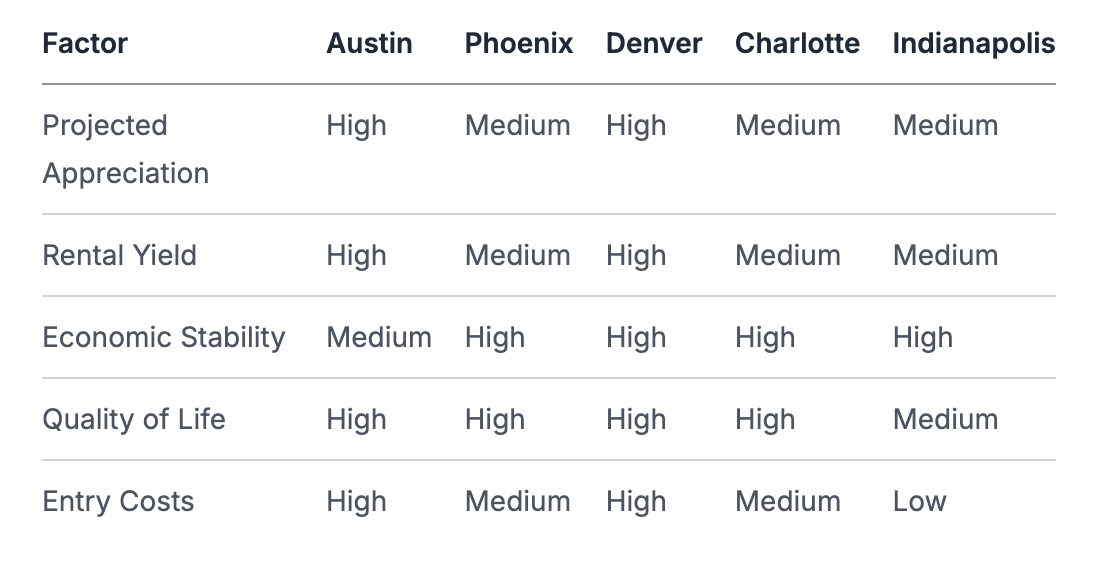

Frameworks for Strategic Market Selection

A data-driven approach using weighted scoring helps compare markets objectively. Key factors to evaluate include:

- Projected Appreciation: Expected property value increases

- Rental Yield: Potential rental income relative to property cost

- Economic Stability: Market resilience during downturns

- Quality of Life: Factors driving population growth and retention

- Entry Costs: Property prices and transaction expenses

This comparison provides a starting point. Investors should adjust criteria and weightings based on their goals and risk tolerance - some may prioritize growth potential while others focus on steady cash flow.

Building and Managing Multi-Market Portfolios

Portfolio diversification across markets helps optimize returns while managing risk. This can include investing in different property types within each market and using various financing approaches like traditional mortgages or private lending. Success requires staying informed about local trends, economic indicators, and regulatory changes that could impact investments.

Taking Action: Getting Started in Each Market

Moving from analysis to action requires building local market knowledge and connections. Join real estate investment groups, attend industry events, and network with local professionals to uncover opportunities. Thorough due diligence on specific properties and neighborhoods remains essential before making investments.

Ready to streamline your real estate syndication and unlock your investment potential? Homebase offers an all-in-one platform to simplify fundraising, investor relations, and deal management. Visit Homebase today to learn more and start growing your portfolio with confidence.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.