Expert Tips for Sponsor Real Estate Success

Expert Tips for Sponsor Real Estate Success

Discover insider strategies for successful sponsor real estate investments. Elevate your partnerships today!

Domingo Valadez

Feb 26, 2025

Blog

The Power Behind Sponsor Real Estate Success

Sponsor real estate partnerships create valuable opportunities for both experienced and new investors. These partnerships match skilled sponsors with investors seeking passive income through real estate. The success of these ventures depends heavily on selecting the right sponsor partner.

The Sponsor's Role: A Driving Force

A sponsor's capabilities directly impact investment outcomes. They guide the entire investment process - from finding promising properties to securing financing and managing operations. Their market knowledge and decision-making abilities determine potential returns. Like a ship's captain, an experienced sponsor can navigate challenging market conditions while an inexperienced one may put investments at risk.

Real estate sponsors oversee investments for passive investors, using their expertise to purchase and manage properties effectively. The best sponsors bring extensive experience and have proven they can handle both strong and weak market cycles. Want to learn more? Check out this guide on evaluating real estate sponsors.

Key Elements of Successful Sponsor Partnerships

The most effective sponsor partnerships include:

- Clear Communication: Regular updates and transparent reporting build trust between sponsors and investors. Having open channels for questions helps maintain strong relationships.

- Aligned Incentives: Fee structures should ensure sponsors and investors share common goals. This motivates sponsors to maximize returns for all parties involved.

- Proven Track Record: Past performance shows a sponsor's abilities. Success across different market conditions demonstrates skill in handling challenges.

Evaluating Potential Sponsors: A Critical Process

Finding the right sponsor requires thorough research. Look into their background, experience, and investment approach. Ask specific questions about how they manage risk and handle market downturns to better understand their capabilities.

The Importance of Long-Term Vision

Strong sponsors focus on building lasting value rather than quick profits. They make decisions with future growth in mind, which helps protect investor interests. This careful approach to planning and execution helps maximize returns while limiting potential risks.

Decoding Sponsor Performance Records

Looking at a sponsor's past results reveals crucial clues about their future potential in real estate deals. Smart investors know that marketing materials only tell part of the story. The real insights come from digging into performance data and spotting warning signs before they become costly mistakes.

Evaluating Gross and Net Returns

Understanding the difference between gross returns and net returns is essential when analyzing sponsor track records. While gross returns show total profits before fees and expenses, net returns reflect what investors actually receive. This distinction matters because high gross returns don't automatically mean high investor profits. Get more details about evaluating sponsors in this guide to sponsor track record analysis.

Understanding Market Cycle Impact

Market conditions heavily influence performance results. A sponsor might excel during boom times but struggle in downturns. By examining how they handled major events like the 2008 financial crisis or recent market shifts, you can assess their risk management skills. This helps determine if they can protect investments when markets get tough.

Identifying Predictive Patterns

Look for consistent patterns in a sponsor's results over time. Good signs include meeting projected returns, controlling costs, and sticking to timelines. Regular returns within a stable range suggest reliability. But frequent budget overruns or missed deadlines may indicate problems with execution. This analysis helps separate skilled sponsors from those who just got lucky in good markets.

Asking the Right Questions

Numbers tell only part of the story. Direct questions reveal a sponsor's true capabilities. Ask about their investment philosophy, how they manage risk, and their approach to working with investors. Quality sponsors provide clear explanations of both successes and challenges. Open communication builds trust and confidence.

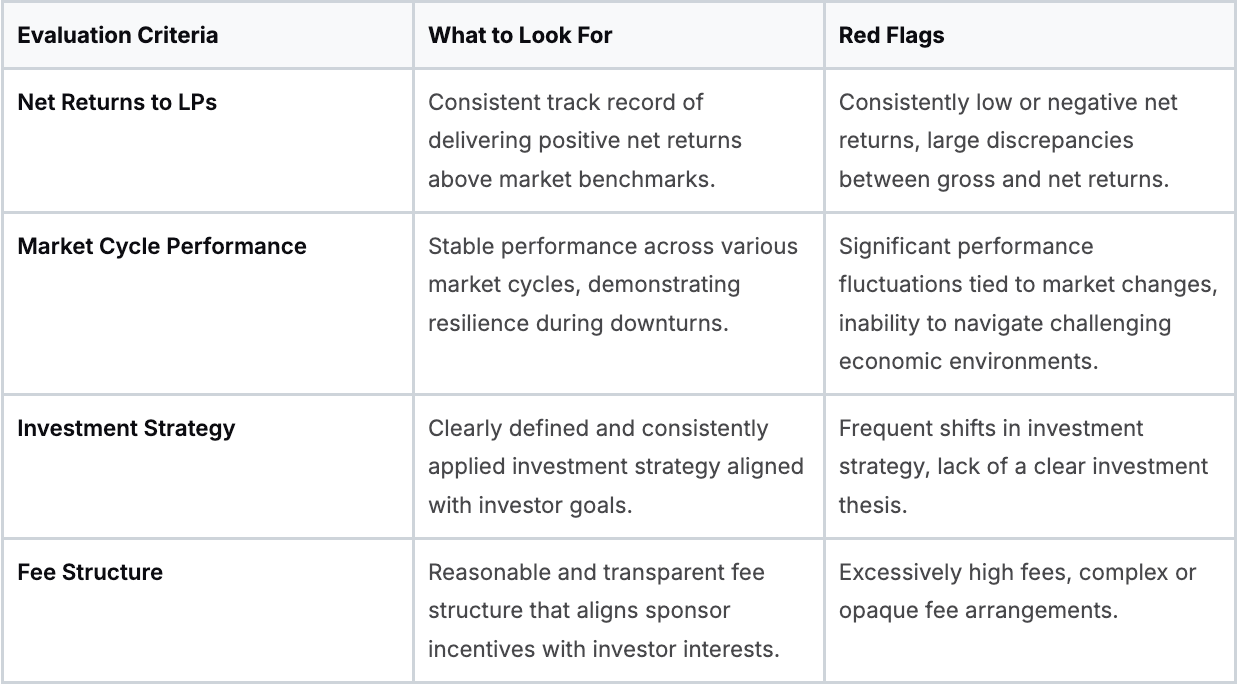

Track Record Evaluation Criteria

When assessing potential sponsors, consider these key evaluation factors:

By thoroughly reviewing track records, asking targeted questions, and understanding broader market context, you can make smarter decisions about sponsor investments. This detailed approach helps identify risks early and select partners positioned for long-term success.

Finding Your Perfect Investment Match

Finding success in sponsor real estate starts with connecting to quality sponsors and identifying promising deals. This means getting familiar with the investment platforms and networks that bring opportunities to investors. Let's explore how to evaluate these resources and use them to build a strong portfolio.

Exploring Investment Platforms and Networks

The real estate investment world offers several platforms connecting investors with sponsors. Each platform has its own focus - some specialize in specific property types like apartments or industrial buildings, while others provide diverse investment choices. This variety helps investors pick opportunities that match their goals.

Real estate networks create valuable spaces for investors to connect and learn. Through events, online seminars, and discussion forums, investors can meet sponsors, experts, and fellow investors. These connections often lead to special investment opportunities not found on public platforms.

Take CrowdStreet, a major real estate platform that has enabled over 800 deals with more than $4.4 billion invested as of early 2024. The platform features projects across 17 property types in 45 states, showing the wide range of investment options available.

Evaluating Investment Platforms: Key Considerations

When choosing a platform, focus on three main factors. First, examine the due diligence process - solid vetting procedures help protect investors. Second, understand the fees and costs to accurately calculate potential returns. Clear fee structures build trust. Third, research the platform's track record through past deals and investor feedback.

Building a Diversified Portfolio: Strategies and Best Practices

Spreading investments across different sponsors, property types, and locations helps manage risk in sponsor real estate. Like a farmer planting various crops to protect against failure, diversifying real estate investments can help balance potential losses in one area with gains in others.

Avoiding Common Pitfalls

Watch out for these typical investor mistakes. First, never skip thorough research on sponsors and deals, even when opportunities seem exciting. Second, avoid chasing high returns without considering risks - better returns usually mean more risk. Finally, maintain good diversification rather than concentrating investments with one sponsor or property type. Following these guidelines helps build a stronger foundation for long-term success.

Master the Art of Sponsor Due Diligence

Conducting thorough research on sponsors is essential for success in real estate investing. A systematic approach to verification helps investors make informed decisions and build strong partnerships. Understanding key aspects like team experience, investment strategy, and risk management is crucial.

Evaluating the Sponsor Team

Start by examining the sponsor's experience and capabilities. Look for a proven track record of successful real estate deals and ability to handle market challenges. The team should have specific expertise in your target property type - for example, multifamily specialists may not be the best fit for retail projects.

Understanding the Investment Philosophy

Review how the sponsor approaches deals and manages assets. Their strategy should be clear and match your investment goals. If you want steady long-term income but the sponsor focuses on quick property flips, it may not be the right partnership. Alignment on investment approach sets expectations for both parties.

Assessing Risk Management Practices

Strong risk management is critical in real estate investing. Ask detailed questions about how the sponsor handles market changes, property issues, and unexpected costs. Clear procedures for risk mitigation indicate professionalism and preparation. Without solid risk management, even good properties can underperform. For more insights, see: How to master real estate syndication.

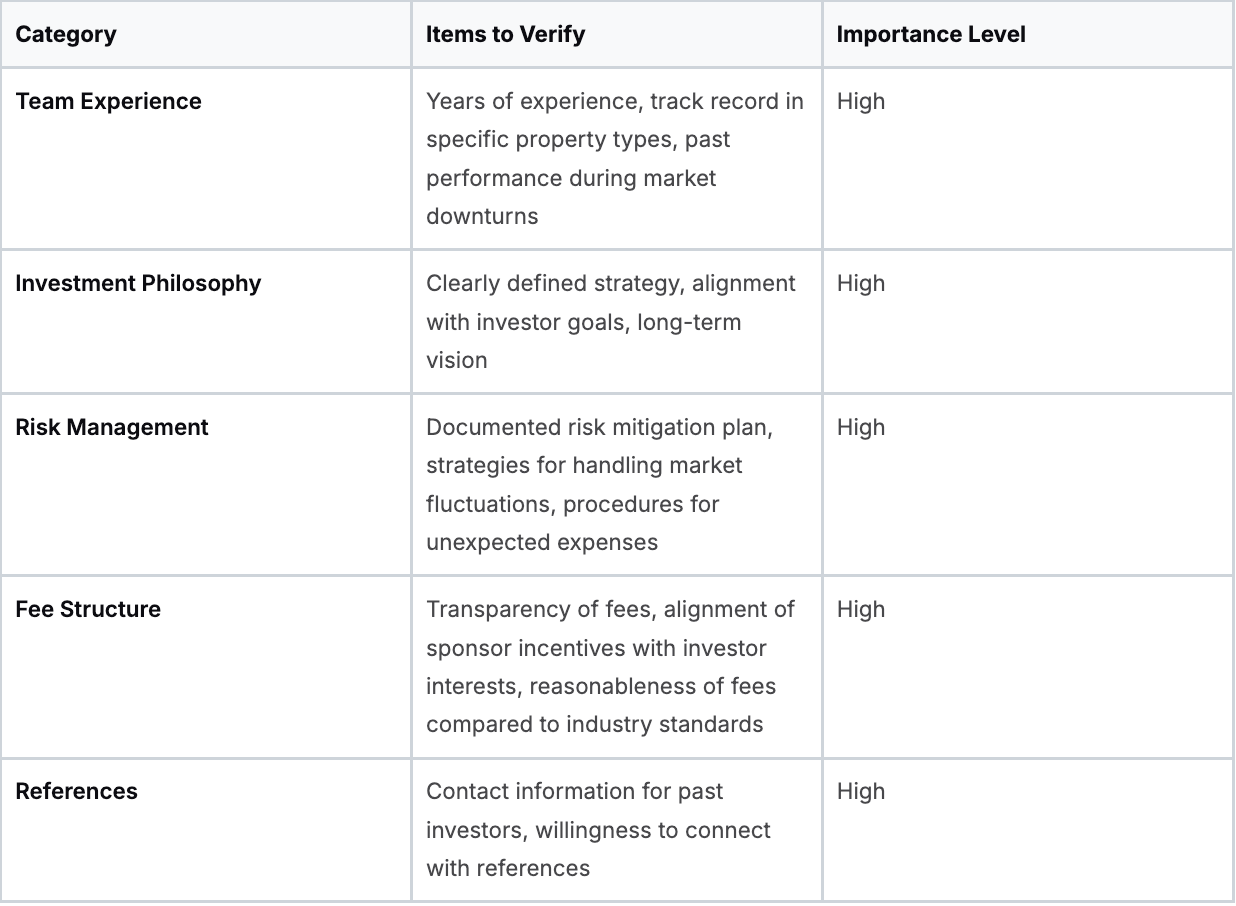

Sponsor Due Diligence Checklist

Use this comprehensive checklist when evaluating potential sponsors:

Taking time to evaluate sponsors thoroughly helps protect your investment and increases the likelihood of meeting your financial goals. This detailed verification process creates a strong foundation for successful real estate partnerships.

Understanding the Money: Fee Structures That Work

Smart investing in sponsor real estate requires understanding fee structures and how they affect investment returns. Fee arrangements directly influence what you earn. By carefully analyzing them, you can spot the setups that ensure everyone - you and the sponsors - pull in the same direction.

Common Fee Components

Sponsors generally charge a mix of fees to cover their services and incentivize performance:

- Acquisition Fees: Charged for finding and securing properties, usually 1-3% of purchase price

- Asset Management Fees: Cover day-to-day property operations, typically 1-2% of net operating income

- Disposition Fees: Earned when selling the property, often 1-2% of sale price

- Carried Interest: The sponsor's profit share, with percentage increasing as returns hit certain levels. A common structure gives sponsors 20% after investors reach target returns

How Carried Interest Works

Carried interest plays a key role in sponsor real estate. It rewards good performance by giving sponsors a bigger slice of profits above set return levels. For example, sponsors may earn a higher percentage once investors get their target returns. This motivates them to maximize returns, though it does mean they'll keep more of the upside.

Red Flags in Fee Structures

While standard fees are fine, excessive ones cut into profits. Compare what different sponsors charge to spot outliers. Watch for warning signs like acquisition fees way above market rates - this could mean the sponsor cares more about upfront fees than long-term success.

Getting Better Terms

Top investors actively discuss fees with sponsors to protect their interests. The goal isn't rock-bottom fees, but finding middle ground that works for everyone. Consider trading lower carried interest for higher performance bonuses to keep sponsors focused on results.

Creating Win-Win Arrangements

The best fee structures benefit both parties. When sponsors do well only if investors do well, it creates true partnership. Getting the incentives right leads to stronger long-term relationships in sponsor real estate. Focus on aligning goals through smart fee design.

Making the Choice: Your Decision Framework

When investing in sponsor real estate, selecting the right sponsor is one of the most important decisions you'll make. Instead of relying on instinct, you need a clear evaluation process. Here's a practical framework to help you assess potential sponsors and find one that matches your investment goals.

Building Your Evaluation Framework

Start with a structured approach to evaluate sponsors effectively. Consider these key elements:

- Investment Goals: Define what you want to achieve - whether that's long-term appreciation, regular income streams, or both

- Risk Profile: Know your comfort level with different investment risks

- Research Process: Create a detailed checklist for investigating each sponsor thoroughly

- Key Criteria: Develop specific factors to evaluate, weighted based on your priorities

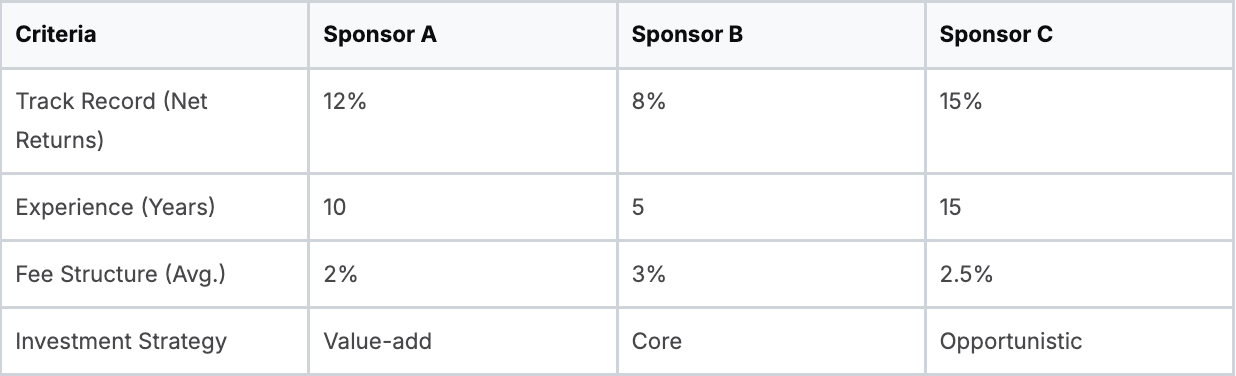

Comparing Multiple Sponsors: Apples to Apples

To make sound comparisons between sponsors, evaluate them using consistent criteria. Here's a simple comparison table:

Weighing the Factors: What Matters Most

Each evaluation factor carries different importance based on your goals. If you need steady income, focus on sponsors with strong cash flow performance. For those comfortable with more risk, consider sponsors specializing in value-add opportunities.

Avoiding Common Pitfalls: Steer Clear of These Mistakes

Watch out for these frequent missteps when selecting sponsors:

- Marketing Influence: Don't let polished materials sway you - focus on verified performance data and direct sponsor interactions

- Overlooking Warning Signs: Pay attention to inconsistencies in track records or unclear responses

- Rushed Research: Take time to thoroughly check the sponsor's background and investment approach

Building Lasting Partnerships: It's a Marathon, Not a Sprint

Think beyond single deals when choosing sponsors. The best partnerships develop over time through mutual trust and shared objectives. Finding the right long-term sponsor partner helps optimize returns while managing risk effectively.

Looking to simplify your sponsor real estate journey? Homebase streamlines the complexities of real estate syndication, from fundraising to investor relations. Learn more about Homebase and how we can help you grow your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.