Single Family vs Multi Family Homes for Real Estate Syndicators

Single Family vs Multi Family Homes for Real Estate Syndicators

Discover the key differences in single family vs multi family homes. Our guide covers financing, risk, and operations to help syndicators choose wisely.

Domingo Valadez

Jan 23, 2026

Blog

For any real estate syndicator, the choice between single-family and multi-family homes boils down to one core trade-off: scalability versus simplicity. Multi-family properties give you centralized operations and serious economies of scale. On the other hand, a portfolio of single-family homes offers a much lower barrier to entry and can ride the wave of the broader housing market's appreciation.

Ultimately, the path you choose as a sponsor hinges on your team's operational muscle, the type of investors you attract, and your long-term vision.

Navigating the Investment Landscape

The decision to focus on single-family rentals (SFRs) or multi-family housing (MFH) isn't just a small detail—it's a choice that defines your entire syndication, from the pitch deck to the final exit. This guide is built for practitioners, moving past the surface-level pros and cons to give you a real framework for aligning your strategy with your operational capabilities and what your investors are looking for.

The market is already telling a compelling story. For the first time ever, investment in single-family housing has outpaced multi-family, now making up 55% of the total annual investment in the residential space. This isn't just a blip; it signals a major institutional shift toward SFRs that savvy sponsors need to understand. You can dig into the research on shifting investment priorities on CoStar.com.

Core Differences at a Glance

Before we get into the nitty-gritty of underwriting and operations, let's lay out the high-level differences from a syndicator's point of view. Each asset class comes with its own set of opportunities and headaches that directly impact how you structure and manage a deal.

This guide will break down these distinctions, offering practical advice you can use when raising capital and keeping your investors happy. We'll explore how to structure deals that play to the strengths of each property type, helping you build a strategy that’s both solid and attractive to capital partners.

Comparing The Financial Performance of SFR and MFH

As a sponsor, your entire syndication hinges on getting the numbers right. When you're weighing single-family rentals (SFRs) against multi-family homes (MFH), you have to go deeper than just surface-level revenue. The key performance indicators (KPIs) you analyze are what will make or break your deal, and they're the bedrock of the story you tell your investors.

The debate over single family vs multi family homes almost always lands on returns, and for a good reason. The data generally shows a slight but consistent edge for multi-family assets. On average, single-family rentals might see an annual return around 8.5%, while multi-family properties can inch closer to 9.3%.

This isn't just theory. We saw this play out when Freddie Mac’s Apartment Investment Market Index, a solid benchmark for investment opportunity, jumped 7.6% year over year. That kind of movement reinforces the underlying strength in the MFH sector.

The Cap Rate Calculation

Let's start with the cornerstone of commercial real estate valuation: the cap rate. You calculate it by dividing the Net Operating Income (NOI) by the property's market value. A higher cap rate often signals a higher potential return, but it can also mean higher risk.

This is where the two asset classes fundamentally diverge. Multi-family buildings are valued almost exclusively on their NOI. For a sponsor, this is huge—it means if you can increase the income, you directly increase the value of the asset.

Single-family homes? They're a different animal. You can calculate a theoretical cap rate, but at the end of the day, an SFR's value is driven by what the house next door sold for—the "comps." Lenders and appraisers will always lean on comparable sales, not your NOI calculations.

Sponsor Takeaway: For MFH, the cap rate is your primary valuation tool. Improving NOI directly increases the property's value. For SFRs, value is tied to the broader housing market, offering less direct control for the sponsor to "force" appreciation through operational improvements alone.

Cash-on-Cash Return Dynamics

For investors chasing immediate income, cash-on-cash return is king. It's a simple, powerful metric: the annual pre-tax cash flow you receive divided by the total cash you put in.

- Multi-Family Homes: These properties are purpose-built for cash flow. With dozens or hundreds of doors, a single vacancy is just a small blip, not a catastrophe that wipes out your income. You also benefit from economies of scale in management and maintenance, which protects your NOI and keeps cash-on-cash returns more stable.

- Single-Family Homes: SFRs tend to have lower initial cash-on-cash returns. A leaky roof or a vacant month can hit your bottom line hard because all your costs are concentrated on one unit. The trade-off, however, is the potential for stronger market appreciation, which appeals to investors playing a longer game.

To really get the most out of either model, a savvy syndicator needs to understand all the crucial tax deductions for real estate investors. These can dramatically improve your net cash flow and make a good deal a great one.

To help visualize these differences, here's a quick breakdown of how the core economic metrics stack up for a sponsor.

Economic Performance Matrix: Single-Family vs. Multi-Family

A comparative analysis of key financial metrics for sponsors evaluating single-family and multi-family investment opportunities.

This matrix clarifies that your choice isn't just about which asset produces a better return on paper, but about which levers you, as the sponsor, can pull to influence that return.

How IRR Tells a Different Story

The Internal Rate of Return (IRR) is where the whole story comes together. It accounts for all cash flows over the entire holding period, plus the profit from the eventual sale. But the path to a high IRR is completely different for SFRs and MFH.

With a multi-family deal, your IRR is driven by your business plan. You're actively creating value by:

1. Renovating units to command higher rents.

2. Implementing RUBS to bill back utilities.

3. Adding amenities like a gym or dog wash station.

For an SFR portfolio, the IRR is far more dependent on external forces. Sure, you can do some cosmetic upgrades, but your big win comes from buying in the right submarket at the right time and selling when prices are high. This makes IRR projections for SFRs inherently more speculative and tied to market cycles you can't control.

Navigating the Underwriting and Financing Landscape

When you're putting a deal together, the financing you land will dictate everything—your terms, your returns, and your ability to actually pull off the business plan. Honestly, the lending worlds for single-family and multi-family are so different, they might as well be on separate planets.

If you’re a sponsor trying to raise capital, getting this difference right is non-negotiable.

For a single-family rental, the financing process feels a lot like getting a mortgage for your own home. Lenders are zeroed in on the borrower's personal financial health. They’ll pull out the microscope for your credit score, debt-to-income ratio, and personal tax returns. The property's value? It's all based on comps—what similar houses down the street sold for recently.

In the single family vs multi family homes debate, this personal dependency is a real bottleneck. You can only sign on the dotted line for so many conventional loans before lenders cut you off. It puts a hard ceiling on how fast you can grow.

The Commercial Approach to Multi-Family Financing

Everything changes when you step up to multi-family properties of five units or more. You're not in the residential mortgage office anymore; you're applying for a commercial loan. Here, the property itself is the star of the show, not your personal balance sheet.

Lenders underwrite these deals based on the asset's economic engine. They want to see the Net Operating Income (NOI), historical rent rolls, and your pro forma for future cash flow. The central question shifts from, "Can the borrower pay us back?" to "Can this property generate enough income to cover the debt?"

This is a complete game-changer for syndicators. It means you can scale a portfolio based on the quality of the deals you find, not the limits of your personal credit. For a much deeper look, our guide on how to finance apartment buildings breaks down the entire process.

Key Insight: Single-family financing is all about the borrower. Multi-family financing is all about the business plan. Lenders for apartment deals are essentially investing in your ability to run that property like a profitable company.

Unlocking Agency Debt with Multi-Family Deals

One of the biggest perks of investing in multi-family is getting access to agency debt. These are the loans backed by Government-Sponsored Enterprises (GSEs) like Fannie Mae and Freddie Mac. This type of financing is usually reserved for larger, stabilized multi-family assets, and it comes with terms you could only dream of in the single-family space.

Let’s see what that looks like in practice for a sponsor:

The non-recourse feature of agency debt is a huge deal for syndicators and their investors. It means if the deal goes sideways, the lender's only remedy is to take the property. They can't come after the personal assets of the sponsor or the limited partners. That de-risking is a massive selling point when you're out raising capital.

On top of that, a longer amortization schedule directly boosts your cash-on-cash return by lowering the monthly mortgage payment. That leaves more cash on the table for investor distributions. For sponsors who want to build a serious, scalable business, the path paved with multi-family assets and agency debt is often the most direct route to major growth.

Aligning Operations with Your Investment Strategy

A great financial model is just a story; it's boots-on-the-ground operations that turn that story into reality for your investors. The day-to-day execution is where deals are won or lost, and the operational playbooks for a scattered portfolio of single-family rentals (SFRs) and a centralized apartment building couldn't be more different. As a sponsor, you have to be brutally honest about which operational model your team is built to handle.

Managing a portfolio of single-family homes is a game of logistics. A leaky faucet in one suburb might be a 30-minute drive from a broken HVAC unit in another. This geographic sprawl creates a ton of friction, driving up costs for vendor travel and coordination. Each house is its own island, demanding individual attention for everything from landscaping to emergency repairs.

A multi-family building, on the other hand, concentrates all that chaos into one location. That centralization is the secret weapon for unlocking massive economies of scale—a critical advantage in the single family vs multi family homes debate.

The Power of Centralized Operations

The efficiency of managing everything under one roof is a game-changer. Instead of sending a plumber on a wild goose chase across three counties, you can have them knock out ten work orders in a single building before lunch. This density drives down the per-unit cost for just about every line item on your P&L.

Let's get practical. Here's what that scale looks like on the ground:

- Maintenance: One on-site maintenance tech can service an entire 100-unit building. To handle 100 separate SFRs, you'd need a complex and expensive network of third-party vendors on speed dial.

- Marketing & Leasing: A single "Now Leasing" banner and one well-crafted Zillow ad can generate leads for multiple vacant units. For SFRs, you're running a separate marketing campaign for every single house.

- Admin: With an apartment complex, you're wrestling with one property tax bill, one insurance policy, and one set of books. With a scattered portfolio, you're multiplying that administrative headache by the number of doors you own.

This operational leverage doesn't just pad the bottom line; it frees up your team's time to focus on high-impact strategic work instead of putting out fires all day.

Sponsor Insight: Think of a multi-family property as a self-contained business. The more units you have under one roof, the more you can spread out your fixed costs like management salaries, software, and marketing. This dilution flows directly to your Net Operating Income (NOI).

Implementing Distinct Value-Add Strategies

How you create value is a direct extension of your operational model. Value-add isn't a generic concept; the strategies that work for a 200-unit apartment complex are often completely irrelevant for a portfolio of rental houses. Your business plan has to reflect these real-world differences to be taken seriously by investors.

In multi-family, value-add is about systematic, scalable improvements that lift the entire property. You're looking for initiatives that can be rolled out across dozens or hundreds of units to boost income or slash expenses.

Common MFH Value-Add Plays:

- Utility Bill-Backs (RUBS): Passing through utility costs to tenants via a Ratio Utility Billing System is a classic move that can instantly add thousands to the NOI with minimal capital outlay.

- Amenity Upgrades: Adding a package locker system, a dog park, or upgrading the fitness center can justify rent bumps across the entire tenant base.

- Operational Tech: Smart locks and online rent payment portals aren't just for tenant convenience; they cut down on administrative waste and make your operation more efficient.

For single-family homes, value-add is a much more granular, house-by-house affair. Here, you're focused on targeted cosmetic upgrades that make one specific property stand out from its neighbors. Think new granite countertops, a bathroom refresh, or enhanced curb appeal—anything to maximize that home's specific rent potential and boost its future sales price based on neighborhood comps.

Whether you're managing a scattered portfolio or a dense apartment community, finding the best property management apps can be a huge help in keeping everything on track. The right tools can help you manage maintenance, communicate with tenants, and monitor finances, no matter the asset type.

Ultimately, your credibility as a sponsor hinges on presenting a business plan that is not just financially compelling but operationally achievable. That starts with matching your team's unique strengths to the right asset class.

Risk, Liquidity, and Investor Appetite: A Tale of Two Asset Classes

A smart syndicator knows a great deal is more than just a slick pro forma. It’s about deeply understanding the risks you're taking on and knowing exactly who your ideal investor is. When you stack up single-family vs. multi-family homes, you'll find they live in two completely different worlds when it comes to risk, liquidity, and the kind of investor they attract. Nailing this analysis is non-negotiable for building a deal that sells and for keeping your investors happy.

The most obvious and often-cited difference is vacancy risk. If a tenant moves out of one unit in a 100-unit apartment building, you've lost 1% of your potential income. It’s a bump in the road, but you're still collecting rent from 99 other doors. But when your single-family rental goes vacant? Your income for that property drops to zero overnight. That’s a 100% loss, instantly flipping a cash-flowing asset into a money pit.

This all-or-nothing reality of single-family rentals creates a highly concentrated risk. Sure, you can spread that risk by building a large portfolio of scattered homes, but that just trades one problem for another: a major operational headache. A single multi-family building, by contrast, has risk diversification built right in.

How the Market Values Them Differently

Beyond simple vacancy, the market forces driving value for these two asset classes couldn't be more different.

A single-family home’s value is welded to the local retail housing market. Its worth rises and falls based on comparable sales ("comps"), school district ratings, curb appeal, and the often-emotional decisions of individual homebuyers.

Multi-family properties, on the other hand, are valued like a business. Their worth is a direct function of their Net Operating Income (NOI). This is a huge advantage for sponsors because it means you’re not just riding the market waves; you can actively "force" appreciation by improving operations, cutting costs, and increasing rents. That lever simply doesn't exist in the same way for an SFR.

Key Differentiator: An SFR is worth what a family will pay to live in it, driven by comps. An MFH is worth what an investor will pay for its income stream, driven by its financial performance. This is the core distinction you must communicate to your investors when you lay out your business plan.

Finding the Right Investor for the Right Deal

These fundamental differences dictate how you should frame your syndication and who you should pitch it to. Different investors are looking for different things. Some love the simple, tangible nature of a house, while others get excited by the scalable, business-like mechanics of an apartment building.

- The Single-Family Investor: This investor might be newer to real estate or primarily chasing appreciation. They're comfortable with the idea of a home's value going up over time and often see SFRs as a more digestible investment. Your pitch to them will likely highlight market growth, the quality of the neighborhood, and the potential for long-term equity build-up.

- The Multi-Family Investor: This is typically a more seasoned investor who speaks the language of cap rates, cash flow, and operational efficiency. They are drawn to the stability of diversified income and the sponsor's skill in creating value. The pitch for an MFH deal is all about the business plan—how you're going to boost NOI, tighten up expenses, and deliver consistent, predictable cash flow.

The current economic environment is also a major tailwind. With the median age of first-time homebuyers hitting record highs due to interest rates and affordability issues, the renter pool is getting deeper and wider. This structural shift is driving incredible demand for all rental housing. In fact, the U.S. is estimated to need 4.3 million new rental units by 2035. You can get a deeper dive into these market dynamics by checking out the 2025 multifamily market recap on vikingcapllc.com.

At the end of the day, a syndicator is a matchmaker. Your job is to connect the right deal with the right capital. By clearly articulating the distinct risk and reward profile of your asset—whether it’s the appreciation-driven SFR or the cash flow-driven MFH—you can build a syndicate of investors who are bought in and aligned with your vision from the very start.

Making the Right Choice for Your Syndication

So, single-family or multi-family? There’s no magic answer here. The best choice for your syndication boils down to a hard look at your team's skills, what your investors are looking for, and your own long-term vision. This isn't about which asset class is "better" in a vacuum; it's about which one is the right fit for you.

Ultimately, the decision starts with some honest self-assessment. Are you set up to manage a scattered portfolio of homes, banking on appreciation? Or is your team built to run a centralized, cash-flowing business contained in one building? Getting that answer right is the first step toward a deal that actually works.

A Framework for Your Decision

Before you even think about sourcing your next deal, pause and run through these questions. Your answers will point you toward the right property type for your specific operational capacity and investor base. A mismatch here is a recipe for headaches later on.

1. What’s Your Target Deal Size and How Do You Plan to Scale?

Think about your growth ambitions. If you want to build a $5 million portfolio, doing it with single-family homes means closing dozens of separate deals. That’s dozens of inspections, dozens of loans, and dozens of closings. You can hit that same $5 million mark with a single multi-family acquisition, which dramatically simplifies the process and makes asset management more efficient from day one.

2. What Are Your Team's Real Operational Strengths?

This is where you need to be brutally honest about what your team is good at. Do you have the systems and logistical know-how to handle maintenance and leasing for properties spread all over a city? Or does your team excel at on-site management, where you can execute a detailed value-add plan in a single, controlled environment? Multi-family operations are all about tenant experience and systematic upgrades, while a single-family portfolio demands an ironclad vendor network and serious routing efficiency.

3. What Do Your Investors Actually Want?

Aligning with your investors is everything. Are your limited partners expecting a steady, predictable check in the mail every quarter? Or are they playing the long game, focused on appreciation over time? The asset class you pick is a direct promise to your LPs about the kind of returns they should expect.

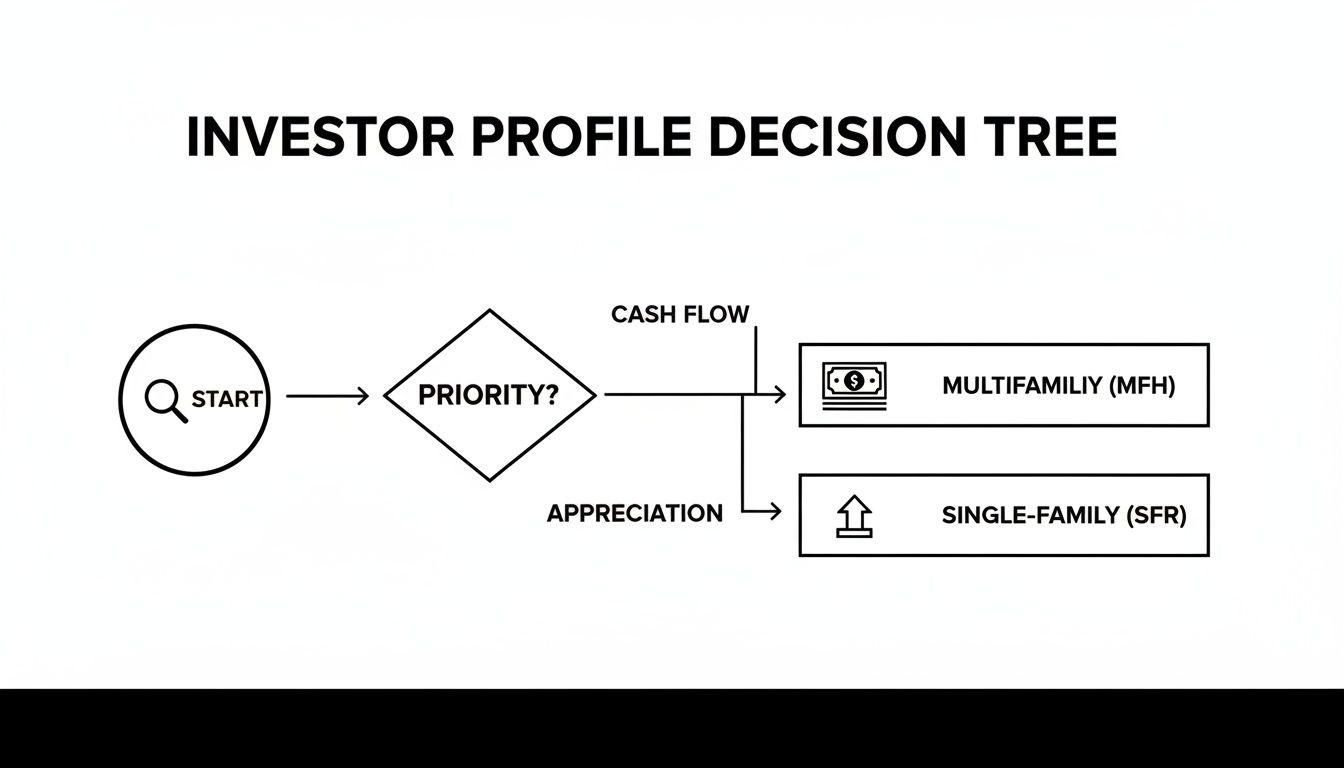

This decision tree breaks it down visually, showing how an investor’s primary goal should steer your strategy.

As you can see, investors who prioritize immediate and consistent cash flow are a perfect match for multi-family deals. On the flip side, those focused on building long-term wealth through market appreciation will feel more at home with a single-family rental strategy.

Final Takeaway: Your job as a sponsor is to be a strategist, not just a deal junkie. The best syndicators don't chase whatever asset class is trendy. They build a well-oiled machine designed to operate one specific type of real estate, and then they find investors who want exactly what that machine produces.

Making a Confident Choice

By using this framework, you can get past the generic pros and cons and make a strategic call that plays to your strengths and delivers on investor expectations. The single-family route offers a simpler structure and a direct link to market appreciation. The multi-family path gives you massive scalability and direct control over your cash flow.

Both can be wildly profitable, but only if you go in with your eyes wide open to the unique operational, financial, and strategic demands each requires.

Frequently Asked Questions

When you're weighing single-family against multi-family, you're not just picking a property type—you're choosing a business model. Both have their place, but they demand different skills, capital, and strategies. Let's break down some of the most common questions sponsors and investors grapple with.

Is It Easier to Get Financing for Single Family or Multi Family Properties?

For someone just starting out, a single-family rental is definitely the path of least resistance for financing. Lenders underwrite these deals (for one-to-four units) using conventional residential mortgages, which means they're looking at your personal credit score and income. It's a familiar process for most people.

But once you’re looking to scale, the script flips entirely. For apartment buildings with five or more units, you step into the commercial lending arena. Here, the game changes. The lender’s focus shifts from your personal finances to the property’s financial performance—specifically its Net Operating Income (NOI).

This is a massive advantage for experienced sponsors. Your personal borrowing capacity no longer limits you, and you can access agency debt from giants like Fannie Mae and Freddie Mac. These loans often come with far better terms, like non-recourse clauses (protecting your personal assets) and longer amortization schedules, which are perfect for structuring large syndications.

Which Property Type Offers Better Appreciation Potential?

This is a classic debate, and the answer depends on whether you prefer to ride a wave or build your own.

Single-family homes have historically shown strong appreciation because their value is tied directly to the emotional, retail-driven housing market. Their worth is based on comparable sales, or "comps," which are influenced by things like school districts, neighborhood charm, and homeowner demand. In a hot market, this can lead to some impressive passive gains.

Multi-family assets are valued completely differently—like a business. Their value is a direct function of the income they produce. While you might not see the same explosive, market-driven price jumps, you have a powerful tool at your disposal: forced appreciation.

As a sponsor, you can directly increase the property's value by improving its operations.

* Renovate units to justify higher rents.

* Add in-demand amenities like a dog park or a package room.

* Bill back utilities to tenants to cut expenses.

Every dollar you add to the NOI has a multiplier effect on the property's valuation.

Key Takeaway: Single-family appreciation is largely passive and market-driven. Multi-family appreciation is active; a savvy operator can literally manufacture value, giving sponsors a strategic lever that just doesn't exist in the single-family world.

How Does Property Management Differ Between Asset Classes?

The day-to-day operations are where you really feel the difference between these two asset classes.

Managing a portfolio of single-family rentals is a game of logistics. Your properties are scattered, sometimes across an entire city. A simple maintenance call can turn into a logistical headache, burning time and fuel as you or your technician drive from one location to the next. This geographic inefficiency drives up costs and slows down response times.

With a multi-family property, everything is consolidated. You have tremendous economies of scale. All your "customers" are under one roof.

* A single on-site manager can handle leasing for the entire building.

* One maintenance person can efficiently tackle multiple work orders in a single afternoon.

* Marketing efforts are concentrated on one location, not dozens.

This centralized model drastically reduces your per-unit operating costs, making management far more streamlined and cost-effective.

Ready to streamline your next real estate deal? Homebase is the all-in-one platform designed for syndicators to manage fundraising, investor relations, and distributions effortlessly. Focus on closing capital, not on busywork.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

The 12 Real Estate Investment Types Syndicators Must Know in 2026

Blog

Explore our guide to the 12 essential real estate investment types. Learn the pros, cons, and returns to find the right strategy for your portfolio.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.