Your Guide to Reg D Rule 506 Capital Raising

Your Guide to Reg D Rule 506 Capital Raising

Master capital raising with our Reg D Rule 506 guide. Learn the key differences between 506(b) and 506(c), investor rules, and how to file your Form D.

Domingo Valadez

Aug 10, 2025

Blog

If you're raising money for a business or real estate deal, you've probably heard about the SEC. The thought of a full-blown public offering—with its mountains of paperwork and staggering costs—is enough to make anyone's head spin. But there's a much more direct route that savvy entrepreneurs and fund managers use all the time: Reg D Rule 506.

Think of it as the private, express lane for raising capital. It's the most common and powerful exemption for private placements, making it essential to understand if you're serious about fundraising.

What Is Reg D Rule 506 and Why Should You Care?

At its heart, Regulation D (Reg D) is a set of rules that lets you sell securities in your company without having to go through the grueling SEC registration process. Rule 506 is the most popular part of Reg D because it offers incredible flexibility.

Here's a simple analogy: A public offering (like an IPO) is like trying to get your product into every Walmart in the country. It's a massive, public-facing effort with endless regulations and hoops to jump through.

A private placement under Rule 506, on the other hand, is like hosting an exclusive, invitation-only trunk show. You skip the red tape of a public launch because you're only dealing with a specific, sophisticated group of people.

The SEC created this "safe harbor" to help businesses—especially startups, small companies, and real estate syndicators—get the funding they need to grow. The logic is that certain investors are financially savvy enough to evaluate the risks themselves, without the SEC holding their hand every step of the way.

The Two Flavors of Rule 506

Rule 506 isn't a one-size-fits-all deal. It comes in two distinct versions, and choosing the right one is critical to your fundraising strategy.

- Rule 506(b): This is the traditional, "private network" route. You can only raise money from people with whom you have a pre-existing, substantive relationship. Think friends, family, and close professional contacts. General advertising is a huge no-no here.

- Rule 506(c): This is the modern, "public megaphone" option. It lets you advertise your deal to the world—on social media, at conferences, anywhere you want. The catch? You can only accept funds from accredited investors, and you must take reasonable steps to verify their status.

We’ll get into the nitty-gritty of 506(b) vs. 506(c) later on, but for now, just know you have two very different tools in your toolkit.

Why Rule 506 Is the King of Private Capital

It's hard to overstate just how dominant Rule 506 is in the private market. It gives fundraisers a clear, reliable path to capital while still protecting investors. A massive advantage is that it preempts state-level "blue sky" laws, which means you don't have to worry about registering your offering in every single state where you have an investor. This alone is a game-changer.

The real magic of Rule 506 is its blend of flexibility and scale. It allows you to raise an unlimited amount of money from an unlimited number of accredited investors. That’s why it works for everything from a small duplex syndication to a billion-dollar venture capital fund.

The data backs this up. For years, studies have shown that Rule 506 of Regulation D accounts for around 94% of all capital raised under Reg D. It’s the undisputed market standard. Even small raises that could fit under other rules often use Rule 506 because it’s so well-understood and trusted in the industry. If you want to dig into the data yourself, you can explore the trends in private offerings and see just how foundational this rule is to capital formation in the U.S.

Choosing Your Path: Rule 506(b) vs. Rule 506(c)

Once you’ve decided to use Reg D Rule 506 for your capital raise, you’re at a crossroads. This next choice is critical and will shape your entire fundraising strategy: will you take the quiet, relationship-based route of Rule 506(b), or the public, broadcast-style approach of Rule 506(c)?

Think of it like this: Rule 506(b) is hosting an exclusive dinner party. You can only invite people you already know and trust. You certainly wouldn't put up flyers around town announcing it.

On the other hand, Rule 506(c) is like throwing a massive block party with an open invitation. You can shout about it from the rooftops, advertise online, and tell the whole world about your investment opportunity. The catch? You have to be much stricter about who you actually let through the door.

The Private Network Approach: Rule 506(b)

Rule 506(b) has long been the workhorse of private placements. Its core principle is a strict prohibition on general solicitation. This means you can't publicly advertise your offering. At all. No social media posts, no website banners, and definitely no email blasts to a list you bought online.

Instead, you must rely on pre-existing, substantive relationships with your potential investors. This is a crucial legal standard. It means you have a real connection with the investor—enough to understand their financial situation and investing savvy before you even bring up the deal.

The big upside to this private approach is flexibility. Under 506(b), you can accept investments from:

- An unlimited number of accredited investors.

- Up to 35 non-accredited but "sophisticated" investors.

A sophisticated investor is someone who has the financial knowledge and experience to fully evaluate the risks of an investment, even if they don't meet the high-income or net worth tests for accreditation. This can be a huge advantage if your network includes sharp, capable people who aren't technically accredited yet.

The Public Megaphone: Rule 506(c)

Introduced as part of the JOBS Act, Rule 506(c) flipped the traditional model on its head by allowing general solicitation. This is a game-changer. It means you can publicly market your offering, dramatically expanding your reach. You can feature your real estate syndication on your website, discuss it on podcasts, or run targeted digital ad campaigns.

However, this marketing power comes with a rigid, non-negotiable condition: you can only accept funds from accredited investors. Period.

Even more importantly, you must take “reasonable steps to verify” that every single one of your investors is, in fact, accredited. It’s not enough for them to just check a box on a form. You have to collect proof, like tax returns, bank statements, or a confirmation letter from their CPA or attorney.

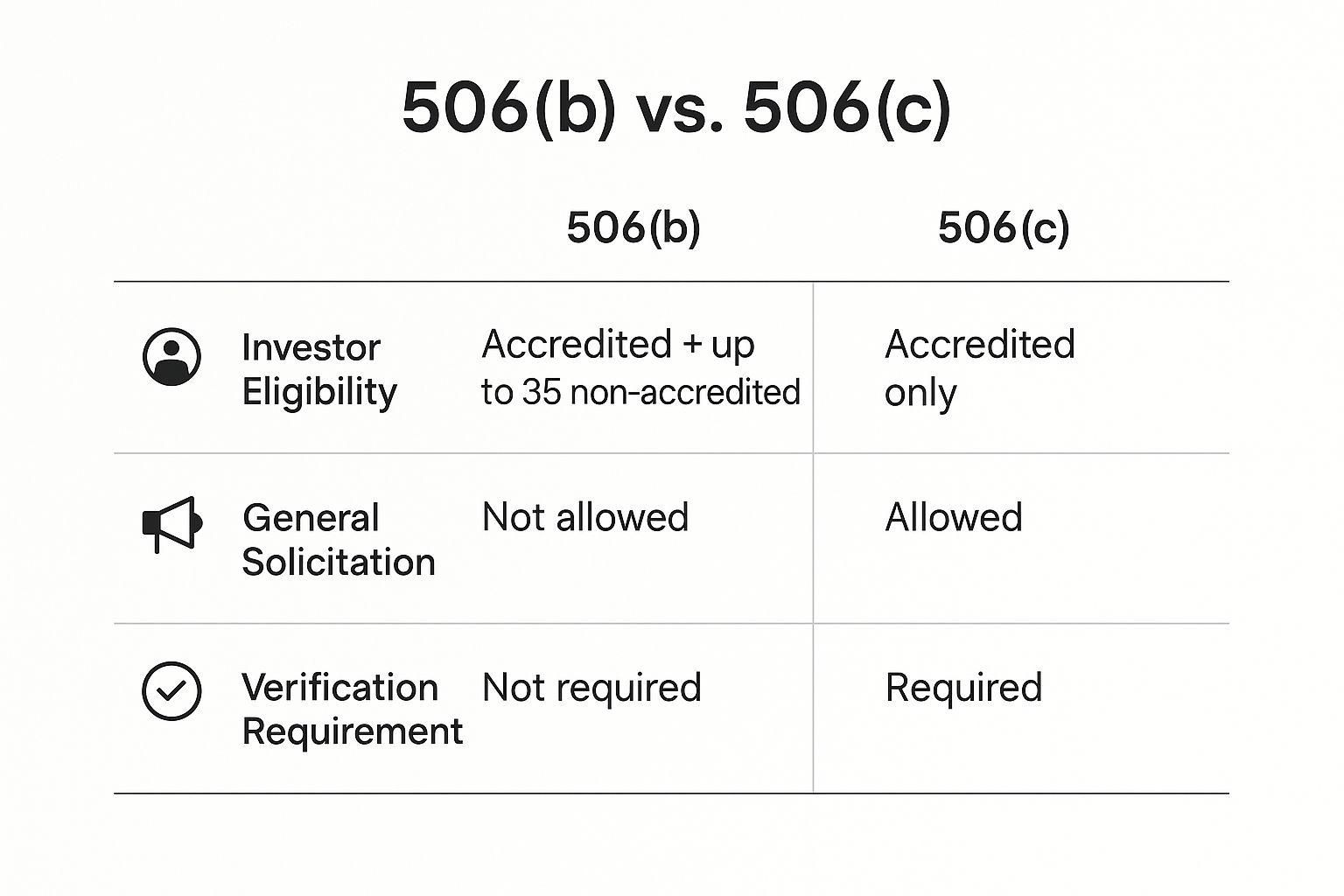

This table breaks down the essential differences between the two rules, helping you see the trade-offs at a glance.

Key Differences Between Rule 506(b) and Rule 506(c)

As you can see, the choice involves a direct trade-off. Rule 506(c) gives you a megaphone to reach a wider audience, but it comes with a higher compliance burden and a more restrictive investor pool.

Ultimately, your decision comes down to one key question: is your existing network strong enough to fund your deal, or do you need to cast a wider net?

If you have a deep rolodex of trusted, sophisticated investors, 506(b) offers a more direct and less complicated path. If you need to reach beyond your immediate circle to find capital, 506(c) gives you the tools to do it—as long as you’re prepared for that rigorous verification process. To explore these paths in greater detail, you can check out our guide on Regulation D Rule 506 for more in-depth scenarios.

Defining Your Investor Pool: Accredited vs. Sophisticated Investors

Before you can even think about raising capital under Reg D Rule 506, you have to get crystal clear on who you're allowed to raise it from. This isn't just a suggestion—it's a core requirement of securities law. The SEC has created specific categories for investors to ensure anyone putting money into private, unregistered deals has the financial standing or the business savvy to understand and handle the risks involved.

The two terms you'll hear over and over are accredited investor and sophisticated investor. They are absolutely not the same thing, and knowing the difference is critical. Your choice between a Rule 506(b) or a Rule 506(c) offering hinges on understanding these definitions inside and out.

What Is an Accredited Investor?

Think of an "accredited investor" as the SEC's way of identifying people or entities financially equipped for the world of private placements. It’s not about how smart they are; it’s a purely objective measure of their financial capacity. In a way, it’s like a financial “driver’s license” that grants access to private market opportunities.

For an individual to be considered accredited, they have to meet at least one of these clear-cut criteria:

- The Income Test: An annual income of over $200,000 (or $300,000 combined with a spouse) for the last two consecutive years, with a solid expectation it will continue.

- The Net Worth Test: A net worth exceeding $1 million, on their own or with a spouse. It’s important to note this calculation excludes the value of their primary home.

- The Professional Test: Certain financial professionals who hold a Series 7, 65, or 82 license in good standing also qualify based on their proven expertise.

Entities can also be accredited, such as banks, investment firms, or any organization where every single owner is an accredited investor. The underlying principle is simple: these investors have the financial means to absorb a potential loss without facing financial ruin.

A key distinction here: with a Rule 506(b) offering, you can typically rely on an investor's self-attestation via a questionnaire. For a Rule 506(c) offering, the burden of proof is on you. You must take "reasonable steps to verify" their accredited status, which often means reviewing tax returns or bank statements.

The Nuance of the Sophisticated Investor

This is where things get interesting, and it’s a flexibility unique to Rule 506(b). While a 506(c) offering is strictly for accredited investors only, a Rule 506(b) deal can bring in up to 35 non-accredited investors, but with a huge caveat: they must be "sophisticated."

So, what does "sophisticated" actually mean? Unlike the hard numbers for accredited status, sophistication is subjective. It’s all about financial acumen.

The SEC defines a sophisticated investor as someone who possesses, either on their own or with a financial advisor, "such knowledge and experience in financial and business matters that they are capable of evaluating the merits and risks of the prospective investment."

Source: U.S. Securities and Exchange Commission

This isn't about the size of their bank account; it's about their experience and analytical ability. A sophisticated investor might be a real estate broker who understands market cycles and property valuation, a retired entrepreneur who has built and sold businesses, or an accountant who can tear apart a financial model—even if their net worth is under $1 million.

Why Disclosures Become Non-Negotiable

If you go the 506(b) route and include sophisticated (but non-accredited) investors, your responsibilities multiply. You are now legally required to give them the same level of detailed information they would get in a fully registered public offering.

This disclosure package must be robust and typically includes:

- A detailed Private Placement Memorandum (PPM).

- Audited financial statements related to the offering.

- A transparent and thorough outline of all potential risks.

- A formal opportunity for them to ask questions and get straight answers.

Skipping these disclosures is a serious compliance breach. The entire point is to level the playing field, arming these non-accredited investors with the information they need to make a genuinely informed decision. And while a PPM isn't technically required for accredited investors in a 506(b), it's a universal best practice that demonstrates professionalism and protects you from future liability.

While Rule 506(b) lives in the quiet world of private networks, Rule 506(c) is all about stepping into the public spotlight. Introduced as part of the 2013 JOBS Act, this rule completely changed how private capital gets raised by allowing something called general solicitation.

Suddenly, sponsors could openly advertise their investment deals. Think social media posts, presentations at industry events, or even a banner on your own website.

This was a massive shift. Imagine you're a real estate sponsor with a fantastic deal but a limited personal network. Before, you were stuck pitching only to people you already knew. Rule 506(c) gives you a megaphone, letting you reach a huge pool of potential investors who would never have heard of you otherwise.

But this new power comes with a critical trade-off. You can cast a much wider net, but you can only accept money from accredited investors. And the responsibility for proving they are accredited falls squarely on your shoulders.

The Strict Mandate of Investor Verification

Under a 506(c) offering, having an investor simply check a box claiming they're accredited won't cut it. You must take “reasonable steps to verify” that every single person investing meets the SEC's definition of an accredited investor. This is the crucial gatekeeper that makes public fundraising legal. Getting it wrong can have serious consequences, potentially torpedoing your entire capital raise.

To make things easier, the SEC provides a "non-exclusive" list of verification methods that are generally considered safe harbors. Think of it as a playbook for staying compliant.

- Reviewing Tax Documents: You can look at an investor’s recent IRS forms (like a W-2 or 1040) to confirm they meet the income test—$200,000 for an individual or $300,000 for a couple.

- Inspecting Financial Statements: Another option is to review bank or brokerage statements to verify their net worth exceeds $1 million (not including their primary residence).

- Third-Party Confirmation Letters: You can also rely on a written letter from a licensed professional—like a CPA, an attorney, or a registered investment adviser—stating they've already done the work to verify the investor's status.

A Facts and Circumstances Analysis

The idea of "reasonable steps" is intentionally flexible. The SEC wants you to look at the specific facts and circumstances of each investor. For example, how did you find them? What's the nature of your relationship? If someone is investing a very large amount, that fact alone might make it more reasonable to believe they are accredited, perhaps requiring less digging on your part.

This verification requirement is the single biggest operational difference between a 506(b) and a 506(c) offering. It requires a documented, ironclad process to prove you did your homework on every investor.

Despite the obvious appeal of public advertising, Rule 506(c) hasn't exactly taken the private markets by storm. Recent data shows that only about 8.4% of venture capital funds have used it to raise capital since it became available. While the rule created a valuable new path to funding, there are still real barriers in the private markets, especially for certain groups of fund managers. You can learn more about the impact of Rule 506(c) on capital markets directly from SEC reports.

This tells us that while 506(c) is a powerful tool, it's not a magic bullet. Using it effectively requires a very careful and deliberate strategy.

How to Confidently File Your Form D

You’ve successfully raised capital under Reg D Rule 506—a huge milestone for any real estate syndicator. But before you pop the champagne, there's one final, crucial step: filing your Form D with the SEC. It might sound like a mountain of paperwork, but with a little preparation, it's more like a straightforward checklist.

Let's start by busting a common myth. Filing a Form D is not an application for approval. It’s simply a notice. You're not asking the SEC for permission; you're telling them, "Hey, we just completed an exempt private offering." They don't approve it, they just file it away.

The Core Filing Process Explained

Breaking it down, filing a Form D really just has a few key steps. The whole point is to report what you did, not to create another obstacle in your capital-raising journey.

The main event happens online through the SEC's EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system. Before you can log in and submit, you’ll need to have your offering's details ready to go.

This includes information about:

* The Issuer: Your company’s basic info—name, address, industry, and who’s running the show (executives and directors).

* The Offering: How much you set out to raise, how much you've sold so far, and what kind of securities you offered (like equity or debt).

* The Investors: A headcount of your accredited and non-accredited investors.

Once you or your attorney have this information pulled together, it gets submitted through the EDGAR portal.

The Critical 15-Day Deadline

When it comes to Form D, the clock is ticking. The SEC is strict about this one.

You must file your Form D no later than 15 calendar days after the first sale of securities. The "date of first sale" is the moment you have the first investor's signed subscription agreement and their money in hand.

Missing this deadline is a bigger deal than you might think. While it won't kill your current offering's exemption, it can get you blocked from using Reg D for future deals for up to a year. This is a "bad actor" disqualification, and it can put a serious dent in your future fundraising plans. It’s best to treat this 15-day window as non-negotiable.

State-Level Filings and Blue Sky Laws

Rule 506 is a federal exemption, which is great because it overrides most state registration rules. However, it doesn't give you a free pass from state regulators entirely. You still need to deal with what are called "blue sky" laws.

In practice, this just means you have to send a notice and pay a fee in every state where you have an investor. The good news is that it’s not a full-blown registration. Most states have made it easy by accepting a copy of your federal Form D filing through the Electronic Filing Depository (EFD) system.

Don't skip this step. Ignoring state-level filings can lead to fines and other penalties. Staying compliant on both the federal and state fronts is a hallmark of a properly managed reg d rule 506 offering. Platforms like Homebase are built to help track these moving parts, ensuring you stay in good standing everywhere you operate.

Your Top Reg D Rule 506 Questions, Answered

As you get deeper into the world of private placements, the nuances of Reg D Rule 506 can feel a bit tricky. Even the most seasoned sponsors run into the same handful of questions time and again. Getting these right isn't just about best practices—it's about protecting your deal and your reputation.

Let's dive into the most common questions we hear from sponsors and provide the straightforward answers you need to fundraise with confidence.

Can I Switch From a 506(b) to a 506(c) Mid-Raise?

This is a big one, and the answer is almost always a hard no. Think of 506(b) and 506(c) as two fundamentally different paths. Once you start down one, you can't just hop over to the other.

Why not? Their core rules are completely at odds. For instance, if you launch a 506(b) and bring in even one non-accredited (but sophisticated) investor, you've immediately closed the door on ever being a 506(c) offering, which strictly prohibits them. On the flip side, if you start advertising your deal under 506(c) rules, you’ve already broken the cardinal rule of a 506(b)—no general solicitation.

Your choice between 506(b) and 506(c) is a foundational decision that shapes your entire capital raise. You have to lock it in before you accept a single dollar from an investor.

What Happens If I File My Form D Late?

So you missed the 15-day deadline to file your Form D after the first sale. It happens, but it's not something to take lightly. While a late filing doesn’t typically kill your current offering's exemption, the ripple effects can seriously impact your future deals.

The SEC can actually prohibit you from using any Regulation D exemption for a full year. On top of that, state regulators often have their own set of fines and penalties they can levy. It's best to treat that 15-day deadline as non-negotiable to keep your compliance record squeaky clean.

Does a Rule 506 Offering Mean I'm Off the SEC's Radar?

Absolutely not. This is one of the most dangerous myths out there. While Rule 506 gives you an exemption from the registration process, it does not give you a pass on the anti-fraud rules.

What does that mean? It means every statement you make to an investor must be truthful and accurate. You are legally responsible for any misleading information or for omitting critical facts about the investment. The SEC has full authority to investigate and prosecute fraud, regardless of whether the offering was registered or exempt.

Keeping all these compliance details straight is exactly where a dedicated platform can make all the difference. Homebase is designed to help real estate sponsors manage the entire lifecycle of a deal—from fundraising and investor verification to document signing and distributions—all while keeping compliance front and center. See how you can professionalize your next syndication at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.