Master Real Estate PPM Strategies for Success

Master Real Estate PPM Strategies for Success

Learn proven real estate PPM techniques from industry experts and boost your portfolio management skills. Start building wealth today!

Domingo Valadez

Jun 2, 2025

Blog

Understanding Real Estate PPM That Actually Works

Let's explore the practical side of real estate PPM (Property Portfolio Management). We're not talking theory here, but the actual strategies successful investors use. This practical knowledge is key for anyone looking to grow from owning a single property to managing a diverse and profitable portfolio. Many investors find this transition challenging because it requires a significant change in perspective.

The Shift From Property Owner to Portfolio Manager

Owning a single property often involves a focus on the tangible aspects of real estate – things like maintenance, tenant relationships, and the appreciation of that individual property. However, real estate PPM requires a much wider view. This broader perspective includes considering market trends, economic cycles, and how to optimize finances across multiple properties. For instance, a portfolio manager might analyze market data to identify emerging investment opportunities in specific regions, while a single property owner might be more concerned with the dynamics of their local neighborhood.

This shift involves a strategic approach to several key areas:

- Diversification: This means spreading investments across different property types, locations, and even investment strategies.

- Financial Optimization: This involves implementing strategies to maximize cash flow and minimize expenses across the entire portfolio.

- Risk Management: This focuses on identifying and mitigating potential threats to the portfolio's performance, such as economic downturns or changes in local regulations.

This professional approach is the dividing line between casual real estate investors and those who build lasting wealth. The global property management market has seen significant growth, estimated to reach $27.81 billion by 2025, fueled by increasing demand for these specialized services. You can find more detailed statistics from Cognitive Market Research.

Real-World Examples of Effective Real Estate PPM

Experienced investors utilize a variety of approaches to real estate PPM, adapting their strategies based on their specific goals and the current market conditions. Some prioritize building a portfolio of cash-flowing properties, focusing on consistent income over rapid appreciation. Others might pursue a value-add strategy, acquiring properties that need renovations or improvements to increase their overall value.

Here are a few examples of how experienced investors structure their approach:

- Geographic Diversification: Investing in properties across different cities or states helps to lessen the impact of localized economic downturns.

- Property Type Diversification: Balancing a portfolio with a mix of residential, commercial, and industrial properties allows investors to capitalize on the unique advantages of different market segments.

- Strategic Refinancing: Leveraging equity gains from appreciating properties can be used to refinance and acquire additional assets, further expanding the portfolio.

The Importance of a Structured Approach

Successful real estate PPM requires a structured approach. This includes setting clear investment goals, defining a specific acquisition strategy, and implementing robust operational systems. This structure provides a framework for making informed decisions and navigating the complexities of managing multiple properties. A well-defined strategy also enables investors to better adapt to changing market conditions and identify new emerging opportunities. These key components are essential for building a sustainable and profitable real estate portfolio.

Building Your Real Estate PPM Foundation That Lasts

A successful real estate PPM (Property Portfolio Management) strategy hinges on a strong foundation. Just like constructing a building, a solid groundwork is essential for the entire structure's stability and longevity. This section explores the key components experienced portfolio managers use, ranging from property selection to financial structuring for sustained growth.

Defining Your Real Estate PPM Acquisition Criteria

Establishing clear acquisition criteria is paramount for effective real estate PPM. Think of these criteria as your guiding principles – a filter to sift through numerous potential investment properties. They help you zero in on opportunities that align with your overarching portfolio goals. These criteria could include preferred geographic locations, property sizes, or specific lease terms.

Importantly, these criteria should be data-driven, rooted in factors that genuinely predict performance. This goes beyond surface-level appeal, delving into the data that underpins a property's potential.

- Market Fundamentals: Analyze the local economy. Is it robust and demonstrating consistent growth?

- Property Condition: Evaluate the property's physical state. Are significant renovations needed, or is it well-maintained?

- Potential for Appreciation: Research factors that suggest the property's value will appreciate over time.

Evaluating Potential Acquisitions: Metrics That Matter

After identifying potential acquisitions, systematic evaluation is essential. This involves using key metrics to gauge the financial viability of each investment.

- Net Operating Income (NOI): This metric represents the property's profitability after deducting operating expenses from revenue.

- Capitalization Rate (Cap Rate): The cap rate expresses the NOI as a percentage of the property's value, enabling comparisons between different properties.

- Cash-on-Cash Return: This metric reveals the annual pre-tax cash flow relative to the initial cash investment, giving a direct measure of your return.

This analytical approach is crucial for informed real estate PPM decisions. Portfolio managers with well-defined acquisition criteria and systematic evaluation processes are statistically more successful. They are 73% more likely to achieve target returns and experience 40% fewer problematic investments. More detailed statistics on real estate portfolio performance can be found here.

Building a Balanced and Diversified Portfolio

Diversification is key for long-term success in real estate PPM. Strategically spreading your investments across different property types and geographic locations helps mitigate risk. It also allows you to capitalize on varied market opportunities.

Consider balancing cash-flowing properties, like multifamily apartments, with properties that offer higher appreciation potential, perhaps in emerging markets. This balanced approach provides a steady income stream while positioning your portfolio for future growth.

Financing Structures for Long-Term Growth

Your real estate PPM strategy's financial structure should be designed for long-term expansion. Explore various financing options, including traditional mortgages, private loans, and joint ventures. Each option has its own set of advantages and disadvantages; choosing the right combination is critical.

Furthermore, establish clear financial goals and operational systems early on. This allows for efficient scaling as your portfolio grows, setting the stage for sustainable expansion without overextending your resources.

Technology That Transforms Real Estate PPM Performance

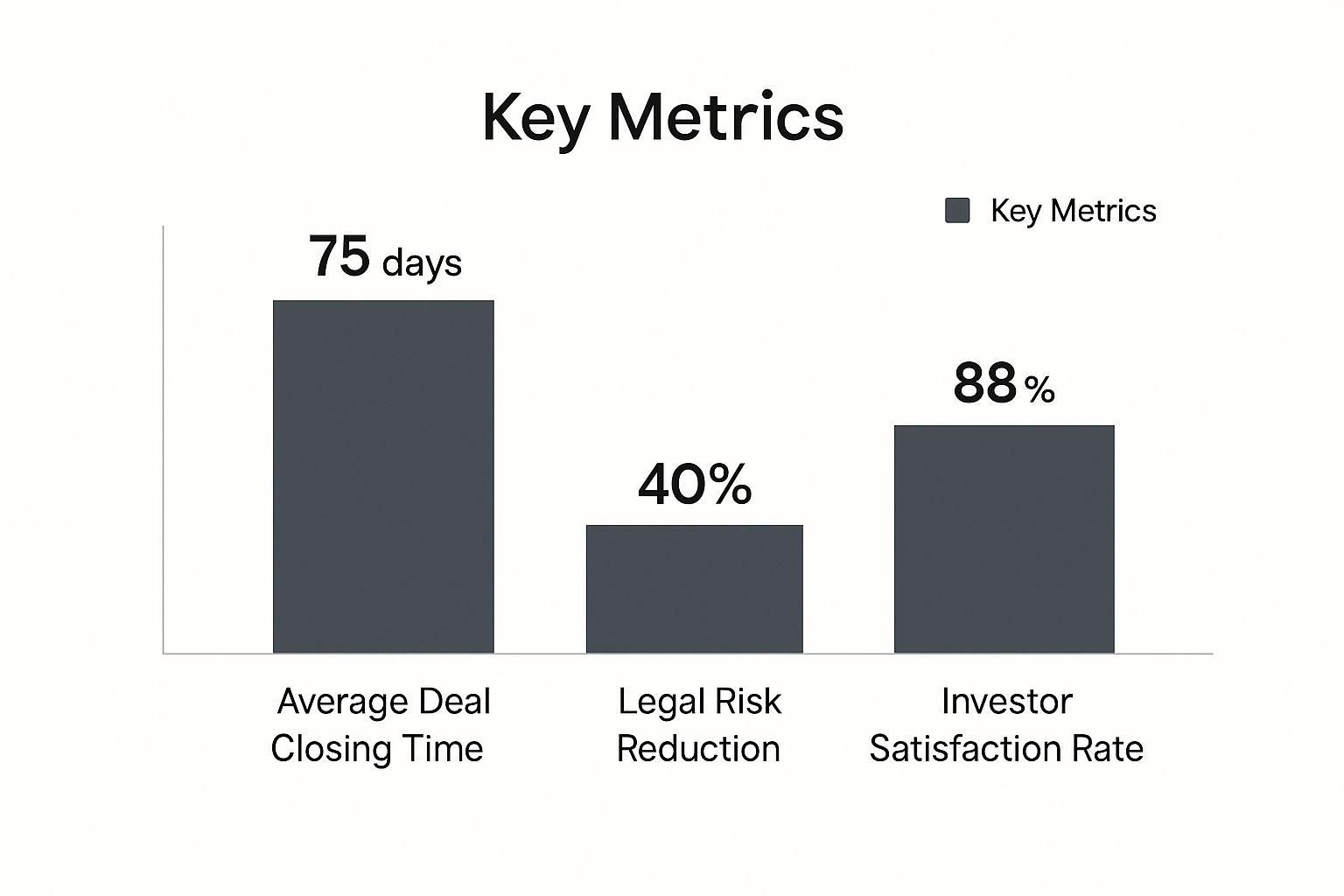

The infographic above highlights the significant impact of technology on real estate portfolio property management (PPM) performance. Key metrics like deal closing time, legal risk reduction, and investor satisfaction are all positively affected. Using the right technology can decrease deal closing times to an average of 75 days, reduce legal risks by 40%, and boost investor satisfaction to 88%.

This underscores the importance of effective technology integration within real estate PPM.

Software Platforms That Streamline Real Estate PPM Operations

Savvy portfolio managers are utilizing technology to optimize their operations and enhance profitability. They recognize that technology's true value lies in providing practical solutions to real-world challenges. This involves selecting appropriate software platforms to manage the intricacies of a growing real estate portfolio.

For example, comprehensive property management software, such as AppFolio or Buildium, can consolidate diverse tasks. Financial tracking, tenant management, and maintenance scheduling can all be managed within a single, centralized platform. This approach not only saves valuable time but also minimizes the risk of errors. Such errors often arise when juggling multiple spreadsheets or disconnected systems. The global property management market is embracing this digital shift, as demonstrated by the growing adoption of these essential software solutions. More insights into this trend can be found here.

To help you choose the right software, let's explore some key features to look for in real estate PPM platforms:

- Automated Reporting: Quickly generate detailed financial reports, offering real-time visibility into portfolio performance.

- Centralized Communication: Improve communication with tenants, contractors, and investors through a unified platform.

- Portfolio-Wide Analytics: Monitor crucial Key Performance Indicators (KPIs) across all properties to pinpoint areas for improvement and growth.

To give you a clearer picture of what's available, let’s look at a comparison of some popular options.

The following table, "Essential PPM Technology Tools Comparison," provides a comprehensive overview of key technology platforms used in real estate PPM. It compares features, pricing, and suitability for various portfolio sizes, offering valuable insights for informed decision-making.

As this table illustrates, choosing the right software depends on the size and specific needs of your portfolio. While cloud-based solutions offer a good balance of functionality and affordability, larger portfolios might benefit from the comprehensive features of ERP systems or the flexibility of custom solutions.

Data Analytics and Optimization Opportunities in Real Estate PPM

Data analytics is revolutionizing portfolio management decision-making. By gathering and analyzing data from multiple sources, managers gain invaluable insights into market dynamics, property performance, and tenant behavior. This data-driven approach allows for the identification of optimization opportunities that might otherwise go unnoticed.

For instance, analyzing tenant turnover rates can uncover underlying issues with certain properties, prompting proactive measures to improve tenant retention. This directly impacts long-term profitability. Similarly, tracking market trends allows portfolio managers to identify emerging investment prospects and make informed decisions regarding acquisitions and dispositions.

Emerging Technologies and Their Impact on Real Estate PPM

Staying abreast of emerging technologies is crucial for success in real estate PPM. It's important to distinguish true innovation from hype, recognizing that not every new technology is transformative.

Here are some promising emerging technologies worth investigating:

- Artificial Intelligence (AI): AI-driven tools automate tasks, analyze data, and generate predictive insights, optimizing portfolio management processes. Learn more about AI in real estate.

- Blockchain Technology: Blockchain enhances transparency and security in real estate transactions, simplifying procedures and minimizing costs.

- Virtual and Augmented Reality (VR/AR): VR/AR transforms property marketing and tenant experiences with immersive virtual tours and interactive visualizations.

By carefully evaluating emerging technologies and selecting those offering tangible advantages, portfolio managers can establish a competitive edge. This strategic approach ensures smart technology investments that genuinely yield results and prepare them for long-term success in the dynamic world of real estate PPM.

Financial Strategies That Maximize Real Estate PPM Returns

The success of your real estate PPM (Property Portfolio Management) depends on more than just picking the right properties. Financial optimization strategies are key to maximizing returns and driving portfolio growth. This section explores proven financial techniques that can significantly impact your bottom line.

Maximizing Cash Flow Across Your Real Estate Portfolio

Consistent cash flow is the foundation of successful real estate PPM. This means securing dependable tenants and implementing effective expense management. Even small adjustments can lead to significant improvements.

Strategically refinancing properties with lower interest rates can free up substantial cash flow for reinvestment or portfolio expansion. Negotiating better contracts with vendors, implementing energy-efficient upgrades, and regularly reviewing operating expenses can create further savings. Over time, these optimizations can generate substantial long-term gains.

Leveraging Appreciation Gains to Fuel Portfolio Expansion

While consistent cash flow is vital, real estate PPM also leverages appreciation. As property values rise, this equity can fuel further growth. You can refinance an appreciated property and use the released equity to acquire additional assets.

This "snowball effect" allows for faster portfolio expansion than relying solely on saved cash. This accelerated growth potential sets real estate PPM apart from traditional buy-and-hold strategies. Maintaining a balance between leveraging gains and preserving cash reserves for unexpected events or market fluctuations is crucial for mitigating risk while capitalizing on opportunities.

Tax Optimization and Depreciation Benefits in Real Estate PPM

Navigating the tax landscape is essential for maximizing real estate PPM returns. Understanding and using available tax benefits can significantly affect profitability. Depreciation allows you to deduct a portion of a property's value annually, reducing your taxable income.

This benefit can free up significant cash flow for reinvestment. Strategic tax planning, such as using 1031 exchanges to defer capital gains taxes, can further enhance returns. Consulting a qualified tax advisor is crucial for leveraging all applicable tax strategies to maximize investment returns. Investors using systematic financial optimization strategies report an average of 23% higher annual returns and maintain 60% larger cash reserves compared to those using basic buy-and-hold approaches. More detailed statistics can be found here.

Structuring Financing for Flexibility and Opportunity

Your real estate PPM financing structure should support current operations and provide the flexibility to seize future opportunities. This might involve securing lines of credit or maintaining healthy cash reserves.

These strategies enable you to act quickly when attractive investment opportunities arise and adapt to changing market conditions. Securing a favorable loan quickly can be the difference between acquiring a promising property and losing it to a competitor. This proactive approach positions your portfolio for long-term success. A well-structured financial foundation is essential for navigating the complexities of the real estate market and maximizing your portfolio's potential.

Market Analysis That Drives Real Estate PPM Growth

Understanding market dynamics is crucial for making profitable real estate PPM (Property Portfolio Management) decisions. It's not enough to passively read market reports; you need an active understanding that informs your investment strategies. This involves conducting practical market research and identifying key trends that directly impact your portfolio.

Evaluating New Markets for Real Estate PPM

Successful portfolio managers don't limit themselves to familiar territory. They actively explore new markets to discover hidden opportunities. This exploration requires a multi-faceted approach.

- Economic Indicators: Analyzing local economic data, such as job growth, population trends, and industry diversification, helps assess a market's potential for future growth.

- Supply and Demand Dynamics: Understanding the balance between available properties and tenant demand offers valuable insight into potential rental income and property appreciation.

- Regulatory Environment: Researching local zoning laws, building codes, and tax regulations is essential for understanding the legal landscape and potential investment risks.

For example, a market with strong job growth and limited housing supply might present an attractive opportunity for multifamily investments. However, strict zoning regulations could increase project costs, requiring careful evaluation.

Timing Portfolio Adjustments Based on Market Trends

Market conditions are constantly evolving. Effective real estate PPM requires adapting to these changes and adjusting your portfolio accordingly. This involves recognizing the optimal times to hold, sell, or acquire properties based on prevailing market indicators.

- Market Peaks: When markets are thriving, it could be a strategic time to sell properties that have appreciated significantly. This allows you to lock in profits and free up capital for future investments.

- Market Downturns: During economic downturns, opportunities may emerge to acquire undervalued properties. This can position your portfolio for strong future growth when the market recovers.

This active management is essential for maximizing returns and mitigating potential losses. Learning about different investment strategies, like Real Estate Syndication, can be beneficial. In the United States, the property management market is expected to reach $98.88 billion by 2029. More detailed statistics can be found here.

Diversification Strategies for Real Estate PPM Growth

Diversification is a cornerstone of risk management in real estate PPM. It involves strategically distributing investments across various property types, geographic areas, and even investment strategies. This approach minimizes the impact of market fluctuations.

- Geographic Diversification: Investing in properties located in different cities or regions reduces the overall risk associated with localized economic downturns or natural disasters.

- Property Type Diversification: Maintaining a balanced portfolio of residential, commercial, and industrial properties can create stable income streams, even if one sector underperforms.

- Investment Strategy Diversification: Balancing cash-flowing properties with those offering higher appreciation potential builds a well-rounded portfolio, providing both consistent income and long-term growth.

Scaling Operations as Your Portfolio Grows

As your real estate portfolio expands, efficiently scaling operations becomes increasingly important. This involves developing systems and processes to handle increasing complexity without compromising profitability.

- Technology Integration: Implementing property management software helps streamline operations, automate tasks, and provides valuable data for making informed decisions.

- Team Building: A skilled team of property managers, legal advisors, and financial professionals is essential for effectively managing a larger and more diverse portfolio.

- Financial Planning: Developing a comprehensive financial plan, including budgeting, forecasting, and risk assessment, is crucial for maintaining financial stability as your portfolio grows.

To better understand the key performance indicators and benchmarks for real estate portfolios, consider the following table:

Real Estate PPM Performance Metrics Dashboard

Key performance indicators and benchmarks for measuring real estate portfolio success across different property types and market conditions

This table summarizes some of the most common metrics used to evaluate the performance of a real estate portfolio. Tracking these metrics and comparing them to industry benchmarks can help identify areas for improvement and optimize investment strategies.

By implementing these strategies, portfolio managers can effectively navigate the complexities of the real estate market, mitigate risks, and position their investments for long-term, sustainable growth. A proactive approach is essential for maximizing returns and achieving success in the competitive real estate PPM landscape.

Risk Management That Protects Your Real Estate PPM Success

Smart risk management is crucial for successful real estate Property Portfolio Management (PPM). It's not about avoiding all risks, but about understanding which risks are acceptable and mitigating those that could seriously impact your investment strategy. This requires implementing proactive strategies to safeguard your investments and ensure long-term portfolio stability.

Identifying and Assessing Potential Risks in Real Estate PPM

The first step in effective risk management is identifying potential threats to your portfolio. This involves a thorough analysis of various factors that could negatively impact its performance.

- Market Risks: Fluctuations in market conditions, such as economic downturns or changes in interest rates, can significantly affect property values and rental income.

- Property-Specific Risks: These risks pertain to individual properties within your portfolio. Examples include physical damage from natural disasters, environmental hazards like asbestos or lead paint, and tenant-related issues like defaults or property damage.

- Financial Risks: These risks arise from the financial structure of your investments, such as loan defaults, interest rate increases, or changes in lending regulations.

- Legal and Regulatory Risks: Shifts in zoning laws, building codes, or environmental regulations can significantly impact property development and ongoing operations.

A comprehensive risk assessment will help you prioritize which risks require immediate action and allow you to allocate resources strategically. This proactive approach enables you to anticipate potential challenges and implement preventative measures.

Implementing Risk Mitigation Techniques

After identifying potential risks, the next step is implementing specific mitigation techniques. Careful planning and proactive strategies are essential in this phase.

- Insurance Optimization: Regularly review your insurance policies to ensure they provide adequate coverage against potential losses, including property damage, liability claims, and natural disasters.

- Tenant Screening Protocols: Implement thorough tenant screening procedures, including background checks, credit history reviews, and reference checks, to minimize the risk of tenant defaults and property damage.

- Emergency Reserve Planning: Maintaining adequate cash reserves is vital for covering unexpected expenses, such as major repairs, extended vacancy periods, or legal fees. For example, a reserve fund equivalent to six months of operating expenses can provide a crucial safety net during market fluctuations.

- Diversification: Diversifying your investments across different property types, geographic locations, and investment strategies can significantly reduce your overall portfolio risk.

These mitigation strategies can substantially improve your portfolio's resilience and minimize potential losses. For instance, studies show that portfolio managers who implement comprehensive risk management strategies experience 58% fewer vacancy periods and 67% lower maintenance costs. They also maintain higher occupancy rates, around 89%, even during economic downturns, compared to those using reactive approaches. Learn more about the benefits of proactive risk management here.

Crisis Management and Portfolio Recovery

Even with meticulous planning, unforeseen events can and do occur. Developing a comprehensive crisis management plan is essential for navigating challenging periods and facilitating portfolio recovery.

- Communication Plan: Establish clear communication channels with investors, tenants, and other stakeholders to maintain transparency and facilitate coordinated action during a crisis.

- Financial Contingency Plans: Having pre-arranged lines of credit or other accessible financial resources can provide crucial support during periods of financial distress.

- Property Management Protocols: Develop detailed procedures for handling emergencies, such as natural disasters, major repairs, or security incidents, to minimize disruptions and ensure tenant safety.

These strategies can help mitigate the impact of unexpected events and position your portfolio for a swift recovery. This also involves learning from past experiences and adapting your strategies to address future challenges.

Long-Term Risk Management in Real Estate PPM

Effective risk management is an ongoing process, not a one-time event. Continuously monitoring market conditions, reevaluating potential risks, and adjusting mitigation strategies are crucial for long-term success in real estate PPM.

- Regular Portfolio Reviews: Regularly review your portfolio's performance and risk profile to identify emerging threats and adjust your strategies accordingly.

- Market Analysis: Staying informed about market trends, economic indicators, and changes in regulations can help you anticipate potential challenges and proactively adapt your investment approach.

- Professional Development: Continuously learning about new risk management techniques and best practices will allow you to stay ahead of emerging threats and maintain a competitive advantage.

By implementing a proactive and adaptable risk management approach, you can protect your investments, navigate market volatility, and position your real estate PPM strategy for sustained growth. Understanding that risk is inherent in real estate investment is key. However, with careful planning and diligent execution, these risks can be managed effectively to achieve your long-term investment goals.

Key Takeaways For Real Estate PPM Success

This section offers practical strategies to boost your real estate Property Portfolio Management (PPM) success. These actionable takeaways, gathered from seasoned portfolio managers, provide clear steps, checklists, and milestones to guide you from initial planning to ongoing optimization. Each point emphasizes immediately applicable strategies with specific performance indicators to help you track your progress.

Foundational Elements for Real Estate PPM

Creating a strong foundation is essential for long-term success. This involves focusing on three key areas:

- Clearly Defined Investment Goals: Setting SMART goals (Specific, Measurable, Achievable, Relevant, and Time-bound) is crucial. A clear objective, such as targeting a specific return on investment within a set timeframe, provides direction and allows you to measure progress effectively.

- Robust Acquisition Criteria: Data-driven criteria are essential for evaluating potential investments. Factors to consider include market fundamentals, property condition, and potential for appreciation. This ensures you're making informed decisions based on solid data.

- Structured Financial Framework: A sound financial plan, encompassing financing options, budgeting, and reserve planning, is the bedrock of a stable portfolio. This framework provides stability and supports sustainable growth.

Sequencing Portfolio Growth for Maximum Efficiency

Strategic sequencing of acquisitions, financing, and operations is key to efficient portfolio expansion.

- Phased Acquisitions: Start with properties aligning with your core investment strategy. Diversify gradually as your portfolio matures. Beginning with a smaller number of properties allows you to gain valuable experience and refine your approach.

- Strategic Refinancing: Use equity gained from appreciating properties to finance future acquisitions. This accelerates growth without depleting cash reserves, allowing you to reinvest profits strategically.

- Operational Scalability: Implement adaptable systems and processes. As your portfolio expands, integrate technology, build your team, and refine financial planning to handle increasing complexity.

Recognizing Warning Signs and Adjusting Your Strategy

Even the best-laid plans require adjustments. Recognizing warning signs and adapting is crucial for long-term success.

- Declining Market Conditions: Stay informed about market trends. Be prepared to adapt. During a downturn, shifting focus from appreciation to cash flow preservation can be a prudent move.

- Underperforming Properties: Regularly monitor property performance. Identify assets not meeting your goals. Be willing to divest underperforming properties and reinvest in more promising opportunities.

- Operational Inefficiencies: Periodically evaluate your operational systems. Identify areas for improvement. Optimizing tenant management, maintenance, or financial tracking can significantly impact your bottom line.

Essential Checklists and Milestone Markers

Checklists and milestones provide a structured approach to tracking progress and achieving your goals.

- Acquisition Checklist: Before acquiring any property, use a comprehensive checklist for due diligence. This includes property inspections, title searches, and financial analysis to minimize risk.

- Financial Performance Milestones: Establish specific financial targets for your portfolio, such as net operating income or cash flow. Regularly track progress against these milestones to ensure investments are performing as expected.

- Portfolio Review Schedule: Regularly review your portfolio's performance and risk profile. Assess market conditions, property performance, and operational efficiency to proactively identify and address potential issues.

By consistently implementing these key takeaways and strategies, you can significantly improve your real estate PPM success and build a profitable, sustainable portfolio.

Are you ready to elevate your real estate syndication business? Homebase provides an all-in-one platform to streamline fundraising, investor relations, and deal management. Visit Homebase today to learn more and optimize your real estate investments.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.