How The Real Estate 1 Percent Rule Can Transform Your Investment Strategy

How The Real Estate 1 Percent Rule Can Transform Your Investment Strategy

Master the real estate 1 percent rule with proven strategies that drive successful property investments. Learn from experienced investors how this powerful metric can help evaluate and build a profitable real estate portfolio.

Domingo Valadez

Jan 2, 2025

Blog

Getting Started With The 1 Percent Rule

Many real estate investors use the 1 percent rule as a quick way to evaluate potential rental properties. This simple calculation suggests that a property's monthly rent should be at least 1% of its purchase price. For example, if you buy a house for $300,000, it should generate monthly rent of $3,000 or more. The rule helps investors quickly determine if a property might generate enough rental income to cover its costs like mortgage payments, taxes and maintenance. By using this initial screen, investors can efficiently review many properties and focus their attention on the most promising opportunities.

Why The 1 Percent Rule Matters

For active real estate investors, having a quick way to assess properties is essential. The 1 percent rule provides exactly that - a clear benchmark for evaluating potential deals. An investor looking at dozens of listings can immediately eliminate properties that don't meet this basic threshold and dedicate more time to analyzing the ones that do. This becomes especially valuable in competitive markets where making fast decisions is crucial.

Applying The 1 Percent Rule In Practice

Using the 1 percent rule is straightforward. Start by looking at a property's purchase price and calculate 1% of that number. Then compare this target amount to the actual or expected monthly rent. Properties that meet or exceed the 1% threshold may deserve a closer look. However, remember that this is just an initial filter. You'll still need to analyze other key factors like property taxes, insurance costs, and expected maintenance expenses before making an investment decision.

When The 1 Percent Rule Might Not Apply

While helpful as a starting point, the 1 percent rule doesn't work equally well in all markets. In expensive cities like San Francisco or New York, property values are often too high relative to rents for properties to meet this threshold. The rule also leaves out important considerations like ongoing expenses, vacancy rates between tenants, and professional property management fees that affect your actual returns. For these reasons, use the 1 percent rule as an initial screen rather than the final word on a property's investment potential.

Beyond The Basics: Refining Your Approach

To use the 1 percent rule effectively, you need to understand its limitations. While it works well for initial property screening, successful investors dig deeper into the specifics of each potential deal. For instance, a property might meet the 1 percent rule but need major repairs soon that would eat into profits. That's why it's important to combine this rule with thorough analysis of the local market, property condition, and all expected costs before making investment decisions.

Making The Numbers Work For You

Understanding how to effectively apply the real estate 1 percent rule requires going beyond basic calculations. Smart investors use this rule as an initial screen to filter potential deals, then conduct deeper analysis to determine if properties align with their investment goals.

Evaluating Properties Efficiently

Successful investors develop systematic approaches to evaluate properties against the 1 percent rule. Many create custom spreadsheets or use real estate software to quickly calculate target rents and compare them to market rates. This allows rapid analysis of multiple listings to identify those meeting the 1% threshold. For instance, an investor analyzing a specific neighborhood could compile listing prices in a spreadsheet to instantly see which properties have potential to generate sufficient rental income.

Market-Specific Adjustments and Creative Approaches

The 1 percent rule needs adaptation based on local market conditions. In high-cost areas, reaching the 1% target often requires strategic thinking. Smart investors look for ways to boost rental income through property improvements. For example, converting unused space into an extra unit or upgrading kitchens and bathrooms can significantly increase rent potential. Some explore alternative rental strategies like short-term or furnished rentals to bridge gaps between market rates and desired returns.

Considering the Nuances

Experienced real estate investors know that successful application of the 1 percent rule requires evaluating multiple factors. They assess property condition, market trends, and appreciation potential alongside the basic calculation. A property meeting the 1% threshold might need extensive repairs that reduce profitability. Conversely, a property slightly below 1% in an appreciating area could still make financial sense. Making informed decisions requires thorough due diligence - from property inspections to market research - to fully understand an investment's potential.

Understanding long-term financial implications is also crucial. You might be interested in: How to master real estate investing structures for a broader perspective on wealth building through real estate. The 1 percent rule works best as one tool among many for analyzing potential investments. When combined with detailed financial analysis and strategic planning, it helps investors make profitable real estate decisions. Success comes from using this rule alongside other metrics while maintaining focus on long-term investment goals.

Navigating Different Market Conditions

Getting the most out of the real estate 1 percent rule means recognizing that real estate markets are fundamentally local. Each market has its own dynamics and traits that affect how well this guideline works in practice. Rather than applying it blindly, smart investors adapt their approach based on specific market conditions.

Understanding Market Variations

The effectiveness of the 1 percent rule varies significantly across different types of real estate markets. In steady, mid-sized cities with moderate but stable growth, the rule often matches up well with typical market rents. But the story changes in hot markets near major tech employers - here, purchase prices frequently rise faster than rents can keep pace, making the 1 percent target harder to reach. Meanwhile, in areas with slower economic growth, hitting the 1 percent number might be easier, but investors need to watch out for higher vacancy rates and declining property values.

Adapting Your 1 Percent Rule Strategy

Success requires adjusting your investment tactics to match local market realities. In competitive areas with strong growth, some ways to boost rental income include:

- Premium Amenities: Installing high-end appliances, smart home systems, or sought-after features can support higher rental rates.

- Short-Term Rentals: Services like Airbnb sometimes produce better monthly income compared to standard leases.

- Niche Rental Strategies: Offering furnished units, student housing, or corporate rentals can command premium prices where appropriate.

In slower-growth markets, the focus shifts to managing costs and maintaining steady returns:

- Value-Add Opportunities: Buying properties under market value and making targeted improvements can increase both rents and overall returns.

- Careful Expense Management: Closely tracking operating costs like property taxes, insurance, and repairs is key to protecting profits.

- Long-Term Investment Horizon: Accepting that appreciation may be gradual means concentrating on reliable cash flow.

Case Study: The 1 Percent Rule in Action

Let's look at two real examples. A downtown condo priced at $500,000 would need $5,000 monthly rent to meet the 1 percent rule - possible with upscale finishes and prime location. Compare this to a similar-sized suburban house bought for $300,000, needing only $3,000 monthly rent. This lower target might be achievable with basic updates while marketing to stable, long-term tenants.

Beyond the Numbers: Local Market Expertise

No matter the location, deep market knowledge is essential for success. Building connections with local real estate professionals, property managers, and fellow investors gives you inside perspective on neighborhood trends, rental patterns, and realistic income potential. This on-the-ground insight helps you apply the 1 percent rule wisely within the context of actual market conditions. While the rule provides a useful starting framework, its real value comes from combining it thoughtfully with detailed understanding of specific local markets.

Understanding The Complete Cost Picture

Looking beyond the initial 1 percent calculation reveals essential financial factors that determine a rental property's true profitability. While this rule provides a helpful starting point, making sound investment decisions requires examining the full range of expenses that impact your returns.

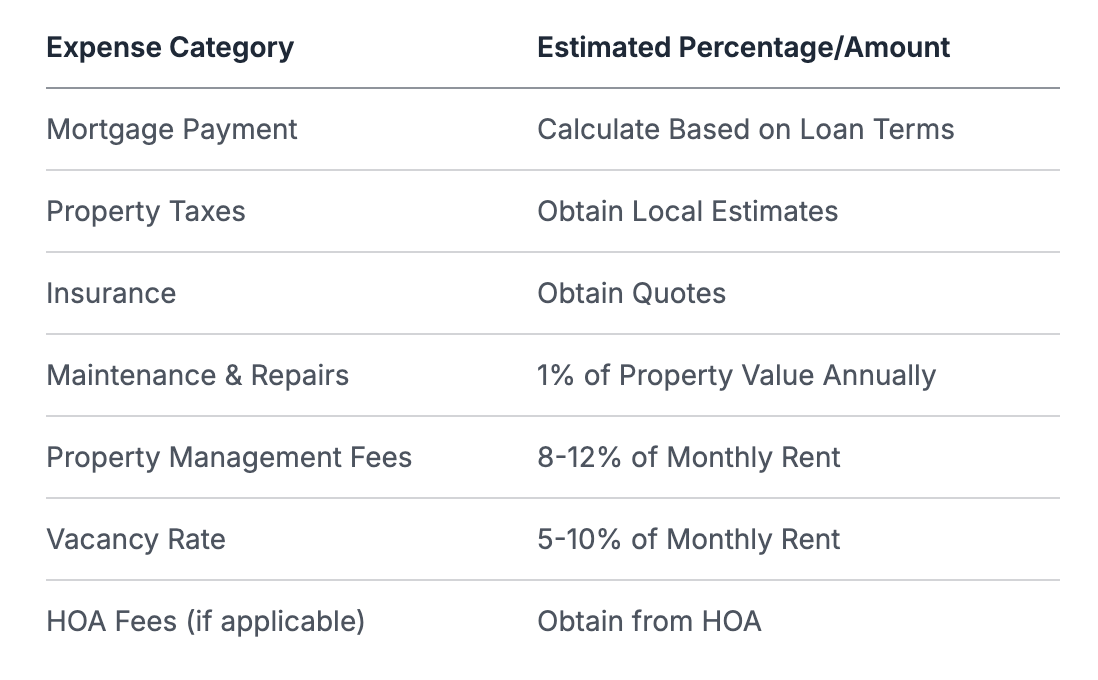

Hidden Expenses: Beyond Rent

The 1 percent rule compares rent to purchase price, but experienced property investors recognize that success depends on accounting for numerous other costs. Here are the key expenses that can significantly affect your bottom line:

- Maintenance and Repairs: All properties need ongoing upkeep and occasional major repairs. Smart investors set aside about 1% of the property value annually for maintenance costs. From fixing leaky faucets to replacing aging roofs, these expenses are unavoidable and must be planned for.

- Property Management Fees: If you hire a management company, expect to pay 8-12% of monthly rent for their services. This fee can take a big bite out of profits, especially in areas with lower rental rates.

- Vacancy Rates: Empty units mean zero income. Plan for 5-10% vacancy time between tenants, depending on your local market. This prevents overestimating your annual rental income.

- Property Taxes and Insurance: These mandatory costs vary dramatically by location. Research specific rates for your target property since they can differ substantially even within the same city.

- HOA Fees: Properties in homeowners associations often have significant monthly dues covering shared amenities and maintenance. While these services add value, the fees directly impact your cash flow.

Creating a Comprehensive Financial Model

A detailed financial analysis should include all income and expenses to accurately project cash flow and returns:

Use this framework as a starting point, but customize it with actual numbers for your specific property and market conditions.

Market-Specific Challenges and Adjustments

The effectiveness of the 1 percent rule varies significantly across different real estate markets. High-cost urban areas often make it difficult to achieve the 1% threshold, requiring investors to look for properties with renovation potential or consider short-term rental strategies. Meanwhile, slower-growth markets might easily meet the 1% target but face challenges like higher vacancy rates and limited appreciation. Success requires understanding your local market dynamics and adjusting your analysis accordingly. This deeper evaluation helps you make better-informed investment choices based on real market conditions rather than simplified rules of thumb.

Adapting To Today's Market Realities

The real estate market is constantly changing, shaped by economic conditions, new technologies, and what tenants want. This means investors need to be flexible in how they apply the 1 percent rule while maintaining a solid grasp of current market conditions. Success comes from blending time-tested principles with modern approaches.

Technology's Impact on the 1 Percent Rule

The rise of digital tools has changed how investors evaluate and operate properties. Websites and apps now offer extensive market data, making it easier to estimate rents and property values accurately. For instance, investors can easily check rental rates in specific neighborhoods, spot emerging patterns, and review past performance data. This helps them make smarter decisions about which properties meet the 1 percent rule criteria. Modern property management software also helps reduce operating costs, which affects the overall profit calculations tied to the 1 percent rule.

Shifting Tenant Preferences and the 1 Percent Rule

Today's renters have different priorities than previous generations. They often look for connected home features, energy-saving appliances, and flexible lease options. This change affects how much rent a property can generate. Properties with sought-after features can often charge higher rents, potentially making it easier to reach the 1 percent rule target. However, adding these features requires upfront costs that need careful consideration in the profit analysis. Understanding what modern tenants want helps investors position their properties effectively and better judge their potential within the 1 percent rule framework.

New Investment Vehicles and the 1 Percent Rule

Recent developments like real estate crowdfunding and shared ownership platforms have created new ways to invest in property, each with its own considerations for the 1 percent rule. These options make it easier to invest in real estate with less money upfront. However, the core principles of the 1 percent rule still matter. Investors should carefully examine expected rental income, costs, and potential returns, adapting the rule to fit each platform's specific features. This includes accounting for platform fees, management structures, and possible risks before relying on simple percentage-based calculations.

Practical Advice for Challenging Markets

When local conditions make meeting the 1 percent rule difficult, investors need to think creatively. One approach is to focus on properties that can be improved - where updates or renovations could lead to higher rents. For example, updating kitchens and bathrooms or adding features tenants want can justify charging more. Some investors find success with different rental strategies, like offering furnished units or short-term stays. Success in tough markets requires thorough research and a deep understanding of local trends. By studying similar properties and keeping up with market changes, investors can make smart choices even when conditions aren't ideal.

Building A Winning Investment Strategy

Getting the most from the real estate 1 percent rule requires more than simple arithmetic. To use this tool effectively, you need to integrate it into a broader investment approach alongside other key principles and metrics.

Combining the 1 Percent Rule With Other Metrics

Smart investors know the 1 percent rule is just the first step in evaluating potential investments. They pair it with other vital measurements to get a complete picture. For instance, the capitalization rate helps assess a property's potential return by looking at net operating income. This means a property that falls slightly short of the 1 percent threshold might still be an excellent investment if it has minimal operating costs and a strong cap rate. Adding cash flow analysis reveals the true income potential after all expenses, giving investors a much clearer view than the 1 percent rule alone provides.

Creating Effective Screening Systems

When looking through hundreds of listings, having a clear system makes all the difference. The 1 percent rule works well as an initial filter in a multi-step screening process. You might start with a simple spreadsheet that automatically flags properties meeting the 1 percent threshold. From there, you can apply additional criteria like location quality, property condition, and cap rate to identify the most promising options. This methodical approach helps focus your time and energy on properties that truly fit your investment goals.

Building Relationships With Real Estate Professionals

Success in real estate investing depends heavily on your network of experts. Local real estate agents can share essential information about market conditions, neighborhood trends, and realistic rental rates. Property managers offer practical insights about operating costs and expected vacancy periods, helping refine your 1 percent rule calculations. Other investors in your network can share their experiences applying the rule in different market conditions, adding valuable real-world perspective to your analysis.

Success Stories and Pitfalls

Real-world examples offer valuable lessons about using the 1 percent rule effectively. Consider the investor who found a property slightly below the 1 percent target but saw potential for improvement. After strategic renovations, the property exceeded the threshold and became highly profitable. On the flip side, learning about common mistakes - like overestimating rental income or missing hidden expenses - helps avoid costly errors. These practical examples from both successful and challenging situations provide concrete guidance for using the rule wisely.

Practical Steps for Implementation

To put these ideas into action, follow a clear process. Begin by outlining your specific investment criteria and target market. Use the 1 percent rule to quickly screen properties, then dive deeper into promising options with detailed financial analysis including cash flow and cap rate calculations. Throughout the process, build and maintain relationships with real estate professionals who can provide market insights and support your investment decisions.

Managing your real estate investments efficiently is key to maximizing returns. Homebase provides a comprehensive platform to streamline this process, from tracking expenses to communicating with investors. Learn more about how Homebase can simplify your real estate syndication journey at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.