A Guide to Real Estate Partnership Agreement Structures

A Guide to Real Estate Partnership Agreement Structures

Explore our complete guide to the real estate partnership agreement. Learn to structure deals, define roles, and protect your investments with confidence.

Domingo Valadez

Jan 28, 2026

Blog

At its core, a real estate partnership agreement is the legally binding document that spells out the terms for everyone involved in a property investment. Think of it as the operational playbook for your joint venture, designed to get everyone on the same page and head off potential disagreements before they ever start.

The Blueprint for Every Real Estate Partnership

Don't let the legal language fool you—your partnership agreement isn't just a dense contract. It's the architectural blueprint for your entire investment. A skyscraper needs a detailed plan to stand tall, and your partnership needs a solid framework to ensure stability, clarify who does what, and align everyone's financial interests from day one.

This document is your single most important tool for navigating the journey of a joint real estate deal. It sets the ground rules and acts as a roadmap for the entire life of the investment, from finding and buying the property all the way through to the final sale.

The Key Players and Their Roles

In the world of real estate partnerships, you'll almost always find two distinct types of partners, each with a very different job:

- General Partners (GPs): These are the "boots on the ground" managers. The GPs are the ones sourcing the deal, overseeing the property, executing the business plan, and handling all the daily operational headaches. In exchange for this control, they typically take on unlimited liability.

- Limited Partners (LPs): These are the passive, "money" partners. LPs contribute the capital needed to get the deal done in exchange for an equity stake. Their involvement in day-to-day management is minimal, and just as importantly, their liability is limited—their financial risk is usually capped at the amount they invested.

This GP/LP structure isn't just common; it's the backbone of the industry. According to IRS data for Tax Year 2022, partnerships in real estate and rental/leasing made up a massive 50.7% of all 4.5 million U.S. partnership returns filed. That staggering number shows just how central this model is to real estate investing.

A well-crafted agreement turns a complex venture into a clear, collaborative success. It’s the foundation that outlines how profits are shared, decisions are made, and potential conflicts are resolved, protecting both the asset and the partners’ relationships.

To really build a strong foundation, it's vital to have a solid grasp of the essential principles within the field of Real Estate Law. This knowledge ensures your agreement isn't just a handshake deal but a document built on solid legal ground.

Choosing Your Investment Vehicle and Legal Structure

Before you even think about writing the first line of your partnership agreement, you have to answer a bigger question: What legal structure will actually own the property? Think of it like picking the right vehicle for a cross-country road trip. A two-seater sports car isn't going to work for a family of five, and a giant RV is overkill for a solo weekend getaway. The vehicle has to fit the journey.

It's the exact same logic with your real estate deal. The entity you form needs to match your investment strategy, how much risk everyone is willing to take, and who will be calling the shots. This decision is the foundation for everything that follows, influencing personal liability, tax treatment, and even how you bring in investor capital.

For most real-estate syndications, the choice almost always boils down to two workhorses: the Limited Liability Company (LLC) and the Limited Partnership (LP). They might sound similar, but the differences between them are night and day.

The Rise of the Versatile LLC

The LLC has become the crowd favorite for modern real estate deals, and for good reason. It’s like a highly versatile SUV—it does a lot of things really, really well. It masterfully blends the personal liability protection you’d get from a corporation with the tax advantages and flexibility of a simple partnership.

Here’s the main draw: an LLC shields all its members from the company's debts. That includes both the sponsors running the deal (the "managing members") and the passive investors. So, if the project goes sideways or gets hit with a lawsuit, creditors can’t come after your personal bank account or home. That peace of mind is huge.

On top of that, LLCs are incredibly flexible. The rulebook for how the company operates is called an Operating Agreement, which is the LLC’s version of a partnership agreement. This document is a blank canvas, letting you spell out exactly how profits are split, who gets to vote on what, and how the entire deal is managed.

The Traditional Limited Partnership

The Limited Partnership (LP) is the old-school model—think of it as a classic, heavy-duty pickup truck built for one job. In an LP, you have two distinct classes of partners. There’s at least one General Partner (GP) who runs the show but also has unlimited personal liability. Then you have the Limited Partners (LPs), who are the passive money partners whose liability is capped at the amount they invested.

That unlimited liability for the GP is the big catch. It means if the deal goes under and owes money, the GP's personal assets are on the table to cover the losses. While LPs were the standard for decades, this exposure is why many sponsors now steer clear. Why take the risk when the LLC offers a better option?

For a deeper dive into how partnership structures can vary, it's also helpful to understand the nuances of a Limited Liability Partnership (LLP), which offers another flavor of protection for its partners.

The core difference often boils down to liability. With an LP, the General Partner is personally exposed. With an LLC, everyone involved, including the managers, enjoys a protective shield around their personal assets.

To really see the difference, it helps to put these two real estate syndication structures side-by-side.

Comparison of Common Real Estate Partnership Entities

This table breaks down the key distinctions between the LLC and the LP, helping you see why one might be a better fit for your specific real estate venture.

As you can see, the LLC generally offers more protection and flexibility, which explains why it has become the dominant choice for syndicators today.

The Core Components of an Ironclad Agreement

A solid real estate partnership agreement isn't just a legal formality—it's the very blueprint for your investment. Its real strength is found in the details. Every single clause has a job to do, and together they create a clear, predictable roadmap that keeps everyone protected.

Let's break down the essential pieces that make up the backbone of any good agreement. Think of them like the gears in a complex watch. When they're all well-defined and working in sync, the whole operation runs like clockwork. But if one is missing or poorly drafted, the entire venture can grind to a messy halt.

Capital Contributions: Who Puts in Money and When

This is where it all starts: the money. This clause needs to spell out the "who, what, when, and how" of funding the deal, and it has to be way more specific than just listing initial investment amounts.

A well-drafted capital contributions clause will clearly state:

* Initial Contributions: The exact dollar amount each partner is on the hook for to get the deal closed and cover upfront costs.

* Contribution Deadlines: Hard deadlines for when the cash needs to hit the bank. Miss a deadline, and there should be consequences.

* Form of Contribution: Is everyone bringing cash? Or is someone contributing an existing property or their professional services? The agreement needs to clarify this and assign a fair market value to any non-cash contributions.

But what about surprises down the road? A new roof, a boiler that gives up the ghost—these things happen. That's where capital calls come into play. This part of the agreement details the process for asking partners for more money after the initial raise. A vague capital call clause is a ticking time bomb.

Your agreement absolutely must define what happens if a partner can't or won't meet a capital call. Common solutions include diluting their ownership percentage, hitting them with a high interest rate on the missed payment, or even forcing them to sell their share back to the partnership at a discount.

Without these pre-agreed penalties, one partner's failure to contribute can put the entire project at risk, forcing the others to unfairly pick up the slack. This section turns a potential crisis into a process you can manage.

Ownership and Membership Interests

Once the money is in the bank, the next question is obvious: who owns what? The ownership and membership interests clause answers that by assigning a specific percentage of the company to each partner. Usually, this lines up directly with how much capital they initially put in.

For instance, if a General Partner (GP) puts in $100,000 and a group of Limited Partners (LPs) contributes a combined $900,000, the ownership might be split 10% for the GP and 90% for the LPs.

But this clause is rarely that simple. It also needs to define the different classes of ownership. GPs and LPs have completely different sets of rights and responsibilities, which brings us to the next critical component.

Management and Voting Rights

This is the big one: who's driving the bus? This section lays out the decision-making power structure, separating the day-to-day management from the huge, game-changing decisions. In just about every syndication or real estate partnership, this power is not split evenly.

The General Partner is almost always given wide-ranging authority to run the property. This includes things like:

* Hiring and firing the property management company.

* Negotiating and signing tenant leases.

* Overseeing renovations and repairs.

* Managing the day-to-day operational budget.

However, this doesn't mean the Limited Partners are completely powerless. The agreement should always carve out a list of major decisions that require a vote from the members. This is a crucial protection for passive investors against a GP going off the rails.

These major decisions typically include:

* Selling or refinancing the property.

* Approving a new annual budget that's way off from the original projections.

* Taking on significant new debt that wasn't in the initial business plan.

* Fundamentally changing the business itself.

This structure strikes a vital balance. It gives the GP the freedom to run the business efficiently without getting bogged down in red tape, while still giving the LPs veto power over the critical moments that could make or break their investment. It's the essential system of checks and balances for any healthy partnership.

Structuring Distributions: Waterfalls and Preferred Returns

When a property starts generating cash flow or is eventually sold, every partner has one question on their mind: "How and when do I get paid?" The answer is found in the financial engine of the agreement—the distribution structure. This isn't just about splitting profits down the middle; it’s a meticulously crafted sequence that dictates who gets paid, in what order, and how much.

Think of the deal's profits as water flowing from a source. Instead of all gushing into one big pool, it cascades through a series of tiers or buckets. This is what we call a distribution waterfall. The first bucket has to be completely full before any profit spills over to the next, and so on. Each bucket represents a different milestone or payout, ensuring everyone is compensated in the exact order you agreed upon.

This tiered system is brilliant because it perfectly aligns the goals of the passive investors (the Limited Partners or LPs) with the active deal sponsor (the General Partner or GP). It creates a powerful incentive for the sponsor to knock it out of the park, since their biggest payday usually comes from the final buckets in the cascade.

The First Bucket: The Preferred Return

The very first tier that needs to be filled in almost every waterfall is the preferred return, often just called the "pref." This is a priority payment that goes straight to the Limited Partners. It’s essentially a thank-you to investors for putting their money on the line first.

The pref is a set annual rate of return (a common range is 6-8%) on an LP's initial investment. The key thing to understand is that LPs are entitled to receive this before the GP gets a single dollar of the profits. It's not a guarantee the investment will perform, but it is a guarantee of their place at the front of the line. If cash flow is low one year and the pref can't be paid, it typically accrues and gets paid out in a future year before any other distributions happen.

This simple mechanism gives investors a layer of protection and sets a clear performance hurdle for the sponsor right from the start.

The Second Bucket: The Return of Capital

Once the preferred return is fully paid out, the waterfall spills into the next tier: the return of capital. The focus here is simple—pay the Limited Partners back their entire initial investment. The goal is to make the investors whole before anyone starts carving up the real profits.

By structuring these first two tiers this way, the agreement puts the LPs' financial security first. Only after their initial capital is back in their pockets and they've received their priority return does the water flow down to the more lucrative profit-sharing splits where the sponsor starts to earn their keep.

This thoughtful, tiered approach is a big reason why sophisticated investors are increasingly drawn to partnerships. A Deloitte report on the commercial real estate outlook highlights this, noting that nearly 24% of large firms are using joint ventures to get into specialized deals, drawn by the clear and aligned financial incentives.

The design of your distribution waterfall says everything about how fair your deal is. A clean, investor-friendly waterfall isn't just a legal clause; it's one of your most effective fundraising tools.

Structuring these financial components correctly builds on the foundational elements of the partnership itself.

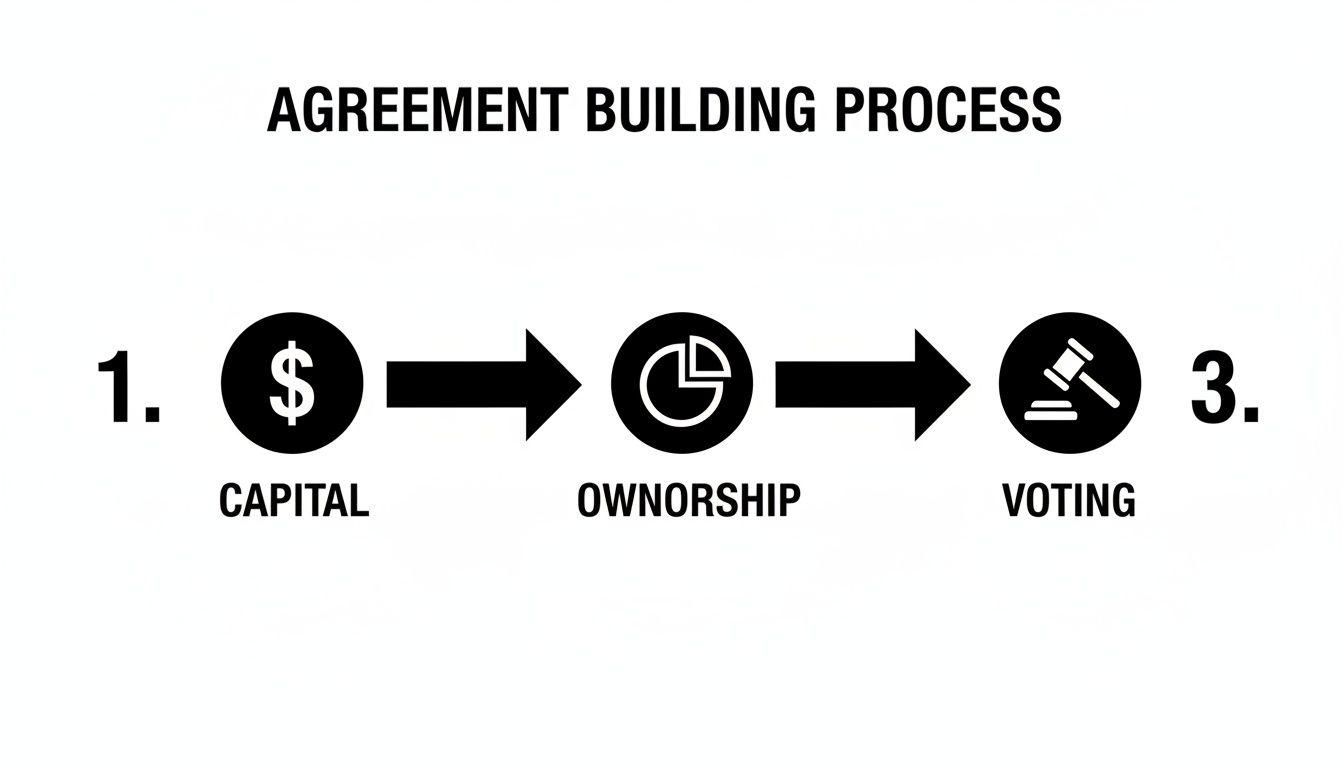

As this image shows, you first have to define the capital contributions, ownership percentages, and decision-making powers. Once that framework is solid, you can effectively layer on the distribution mechanics.

The Final Tiers: The Sponsor's "Promote"

After the investors have received their pref and gotten their capital back, we get to the exciting part—the profit-sharing tiers. This is where the General Partner is rewarded for their expertise and hustle through something called the promote, also known as carried interest.

The promote is the GP's disproportionate share of the profits. For example, a common split at this stage might be 70/30, meaning 70% of profits go to the LPs and 30% go to the GP. This happens even if the GP only contributed a tiny fraction of the initial equity.

More complex waterfalls might even have multiple profit-sharing tiers, or hurdles, where the sponsor’s promote actually increases as the deal’s performance hits higher benchmarks.

- Tier 3 (The Catch-Up): Some agreements include a "catch-up" provision. This allows the GP to receive a much larger slice of the profits (sometimes 100%) until their share "catches up" to a certain overall percentage, like 20% of all profits paid out to date.

- Tier 4 (The Final Split): After any catch-up, all remaining cash is simply distributed according to a final, predetermined ratio, such as 80/20 or 70/30, for the life of the project.

This entire structure pushes the GP to do more than just meet expectations. Their biggest reward is directly tied to the project’s massive success, which keeps everyone in the boat rowing hard in the same direction.

Planning for the Inevitable: The “What If” Clauses That Save Partnerships

A solid partnership agreement isn't just about the good times—how you'll split profits or who makes the day-to-day calls. The real strength of your agreement shines through when things get complicated. This is where we get into the critical "what if" clauses, the ones that act as your pre-negotiated roadmap for navigating the unexpected turns.

Think of these clauses as the guardrails on a mountain road. You hope you never need them, but you’re incredibly grateful they’re there if you do. By tackling these tough conversations upfront, you're building a truly resilient partnership that protects not only the investment but also the relationships you've built. It's about creating certainty when the future is anything but.

Restricting the Transfer of Ownership

First things first: you need to control who's in the deal with you. You chose your partners for a reason—their capital, their expertise, their track record. The last thing you want is for one partner to suddenly sell their stake to a stranger, leaving you in business with someone you've never met and don't trust.

This is exactly what transfer restrictions are for. These clauses make it crystal clear that no one can sell, gift, or otherwise transfer their ownership interest without getting the thumbs-up from the other partners, usually the General Partner.

A classic and highly effective tool here is the Right of First Refusal (ROFR). In simple terms, if a partner gets a legitimate offer for their shares from an outsider, the ROFR forces them to offer those same shares to the existing partners first, on the exact same terms. This gives you and your team the power to keep your circle tight.

These restrictions aren't just about personal preference; they're also essential for staying on the right side of securities laws, which often place strict limits on how many investors can be in a private deal.

Defining the Exit with Buy-Sell Provisions

Life happens. What if a partner dies, goes through a messy divorce, files for bankruptcy, or just decides they want out? Without a plan, any of these events can throw the entire project into chaos. The solution is a buy-sell provision—think of it as a prenup for your real estate venture.

This clause defines the specific "trigger events" that allow (or force) the partnership to buy out a member's interest. It lays out the entire process ahead of time, typically covering:

- Triggering Events: A definitive list of scenarios like death, long-term disability, personal bankruptcy, or a voluntary decision to leave.

- Valuation Method: How do you determine the price? The clause should specify whether you'll use a third-party appraisal, a predetermined formula tied to performance, or another agreed-upon method.

- Funding Mechanism: How will the buyout actually be paid for? You might use cash reserves, set up an installment plan, or even fund it with life insurance policies taken out on the key partners.

Having this structure in place is becoming more important than ever. The global real estate secondaries market, which is built on these kinds of organized ownership transfers, hit a record US$24.3 billion in 2024, with sponsor-led deals driving most of the action. You can see more data on this trend by reviewing insights from CBREIM.com.

The Orderly End with Dissolution Terms

While the goal is always a profitable exit, no venture is meant to last forever. The dissolution clause provides a clean, orderly process for winding everything down when the investment has run its course or if the partnership hits a dead end. It spells out the conditions for termination, like the sale of the final asset or a majority vote from the partners.

Crucially, it also confirms the final "waterfall" for distributions. This ensures all debts are paid first, followed by the return of any remaining investor capital. Only then are the final profits distributed according to the splits you all agreed on from day one.

Navigating Disagreements with Dispute Resolution

Even with the best people and the best agreement, disagreements are bound to pop up. Rather than lawyering up and heading straight to court, a dispute resolution clause offers a saner, cheaper path forward. It usually requires partners to try resolving issues through negotiation or mediation first.

- Mediation: A neutral third party comes in to help facilitate a productive conversation and guide you toward a solution everyone can live with. It's non-binding but incredibly effective.

- Arbitration: If mediation doesn't work, an arbitrator (or a panel) acts like a private judge. They hear both sides and make a final, legally binding decision without the time and expense of a public court battle.

These steps can save a staggering amount of time, money, and heartache, preserving relationships that would otherwise be destroyed by litigation.

Your Pre-Launch Checklist for a Smooth Syndication

The agreements are signed, the deal is identified, and you're ready to start raising capital. But hold on. Before you officially launch your syndication, there's a critical "pre-flight" check to run through.

Think of this as the final walk-around before takeoff. Taking a few moments to systematically confirm every piece is in place ensures your partnership not only starts on a solid legal foundation but also operates smoothly from the very beginning. This sets the tone for great investor relationships and lets you focus on what you do best—executing the business plan.

Legal and Compliance Final Review

Before you accept a single dollar, a final legal sweep is an absolute must. This is your last chance to catch a small oversight that could become a huge compliance headache down the road.

First, sit down with your securities attorney one last time. Make sure your Private Placement Memorandum (PPM) and the operating agreement are perfectly in sync. They need to tell the exact same story and, most importantly, comply with all SEC regulations, whether you're operating under Regulation D Rule 506(b) or 506(c).

Next, double-check that your entity is officially and correctly formed. Is the LLC or LP properly filed with the state? Do you have your Employer Identification Number (EIN) from the IRS? You can't even open a bank account without these, so they're non-negotiable.

Investor Onboarding and Document Management

How you bring investors into the deal says a lot about you. A clunky, disorganized process can raise red flags and erode confidence before you've even started. A smooth, professional onboarding experience, on the other hand, builds immediate trust.

Your goal is to make it simple and clear for your investors. Here’s a good flow to follow:

- Review Offering Documents: Give them a single, easy-to-access location for the entire deal package.

- Sign Subscription Agreement: Use a modern e-signature platform to get the subscription documents signed. This is the document where they formally commit to the deal.

- Verify Accreditation: Have a straightforward system in place for collecting and verifying that your investors are accredited. This is a crucial compliance step you can't skip.

- Fund the Investment: Provide crystal-clear wire or ACH instructions for transferring their funds into the new entity's dedicated bank account.

A disorganized onboarding experience is a major red flag for investors. Using a dedicated investor portal, like Homebase, can automate these steps, from e-signatures to accreditation, creating a professional and frictionless experience that helps you close capital faster.

By running through this checklist, you can move forward with confidence, knowing all the administrative and legal boxes are ticked. This frees you up to stop worrying about paperwork and start focusing on what really matters: executing your strategy and delivering great results for your partners.

A Few Final Questions, Answered

Even with the best guide, a few questions always pop up when you're in the trenches putting a deal together. Let's tackle some of the most common ones we hear from investors and sponsors alike.

Do I Really Need a Lawyer for This?

I get it. You see a template online, and the temptation to save a few thousand dollars on legal fees is strong. But trust me on this one: it's a classic case of being penny-wise and pound-foolish.

Your partnership agreement isn't just a formality; it's the financial and operational bedrock of your entire deal. An experienced real estate attorney does more than just fill in the blanks on a template. They’re a strategist.

They will help you:

* Stress-Test Your Deal: They’ll poke holes in your plan and identify the potential conflicts and risks you haven't even thought of yet.

* Customize Everything: Every clause will be tailored to your specific property, your partners' unique situations, and your state's particular laws.

* Keep You Compliant: They’ll make sure your agreement and how you raise money stay on the right side of complex securities laws.

Think of it this way: the cost of a good lawyer is an investment in preventing a future catastrophe. It's a tiny fraction of what a messy lawsuit or a failed partnership will cost you down the road.

What Are the Biggest Mistakes People Make?

Partnerships rarely fail because of bad intentions. They fail because of bad preparation, usually memorialized in a poorly drafted agreement. The most damaging mistakes almost always boil down to a lack of clarity.

If there's one pitfall that sinks more deals than any other, it's fuzzy capital call language. When the roof unexpectedly needs replacing and you need more cash, what happens if a partner can't or won't pay up? Without a crystal-clear process and consequences, the other partners are left holding the bag, potentially risking the entire investment.

Other classic blunders include poorly defined management roles (who really makes the final call?), no clear voting mechanism for major decisions, and forgetting to include a buy-sell agreement to handle a partner's unplanned exit.

How Can We Change the Agreement Later On?

Markets shift, opportunities pop up, and life happens. Your partnership needs to be able to adapt without falling apart. A solid real estate partnership agreement will have a dedicated clause that spells out exactly how to make changes.

It’s not something you can do on a whim. The process is formal and designed to protect everyone. Typically, it involves:

1. A Written Proposal: The change gets put down in writing so everyone is looking at the same thing.

2. A Partner Vote: The amendment has to be approved by a predetermined percentage of the ownership—often a supermajority of 67% or more.

3. Making It Official: Once it passes the vote, the amendment is signed by the partners and formally attached to the original agreement.

This structure ensures that no single partner can change the rules of the game unilaterally. It forces transparency and builds consensus, which is exactly what you want in a healthy partnership.

Ready to streamline your next real estate syndication? Homebase provides an all-in-one platform for fundraising, investor relations, and deal management, helping you close capital faster and build stronger relationships. See how we can simplify your process.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Financial Modeling Real Estate: A Practical Guide to Building Winning Models

Blog

Master financial modeling real estate with practical pro formas, waterfalls, and IRR insights to attract investors.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.