Real estate debt funds: A Beginner's Guide to Smarter Real Estate Financing

Real estate debt funds: A Beginner's Guide to Smarter Real Estate Financing

Explore how real estate debt funds work, from capital structure to returns, and learn how they fit into a diversified investing strategy.

Domingo Valadez

Jan 31, 2026

Blog

At its core, a real estate debt fund is a pool of capital that acts as a private lender, providing loans for property deals that don't quite fit the rigid criteria of traditional banks. Instead of buying a slice of the property itself (equity), investors in these funds step into the role of the lender, earning their returns from the interest paid on those loans.

What Are Real Estate Debt Funds and Why Do They Matter Now

Think of it this way: if a traditional bank is a major commercial airline with fixed routes and schedules, a real estate debt fund is like a private charter jet. It’s more nimble, flexible, and can create a custom-tailored flight plan to get a developer exactly where they need to go, often on a much faster timeline.

These funds aren't just filling a small niche anymore; they've become a powerhouse in the world of Commercial Real Estate Lending. The global commercial real estate debt market has swelled to an incredible $11.9 trillion. That puts it on par with the entire traditional fixed-income market, which is why it's grabbing so much attention from investors around the globe. For savvy syndicators and multifamily operators, understanding this space is no longer optional.

The Rise of Private Real Estate Credit

So, what’s fueling this explosive growth? A lot of it traces back to the 2008 financial crisis. In its aftermath, new regulations like Dodd-Frank tightened the reins on big banks, making them far more conservative and risk-averse. This created a huge funding gap, especially for projects that were a little outside the box, like a heavy value-add renovation or a new construction project in an up-and-coming neighborhood.

Private real estate debt funds moved in to fill that void. They brought a few key advantages to the table that banks simply couldn't match:

- Speed: Debt funds are built for agility. They can underwrite and close a deal in a fraction of the time it takes a large, bureaucratic bank.

- Flexibility: Need a loan with an interest reserve for a repositioning? Or a future funding facility for renovations? Debt funds can structure creative terms that align with the project’s specific business plan.

- Access to Capital: They’re the go-to source for financing that banks often shy away from, like bridge loans for transitional assets or mezzanine debt to plug a hole in the capital stack.

This evolution means that for a growing number of real estate sponsors, debt funds aren't just an "alternative" anymore. They are a primary, indispensable partner for getting deals done.

An Opportunity for Sponsors and Investors

This private credit boom has created a compelling, two-sided opportunity. For property sponsors, it’s a vital lifeline to capital, allowing them to acquire and execute their business plans, particularly when traditional credit markets are tight.

For investors, it opens up a different way to participate in real estate—one with a risk and return profile that’s distinct from direct ownership. Rather than riding the rollercoaster of property values and rental income, debt fund investors can earn steady, predictable income from contractually obligated interest payments. In times of economic uncertainty, that kind of stability is incredibly attractive. As these funds continue to scale, so does the demand for platforms that can handle the operational side, making everything from fundraising and investor communications to distributions run smoothly.

What Kinds of Real Estate Debt Funds Are There?

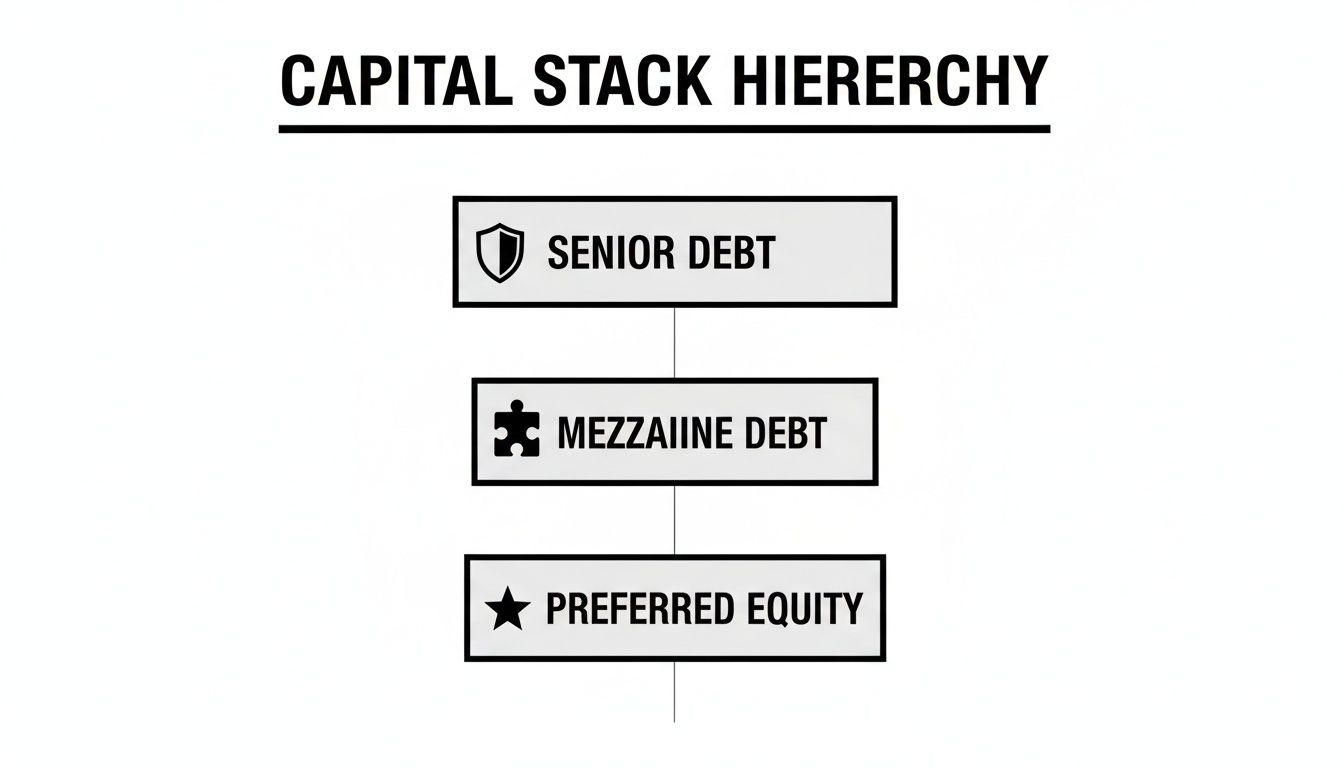

Not all real estate debt funds are cut from the same cloth. The best way to think about them is to picture a building's financial structure, or what we in the industry call the capital stack. Each type of debt occupies a different "floor" in that building, with each floor representing a unique level of risk and potential reward.

Think of the capital stack as the complete list of everyone who has a financial stake in a property, from the safest loan to the riskiest equity. If the project ever gets into trouble and has to be sold, the people on the bottom floors get their money back first. The investors at the top of the stack get paid last, but they're compensated with the chance for much higher returns for taking on that extra risk.

Let's walk through the most common types of debt funds you'll come across, starting from the ground floor up.

Senior Debt: The Foundation of the Deal

Senior debt is the ground floor of the capital stack. It’s the most common, most secure, and generally the largest piece of financing a property gets. When you hear someone talk about a standard commercial real estate mortgage from a big bank or a conservative debt fund, this is what they mean.

Because it’s in the first-lien position, the senior lender has the primary claim on the property if the borrower defaults. This "first in line" status makes it the lowest-risk form of debt, which naturally means it offers the lowest returns—usually a straightforward fixed interest rate.

- Best For: Stable, predictable assets, like a fully occupied apartment building or a grocery store-anchored shopping center.

- Sponsor Profile: A sponsor who needs reliable, long-term financing for a core asset with a solid performance history.

This is the bedrock of most deals, often providing 65% to 75% of the property's total value.

Bridge Loans: The Short-Term Connector

Bridge loans do exactly what their name implies: they "bridge" a gap. These are short-term loans, typically for one to three years, used to fund a property that’s in transition and can’t yet qualify for long-term, stable financing.

Imagine a sponsor buys an older office building that’s only 70% leased and needs a major facelift. A traditional bank might pass on that deal. But a bridge lender sees the opportunity. They provide the money to buy the property and fund the renovations. Once the work is done and the building is leased up to, say, 95% occupancy, the sponsor can get a permanent loan (at a much better rate) to pay off the bridge lender.

Mezzanine Debt: The Gap Filler

Sometimes, the senior loan and the sponsor's own cash don't quite cover the total project cost. That's where mezzanine debt comes in. It’s a specialized type of financing that sits just above the senior loan but below the sponsor's equity, filling that crucial funding gap.

It's really a hybrid of debt and equity. Instead of being secured by the property itself, a mezzanine loan is usually secured by a pledge of the ownership shares in the company that owns the building.

Because a mezzanine lender is second in line behind the senior lender, they take on more risk. If things go south, the senior lender has to be paid back every penny before the mezzanine lender sees anything. To make up for that risk, mezzanine loans come with much higher interest rates.

Preferred Equity: The Debt-Like Equity

Climb one more floor up the capital stack and you'll find preferred equity. While it's technically an equity investment, it often functions more like debt, which is why many debt funds offer it as part of their product suite. Investors in preferred equity get a fixed rate of return, much like interest on a loan, and they get paid before the common equity investors (the sponsor and their partners) see any profit.

Preferred equity doesn't have a fixed maturity date like a loan, but it often has a date by which it must be bought out. For sponsors, it’s a great way to bring in more capital without giving up more ownership or control. For investors, it offers a higher return than traditional debt positions.

Comparison of Real Estate Debt Fund Types

To put it all together, here's a quick cheat sheet. This table breaks down the key characteristics of these common debt strategies, helping you see where each fits in the capital stack and what kind of risk and return to expect.

As you can see, there’s a clear trade-off. The higher you go in the capital stack, the more leverage you can get and the higher the potential returns, but that always comes with an increase in risk. Understanding these dynamics is the key to successfully structuring deals and investing in real estate debt.

Evaluating Returns and Managing Investor Risks

When you're looking at a real estate debt fund, the first thing to get a handle on is where the returns actually come from. It's a different game than investing in equity, where you're betting on property values going up. With debt, the returns are far more predictable.

The main driver is simple: interest income. Every loan in the fund's portfolio is designed to generate a steady stream of cash flow from contractually required payments. That's the bedrock of your yield.

But it doesn't stop there. Fund managers have a few other ways to boost returns, which come from fees charged to the borrower:

- Origination Fees: Think of this as a setup fee. It’s charged upfront when the loan is made, usually 1-2% of the total loan amount.

- Exit Fees: When the borrower pays off the loan, they often pay a final fee, giving returns a little kick at the end.

- Prepayment Penalties: If a borrower decides to pay back the loan early, these penalties kick in. They’re designed to make up for the future interest income the fund would have otherwise received.

When you combine the steady interest payments with these fees, you get a return profile that's typically much more stable and less volatile than owning property directly.

Identifying and Mitigating Key Risks

Of course, attractive returns never come without some level of risk. A smart investor knows to look under the hood to see how a fund manager protects their capital. The risks in real estate debt are layered, involving everything from the borrower's reliability to a sudden shift in the market.

To get a clearer picture, many sophisticated managers now lean on tools like predictive analytics for real estate investment. This allows them to run different "what-if" scenarios and stress-test their loan portfolios against potential downturns, giving their underwriting a strong, data-driven backbone.

The infographic below breaks down the capital stack, which is crucial for understanding risk. It shows you who gets paid back first if things go wrong.

As you can see, senior debt sits at the bottom, meaning it's the most secure position. Senior lenders have the first claim and must be paid back in full before anyone else sees a dime.

Proactive Risk Management Strategies

The best fund managers don't wait for problems to pop up. They build a fortress around their investors' capital from the very beginning. It all comes down to a disciplined, proactive approach to the biggest risks in the lending business.

- Borrower Default Risk: This is the big one—the risk a borrower simply stops paying. The defense here is rigorous underwriting. Managers dig deep into a borrower's financial history, the quality of the property, and the credibility of their business plan. Crucially, they make sure the borrower has plenty of their own money—"skin in the game"—in the deal to keep everyone's interests aligned.

- Market Risk: A recession or a major downturn can hit property values hard, making it difficult for a borrower to repay or refinance. The classic hedge against this is asset diversification. By spreading loans across different property types (like multifamily and industrial) and various cities or states, managers avoid being wiped out by a single market's slump.

- Interest Rate Risk: When rates spike, borrowers with floating-rate loans can get squeezed, and the fund's own financing can become more expensive. Managers can counter this by using financial hedges or by sticking to fixed-rate loans that offer more stability.

A key defense mechanism is the use of protective loan covenants. These are rules written into the loan agreement that the borrower must follow, such as maintaining a certain occupancy level or debt service coverage ratio. If a covenant is breached, it gives the lender an early warning sign and the right to step in before the situation deteriorates further.

The real estate debt fund space is no longer a niche—it's an industry powerhouse. Top managers are deploying billions globally, filling a critical financing gap that traditional banks have left open. With a huge amount of commercial real estate debt coming due, borrowers are increasingly turning to these non-bank lenders for their flexibility and creativity. By understanding both the sources of return and the robust risk mitigation strategies that good managers use, investors can approach these opportunities with confidence.

How to Structure a Deal with a Debt Fund

Getting a loan from a real estate debt fund isn’t like walking into a bank. It’s a methodical process that starts with a compelling pitch and ends with a complex legal agreement. For sponsors, knowing how to navigate this path is what separates the pros from the amateurs and ultimately determines how efficiently you can get capital in the door.

It all kicks off with the term sheet—sometimes called a Letter of Intent (LOI). Think of this as the handshake agreement. It’s a non-binding document that lays out the big-picture terms: the loan amount, interest rate, term, and major fees. This is your first real conversation with the lender, and it sets the tone for everything to come.

A solid term sheet is clear and direct, and it needs to be backed by a professional presentation. This is your chance to show you’ve done your homework and have a viable business plan.

Crafting a Fundable Deal Package

Once you’ve agreed on a term sheet, the real heavy lifting begins. The fund’s underwriters are going to put your deal under a microscope to poke holes in your assumptions and measure their risk. Your job is to make their job easy by handing them a truly 'fundable' deal package right from the start.

This package is your project’s biography. It needs to be organized, thorough, and brutally honest.

- Executive Summary: A punchy, one-page snapshot of the deal. It should cover the property, your plan, and the financing you need.

- Detailed Pro Forma: This is your financial model. It needs to show projected income, expenses, and returns. Be prepared for lenders to stress-test these numbers, so keep them realistic and defensible.

- Sponsor Track Record: Show, don't just tell. This is where you prove you can deliver, with case studies of similar projects you’ve successfully completed.

- Third-Party Reports: Things like the property appraisal, environmental site assessments, and property condition reports. Having these ready to go shows you’re a serious, proactive operator.

A well-prepared package signals professionalism and reduces friction in the underwriting process. Lenders are more likely to prioritize deals from sponsors who demonstrate they are organized and have anticipated the lender's needs.

Putting together a complete and well-organized package can literally shave weeks off your closing timeline. These lenders are looking at dozens of deals; the easier you make it for them to get to "yes," the better your odds.

Navigating Key Loan Agreement Terms

The loan agreement is the final word—the legally binding contract that dictates every aspect of the financing. While the term sheet outlines the business deal, the loan agreement gets into the nitty-gritty legal details. For a sponsor, understanding these terms is just as fundamental as understanding the real estate capital stack.

Pay close attention to these critical clauses that every lender will focus on:

- Interest Rate Structure: Is the rate fixed, or does it float? If it’s a floating rate (usually tied to a benchmark like SOFR), is there an interest rate cap to protect you if rates spike?

- Loan Covenants: These are the rules you have to live by for the life of the loan. They can be financial, like maintaining a minimum Debt Service Coverage Ratio, or operational, like submitting quarterly financial statements. Violate a covenant, and you could be in default, so you better be sure you can comply.

- Prepayment Penalties: Debt funds have to deliver a certain return to their investors. If you pay the loan off early, they miss out on that expected interest. Prepayment penalties are how they make up for it. Common structures are "yield maintenance" or a simple declining penalty, like 3% in year one, 2% in year two, and 1% in year three.

Ultimately, closing a deal with a real estate debt fund comes down to preparation, transparency, and seeing the deal from the lender’s point of view. When you build a compelling case and negotiate the final agreement with care, you’re not just getting a loan—you’re forging a partnership that can fuel your portfolio’s growth.

Modernizing Your Operations from Fundraising to Payouts

Landing the financing from a real estate debt fund is a huge win, but it's really just the starting line. Once that deal is funded, the real work on the equity side kicks in: managing investors, wrangling legal documents, and making sure everyone gets paid on time. For a growing firm, this operational side of the business can quickly become a massive time sink, distracting you from what you do best—finding the next great deal.

For years, this meant living in a world of complex spreadsheets, chasing down investors for wet signatures, and manually updating contact lists. These old-school methods aren't just slow; they're risky, create a clunky experience for your investors, and simply don't scale. As your investor base grows, the administrative headache gets exponentially worse.

Think about launching a new offering. You’re suddenly buried in an avalanche of emails, trying to track commitments in a messy Excel file, and individually verifying every investor's accreditation status. This is the kind of operational friction that can stall a sponsor's growth.

From Manual Chaos to Automated Efficiency

This is where modern platforms come in. Instead of duct-taping together a bunch of different tools, a centralized system like Homebase pulls every part of the investor management process into one clean, intuitive portal. What was once a fragmented mess becomes a smooth, repeatable workflow.

Let's walk through a typical fundraising process. With an all-in-one platform, you can:

* Set up a professional deal room that houses all the necessary documents, financials, and project details in one secure spot.

* Gather soft commitments or take live investments right through the portal, giving you a real-time pulse on your capital raise.

* Automate KYC/AML checks and accreditation verification, which takes a huge compliance burden off your shoulders.

* Execute subscription documents with e-signatures, slashing the closing timeline from weeks down to just a few days.

This kind of automation creates the professional, transparent experience that today’s investors have come to expect. It signals that you run a tight ship and that you respect their time.

A Central Hub for Investor Relations

The value doesn't stop once the fundraise is over. A dedicated investor portal becomes the command center for all ongoing communication and management, finally putting an end to scattered email chains and endless one-off phone calls.

By bringing all investor-related tasks into a single system, you create one source of truth for your entire portfolio. This cuts down on data entry errors, keeps you compliant, and frees up your team to focus on high-value work like asset management and deal sourcing.

The dashboard below gives you a clear, at-a-glance view of how your capital raise is progressing and who your most engaged investors are.

This centralized view helps sponsors make smarter decisions with real data, while giving investors the transparency they deserve.

The market is clearly rewarding this kind of operational excellence. Fundraising for real estate debt strategies saw inflows of nearly $13 billion through the second quarter, on track with the $20-25 billion raised annually in the two years prior. In this competitive environment, having the right tools is non-negotiable. The share of funds closing below their target has also dropped from 62% to 49%, a clear sign that sponsors with efficient operations are hitting their goals more consistently, as highlighted in the latest private markets report from NEPC.

Ultimately, by getting your back-office operations in order, you’re not just saving time—you’re building a scalable foundation for growth. You can raise capital faster, build stronger relationships with your investors, and get back to focusing on what truly matters: executing your business plan.

Where Capital is Headed in Real Astate

The whole financial bedrock of real estate has shifted. What used to be a niche product, real estate debt funds, have stormed the main stage and are now a core part of how deals get done. They're no longer the "alternative" lender; for many sponsors, they're the first call, especially when a deal needs speed and a creative structure that a traditional bank just can’t offer.

This isn’t just some passing trend. It's a permanent change in how real estate projects get financed. As the private credit world keeps expanding, it's opening up huge possibilities for sharp sponsors and savvy investors. Being able to tailor financing to fit the exact needs of a project—whether it's a tricky value-add repositioning or a complex ground-up development—is a massive advantage that can make all the difference in a competitive market.

A New Standard for How You Operate

But just knowing about these new financing options isn’t enough to win. The firms that are truly crushing it understand that a modern capital structure has to be matched with an equally modern operational backbone. To succeed today, you have to nail both sides.

Success isn't just about finding a good deal and the right debt anymore. It’s about building an efficient, scalable machine to manage the equity that makes those deals possible. That's what separates the good operators from the great ones.

This means bringing in technology to handle the entire investor journey—from the first pitch and all the compliance paperwork to ongoing updates and sending out distributions. By getting the administrative grunt work off their plates, sponsors can free up their time to focus on what actually moves the needle: building strong investor relationships, executing the business plan, and finding that next great deal.

Setting Your Firm Up to Scale

At the end of the day, the future of real estate capital is all about specialization, speed, and precision. Debt funds provide the flexible fuel, but it’s a sophisticated operational engine that really lets a firm hit the gas.

Sponsors who adopt platforms to run their back-office aren't just saving a few hours here and there. They're laying the groundwork for real, sustainable growth. They can give their investors a better experience, offer more transparency, and build a firm that’s ready to scale and pounce on the opportunities of tomorrow.

Frequently Asked Questions About Real Estate Debt Funds

Diving into the world of real estate debt funds can feel complex, and it’s natural for both sponsors and investors to have questions. Let's tackle some of the most common ones to clarify how these funds work and where they fit in the investment landscape.

How Do Real Estate Debt Funds Differ from REITs?

It really boils down to a simple question: do you want to be the bank or the landlord?

When you invest in a real estate debt fund, you're essentially stepping into the role of the lender. Your returns are generated from the interest paid on loans that are backed by physical property. This creates a predictable, contractual income stream, much like other fixed-income investments.

Investing in an equity REIT (Real Estate Investment Trust), on the other hand, is like becoming a landlord. Your financial success is directly linked to how well the underlying properties perform—think rental income and appreciation. The potential upside can be higher, but so is the volatility.

The bottom line: A debt fund is a private investment in a loan, offering steady, contracted returns. A REIT is typically a publicly-traded investment in a portfolio of actual properties, with returns that rise and fall with market performance and property operations.

What Is a Typical Loan Timeline for a Debt Fund?

There’s no one-size-fits-all answer here, because the loan’s timeline is built around the specific project it’s financing. The term is designed to match the sponsor's business plan.

- Bridge Loans: These are the sprinters. They're short-term, usually running 1-3 years, and are meant to "bridge" a property through a transition—like a renovation or lease-up—until it’s ready for permanent financing.

- Construction or Value-Add Loans: Think of these as marathon loans. For bigger undertakings like ground-up development or a major repositioning, the terms are naturally longer, typically falling in the 3-7 year range.

The fund itself also has its own lifecycle. Most are structured to last 7-10 years, which includes an initial period for deploying the capital into new loans, followed by a management phase to service those loans and see them through to repayment.

Are Debt Funds a Smart Play During Economic Uncertainty?

When the economic forecast looks a bit cloudy, many savvy investors see debt funds as a defensive move. Their senior position in the capital stack gives them a built-in layer of protection.

Here’s why: debt holders are first in line to get paid, ahead of equity investors. This creates a buffer if property values start to slide. If a property's value drops, the equity investors are the ones who take the first hit. The debt fund’s return is based on a fixed interest rate, which helps insulate it from the operational ups and downs that hammer equity returns.

Of course, no investment is without risk. The main concern here is a borrower defaulting on their loan, a risk that naturally ticks up during a serious downturn. That’s why rigorous, disciplined underwriting is the best defense a fund manager has.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Investment Management Real Estate: Master investment management real estate Playbook

Blog

Explore investment management real estate best practices, metrics, and tech to scale your portfolio with confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.