Preferred Return Real Estate: Top Strategies for Investors

Preferred Return Real Estate: Top Strategies for Investors

Discover expert strategies in preferred return real estate investing. Learn to identify opportunities and boost your returns.

Domingo Valadez

May 10, 2025

Blog

Preferred Return Real Estate: The Essential Investor Guide

Understanding preferred return is essential for anyone investing in real estate syndications. This key metric sets a benchmark return, giving a certain percentage of profits to limited partners (LPs) before the general partners (GPs) receive any. This arrangement creates a financial safeguard for investors. This section explores why this mechanism is so important for real estate investors of all experience levels.

Real estate has a long history as a strong investment. A 145-year study showed that rental properties earned an average annual return of 7.05%, slightly outpacing stocks at 6.89% across 16 developed countries. This highlights real estate's potential for consistent long-term growth. Learn more at SparkRental.

Defining Preferred Return and Its Importance

Preferred return acts as a primary claim on profits. Imagine baking a cake and agreeing your friend gets the first few slices. The preferred return is similar to those first slices, guaranteeing investors a predetermined share of the profits before sponsors participate. This prioritization protects investor capital and incentivizes sponsors to perform well.

This structure also builds in accountability. By prioritizing the LPs' return, GPs are motivated to manage the investment wisely to reach that preferred return threshold. If a property underperforms, it likely won’t generate enough profit to meet the preferred return, leaving the sponsor with nothing. This motivates careful decision-making and aligns everyone’s interests.

Simple vs. Compounding Preferred Returns

How preferred return is calculated can significantly affect your total return. There are two main methods: simple and compounding. Simple preferred return is calculated only on the initial investment. Compounding preferred return, however, is calculated on the initial investment plus any accumulated unpaid preferred return from prior periods. This seemingly minor difference can add up significantly, especially with long-term investments. Understanding this is crucial for accurate return projections.

Preferred Return vs. Other Metrics

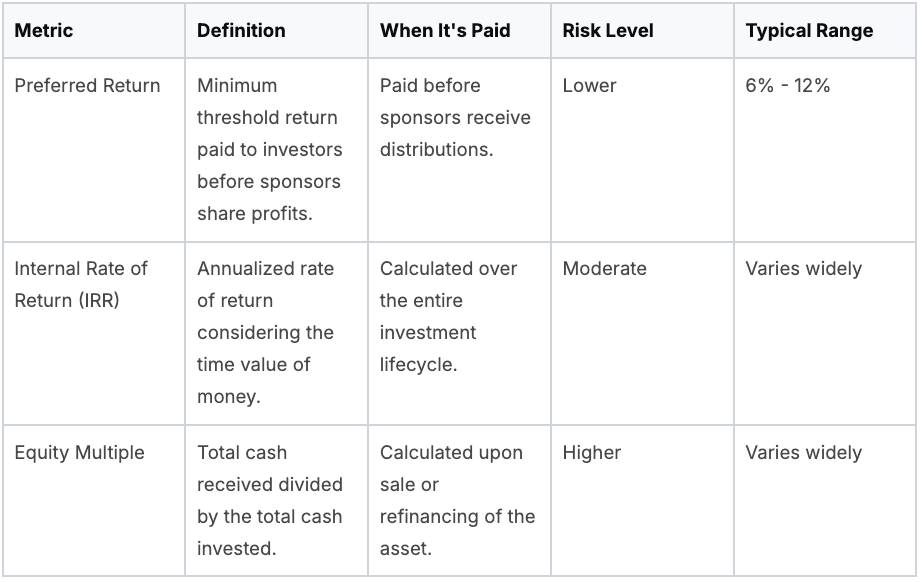

It's important to differentiate preferred return from other real estate investment metrics. While metrics like Internal Rate of Return (IRR) and Equity Multiple look at the overall profitability, preferred return focuses specifically on distribution order and priority. To understand these differences better, review the following comparison table.

To help clarify the distinctions, the following table compares preferred return to other common investment metrics.

Preferred Return vs. Other Investment Metrics: This comparison table shows how preferred return differs from other common real estate investment performance metrics.

These metrics provide a complete picture of an investment’s potential when analyzed together. While a high preferred return is appealing, it’s not the only factor. Smart investors examine preferred return, IRR, and equity multiple together to make well-informed decisions.

Inside the Waterfall: How Preferred Returns Actually Work

Beyond the glossy brochures and enticing presentations, the actual mechanics of preferred returns play a crucial role in shaping your real estate investment outcomes. This section pulls back the curtain on waterfall distribution structures, clearly explaining how funds generated by a property are distributed to investors. We'll use real-world examples with concrete numbers to make this process easier to understand.

Understanding Waterfall Distribution

Think of a series of cascading pools, each representing a different level of return. This visualizes the "waterfall" structure, which dictates how profits are allocated. Initially, funds flow into the preferred return pool, compensating investors up to their pre-agreed rate of return. Only after this initial obligation is met does the excess flow down to the next level, which is often a split between investors and sponsors. This structure prioritizes investor returns, providing a level of security.

Real-World Examples Across Asset Classes

Let's illustrate with a multifamily property generating $100,000 in profit. If the investment was $1 million with an 8% preferred return, the first $80,000 goes directly to the investors. The remaining $20,000 might then be split, perhaps 50/50, between investors and sponsors. This demonstrates how the preferred return acts as a crucial benchmark. Similar principles apply to commercial real estate investments, although the specific numbers and profit-sharing ratios will naturally vary depending on the deal's specifics and prevailing market conditions.

Accrual Provisions and Their Impact

A crucial element within preferred returns is the accrual provision. This determines how any unpaid preferred returns are treated. Cumulative preferred returns accrue over time, which means any shortfall in one period is added to the preferred return calculation for the next. Conversely, non-cumulative preferred returns do not accrue. This key difference can substantially affect overall returns throughout the investment's lifetime, especially during periods of lower-than-projected performance. You might find this helpful: How to master the equity waterfall.

Preferred Return vs. Promote: The Partnership Dynamic

Preferred returns are fundamentally connected to the promote, which is the sponsor’s share of the profits after the preferred return is satisfied. The interplay between these two factors determines the balance of risk and reward. A higher preferred return may initially reduce the sponsor's potential profit but it also incentivizes them to drive higher overall returns, benefiting everyone involved. Real estate investment trusts (REITs), which offer a way to invest in real estate without directly managing properties, also have a history of solid performance. From 1972 to 2023, REITs provided an average annual return of 11.1%, slightly trailing the S&P 500's 12.1% return over the same period. For a deeper dive into these statistics, visit: SparkRental.

Underperforming Properties: The Unspoken Reality

What happens when a property doesn't perform as expected? This scenario, often overlooked in initial investment discussions, underscores the importance of preferred returns. If a property generates insufficient cash flow to cover the preferred return, sponsors generally forgo their profit share until the investors' preferred return is fully paid. This arrangement acts as a protective buffer for investors, mitigating potential losses and highlighting the critical need for comprehensive due diligence. Understanding this downside protection offered by preferred returns is vital for making well-informed investment decisions.

Current Market Rates: What Top Investors Are Accepting

The world of preferred return real estate investing is dynamic. Rates fluctuate based on various investment strategies. Understanding this market is crucial for both sponsors and investors. It involves looking beyond basic numbers and examining the factors driving preferred return rates.

Factors Influencing Preferred Return Rates

Several key factors influence what preferred return rates investors will accept. Property location is a significant factor. Prime locations often command lower preferred returns because they are seen as less risky. Properties in emerging markets may offer higher preferred returns to balance the increased risk.

The sponsor's track record is another important element. Sponsors with a history of success often secure lower preferred returns. This is because investors are more confident in their ability to perform well. The amount of leverage used in the deal also affects the preferred return.

Higher leverage usually means higher risk, leading investors to seek higher preferred returns. For instance, a multifamily property in a desirable urban area with an experienced sponsor and low leverage might have a preferred return of 6-8%. A comparable property in a secondary market with a less experienced sponsor and higher leverage could require a 10-12% preferred return, or more.

Additionally, real estate syndications can have even higher preferred returns. Some platforms report average annualized returns around 18.1% for completed deals. You can learn more about this at SparkRental.

Decoding the "Higher is Better" Myth

New investors often assume a higher preferred return automatically signals a better deal. However, experienced investors know this isn’t always true. Sometimes, inflated preferred returns can hide underlying issues within a deal.

This tactic might attract investors but could sacrifice overall long-term returns. A truly strong deal provides a balanced preferred return. It aligns with current market conditions and the investment’s fundamentals.

Evaluating Preferred Return Structures

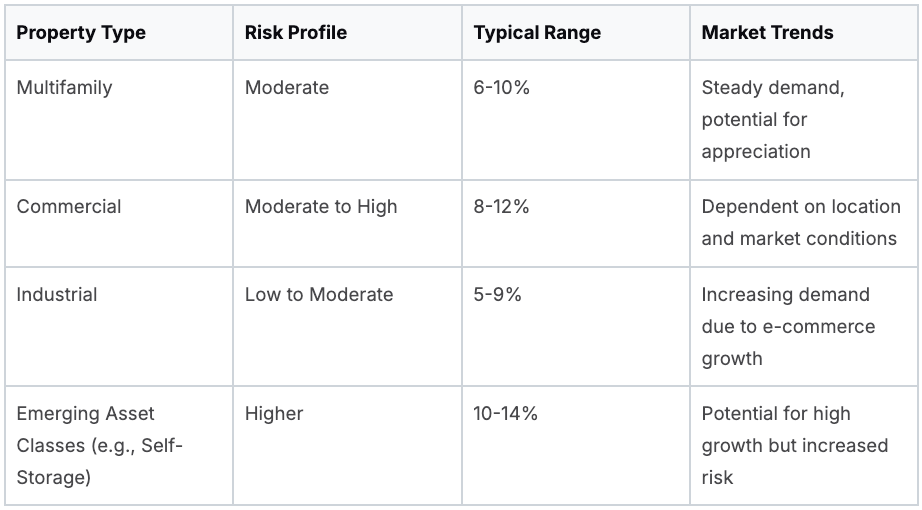

Investors should consider several interacting factors to evaluate preferred return structures effectively. This involves analyzing the property type, risk profile, and overall market trends. The following table offers a general overview of typical preferred return ranges for different real estate asset classes.

To help illustrate this, let's examine the following data:

Preferred Return Rates by Property Type

This table serves as a starting point for assessing preferred return rates. However, thorough due diligence is crucial. You must consider the specific details of each deal. Understanding the factors that influence preferred returns is essential.

Avoid the pitfall of chasing high rates without considering the larger context. By doing so, investors can make informed decisions. They can then maximize their chances of success in preferred return real estate. This knowledge helps determine if a return structure reflects genuine market value or unrealistic projections. A well-structured deal balances the interests of both sponsors and investors, benefiting all parties.

Beyond The Numbers: Preferred Return Vs. IRR

Many real estate investors confuse preferred return with IRR (Internal Rate of Return), sometimes with costly consequences. While related, these two metrics offer different perspectives on an investment's performance. Understanding the distinction between them is key to making sound investment decisions.

Preferred Return: The Initial Hurdle

The preferred return is essentially the first claim on profits in a real estate deal. It represents the minimum return investors are entitled to before sponsors begin to share in the profits. This structure protects investors and incentivizes sponsors to achieve strong performance.

For example, a preferred return of 8% means investors receive 8% of their initial investment annually before the sponsor receives any profit distributions. This prioritizes the return for the investor.

IRR: The Comprehensive Return

IRR offers a broader, more holistic view of an investment's performance over its entire life cycle. It considers the timing and size of all cash flows: the initial investment, ongoing distributions, and the final sale proceeds.

IRR is the annualized rate of return that makes the net present value of all these cash flows equal to zero. In simpler terms, IRR represents the true return on investment, accounting for the time value of money.

Case Studies: Unmasking the Differences

Let's look at two hypothetical scenarios to highlight the difference. Imagine one property with a 10% preferred return. However, due to slower appreciation and a delayed sale, the final IRR is only 7%.

Now consider another deal with a lower 8% preferred return that ultimately delivers a 12% IRR thanks to strong property performance and a favorable sale. These examples illustrate how a high preferred return doesn't automatically translate to a high IRR.

Timing Matters: How Distributions Impact IRR

The timing of distributions plays a critical role in the IRR calculation. Early and consistent distributions boost IRR, whereas delayed distributions can diminish it, even if the total profit remains the same.

A project distributing most of its profits in later years might have a lower IRR compared to a project with steady distributions throughout its life cycle, even if the total eventual payout is higher in the first project.

Sophisticated Evaluation: Combining Preferred Return and IRR

Smart investors leverage both preferred return and IRR when evaluating potential deals. The preferred return sets a baseline expectation and offers a degree of downside protection. The IRR provides a more complete picture of potential profitability.

By considering these metrics in tandem, investors can distinguish between genuine opportunities and investments with potentially misleading structures. Understanding both is crucial for navigating the complexities of preferred return real estate investments. Don't rely on one number alone; use both to inform your decisions and maximize your chances of investment success.

Decoding the Fine Print: What Offering Documents Hide

The appeal of preferred return real estate investments often hinges on the promise of steady returns. However, the reality often lies buried within the dense legal jargon of offering documents. A thorough understanding of these complexities is essential for making sound investment decisions and safeguarding your capital.

Unmasking Catch-Up and Lookback Provisions

Catch-up clauses and lookback provisions are frequently found in preferred return structures and can significantly impact investor returns. A catch-up clause allows the sponsor to receive a larger portion of profits after investors receive their preferred return, but before the normal profit split resumes. This enables sponsors to recover their initial investment more quickly. For instance, a catch-up clause might dictate that the sponsor receives 100% of the profits after the preferred return is paid until they reach a specified return threshold.

Lookback provisions, conversely, consider past performance when determining the preferred return. This is particularly relevant in cumulative preferred return structures. Should the investment underperform in its early years, a lookback provision could oblige the sponsor to compensate investors for any missed preferred return before they can share in profits.

Clawback Mechanisms: A Double-Edged Sword

Clawback mechanisms aim to protect investors if a deal substantially underperforms initial projections. These provisions empower investors to recoup previously distributed profits from the sponsor if certain performance benchmarks aren't attained. While seemingly beneficial, clawback mechanisms can introduce complexities and disputes if the terms are unclear. Crucial questions to address in the offering documents include defining "significant underperformance" and outlining how the clawback amount is calculated.

Red Flags: Spotting Potential Issues

Seasoned investors possess a keen eye for warning signs within offering documents. Ambiguous language about distributions, especially concerning timing and calculations, is a significant red flag. Overly optimistic income projections that appear disconnected from market realities should also trigger concern. Other red flags include convoluted fee structures, and a lack of transparency regarding the sponsor's track record and experience.

Asking the Right Questions

Before committing funds, astute investors actively engage with sponsors, posing targeted questions about preferred returns. They seek a precise understanding of how the preferred return is calculated, what happens if the investment underperforms, and their rights as investors. Inquiries about the sponsor's experience, investment strategy, and any potential conflicts of interest are also essential. These questions, coupled with a detailed review of offering documents, help uncover potential problems and facilitate confident investment choices.

Real-World Impact of Terminology

Slight variations in wording can dramatically affect investor outcomes. For example, a "non-cumulative preferred return" differs significantly from a "cumulative preferred return." With a non-cumulative preferred return, any unpaid preferred return in a given period is forfeited. With a cumulative preferred return, it accrues and must be paid before the sponsor receives any profit distributions. Grasping these seemingly minor differences in terminology is vital for assessing the true risk and reward profile of a preferred return real estate investment. By deciphering the fine print and posing critical questions, you transition from a passive observer to an active participant in your investment journey.

Navigating Preferred Return Structures Like a Pro

The preferred return percentage in preferred return real estate is only the first step. The actual structure underpinning that percentage significantly impacts your final return. This section explores the key differences between various preferred return structures and how they can affect your investment.

Simple vs. Compounding Calculations

The method used to calculate your preferred return plays a substantial role in your overall profit. Simple preferred return is calculated only on the initial investment amount. For example, a $100,000 investment with an 8% simple preferred return would yield $8,000 annually, regardless of the investment's timeframe.

Compounding preferred return, on the other hand, factors in any accrued, but unpaid, preferred return from previous years. Using the same $100,000 example, if only $6,000 was generated in the first year, the $2,000 shortfall would be added to the following year’s preferred return calculation. Over a typical 5-7 year hold period, this difference between simple and compounding interest can become significant.

Cumulative, Partially Cumulative, and Non-Cumulative Structures

Beyond the calculation method, there are crucial distinctions between fully cumulative, partially cumulative, and non-cumulative preferred return structures. A fully cumulative structure ensures all unpaid preferred returns accrue over the investment period.

Partially cumulative structures may accrue unpaid preferred returns, but only under specific conditions. For instance, this could be tied to the property achieving a pre-determined performance threshold. Non-cumulative structures offer no such protection; any unpaid preferred return is lost.

Real-World Scenarios: Impact on Returns

A hypothetical scenario can illustrate these differences. Consider a five-year investment with an 8% preferred return. In a robust market where the property performs well, all three structures (fully cumulative, partially cumulative, and non-cumulative) would likely yield similar returns.

However, if the market experiences a downturn and the property underperforms for a year or two, a cumulative structure provides the greatest protection for investor capital. The accrued, unpaid preferred return would be paid out once the property’s performance recovers. A partially cumulative structure offers some protection, depending on its specific terms, while the non-cumulative structure results in a permanent loss of return for those underperforming years.

Analyzing Deal Structures for Capital Protection

Analyzing completed real estate deals offers valuable insights. By examining actual, anonymized deal structures that have run through full investment cycles, we can see how different preferred return variations perform over time. This analysis consistently highlights the effectiveness of cumulative structures in protecting investor capital during market fluctuations.

Understanding these nuances empowers you to evaluate preferred return real estate investments aligned with your risk tolerance and financial goals. Instead of passively accepting standard terms, you can make informed decisions that meet your individual needs, maximizing preferred return opportunities while mitigating potential downsides.

Ready to simplify your real estate syndication process and manage your investor relations more effectively? Homebase offers an all-in-one platform to streamline fundraising, investor communication, and deal management. From automated workflows to integrated reporting, Homebase allows you to focus on business growth instead of spreadsheet management. Learn more at Homebase today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.