Offering Memorandum Sample: 8 Fundraising Formats

Offering Memorandum Sample: 8 Fundraising Formats

Explore our offering memorandum sample with 8 unique formats to elevate your 2025 fundraising pitch. Click to learn more!

Domingo Valadez

May 5, 2025

Blog

Decoding the Offering Memorandum: Your 2025 Guide

In real estate syndication and multifamily investing, securing capital is essential for project success. Attracting investors requires a clear vision and a transparent presentation of the opportunity. This is where the offering memorandum (OM) becomes vital. A cornerstone of fundraising, the OM has evolved, reflecting changes in regulations, investor knowledge, and market conditions. Its effectiveness lies in balancing legal compliance with a persuasive investment thesis.

Historically, OMs were dense legal documents. Today, an effective OM goes beyond mere compliance. It addresses investor concerns, anticipates questions, and presents potential returns while outlining the risks. The modern OM must resonate with savvy investors who expect data-driven decision-making and transparency.

In this 2025 guide, we'll explore the complexities of the offering memorandum, examining eight different types for specific real estate investment scenarios. Whether you're a seasoned real estate sponsor or new to syndication, this guide offers insights and best practices for crafting a compelling OM. Prepare to improve your fundraising and unlock the potential of your next real estate venture.

Eight Types of Offering Memoranda for Real Estate

Offering memoranda are tailored to various investment structures and property types. Understanding these distinct types is crucial for choosing the right OM for your project. Here are eight common types:

- Equity OM: For raising equity capital, outlining ownership structure and investor rights.

- Debt OM: Focused on securing loans, detailing terms, interest rates, and collateral.

- Preferred Equity OM: A hybrid approach, combining features of both equity and debt.

- Fund OM: Used for establishing investment funds, outlining investment strategy and management fees.

- Joint Venture OM: For partnerships, clarifying roles, responsibilities, and profit sharing.

- Development OM: For ground-up construction projects, highlighting development plans and timelines.

- Value-Add OM: Focusing on properties with potential for improvement and increased value.

- REIT OM: Specifically for Real Estate Investment Trusts, adhering to regulatory requirements.

Best Practices for a Compelling Offering Memorandum

A well-crafted OM is key to attracting investors. Here are some essential best practices:

- Executive Summary: Provide a concise overview of the investment opportunity.

- Market Analysis: Demonstrate market demand and potential for growth.

- Investment Strategy: Clearly define the investment approach and rationale.

- Financial Projections: Present realistic and data-backed financial forecasts.

- Risk Factors: Transparently disclose potential risks and mitigation strategies.

- Team Expertise: Highlight the experience and qualifications of the management team.

- Legal Structure: Clearly outline the legal and regulatory framework.

- Use of Proceeds: Specify how the raised capital will be utilized.

Crafting Your Offering Memorandum: A Step-by-Step Guide

Creating a compelling OM is a structured process. Follow these steps to develop an effective document:

- Define Investment Objectives: Clearly outline the goals of the investment.

- Conduct Thorough Due Diligence: Gather all necessary data and information.

- Engage Legal Counsel: Ensure compliance with all applicable regulations.

- Develop a Compelling Narrative: Present a clear and persuasive investment thesis.

- Design a Professional Document: Ensure a visually appealing and easy-to-read format.

- Distribute to Target Investors: Reach out to potential investors through appropriate channels.

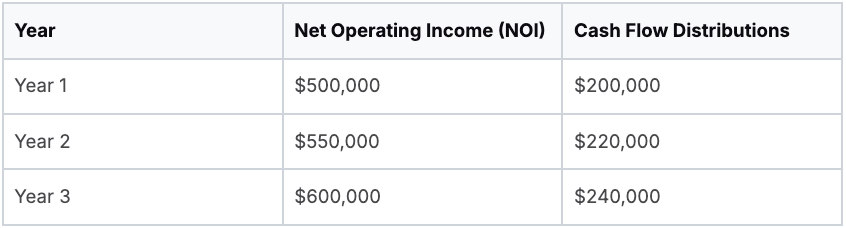

Example: Illustrative Offering Memorandum Excerpt

Let's look at a brief example of how to present financial projections within an OM:

This simple table illustrates projected returns, making the information easily digestible for potential investors. Remember, clear and concise presentation is key.

Traditional Private Placement Offering Memorandum

The Traditional Private Placement Offering Memorandum (PPM) is a crucial document for private real estate investment. For syndicators, sponsors, and multifamily investors seeking accredited investors, understanding its purpose is essential. The PPM presents the investment opportunity while ensuring legal compliance and facilitating informed decisions.

This legal document is used when offering securities exempt from SEC registration under Regulation D. This framework, often used by Wall Street investment banks and private equity firms, allows capital raising outside public markets. The PPM details the investment, including operations, financials, and potential risks, protecting both issuers and investors.

Key Features and Benefits

The PPM offers several key features and benefits:

- Detailed Company & Business Plan Overview: Investors gain a deep understanding of the business, its market, and growth strategy.

- Financial Statements & Projections: Historical and projected financials allow investors to assess potential ROI.

- Risk Factors Section: Potential risks are transparently outlined for informed decision-making.

- Use of Proceeds Breakdown: The PPM clearly shows how the capital will be used, building investor confidence.

- Management Team Biographies: The experience and expertise of the leadership team are highlighted.

- Terms of the Offering: Investment amount, ownership structure, and exit strategy are clearly defined.

- Subscription Instructions & Agreements: Investors receive the necessary information and documents to participate.

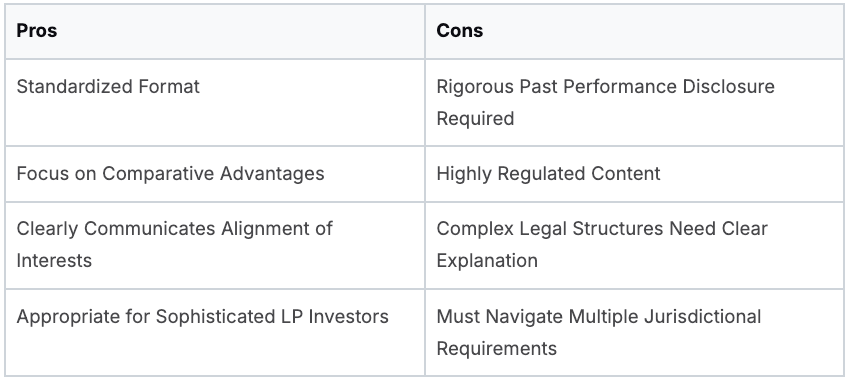

Pros and Cons of Using a PPM

Like any tool, the PPM has advantages and disadvantages.

Pros:

- Comprehensive Disclosure: Protects issuers from liability by ensuring informed investors.

- Credibility: A professional and transparent approach establishes credibility with sophisticated investors.

- Flexibility: The PPM adapts to various private placement offerings.

- Exemption from Public Registration: Streamlines fundraising and reduces costs.

Cons:

- Costly Preparation: Professional drafting and review can range from $15,000 to $50,000+.

- Time-Consuming Development: Compiling information can take 1-3 months.

- Substantial Disclosure Requirements: Requires revealing potentially sensitive company information.

- Periodic Updates: The PPM requires updates as the business and market change.

Practical Tips for PPM Implementation

Here are some practical tips for creating a strong PPM:

- Legal Counsel: Engage experienced securities attorneys, such as those at Skadden, Arps, Slate, Meagher & Flom, for review and compliance.

- Defensible Projections: Base financial projections on realistic assumptions and market analysis.

- Thorough Risk Disclosure: Identify and disclose all material risks.

- Disclaimers & Legends: Include appropriate disclaimers and legends for protection.

- Professional Presentation: Present information clearly, concisely, and in an organized manner.

The PPM is more than a legal formality; it’s a powerful tool. By following best practices and prioritizing disclosure, you can use the PPM to raise capital effectively, build trust, and protect all parties.

Real Estate Offering Memorandum

A Real Estate Offering Memorandum (OM) is a key document for showcasing real estate investment opportunities. It provides potential investors with a comprehensive overview of a project, whether it's a multifamily acquisition, new development, or a real estate fund. Unlike a generic offering memorandum, the real estate OM focuses specifically on property details, market analysis, investment strategies, and financial projections relevant to the real estate sector. This specialized focus makes it essential for syndicators, investors, and sponsors raising capital.

Key Features of a Real Estate OM

Key features often included in a real estate OM are:

- Detailed property descriptions with high-quality photos and floor plans

- In-depth location and market demographic analysis

- Competitive property analysis highlighting the investment’s advantages

- Existing rent rolls and tenant information (for income-producing properties)

- Planned capital improvements

- Pro forma financial statements projecting future performance

- The proposed investment exit strategy

- Discussion of tax implications specific to real estate investments

The visual format, using property images and financial charts, allows investors to easily visualize the opportunity. The use of industry-specific metrics, such as capitalization rate (cap rate) and net operating income (NOI), provides a standardized evaluation framework. Including geographic and market-specific data contextualizes the investment within its target market.

Challenges in Creating a Real Estate OM

Developing a comprehensive real estate OM requires specific real estate knowledge and expertise. It often involves commissioning third-party reports, such as environmental assessments and engineering studies. Keeping market data current is also critical, requiring consistent updates. Finally, property-specific risks, like environmental liabilities or title issues, necessitate careful and transparent disclosure.

Leading Firms and Resources

Companies like CBRE Investment Properties, Marcus & Millichap, Eastdil Secured, and Cushman & Wakefield are known for producing high-quality real estate offering memoranda, often setting industry best practices. Along with Real Estate Investment Trusts (REITs), real estate private equity firms, and commercial mortgage-backed securities (CMBS) issuers, they have refined the use of real estate OMs for raising capital. For further guidance, consider this helpful resource: How To Create a Powerful Real Estate Offering Memorandum.

Tips for an Effective Real Estate OM

To maximize the impact of your real estate OM, consider these tips:

- Visual Appeal: Use professional photography and, if possible, virtual tours.

- Market Context: Include detailed market comparisons to showcase value.

- Transparency: Clearly outline all financial projection assumptions.

- Risk Disclosure: Disclose any known property condition issues.

- Regulatory Compliance: Include all relevant zoning and entitlement information.

By following these practices, a real estate OM becomes a powerful tool for securing investment capital and achieving successful real estate ventures.

Regulation D Rule 506(c) Offering Memorandums

The Regulation D Rule 506(c) Offering Memorandum represents a significant change in how private placements are conducted. Unlike traditional private placements, Rule 506(c), enacted as part of the JOBS Act of 2012, permits general solicitation and advertising. This means businesses can actively market investment opportunities to a wider audience, potentially speeding up the capital raising process. However, there's an important requirement: all investors must be verified as accredited investors.

For real estate syndicators, multifamily investors, and sponsors, this offering type is a powerful tool. Instead of relying solely on existing networks, imagine promoting your real estate syndication to a large pool of potential investors. This is the potential of 506(c).

Key Features of a 506(c) Offering Memorandum

- Marketing-Oriented Executive Summary: This summary is designed to be engaging and highlight the investment's potential.

- Clear Description of Accredited Investor Verification Requirements: The memorandum must clearly explain how investor accreditation will be verified. Transparency is key.

- Detailed Investment Highlights Section: This section provides a concise overview of the investment's key aspects, potential returns, and advantages.

- Prominent Disclaimers Regarding General Solicitation: Clear disclaimers are essential for compliance and managing investor expectations.

- Digital-Friendly Format: The memorandum should be optimized for online distribution to reach and engage potential investors effectively.

- Integration with Verification Service Providers: This streamlines the essential accreditation verification process.

- Standard Legal Disclosures and Risk Factors: While marketing is encouraged, full risk disclosure remains a legal and ethical requirement.

Pros of Using a 506(c) Offering

- Expanded Reach: Public marketing and advertising greatly expands the potential investor base.

- Faster Capital Raise: Broader outreach can lead to a more efficient fundraising process.

- Modern Format: Digital-friendly formats improve accessibility and engagement.

Cons of Using a 506(c) Offering

- Strict Verification: Thorough accredited investor verification is essential and can be complex.

- Higher Regulatory Scrutiny: General solicitation attracts more attention from the SEC.

- Increased Compliance Burden: Navigating the regulations around 506(c) requires careful attention to detail.

- Reputational Risk: Insufficient verification processes can significantly harm your reputation.

Real-World Examples of 506(c) Offerings

Platforms like RealtyMogul, EquityZen, SeedInvest, and Republic utilize the 506(c) framework. They offer diverse investment opportunities ranging from commercial real estate and pre-IPO investments to startup funding and private equity placements. These examples illustrate the versatility and reach of this offering type.

Tips for Implementing a 506(c) Offering

- Partner with Accredited Investor Verification Services: Outsourcing verification simplifies the process and boosts credibility.

- Implement Robust Documentation Procedures: Maintain thorough records of every investor's verification process.

- Balance Marketing Appeal with Regulatory Compliance: A compelling offering is important, but never compromise compliance.

- Include a Clear Call-to-Action: Guide interested investors toward the next step in the investment process.

- Consider Multi-Channel Distribution Strategies: Maximize reach by using a blend of online and offline marketing methods.

Evolution and Popularity of 506(c)

The 506(c) offering memorandum gained traction after the SEC adopted rules implementing the JOBS Act in 2013. This legislation sought to simplify capital formation for small and emerging businesses by relaxing certain securities regulations. For real estate professionals, 506(c) offers a notable edge in a competitive landscape. Its capacity to connect with a wider group of accredited investors makes it an efficient tool for raising capital and expanding real estate ventures. This offering type is a valuable option for real estate professionals looking to enhance their fundraising strategies.

Digital Offering Memorandums: A Modern Approach to Real Estate Fundraising

Real estate investment is a dynamic field, and even traditional processes like using offering memorandums are changing. The Digital/Interactive Offering Memorandum is quickly replacing static PDFs, offering a more engaging experience for potential investors.

Instead of dense text and static charts, investors can interact with embedded videos, explore adjustable financial models, and visualize data through animated graphics. It's like upgrading from a simple brochure to a dedicated website for your investment opportunity. This is particularly helpful for real estate syndicators and sponsors working with tech-savvy multifamily investors.

Key Features and Benefits

Here are some key features of a Digital/Interactive Offering Memorandum:

- Embedded Video Presentations: Build trust and personalize the project by allowing potential investors to hear directly from the management team.

- Interactive Financial Models: Give investors control, allowing them to explore different scenarios and understand potential ROI based on various assumptions.

- Digital Data Rooms: Centralize all supporting documentation in a secure, accessible location using platforms like DealRoom. This simplifies document management and ensures version control.

- Animated Graphics and Visualizations: Make complex data easily digestible and compelling, enhancing understanding of the investment opportunity.

- Secure Access Controls and Analytics Tracking: Maintain confidentiality and gain valuable insights into investor engagement by tracking document views.

- Mobile-Responsive Design: Ensure a seamless experience for investors accessing the information on any device.

- Clickable Table of Contents and Cross-References: Simplify navigation and access to specific information within the document.

Pros and Cons for Real Estate Syndicators

Pros:

- Enhanced Investor Engagement and Understanding: Interactive formats improve information retention and connection with the project.

- Real-Time Analytics: Track investor interest and tailor follow-up strategies.

- Easy Updates: Quickly revise and redistribute the memorandum as information changes.

- Efficient Distribution: Reach a wider, global investor audience easily.

- Cost Savings: Reduce printing and distribution costs significantly.

Cons:

- Higher Upfront Development Costs: Creating a digital offering memorandum requires specialized expertise.

- Technical Compatibility: Thorough testing is essential to ensure consistency across devices and browsers.

- Security Concerns: Robust security measures are vital for protecting confidential data.

- Traditional Investor Preferences: Some investors may still prefer printed documents.

- Specialized Expertise: May require outsourcing to digital design professionals.

Examples and Growing Popularity

Platforms like Carta, AngelList, and Computershare have popularized digital offering documents across various investment contexts. This trend is further fueled by investment technology platforms, digital investor relations firms, financial technology startups, and progressive investment banks. While commonly seen in equity offerings and M&A deals, these principles are equally applicable to real estate syndications.

Tips for Implementation

- Static Fallbacks: Ensure all digital elements have static versions for accessibility.

- Document Analytics: Track investor engagement for valuable insights.

- Cross-Device Testing: Guarantee a seamless user experience across all platforms.

- Balance Interactivity and Loading Speed: Avoid overly complex designs that slow performance.

- Progressive Disclosure: Present complex information in digestible chunks.

The Digital/Interactive Offering Memorandum is a significant step forward in real estate fundraising. It's a powerful tool for syndicators to communicate investment opportunities and engage potential investors effectively. While initial costs and technical aspects need consideration, the long-term benefits make it a worthwhile investment for sponsors who want to stay ahead in the market.

Fund/Private Equity Offering Memoranda and Real Estate

A Fund/Private Equity Offering Memorandum (OM) is essential for raising capital for investment funds like private equity, venture capital, and hedge funds. It differs significantly from a standard real estate offering memorandum, targeting sophisticated institutional investors. Many of its principles and best practices translate directly to raising capital for larger real estate syndications and funds, allowing sponsors to attract a wider investor pool and potentially secure larger investments.

While a typical real estate OM focuses on specific properties or portfolios, a Fund/Private Equity OM emphasizes the fund itself. It provides a comprehensive overview of the fund's structure, investment strategy, management team's expertise, and, critically, its track record—a key factor for institutional investors.

Key Features of a Fund/Private Equity OM

- Fund Structure and Legal Organization: A detailed explanation of the fund's legal structure (e.g., limited partnership, LLC), domicile, and key organizational details.

- Investment Strategy and Thesis: This section articulates the fund's core investment philosophy, target asset class, geographic focus, and the rationale behind its investment decisions.

- Portfolio Construction Methodology: Outlines how the fund manager plans to build and manage the portfolio, including diversification strategies, risk management, and exit strategies.

- Management Team Track Record and Case Studies: Showcases the management team's experience and expertise, often including case studies of successful prior investments. This mirrors highlighting successful past real estate projects for individual syndications, but on a larger scale.

- Detailed Fee Structure: Clearly outlines all fund fees, including management fees, carried interest (performance-based incentives), and other expenses. Transparency is crucial.

- Limited Partner Rights and Governance: Specifies the rights and responsibilities of the limited partners (LPs), including voting rights and governance procedures.

- Capital Call Procedures: Describes the process for calling capital commitments from LPs to fund investments as opportunities arise.

- Distribution Waterfall Explanation: Details how profits are distributed between the fund manager and LPs, outlining different tiers and hurdles for profit sharing, similar to preferred return and profit split structures in real estate syndications.

- Past Performance Data with Appropriate Disclaimers: Presents historical performance data, if available, with disclaimers stating that past performance is not indicative of future results.

Pros and Cons of a Fund/Private Equity OM

Examples and Implementation Tips

Examples of these documents include fund memoranda from firms like Sequoia Capital, Blackstone, Andreessen Horowitz, and Apollo Global Management.

When adapting these principles for real estate syndications, consider:

- Present track record consistently: Use standardized metrics for presenting past real estate project performance.

- Clearly define and illustrate the waterfall structure: Ensure transparency in explaining the profit split and preferred return mechanisms.

- Include case studies of successful prior investments: Showcase past successes with detailed case studies, highlighting returns and key achievements.

- Address relevant regulatory considerations: Comply with all relevant securities regulations and investor protection laws.

Fund/Private Equity OMs are popularized by alternative investment managers, institutional placement agents, fund formation law firms, and pension and endowment investment committees. These groups are increasingly involved in larger real estate funds, bridging the gap between private equity and sophisticated real estate investing. By understanding the structure and principles of a Fund/Private Equity OM, real estate sponsors can enhance their offerings and attract larger, more sophisticated investors.

Regulation A+ Offering Memorandum Explained

A Regulation A+ Offering Memorandum is a fundraising tool for businesses seeking growth capital from a wider pool of investors. This includes non-accredited investors, while offering a reduced regulatory burden compared to a full Initial Public Offering (IPO). It's a middle ground between private placements and traditional IPOs, making it attractive for real estate syndicators, multifamily investors, and sponsors. Regulation A+ allows companies to raise up to $75 million for project funding.

This hybrid offering memorandum combines the structured disclosure of a regulated offering with marketing elements to attract a wider audience. It uses a simplified disclosure process compared to a full IPO, making it more cost-effective. The document is an SEC-qualified offering circular, providing investors with key information while allowing companies to present their offering persuasively.

Key Features of a Regulation A+ Offering

- SEC-Qualified Offering Circular Format: Ensures regulatory compliance and builds investor confidence.

- Simplified Financial Disclosure Requirements: Reduces the cost and complexity of preparing the offering.

- Testing-The-Waters Provisions: Allows companies to gauge investor interest before full launch.

- Ongoing Reporting Obligations Disclosure: Transparency about post-offering reporting.

- Investor Limits for Non-Accredited Participants: Protects non-accredited investors.

- Marketing-Oriented Presentation Style: Engages potential investors.

- Digital Distribution and Social Media Integration: Facilitates broader reach.

Pros of Using Regulation A+

- Access to the General Public: Expands the potential investor pool.

- Lower Compliance Costs Than a Traditional IPO: Makes raising substantial capital more attainable.

- General Solicitation Permitted: Enables broader marketing.

- Liquidity Options Through Secondary Trading: Offers potential exit strategies.

- Less Extensive Reporting Than Public Companies: Reduces administrative burden.

Cons of Using Regulation A+

- SEC Qualification Process Required: Involves time and resources.

- Ongoing Reporting Obligations After the Raise: Entails ongoing costs.

- Higher Costs Than Private Offerings: Reflects increased oversight.

- Investment Limits for Non-Accredited Investors: Restricts individual amounts.

- Two-Tier System: Tier 2 offerings (up to $75 million) have more stringent reporting.

Real-World Examples of Regulation A+

- StartEngine: A platform facilitating Reg A+ offerings.

- Fundrise: Utilizes Reg A+ for real estate investments.

- Brewdog's Equity for Punks: Used Reg A+ for crowdfunding.

- Elio Motors: Leveraged Reg A+ for capital raising.

Tips for Implementing Regulation A+

- Clear Language: Crucial for retail investors.

- Complementary Marketing Campaign: Essential for reaching a broad audience.

- Budget for Ongoing Compliance: Factor in post-offering costs.

- Consider Broker-Dealer Partnerships: Can enhance distribution.

- Robust Investor Communications Platform: Facilitates transparent communication.

The Rise of Regulation A+

The JOBS Act Title IV implementation spurred the adoption of Regulation A+. Equity crowdfunding platforms, direct-to-consumer brands, and the SEC's modernization efforts have contributed to its increasing popularity. For real estate professionals, Regulation A+ offers a pathway to access more capital while remaining compliant and engaging a wider investor pool.

PPM Templates and Standardized Formats

A Private Placement Memorandum (PPM) is essential for raising capital, particularly for real estate syndicators and multifamily investors. Creating one from scratch is time-consuming and costly. PPM templates and standardized formats offer a more efficient solution, allowing sponsors to create compliant documents while managing legal expenses.

These templates offer a structured framework, complete with pre-built sections, pre-drafted legal disclaimers, and a fill-in-the-blank format for specific company information. This organized structure ensures consistent disclosure of crucial information, such as risk factors and subscription agreements, minimizing the risk of omissions. Customizable risk factor libraries and integrated subscription documents further streamline the creation process. Often, industry-specific variations are available, tailoring the template to the nuances of real estate syndications or multifamily investments.

Features and Benefits

- Standardized Section Organization: Ensures a logical flow and comprehensive coverage.

- Pre-Drafted Legal Disclaimers and Legends: Saves time and reduces legal review expenses.

- Fill-in-the-Blank Format: Simplifies the inclusion of company-specific information.

- Customizable Risk Factor Libraries: Provides a solid starting point for identifying and disclosing relevant risks.

- Integrated Subscription Documents: Facilitates the investor onboarding process.

- Compliance Checklists: Assists in meeting regulatory requirements.

- Industry-Specific Variations: Caters to the unique needs of real estate and other sectors.

Pros

- Reduced Document Preparation Time: Sponsors can focus on deal-making, not paperwork.

- Lower Legal Costs: Standardization minimizes billable hours spent on drafting.

- Consistent Disclosure Coverage: Reduces the risk of legal issues.

- Minimized Risk of Omissions: Protects both sponsors and investors.

- Easy Updates for Multiple Offerings: Streamlines repeat fundraising.

Cons

- Customization Needs: May not fully address the unique aspects of every offering and requires careful tailoring.

- Generic Appearance: Using a template without proper customization can appear unprofessional.

- Potential for Outdated Information: Regular template updates are crucial for maintaining compliance.

- Less Distinctive Presentation: A highly customized PPM can convey a stronger sense of professionalism.

- Perception of Lack of Effort: Investors may perceive a generic PPM negatively.

Examples

- RocketLawyer PPM templates: Offers a range of business document templates.

- LawDepot offering document generators: Provides online tools for creating legal documents.

- VC ExpertLegal investment document templates: Specifically designed for venture capital and private equity transactions.

Tips for Implementation

- Legal Review: Always have an attorney review the final document for legal compliance.

- Thorough Customization: Tailor the language to accurately reflect your specific offering.

- Regular Updates: Stay informed about regulatory changes and update templates accordingly.

- Industry-Specific Templates: Utilize these when available to address specific legal and regulatory considerations.

- Business-Specific Risks: Supplement template risk factors with those specific to your investment opportunity.

Popularity and Evolution

PPM templates have gained popularity alongside the rise of legal document service providers and automated document generation tools. This, combined with increasing standardization of legal practices and the availability of model documents from industry associations like the National Venture Capital Association (NVCA), has made template usage common practice. For real estate syndicators and multifamily investors, the efficiency and cost-effectiveness of PPM templates are essential, allowing them to prioritize deal identification and execution over complex legal documentation.

Value Proposition

This approach addresses a significant challenge for real estate sponsors: the considerable time and expense associated with PPM creation. By using templates and standardized formats, sponsors can significantly streamline this process, reduce legal costs, and ensure compliance while concentrating on their core business objectives.

Mergers & Acquisitions in Real Estate

The Merger & Acquisition (M&A) Offering Memorandum, often called a Confidential Information Memorandum (CIM), is a key document in the sale of a business or major corporate assets. While not directly tied to raising capital for a specific real estate project like other offering memorandums, understanding the M&A process and the role of the CIM can be invaluable. This is especially true for real estate syndicators, multifamily investors, and sponsors looking to exit investments through a sale or attract strategic partners. This document represents the gold standard for presenting an investment to sophisticated investors, showcasing the expected professionalism in larger transactions.

The CIM provides potential acquirers with a complete overview of the target company, facilitating a competitive sale process. This structured approach lets buyers perform due diligence and evaluate the investment. Think of it as a highly refined sales pitch designed to maximize business valuation and attract the right buyers.

Key Features of an M&A Offering Memorandum

- Blind Teaser Introduction: The CIM often begins with a “blind teaser,” omitting the company’s name for initial confidentiality while generating interest.

- Executive Summary: This section concisely presents the key investment highlights and opportunity.

- Company Overview: This details the company’s history, development, management team, and organizational structure.

- Product/Service Portfolio Analysis: This translates to property portfolio analysis for real estate, offering a detailed look at the assets and their market positioning.

- Operational Overview: This section covers facilities, systems, processes, and technology. For real estate, this includes property management discussions.

- Customer and Supplier Relationships (if applicable): This analyzes key relationships. In real estate, tenant profiles and contractor relationships are relevant.

- Market Analysis and Competitive Positioning: This assessment of the target market and competitive landscape is critical for real estate investments.

- Financial Performance and Projections: Historical financial data, key performance indicators (KPIs), and future projections, including pro forma statements, are crucial for real estate investments.

- Growth Opportunities for Acquirers: This outlines post-acquisition value creation, such as value-add opportunities or market expansion in real estate.

- Transaction Process Timeline: This provides a clear outline of the proposed sale process and anticipated timeline.

Pros and Cons of Using a CIM

Using a CIM offers several advantages:

- Maximizes business valuation through buyer competition.

- Systematically presents key value drivers.

- Controls information flow to qualified parties.

- Uses a standardized format familiar to strategic and financial buyers.

However, there are also drawbacks to consider:

- Requires significant due diligence and preparation.

- Risk of selective disclosure allegations.

- Potential confidentiality breaches.

- Time-intensive preparation (often 2-3 months).

- Balancing promotional aspects with factual accuracy.

Examples and Tips

While specific CIMs are not publicly available due to confidentiality, the principles and structures are consistent across firms like Goldman Sachs, JP Morgan Chase, Lazard, and Houlihan Lokey when managing sell-side M&A transactions.

Real estate sponsors can apply CIM principles with these tips:

- Establish strong Non-Disclosure Agreement (NDA) procedures.

- Prepare a comprehensive data room (physical or virtual).

- Highlight potential synergy opportunities.

- Present normalized or adjusted EBITDA with a clear methodology.

- Include management succession plans, if applicable.

- Present realistic, data-backed growth projections.

Applying CIM Principles in Real Estate

Investment banking firms, business brokers, M&A advisors, private equity firms (for portfolio company exits), and corporate development departments typically use CIMs. While these entities operate in larger transactions, real estate sponsors can adopt these best practices. By understanding the CIM, syndicators and sponsors can improve their investment presentations, attracting sophisticated investors and maximizing asset value.

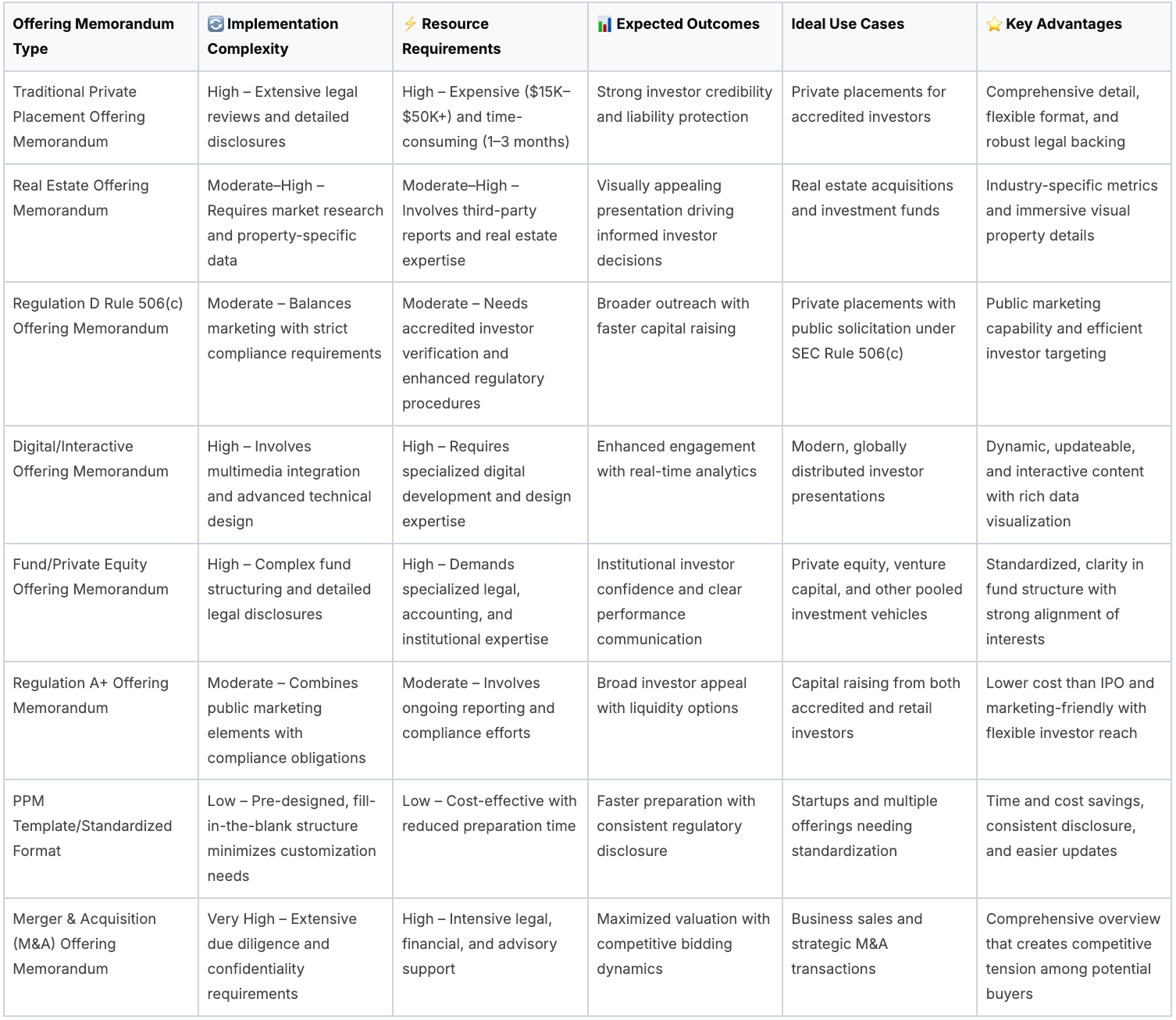

8 Offering Memorandum Templates Overview

Crafting Your Winning Offering Memorandum: Next Steps

Creating a compelling and compliant offering memorandum is essential for fundraising success. Whether it's a Traditional Private Placement, a Regulation D Rule 506(c) offering, a Fund/Private Equity memorandum, or a Regulation A+ offering, understanding the nuances of each is crucial. From Real Estate and M&A offerings to using a PPM template or a Digital/Interactive Offering Memorandum, choosing the right format is the first step.

Key takeaways for creating your offering memorandum include tailoring the content to your audience, ensuring alignment with the chosen investment structure (e.g., 506(c), Regulation A+), and meticulous adherence to legal and regulatory requirements. Consult with legal and financial professionals to ensure compliance and optimize your offering.

Adaptability is also key. The regulatory environment and investor expectations are constantly changing. Stay informed about trends like the rise of digital securities and evolving SEC guidelines to ensure your offering memorandum stays current and competitive.

Key Principles for a Successful Offering Memorandum

By implementing these key principles, you'll be well-positioned to create an offering memorandum that effectively communicates your investment opportunity and attracts the capital you need.

- Target Audience Focus: Speak directly to the interests and needs of your potential investors.

- Structure Alignment: Ensure the memorandum aligns perfectly with your chosen investment framework.

- Regulatory Compliance: Maintain strict adherence to all legal and regulatory requirements.

A clear, comprehensive, and compliant offering memorandum is more than just a legal document; it's a powerful tool for building trust and securing investor confidence.

Streamline Your Real Estate Syndication with Homebase

Ready to simplify your real estate syndication process and create winning offering memorandums? Homebase offers an all-in-one platform designed to simplify fundraising, investor relations, and deal management.

From automated workflows and KYC/AML verification to secure document sharing and integrated reporting, Homebase empowers you to focus on portfolio growth. For a flat fee of $350/month, unlock unlimited deal and investor management, white-glove migration services, and 24/7 customer support. Take control of your syndication journey and experience the Homebase advantage. Visit Homebase today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.