Investing in Apartment Buildings: Key Tips for Success

Investing in Apartment Buildings: Key Tips for Success

Learn essential strategies for investing in apartment buildings. Discover how to maximize returns and build wealth with expert guidance.

Domingo Valadez

Jun 8, 2025

Blog

Why Smart Investors Are Choosing Apartment Buildings Now

The real estate market is always changing, and smart investors are increasingly looking at apartment buildings as a strong investment opportunity. This isn't a temporary fad; strong economic and demographic trends are pushing this change. Let's explore why apartment buildings are getting so much attention.

Recession-Resistant Resilience

A primary reason for the growing interest in apartment buildings is their resilience, especially during tough economic times. Everyone needs a place to live, which makes multifamily housing a more stable investment than other options. This stability is strengthened by the diverse income from multiple units.

For example, if one apartment is empty, the income from the other occupied units lessens the impact. This built-in diversification reduces risk and provides a steady income flow.

Additionally, managing apartment buildings is more efficient and cost-effective. Instead of handling many separate properties, you manage a single building, simplifying operations and potentially increasing profits. This efficient management structure offers a significant advantage compared to managing multiple single-family homes.

Riding the Wave of Renting

Current demographics further support investing in apartment buildings. Millennials and Gen Z, the largest groups of renters, prioritize lifestyle and flexibility. They often prefer the ease and mobility of renting over the responsibilities of owning a home.

This preference creates consistent demand, especially in desirable urban areas. This demand supports the long-term success of apartment building investments. The U.S. multifamily market itself is a strong opportunity. In the last year, sales have reached $157.7 billion, according to MSCI Real Capital Analytics.

This impressive number highlights the sector's strength. The market has shown resilience, with occupancy rates remaining high even with new construction. This is largely driven by the increasing number of renters. This renter growth, double that of owner-occupied homes, is mainly due to rising home prices and mortgage rates. For more detailed information, check out this market snapshot: https://arbor.com/blog/u-s-multifamily-market-snapshot-may-2025/

Unlocking Multiple Income Streams

Apartment buildings offer more than just rental income. Adding amenities like laundry facilities, parking, or storage units can create extra revenue and increase the property's value. These additional income sources boost cash flow and provide another level of financial security.

This diversified income is a powerful way to maximize returns and build long-term wealth. These are just some of the reasons why smart investors are focusing on apartment buildings. The potential for substantial returns, combined with inherent stability, makes this asset class an attractive option in today's market.

Reading Market Trends Like A Seasoned Pro

Successfully investing in apartment buildings starts with a solid grasp of market dynamics. Simply finding a building isn't enough. You need to analyze the underlying trends to see if the market supports long-term growth. This means looking beyond the surface and delving into the factors that drive profitability.

Identifying Emerging Markets

Smart investors seek out emerging markets. These are locations poised for growth that aren't yet oversaturated. Such markets offer opportunities for higher returns because of lower entry costs and the potential for increased future demand. A key indicator of an emerging market is a supply-demand imbalance. Markets with limited new construction, combined with growing populations and employment, often see rising rents and property values.

For example, a city experiencing a tech boom might have a surge in rental demand as new jobs appear. If construction lags behind this job growth, it creates a desirable environment for apartment building investments. This means identifying areas where job growth is outpacing housing supply.

Analyzing Metro Area Performance

Certain metro areas present compelling investment prospects due to a confluence of positive factors. These often include robust employment growth, limited housing supply, and rising rental demand. Recognizing these key characteristics can help investors pinpoint markets with strong growth potential. This requires diligent research and analysis of economic indicators and demographic trends.

However, it's equally vital to identify signs of an overheated market. Rapid price increases, excessive speculation, and low cap rates can signal a potential bubble. Understanding how to spot an overheated market is crucial for making informed investment decisions. This highlights the importance of thorough due diligence and careful market analysis.

Global Investment Flows and Secondary Markets

Global investment flows are significantly impacting local apartment markets. While major metropolitan areas have historically attracted substantial investment, there's a growing trend towards secondary markets. These smaller cities frequently offer higher risk-adjusted returns due to reduced competition and the potential for greater growth.

Investing in apartment buildings has become a global phenomenon, especially in specific high-growth markets. Over the past five years, these markets—known as the "Living 15"—accounted for 98% of living investment and 32% of global commercial real estate investment. This represents a 19% increase from the preceding five-year period. Learn more about global living investments here. This influx of capital further influences local market dynamics, making careful analysis all the more critical.

Frameworks for Evaluating Market Fundamentals

A strong framework for evaluating market fundamentals is essential for long-term success in apartment building investing. This framework should encompass several key elements:

- Economic indicators: Job growth, population growth, and income levels.

- Supply and demand dynamics: New construction, vacancy rates, and absorption rates.

- Rental market trends: Rent growth, affordability, and tenant demographics.

- Regulatory environment: Zoning laws, building codes, and rent control policies.

By carefully considering these factors, investors can make informed decisions about where and when to invest. This comprehensive approach helps mitigate risk and identify opportunities that align with individual investment goals. Understanding these market trends allows you to navigate the complexities of apartment building investing with greater confidence and improve your likelihood of success.

Mastering The Financing Game That Others Struggle With

Financing can often feel like the biggest hurdle when investing in apartment buildings. However, a solid understanding of what lenders are looking for can simplify the process and unlock profitable opportunities. This section explores how successful investors secure financing for their apartment building ventures.

Understanding Lender Priorities

Lenders seek assurance of profitability and a borrower's ability to repay the loan. They prioritize deals demonstrating strong financial metrics, experienced management teams, and properties located in desirable markets. This translates to presenting a well-structured deal that minimizes risk and maximizes potential returns.

Savvy investors grasp these priorities and structure their deals accordingly. They focus on key metrics like net operating income (NOI), debt service coverage ratio (DSCR), and loan-to-value ratio (LTV). These figures provide a snapshot of the property's financial health and the borrower's capacity to manage debt obligations.

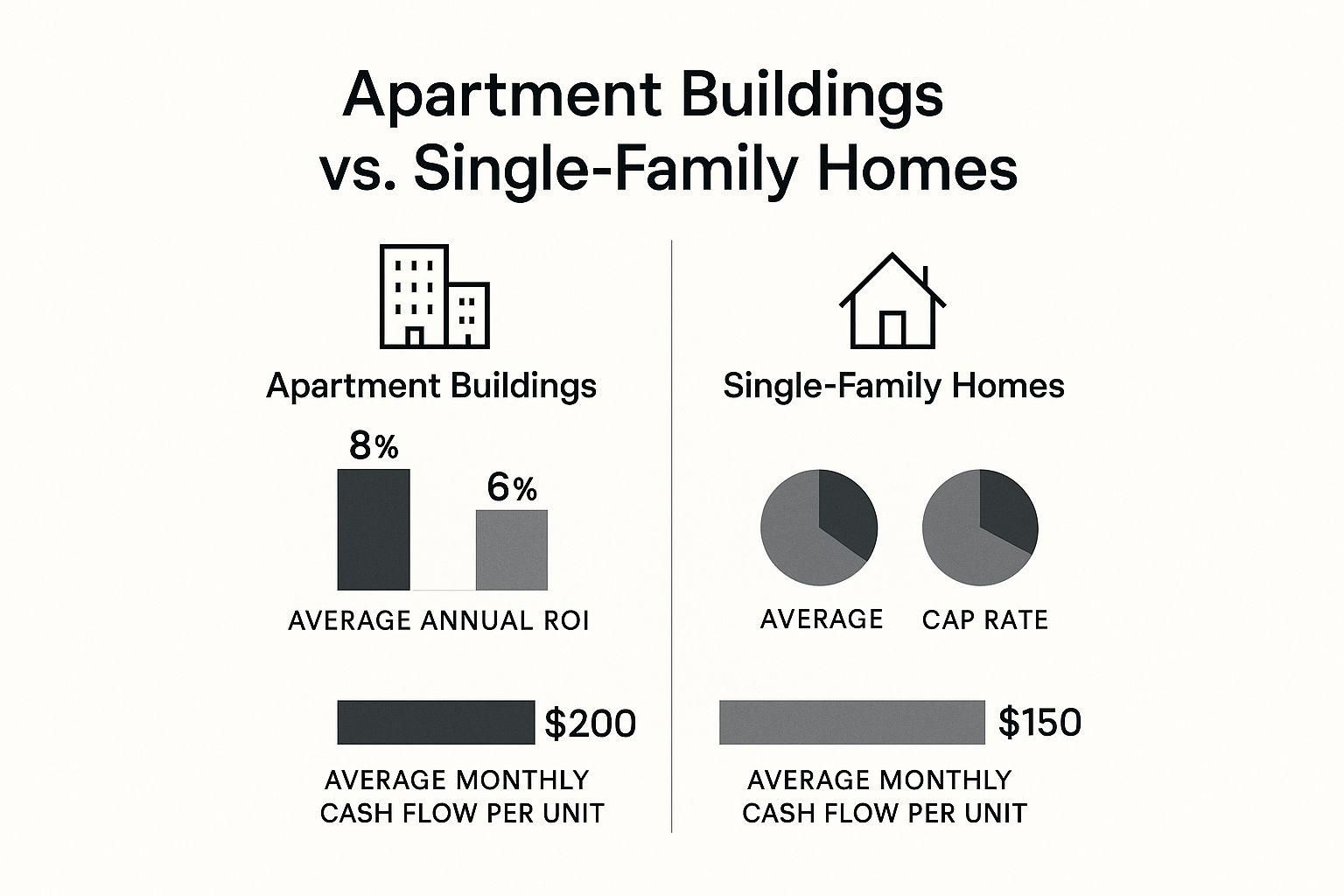

The infographic above provides a visual comparison of key financial metrics for apartment buildings versus single-family homes. The data illustrates how apartment buildings generally outperform single-family homes in key areas such as ROI, cap rate, and monthly cash flow per unit. This superior performance makes apartment buildings a more appealing prospect for lenders.

Creative Financing Strategies

Beyond conventional loans, seasoned investors often explore more creative financing options. These can include joint ventures, syndications, and private money loans. Such strategies can open doors to capital that might otherwise be inaccessible, often with more flexible terms.

For instance, a syndication pools capital from a group of investors, enabling them to collectively purchase larger properties than they could individually. This collaborative strategy expands opportunities and distributes risk.

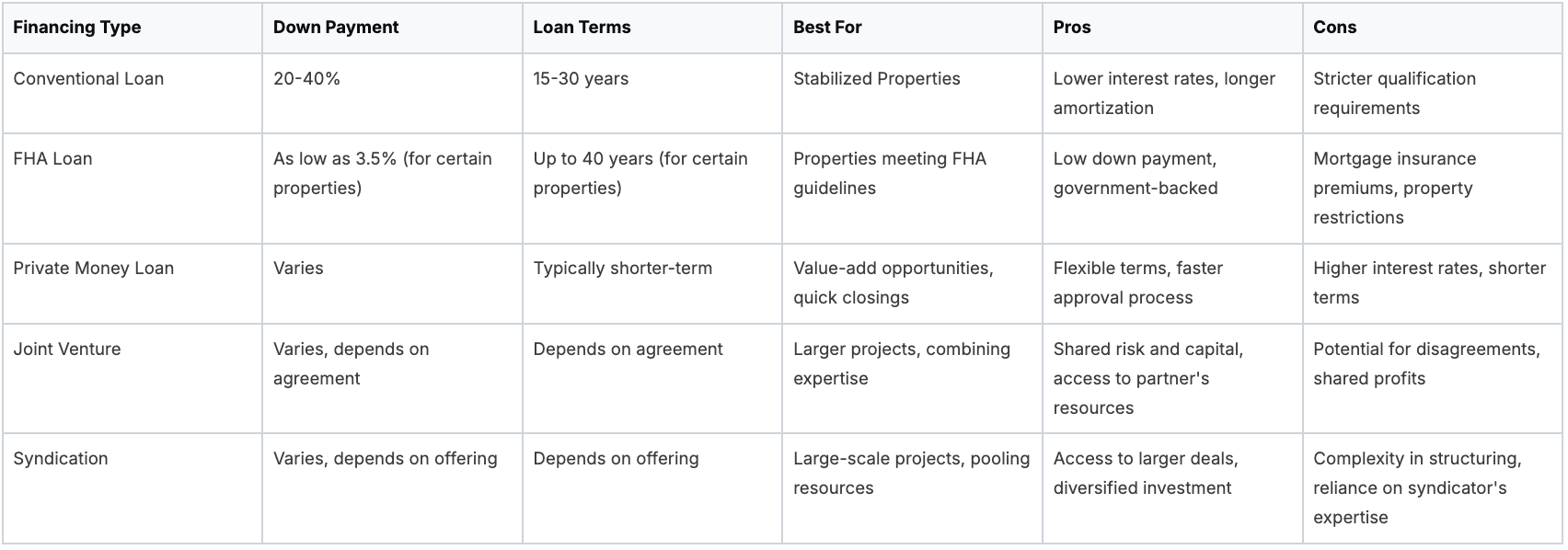

To help illustrate the different financing options available, let's take a look at the following comparison:

Apartment Building Financing Options Comparison

A comprehensive comparison of different financing methods including loan terms, down payment requirements, and ideal use cases

This table summarizes the key features, advantages, and disadvantages of various financing methods. Carefully considering these factors will help investors choose the best fit for their specific needs and circumstances.

Maximizing Leverage and Minimizing Risk

Leverage – the use of borrowed funds to amplify potential returns – is a fundamental tool in real estate investment. However, responsible leverage management is crucial. Over-leveraging can quickly lead to financial strain if the property's performance falls short of projections.

Experienced investors strive for a balanced approach. They utilize leverage strategically to boost profits while ensuring they can comfortably manage their debt service. This careful approach protects their investment and mitigates potential downside risks.

Working With Commercial Lenders

Cultivating strong relationships with commercial lenders is vital for sustained success in apartment building investing. Lenders appreciate borrowers who are organized, transparent, and possess a clear understanding of their investment strategy. This involves providing a comprehensive loan package, complete with detailed financial projections, a thorough market analysis, and a well-defined management plan.

By presenting themselves as reliable and knowledgeable, investors can negotiate favorable loan terms and secure access to capital for future acquisitions.

Refinancing Strategies and Equity

Refinancing is a powerful tool for tapping into built-up equity and fueling portfolio growth. As property values increase and loan balances decrease, investors can refinance to access this accumulated equity. This capital can then be used for property improvements, acquiring additional properties, or diversifying their investment portfolio.

Strategic refinancing can significantly accelerate wealth creation and enable investors to scale their real estate holdings. Understanding the complexities of refinancing and collaborating with lenders to identify optimal strategies are crucial to maximizing the benefits of this valuable tool. For more information on multifamily investing, consider this resource: How to Invest in Multifamily Properties.

Deal Analysis That Separates Winners From Disasters

Investing in apartment buildings requires a comprehensive strategy. It's more than just finding an appealing property; it demands a thorough deal analysis to distinguish profitable investments from potential losses. This involves carefully examining the property's financials, potential risks, and opportunities for increasing value. This disciplined approach separates successful investors from those who stumble.

Essential Financial Metrics

Analyzing apartment building deals starts with understanding key financial metrics. Net operating income (NOI), calculated by subtracting operating expenses from revenue, is a fundamental indicator of profitability. The cap rate, derived by dividing NOI by the property's purchase price, helps investors assess potential return on investment.

Another vital metric is the cash-on-cash return. This measures the annual pre-tax cash flow relative to the initial cash investment, providing insights into the property's immediate income-generating capability. Evaluating these metrics helps determine if the investment aligns with your financial objectives.

Due Diligence: Uncovering Hidden Problems

Thorough due diligence is essential when investing in apartment buildings. This extends beyond reviewing provided financials. It involves a detailed property inspection, assessing its physical condition, and reviewing existing leases and tenant history. This comprehensive approach uncovers potential issues early.

Due diligence also includes analyzing market conditions, local regulations, and potential environmental concerns. A comprehensive process mitigates risk and ensures informed investment decisions. This in-depth analysis can reveal hidden problems that could significantly impact future performance.

Conservative Underwriting and Upside Potential

Conservative underwriting means making realistic assumptions about income and expenses, factoring in potential vacancies and repair costs. While optimistic projections can be enticing, a conservative approach helps avoid overpaying and ensures the investment can withstand unexpected challenges.

However, balancing conservative underwriting with identifying genuine upside potential is key. This could include value-add improvements, such as renovations or amenity upgrades, to increase rents and property value. This balanced approach maximizes potential returns while mitigating risks.

Evaluating Value-Add Opportunities

Value-add investments focus on improving a property to boost income and value. This often involves renovations, upgrades, or improved management practices. Accurately estimating renovation costs is crucial for projecting realistic returns. Detailed cost analysis ensures the investment is profitable.

Projecting realistic rental growth is also essential for value-add investments. Market research, competitor analysis, and understanding local rental trends inform realistic projections. This forward-looking perspective ensures the investment aligns with market realities and delivers anticipated returns.

The multifamily sector, including apartment buildings, is navigating a dynamic environment in 2025. Construction starts are projected to be 74% below their 2021 peak and 30% below pre-pandemic averages due to rising interest rates and construction lead times. However, demand remains strong, particularly in east-coast hubs with limited supply and high barriers to homeownership. Explore this further here. This presents both challenges and opportunities.

Red Flags and Negotiation Strategies

Recognizing red flags is critical. These warning signs can include inconsistent financials, deferred maintenance, high tenant turnover, or unfavorable market trends. Early identification prevents costly mistakes.

Finally, effective negotiation strategies, supported by solid financial analysis, are essential for securing favorable deal terms. Understanding the property's true value and potential allows investors to negotiate confidently and maximize returns. This strategic approach contributes significantly to long-term profitability.

Turning Average Properties Into Cash-Flowing Assets

Turning an average apartment building into a thriving investment isn't just about collecting rent. It requires proactive management and a keen eye for increasing value. This section explores proven strategies to maximize returns from apartment building investments.

Boosting Rental Income and Cutting Expenses

Increasing your net operating income (NOI) is paramount. This means strategically raising rental income while lowering operating expenses. One effective way to boost income is by offering desirable amenities that tenants will pay for. Think upgraded appliances, in-unit laundry, or covered parking. This adds value and justifies higher rents.

Also, explore ways to reduce operating expenses. Switching to energy-efficient lighting, using smart thermostats, and negotiating better deals with suppliers can significantly impact your bottom line. These small changes add up to substantial savings over time.

Renovations That Deliver High Returns

Not all renovations are equal. Some offer a much better return on investment than others. Focus on upgrades tenants value, such as kitchen and bathroom renovations. These can significantly increase your property's appeal and justify rent increases. These improvements attract and retain quality tenants, minimizing vacancies and boosting your NOI. You might be interested in: How to Invest in Multifamily Properties.

Modernizing kitchens with stainless steel appliances and granite countertops can attract prospective tenants. Similarly, upgrading bathrooms with new fixtures and stylish tile can significantly enhance a unit's appeal.

Using Technology for Tenant Satisfaction and Profit

Technology is essential in modern property management. Online rent payment systems, high-speed internet access, and property management software streamline operations and enhance tenant satisfaction. This improves efficiency and attracts tech-savvy renters.

Using technology to track maintenance requests and manage repairs can also reduce downtime and improve tenant relations. This proactive approach minimizes disruptions and creates a positive tenant experience.

Effective Tenant Screening and Retention

Finding and keeping good tenants is fundamental to success. A robust tenant screening process, including credit checks, background checks, and rental history verification, minimizes risks and helps you select reliable tenants. This reduces the likelihood of late payments, property damage, and evictions.

Tenant retention is equally important. Happy tenants renew their leases, which reduces turnover costs and maintains a stable income. Being responsive to maintenance requests, fostering a sense of community, and offering lease renewal incentives are all valuable tools.

Building a Reliable Team

Managing an apartment building often requires a skilled team. This might include property managers, maintenance professionals, and reliable contractors. A strong team ensures your property is well-maintained, issues are addressed promptly, and tenant needs are met.

A dependable team improves tenant satisfaction, reduces operational headaches, and contributes to your investment's long-term value. This collaborative approach frees up your time to focus on strategic decisions and portfolio growth.

Addressing Common Management Challenges

Managing apartment buildings comes with challenges. Difficult tenants, maintenance emergencies, and regulatory requirements are all part of the job. Having a plan to address these challenges proactively is essential.

Clear communication channels with tenants, a preventative maintenance schedule, and staying informed about local regulations can prevent problems before they escalate. This helps maintain smooth operations and protects your investment.

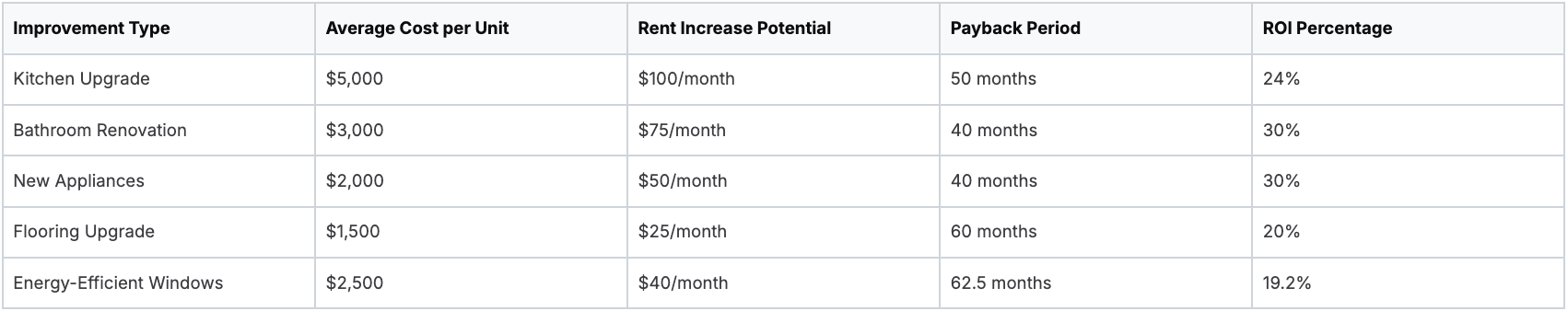

Value-Add Improvement ROI Analysis

Analysis of common apartment building improvements showing investment costs and expected return on investment

Note: These figures are averages and can vary based on location, property type, and market conditions.

By implementing these strategies, you can transform an average apartment building into a high-performing asset. This generates substantial cash flow and builds long-term wealth. This proactive approach to management and value creation sets the stage for continued success in apartment building investing.

Building Serious Wealth Through Strategic Portfolio Growth

Building a substantial real estate portfolio requires a shift in perspective. It's not just about owning a single apartment building; it's about envisioning long-term, sustainable growth. This involves strategic planning and a commitment to building wealth over generations through smart apartment building investments.

Reinvesting Cash Flow for Exponential Growth

One of the most effective strategies for portfolio growth is reinvesting cash flow. Instead of pocketing all your profits, reinvest earnings into property improvements or down payments on additional buildings. This can significantly accelerate growth compared to relying solely on new capital.

For example, the cash flow from one apartment building could fund amenity upgrades in another, attracting higher-paying tenants and increasing its value. This creates a snowball effect, with each investment fueling further growth.

Refinancing to Unlock Growth Opportunities

Refinancing offers another powerful tool for portfolio expansion. As your property appreciates, refinance to access the increased equity. These funds can then be used to acquire new properties or make significant improvements to existing ones.

Refinancing essentially lets you leverage the growth of your initial investment to expand your portfolio without needing substantial new capital. It provides access to funds tied up in your existing assets, creating opportunities for further investment.

Identifying Your Next Acquisition: Strategic Targeting

Effective portfolio expansion requires a disciplined approach to identifying new acquisitions. This involves analyzing market trends, evaluating potential deals, and aligning them with your investment goals. Are you focused on value-add opportunities in emerging markets or stable cash-flowing assets in established areas?

Clearly defined investment criteria help you narrow your search and focus on properties that match your long-term objectives. This focused approach maximizes efficiency and prevents impulsive decisions.

Balancing Aggressive Growth with Smart Risk Management

While aggressive growth can be attractive, it's crucial to balance it with sound risk management practices. Diversification is key. Spreading investments across different markets and property types mitigates the impact of a downturn in any one area.

For instance, owning apartment buildings in both urban and suburban locations helps balance market fluctuations and reduce overall portfolio risk. This approach provides a safety net and protects you from overexposure to any single market.

Tax Optimization for Apartment Investments

Savvy investors understand the importance of tax optimization. Depreciation, a significant tax benefit for real estate investors, allows you to deduct a portion of the property's cost over time, reducing taxable income.

1031 exchanges enable you to defer capital gains taxes when selling a property by reinvesting the proceeds into a similar one. These tax strategies can significantly improve your returns and contribute to long-term wealth creation. Consulting with a tax advisor specializing in real estate investment is highly recommended.

The Art of Timing: Holding, Selling, and Market Cycles

Knowing when to hold, when to sell, and how to navigate market cycles are essential skills for maximizing returns. Holding properties during appreciation builds wealth, while strategically selling at peak market value unlocks substantial profits.

This requires a deep understanding of market dynamics, economic indicators, and local trends. It's about recognizing opportunities and acting decisively when the time is right.

Mindset Shifts for Long-Term Success

Building a substantial apartment building portfolio requires more than just financial strategies. It also involves cultivating the right mindset. This includes developing patience, discipline, and a long-term perspective.

Real estate investment is not a quick path to riches. It requires sustained effort, careful planning, and the ability to weather market changes. Embracing a long-term vision and focusing on sustainable growth are crucial for building generational wealth. It's a marathon, not a sprint. Having a clear vision, adapting to market shifts, and staying committed to your goals are fundamental to achieving lasting success. This involves learning from both wins and losses, continuously seeking knowledge, and building strong relationships with industry professionals.

By embracing these strategies and maintaining a long-term perspective, you can transform your apartment building investments into a powerful engine for substantial wealth creation and a lasting legacy.

Key Takeaways

Investing in apartment buildings can be a lucrative opportunity, but achieving success requires a strategic approach. Whether you're a beginner or a seasoned investor, this section presents key takeaways from industry experts and proven strategies to guide your investment journey. We'll provide you with actionable checklists and practical advice to confidently navigate the market, analyze potential deals, assemble a strong team, and ultimately achieve your investment goals.

Market Research: Your Foundation for Success

Thorough market research is essential for successful apartment building investing. Understanding market dynamics, identifying emerging trends, and recognizing potential risks are crucial for making informed decisions.

- Focus on Fundamentals: Analyze key economic indicators such as job growth, population growth, and income levels.

- Supply and Demand: Evaluate the balance between housing supply and demand, considering new construction, vacancy rates, and absorption rates.

- Rental Trends: Stay updated on rent growth, affordability, and tenant demographics.

- Regulatory Environment: Understand local zoning laws, building codes, and rent control policies.

By diligently researching these factors, you can identify promising markets and avoid potential downsides. A solid understanding of market fundamentals empowers you to make strategic investment choices.

Deal Analysis: Separating Winners From Losers

Effective deal analysis distinguishes profitable investments from potential losses. A disciplined approach to evaluating financial metrics and conducting due diligence is critical.

- Key Metrics: Become proficient with essential financial metrics, including net operating income (NOI), cap rate, cash-on-cash return, and debt service coverage ratio (DSCR).

- Due Diligence: Conduct thorough due diligence, going beyond the provided financials to inspect the property, assess its condition, and review tenant history.

- Conservative Underwriting: Use realistic assumptions about income and expenses, factoring in potential vacancies and repair costs to prevent overpaying.

- Upside Potential: Identify opportunities for value-add improvements that can increase rents and property value.

By applying these principles, you can confidently assess investment opportunities and make sound decisions based on solid data analysis. Thorough deal analysis significantly reduces risk and improves the probability of success.

Building Your A-Team: The Power of Collaboration

Building a reliable team is crucial for effectively managing your apartment building and maximizing returns. Surround yourself with skilled professionals who can contribute to your overall success.

- Property Management: Partner with experienced property managers familiar with local market conditions and capable of handling day-to-day operations efficiently.

- Maintenance Professionals: Establish connections with dependable maintenance professionals to address repairs promptly and prevent costly problems.

- Contractors: Build a network of trusted contractors for renovations and upgrades, ensuring quality work at competitive prices.

- Financing Partners: Develop relationships with commercial lenders and explore financing options to secure favorable terms.

A skilled team ensures smooth operations, enhances tenant satisfaction, and allows you to focus on strategic decision-making and portfolio growth. Collaboration is essential for long-term success.

Financial Strategies for Growth: Leveraging Your Assets

Strategic financial planning is vital for wealth creation through apartment building investments. Understanding leverage, refinancing, and tax optimization techniques can significantly affect your returns.

- Leverage: Use leverage wisely to magnify potential returns, but avoid over-leveraging which can create financial strain.

- Refinancing: Utilize accumulated equity through refinancing to fund future acquisitions or finance property improvements.

- Tax Optimization: Maximize tax benefits such as depreciation and explore strategies like 1031 exchanges to minimize tax liabilities.

By strategically leveraging your assets and understanding tax implications, you can accelerate portfolio growth and build lasting wealth.

Long-Term Vision: Building Generational Wealth

Building a substantial apartment building portfolio is a long-term endeavor requiring patience, discipline, and a strategic mindset.

- Reinvesting Cash Flow: Reinvest profits into property improvements or down payments on additional buildings to expedite portfolio growth.

- Strategic Acquisitions: Develop clear investment criteria and target acquisitions that align with your long-term objectives.

- Risk Management: Diversify your portfolio across various markets and property types to mitigate risk.

- Market Cycles: Understand market cycles and time your investments strategically to maximize returns.

By maintaining a long-term vision and adapting to market dynamics, you can build a sustainable investment strategy that creates generational wealth.

For a comprehensive solution to streamline real estate syndication and manage your expanding portfolio, consider Homebase. This platform simplifies fundraising, investor relations, and deal management, empowering you to focus on scaling your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.