How to Verify Accredited Investors: Expert Guide

How to Verify Accredited Investors: Expert Guide

Discover how to verify accredited investors using proven strategies and expert tips. Ensure compliance and safeguard investments effectively.

Domingo Valadez

May 9, 2025

Blog

Demystifying Accredited Investor Requirements

Understanding accredited investors is key for anyone involved in real estate syndication. These investors are individuals or entities considered financially savvy enough to participate in unregistered securities offerings, which often carry higher risk. The Securities and Exchange Commission (SEC) sets the regulations that determine this designation.

Financial Thresholds for Individual Investors

The SEC has established specific financial criteria for individual investors. One way to qualify is through income: an individual must have earned an annual income exceeding $200,000, or $300,000 jointly with a spouse, for the two most recent years. Alternatively, an individual can qualify based on net worth. This requires a net worth exceeding $1 million, excluding the value of their primary residence.

Requirements for Entities

Accredited investor status also applies to various entities. Generally, an entity qualifies if it has total assets exceeding $5 million. There's another way for entities to qualify: if all owners are already accredited investors. This includes a wide range of organizational structures, such as trusts, corporations, and partnerships.

Verification of Accredited Investor Status

Verifying accredited investor status is critical for anyone issuing securities. This ensures compliance with SEC regulations, particularly Rule 506(c), which mandates that issuers take "reasonable steps" to confirm investors meet the criteria.

This process can involve reviewing financial documents like tax returns and statements, or obtaining third-party verification from professionals such as CPAs or attorneys. Common verification methods include confirming an income over $200,000 (or $300,000 for joint filers) or a net worth over $1 million (excluding the primary residence). As of 2021, the SEC has emphasized flexibility in verification methods, allowing issuers to tailor their approach to the specifics of each offering. For more in-depth information, check out this guide to the accredited investor verification process: A Guide to the Accredited Investor Verification Process.

Expanding the Definition: Knowledge and Expertise

The criteria for accredited investor status have recently expanded beyond purely financial measures. Now, certain professional certifications, designations, and specialized knowledge can also qualify individuals. This recognizes that financial sophistication isn't solely measured by income or net worth, but also by expertise and experience.

This broader definition is a significant step towards a more diverse and inclusive investor pool, opening up opportunities for individuals who might not have met the traditional financial thresholds. A thorough understanding of these requirements is vital for both individuals seeking private investment opportunities and issuers raising capital.

SEC-Approved Verification Methods That Actually Work

Now that we understand who qualifies as an accredited investor, let's explore how to verify this status. This isn't simply a procedural step; it's a legal requirement. Correct verification protects both you, as the syndicator, and your investors. It ensures compliance with SEC regulations, specifically Rule 506(c), allowing you to proceed confidently with your real estate syndication.

Income Verification

One common verification method is income verification. This confirms an individual investor's annual income has exceeded $200,000, or $300,000 jointly with a spouse, for the past two years. Reviewing tax returns (W-2s, Form 1099, K-1s) or other official income documents typically accomplishes this. Be sure to keep copies of these documents for your records.

Net Worth Verification

Investors can also qualify based on net worth, which must exceed $1 million, excluding their primary residence. Verification involves reviewing bank statements, brokerage account statements, and other financial documents. Remember, accurate calculations are crucial, as the primary residence is excluded.

Third-Party Verification

Many syndicators choose third-party verification for added assurance and a more streamlined process. This involves hiring a Certified Public Accountant (CPA) or an attorney to review the investor's financial documents and offer an independent verification opinion. This adds credibility and minimizes potential compliance problems.

Reviewing Written Representations (For Returning Investors)

The SEC introduced new verification methods in November 2020 under Rule 506(c)(2)(ii)(E). These changes allow issuers to rely on written representations from previously verified investors, provided there's no conflicting information. This simplifies the process for returning investors, reducing friction while maintaining regulatory compliance. Learn more about these updates: New Verification Method To Determine Accredited Status. Before this update, relying solely on prior verifications wasn't allowed, highlighting the importance of staying current with SEC regulations.

Using Technology for Verification

Platforms like Homebase offer tools to streamline verification. These tools automate document collection, securely store investor information, and may integrate with third-party verification services. This reduces administrative work and creates a more professional experience for investors, allowing you to focus on building relationships and closing deals.

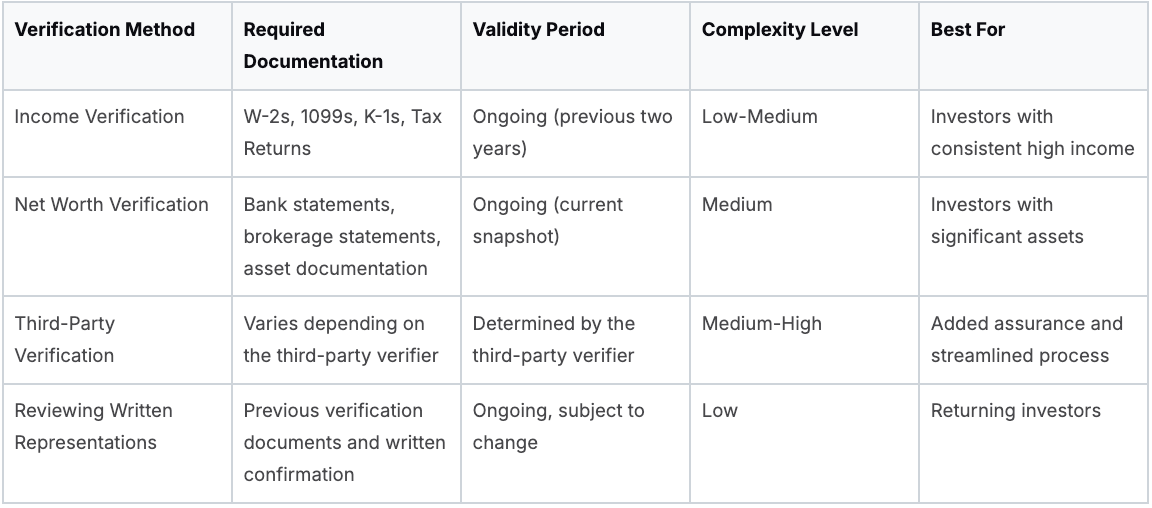

To summarize the different verification methods, let's look at the following comparison:

The following table compares the various SEC-approved verification methods, their documentation requirements, validity periods, and relative complexity for issuers and investors.

This table provides a quick overview of the different verification methods available. Choosing the right method will depend on your specific needs and the investor's situation. Consulting with a legal professional is always recommended for complex situations.

Understanding Your Investor Pool: Demographics Matter

Knowing how to verify accredited investors is essential. However, understanding who these investors are is equally crucial. This goes beyond simply meeting the criteria. It requires understanding the demographics and behaviors of this distinct group. This knowledge helps tailor your verification process and investor relations strategy for maximum effectiveness.

Who Are Accredited Investors? A Look at Demographics

Accredited investors often share common traits. Many are high-net-worth individuals with significant investment experience. They are often business owners, executives, or professionals in fields like finance, law, or medicine. But it’s important to remember the accredited investor pool isn't a monolith. Diversity exists within this group. Factors like age, location, and investment preferences play a significant role.

For instance, while many accredited investors are older, nearing retirement, a growing number of younger entrepreneurs and tech professionals are also qualifying. Accredited investors may also be concentrated in specific geographic areas with robust economies and active business communities. Grasping these demographic nuances enables a more focused and successful approach to investor verification.

The Importance of Investor Behavior in Verification

Investor behavior also impacts your verification process. Some investors are highly organized, readily providing necessary documents. Others may need more guidance or be less responsive. Some may prioritize privacy, preferring methods that minimize the disclosure of personal financial data.

Therefore, a flexible verification process is key. Offering multiple verification options, such as income verification, net worth verification, and third-party verification, improves the investor experience. Platforms like Homebase provide tools and resources to streamline this process, simplifying verification for everyone involved.

The Size and Scope of the Accredited Investor Pool

The U.S. has a substantial number of accredited investors, though precise figures are elusive. The qualifications—a net worth over $1 million (excluding the primary residence) or an annual income exceeding $200,000—limit the pool to a select portion of the population. As of 2020, about 13% of U.S. households had a net worth above $1 million, highlighting this group's exclusivity.

This emphasizes the importance of accurate verification. Ensuring only qualified individuals participate in these higher-risk investments is paramount. Learn more about Accredited Investor Verification. This meticulous process protects both investors and issuers from potential legal and financial issues.

Understanding these demographic and behavioral trends is essential for strong investor relationships. By recognizing the nuances within the accredited investor pool, you can develop a more targeted and efficient verification approach. This ultimately leads to a smoother and more successful investment experience.

Overcoming Verification Hurdles: Solutions That Work

Verifying accredited investors presents unique challenges that can impact the overall efficiency and effectiveness of the process. Finding the right solutions, however, can make a significant difference in ensuring a smooth experience for both issuers and investors.

Addressing Investor Privacy Concerns

A primary concern for many investors is the privacy of their sensitive financial information. Hesitation to share such data is entirely understandable, and addressing these concerns proactively is essential.

Transparency is key. Clearly communicating how data is used and stored, and emphasizing secure handling practices in compliance with privacy regulations can build trust. Offering alternative verification methods, such as third-party verification through a trusted CPA firm, empowers investors with greater control over their information.

Handling Documentation Inconsistencies

Investors often have complex financial situations, leading to potential inconsistencies in the documentation they provide. Income from various sources or assets held across different jurisdictions can complicate the collection of complete and consistent records.

Flexibility and open communication are vital in these situations. Working patiently with investors to gather the necessary documents fosters a positive relationship. Providing clear, upfront guidelines on required documentation can simplify the process from the outset.

Navigating International Verification Complexities

International verification introduces additional challenges. Varying financial reporting standards across different countries can create confusion and delays.

For international investors, using a specialized third-party verification service familiar with international regulations is highly recommended. This approach ensures compliance and streamlines the process, minimizing potential roadblocks.

Managing Verification Timing and Documentation Gaps

Timing is another crucial factor in the verification process. While prompt verification is essential to avoid investment delays, rushing the process can lead to errors. A balanced approach requires a structured workflow that prioritizes both speed and accuracy.

Technology solutions like Homebase can automate parts of the verification process, reducing manual work and improving efficiency. Proactively addressing documentation gaps by requesting missing information early also helps prevent delays.

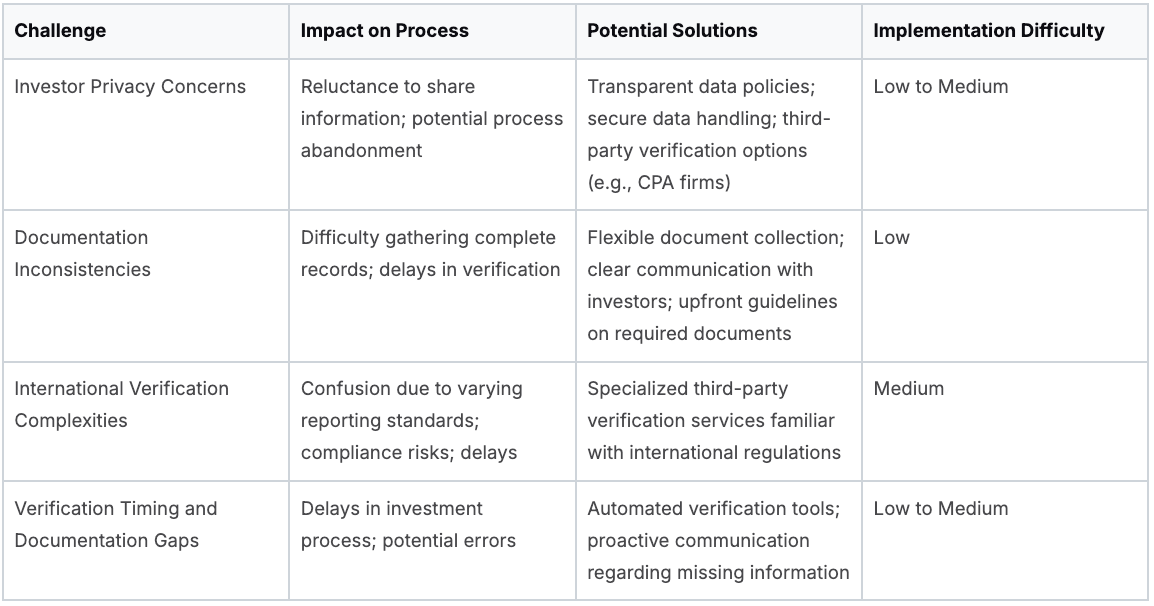

To further clarify common verification challenges and their solutions, let's examine the following table:

Accredited Investor Verification Challenges & Solutions

This table summarizes the key challenges and provides actionable solutions that issuers can implement to improve the verification process.

Real-World Solutions for Smooth Verification

Leading issuers employ several best practices to streamline verification. Establishing clear communication channels with investors, providing regular updates and promptly answering questions, are essential. Leveraging technology to automate document collection and securely store data enhances efficiency and security.

Many issuers also utilize third-party verification services, particularly for complex or international situations. This offers independent verification and reduces the workload on internal teams. By proactively addressing potential challenges and implementing practical solutions, issuers create a smooth and efficient verification process that respects investor sensitivities while maintaining compliance. This results in a positive investor experience and sets the stage for a successful offering.

Third-Party Verification: When to Outsource Compliance

Handling accredited investor verification in-house might seem straightforward, but it's not always the most efficient or cost-effective solution. This section explores the advantages and considerations of outsourcing this critical compliance process to third-party verification providers.

The Rise of Verification Partners

A growing network of verification partners is transforming how issuers manage compliance. These partners range from technology platforms like VerifyInvestor that automate the verification process to specialized legal firms offering detailed verification opinions. This provides issuers with greater choice and flexibility.

Some platforms offer integrated solutions that manage the entire investor onboarding process, including KYC/AML checks. Others focus solely on accredited investor verification. This specialization allows issuers to select the service that best suits their needs.

Cost-Benefit Analysis: In-House vs. Outsourcing

Deciding whether to outsource verification requires a thorough cost-benefit analysis. In-house verification might appear cheaper initially, but it carries hidden costs.

These include:

- Staff time spent reviewing documents

- Potential compliance risks from errors

- The expense of maintaining secure data storage

Third-party providers often offer economies of scale, potentially lowering overall costs. They also provide specialized expertise, minimizing compliance risks and allowing your team to focus on other essential tasks.

Different Service Models: Finding the Right Fit

Third-party verification providers offer various service models. Some offer automated platforms where investors upload their financial documents for automated review, significantly speeding up the process. Others provide a more hands-on approach, with legal professionals carefully reviewing each investor’s documentation.

Choosing the right service model depends on several factors:

- Your offering size

- Investor demographics

- Risk tolerance

For example, a larger offering with complex investor profiles might benefit from a hands-on approach. A smaller offering with straightforward investor qualifications might be better suited to an automated platform. You might be interested in: How to master modern compliance management solutions.

Selecting a Verification Partner: Key Criteria

Choosing the right verification partner requires careful evaluation. Consider these key factors:

- Proven Experience: Look for providers with a demonstrated history of verifying accredited investors and a strong compliance record.

- Data Security: Ensure the provider implements robust data protection measures, including encryption and secure storage protocols.

- System Integration: Seamless integration with your existing systems simplifies data transfer and reduces manual work.

- Ongoing Compliance Monitoring: Choose a partner that provides regular updates and support to ensure your verification process stays current with regulations.

Building Your Verification Documentation System

A successful accredited investor verification process relies heavily on a well-organized documentation system. This system not only protects you during regulatory reviews but also provides a clear audit trail. Let's explore a practical framework for establishing robust record-keeping practices.

Essential Verification Records

Maintaining comprehensive records is paramount. These records demonstrate your "reasonable steps" in verifying accredited investor status, a requirement mandated by the SEC. For each investor, keep detailed records of the following:

- Verification Method Used: Clearly document whether income verification, net worth verification, or third-party verification was used.

- Supporting Documentation: Retain copies of all reviewed documents, such as tax returns, bank statements, or third-party verification letters.

- Date of Verification: Precisely record the date the verification process was completed.

- Investor Confirmation: Keep a signed acknowledgment from the investor confirming their accredited status.

Retention Periods and Secure Storage

Establish clear retention policies for these critical records. While specific regulations may vary, a best practice is to retain verification documents for a minimum of five years after the offering closes. This timeframe generally covers typical statutes of limitations for securities-related matters.

Securely store these sensitive documents. Consider options like encrypted digital storage solutions or physical storage in locked cabinets with restricted access. A robust system balances easy access for authorized personnel with strong safeguards against unauthorized disclosure.

Practical Templates and Audit Trails

Using standardized templates streamlines documentation and ensures consistency. Develop templates for the following:

- Verification Logs: These logs should summarize key information for each investor, such as the verification date, method used, and references to supporting documents.

- Audit Trails: These trails should meticulously document each step of the verification process. This includes details on who reviewed the documents, when the review occurred, and any discrepancies identified.

These tools facilitate efficient information retrieval during regulatory reviews and strengthen your overall compliance posture.

Handling Verification Updates and Renewals

Investor financial situations can change over time. Implement a system for handling verification updates, especially for returning investors. For example, consider a two-year renewal cycle where investors reconfirm their accredited status by providing updated financial documentation. This practice ensures ongoing compliance and prevents issues stemming from outdated information.

Balancing Documentation with Data Privacy

Thorough documentation is crucial, but it's equally important to respect investor privacy. Implement essential data protection measures such as:

- Secure Storage: Utilize encryption and access controls to protect sensitive investor data.

- Limited Access: Restrict access to verification documents to authorized personnel only.

- Privacy Policies: Clearly communicate your data privacy policies to investors, outlining how their information is collected, used, and protected.

By balancing these considerations, you can build a verification documentation system that safeguards both your compliance requirements and your investors' trust. Learn more at Homebase.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.