How to Find Private Investors for Real Estate

How to Find Private Investors for Real Estate

Discover how to find private investors for real estate with proven strategies for preparing, networking, and pitching your deals to secure funding.

Domingo Valadez

Oct 5, 2025

Blog

Before you even think about reaching out to anyone, you need to get your house in order. Finding private investors for real estate isn't just about having a good deal; it's about building an undeniable foundation of credibility. Think of it this way: when an investor looks at your opportunity, they should see a polished, professional package, not a rough idea scribbled on a napkin.

This upfront work is what separates the pros from the amateurs. It shows you’ve done your homework and, more importantly, that you respect their capital.

Building Your Foundation to Attract Capital

Long before you draft an outreach email or walk into a networking event, the real work begins. Experienced investors don't throw money at vague concepts; they invest in well-researched, professionally presented opportunities from operators they can trust.

Your first job is to build a case so compelling that it answers an investor’s questions before they even think to ask them. This prep work signals that you're a serious operator who has done the rigorous due diligence required to be a good steward of their investment. It's all about building confidence from the very first impression.

Crafting an Irresistible Deal Package

Think of your deal package as your business card, resume, and pitch deck all rolled into one. It needs to tell a powerful story that's deeply rooted in hard data. This is no place for generic templates. A truly effective package is tailored to the specific deal and anticipates every bit of investor scrutiny.

Here’s what every solid deal package should include:

- Executive Summary: A crisp, one-page snapshot that gets straight to the point. It needs to hook the reader by summarizing the opportunity, the market, the projected returns, and why your team is the right one for the job.

- Financial Projections: This is the heart of the package. Include a detailed pro forma with crystal-clear assumptions, a full cash flow analysis, and a sensitivity analysis showing best-case, worst-case, and most-likely scenarios.

- Market Analysis: Don't just pull basic demographics. You need to dig deeper. Provide solid data on comparable sales, local rental trends, economic drivers in the area, and any planned infrastructure projects that could boost property values.

- Exit Strategy: Be crystal clear about how and when your investors will get their money back, plus a profit. Outline your primary and secondary exit plans, whether that's a refinance after stabilization or a sale in 5-7 years.

A deal package that looks like it took you 20 minutes to throw together will get about 20 seconds of an investor's time. One that shows deep analysis and meticulous preparation commands respect and invites a serious conversation.

Defining Your Ideal Investor Avatar

Here's a truth many people miss: not all money is good money. Trying to appeal to every type of investor is a surefire way to appeal to no one. You need to get laser-focused by creating an "investor avatar"—a detailed profile of the exact person you want to partner with. This clarity will guide everything from your networking strategy to your pitch.

Ask yourself these kinds of questions to build your avatar:

- What are their investment goals? Are they a retiree looking for passive monthly cash flow, or a younger professional hunting for a big capital appreciation win?

- What's their risk tolerance? Does this person prefer the stability of a Class A apartment building, or are they excited by the higher risk and potential reward of a ground-up development project?

- How involved do they want to be? Are you looking for a completely silent partner, or someone who wants regular updates and a bit of input?

For example, your avatar might be "Dr. Sarah," a 55-year-old surgeon with a high income but zero free time. She’s looking to put $100,000 to work in a passive real estate deal that generates reliable quarterly checks for her retirement fund. Knowing this, you can tailor your pitch to highlight stability, predictable returns, and hands-off management—exactly what she needs to hear when she's trying to find private investors for real estate.

Tapping Your Inner Circle for Initial Funding

Before you ever draft a cold email or attend a massive industry conference, your search for private real estate investors should start right in your own backyard. Seriously. The very first people who are likely to back your deals are the ones who already know and trust you: your friends, family, and professional colleagues.

This "warm network" is probably your single most powerful asset when you're just getting started.

The trick is to handle these relationships with a ton of professionalism and respect. You want to avoid making things awkward or straining personal ties. This isn’t about hitting up your aunt for a loan at Thanksgiving; it's about presenting a legitimate, well-vetted investment opportunity to people who already believe in your character and drive. The goal here is to gauge their interest, never to pressure them.

Starting the Conversation Naturally

The absolute worst thing you can do is spring a formal, out-of-the-blue pitch on someone you know. It’s just weird. Instead, learn to weave your real estate ventures into your everyday conversations. This lets you introduce what you’re doing in a much more organic way, giving people a comfortable opening to ask questions if they’re curious.

Think about these kinds of soft openings:

- When a friend asks what you've been up to: "It's been a busy month! The day job is going well, and I've been spending my nights digging into the numbers on a new multifamily property I'm trying to acquire. The potential on this one looks really solid."

- During a casual lunch with a former colleague: "It's wild how much the city is changing, right? I've been focusing my real estate efforts on the North End, and the rental demand there is just incredible. We're projecting great cash flow from a duplex I'm about to put under contract."

See the difference? Neither of those is a direct ask. They're conversation starters that frame you as a serious operator. They naturally open the door for questions like, "Oh, really? How does a deal like that actually work?" or "Do you ever bring on partners for those things?" That's your cue.

Expanding Beyond Friends and Family

Your warm network is bigger than you think. It's not just your personal friends and family; it includes all the professionals who already see you as a competent client. People like your accountant, your lawyer, or even your financial planner can be fantastic sources of capital. And if they can't invest themselves, they often have a whole network of high-net-worth clients they can refer you to.

When you approach a professional for their advice, you're also subtly pitching them on your own expertise. If your accountant is impressed by how you've structured the financials for a deal, they are far more likely to consider investing themselves or referring you to another client who's looking for that exact kind of opportunity.

The next time you meet with your CPA, don't just stick to taxes. Bring a clean, one-page summary of a deal you’re looking at. You could frame it as, "Hey, I'm analyzing this investment property and wanted to get your thoughts on the most tax-efficient way to structure the entity."

This simple move accomplishes three things at once: it shows them you're proactive, it gives them a peek at the quality of your deal flow, and it instantly positions them as a potential partner in your success. By building on these existing foundations of trust, you create the momentum you need to attract outside capital down the road.

Strategic Networking to Meet Active Investors

Your personal network is a great starting point, but if you're serious about scaling your portfolio, you need to go where the money is. Finding private investors for real estate is a contact sport. You have to intentionally put yourself in the rooms where high-net-worth individuals, experienced operators, and other key professionals gather.

This isn't about collecting a fat stack of business cards that will just gather dust on your desk. It’s a targeted mission to build real relationships with people who get it—people who understand the real value of real estate. The goal is to shift from being another face in the crowd to becoming the go-to expert who consistently brings solid deals to the table.

Identifying High-Impact Events and Groups

Forget the generic Chamber of Commerce mixers. Your time is your most valuable asset, so you have to be surgical about where you spend it. Zero in on events that attract your ideal investor avatar and are directly tied to real estate or wealth management.

Your priority list should look something like this:

- Local Real Estate Investor Association (REIA) Meetings: This is ground zero. You'll meet everyone from hard money lenders for fix-and-flips to potential partners for your next syndication, all in your own backyard.

- Niche Industry Seminars: Think deeper than just "real estate." If you're focused on self-storage, you need to be at a self-storage conference. If affordable housing is your game, go to events for that specific niche.

- Family Office or Wealth Management Conferences: These aren't cheap, but the concentration of capital in one room is often unmatched. These events are literally designed for high-net-worth individuals and the people who advise them.

- Charity Galas and Fundraisers: Successful people are often heavily involved in philanthropy. Attending these events lets you connect on a more personal level over shared values, which is a powerful way to start any business relationship.

Here's a pro tip: The person you're looking for isn't just "an investor." They're a business owner, a doctor, or an executive who also happens to invest in real estate. Find them in their natural habitats, not just at real estate events.

Moving from Handshake to Meaningful Conversation

Walking into a room full of strangers can be daunting, but the right mindset changes everything. Drop the sales pitch. Seriously. Your only goal at first should be to learn about other people and what they're passionate about. Genuine curiosity is your best tool.

Instead of blurting out, "I'm looking for investors," try a more natural approach. When they ask what you do, you could say something like, "I specialize in acquiring undervalued multifamily properties in the downtown core and creating value for our partners." It’s confident, it's specific, and it naturally makes them want to ask a follow-up question.

A great question to ask them is, "What kind of projects are you most excited about right now?" This puts the spotlight on them and gives you critical intel on their investment appetite. The key here is to listen more than you talk. Your mission in that first meeting is just to make a connection and see if there's enough common ground for a future conversation.

The Art of the Follow-Up

The real work starts after you leave the event. A business card is just a piece of paper until you do something with it. Your follow-up needs to be prompt, personal, and genuinely helpful.

Here’s a simple system that actually works:

- The 24-Hour Connection: Within 24 hours, find them on LinkedIn and send a personalized connection request. Reference something specific from your conversation to jog their memory. Something like, "It was great chatting with you last night at the REIA meeting about the industrial development near the port. Your insights were fascinating."

- The Value-Add Email: A few days later, send a short email. Do not ask for money. Instead, offer something of value. Maybe you mentioned a market report, a great contractor you use, or an article about a trend you discussed. This move positions you as a helpful resource, not just another person with their hand out.

- The Long-Term Nurture: Add them to your CRM or even a simple spreadsheet. From there, you can periodically send them market insights, updates on deals you're working on, or case studies from successful projects. This keeps you top-of-mind, so when they are ready to deploy capital, you're the first person they think of. This methodical process turns a brief handshake into a potentially lucrative, long-term partnership.

Finding Real Estate Investors Using Digital Platforms

Gone are the days when finding private money meant shaking hands at the local country club or real estate meetup. Today, your digital presence is your most powerful fundraising tool. It’s how you connect with accredited investors actively searching for deals, often well beyond your own backyard.

The trick is to stop thinking of your online profiles as a digital business card and start treating them as a strategic asset. You're building an inbound lead generation machine, one that brings qualified investors to you.

Optimize Your LinkedIn Profile to Attract Capital

Think of your LinkedIn profile less as a resume and more as an investor-facing landing page. It needs to instantly tell a potential partner who you are, what you’ve accomplished, and exactly where your focus lies in the real estate world. A generic profile just listing your job history isn’t going to move the needle.

You have to meticulously craft your profile to catch the eye of high-net-worth individuals. This goes way beyond just having a professional headshot; it's about smart keyword placement and telling a compelling story.

- Rethink Your Headline: Instead of a simple "Real Estate Agent," try something more specific and benefit-driven, like "Multifamily Real Estate Investor | Helping Professionals Build Passive Income Through Syndicated Apartment Deals." This immediately tells them what you do and for whom.

- Craft a Compelling "About" Section: This is your space to tell your story. Why are you passionate about real estate? What's your core investment philosophy? More importantly, showcase your track record with hard numbers (e.g., "Successfully managed a portfolio of 32 units with an average cash-on-cash return of 9%").

- Share High-Value Content: Don't just be a consumer of content—be a creator. Regularly post market updates, insightful articles on real estate trends, and case studies of past deals (without explicitly asking for money). This positions you as an expert, not just someone looking for a check.

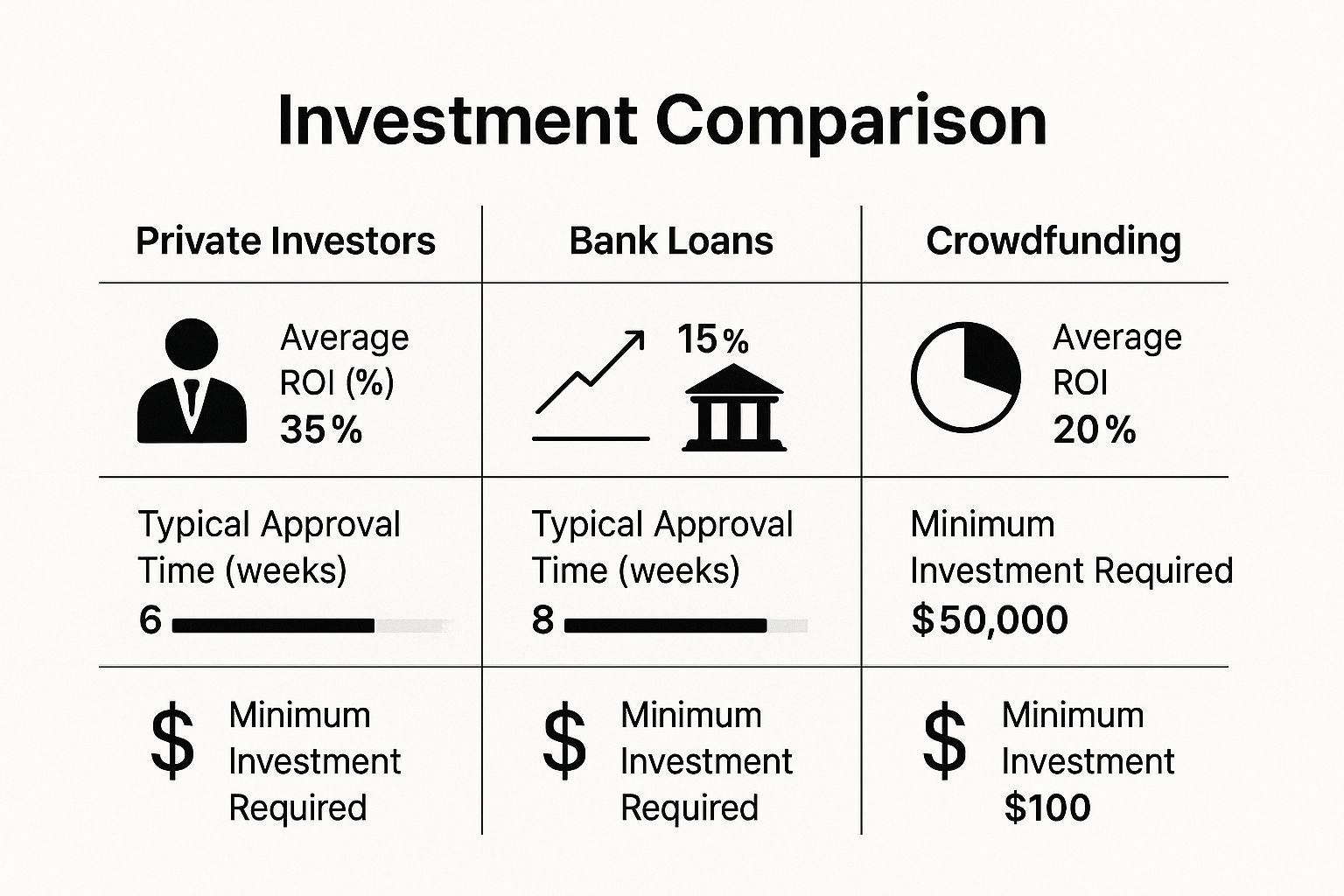

This infographic really breaks down the different funding routes, showing why so many experienced investors lean toward the flexibility and speed of private capital.

As you can see, while traditional bank loans provide a certain structure, private money and crowdfunding often win on flexibility and how quickly you can get to the closing table.

Digital Platforms for Finding Real Estate Investors

Choosing the right online platform is crucial. Each one attracts a different type of investor and requires a unique approach. Below is a breakdown to help you focus your efforts where they'll have the most impact.

Ultimately, a multi-platform strategy often works best. You build authority on forums while using LinkedIn to nurture specific, high-value relationships.

Engage in Niche Forums to Build Authority

Online communities like BiggerPockets or specialized subreddits are absolute goldmines for connecting with a highly motivated audience. The only rule? You have to give before you get. The entire game is about providing value long before you ever even hint that you have a deal.

Your mission is to become a trusted, go-to voice. When someone asks a complex question about underwriting a deal in your market, jump in with a detailed, genuinely helpful response. When you consistently offer up your expertise for free, you build a powerful reputation that makes investors want to seek you out.

Investor Magnet Tip: Whatever you do, never post a direct solicitation like, "I'm raising money for a new deal!" Not only is it often against the rules, but it makes you look like an amateur. Build your profile, contribute to the community, and let your expertise do the talking. The right people will find you.

Crafting Outreach That Gets a Response

Whether you're reaching out on LinkedIn or through a warm email, your first message has to be personalized and centered on providing value. Generic, copy-and-paste messages are a one-way ticket to the trash folder. Show them you’ve actually done your homework.

Here’s what a successful, non-salesy outreach message might look like:

"Hi [Investor Name], I saw your recent comment on BiggerPockets about the challenges of investing in industrial properties in the Southeast. I’ve been focused on that exact submarket for the past five years and recently closed a deal with similar hurdles. If you're open to it, I'd be happy to share how we navigated the zoning issues. No pitch, just sharing insights."

This approach immediately offers value and opens the door for a real conversation. For more in-depth tactics on identifying and engaging potential partners, check out these 13 powerful ways to generate real estate sales leads. When you shift your focus from "finding" investors to "attracting" them, you'll discover the best ones start coming to you.

Mastering Your Pitch and Securing Commitments

You can have the most incredible deal on paper, but if you fumble the pitch, it's all for nothing. After all the painstaking work of finding private investors for real estate, this final step is where you turn a prospect’s interest into a firm commitment. It’s your chance to bring the numbers to life with a compelling story and transform a spreadsheet into a shared vision.

The real key here is to go beyond just spitting out facts and figures. You have to read the room. You have to understand who you're talking to and shape your delivery to match what truly motivates them. A sharp, well-prepared presentation communicates professionalism and builds that last bit of trust you need to get a deal over the finish line.

Tailoring Your Message to the Investor

Let's be clear: not all investors are the same. If you launch into a deep-dive analysis of rental comps with a big-picture visionary, their eyes will glaze over. On the flip side, a high-level overview isn't going to cut it for an analytical, numbers-driven person. Learning to pivot your communication style is a superpower in this business.

Before you even think about opening your laptop, figure out who’s sitting across the table from you:

- The Analytical Investor: This person lives and breathes details. They want to poke holes in your assumptions, stress-test your pro forma, and understand every single line item. For them, you need to lead with the hard data, your detailed financial models, and a crystal-clear breakdown of your due diligence process.

- The Visionary Investor: They're buying into the story and the potential. Start with the "why." Talk about the transformation of the property, the growth story of the neighborhood, and the long-term market opportunity. Visuals are your best friend here—paint a picture of the future that gets them excited.

- The Relational Investor: This type of investor is often backing you more than the deal itself. They value trust, transparency, and the feeling of a true partnership. You should spend more time on your background, your team's track record, and how you plan to maintain clear and consistent communication.

The Anatomy of a Winning Pitch Deck

Think of your pitch deck as the visual anchor for your conversation. It needs to be clean, professional, and dead simple to follow. It’s a highlight reel, not an encyclopedia. Each slide should land one single, powerful point.

A persuasive deck that I've seen work time and again generally flows like this:

- The Opportunity: Start with a one-slide executive summary that grabs their attention right away.

- The Problem/Story: Why is this property a hidden gem? Is it undervalued? Is the area about to pop?

- The Solution: This is your business plan. Lay out exactly how you're going to create value.

- Market Analysis: Give them the key data points that prove the location is solid.

- Financial Projections: Show them the numbers—projected returns, cash flow, and your exit strategy.

- The Team: Who are you and your key partners? Showcase your bios and track records.

- The Ask: Be direct. Clearly state how much funding you need and what the proposed terms are.

A great pitch feels less like a formal presentation and more like a guided conversation. Use your deck to support what you’re saying, but always prioritize making eye contact and having a genuine back-and-forth. It shows you know your stuff cold.

The Art of the Strategic Follow-Up

The meeting’s over, but you're not done yet. A thoughtful, methodical follow-up process can keep the momentum going without making you seem desperate or pushy. Your goal is simple: stay top-of-mind and make it incredibly easy for them to say yes.

This process is more critical than ever right now. Heading into 2025, the financing world is shifting. A ton of commercial debt is maturing into a much higher-interest-rate environment. This has actually made alternative funding like private credit and preferred equity more appealing to investors, especially when they see a sponsor who can navigate complex deals that go beyond simple bank loans. You can get more expert takes on this trend and learn how to navigate the 2025 real estate market on ropesgray.com.

Your follow-up needs to show you get this. A simple three-step sequence works wonders:

- The Same-Day Thank You: Within a few hours of the meeting, shoot them a brief email. Thank them for their time and mention one specific, key point you discussed.

- The Information Packet: The next day, send everything you promised—the full deal package, the detailed pro forma, or any other documents they asked for.

- The Gentle Nudge: If you haven’t heard back in 4-5 business days, send a polite, no-pressure check-in. Something as simple as, "Just wanted to see if you had any initial questions on the materials I sent over," is perfect.

This approach respects their time while showing that you're diligent and genuinely excited about the opportunity, moving you one big step closer to getting that check signed.

Navigating the Legal Side of Private Money

Getting that "yes" from a private investor is a huge win, but it’s also the moment things get serious. Really serious. The second you take outside capital, you're not just a real estate operator anymore—you've stepped into the world of securities.

Ignoring this shift can land you in a world of legal and financial trouble. This isn't meant to scare you off. It's about giving you the know-how to raise capital the right way, protecting both your business and your investors' trust. A solid legal framework is what separates the pros from the amateurs; it shows you’re a credible operator who takes this responsibility seriously.

Understanding SEC Regulations in Plain English

When you raise money for a real estate deal, you're almost always offering what the law calls a "security." That puts you squarely under the watch of the U.S. Securities and Exchange Commission (SEC). You can’t just cash a check and promise a return without following their rules. For most real estate sponsors, this means using one of two common exemptions under Regulation D.

- Rule 506(b): This is the classic "friends and family" route. It's perfect for raising capital from people you already know. You can bring in an unlimited number of accredited investors and up to 35 non-accredited (but financially savvy) investors. The catch? You are strictly forbidden from any form of public advertising or general solicitation. No social media blasts, no public-facing webinars.

- Rule 506(c): This is your path to scaling up. Rule 506(c) lets you advertise your deal to the public—think online ads, social media campaigns, and email lists. The trade-off is that you can only accept money from verified accredited investors, and the burden is on you to take "reasonable steps" to confirm their status.

Picking the right exemption is one of your first big decisions. A 506(b) is often simpler if you have a strong personal network, whereas a 506(c) opens the door to a much wider pool of capital.

Your Non-Negotiable Legal Documents

To do any of this by the book, you need a set of ironclad legal documents. And no, you can't just pull these off the internet. They need to be drafted by a qualified securities attorney who gets the nuances of your specific deal.

The cornerstone document is the Private Placement Memorandum (PPM). Think of it as the bible for your deal—it discloses everything an investor needs to know, including all the potential risks. To dig deeper into this, check out our guide on crafting a professional Private Placement Memorandum.

Hiring a good securities attorney isn't an expense; it's an investment in the longevity and integrity of your business. It’s the single best way to ensure you're starting an investor relationship on a foundation of transparency and trust.

Why Professionalism in Compliance Matters

The market is heating up. In the first half of 2025, private real estate fundraising bounced back in a big way, with commitments hitting roughly US$110.54 billion. That's a 16 percent jump from the previous year. You can read more about this private real estate market surge at alterdomus.com.

More capital is flowing, but that also means investors are being more selective. They're looking for operators who know their stuff.

When you're talking to potential investors, showing you understand sophisticated financial strategies can instantly set you apart. For instance, being able to confidently discuss tax-deferral strategies by understanding 1031 exchanges signals that you’re thinking critically about maximizing their net returns. This level of financial fluency, backed by impeccable legal compliance, is what turns a one-time fundraiser into an operator who builds a loyal base of capital partners for years to come.

Common Questions About Finding Investors

If you're new to raising private capital, you've probably got questions. That's a good thing. Thinking through these common sticking points shows potential partners you've done your homework and considered the deal from all sides.

Let's start with a big one: bringing in family or friends as investors. It's tempting to keep things casual, but that's a mistake. You absolutely have to treat them like any other investor. That means getting an attorney to draft up all the proper legal documents—the PPM, the operating agreement, everything. It protects everyone and, just as importantly, protects your relationships.

How Much Equity Should You Offer?

Figuring out the right equity split is always a balancing act, and honestly, there's no magic number. Every deal is different.

For a straight debt deal, you'll often see a fixed interest rate somewhere in the 8-12% range. But when it comes to equity partnerships, things get more creative. A 50/50 split on profits after everyone gets their initial capital back is a pretty common starting point. Of course, that can easily shift depending on who brings what to the table—especially who has the experience and who's managing the asset day-to-day.

The goal is to find a true win-win. Run the numbers on a few different scenarios. You could offer a preferred return to your investors, for example. The key is to find that sweet spot where their capital is rewarded generously, and you’re fairly compensated for finding the opportunity and making it happen.

Ready to make your fundraising and investor management a whole lot easier? Homebase is an all-in-one platform built to handle your deals, documents, and distributions. It lets you focus on what really matters: closing deals and building great investor relationships. Learn more and get started today at Homebase.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.