How to Find Investors in Real Estate: Proven Strategies to Grow Your Portfolio

How to Find Investors in Real Estate: Proven Strategies to Grow Your Portfolio

Learn how to find investors in real estate with proven tips. Discover effective strategies to secure funding and maximize your investment success.

Domingo Valadez

Aug 27, 2025

Blog

Finding the right investors for your real estate deal really boils down to two things: having a deal presentation that’s absolutely rock-solid and getting out there to network like your business depends on it—because it does.

You have to do the heavy lifting before you ever start looking for capital. If you can’t clearly and confidently explain why your deal is a winner, you’ve lost before you’ve even started.

Laying the Groundwork to Attract Investors

Before you even think about attending a meetup or sending a single email, the most critical work is happening behind the scenes. Let’s be real—serious investors see hundreds of deals. They’re drawn to professionalism and deep preparation, not just a vague idea.

Your job is to build a foundation so solid that it preemptively answers every tough question an investor might throw at you. Without this prep work, the best networking in the world won’t save a sloppy presentation.

Define Your Ideal Investor Profile

Not all money is good money. The first thing you need to do is get laser-focused on the type of person you want to partner with.

Are you looking for a silent partner who just wants to write a check and see a return? Or do you need an active collaborator who brings their own industry experience to the table? A great starting point is learning how to create buyer personas that drive growth; this will sharpen your entire outreach strategy.

Think about what really matters:

- Experience Level: Are you targeting a seasoned real estate pro or a high-net-worth individual from a totally different field?

- Risk Tolerance: Is your deal a stable, cash-flowing asset for a conservative investor, or is it a value-add project that suits someone chasing bigger returns?

- Capital Amount: Do you need one whale to write a $1M check, or are you looking for ten partners to put in $100k each?

When you know exactly who you're looking for, your search stops being a random shot in the dark and becomes a targeted hunt. It's the difference between wasting time and closing deals.

Prepare Your Investment Package

Okay, so you know who you're looking for. Now you need the right tools to get their attention. A professional investment package isn't optional—it's the price of admission.

This should include a clean, concise deal summary (sometimes called a "teaser") that lays out the opportunity in one or two pages. But the centerpiece is a full-blown business plan that dives deep into your market analysis, financial projections (IRR, cash-on-cash return, etc.), and your team’s track record. Even a small history of successful projects can build massive credibility.

Building Your Network Through In-Person Connections

As great as digital tools are, some of the strongest and most profitable partnerships I’ve ever seen were started face-to-face. There’s a certain level of trust that only a handshake and a real conversation can build—something an email just can’t touch. If you're serious about finding real estate investors, you have to get out from behind your screen and into the rooms where the deals actually happen.

The goal isn't just to collect a stack of business cards. It's about starting real conversations that lay the groundwork for future collaboration. When you shift your mindset like this, networking stops feeling like a chore and becomes one of your best business-building tools.

Get the Most Out of REIAs and Local Meetups

For in-person networking, local Real Estate Investment Associations (REIAs) and smaller meetups are ground zero. These rooms are packed with people who are actively looking to put capital to work and find reliable partners. Just by showing up consistently, you start to build a reputation as a serious player in your local market.

When you walk in, make it your mission to connect with new people every single time. Don't just gravitate toward the familiar faces.

Here’s how to make those hours count:

- Show Up Early. The best, most relaxed conversations often happen before the main event even kicks off. It's the perfect time for a casual one-on-one.

- Ask Better Questions. Skip "What do you do?" Instead, try something like, "What kind of projects are you excited about right now?" This question alone can open up a far more interesting and productive discussion.

- Nail Your Elevator Pitch. You need a clear, compelling way to explain who you are and what you're looking for in under 30 seconds. Practice it until it feels natural.

The real win at a networking event isn't closing a deal on the spot. It's making a strong enough connection that your follow-up email or call is actually welcomed, not seen as spam.

Look for Investors Beyond the Usual Real Estate Circles

Here's a secret: some of the best potential investors never set foot in a real estate event. Think about high-net-worth professionals—doctors, lawyers, successful tech founders. They move in entirely different circles, and you need to meet them where they are.

Consider getting a ticket to events like:

- Charity galas and fundraisers

- Local Chamber of Commerce meetings

- Niche hobbyist groups (think country clubs, classic car shows, or wine-tasting events)

In these environments, you'll likely be one of the only real estate experts in the room, which instantly makes you a person of interest. The conversation won't be about a specific deal; it's about building a genuine relationship first. You're planting a flag, making sure you're the first person they think of when they decide it's time to invest in property. I've seen a casual chat at a charity auction turn into the origin story for a multi-million dollar partnership more than once.

Using Digital Platforms to Find Investors

While nothing beats a handshake for building rock-solid trust, you can't ignore the sheer scale and speed of the online world. Your next capital partner is almost certainly online right now. The trick is knowing where to find them and how to cut through the digital noise.

A smart online strategy isn’t about just having a presence; it's about turning that presence into a magnet for investment capital. Think of it this way: investors are constantly scanning for opportunities online. Your digital footprint is their first impression of you and your deals, long before you ever speak.

Optimize Your LinkedIn Profile for Investor Attraction

Your LinkedIn profile is so much more than a digital resume. It needs to be your professional billboard, screaming "real estate expert" to anyone who lands on it. Too many operators have a profile that just lists their old jobs. You need to treat it like a dedicated landing page designed specifically to attract and qualify potential investors.

Start with your headline. It should instantly communicate your value. Ditch something generic like "Real Estate Professional" and go for something specific and powerful, like "Multifamily Syndicator | Acquiring Value-Add Apartments in the Southeast." Right away, an investor knows your niche and your market.

Make the "Featured" section your portfolio highlight reel. This is prime real estate on your profile. Use it to showcase things like:

- A quick case study of a successful deal (with returns, if you can share them).

- A market analysis report you wrote for your target city or neighborhood.

- A direct link to your company website or investment portal.

When you do this, you’re positioning yourself as a credible, active operator before you even think about sending a connection request.

Engage Authentically in Niche Online Communities

Beyond just polishing your own profile, you need to go where the investors are. Specialized online communities are an absolute goldmine. I’m talking about places like the forums on BiggerPockets or dedicated real estate investment groups on LinkedIn.

But just joining is step zero. You have to participate and consistently add value. Jump into discussions, answer questions, share a key insight from your latest market research, or post a quick breakdown of a deal you analyzed—even if it's one you decided to pass on. This builds your reputation and establishes you as a voice of authority.

When you finally do reach out to someone directly, it's no longer a cold message. They've likely already seen your name and associate it with helpful expertise.

The goal online is to give before you ask. Share your knowledge freely and build a reputation as a go-to resource. Investors are far more likely to respond to someone who has already provided them with value.

It also pays to align your online activity with what’s hot in the market. Investor interest follows major economic trends. Right now, with the explosion of AI, investment in specialized sectors like data centers has skyrocketed, making it arguably the most promising real estate sector globally. If you’re active in these high-demand niches and share relevant content, you’ll naturally attract the right kind of attention. You can get a great overview of these trends from PwC's global outlook.

Using Market Data to Pinpoint Active Investors

Stop guessing where the money is and start following the data. The most effective way I've found to track down real estate investors is by figuring out who's already writing checks in my target market. This data-first approach completely changes the game, turning a cold, generic outreach into a warm, highly relevant conversation.

Instead of casting a wide, hopeful net, you’re pinpointing the exact people and companies deploying capital right now. This makes your search a surgical operation, focusing your time and energy on prospects who have already shown, through their actions, that they're interested in assets just like yours.

Tapping Into Public Records

Your first port of call should be public records. County tax assessor and recorder offices are gold mines of information, documenting every single property transaction. It might sound a bit old-school and tedious, but this is where you find the actual names of buyers—either individuals or, more often, the LLCs they operate under.

A little bit of online detective work on an LLC name can often lead you straight to the people in charge. This isn't just a name; it's a hot lead. You know they're active, you know what they buy, and you know exactly where they buy it.

This process is the foundation for building a hyper-targeted list. Once you've identified these potential investors, mastering the sales lead qualification process becomes essential to figure out which prospects are truly worth pursuing.

Leveraging Commercial Databases and Reports

If you want a more big-picture view, it's time to turn to commercial real estate databases and industry reports. Powerhouse firms like CoStar, Reonomy, JLL, and MSCI spend their time compiling huge amounts of transactional data, which gives you incredible insight into market trends and the major players. These platforms let you filter recent sales by property type, size, and location.

A powerful outreach message isn't just about your deal; it's about their recent activity. Referencing a specific property they recently purchased shows you've done your homework and immediately sets you apart from the crowd.

This kind of granular data helps you spot patterns. For instance, you might notice that a particular private equity fund has snapped up three B-class apartment buildings in your submarket over the last 12 months. That isn't just an interesting fact; it’s a blinking neon sign pointing directly to their investment thesis.

Tracking these transaction volumes also gives you a feel for broader investor sentiment. For example, while global real estate investment volumes saw a slight 2% dip year-over-year, the Americas region actually showed surprising strength, with investment in retail and hotels on the rise. Knowing these macro trends helps you frame your deal within a larger, positive market story.

This whole process shows how online research and offline digging work together to build a solid pipeline of potential investors.

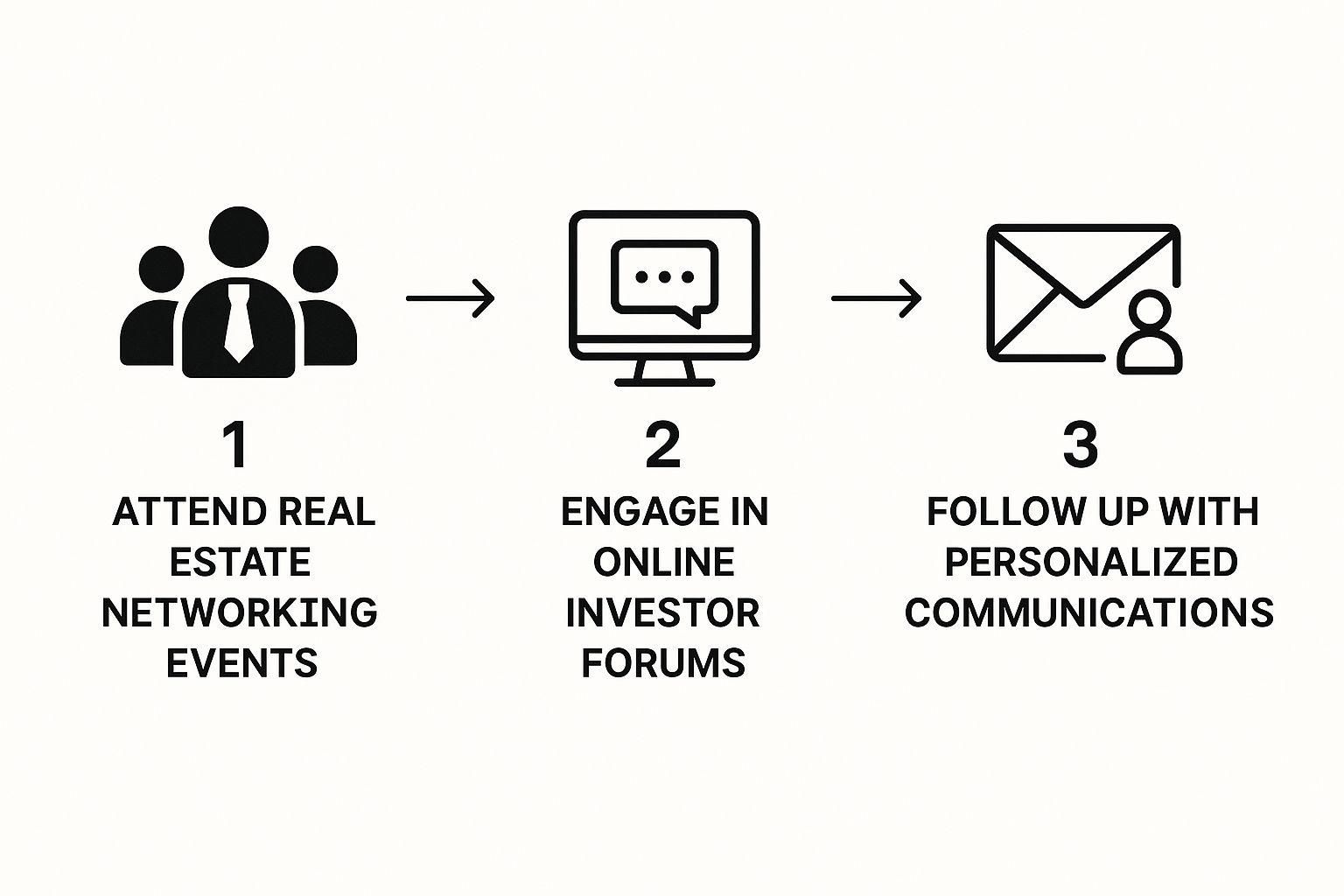

The key takeaway here is that finding investors isn't a one-and-done task. It's a multi-channel effort that blends traditional networking with smart digital engagement, all culminating in a personalized follow-up that gets noticed.

Crafting a Pitch That Secures Capital

Getting an investor to take your call is a big win, but it's just the first step. The real work begins now: convincing them your deal is where they should put their money. This is where a powerful, well-crafted pitch makes all the difference. It’s how you turn a promising conversation into a funded deal.

Your proposal has to do more than just list the facts and figures. It needs to tell a compelling story. This is your chance to showcase your expertise, prove the deal is solid, and build the kind of trust that gets checks written.

The Anatomy of a Winning Pitch Deck

Think of your pitch deck as the visual guide to your investment story. It needs to be clean, professional, and straight to the point. The goal isn’t to overwhelm with data, but to create clarity and make an impact.

Every solid pitch deck I’ve seen has these key elements:

- Executive Summary: This is your elevator pitch. In just a slide or two, you need to grab their attention by outlining the opportunity, the key numbers, and exactly why it’s a smart investment.

- The Property & Market Story: Don't just list the address and square footage. Paint a picture. Why this property? Why this market, and why now? Use great photos and sharp market data to make your case.

- The Business Plan: This is your "how." How are you going to make money? Whether it's through renovations, raising rents, or bringing in better management, spell out your value-add strategy clearly.

- Financial Projections: Here's where you let the numbers do the talking. You need to highlight the metrics that matter most to investors: the projected Internal Rate of Return (IRR), cash-on-cash return, and equity multiple.

- Your Team: Who is behind this deal? Briefly introduce the key players and highlight the specific experience that proves you can actually pull this off.

As you get closer to securing capital, it's essential to get comfortable with the paperwork. The whole process often starts with understanding the term sheet definition.

Telling a Story with Your Data

Numbers on their own are just… numbers. They can be boring and forgettable. Your job is to weave them into a narrative that resonates. For example, don't just state a projected 2.2x equity multiple. Instead, explain that "for every dollar you invest, we project you'll get back $2.20 over the life of the project." That's a story they'll remember.

A common mistake is treating the pitch like a data dump. Instead, think of yourself as a guide. You are leading the investor on a journey from their initial capital to their final return, explaining every step with confidence and clarity.

You can also use broader market trends to build confidence. For example, direct real estate transaction volumes hit US$179 billion globally in just the second quarter of a recent year—a 14% jump from the previous quarter. Tying your specific deal into this kind of positive momentum shows you have your finger on the pulse of the market.

Presenting and Handling Objections

How you deliver your pitch is just as important as the slides themselves. You need to present with confidence and be ready to defend every single assumption you've made. Expect tough questions. In fact, you should hope for them—it means the investor is engaged and taking your deal seriously.

Think ahead about the potential holes they might poke in your plan and have your answers ready. If they think your renovation budget looks a little rich, be ready to show them the contractor bids you've already sourced. If your rent growth projections seem optimistic, have the local market comps on hand to prove they’re realistic. This is a critical part of learning https://www.homebasecre.com/posts/how-to-find-private-investors who will trust you for the long run.

Common Questions About Finding Investors

Even with the best-laid plans, you're going to have questions when you start raising capital. It's completely normal. Getting straight answers to these tricky questions can be the difference between getting stuck and moving forward with confidence.

Let's tackle some of the most common hurdles you'll face on the road to finding real estate investors.

How Much Equity Should I Offer an Investor?

This is the big one, isn't it? The honest answer is always: it depends. There’s no magic number or universal formula. The equity you offer is a negotiation, a balancing act between the value you bring—finding the deal, executing the business plan—and the capital your investor provides.

A common starting point, especially in syndications, is a 70/30 split. In this setup, the investors (the limited partners) get 70% of the profits, and you (the general partner) get 30%. But this is just a baseline and can swing wildly depending on the situation.

- The Deal Itself: Is this a can't-miss deal in a prime location? A truly exceptional opportunity gives you leverage to keep a larger piece of the pie.

- Your Experience: If you're a seasoned operator with a fantastic track record of delivering returns, you can command a better split. Your history de-risks the deal for investors.

- Investor's Role: Is the investor just writing a check, or are they bringing something else to the table, like construction expertise or local connections? A more active partner will naturally expect a larger share.

What Is the Difference Between Debt and Equity Partners?

Getting this right is absolutely crucial. You're dealing with two completely different types of capital.

A debt partner is simply a lender. Think of them like a private bank. They give you a loan for your project, and you pay them back with a fixed interest rate. They don't have any ownership in the property, and their potential profit is capped.

An equity partner, on the other hand, becomes a co-owner with you. They’re buying a piece of the deal. They put up capital in exchange for a percentage of ownership and a share of all future profits (and, importantly, losses). Their risk is much higher, but so is their potential reward.

The Bottom Line: Debt is a loan with a fixed return for the lender. Equity is selling a piece of your deal, sharing both the risks and the rewards with your partner.

How Can I Find Investors with No Track Record?

This is the classic chicken-and-egg problem. Investors want to see a history of success, but how do you build that history without an investor for your first deal? The key is to shift their focus away from your past performance and onto your present credibility.

You have to build trust in other ways.

- Bring an A+ Deal: Your market research, underwriting, and business plan have to be airtight. If the deal itself is incredibly compelling and thoroughly vetted, it can overshadow your lack of experience.

- Partner with Experience: You don't have to go it alone. Find a co-sponsor or partner who already has a solid track record. This lets you "borrow" their credibility while you get your feet wet.

- Think Smaller: Your first deal doesn't need to be a skyscraper. Focus on smaller projects that require less capital. It's a lot easier to find someone to write a $50,000 check for your first flip than it is to raise $1,000,000 for a multifamily syndication.

Ready to stop juggling spreadsheets and start closing deals? Homebase provides an all-in-one platform to manage your fundraising, investor communications, and deal administration, so you can focus on what you do best: finding great properties. See how we can streamline your real estate syndication at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Mastering LTV in Real Estate for Smarter Syndication

Blog

Unlock the power of LTV in real estate. This guide explains the LTV formula, its impact on financing, and how syndicators use it to structure winning deals.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.