Fundraising Software Comparison for Syndicators

Fundraising Software Comparison for Syndicators

Our fundraising software comparison helps real estate syndicators choose the right platform. We analyze features, pricing, and use cases for top tools.

Domingo Valadez

Aug 21, 2025

Blog

Picking the right fundraising software is one of the most important decisions a real estate syndicator can make. The stakes are incredibly high. For this specific niche, a good fundraising software comparison has to go way beyond a simple feature checklist. We need to look at tools built from the ground up for complex equity structures, investor accreditation, and secure document distribution—all areas where a generic platform will completely miss the mark.

The Real Estate Syndicator's Software Dilemma

Real estate syndication isn't like other kinds of fundraising. It operates within a very specific legal and financial world. Your software isn't just a portal for collecting money; it's the central nervous system for managing multi-million dollar deals and the sophisticated investors who fund them. Trying to use a tool designed for a charity or a tech startup is a recipe for disaster, opening you up to compliance headaches and a clunky investor experience that could kill your next capital raise.

The right platform can be a genuine force multiplier. It automates the tedious stuff and presents a polished, professional image to your limited partners (LPs). The wrong one, however, creates endless administrative logjams, leaves you vulnerable to security risks, and frankly, makes your entire operation look amateur. This guide is a practical, no-nonsense fundraising software comparison, focusing only on the platforms that actually get how a syndicator works.

Why Standard Tools Just Don't Cut It

A classic mistake new syndicators make is trying to duct-tape a solution together with generic software. A tool built for nonprofits, for instance, is designed to collect simple donations, not to manage capital accounts or calculate complicated distribution waterfalls. You'll quickly find that the functions you need most are completely absent, forcing you back into risky, manual workarounds with spreadsheets.

Here are a few essential features you simply won't find in standard software:

* Accreditation Verification: Built-in workflows to collect and verify that your investors meet SEC requirements.

* Complex Equity Structures: The ability to model and manage different share classes, preferred returns, and sponsor promotes.

* Secure Deal Rooms: A single, secure portal where LPs can review offering memorandums, sign subscription agreements, and access other sensitive documents.

* Automated Distributions: Tools to automatically calculate and process investor payouts based on your specific waterfall model.

Key Comparison Criteria for Syndication Software

To make a smart choice, your fundraising software comparison has to be rooted in the day-to-day reality of running a real estate deal. We're going to evaluate the top platforms based on what actually impacts your efficiency and your investors' confidence. The table below breaks down the core pillars of our analysis.

Comparing the Top Real Estate Syndication Platforms

Diving into the world of syndication software can feel like a lot to take on. Every platform promises to be the magic bullet for your operational woes, but the reality is that each one is built with a specific type of syndicator in mind. To really figure out which is right for you, you have to look past the marketing and understand who they're truly built for.

This space is growing for a reason. The online fundraising software market, valued at a staggering USD 8.4 billion in 2024, is expected to rocket to USD 16.9 billion by 2033. This isn't just a trend; it's a fundamental shift in how capital gets raised, and real estate is right at the center of it.

Let's break down the major players.

Juniper Square: The Institutional Powerhouse

If you're playing in the big leagues with institutional capital, multiple funds, and complex waterfalls, Juniper Square is likely already on your radar. It’s the undisputed heavyweight champion for established firms that need a single, bulletproof system for everything from fundraising to intricate investor reporting.

This is the platform you choose when your LPs are family offices or institutions that demand a certain level of polish and sophistication. Juniper Square is less about flashy features and more about robust, reliable infrastructure for managing serious capital.

AppFolio Investment Management: The All-In-One Ecosystem

AppFolio Investment Management (which you might remember as CrowdStreet) is designed for a very specific operator: the vertically integrated syndicator. If you not only raise the capital but also manage the properties yourself, this platform is a game-changer.

Its true strength comes from its deep integration with the AppFolio property management suite. This creates a seamless flow of information from the asset level right up to the investor portal, allowing you to give your LPs a level of transparency—like real-time performance metrics—that standalone platforms just can't match.

Key Differentiator: The magic of AppFolio is connecting your fundraising efforts directly to your back-office property operations. For sponsors who manage the entire lifecycle of an asset, this unified view is a massive operational advantage.

SyndicationPro: The User-Friendly Scaler

SyndicationPro hits the sweet spot for the syndicator who's past the startup phase and is ready to scale but isn't quite at the enterprise level yet. The platform is laser-focused on making the capital-raising process as smooth as possible for both you and your investors.

It has a clean, modern interface and a deal room that’s incredibly straightforward to use. Where it really shines, though, is its built-in CRM, which helps you manage and nurture investor relationships—a critical piece of the puzzle for any growing syndication business. A good CRM is a must, but some syndicators also use dedicated tools like the best cold email software to expand their investor outreach.

InvestNext: The Emerging Contender

For those just starting out or running a smaller, leaner operation, InvestNext is a fantastic option. It delivers the core essentials—a professional investor portal, document management, and automated distributions—in an affordable and easy-to-use package.

Think of it as the perfect step up from managing everything in spreadsheets. InvestNext gives you the tools you need to professionalize your back-end, build credibility, and provide a great experience for your investors without the hefty price tag or complexity of the larger platforms.

High-Level Feature Comparison of Leading Syndication Platforms

To help you see how these platforms stack up at a glance, here’s a quick breakdown of their core strengths and who they serve best. This isn't about which one is "best" overall, but which one is the best fit for your business today.

Ultimately, the right choice depends entirely on your scale, your business model, and the experience you want to provide for your investors. Each of these platforms excels in its niche.

A Deep Dive Into Critical Syndication Features

Let’s move past the glossy brochures and get into what really matters. A real fundraising software comparison has to get granular, looking at the features you’ll be using day-in and day-out. These tools are the engine of your syndication business, and they have a direct impact on your investors' confidence and your own sanity. A generic checklist just won't do; the devil is in the details of how these features actually work.

I'm going to break down the core functions that matter most, from the look and feel of your investor portal to the nitty-gritty of automated financial distributions. This isn't just about what a platform can do, but how well it holds up under the pressure of a live real estate deal. The market for these tools is blowing up, which tells you how much the game has changed for raising capital.

The global fundraising software market was pegged at around USD 1.2 billion in 2023 and is expected to hit USD 2.5 billion by 2032. This explosive growth shows just how much demand there is for specialized tools that can handle complex fundraising and keep investors happy. You can find more details on this trend in a market report from DataIntelo.

The Investor Portal Experience

Your investor portal is, for all intents and purposes, the digital front door to your business. Once a deal is funded, it's often the single most common way your Limited Partners (LPs) will interact with your firm. A clunky, confusing, or cheap-looking portal can kill trust and create a constant stream of support emails for your team.

On the flip side, a clean, intuitive dashboard makes investors feel empowered. It gives them self-service access to the info they want, when they want it. That builds confidence and, just as importantly, frees you up to find the next deal instead of hunting down K-1s.

When you're kicking the tires on different platforms, ask yourself these questions:

* Dashboard Clarity: Can an investor instantly see their total commitment, distributions received, and how their investments are doing? Or do they have to click around a bunch?

* Mobile Experience: Does the portal work flawlessly on a phone? A lot of your LPs will be checking in while on the go.

* Branding and Customization: Can you make it look like your company? Your logo and colors create a seamless, professional experience that builds your brand.

Situational Insight: If you're targeting high-net-worth folks who aren't necessarily tech wizards, a platform like InvestNext with its famously simple interface is a huge win. But if you're chasing institutional money, the sophisticated reporting dashboards from a platform like Juniper Square project the high-end image those LPs expect to see.

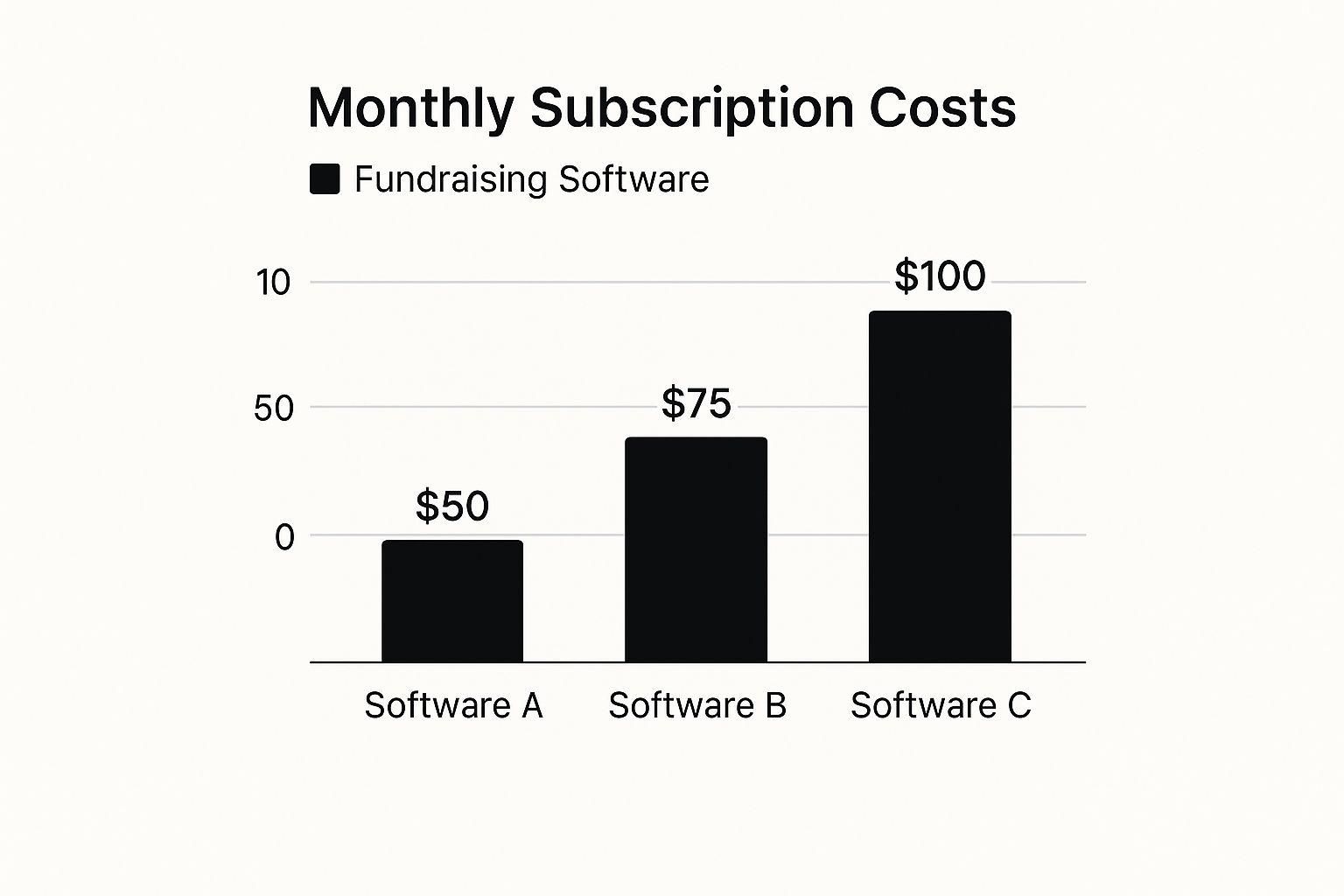

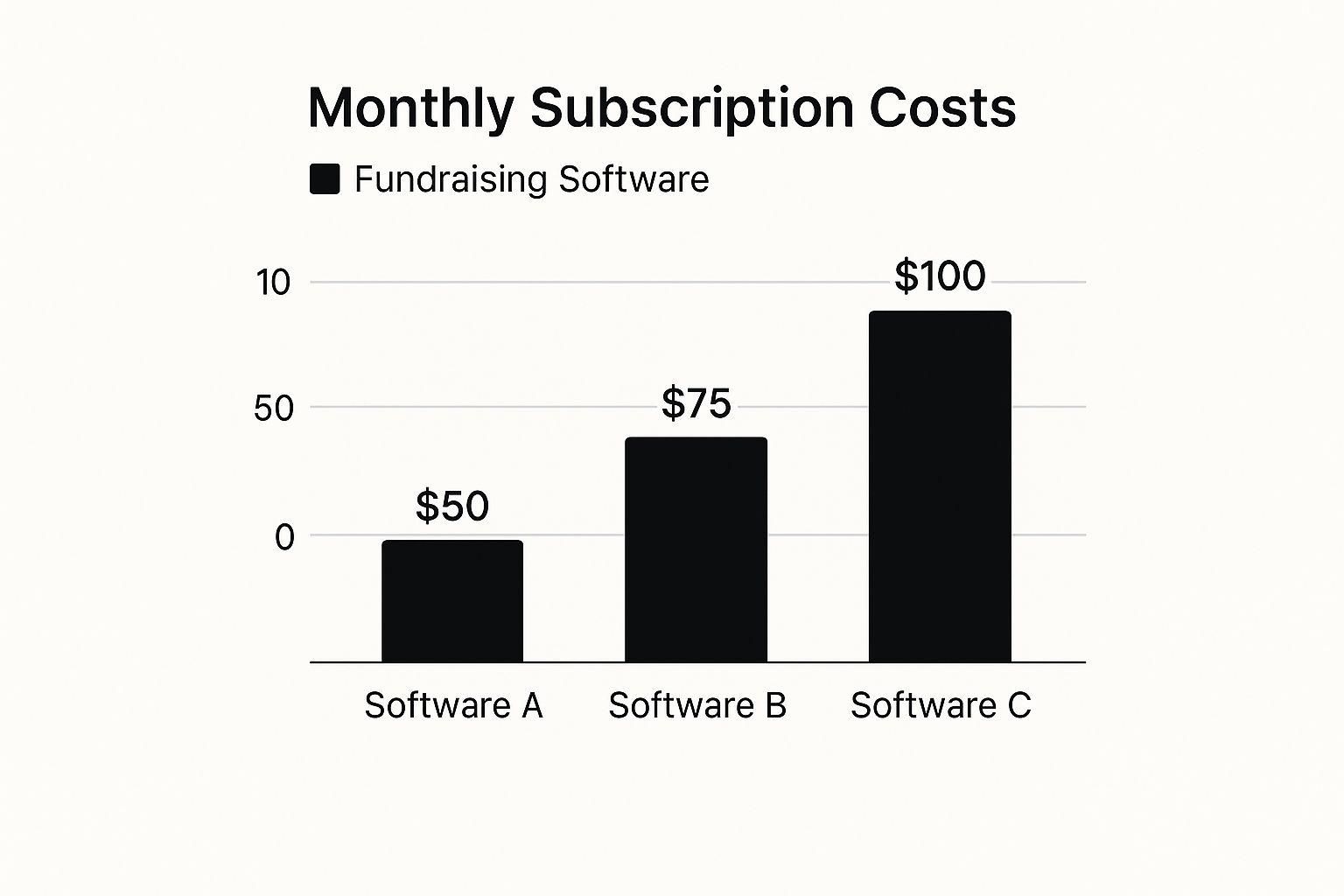

This chart gives you a quick visual on how monthly costs can really stack up between different options.

As you can see, the starting price points can be worlds apart, which is a massive consideration for new or growing syndicators trying to keep a lid on overhead.

CRM and Communication Tools

Your investor list is gold. A powerful, built-in Customer Relationship Management (CRM) system is non-negotiable if you want to manage those relationships effectively. Trying to run a serious operation with spreadsheets and a messy inbox is a recipe for disaster—you'll miss follow-ups and let potential capital slip through your fingers.

A good syndication CRM is more than just a digital address book. It should let you track every single interaction, tag investors based on their interests or accreditation status, and send out highly targeted emails.

Here’s a real-world example of why this matters. Imagine you have a new 506(c) offering that’s only open to accredited investors. With a solid CRM, you can:

1. Instantly filter your database to pull up only your accredited LPs.

2. Send a personalized email blast about the new deal exclusively to that group.

3. See exactly who opened the email, clicked the link, and showed interest.

You simply can't achieve that level of precision without a purpose-built CRM. It's a foundational piece of any fundraising software worth its salt.

Document Management and E-Signatures

Real estate syndication is a paper-pusher's nightmare. From the PPM and subscription agreements to K-1s, keeping all those files secure and organized is a huge job. The best platforms give you a centralized, secure vault for every document related to a deal.

But the real game-changer is integrated e-signatures. Creating a seamless workflow where an investor can review a sub doc and sign it right there in the portal is a massive upgrade from the old way of emailing PDFs back and forth.

You should also look for platforms that provide a clear audit trail for every signed document. This gives you a verifiable record for compliance and peace of mind. The goal is to make the entire journey, from document review to final signature, as smooth and painless as possible for your investors.

Distribution Waterfall Automation

Let’s be honest: calculating and processing investor distributions is one of the most stressful and error-prone jobs in this business. One small miscalculation in a complicated, multi-tiered waterfall can have serious financial and legal blowback. This is where automation isn't just a nice-to-have; it's a lifesaver.

The top software solutions let you build your exact distribution waterfall—preferred returns, sponsor promotes, multiple hurdles, you name it—right into the system. When it's time to pay out cash flow, you just click a button and the platform does all the heavy lifting.

This feature doesn't just save you a ton of time; it drastically cuts down the risk of human error. It guarantees every investor gets paid exactly what they're owed, on time, every time.

Key Takeaway: A slick investor portal is great for making a first impression, but automated waterfall calculations are what protect your back office. This one feature can save you from incredibly costly mistakes and sleepless nights, making it a non-negotiable in your software search. It's the difference between a platform that just looks good and one that works perfectly when it counts.

Breaking Down the True Cost of Ownership

When you're comparing fundraising software, the sticker price is just the starting point. It's easy to get drawn in by a low monthly fee, but the real cost—the true cost of ownership—is buried much deeper. To make a smart choice, you have to dig into the details and understand how a platform's pricing will actually affect your bottom line as you grow.

Many platforms have pricing models that look great when you're small but can quickly get out of hand as your business scales. You'll see everything from per-investor fees to pricing based on a percentage of your assets under management (AUM). Understanding these nuances is the key to avoiding a nasty surprise on your invoice six months from now.

Uncovering the Hidden Costs

Beyond the subscription fee, a whole host of other costs are often tucked away in the fine print. These can pile up fast, turning what seemed like an affordable tool into a serious budget item. It’s absolutely critical to ask pointed questions about these fees before you sign anything.

Keep an eye out for these common "gotchas":

- Implementation and Onboarding Fees: Many of the more robust platforms will charge you a one-time fee to get set up. This can cover data migration, account configuration, and team training, and it often runs from a few hundred to several thousand dollars.

- Premium Support Packages: Basic email support might be included, but if you want a dedicated account manager or priority phone access, that's usually a separate, recurring fee.

- Transaction and Processing Fees: Every time money moves, someone has to pay a processing fee. Some software providers eat this cost, but many pass it directly on to you—sometimes with their own little percentage tacked on top.

- Add-On Modules: Need to run complex waterfall calculations or generate institutional-grade reports? Those advanced features often aren't part of the standard package. They come as pricey add-on modules you have to buy separately.

Key Insight: Never assume a feature is included in the base price. Always get a detailed breakdown of what your subscription covers versus what counts as an extra. I've seen syndicators choose a platform because it looked cheap, only to find it became the most expensive option once they added the features they actually needed to run their business.

Modeling Cost Scenarios by Syndicator Size

The best way to get a feel for these costs is to see how they apply in the real world. A platform that’s a perfect fit for a newcomer could be a financial disaster for a large firm, and the reverse is also true. Let's walk through how this might look for syndicators at different stages.

The Small Syndicator (1-2 Deals, <$10M AUM)

If this is you, you need predictability. A platform with a simple, flat monthly fee is your best friend. For example, a provider like Homebase offers a straightforward $250/month fee for unlimited deals and investors. An AUM-based model, on the other hand, is often a poor fit here, especially if the platform has a high minimum fee that you can't justify yet.

The Medium Syndicator (3-5 Deals, $10M-$50M AUM)

As you start closing more deals, your needs become more complex. Platforms with tiered pricing based on your number of active investors or deals often hit the sweet spot. You need more powerful features, but you're not quite ready for a full enterprise solution. For this profile, expect your total cost of ownership to land somewhere between $8,000 to $20,000 annually.

The Large Syndicator (Multiple Funds, >$50M AUM)

Once you're operating at this scale, AUM-based pricing is the industry standard. Yes, the annual cost can easily climb past $30,000 to $50,000, but you're paying for more than just software. You're paying for institutional-grade security, rock-solid compliance tools, and sophisticated reporting that your investors demand. The cost is high, but the price of a compliance slip-up or a clunky investor experience is far, far higher. It’s an investment to protect the business.

Which Fundraising Software Is Right for You?

When it comes to choosing your platform, the goal isn't to find the "best" software on the market. It's about finding the right fit for where your business is today. What a first-time syndicator needs is worlds away from what a seasoned institutional fund manager requires. Let's break down which platform makes sense for you.

The broader market for specialized software is booming—the non-profit software space alone was valued at USD 4.25 billion in 2025 and continues to grow. This just highlights a universal need for tools that solve specific problems. As a syndicator, this means picking a platform that not only handles your current deals but is also built for the future with solid security and integration. You can see the full report on non-profit software trends for more on these market dynamics.

Here, we'll move past feature lists and get into practical, real-world recommendations. I’ll connect the dots between each platform’s strengths and what your syndication business actually needs to grow.

For the First-Time Syndicator

If you’re launching your first or second deal, your focus should be on three things: simplicity, affordability, and credibility. You need a platform that makes you look professional from day one, without a complicated setup or a massive price tag. Your primary job is to create a smooth, confidence-inspiring experience for your first crucial group of investors.

For this exact scenario, a platform like InvestNext is a fantastic starting point. It delivers a clean, modern investor portal and handles all the core functions—document management, e-signatures, and distributions—without any fuss. Its design is so intuitive that both you and your investors will be up and running in no time.

Another great option, especially if you want predictable costs, is Homebase. Its flat-fee model is a huge advantage for new syndicators. You don't have to worry about your bill creeping up as you add more investors or deals, which lets you focus on what really matters: getting your business off the ground.

For the Growing Firm

You’ve got a few deals under your belt, and your investor list is growing fast. At this point, spreadsheets aren't just inefficient; they're a liability. Your biggest needs now are a robust CRM to manage all those relationships, automation to take repetitive tasks off your plate, and tools that help you scale without dropping the ball.

This is where SyndicationPro really shines. Its built-in CRM is purpose-built for nurturing investor relationships, letting you track every interaction and segment your contacts for targeted fundraising. The platform's streamlined deal rooms make the capital-raising process incredibly smooth, which is vital as you start launching deals more often. Our definitive guide to real estate fundraising dives deeper into strategies for this growth stage.

Key Recommendation: For a growing firm, the decision really comes down to CRM and automation. A platform that centralizes all your investor communication and automates workflows is no longer a "nice-to-have." It's essential for managing more deals and a bigger investor pool without letting critical relationships fall through the cracks.

For the Institutional Fund Manager

Once you reach the institutional level, the game changes. You’re managing multiple funds, dealing with complex waterfall distributions, and serving sophisticated LPs like family offices. Your software requirements are now driven by security, compliance, and advanced reporting. Your investors expect an institutional-grade experience, and your platform has to match that level of professionalism.

Juniper Square is the undisputed leader in this arena. It was built from the ground up for the complexities of institutional fund management. The platform offers robust, auditable reporting, top-tier security protocols like SOC 2 compliance, and the power to manage the most intricate partnership accounting.

While it’s a significant financial commitment, the cost is easily justified by the risk it mitigates and the operational horsepower it provides. For firms operating at this level, Juniper Square delivers the essential infrastructure needed to manage substantial assets and meet the high expectations of institutional investors.

Answering Your Key Software Questions

Diving into the world of syndication software can feel overwhelming. Every platform promises to be the best, but what does that actually mean for your day-to-day operations? It’s easy to get lost in feature lists, so let’s cut through the noise and tackle the real-world questions that syndicators are asking.

Choosing the right software isn't just about what it can do; it's about how it fits into your workflow, protects your investors, and grows with your business. This is about making a practical decision that will save you headaches down the road.

Integrated CRM vs. Third-Party Tools

One of the first big questions you'll face is about the CRM. Should you go for a platform with a built-in customer relationship manager, or try to connect a specialized tool like Salesforce? While a standalone CRM offers deep customization, the reality of integration is often messy and expensive. If it’s not set up perfectly, you end up with data living in two different places.

For most syndicators I talk to, a platform with a solid, integrated CRM is the smarter play. It gives you a single, reliable source for every investor interaction, commitment, and document. When an investor calls, you shouldn't have to toggle between systems to see their history—it should all be right there.

Essential Security and Compliance Features

In our business, protecting investor information isn't optional; it's a fundamental requirement. A single data breach can destroy your reputation and put you in serious legal trouble. Because of this, a few security features are simply non-negotiable.

Here’s what you absolutely need to look for:

- SOC 2 Compliance: This isn't just marketing fluff. It's proof from an independent auditor that the software company handles your data securely and respects your clients' privacy.

- Bank-Grade Encryption: Your data needs protection at all times—whether it's sitting on a server ("at rest") or being sent over the internet ("in transit").

- Two-Factor Authentication (2FA): This is a simple but powerful tool that adds a crucial layer of security, making it much harder for someone to gain unauthorized access to your account or your investors' portals.

A platform that cuts corners on security is a risk you cannot afford to take. The potential cost of a compliance failure far outweighs any savings from choosing a less secure option.

Realistic Implementation Timelines

So, how long does it really take to get up and running? The answer depends entirely on the platform and the complexity of your business. Some of the more streamlined tools can be set up and ready for a new deal in just a couple of days.

However, if you're migrating a lot of historical data from past deals and have a large investor base, you need to be more realistic. A full implementation for a comprehensive system can easily take four to eight weeks. Before you sign any contract, ask the vendor for a detailed implementation plan. Knowing the timeline upfront will prevent major bottlenecks and ensure a smooth transition for everyone involved. For a broader perspective on the fundraising landscape, events like The State of Fundraising Conference can also offer valuable context on the latest trends in fundraising.

Ready to simplify your syndication process with a platform that answers all these questions and more? Homebase offers a secure, all-in-one solution with a built-in CRM and a flat-fee structure designed for growth. Explore how Homebase can streamline your next deal today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.