Flow of Fund Analysis: Your Complete Investment Guide

Flow of Fund Analysis: Your Complete Investment Guide

Master flow of fund analysis with proven strategies from investment professionals. Discover how to read market signals and optimize portfolios.

Domingo Valadez

May 30, 2025

Blog

Understanding Flow of Fund Analysis Like A Pro

Flow of fund analysis provides valuable information beyond simple metrics. It offers a window into the movements of "smart money," showing where institutional investors and portfolio managers are investing. This analysis provides a glimpse into potential market trends. Traditional indicators often lag behind these crucial flow signals. Seasoned professionals use this information to anticipate market shifts and find investment opportunities before they become widely known.

Decoding the Psychology of Fund Flows

Understanding the psychology driving fund flow is essential. Large inflows into a sector can suggest increasing investor confidence. Conversely, significant outflows might signal concerns about future performance. However, it's crucial to remember these aren't foolproof indicators. Sometimes, outflows can indicate profit-taking after strong growth, not necessarily a loss of market confidence. This nuance underscores the importance of carefully interpreting flow of fund data.

Distinguishing between retail and institutional flows offers further insights. Retail investors often react more emotionally to market events, resulting in more volatile flow patterns. Institutional investors, however, typically have a more strategic, long-term approach. Recognizing these differences leads to a more accurate understanding of market sentiment. This is a key differentiator between novice and experienced investors.

Leveraging Flow Data for Informed Decisions

Integrating flow of fund analysis into your investment strategy can be highly advantageous. Tracking the velocity of money movements is a useful technique. Rapid inflows or outflows can indicate stronger conviction behind investment decisions. This serves as a powerful signal for predicting market turning points.

Analyzing concentration ratios also reveals when markets become overly saturated. High concentration in a particular asset class could suggest a potential bubble. Low concentration might point to undervalued opportunities. This information helps identify potential investments or warnings of market corrections. For a more detailed look at real estate fund allocation, explore this resource on real estate fund raising.

Data providers like EPFR offer critical data for comprehensive flow of fund analysis. They track over 151,000 share classes and more than $55 trillion in assets under management (AUM). Their data covers various asset classes, including equity funds, bond funds, money market funds, alternative funds, and multi-asset funds. Analyzing these flows allows investors to better grasp market dynamics and anticipate future trends. You can discover more insights about fund flow data.

Reading Mutual Fund Flows For Market Timing

Mutual fund flows provide a real-time snapshot of the collective investment decisions of millions. Understanding these flows is crucial for gaining actionable market insights. This involves separating significant trends from short-term market fluctuations. Professional fund managers track these movements closely to anticipate sector rotations and overall market cycles.

Identifying Meaningful Trends in Fund Flows

Even small percentage shifts in fund flows can indicate important changes in investor confidence. For instance, a steady flow of investments into a specific sector may suggest growing optimism about its potential. Conversely, significant outflows could signal rising concerns, potentially preceding a market correction. Analyzing current flow data alongside historical trends offers valuable perspective, helping investors assess the potential scale of market movements.

It's important to remember that outflows don't necessarily indicate imminent decline, and inflows don't guarantee future gains. Outflows could simply represent investors taking profits after a period of strong returns. Likewise, large inflows might signify excessive optimism and a potential market bubble. The movement of money within the mutual fund sector provides essential insight into investor sentiment.

In the week ending May 21, 2025, total estimated outflows from long-term mutual funds reached $7.64 billion. This represented less than 0.1 percent of total long-term mutual fund assets as of March 31, 2025. More detailed information on mutual fund statistics can be found at the Investment Company Institute (ICI).

Seasonal and Cyclical Patterns in Flow of Funds

Experienced investors also consider seasonal and cyclical patterns in fund flows. Certain times of the year, such as the end of the tax year, often exhibit predictable flow patterns. Understanding these patterns can be beneficial for strategic investment decisions. For example, anticipating increased investment into certain asset classes during specific periods allows investors to potentially capitalize on price increases.

Flow of Funds and Performance

The relationship between fund flows and investment performance is key. While following popular investment trends can be profitable, especially in momentum-driven markets, a contrarian approach can also yield rewards. This strategy involves identifying instances where substantial outflows may create buying opportunities in undervalued assets.

Ultimately, interpreting flow of funds data effectively equips investors to make more informed decisions. By grasping the nuances of fund flows, investors can better navigate market complexities and potentially improve their investment outcomes.

ETF Flow Patterns That Drive Modern Markets

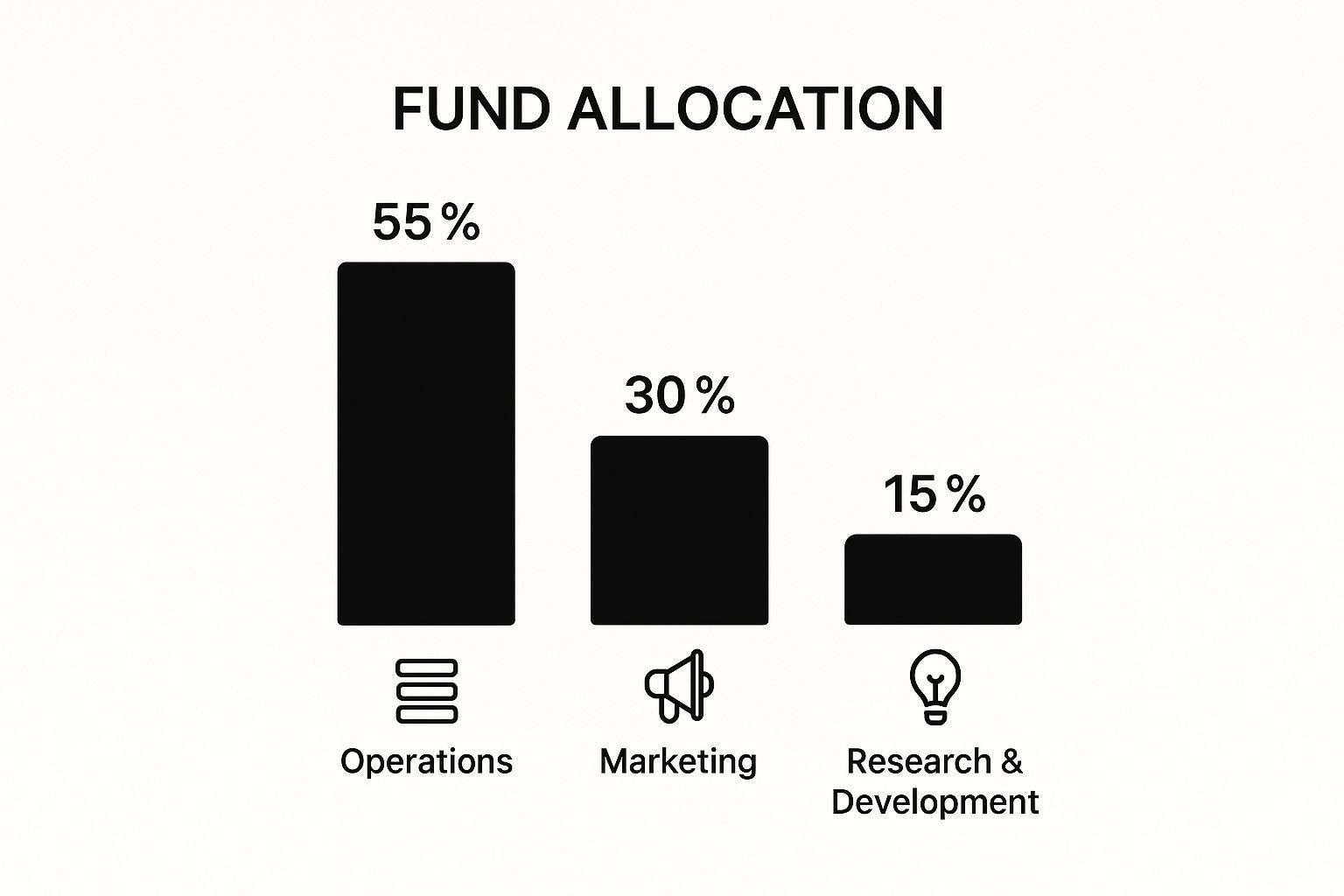

The chart above depicts a hypothetical fund allocation. It designates 55% to Operations, 30% to Marketing, and 15% to Research & Development. This visualization emphasizes the relative weight of each area within the overall fund strategy. The allocation suggests a prioritization of core business operations, coupled with a strong emphasis on marketing to drive revenue growth.

Research and development, while still allocated funding, receives a comparatively smaller portion. This could indicate a company operating in a mature industry, or one focusing on optimizing existing products and services rather than extensive new product development.

Exchange-traded funds (ETFs) have reshaped how capital moves within financial markets. They introduce a new level of dynamism that affects all investors, including individuals. This differs markedly from traditional mutual fund flows, a distinction with important implications for your investment approach.

For instance, the unique creation and redemption mechanism of ETFs contributes significantly to intraday liquidity. This allows investors to respond rapidly to market fluctuations. Moreover, analyzing ETF flows offers insights into broader market sentiment. By tracking these flows, you can identify which sectors and asset classes are drawing the most investment capital.

Sector-Specific ETF Flows: A Deeper Dive

The increasing popularity of sector-specific ETFs provides more targeted investment opportunities. Investors can gain exposure to specific industries, allowing them to capitalize on particular market trends. Suppose an investor is optimistic about the future of renewable energy. They can invest in a clean energy ETF, concentrating their investment in the growth potential of that specific sector.

Analyzing fund flows into these specialized ETFs offers valuable data on investor sentiment toward particular sectors. This information can uncover emerging trends and potential investment opportunities.

Understanding how institutional investors utilize ETFs is also essential. Their large-scale trading activity can significantly influence both market liquidity and price movements. This presents a unique opportunity for individual investors to potentially learn from institutional investors. Observing institutional fund flow patterns can provide insights into which sectors and assets are attracting their attention.

To better understand the key differences between ETFs and mutual funds, let's examine the following table:

This table summarizes some key distinctions between ETF and mutual fund flow characteristics, highlighting the unique advantages and disadvantages of each. By understanding these differences, investors can make more informed decisions about which investment vehicle aligns best with their individual needs and goals.

In the global ETF market, 2024 witnessed record inflows of USD 1.5 trillion, exceeding the previous high of USD 1.2 trillion set in 2021. Total assets in global ETFs climbed to a new peak of USD 13.8 trillion. More detailed statistics can be found at Morningstar. This growth highlights the expanding role of ETFs in today's markets.

However, it’s important to distinguish between genuine market shifts and short-term, technical movements such as index rebalancing. These events can create temporary flow patterns that don't necessarily reflect sustained investor sentiment.

Identifying Genuine Market Signals

Examining fund flows provides crucial insights into market timing and investor behavior. By studying ETF flow patterns, investors can potentially differentiate between genuine market shifts and temporary technical fluctuations. This nuanced perspective is key to understanding real changes in investor sentiment.

For example, consistent and growing flows into a particular sector over a sustained period might suggest a strong underlying trend. Conversely, abrupt, large inflows quickly followed by outflows might just indicate short-term trading. Understanding these dynamics allows investors to make more informed decisions. They can distinguish between enduring investment themes and transient market noise.

Professional Flow of Fund Data Analysis Techniques

Analyzing raw flow of fund data requires a structured approach. It's about separating meaningful shifts in asset allocation from temporary market fluctuations. Professionals use several key techniques to achieve this.

One such technique is the use of velocity metrics. These metrics help understand the speed and urgency of money movements, offering valuable insights into investor conviction.

Another important tool is the use of concentration ratios. Think of a crowded elevator: too many people, and it’s at capacity. Similarly, concentration ratios measure market saturation. A high concentration in a particular asset might signal a potential bubble. Conversely, low concentration could indicate undervalued opportunities. This information can help investors identify opportune entry or exit points.

Normalizing Flow Data

A crucial aspect of professional flow of fund analysis is data normalization. This means adjusting data across different market conditions and time periods, accounting for factors like market size and trading volume. For example, a $1 billion inflow into a small-cap fund has a significantly greater impact than the same inflow into a large-cap fund. Normalizing the data allows analysts to compare flows across diverse asset classes and market environments for a more precise evaluation of investor behavior.

For those interested in real estate investment, this resource offers further insights into specific flows: How to master real estate fund raising.

Combining Flow Analysis With Other Indicators

Combining flow of fund analysis with other indicators strengthens the analytical signal. Momentum oscillators, for example, can validate flow-based insights by highlighting the strength of price trends. Likewise, volatility measures help assess the risk associated with flow-driven market movements.

Consider a situation with significant fund inflows coupled with rising volatility. This could indicate increased uncertainty and risk, despite the positive flow of funds. This combined approach offers a more holistic understanding of market dynamics, leading to better investment decisions.

Practical Applications of Flow Analysis

Analysts learn to apply these techniques through practical examples. This might involve examining historical flow of fund data to spot recurring patterns or monitoring real-time flows to predict market turning points. Mastering these techniques empowers investors to transform raw data into valuable insights, enabling them to grasp market dynamics and make smarter investment choices. They develop a deeper understanding of how money moves and its implications for future market performance.

Geographic And Sector Flow Intelligence

Following the flow of funds offers valuable insights into emerging investment opportunities, often before they become widely recognized. Understanding where sophisticated investors are allocating capital, whether rotating into emerging markets or taking defensive positions in developed markets, can provide a powerful predictive edge. This section explores how analyzing these fund flows can enhance investment strategies.

Decoding Geographic Flow Patterns

Geographic flow patterns provide a window into where investors perceive value. Increased investment flows into a specific region might signal positive economic prospects or the presence of undervalued assets. This information can be invaluable for uncovering potential investment opportunities.

Additionally, understanding the underlying drivers of these flows, such as political stability, regulatory changes, or demographic trends, can help assess the sustainability of a particular investment theme. This deeper analysis provides a more nuanced perspective on regional investment dynamics.

Analyzing regional fund flows can also serve as an early warning system for potential risks. Substantial outflows from a region might indicate growing concerns about economic or political instability. Recognizing these warning signs can help investors manage risk and protect capital in a volatile global market.

Sector Flows and Industry Cycles

Analyzing sector flows can be a powerful tool for anticipating industry cycles. For example, a surge in fund flows into the technology sector could signal the beginning of a new growth cycle. Conversely, sustained outflows from the energy sector might foreshadow a decline in demand or structural changes within the industry.

By understanding the dynamics of sector flows, investors can gain insights into the underlying forces shaping industry trends. This knowledge empowers them to proactively adjust their portfolios and capitalize on emerging opportunities while mitigating potential risks.

Currency Movements and International Fund Flows

International fund flows are intricately linked with currency movements. If investors anticipate a rise in a particular currency, they may increase their investments in assets denominated in that currency. This increased demand can further strengthen the currency, creating a reinforcing loop.

The interplay between currency fluctuations and international fund flows underscores the interconnectedness of global financial markets. By monitoring both, investors can gain a more comprehensive understanding of market dynamics and identify potential opportunities or risks.

Sector Bubbles: Early Warning Signs

Identifying early warning signs of sector bubbles is crucial for protecting capital. A rapid surge in fund flows into a specific sector, coupled with inflated asset prices and excessive optimism, could indicate unsustainable growth.

While detecting early signs of a bubble can be challenging, actively monitoring fund flows and valuations can help investors avoid potential losses. This vigilance empowers them to take preemptive action and reduce exposure to overvalued assets.

Flow Persistence and Participant Quality

Distinguishing between sustainable investment themes and short-lived trends requires careful consideration of flow persistence and participant quality. Persistent inflows from long-term, institutional investors typically signal stronger conviction compared with erratic flows driven by short-term speculation.

Understanding the source and consistency of fund flows provides valuable insights into the long-term potential of a market or sector. This analysis helps differentiate between sustainable trends and speculative bubbles, enabling more informed investment decisions.

To illustrate the practical application of flow analysis, consider the following table:

Regional Fund Flow Indicators: Key metrics and patterns for analyzing geographic fund flows and their market implications

This table highlights how regional fund flow indicators offer valuable insights into global market dynamics. By tracking these indicators and understanding the underlying drivers, investors can make more informed asset allocation decisions.

By understanding how professional investors utilize geographic and sector flow of funds analysis, individual investors can potentially enhance their own investment strategies. This approach empowers them to anticipate market shifts, position their portfolios strategically, and capitalize on emerging opportunities. By staying ahead of the curve, investors can potentially achieve superior long-term returns.

Building Winning Strategies With Flow Analysis

Transforming an understanding of flow of funds into profitable investment decisions requires proven frameworks. This section examines how successful investors combine flow signals with fundamental and technical analysis to improve their timing and security selection.

Identifying High-Conviction Opportunities

Professional investors utilize specific criteria to pinpoint high-conviction opportunities using flow of funds analysis. One key factor is the persistence of flows. Consistent inflows over an extended period suggest stronger conviction than sporadic bursts of investment.

For example, imagine sustained inflows into renewable energy ETFs (Exchange Traded Funds). This could signal a long-term trend, rather than fleeting market interest.

Another important criterion is the quality of participants. Flows originating from established institutional investors generally carry more weight than those from retail investors.

This is because institutional investors typically conduct more in-depth research and possess a longer-term perspective. Their consistent engagement in a particular sector often indicates greater confidence in its future prospects.

Position Sizing and Flow Momentum

Position sizing, the process of determining how much capital to allocate to each investment, can be informed by flow momentum. Strong and persistent inflows can justify larger positions.

Conversely, weakening flows or substantial outflows might suggest reducing exposure. This dynamic approach allows investors to adapt to changing market conditions and optimize their portfolio allocation.

Imagine a scenario where a real estate investment trust (REIT) experiences significant inflows coupled with positive news about the real estate market. This confluence of factors could encourage investors to increase their position.

However, if the positive news is followed by declining inflows, a more cautious approach might be warranted.

Risk Management and Flow-Driven Volatility

Flow of funds can introduce volatility into markets. Sudden large inflows or outflows can dramatically impact asset prices. Therefore, effective risk management strategies must account for flow-driven price swings.

Consider a small-cap stock experiencing a sudden surge in popularity due to positive media coverage. The resulting inflow can drive up the stock price rapidly.

However, this price increase may not be sustainable if the underlying fundamentals don't justify the valuation. Investors who analyze flow of funds can use volatility measures like beta to understand price sensitivity relative to the market. This awareness helps anticipate potential price corrections and manage risk effectively.

Entry and Exit Timing Using Flow Analysis

Mastering the art of using flow analysis for entry and exit timing involves combining it with other indicators. For instance, strong inflows into a sector combined with positive technical indicators, such as a breakout above a resistance level, could signal an opportune entry point.

Conversely, weakening flows accompanied by bearish technical patterns might suggest it’s time to exit. This integrated approach can help investors identify potential entry and exit points.

Practical Guidelines and Avoiding Pitfalls

Successfully integrating flow analysis into an investment strategy requires discipline and a clear framework. It's important to establish clear criteria for evaluating flow signals and to maintain consistency.

For example, an investor might increase their position only if inflows exceed a certain threshold for a specified period. This disciplined approach can prevent impulsive decisions.

Additionally, avoiding common pitfalls is crucial. One such pitfall is blindly following the crowd. While momentum investing can be effective, it’s important to differentiate between informed investments and potential speculative bubbles.

Remember, flow of funds analysis is just one tool. It should be used in conjunction with fundamental analysis, technical analysis, and risk management principles.

Key Takeaways

This section offers a practical guide to incorporating flow of funds analysis into your investment approach. It summarizes important techniques, potential red flags, and key performance indicators (KPIs) employed by professional analysts. This includes actionable frameworks, setting realistic expectations, and adaptable step-by-step checklists for various market conditions. By understanding these takeaways, you can significantly enhance your investment outcomes.

Actionable Frameworks for Flow of Funds Analysis

- Identify Smart Money Movements: Observe the investment activity of institutional investors in Exchange Traded Funds (ETFs) and mutual funds to understand where "smart money" is being directed. This offers valuable foresight into potential market trends before they become widely recognized.

- Interpret Flow Signals: Recognize that inflows don't always guarantee positive returns, and outflows don't necessarily indicate impending trouble. Factor in elements like profit-taking and general market sentiment when analyzing flow data. For example, substantial outflows after a period of significant market gains could simply represent profit-taking rather than a decline in investor confidence.

- Analyze Velocity and Concentration: Velocity metrics show the speed and conviction of money movements. Concentration ratios help assess market saturation. A high concentration in a specific asset class might suggest a potential bubble, while a low concentration might indicate undervalued assets.

Warning Signs and Success Metrics

- Distinguish Between Strategic and Tactical Flows: Learn to differentiate between long-term strategic asset allocation adjustments and short-term tactical trades. Consistent flows from institutional investors typically indicate stronger conviction compared to the often erratic activity of retail investors.

- Combine Flow Analysis With Other Indicators: Integrate flow of funds analysis with fundamental and technical analysis. For instance, corroborate insights derived from flow data with momentum oscillators or volatility measures. This multifaceted approach strengthens signal accuracy and reduces reliance on any single data point.

- Measure Flow Persistence and Participant Quality: Assess the consistency of flows and the types of investors involved. Sustained flows from institutional investors generally hold more significance than short-term flows from retail investors, suggesting more thorough due diligence and a long-term investment horizon.

- Geographic and Sector Focus: Track smart money across geographic regions and market sectors. Monitoring geographic flow patterns helps identify regions perceived as offering value, while analyzing sector flows can help anticipate industry cycles.

Integrating Flow Analysis Into Your Investment Process

- Develop Step-by-Step Checklists: Create checklists tailored to different market conditions to guide your flow of funds analysis and ensure a systematic approach to data interpretation. This standardizes your process and helps guarantee you consider all crucial factors.

- Establish Benchmark Criteria: Define clear benchmarks for evaluating flow signals. You might, for example, establish a minimum inflow threshold before increasing your investment in a particular asset. This adds a quantifiable element to your analysis.

- Adapt to Changing Market Conditions: Adjust your strategy as market dynamics shift. No investment strategy remains static. Continuously monitor flow of fund data and other indicators to adapt to evolving market conditions and maintain alignment with your investment goals.

Homebase, the all-in-one platform for real estate syndication, can help streamline your investment management. From fundraising to investor relations, Homebase simplifies the complexities of real estate investing. Visit Homebase to learn more and discover how it can optimize your investment strategy.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Financial Modelling Real Estate: Win Deals with financial modelling real estate

Blog

Explore financial modelling real estate techniques to structure deals, forecast returns, and secure financing with confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.