Finding Real Estate Investors: Proven Strategies for Success

Finding Real Estate Investors: Proven Strategies for Success

Discover effective tips for finding real estate investors today. Learn proven methods to connect with the right capital partners for your deals.

Domingo Valadez

Oct 8, 2025

Blog

Before you even think about picking up the phone or sending that first email, your most important work happens behind the scenes. Finding real estate investors is less about a sales pitch and more about presenting a bulletproof case for your deal. You need to build a machine of credibility, and that starts with a professional investor package that leaves no stone unturned.

This foundation is what gives investors the confidence to write that check.

Building Your Foundation to Attract Capital

Think of it this way: investors are bombarded with opportunities every single day. Yours has to cut through the noise. It’s not just about promising great returns; it’s about demonstrating your professionalism and clarity from the very first impression. This preparation phase is where you win or lose before the game even begins.

You’re not just selling a property; you’re selling your ability to execute a plan. A vague concept doesn't inspire confidence. A detailed, well-researched strategy, on the other hand, shows you're a serious operator who has already done the heavy lifting.

Craft a Deal-Specific Business Plan

Forget the generic business plan templates. They’re useless here. Your document has to be a custom-built roadmap for the specific asset you're raising capital for. It needs to anticipate and answer every single question a savvy investor is going to throw at you.

Your plan should tell a compelling story, not just spit out numbers. What’s the narrative behind this asset? Why is this a smart investment right now? What’s the unique angle or market inefficiency you’re exploiting?

A winning plan absolutely must include:

- Executive Summary: A powerful, one-page snapshot that grabs their attention and sums up the entire opportunity. Make it punchy.

- Market Analysis: Go deep on the submarket. Talk about rent growth, occupancy trends, new employers moving in—the real drivers of value.

- Property Details: A thorough breakdown of the asset, its current condition, and its competitive position in the local market.

- Financial Projections: This is the core. Show your detailed pro forma with projected cash flow, internal rate of return (IRR), and equity multiple over a 5-10 year hold period.

This level of detail proves you're not just dreaming; you're prepared to execute.

Assemble a Professional Investor Package

That deal-specific business plan is the heart of your larger investor package, which is essentially your #1 marketing tool. It needs to be polished, professional, and incredibly easy to digest.

The centerpiece is the Investment Memorandum (IM)—sometimes called a Private Placement Memorandum (PPM). This document is where all your research, financial models, and narrative come together into one cohesive story. For a complete walkthrough, check out our guide to creating a real estate investment memorandum at https://www.homebasecre.com/posts/investment-memorandum-real-estate.

A well-crafted investor package does more than just present a deal—it builds trust. It signals that you’re organized, thorough, and that you respect both their capital and their time.

Document Your Track Record

Don’t have a massive portfolio yet? That’s okay. What you do have, you need to document meticulously. Don't discount smaller wins or tangentially related experience. Did you successfully manage your own rental property? Were you involved in a smaller deal, even in a junior capacity?

Highlight every relevant accomplishment you can:

- Successfully renovated and flipped a personal property for a profit.

- Managed a small multi-family building with 100% occupancy for two straight years.

- Sourced and underwrote an off-market deal, even if you weren't the one to ultimately close it.

Frame your experience to showcase your skills in sourcing, underwriting, and asset management. The key is honesty and transparency. A small but successful and real track record is infinitely more compelling than inflated claims.

As you put these foundational pieces together, remember that your ultimate goal is to get to a "yes." Understanding how to successfully close deals is crucial, because all this prep work culminates in that final conversation. Your business plan and documented history are what make that "yes" an easy, logical decision for the investor.

Tapping Your Inner Circle for That First Deal

When you're just getting started, the whole idea of "finding investors" can sound pretty intimidating. But here's the thing: your first investor is probably someone you already know. The real trick is learning how to turn a personal relationship into a professional one without making Thanksgiving dinner incredibly awkward.

Let's be clear, this isn't about hitting up your aunt for a loan. It's about presenting a legitimate, well-vetted investment opportunity to people who already have a baseline of trust in you. Forget the cheesy, desperate pitch you see in movies. This is a business conversation, and it needs to be handled with respect for both the relationship and their money.

Figuring Out Who to Talk To

Before you pick up the phone, you need to do a little homework. Take a hard look at your network and think strategically. Not everyone you know is a potential investor, and that’s okay. You're looking for people who not only have the financial means but also the right mindset for this kind of thing.

Think beyond your immediate family. Who do you know that runs a successful small business? Who's a doctor or a lawyer? Who's mentioned in passing that they're looking for better places to put their money than the stock market? These are the people who get the concept of calculated risk and are often actively looking for ways to grow their wealth.

Jot down a list and, for each person, ask yourself:

- Financial Capacity: Realistically, do they have the disposable income to consider an investment?

- Trust Level: How solid is your relationship? Remember, they're investing in you as much as they're investing in the property.

- Business Savvy: Do they have a background in business or other investments? This isn't a deal-breaker, but it can make the conversation go a lot smoother.

How to Bring It Up Without Being Weird

Your approach is everything. A clumsy, out-of-the-blue pitch is the fastest way to kill a conversation and maybe even strain a friendship. The goal is simply to share what you're passionate about, not to corner someone into a decision.

Start by just talking about what you're up to in real estate. Share your genuine excitement about a property you're analyzing or a local market trend that's caught your eye. Frame it as sharing a part of your life, the same way you'd talk about a new hobby or project at work.

For instance, you might say, "Man, I've been buried in spreadsheets for this duplex over on the east side. It's been a ton of work, but the numbers are starting to look really compelling." This opens a natural door for them to ask questions if they're curious. No pressure.

The best "pitch" isn't a pitch at all. It's leading with your own passion and competence. When people see you know your stuff and are serious about what you're doing, their curiosity is a natural next step.

This lets you gauge their interest organically. If they lean in and start asking for details, that's your cue to offer to share your formal investor presentation.

Get Your Ducks in a Row First

Seriously, don't even think about having these conversations until you are 100% prepared. When you're dealing with friends and family, your responsibility to be buttoned-up is even higher. You need all your legal and financial documentation ready to go before a single dollar is on the table.

This means you’ve already talked to a lawyer and have a rock-solid operating agreement and, if needed, a Private Placement Memorandum (PPM). These documents are non-negotiable. They protect you and your investors by clearly laying out the terms, risks, and structure of the whole deal. Coming to the table this prepared shows you're a professional, not just some amateur with a half-baked idea.

Being prepared puts you in a position to capitalize on market opportunities. In fact, the first half of 2025 saw a 21% rise in global real estate investment volumes, with cross-border capital flowing into the U.S. surging 26% year-over-year. You can dig deeper into these global investment trends on JLL's market perspectives page.

Turning a "No" Into Your Next "Yes"

Even if someone in your network isn't in a position to invest, they can be an incredibly valuable resource. Your network isn't just a direct line to capital; it's a web of potential referrals.

Let's say you've shared your project, and they're impressed but can't participate right now. That's the perfect time to respectfully ask for an introduction. You could try something like, "I really appreciate you taking the time to look at this. Since you know so many people in the local business community, I was wondering if anyone comes to mind who might be a good fit for this kind of opportunity?"

It’s a simple question, but it can unlock a whole new circle of potential partners. A warm introduction from someone who knows and trusts you is one of the most powerful fundraising tools you have. It can shave months off your search for the right real estate investors.

Finding Investors in the Digital World

Your next investor might not be at a local meetup. They could be three time zones away, scrolling through their LinkedIn feed. The internet has completely shattered geographical barriers, creating a truly global marketplace for capital. Knowing how to navigate this space is a modern superpower for anyone serious about raising money for real estate deals.

This isn't about spamming inboxes or blasting out generic pitches. It’s about being strategic, positioning yourself as an authority, and making intelligent connections. When you get your digital presence right, you start attracting inbound interest from accredited investors who are actively looking for deals just like yours.

Master LinkedIn for High-Value Connections

Think of LinkedIn as less of a resume site and more of a powerful search engine for capital. It’s your digital headquarters for fundraising, but success here requires a shift in mindset—from broad "networking" to surgical, targeted prospecting.

First things first, your personal profile needs to be rock solid. Your headline should scream what you do. Something like "Multifamily Real Estate Sponsor | Commercial Real Estate Acquisitions" is direct and effective. Then, flesh out your experience section with details on past deals. Even the smaller wins build credibility and show you have a track record.

Once your profile is polished, it's time to go on the offensive. Use LinkedIn’s search filters to zero in on the exact people you want to talk to:

- Job Titles: Hunt for titles like "Family Office Manager," "Private Equity Real Estate," or simply "Accredited Investor."

- Keywords: Get specific with terms like "real estate investing," "private placements," or the asset classes you focus on, such as "self-storage."

- Company: You can even target professionals at private wealth management firms or private equity groups.

When you reach out to connect, never lead with a pitch. That’s the fastest way to get ignored. Your initial message should feel genuine. Mention a group you’re both in, a post they recently commented on, or a shared professional interest. Build a real rapport first. The opportunity to discuss your deals will come naturally from there.

Engage in Niche Online Communities

Beyond the corporate polish of LinkedIn, you'll find incredible opportunities in specialized online forums where investors gather to talk shop. These communities are less formal and offer a direct line to passionate, knowledgeable people who live and breathe real estate.

BiggerPockets is probably the biggest and most active community out there. The real magic happens in the forums. By consistently asking smart questions and providing thoughtful answers, you build a reputation as a competent operator people want to work with.

And don't sleep on Reddit. Niche subreddits like r/realestateinvesting are home to some surprisingly sophisticated investors. The key to Reddit is authenticity. The community values genuine contribution and can smell a sales pitch a mile away. Share a detailed case study of a past deal—wins and losses included—or ask for feedback on a market analysis you've done. This builds trust and often leads to private messages from interested investors.

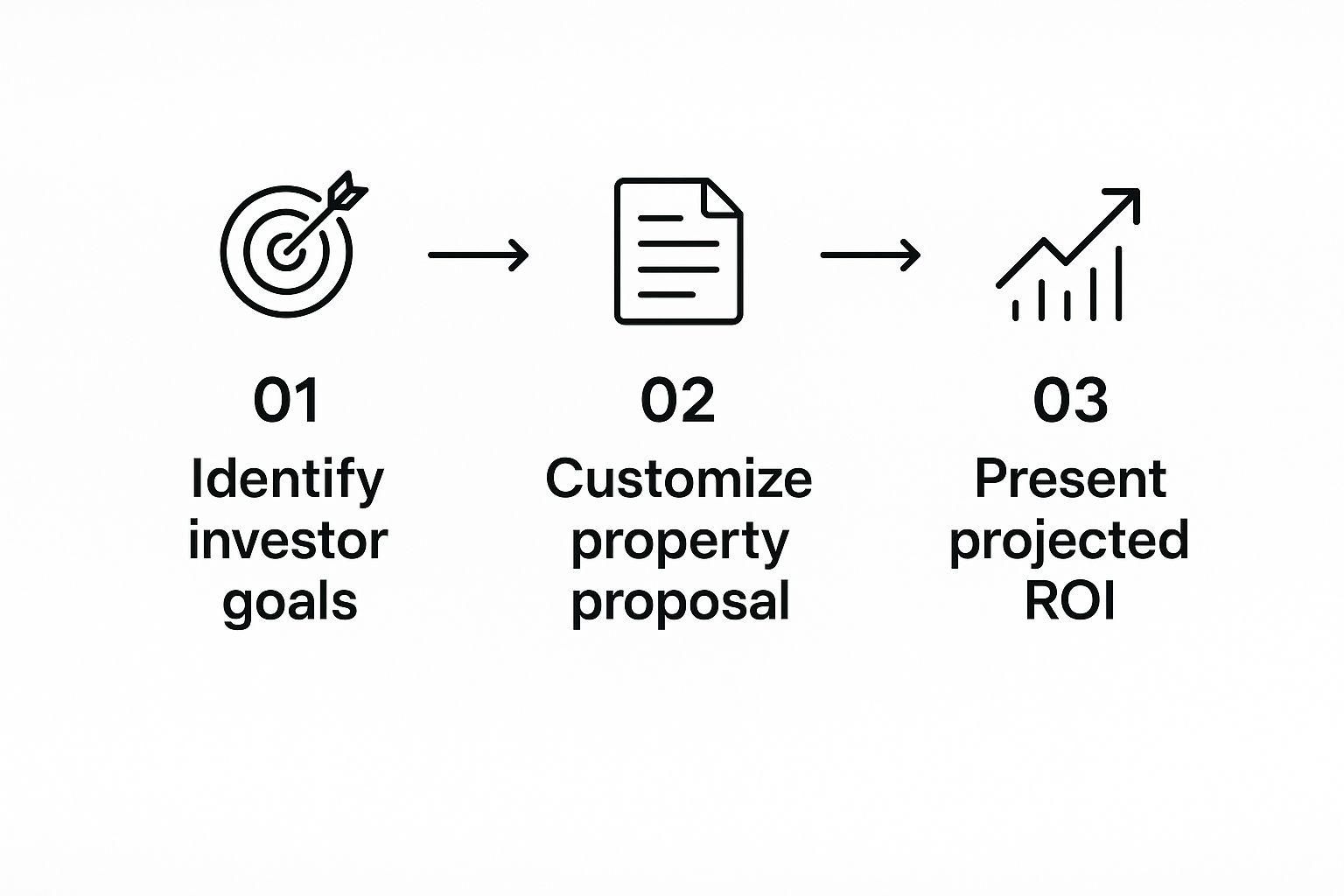

This infographic really nails the core process of aligning your deal with what an investor is actually looking for.

It’s a powerful reminder that successful fundraising is about tailoring your pitch to the investor, not just listing your deal's features.

Comparing Digital Investor Outreach Channels

To get the most out of your online efforts, you need to understand where to spend your time. Each platform has its own culture and attracts a different type of investor. Choosing the right channel for your specific goals is half the battle.

Ultimately, a multi-channel approach often works best. Use one platform to build broad authority and another for highly targeted, one-on-one outreach.

Vet and Approach Crowdfunding Platforms

Real estate crowdfunding sites have opened up a whole new world for sourcing capital. But they're not all created equal. It's best to view them as a powerful tool for both raising funds and dramatically expanding your professional network.

Before you even think about submitting a deal, do your homework on the platform itself.

- Investor Base: Does the platform cater to high-net-worth individuals, or is it more focused on institutional capital? Make sure their audience is your audience.

- Deal Structure: Look at their past deals. Do their typical preferred returns and equity splits align with your financial models?

- Fees and Terms: You have to understand the fee structure inside and out. High platform fees can eat into your returns and make your deal less attractive to investors.

Getting your deal featured on a top-tier platform like CrowdStreet or RealtyMogul provides immense social proof. It validates your underwriting and puts your opportunity in front of a pre-qualified audience that would have been impossible to reach on your own. For more advanced methods, look into personalized real estate lead generation ideas that can help you stand out.

The most effective digital strategy combines broad visibility with targeted, personal outreach. Use platforms to build your reputation at scale, then use that reputation to open doors for one-on-one conversations.

At the end of the day, finding investors online comes down to credibility and targeted communication. Build a professional digital footprint, engage authentically where your ideal investors hang out, and treat every online interaction as a chance to prove your expertise.

Building Trust Through In-Person Networking

In a world filled with digital noise, the power of a firm handshake and direct eye contact has never been more valuable. Finding investors online is a great start, but building the deep, foundational trust that leads to seven-figure commitments? That almost always happens face-to-face.

Remember, capital follows confidence. And nothing builds confidence faster than a genuine, in-person connection. This is how you transform from just another name in an inbox into a credible operator they can actually see themselves partnering with. Every conversation is a chance to build a long-term relationship.

Finding the Right Rooms to Be In

Your time is your most valuable asset, so don’t waste it in the wrong rooms. The mission isn’t to attend every event on the calendar; it's to strategically place yourself where capital is already flowing and real estate conversations are expected. Success here is a game of quality over quantity.

Think beyond the standard real estate meetups. You need to go where high-net-worth individuals and the professionals who advise them congregate.

- Local REIA Meetings: Your local Real Estate Investor Association (REIA) is ground zero. These meetings are fantastic for connecting with other active operators and, more importantly, finding smaller private investors who are already sold on the asset class.

- Wealth Management Seminars: Often hosted by financial advisory firms, these events are packed with people actively looking for ways to grow their wealth outside the stock market. You’ll likely be one of the few real estate experts there, giving you an instant edge.

- Industry-Adjacent Conferences: What about events for attorneys, CPAs, or dentists? These professionals often have significant disposable income and are prime candidates for passive real estate investments.

Your Pre-Event Game Plan

Walking into a networking event without a plan is like driving to a new city without a map. You might stumble upon your destination, but you’ll waste a ton of time and energy. Before you even think about your business cards, define what a “win” looks like.

Here's a hint: it’s not walking out with a check. The real goal is to secure a few high-quality follow-up meetings. Aim for two to three meaningful conversations, not 20 superficial handshakes.

Next, you need to nail your elevator pitch. It shouldn't sound salesy. It needs to be a concise, compelling story about the problem you solve for them.

Bad Pitch: "I syndicate multifamily deals and I'm looking for investors."

Good Pitch: "I help busy professionals build passive income by giving them access to institutional-quality apartment deals they couldn't find on their own."

See the difference? The second one is all about their needs, not yours. It sparks curiosity and invites the most important question: "How do you do that?"

Navigating the Room with Purpose

Once you arrive, it's tempting to find people you already know or hover by the food table. Don't do it. You need a strategy. Scan the room and look for small groups—two or three people are much easier to approach than a large, closed-off circle.

When you join a conversation, your first job is to listen, not talk. Ask open-ended questions about their work or what they’re seeing in the market. People love talking about themselves. By showing genuine interest, you build immediate rapport and gather the intel you need to tailor your own story when it's your turn to speak.

This simple shift turns a transaction into a conversation, and that’s how you start building real trust.

Mastering the Art of the Follow-Up

The real work starts after you leave the event. That stack of business cards on your desk is worthless without a deliberate follow-up strategy. The key is to be prompt, personal, and persistent—without being a pest.

Within 24 hours, send a personalized email to every important person you met. No templates. Reference a specific detail from your conversation to jog their memory and show you were actually listening.

Your email must have a clear call to action. Don't just say, "It was nice meeting you." Propose a specific next step.

- Example 1: "It was great learning about your experience with 1031 exchanges. I have a deal coming up that might be a perfect fit. Do you have 15 minutes for a brief call next week to see if it aligns with your goals?"

- Example 2: "I really enjoyed our chat about the industrial market. I just finished a market report for the submarket I focus on—would you be interested if I sent it over?"

The goal of the first follow-up isn't to get the investment; it's to get the next conversation. By providing value and demonstrating your professionalism, you turn a handshake into a tangible opportunity. That's how you lay the groundwork for a profitable, long-term partnership.

Uncovering Niche and Alternative Funding Sources

The most sophisticated operators know a secret most people miss: the biggest pools of capital are often hiding in plain sight. While everyone else is fighting for attention at the same old networking events, you can unlock massive opportunities by exploring untapped, alternative funding sources.

This is all about moving beyond the obvious. It’s a completely different game that requires finesse and a deep understanding of where serious wealth actually lives and how it moves.

Build a Professional Referral Pipeline

Here’s a hard truth: some of the best investors you’ll ever find will never attend a REIA meeting. Their capital is managed by a tight circle of trusted advisors whose entire job is to find them quality opportunities.

Your goal is to become one of those opportunities.

Think about the professionals who are in the trenches with high-net-worth individuals every single day:

- Wealth Advisors & Financial Planners: These folks are constantly on the hunt for non-correlated assets to get their clients away from stock market volatility. Real estate is a perfect fit.

- CPAs: Accountants have an almost intimate knowledge of their clients' finances. They're often the first to know when a client has a major liquidity event, like selling a business, which creates an urgent need to deploy capital wisely.

- Estate & Trust Attorneys: These attorneys are the gatekeepers to generational wealth. They work directly with family offices and trusts that are looking for stable, long-term investments to preserve their capital.

Now, approaching these professionals isn't about a hard sell. It’s about education. Offer to host a "lunch and learn" at their office. Bring a killer case study showing how a real estate deal can solve a major tax headache for their clients or provide steady cash flow for retirement.

You’re not asking them for money. You're positioning yourself as a valuable resource that makes them look good.

The most powerful introduction you can get is from a trusted advisor. When a CPA tells their client, "You need to talk to this person," you've just bypassed the entire credibility-building phase. The trust is already baked in.

This one strategy turns your one-to-one grind into a one-to-many model. You’re building a pipeline that brings pre-vetted, high-quality investors directly to your doorstep.

Tap Into Self-Directed IRA Capital

There is a staggering amount of investment capital just sitting in retirement accounts, waiting to be put to work. A Self-Directed IRA (SDIRA) is a powerful tool that allows people to invest their retirement funds in alternatives like real estate, but most account holders have no idea how to do it.

This is a massive, underserved market.

Connecting with these investors usually means going through the custodians that hold the accounts. Companies like Equity Trust or Alto IRA are the gatekeepers to thousands of potential partners. You can get in front of them by:

- Speaking on their educational webinars.

- Getting your deals featured on their internal investor marketplaces.

- Networking at events they sponsor for alternative asset investors.

The key here is to present deals that are a perfect fit for a retirement account—think stable, cash-flowing assets with a long-term hold strategy. You’re not just pitching a deal; you're providing a solution for people who want to diversify their retirement but don't know where to start.

Target Under-the-Radar Family Offices

When most people hear "family office," they picture a massive, institutional firm. The reality? There are thousands of smaller family offices managing the wealth of a single family.

They don't have websites or fancy downtown offices. This makes them tough to find, but they are incredibly valuable partners if you can get in the door.

Finding them requires a more creative, relationship-first approach. These are the people you meet through warm referrals from attorneys, at charity galas, or inside exclusive private investment clubs. They value discretion and personal relationships above all else. Your professional track record and the quality of your personal network are your entry tickets here.

Position Your Deals for Niche Investors

Not all capital is generic. Some of the most active investors out there are highly specialized, laser-focused on specific asset classes that are riding major economic waves. If you can align your deals with these trends, you can attract sophisticated capital that is actively hunting for exactly what you have.

For example, traditional commercial real estate is facing serious supply issues. But digitally critical assets like data centers? They're absolutely booming. The UK recently approved a £10 billion data center project, and another $1.2 billion was just secured for new construction in Northern Virginia.

This shows an immense investor appetite for niche assets, and you can learn more about these global real estate trends on JLL.com. To attract these investors, your entire pitch has to speak their language.

If you're targeting industrial investors, your analysis better focus on logistics, supply chain efficiency, and ceiling heights. If it's a data center, you need to be talking about power availability and fiber connectivity. Tailoring your approach this way shows you understand their specific world, instantly making you a far more credible operator.

Common Questions About Raising Real Estate Capital

Once you've found potential investors and are ready to talk shop, a whole new set of questions comes up. Moving from an introduction to a commitment is a delicate dance. It requires more than a great deal—you need to project clarity, confidence, and a real command of how capital raising actually works.

Getting ahead of these common questions will prepare you for those critical moments when a handshake starts turning into a signed agreement.

It's a tough fundraising environment out there. According to the 2024 McKinsey global private markets report, fundraising dropped by a sharp 28% even as global deal values grew 11% to $707 billion. What does that tell us? Deals are still getting done, but investors are being far more selective about where they place their money.

How Should I Structure My First Pitch to an Investor?

Your first real pitch shouldn't feel like you're standing at a podium. Think of it less as a formal presentation and more as a structured, professional conversation. The goal here is to build genuine rapport and establish your credibility, not to steamroll them with a 50-slide deck.

Lead with the story behind the deal. Why this property? Why now? What's the compelling angle that makes this a unique opportunity? After you've hooked them with the narrative, you can smoothly transition into the high-level numbers.

For that initial chat, be ready to cover these points concisely:

- The Big Picture: Briefly explain the market, the submarket, and the specific opportunity you're tapping into.

- The Asset: Describe the property itself and the core of your business plan, whether it's a value-add renovation or a ground-up development.

- The Numbers: Share the key projections investors care about most—the projected IRR, equity multiple, and the anticipated cash-on-cash return.

The key is to keep it conversational. You want to invite questions and create a dialogue. This first meeting is all about sparking their interest and earning the right to a deeper conversation later.

What Legal Documents Do I Need Before Taking Funds?

This one is non-negotiable. Never, ever accept investor capital without having your legal framework locked down. Taking a check before the paperwork is done is not only amateurish—it puts both you and your investors in a legally precarious position.

Before a single dollar changes hands, you must have professionally drafted legal documents that outline every aspect of the deal. This is the bedrock of a secure and transparent partnership.

Your real estate attorney is your best friend here, but you'll need two core documents ready to go at a minimum:

- Private Placement Memorandum (PPM): This is your full disclosure bible. It lays out the entire investment offering, details your business plan, and, most importantly, clearly states all the potential risks involved.

- Operating Agreement: Think of this as the official rulebook for the LLC that will own the property. It defines everything from ownership percentages and voting rights to distribution schedules and the responsibilities of the general partners.

Having these documents prepared and ready to share proves you're a serious operator who respects the process and is committed to protecting your investors' interests.

How Do I Figure Out Deal Structures and Equity Splits?

Working out how much equity to offer an investor can feel like the trickiest part of the puzzle. While every deal has its own nuances, there are some well-established structures that serve as a great starting point for any negotiation. The ultimate goal is to create a structure that feels fair and incentivizes everyone to win together.

A common approach involves a preferred return, often called the "pref." This is a powerful feature for investors because it means they get paid first, up to a certain threshold (a typical pref is 8%), before the sponsor (that's you) starts sharing in the profits.

Once that preferred return is met, any additional profits are distributed based on a predetermined split. A 70/30 split is common, where 70% of the remaining profit goes to the investors and 30% goes to you. More complex deals might use a "waterfall" structure where that split changes as the deal hits higher return milestones. The bottom line is to find a structure where everyone's interests are aligned for success.

Building long-term trust means expertly managing investor documents, distributions, and communications. Homebase simplifies this entire back-office operation with a professional, easy-to-use investor portal that automates the tedious work. From secure e-signatures on subscription agreements to seamless ACH distributions, our platform frees you up to do what you do best: find great deals. See how you can streamline your operations at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Syndicator's Guide to Commercial Real Estate Valuation

Blog

Master commercial real estate valuation with our syndicator's guide. Learn the income, sales, and cost approaches to build investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.