Find Investors for Real Estate: Essential Tactics

Find Investors for Real Estate: Essential Tactics

Discover how to find investors for real estate using proven tactics. Learn actionable tips to secure funding and build valuable partnerships.

Domingo Valadez

May 8, 2025

Blog

Why Smart Money Gravitates to Real Estate Investments

Real estate has always been a fundamental part of a well-diversified investment portfolio. But why is it so appealing to experienced investors? The answer combines financial and psychological factors that truly distinguish real estate from other investment opportunities.

For many, the tangible aspect of owning a physical property offers a sense of security and control difficult to find elsewhere. This inherent stability is a significant factor for those pursuing long-term financial success. Real estate also presents a unique blend of wealth-building strategies that cater to various investment objectives.

Let’s explore these strategies in more detail.

Appreciation Potential

A primary reason investors are drawn to real estate is its potential for appreciation. This refers to the increase in property value over time, which can result in substantial capital gains upon sale.

Historically, real estate values have generally trended upwards, often exceeding inflation and providing a cushion against economic downturns. This potential for sustained growth is a major incentive for those looking to build wealth. It's important to remember, however, that appreciation is not a guarantee and fluctuates depending on market dynamics and location.

Generating Passive Income

In addition to appreciation, real estate offers the ability to generate passive income through rental properties. This steady income stream can provide financial stability and supplement other income sources.

For investors seeking regular cash flow, rental properties deliver a tangible and predictable return on investment. This predictability is especially appealing to those prioritizing financial security, allowing them to build wealth gradually while receiving a consistent cash flow.

The Advantage of Tax Benefits

Real estate also presents distinct tax advantages. These benefits can significantly lower an investor's tax liability, making real estate an even more attractive investment vehicle.

Deductions for mortgage interest, property taxes, and depreciation can shield a substantial portion of income from taxation. These tax advantages can boost the overall return on investment and help investors keep more of their profits.

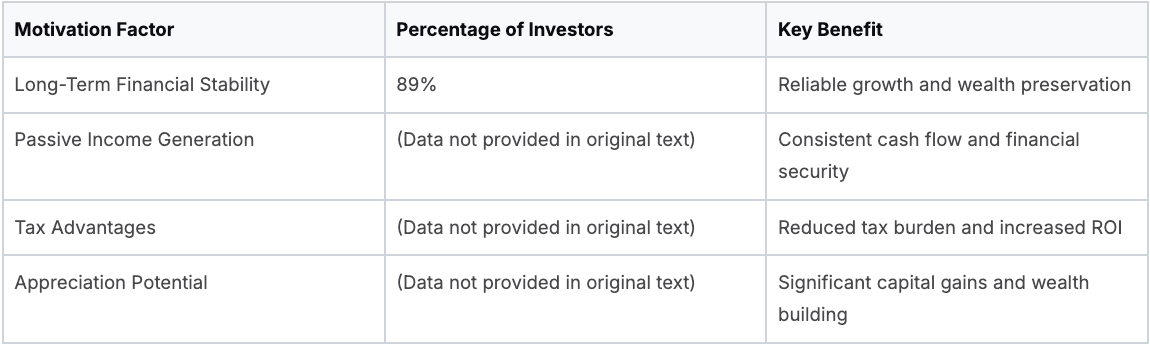

According to Better Homes and Gardens Real Estate, 89% of U.S. investors are interested in real estate investments, primarily driven by the desire for long-term financial stability. This highlights the allure of real estate as a powerful tool for building lasting wealth and achieving financial security.

To further understand investor motivations, let's examine the following table:

Investor Motivations for Real Estate Investment This table outlines the primary reasons investors choose real estate over other investment types.

This table showcases the key motivations driving real estate investment, emphasizing long-term stability, income generation, and tax benefits. While the original text doesn't provide specific percentages for all motivations, the cited statistic highlights the significant emphasis on long-term financial stability.

Understanding these core motivations—appreciation, passive income, and tax advantages—is crucial when seeking investors for your real estate projects. By clearly communicating how your project aligns with these investor priorities, you significantly improve your chances of securing funding. This focused approach builds credibility and trust, distinguishing your proposal from the competition.

Navigating Today's Real Estate Investment Landscape

Before embarking on your quest to find real estate investors, it's essential to grasp the current market dynamics. This means analyzing trends from the perspective of active investors, identifying which property types are attracting capital, and understanding why others are being overlooked. This knowledge is crucial for effectively positioning your project.

Understanding Investor Appetites

The real estate market is in constant flux, influenced by economic shifts, interest rates, and overall investor sentiment. For example, during times of economic uncertainty, investors often gravitate towards safer assets like multifamily properties or well-established commercial spaces.

Conversely, periods of economic growth may spark increased interest in higher-risk, higher-reward opportunities such as land development or emerging asset classes. Understanding these trends is key to tailoring your pitch to current investor priorities.

Keeping abreast of geographic market trends is equally vital. Certain regions may experience a surge in investor activity due to factors like population growth, job creation, or infrastructure development. Showcasing your project within a desirable market can greatly enhance its appeal.

Identifying Promising Property Types

Different property types hold varying levels of appeal for investors. Some sectors, like industrial real estate, have witnessed growing interest due to the rise of e-commerce and the resulting demand for logistics and warehousing space. Understanding the nuances of each sector and aligning your project with in-demand property types can provide a significant advantage.

Other sectors, such as retail, might be facing challenges due to the shift towards online shopping. This doesn't negate the potential for retail investments, but it underscores the need for a robust investment thesis and a clear understanding of market-specific conditions.

Aligning Your Project With Market Realities

The U.S. real estate market has demonstrated resilience despite economic headwinds. Recent years saw approximately 4.1 million transactions, a modest increase of 0.8% from the previous year. This stability is attributed to factors like improved job growth and slightly lower mortgage rates, helping maintain buyer interest despite higher prices.

The median home price reached $375,000, a 5% rise from 2023, indicating continued demand. However, challenges remain, including high mortgage rates and affordability issues, particularly impacting first-time homebuyers. More detailed real estate statistics can be found here.

Ultimately, securing real estate investors depends on your ability to effectively position your project within the larger market context. By understanding investor preferences, identifying promising property types, and showcasing your project's unique strengths, you significantly improve your chances of attracting the necessary capital. This knowledge is fundamental to crafting a compelling investment proposal.

Crafting Investment Proposals That Actually Get Funded

Attracting investors for your real estate ventures requires a compelling investment proposal. Think of your proposal as a bridge connecting your vision with an investor's capital. A weak bridge won't hold up, but a strong one paves the way to funding. This section explores the essential elements of a winning proposal, transforming it into a powerful tool.

Market Analysis: Painting a Clear Picture of Opportunity

A robust market analysis is the foundation of any successful proposal. It's more than just presenting data; it’s about clearly illustrating the opportunity. This means going beyond basic statistics and demonstrating a deep understanding of the target market. This includes understanding demographics, growth potential, and the competitive landscape.

A strong market analysis might reveal untapped demand within a niche. It could also identify emerging trends that position the project for long-term growth. This level of detail builds investor confidence and sets the stage for a compelling narrative.

Financial Projections: Building Trust Through Transparency

Financial projections give investors a tangible roadmap, outlining expected returns and demonstrating the project’s financial viability. These projections need to be realistic, data-driven, and transparent. Clearly present the assumptions behind your calculations.

This allows investors to understand your logic and build trust in your projections. Transparency builds a foundation of trust that supports the entire investor-developer relationship.

Risk Assessment: Demonstrating Foresight, Not Fear

Every investment has risks. A well-crafted risk assessment acknowledges challenges and demonstrates foresight. By proactively identifying potential obstacles and outlining mitigation strategies, you showcase a thoughtful approach. This reassures investors that you’ve considered both the upside and the downside. This proactive approach demonstrates your ability to navigate potential challenges and protect their investment.

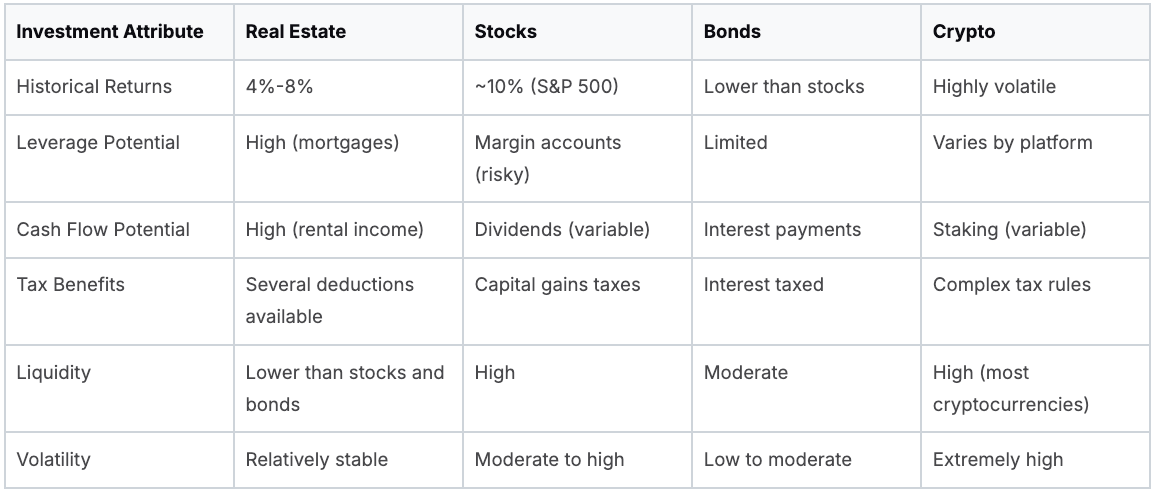

Real Estate's Place in the Investment Landscape

Real estate offers unique advantages compared to other investment types. Historically, it has created wealth for many, largely due to the leverage involved. Investors can use mortgages, maximizing returns on a smaller initial investment. Real estate also generates cash flow through rental income and offers tax benefits, diversifying portfolios.

To understand these differences clearly, let's look at the following comparison:

Real Estate vs. Other Investment Types Comparison of key attributes between real estate and other popular investment vehicles

The table above highlights key differences in historical returns, leverage potential, and other factors. While real estate offers advantages like cash flow and leverage, stocks, as represented by the S&P 500's average 10% annual return, have historically seen higher returns. Learn more about the historical performance comparison between real estate and stock investing at theluxuryplaybook.com.

Visual Communication: Making Complex Data Accessible

Finally, leverage the power of visual communication. Charts, graphs, and tables transform complex data into easily digestible insights. This enhances the clarity and impact of your proposal. A visually appealing presentation grabs attention and helps investors quickly grasp key information. This makes it easier for them to understand the opportunity and make informed decisions. This reinforces professionalism and dedication to a compelling case.

Where to Find Investors for Real Estate That Others Miss

While networking events and online platforms are common ways to find real estate investors, thinking outside the box can unlock access to untapped capital. This involves understanding different investor categories and strategically targeting those aligned with your project and market conditions.

Tapping Into Untapped Networks

Beyond the usual sources, consider less conventional options. High-net-worth individuals often seek investments with tax advantages, making real estate appealing. Approaching them through targeted introductions or specialized wealth management firms can open doors to significant funding. Attending industry conferences or charitable events frequented by these individuals can create valuable networking opportunities.

Family offices, which manage the wealth of affluent families, are another often overlooked source. These groups often prioritize long-term growth and wealth preservation, aligning with real estate’s stability. Accessing these investors often requires warm introductions through professional networks.

Leveraging Professional Relationships

Your existing professional network can be invaluable. Attorneys, CPAs, and wealth advisors often have connections with individuals seeking investment opportunities. These professionals can be trusted intermediaries, facilitating introductions to qualified investors. They can also offer insights into structuring deals that benefit all parties.

Building strong relationships with these professionals is key. Regular communication and collaboration ensure they keep you in mind for suitable investment opportunities. This positions you as a reliable partner, increasing your chances of valuable introductions. Staying in touch, sharing project updates, and offering reciprocal support are all important.

Matching Investors to Project Needs

Not all investors are the same. Sophisticated investors might be interested in complex development projects with higher risk and potentially greater returns. Conservative investors may prefer stable, income-generating properties like multifamily housing.

Matching your project to the right investor is crucial. This means understanding your project's risk profile, return potential, and overall investment thesis. It also involves crafting a compelling narrative that resonates with your target investor group. This is especially important for niche real estate investment strategies or commercial property development.

Exploring Emerging Platforms

Online platforms are constantly evolving, offering new ways to connect with potential investors. Crowdfunding platforms and real estate investment marketplaces broaden your reach. These platforms offer a streamlined approach to fundraising, often attracting investors seeking passive participation in real estate projects. Learn more in our article about How to master real estate capital raising strategies.

However, vet these platforms carefully, considering fees, due diligence processes, and investor accreditation requirements. Choosing the right platform depends on your target investor and project specifics. A platform specializing in accredited investors may be better for larger, more complex developments.

By looking beyond traditional channels, you can uncover a wealth of investment opportunities. This includes leveraging professional relationships, understanding investor motivations, and utilizing emerging platforms. This proactive approach not only increases your funding chances but also builds a diverse network of capital partners for long-term success. Securing investment isn’t just about finding capital; it’s about building lasting relationships that fuel growth.

Building Investor Relationships That Survive Market Cycles

Building enduring relationships with investors is essential for long-term success in real estate. While securing that initial funding is a critical first step, cultivating a community of investors provides more reliable access to capital across multiple projects. This ongoing support can also help you navigate the inevitable market fluctuations. Doing so requires a shift in perspective: from viewing investors as simply sources of capital to valuing them as true business partners.

Communication: The Foundation of Trust

Consistent and transparent communication builds trust and fosters strong investor relationships. Establish a regular communication schedule that keeps investors informed without overwhelming them. Regular newsletters, for example, can offer valuable market updates and project highlights. Additionally, personalized updates on individual investments demonstrate that you value each investor’s contribution.

However, effective communication isn't solely about frequency; it’s also about quality. Be proactive in sharing both positive and negative news. Transparency, even when discussing challenges, shows integrity and strengthens investor confidence. This openness builds a foundation of trust that can weather market volatility.

Transparency: Building Unshakable Confidence

Transparency goes beyond communication to encompass all aspects of your interactions with investors. Provide clear and accurate financial reporting, offering investors insights into project performance and overall financial health. This open approach reinforces your professionalism and builds trust.

Consider using a platform like Homebase, which provides tools for streamlined reporting and document sharing. This not only simplifies your workflow but also reinforces your commitment to transparency and efficient investor relations. For instance, easy access to project financials fosters a sense of confidence and partnership.

Reporting Frameworks: Demonstrating Professionalism

Establish a robust reporting framework that keeps investors informed and engaged. Regular updates on key metrics, such as occupancy rates and net operating income, provide valuable insights into project performance. This data-driven approach also empowers investors to make informed decisions about future investments.

Moreover, providing context and analysis along with the raw data adds significant value. Explain any deviations from projections and outline your strategies for addressing challenges. This insightful commentary elevates your reporting beyond just numbers, demonstrating your expertise and commitment to maximizing investor returns.

From Capital Sources to Genuine Partnerships

Building investor relationships is about more than just securing funding; it’s about creating mutually beneficial scenarios. By prioritizing clear communication, transparency, and professional reporting, you cultivate a community of engaged and supportive investors. These strong relationships can provide access to consistent capital, even during market downturns, fueling your continued growth and creating shared success over time.

Navigating Legal Requirements When Finding Investors

Finding investors for real estate involves more than just a compelling pitch. It requires a firm grasp of legal regulations. Overlooking securities compliance can derail even the most lucrative ventures. This means understanding the rules governing how you raise capital and structure your investments. This knowledge protects both you and your investors.

Understanding Securities Regulations

Real estate investments often involve securities, regulated by federal and state laws. The Securities Act of 1933 and the Securities Exchange Act of 1934 are key federal laws governing the offer and sale of securities. These regulations aim to protect investors from fraud and ensure market transparency. Understanding these regulations is crucial for anyone seeking outside investment.

One common fundraising method is through private placements. These offerings are typically exempt from registration with the Securities and Exchange Commission (SEC) but have specific requirements, including limits on the number and type of investors. Additionally, crowdfunding regulations have emerged as a newer fundraising avenue, offering both opportunities and unique legal considerations. Navigating these requires careful attention to detail.

Investor Accreditation: A Crucial Distinction

A critical aspect of securities regulations is investor accreditation. Accredited investors, defined by the SEC, are individuals or entities meeting specific financial benchmarks. These include a net worth exceeding $1 million (excluding their primary residence) or an annual income over $200,000 (or $300,000 jointly with a spouse) for the past two years.

Different rules apply to accredited and non-accredited investors, affecting your fundraising strategy. Knowing your target investor's accreditation status is essential, as it dictates the type of offering you can make and the information you must disclose. This distinction influences your marketing and how you structure investments. For instance, offerings to non-accredited investors often require more extensive disclosures and investor protections.

Legal Structures for Real Estate Investments

Choosing the right legal structure is vital for protecting investments and minimizing liability. Several common structures exist, each with its own tax and liability implications. Limited Liability Companies (LLCs) offer a flexible structure combining pass-through taxation with limited liability protection.

Delaware Statutory Trusts (DSTs) allow fractional ownership of institutional-grade real estate, offering potential tax benefits and diversification. Real Estate Investment Trusts (REITs) are publicly traded companies owning or financing income-producing real estate, providing liquidity and diversification for investors. Finally, various partnership arrangements can be tailored to specific investment objectives.

Understanding the nuances of each structure is crucial. For example, an LLC might suit a smaller development project, while a DST might be more appropriate for passive ownership in a larger, established property. Making informed decisions aligned with your investment strategy is key.

Building Compliant Investment Relationships

Building compliant investment relationships requires careful attention to legal documentation and ongoing communication. Clear, comprehensive operating agreements or partnership agreements are essential. These agreements should outline the roles and responsibilities of all parties, profit and loss distribution, and the dispute resolution process.

Maintaining proper records and following regulatory requirements is crucial to avoid legal issues. Transparency and communication are vital for strong investor relationships. Regular updates and clear financial reporting build trust and demonstrate professionalism. This open communication fosters confidence and protects all parties, especially in navigating the complexities of real estate transactions.

Successfully navigating the legal side of finding real estate investors requires a proactive approach and commitment to compliance. Understanding securities regulations, investor accreditation, and choosing the appropriate legal structure allows you to build strong, compliant investment relationships, protecting both you and your partners. Streamline investor management and ensure compliance with Homebase, the all-in-one platform built for real estate syndicators.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.