Difference Between General Partnership and Limited Partnership

Difference Between General Partnership and Limited Partnership

Explore the difference between general partnership and limited partnership. Understand liability, control, and tax implications for your real estate venture.

Domingo Valadez

Jan 20, 2026

Blog

The real heart of the matter when comparing a general partnership to a limited partnership comes down to two things: liability and control. It's a simple distinction with massive consequences for everyone involved in a real estate deal.

In a general partnership (GP), think of it as an "all in, all together" setup. Every partner typically has a say in the business, but they also share unlimited personal liability for all its debts. One bad move can put everyone's personal assets on the line.

A limited partnership (LP), on the other hand, creates a clear division. It’s designed to shield passive investors by capping their financial risk to whatever they've invested. All the day-to-day management—and the unlimited liability that comes with it—is concentrated in the hands of a single general partner, who is usually the deal sponsor.

Understanding the Core Partnership Structures

Picking the right legal structure is arguably the most important decision you'll make when putting together a real estate deal with outside investors. This isn't just paperwork; it directly defines your personal risk, how the project will be run, and frankly, whether you'll even be able to attract capital in the first place.

While both are technically "partnerships," they serve completely different purposes in the world of real estate syndication. An inexperienced choice here can lead straight to financial disaster.

- General Partnership (GP): This is the simplest, most informal kind of partnership. If two or more people just decide to go into business together without filing any official paperwork, they've likely formed a GP. Everyone shares in the management and, most critically, everyone is personally on the hook for the business's debts. A lawsuit or a defaulted loan can go after any partner's personal bank account, house, or other assets.

- Limited Partnership (LP): This structure is much more formal and is the bedrock of real estate syndication. It creates two distinct classes of partners: the General Partner (the sponsor running the show) and the Limited Partners (the passive investors). The GP makes the decisions and carries the unlimited liability. The LPs contribute capital, take a backseat on management, and in return, their liability is strictly limited to the amount of money they put into the deal. This protection is precisely why it's the industry standard.

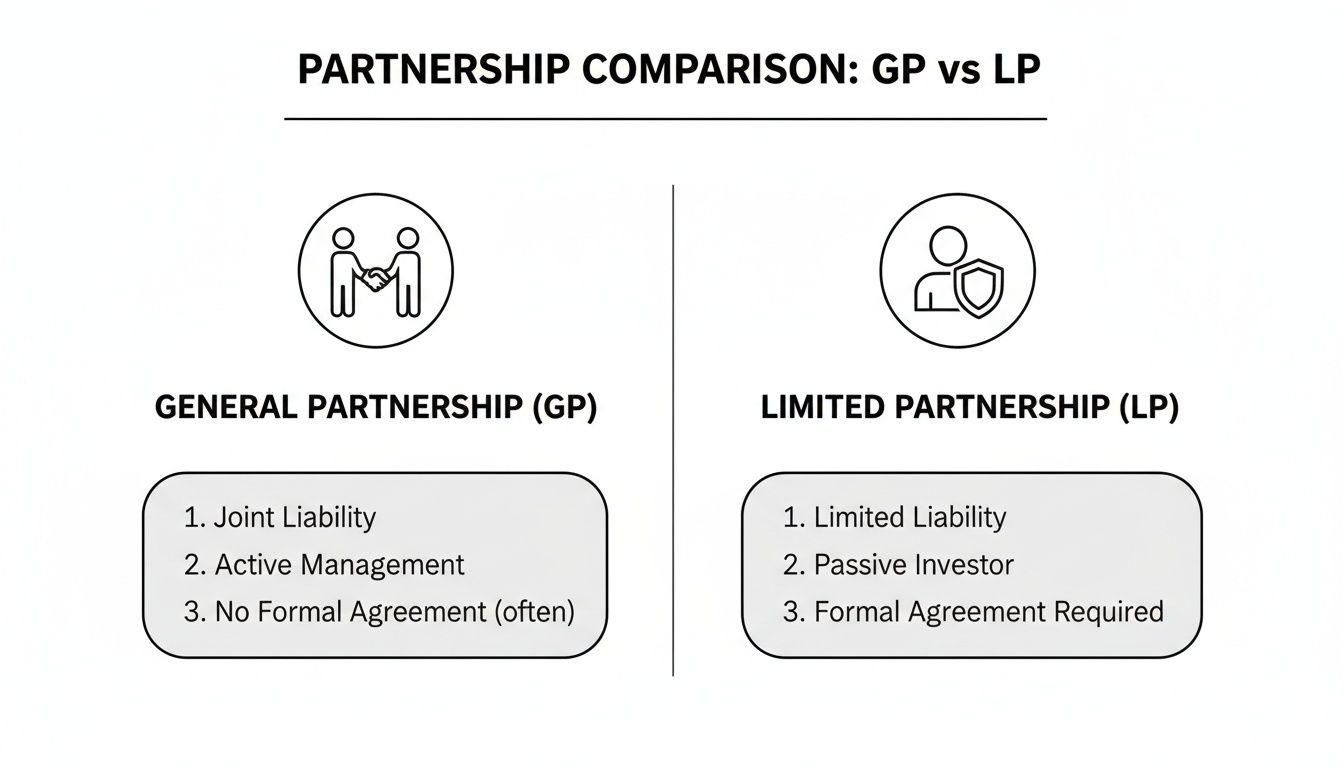

This side-by-side comparison chart breaks down how these two structures really stack up.

As you can see, the LP's biggest advantage for anyone trying to raise money is that protective shield it offers to investors. Without it, you’d have a hard time finding anyone willing to write a check.

Key Differences at a Glance

Let's distill this down into a quick-reference table focused specifically on what matters in a real estate deal.

Key Differences GP vs LP for Real Estate Deals

This table offers a high-level overview comparing the fundamental characteristics of General Partnerships and Limited Partnerships in the context of real estate syndication.

The critical takeaway for any sponsor is this: sophisticated investors will almost never accept the unlimited personal risk that comes with a general partnership. It's a non-starter.

The Limited Partnership structure was specifically created to solve this problem. It legally separates active management from passive investment, giving investors the confidence they need to commit capital to your deal. For anyone serious about building a scalable real estate investment business, the LP isn't just the better choice—it's the only practical choice.

Defining the Core Partnership Structures

Before we jump into a side-by-side comparison, let’s get a solid handle on what these two partnership models actually are, especially in the high-stakes game of real estate investing. The distinction between a general partnership and a limited partnership isn’t just a legal footnote; it fundamentally dictates who has control, who bears the risk, and how you can raise capital. Picking the wrong structure can put you and your investors in a world of financial hurt.

At its most basic, a general partnership (GP) is what most people think of when two or more people decide to go into business together. It's the simplest structure, often formed by default with nothing more than a handshake agreement. In this setup, all partners typically share in the day-to-day management, the profits, and—this is the critical part—unlimited personal liability for the business's debts.

This means if the partnership can't pay its bills or gets hit with a lawsuit, creditors can go after each partner's personal assets. We're talking about their homes, their savings, and anything else they own. There’s no legal wall between the business and the partners themselves.

The General Partnership Model

A general partnership runs on a simple premise: shared risk, shared reward. It’s a structure built on a foundation of mutual trust and equal standing, which works well for small, hands-on collaborations.

- Equal Management Rights: Unless a formal partnership agreement says otherwise, every partner gets an equal vote in how the business is run.

- Joint and Several Liability: This is the GP's biggest Achilles' heel. It means any single partner can be held liable for 100% of the partnership's debts, no matter what their ownership stake is or who was actually at fault.

- Informal and Risky Creation: Because a general partnership doesn't require a formal state filing, it can be created accidentally. Two people working on a flip together could unknowingly form one, leaving them completely exposed.

This level of personal risk is precisely why the general partnership model is a non-starter for real estate syndication, where passive investors must have their personal wealth shielded from the deal's liabilities.

The Limited Partnership Advantage

A limited partnership (LP), on the other hand, is a more sophisticated structure specifically designed to bring in passive capital. It achieves this by creating two very different classes of partners, which is the magic ingredient for real estate syndication.

A Limited Partnership creates a legal firewall. It separates the active manager who assumes the risk from the passive investors who provide the capital, making large-scale investment possible. This division is the foundation of modern real estate syndication.

The LP structure is built on two distinct roles:

- The General Partner (GP): This is you, the sponsor or operator. You run the show, execute the business plan, and take on unlimited personal liability for the partnership's debts and obligations.

- The Limited Partners (LPs): These are your passive investors. They contribute the capital, and in return, they get limited liability. Their potential loss is strictly capped at the amount they invested. The trade-off is they cannot be involved in managing the asset.

Grasping these fundamental roles is the key to understanding why one structure works for syndication and the other doesn't. Many real estate deals are a form of direct investment vehicle; exploring how Direct Participation Program (DPP) Investments work can offer more context, as they often make investors direct partners in an enterprise. The clear-cut separation of duties and liability is exactly why the LP is the go-to entity for syndicators.

Comparing Liability and Management Control

When you’re setting up a real estate deal, two things matter more than anything else: who’s on the hook if things go wrong, and who gets to call the shots. This is the heart of the debate between a general partnership (GP) and a limited partnership (LP). These aren't just details for the lawyers; they define the risk and reward for everyone at the table.

In a general partnership, everyone is in it together, for better or worse. All partners share unlimited liability, meaning their personal assets are fair game to cover the partnership's debts. It’s a structure built on total shared risk.

A limited partnership, on the other hand, is specifically designed to separate risk from capital. It creates a firewall around the passive investors, which is why it’s the go-to structure for raising money in real estate syndication.

The Critical Role of Liability Protection

The scariest part of a general partnership is a concept called "joint and several liability." In plain English, it means a creditor can chase any one partner for the entire debt of the business, no matter how small their stake was. It’s then up to that partner to try and get the others to pay them back.

Let's walk through a real-world nightmare scenario:

- The Setup: Two friends, Alex and Ben, form a general partnership to flip a duplex.

- The Mistake: Alex decides to hire a cheaper, uninsured contractor to save a few bucks. Ben isn't even aware. The contractor messes up big-time, causing serious damage to the neighbor’s foundation.

- The Fallout: The lawsuit and repairs come to $500,000—way more than the property is worth. The neighbor's lawyer can legally go after Ben for the full amount, seizing his family home, retirement accounts, and savings, even though he had nothing to do with the bad decision.

This is exactly why you'll never find a passive investor willing to join a general partnership. The risk is just too great.

A limited partnership solves this problem completely. It puts a hard stop on a limited partner's financial risk, capping their exposure at the exact amount they invested. This liability shield is non-negotiable for anyone serious about raising capital for a real estate syndication.

The numbers tell the story. While general partnerships are common, LPs are where the serious money is. According to 2021 IRS tax data, limited partnerships accounted for just 9.9% of all partnerships, but they involved a massive 10.4 million partners and generated $1.4 trillion in pass-through income. It's a clear sign that LPs are the vehicle for large-scale, capital-heavy projects, like the deals managed through platforms like Homebase. You can dive into the complete partnership statistics from the IRS to see the full picture.

Centralized Management vs. Democratic Control

Beyond the liability shield, the way decisions are made is a night-and-day difference between these two structures. A general partnership is usually a democracy, where all partners have an equal say in running the business.

While that might sound fair on the surface, in the fast-paced world of real estate, it’s often a recipe for disaster.

- Decision Paralysis: Imagine trying to get five partners to agree on a counteroffer before a deadline expires. Requiring a consensus on every little thing slows the deal down and can lead to missed opportunities.

- Conflicting Agendas: Different partners will inevitably have different opinions on strategy, spending, and when to sell. These internal conflicts can easily poison a deal from the inside out.

The limited partnership structure is built for speed and efficiency. It concentrates all decision-making power with the General Partner (GP), or the sponsor. This isn't about control for control's sake; it's a feature designed for decisive action.

The GP has the sole authority to manage the property, negotiate with lenders, and execute the business plan without needing to take a vote. This is a huge advantage when you need to act fast, whether it's navigating a tricky renovation or jumping on a great offer to sell.

For the limited partners, it’s a simple trade-off: they give up control in exchange for a passive investment with protected liability. They’re betting on the sponsor’s expertise to deliver returns. This clear separation of duties is a fundamental difference between a general partnership and limited partnership.

How Capital and Profits Are Allocated

The way money flows into and out of a partnership is where these two structures really diverge. Understanding how capital is raised and profits are split is critical, as it directly shapes the risk, reward, and role of everyone at the table. It’s what makes a deal either attractive or a non-starter for both sponsors and investors.

In a classic general partnership, things are usually straightforward. Capital contributions and profit splits tend to be symmetrical. If you and a partner both put in 50% of the cash, you’ll likely split the profits 50/50. While you can certainly draft an agreement to change this, the default assumption is one of shared input for shared output.

The limited partnership model, on the other hand, operates on a completely different, asymmetrical logic. This is precisely why it’s become the go-to structure for real estate syndications. The roles of providing capital and managing the deal are intentionally separated.

Capital Contributions: The Investor's Role

In a limited partnership, the heavy lifting of funding the deal falls almost entirely on the limited partners (LPs). They act as the passive equity investors, often putting up 90% to 100% of the capital needed to buy and improve the property. Their role is purely financial—they provide the funds and expect a return.

The general partner (GP), or sponsor, typically contributes a much smaller slice of the equity, often just 5% to 10%. In some deals, a GP's contribution is almost entirely "sweat equity"—their expertise in finding the deal, their time spent executing the business plan, and their network. This setup is a game-changer because it allows a talented sponsor to control a significant real estate asset with a relatively small personal investment, making syndication possible.

The core difference is this: a limited partnership unbundles capital from management. Limited partners provide the fuel (money), while the general partner acts as the engine and steering wheel (deal execution). This creates a powerful specialization of roles you just don't get in a general partnership.

Profit Allocation: The Syndication Waterfall

Distributing profits in a limited partnership is far more sophisticated than a simple percentage split. It’s designed to first protect investor capital and then reward the sponsor for strong performance. This is done through a tiered structure known as a distribution waterfall.

This waterfall isn’t a free-for-all. It has a specific, multi-step order:

- Return of Capital: The first priority is always getting the limited partners' initial investment back to them.

- Preferred Return: Next, LPs usually earn a preferred return (or "pref"). Think of this as an annual hurdle rate, often 6-8%, that the sponsor must deliver to investors before they can earn a significant share of the profits.

- The Promote: Once LPs have received their capital back plus their preferred return, the remaining profits are split. This is where the GP gets their big reward—a disproportionate share called the promote or carried interest. A common split here is 70/30, meaning 70% of these excess profits go to the LPs and 30% goes to the GP.

This structure powerfully incentivizes the GP to exceed the minimum return targets. Their real payday comes from the promote. Of course, the GP also earns fees for their active work, like acquisition fees for finding the deal and asset management fees for overseeing the property.

You can even see how effective this model is by looking at publicly traded Master Limited Partnerships (MLPs). Research has shown that general partner interests in MLPs grew their cash flows per share at 2.4 times the rate of limited partner units, and their yields climbed by 8% annually. This highlights how the GP structure is engineered to capture outsized returns for successful management, a model that often includes safeguards like subordinating GP distributions to protect LPs if cash flow dips. You can dig deeper into how these partnership models perform in public markets to see the financial dynamics in action.

Understanding Formation and Regulatory Hurdles

When you're weighing a general partnership against a limited partnership, how you actually create them is one of the most glaring differences. The simplicity of starting a general partnership is its biggest draw, but frankly, it’s also its greatest danger, especially in the world of real estate.

A general partnership can be born from a handshake, a verbal agreement, or even just by two or more people acting like business partners. This informality is tempting—no state filings, no legal fees, no paperwork. But that ease comes at a steep price. Without a written agreement spelling out roles, responsibilities, and what happens when someone wants out, you're setting the stage for bitter disputes and, as we've covered, unlimited personal liability.

The Formalities of a Limited Partnership

A limited partnership (LP), on the other hand, is a different beast entirely. It’s a formal legal entity that you can't just stumble into. Forming an LP is a deliberate, structured process with specific legal steps designed to protect everyone involved.

For real estate syndication, this formal structure is non-negotiable. It's what gives your limited partners their liability shield and what legally defines your authority as the general partner right from the start.

Here’s what that process typically looks like:

- Filing a Certificate of Limited Partnership: You’ll file this document with the secretary of state where the LP is formed. It’s the official birth certificate of your business, putting the public on notice that you exist and how you’re structured.

- Drafting a Limited Partnership Agreement: This is the operational bible for your deal. It’s the legal document that governs everything—from who puts in what capital and how profits are split to the specific rights and duties of both the general and limited partners. For a deeper dive, check out our guide on what is a limited partnership agreement.

- Appointing a Registered Agent: Every LP needs to name a registered agent—a person or service designated to receive official legal notices and tax documents.

This formal structure isn't just modern legal red tape; it has deep historical roots. Looking back at 19th-century New York, you can see that limited partnerships were magnets for capital in a way general partnerships never were. By 1853 alone, "special partners"—the ancestors of today’s LPs—poured over $6 million into new ventures. This shows that the limited liability structure has always been key to pooling serious capital for major projects. You can discover more insights about partnership capital formation to see these historical trends for yourself.

Navigating Securities Regulations

Here’s where another layer of complexity comes in, and it's almost exclusively a concern for limited partnerships. The moment you start raising money from passive investors for a real estate deal, you're no longer just buying property—you're selling a security.

This is a crucial point for every real estate sponsor to understand: an interest in a limited partnership is considered a security. This means your offering must comply with federal and state securities laws enforced by the Securities and Exchange Commission (SEC).

Getting this wrong can have severe consequences, from hefty fines to having to unwind the entire deal. These regulations are all about investor protection. They exist to make sure the people putting up the capital are fully informed and can financially handle the risks they're taking.

For most real estate syndicators, complying means raising capital under an SEC exemption, like Regulation D. This often requires that your limited partners be accredited investors, which means they meet specific income or net worth criteria. As a sponsor, you have to take reasonable steps to verify their status, which means collecting and reviewing sensitive financial documents.

This is exactly the kind of administrative headache that modern platforms like Homebase are designed to solve. We can help automate this verification process, ensuring you stay compliant while giving your investors a smooth, professional onboarding experience.

Choosing the Right Structure for Your Real-Estate Deal

After laying out the differences in liability, management, and the flow of money, the right choice for a real estate syndicator should be crystal clear. Deciding between a general partnership and a limited partnership isn't just about preference; it's a foundational business decision that dictates how you can operate and grow. If your strategy involves bringing in capital from passive investors, the limited partnership is the industry standard for some very good reasons.

A general partnership, with its all-for-one approach to control and unlimited liability, just doesn't fit the syndication model. It's a structure that works best for a simple joint venture—maybe two highly trusted partners actively managing a property together, both comfortable putting their entire personal net worth on the line. For anything more complex than that, it's a recipe for unacceptable risk.

The Decisive Factors for Sponsors

For any sponsor who wants to build a real estate business that can scale, the decision really comes down to three things you can't compromise on. These are the pillars of any successful syndication, and only a limited partnership (or a similarly structured LLC) gets the job done.

- Investor Liability Protection: This is the big one. Sophisticated passive investors simply will not expose their personal assets to the unlimited risks of a real estate deal. The liability shield an LP provides is the ticket to entry for attracting outside capital.

- Centralized Sponsor Control: Real estate deals require quick, decisive leadership. The LP structure places all management authority squarely with the general partner, which means you can execute your business plan without getting bogged down by a committee vote on every decision.

- Scalability for Fundraising: A formal LP structure, backed by a solid partnership agreement, creates a professional framework that inspires investor confidence. It’s a repeatable model you can use to raise capital for one deal after another.

The core difference is that a general partnership is a collaboration model, while a limited partnership is an investment model. One is designed for active participants, the other for separating passive capital from active management—the very essence of real estate syndication.

Ultimately, the structure you choose sends a powerful message. A general partnership screams "high-risk, informal arrangement." A limited partnership, on the other hand, signals a professional, secure, and well-managed investment opportunity—one designed to protect investor capital while giving you the control needed to deliver returns.

While General Partnerships and Limited Partnerships offer distinct benefits, investors should also consider other common structures, such as deciding whether to buy a short-term rental in your name or through an LLC, to align with their investment strategy. For the syndicator, however, the LP provides the essential legal and financial framework necessary to build trust, attract capital, and execute complex real estate strategies.

Frequently Asked Questions

Even with the core concepts down, real estate sponsors and investors usually have a few lingering questions. Let's tackle some of the most common ones that come up when deciding between these partnership structures.

Can a Limited Partner Lose More Than Their Initial Investment?

In a word, no. A limited partner's potential loss is strictly capped at the amount of capital they've contributed to the deal. This is the entire point of the LP structure and the legal firewall that makes passive real estate investing possible for so many.

Personal assets like your home, savings, or other investments are completely shielded from any partnership debts or legal claims that might arise. This fundamental protection is the bedrock of real estate syndication.

Is an LLC Better Than a Limited Partnership for Syndication?

This is a great question, and the answer is: it depends. A Limited Liability Company (LLC) offers very similar liability protections, and honestly, many modern syndications use an LLC structure that elects to be taxed as a partnership.

The choice often boils down to subtle differences in state law, the preferences of legal counsel, or even just what investors are most comfortable with. Both structures get the job done by separating passive investors from active management and liability. For a real estate syndicator, the day-to-day operations look almost identical under either structure.

The key takeaway is that both an LP and a manager-managed LLC are designed to separate passive capital from active management. The specific choice is often a strategic legal decision, but the core function in syndication remains the same.

What Happens If a General Partner in an LP Wants to Leave?

A general partner leaving is a major event, and it’s something that absolutely must be planned for in the Limited Partnership Agreement from day one. A well-constructed agreement will have a clear roadmap for what happens next, whether it’s a process for succession, a partner buyout, or even dissolving the partnership.

Without these clauses, you’re flying blind. A typical process might involve a majority vote from the limited partners to approve a new GP or decide on the asset's future. If the agreement is silent on this, state law might automatically dissolve the partnership, which could be a disaster for everyone. This is why a rock-solid legal agreement isn't just a suggestion; it's essential to protect the investment through any leadership changes.

Streamlining your real estate syndication is simpler than you think. Homebase is the all-in-one platform trusted by sponsors to manage fundraising, investor relations, and distributions with ease. Discover how you can focus on deals, not busywork, by visiting https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Your Guide to Hard Money Commercial Lending in 2026

Blog

Unlock deals with our guide to hard money commercial lending. Learn how syndicators can leverage asset-based financing for rapid acquisitions and growth.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.