Define Mezzanine Loan A Guide to Hybrid Financing

Define Mezzanine Loan A Guide to Hybrid Financing

Need to define mezzanine loan? Our guide demystifies this hybrid financing tool, explaining its role in the capital stack with clear, real-world examples.

Domingo Valadez

Oct 25, 2025

Blog

A mezzanine loan is a unique form of financing that acts as a bridge, filling the gap between what a traditional bank will lend and the cash a developer has on hand. Think of it as the middle layer of a project's funding—it sits just above the primary mortgage (senior debt) but below the owner's own investment (equity).

This position in the "capital stack" makes it a go-to solution when a project is promising but the numbers don't quite line up for conventional financing alone.

What Exactly Is a Mezzanine Loan?

Let's break it down with a simple real estate scenario. Imagine you want to buy a commercial building. A bank agrees to lend you 70% of the purchase price, but you only have enough cash for a 10% down payment. You're left with a 20% shortfall. That's precisely where a mezzanine loan comes in.

This financing isn't just a standard loan; it's a hybrid with two key parts:

- It's part debt: You make regular interest payments, just like with a typical loan. However, because the lender is taking on more risk, these rates are significantly higher than a bank's, often falling between 12% and 20%.

- It's part equity: The lender also gets what’s called an "equity kicker," usually in the form of warrants. This gives them the option to convert a piece of the loan into an ownership stake down the road, letting them share in the profits if the project is a big success.

This structure is a direct result of its place in the repayment line. If the project goes belly-up, the mezzanine lender only gets paid after the primary bank is made whole. More risk for them means they need the potential for a higher reward.

Essentially, mezzanine financing gives a borrower more capital than a bank will offer, but without diluting their ownership as much as bringing in a pure equity partner would. It’s the flexible middle ground.

This blend of features makes it perfect for specific situations, like getting a major real estate development off the ground, funding a management buyout, or powering a company's big expansion push. It's the fuel that helps ambitious projects get across the finish line.

Mezzanine Loan At a Glance

To quickly summarize, here are the core characteristics of a typical mezzanine loan.

This table highlights why it's considered a hybrid tool—it borrows features from both traditional debt and equity investing to create a highly specialized financing solution.

Finding Its Place in the Capital Stack

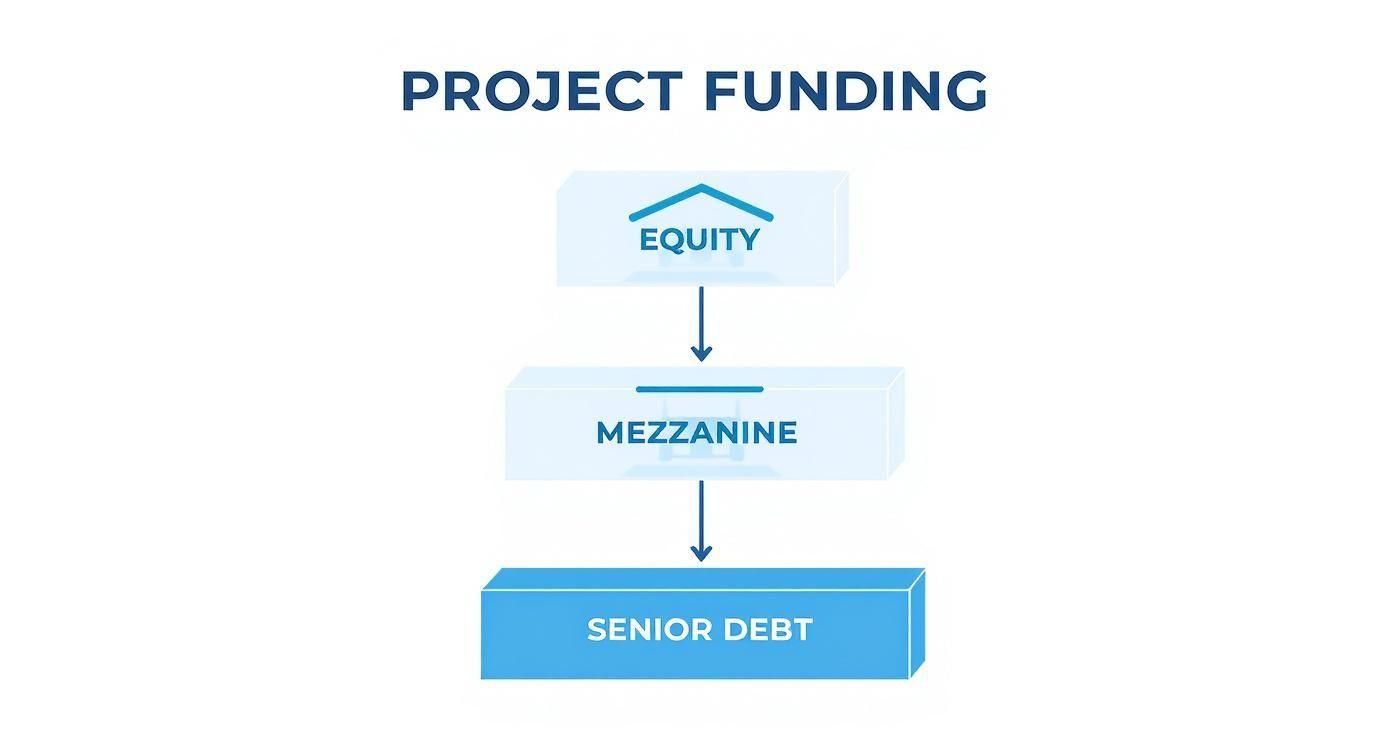

To really get what a mezzanine loan is, you have to understand where it fits in the financial food chain. Think of a project's funding as a layered cake—what we in the industry call the capital stack. Each layer is a different type of money with its own level of risk and a specific spot in the line for repayment. It's the blueprint for who gets paid first if things go sideways.

The foundation, the biggest and safest layer, is senior debt. This is your classic bank mortgage. It's the most secure position, which means it has the lowest risk and, you guessed it, the lowest interest rates.

At the very top, you have equity—the skin in the game from the project's owners and investors. This is the riskiest spot. Equity holders get paid last, but they also get the biggest slice of the profits if the project is a home run.

Mezzanine financing lives right in that sweet spot in the middle, sandwiched between the secure senior debt and the high-risk/high-reward equity.

The Pecking Order of Repayment

This position in the stack is everything. It determines the risk, the cost, and the potential reward for the lender. If a project defaults and has to be liquidated, there's a strict "pecking order" for who gets their money back, starting from the bottom of the stack and working up.

This infographic breaks down the hierarchy of project funding in a typical capital stack.

As you can see, senior debt is the bedrock. Mezzanine financing is the middle floor, and equity sits up on the roof. This visual makes it clear: mezzanine lenders are second in line. They don't see a dime until the senior debt holders are paid back in full.

This subordinate position is precisely why mezzanine loans carry higher interest rates and often come with an "equity kicker"—a feature that gives the lender a small piece of ownership or a share of the profits. More risk demands a greater reward.

Don't underestimate its importance; the market for this kind of financing is huge, with a potential size estimated in the hundreds of billions. It's a critical tool for filling funding gaps in commercial real estate deals.

Understanding the senior debt that sits below mezzanine financing is also key. You can get a feel for this by looking at historical CMBS market trends. Once you grasp this hierarchy, the strategic value of mezzanine loans becomes crystal clear. For a more detailed breakdown, check out our complete guide on the https://www.homebasecre.com/posts/real-estate-capital-stack.

What Makes a Mezzanine Loan Tick?

To really get what a mezzanine loan is, you have to look past the definition and examine its moving parts. It’s a true hybrid, blending the predictable, fixed payments of debt with the high-stakes, high-reward nature of equity. This split personality is exactly what makes it so powerful and flexible.

On the one hand, it acts like a regular loan, requiring you to make scheduled interest payments. But on the other, it has an equity feature that gives the lender a potential piece of the upside—their reward for taking on more risk.

The Debt Side: Higher Interest and a Backseat Position

The debt part is simple enough to understand, but it comes with a pretty big string attached: it’s expensive. Mezzanine loans are subordinate, which is just a fancy way of saying the lender gets paid back after the senior lender (usually a bank) gets their money.

Because they’re second in line if things go wrong, mezzanine lenders take on a lot more risk. To make that risk worthwhile, they charge much higher interest rates.

You’ll typically see interest rates on these loans ranging from 12% to 20% per year, though they can swing anywhere from 9% to 30%. This premium reflects the fact that the debt is usually unsecured and sits behind the primary mortgage. It’s the cost of getting that extra capital the bank wouldn't give you. For a closer look at this structure, you can explore more details about mezzanine financing and how it fits into the bigger picture.

The Equity Side: The "Kicker"

Here’s where things get interesting. The equity component is what really sets mezzanine financing apart from other loans. It’s often called an "equity kicker" or a warrant, and it’s the lender's real prize for taking that subordinate position.

This kicker gives the lender the right—but not the obligation—to convert some of their debt into an ownership stake in the company or property down the road. If your project is a huge success and the value skyrockets, the lender can exercise their option and share in that growth. This can boost their total return far beyond what they'd make from interest alone.

Smart Payment Structures: Meet PIK Interest

Finally, one of the most practical features you'll find in mezzanine loans is a flexible payment option called Payment-In-Kind (PIK) interest. This is a game-changer for borrowers who need to keep cash in the business.

What is PIK Interest? Instead of writing a check for interest every month, PIK interest gets tacked onto the principal loan balance. You then pay all that accrued interest back in one lump sum, along with the original loan amount, when the loan matures.

This is perfect for businesses in a high-growth phase or for real estate developers who need every dollar for construction. It lets you use your cash to build value now instead of draining it on early debt service payments.

When to Use a Mezzanine Loan

Knowing what mezzanine financing is and knowing when to actually use it are two different things. This isn't your everyday business loan; it's a strategic tool for high-stakes situations where traditional funding just doesn't cut it. Think of it as a way to unlock major growth, push through a big transaction, or simply bridge a critical funding gap.

A classic example is a leveraged buyout (LBO). Here, a private equity firm might use mezzanine debt to reduce the amount of its own money needed to buy another company, which in turn juices their potential return on investment. The acquired company's own cash flow is then tapped to pay back the loan.

It’s also a popular choice for companies gearing up for a major expansion, like building a new factory or rolling out a new product line. Mezzanine financing provides that big injection of cash without diluting the founders' ownership nearly as much as raising another round of equity would.

Common Scenarios for Mezzanine Financing

Mezzanine debt really shines when a project or business needs a substantial amount of capital for a transformative moment.

Here are a few of the most common applications:

- Strategic Acquisitions: This type of loan can supply the missing funds needed to expand operations or close complex M&A deals in Dubai.

- Corporate Recapitalization: A company can use mezzanine debt to completely overhaul its balance sheet, often by buying out certain shareholders or refinancing more restrictive debt.

- Real Estate Development: Developers constantly use it to fill the gap between their primary construction loan and the equity they have on hand. It's often the key to getting a big project off the ground.

For many growing businesses, especially in fast-moving sectors like tech, mezzanine financing is an essential lifeline. It provides the fuel for innovation and expansion when traditional bank loans are harder to come by, particularly during challenging economic times.

You can see its impact in markets like the UK, where fintech startups managed to raise $12.5 billion in 2022. This kind of growth was often supported by flexible capital from mezzanine lenders, proving just how vital it is for small and medium-sized businesses looking to scale.

Weighing the Benefits and Risks

Like any powerful tool in the world of finance, mezzanine debt is a double-edged sword. It can unlock incredible growth, but it demands respect and careful handling. Let's break down what that really means for a borrower.

On one hand, the biggest draw is getting your hands on a significant chunk of capital without giving away the farm. Unlike a straight equity deal where you're selling off large ownership stakes, a mezzanine loan lets you keep more control and a bigger slice of the future profits. This is a huge win for sponsors who believe in their project's upside.

The terms can also be surprisingly flexible compared to what a traditional bank offers. Lenders might agree to things like PIK (Payment-in-Kind) interest, where instead of paying cash interest each month, the balance just gets added to the loan. This can be a lifesaver for preserving cash flow when a project is just getting off the ground. Plus, the interest you do pay is usually tax-deductible, which helps soften the blow of the high cost.

Mezzanine financing is all about bridging the gap. It lets you take on a bigger project than your equity alone would allow, essentially amplifying your potential return on that equity and making the whole deal more profitable.

Of course, this power comes at a price. There's no getting around the fact that mezzanine financing is expensive. We're talking interest rates that are worlds away from your standard bank loan, reflecting the much higher risk the lender is taking.

A Balanced View for Borrowers

So, is it worth it? That's the million-dollar question, and it comes down to a careful weighing of the trade-offs.

The high cost is the most obvious downside, but the devil is often in the details—specifically, the loan covenants. These are the rules of the road set by the lender, and they can be quite strict. Break them, and the consequences are severe.

Remember, the lender’s collateral isn't the physical property; it's your ownership stake in the company that owns the property. If you default, you’re not just facing foreclosure—you could be handing the keys to the entire project over to your mezzanine lender. It’s a high-stakes game.

To make sense of these competing forces, it helps to see them side-by-side.

Mezzanine Financing Pros and Cons

Here’s a comparative look at the advantages and disadvantages of using mezzanine loans from the borrower's perspective.

At the end of the day, a mezzanine loan isn't for every deal. It's best suited for strong projects with a clear, predictable path to profitability. You need absolute confidence that the project can generate enough cash to handle the hefty debt payments and still deliver the fantastic returns everyone at the table is expecting.

Got Questions About Mezzanine Loans?

Let's tackle some of the most common questions that pop up when people first dive into mezzanine finance. These answers should help clear up any lingering confusion and solidify your understanding of how this unique tool works in the real world.

Is Mezzanine Financing Debt or Equity?

This is the classic question, and the answer is: it's a hybrid of both.

On the company's books, it's treated like debt. It sits on the balance sheet as a liability and comes with a schedule of regular interest payments, just like a bank loan. But because it's a riskier, subordinate loan, lenders need a little something extra for their trouble.

That "extra" is an equity component, often called a "kicker" or a warrant. This gives the lender the right to convert their debt into an ownership stake down the road, letting them share in the upside if the business or project really takes off. So, it behaves like debt day-to-day but carries the potential returns of an equity investment.

Think of it this way: mezzanine financing has the body of a loan but the soul of an equity investment. That dual nature is what makes it so powerful.

What Exactly Is an Equity Kicker?

The equity kicker (or warrant) is the lender's reward for taking on all that risk. It’s what makes the whole deal attractive.

Essentially, it's a provision that gives the lender the right—but not the obligation—to buy a certain amount of equity in the company at a set price. If the company’s value skyrockets, the lender can exercise those warrants and cash in on that growth.

This potential for a big payday boosts their total return far beyond what they'd make from interest payments alone. It’s the secret sauce that convinces them to fund deals that traditional banks might walk away from.

How Is a Mezzanine Loan Different from a Second Lien Loan?

Good question. Both sit below senior debt in the capital stack, but the key difference boils down to one word: security.

A second-lien loan is exactly what it sounds like—it's secured by a second-priority claim on the company's actual assets (the collateral). If the borrower defaults, second-lien holders get to claim those assets right after the senior lender is paid off.

A mezzanine loan, on the other hand, is usually unsecured. Its claim isn't on a specific building or piece of equipment, but on the company's future cash flow. In a bankruptcy, mezzanine lenders are way down the pecking order—they only get paid after all secured lenders, including first and second lien holders, have been made whole. This makes their position much riskier.

At Homebase, we know the capital stack inside and out. Our platform helps real estate sponsors streamline their fundraising and keep investors happy, so you can focus on putting the right deal together. See how we can simplify your next syndication at https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Guide to Real Estate Financial Modelling for Syndicators

Blog

Master real estate financial modelling with this guide. Learn to build models that analyze deals, forecast returns, and build unwavering investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.